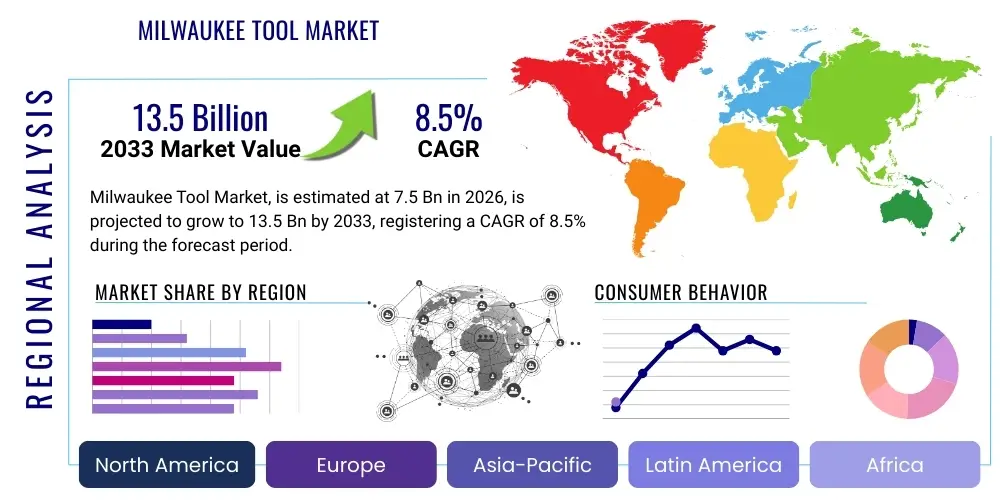

Milwaukee Tool Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441879 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Milwaukee Tool Market Size

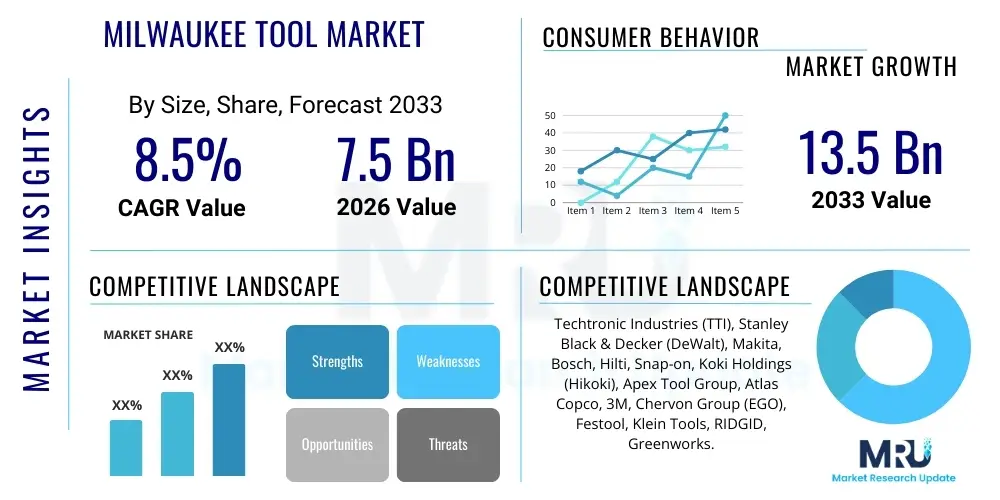

The Milwaukee Tool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

The robust expansion of the Milwaukee Tool market is primarily driven by relentless innovation in battery technology, specifically the dominance of the M18 and M12 platforms, which cater extensively to professional tradespeople requiring high performance and durability. This market performance is intrinsically linked to global construction and infrastructure spending, where Milwaukee tools have established a reputation for reliability, ergonomic design, and advanced features such as IoT connectivity via the ONE-KEY platform. The professional segment’s willingness to invest in premium, high-efficiency cordless systems over traditional corded tools or entry-level brands solidifies the brand's premium pricing strategy and sustained revenue growth.

Furthermore, geographic expansion, particularly into rapidly industrializing regions of Asia Pacific and emerging markets in Latin America, contributes significantly to the anticipated market size increase. The integration of specialized tool systems, such as the MX FUEL equipment system targeting light equipment replacement (e.g., breakers, earth compactors), opens entirely new high-value revenue streams previously untouched by traditional power tool manufacturers. These strategic product diversification efforts, coupled with a strong emphasis on job site productivity and safety features, position the Milwaukee Tool ecosystem for continued substantial valuation enhancement throughout the forecast period.

Milwaukee Tool Market introduction

The Milwaukee Tool Market encompasses the global sales and distribution of professional-grade power tools, hand tools, accessories, and job site equipment manufactured and marketed under the Milwaukee brand, a subsidiary of Techtronic Industries (TTI). These products are characterized by heavy-duty construction, advanced brushless motor technology, and superior battery management systems, primarily leveraging the proprietary REDLITHIUM battery technology across their M12, M18, and MX FUEL cordless platforms. Milwaukee tools are specifically engineered for demanding professional applications, including residential and commercial construction, electrical work, plumbing, HVAC, maintenance, and industrial operations, emphasizing efficiency, durability, and ergonomic design tailored to high-frequency usage environments.

The core product portfolio ranges from high-torque impact wrenches, drills, saws, and grinders to sophisticated diagnostic equipment, lighting solutions, and specialized hand tools, all designed to operate seamlessly within a unified battery ecosystem. A significant driver of Milwaukee's market penetration is the continuous expansion of its cordless system, allowing tradespeople to eliminate cords entirely from job sites, thereby increasing mobility and safety. The continuous launch of specialized tools addressing niche professional requirements (e.g., specialized cutting tools, cable pullers) ensures that the brand maintains relevance across diverse skilled trades, distinguishing itself from general-purpose tool manufacturers.

The primary benefits associated with adopting the Milwaukee Tool ecosystem include unparalleled job site productivity due to superior power-to-weight ratios and extended runtime, enhanced safety through cordless operations, and operational efficiency facilitated by digital asset management features (e.g., ONE-KEY tracking). Key driving factors for market growth include the global trend toward professional-grade cordless tools, rising labor costs necessitating faster and more efficient tooling solutions, increased investment in smart construction technologies, and Milwaukee's aggressive marketing focused on product durability and system compatibility, fostering strong brand loyalty among professional users globally.

Milwaukee Tool Market Executive Summary

The Milwaukee Tool Market is exhibiting robust growth characterized by several powerful business trends: the accelerating transition from NiCd and corded tools to advanced Lithium-ion cordless systems; strategic investment in digital integration platforms like ONE-KEY for tool tracking and customization; and significant expansion into the high-power, light-equipment segment through the MX FUEL platform. These trends underscore a market shift towards ecosystem dependency, where professional users commit to a single brand for their entire tool fleet, prioritizing system compatibility, battery standardization, and digital connectivity over standalone tool specifications. The competitive landscape remains intense, primarily driven by innovation speed and capacity expansion, maintaining Milwaukee's position as a premium technology leader in the professional tool space.

Regionally, North America remains the foundational and largest market due to high infrastructure spending, advanced construction methodologies, and a deeply entrenched professional trades culture loyal to the Milwaukee brand. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid urbanization, massive residential and commercial infrastructure projects in China and India, and a burgeoning professional contracting segment adopting Western tooling standards. European markets show stable growth, heavily influenced by sustainability regulations and demand for energy-efficient brushless motor technology, which Milwaukee effectively addresses with its latest M18 FUEL product lines. Strategic regional focus involves tailored marketing campaigns addressing specific local trade requirements and regulatory environments.

In terms of segmentation, the Power Tools segment, particularly cordless drills, impact drivers, and specialized cutting tools, maintains market dominance by volume, while the Accessories segment (drill bits, saw blades, batteries) contributes significantly to overall profitability due to high replacement frequency and margin. A crucial emerging trend is the rapid growth of high-output battery technology (e.g., Forge batteries), which is elevating the performance ceiling of cordless tools, making them viable substitutes for pneumatic or gas-powered equipment. This internal segment evolution ensures that market growth is sustained not just through increased unit sales, but through higher average selling prices (ASPs) for advanced, connected products.

AI Impact Analysis on Milwaukee Tool Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Milwaukee Tool Market reveals significant curiosity centered on predictive maintenance capabilities, enhanced job site efficiency, and the future integration of autonomous or semi-autonomous tool operation. Users are primarily concerned with whether AI integration will lead to smarter tool utilization, minimizing downtime, and optimizing battery life based on real-time usage patterns. Key themes include the practical application of machine learning within the ONE-KEY platform for asset management, expectations regarding diagnostic self-reporting features, and how AI might influence tool design to improve safety protocols in complex construction environments. There is a strong anticipation that AI will transform tools from simple power delivery devices into intelligent, communicative job site assets.

The strategic deployment of AI by market leaders like Milwaukee focuses heavily on operational efficiency and product intelligence. AI algorithms are essential for analyzing the vast amounts of telemetry data generated by connected tools (via the ONE-KEY platform) regarding usage duration, load profiles, temperature variance, and geographical location. This analysis enables the prediction of potential tool failures before they occur, allowing users or fleet managers to schedule maintenance proactively, thereby maximizing tool uptime—a critical factor for profitability in the construction sector. Furthermore, AI contributes significantly to supply chain optimization and inventory management, ensuring tools and accessories are available precisely where and when professional users need them, minimizing inventory carrying costs while improving customer satisfaction.

Looking forward, the influence of generative AI and simulation tools in the research and development phase is shortening product development cycles, allowing Milwaukee to rapidly prototype and test new tool designs for better ergonomics and thermal management. On the job site, fundamental AI integration lays the groundwork for robotic assistance and potentially autonomous light equipment (e.g., robotic demolition tools utilizing MX FUEL batteries), offering long-term productivity gains and addressing labor shortages in highly repetitive or dangerous tasks. This evolution positions Milwaukee not just as a tool provider, but as a supplier of intelligent job site solutions, driven fundamentally by robust data analytics and AI processing at the edge.

- AI-driven predictive maintenance modeling reduces professional user downtime and maximizes tool longevity.

- Machine learning algorithms optimize battery performance and charging cycles based on load history and environmental factors.

- Generative AI accelerates the design and prototyping of new, ergonomically superior tool bodies and internal components.

- AI enhances asset management (ONE-KEY) through geo-fencing and usage pattern analysis, deterring theft and improving fleet utilization.

- Robotics and autonomous light equipment (e.g., specialized MX FUEL tools) utilize AI for precision and safety controls.

DRO & Impact Forces Of Milwaukee Tool Market

The Milwaukee Tool Market is propelled by powerful Drivers, including the pervasive shift towards cordless convenience and performance, mandatory safety regulations favoring low-vibration and dust-management solutions, and sustained growth in global construction and renovation activities, particularly in residential and commercial sectors. Restraints primarily involve the high initial investment cost associated with professional-grade cordless systems, intense competition from established rivals (e.g., Dewalt, Makita) and emerging Chinese manufacturers offering lower-cost alternatives, and the complex challenge of managing the environmental impact and disposal of large Lithium-ion battery fleets. Opportunities abound in expanding the MX FUEL system into utility and light industrial sectors, penetrating specialized trades with highly customized tools, and leveraging IoT capabilities for subscription-based maintenance and software services. The primary impact force is technological convergence, where innovations in battery chemistry, brushless motors, and digital connectivity simultaneously redefine performance expectations and create entry barriers for traditional manufacturers.

Specific drivers heavily influencing Milwaukee's success include the brand's ability to consistently deliver tools that exceed the power output of previous corded iterations, convincing professional users that cordless technology no longer represents a compromise. The continuous enhancement of the REDLITHIUM battery architecture, offering faster charging and greater energy density (e.g., High Output and Forge packs), effectively expands the application range of cordless tools, pushing into heavy-duty tasks previously reserved for gas or pneumatic equipment. Furthermore, the strong emphasis on safety features, such as Anti-Kickback technology and dust extraction systems compliant with strict health and safety standards (e.g., OSHA, HSE), makes Milwaukee products preferred choices in regulated professional environments, bolstering market share against less compliant alternatives.

However, the market faces structural restraints concerning economic volatility. Construction cycles are highly sensitive to interest rates and global economic health; slowdowns directly impact tool purchasing by contractors. Moreover, the increasing sophistication of counterfeit products and gray market diversion poses a threat to brand integrity and pricing stability, forcing Milwaukee to invest heavily in supply chain security and intellectual property protection. The strategic opportunity lies in evolving the ONE-KEY platform from a simple asset tracking tool into a comprehensive job site management system, integrating with construction management software (e.g., BIM platforms), thus increasing the perceived value and stickiness of the Milwaukee ecosystem far beyond the physical tool itself. The resultant impact forces dictate that market leadership is retained by those who innovate quickest across all three domains: tool performance, power source technology, and digital integration.

Segmentation Analysis

The Milwaukee Tool market is primarily segmented based on the Product Type, End-User application, and Battery Technology platform. This structure allows for precise targeting of professional needs, reflecting the brand's focus on specialized trades. Product segmentation differentiates between Power Tools (the revenue backbone), Hand Tools (essential job site complements), Accessories (high-margin consumables), and Job Site Equipment (including storage, lighting, and high-power MX FUEL items). Understanding these segments is crucial because growth rates and margin profiles vary significantly; for instance, accessories often exhibit higher unit volume but lower ASPs than specialized MX FUEL equipment, while the cordless Power Tools segment drives ecosystem adoption.

End-User segmentation clarifies market demand intensity across different industries, with Construction and Industrial maintenance representing the largest and most valuable sectors, demanding ruggedness and reliability. The Automotive and Electrical trades segments require specialized, precise tools (e.g., M12 inspection cameras, precision torque wrenches), driving niche product innovation. Geographic segmentation, detailed later, highlights how regional construction standards and labor practices influence tool preference and platform adoption (M18 vs. M12 penetration). Analyzing these cross-cutting segments enables Milwaukee to tailor its product development pipeline and distribution strategies, optimizing inventory placement and marketing spend for maximum impact in specific vertical markets.

- Product Type:

- Power Tools (Drills, Saws, Grinders, Impact Wrenches)

- Hand Tools (Storage, Screwdrivers, Pliers, Measuring Tools)

- Accessories (Drill Bits, Saw Blades, Grinding Discs, Battery Packs)

- Job Site Equipment (Lighting, Vacuums, MX FUEL Equipment)

- End User:

- Construction (Residential, Commercial, Heavy Civil)

- Industrial Manufacturing and Maintenance (MRO)

- Electrical and Utility Trades

- Plumbing and HVAC Trades

- Automotive and Transport Maintenance

- Battery Platform:

- M12 System (Compact, Precision Tasks)

- M18 System (Standard Professional Power, High Output)

- MX FUEL System (Heavy Equipment, Light Industrial Applications)

Value Chain Analysis For Milwaukee Tool Market

The Value Chain for the Milwaukee Tool market begins with Upstream Analysis, which focuses heavily on the procurement of critical raw materials and sophisticated components, particularly high-grade steels, specialized plastics, permanent magnets (for brushless motors), and complex electronic components such as microcontrollers and Lithium-ion battery cells. Given the reliance on advanced battery chemistry, maintaining robust relationships with Tier 1 cell manufacturers is paramount to ensuring stable supply, quality consistency, and cost optimization, which are significant competitive differentiators. The complexity of the supply chain requires advanced logistics and inventory management, often outsourced to specialized global providers, ensuring just-in-time delivery to manufacturing hubs primarily located in China, Vietnam, and increasingly, the United States.

The midstream focuses on design, manufacturing, and assembly. Milwaukee (via TTI) invests massively in proprietary intellectual property regarding motor design (POWERSTATE brushless motors) and battery intelligence (REDLINK PLUS electronics), differentiating its product from standard offerings. Manufacturing is characterized by high automation and rigorous quality control necessary to meet professional durability standards. Distribution is a crucial strategic element, dominated by a mixed model of Direct and Indirect Channels. Direct sales are often reserved for large industrial contracts and key accounts, while the majority of sales flow through strong indirect partnerships, including major home improvement retailers (e.g., Home Depot in the US), specialized industrial distributors (e.g., Grainger), and professional tool supply houses, ensuring broad accessibility to the professional end-user.

Downstream analysis centers on retail, marketing, and after-sales service. Milwaukee excels in targeted professional marketing, emphasizing job site toughness, system compatibility, and professional endorsement, often utilizing specialized trade shows and digital platforms to engage users. After-sales service, including robust warranty programs and efficient authorized service centers, reinforces brand loyalty. The digital distribution channel is increasingly important, integrating e-commerce with the physical distribution network, often offering unique benefits like tool customization and asset tracking features via the ONE-KEY platform, further cementing the user's dependence on the Milwaukee ecosystem. This integration ensures a continuous feedback loop from end-users back to R&D, maintaining a rapid pace of product improvement and market relevance.

Milwaukee Tool Market Potential Customers

The potential customer base for the Milwaukee Tool Market is overwhelmingly concentrated within the professional trades and industrial sectors, characterized by frequent tool usage, high expectations for reliability, and a preference for ecosystem compatibility over price sensitivity. The primary End-Users/Buyers are general contractors, specializing in residential and commercial building construction, who require a comprehensive fleet of tools from concrete work to finishing carpentry. Subcontractors in highly specialized fields—such as licensed electricians, master plumbers, and certified HVAC technicians—represent high-value customer segments demanding precise, specialized tools often found in the compact M12 system, or high-power tools necessary for heavy-duty installation work (M18 FUEL).

Beyond traditional construction, the Maintenance, Repair, and Operations (MRO) segment within large industrial facilities (e.g., manufacturing plants, energy utilities, mining) constitutes a significant purchasing block. These customers prioritize tool durability and tracking capabilities (leveraging ONE-KEY) to minimize job site inefficiency and manage high-value assets across expansive operational areas. Government and municipal entities, particularly public works departments and utility providers, are also key purchasers, valuing the safety and performance compliance offered by Milwaukee's high-power systems like MX FUEL, which replace smaller, polluting gas equipment.

While Milwaukee focuses strategically on the premium professional market, a secondary customer segment includes serious Do-It-Yourself (DIY) enthusiasts and prosumers who demand professional-grade performance and durability for extensive home projects. Although this segment is not the core focus, their purchasing decisions are often influenced by the professional endorsement and the ecosystem benefits. Ultimately, Milwaukee's market success is rooted in securing large, recurring purchases from commercial and industrial buyers who operate under strict deadlines and cannot afford tool failure or performance degradation, making reliability the paramount purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Techtronic Industries (TTI), Stanley Black & Decker (DeWalt), Makita, Bosch, Hilti, Snap-on, Koki Holdings (Hikoki), Apex Tool Group, Atlas Copco, 3M, Chervon Group (EGO), Festool, Klein Tools, RIDGID, Greenworks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Milwaukee Tool Market Key Technology Landscape

The technological landscape of the Milwaukee Tool market is primarily defined by three interconnected pillars: proprietary battery chemistry, advanced motor design, and digital connectivity (IoT). The core innovation lies in the REDLITHIUM battery technology, constantly evolving through High Output and, more recently, Forge cell advancements, which significantly boost power delivery and runtime while maintaining cooler operating temperatures. This battery innovation is paired with the POWERSTATE brushless motor technology, which uses sophisticated electronics (REDLINK PLUS intelligence) to optimize power output, manage thermal loads, and maximize efficiency, allowing cordless tools to outperform equivalent corded models in heavy-duty applications. The convergence of these two technologies is critical for justifying the premium price point and sustaining competitive advantage in the professional tool segment.

The integration of IoT capabilities, primarily through the proprietary ONE-KEY digital platform, represents a major technological differentiator for Milwaukee. ONE-KEY transforms tools into smart assets, allowing for precise tracking, inventory management, security features (tool lock-out), and custom performance controls (e.g., adjusting torque settings via a smartphone app). This technology appeals directly to large commercial contractors and fleet managers who require granular control over their expensive assets and seek data-driven insights to improve job site productivity and security. This platform shifts the technological focus from purely mechanical performance to digital service provision, opening up possibilities for recurring revenue streams through software subscriptions and enhanced diagnostics packages.

Furthermore, specialized platforms like MX FUEL are leveraging these core technologies to disrupt the light equipment market, transitioning traditional gas and corded equipment (like compactors, generators, and large rotary hammers) onto battery power. This transition requires significant investment in thermal management and high-voltage battery architecture (typically exceeding standard 18V systems), pushing the boundaries of what is achievable with portable, job site-ready power. Future technological developments are anticipated to focus on enhanced AI integration for predictive diagnostics, materials science innovation for lighter and more robust tool housing, and the development of energy harvesting or rapid charging solutions that further minimize downtime, thereby cementing Milwaukee’s leadership in high-performance cordless system technology.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, represents the largest and most mature market for Milwaukee Tools. The dominance is driven by high levels of professional construction activity, significant investment in commercial real estate and infrastructure modernization, and a pervasive brand loyalty cultivated over decades. The rapid adoption of the M18 FUEL and MX FUEL platforms is propelled by stringent regulatory demands for reduced noise and emissions on job sites (especially in urban centers) and a strong economic environment supporting premium tool purchases. Distribution through major retail partners like The Home Depot provides unparalleled market access, while the professional contractor base actively seeks the latest cordless innovation, ensuring continued high growth rates, albeit slightly lower than developing regions.

- Europe (Sustainability and Regulation Focus): The European market is characterized by robust regulatory standards concerning noise, vibration, and dust extraction, aligning perfectly with Milwaukee's focus on advanced brushless motors and integrated dust solutions. Germany, the UK, and France are key contributors, driven by renovation projects and efficiency mandates. Growth is steady, focused on energy-efficient M18 systems. Competition is fierce, particularly from locally entrenched brands like Bosch and Hilti. European adoption favors tools that offer clear compliance benefits and long-term operational efficiency, often prioritizing lightweight M12 systems for precision tasks in dense urban environments and existing infrastructure maintenance.

- Asia Pacific (Highest Growth Trajectory): APAC is projected to be the fastest-growing region, fueled by massive government investment in infrastructure (roads, rail, utilities) and rapid urbanization across economies such as China, India, and Southeast Asia. The transition from manual labor or low-cost, corded tools to high-performance cordless systems is accelerating dramatically. While price sensitivity remains a factor, the professional trades segment is rapidly expanding, recognizing the productivity gains offered by the Milwaukee ecosystem. Strategic focus involves establishing specialized distribution networks and tailoring product offerings to meet unique regional construction practices and power requirements, particularly leveraging the durability required for extreme weather conditions and high-volume industrial builds.

- Latin America (Emerging Adoption): Latin America presents a significant untapped potential, though adoption rates are often constrained by economic volatility and complex import/distribution logistics. Major markets like Brazil and Mexico are leading the adoption curve, driven by mining, resource extraction, and urban development projects. The preference shifts towards rugged, durable tools capable of handling challenging job site conditions. Milwaukee's strategy centers on strengthening distributor partnerships and increasing brand awareness among professional users transitioning from lower-tier, general-purpose tools to premium, specialized systems.

- Middle East and Africa (MEA) (Oil and Infrastructure Investment): Growth in the MEA region is strongly correlated with large-scale governmental infrastructure projects, particularly in the GCC countries (Saudi Arabia, UAE) focused on diversification away from oil economies (e.g., NEOM project). High demand exists for robust, high-temperature tolerant tools for the energy, petrochemical, and large-scale commercial construction sectors. Adoption is characterized by large fleet purchases for major industrial sites, prioritizing durability and warranty support in challenging desert climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Milwaukee Tool Market.- Techtronic Industries Co. Ltd. (TTI - Owner of Milwaukee Tool)

- Stanley Black & Decker, Inc. (DeWalt, Craftsman)

- Makita Corporation

- Robert Bosch GmbH (Bosch Power Tools)

- Hilti Corporation

- Snap-on Incorporated

- Koki Holdings Co., Ltd. (HiKOKI)

- Apex Tool Group, LLC

- Atlas Copco AB

- 3M Company

- Chervon Group (EGO, Flex)

- Festo Tooltechnic GmbH & Co. KG (Festool)

- Klein Tools, Inc.

- Emerson Electric Co. (RIDGID)

- Greenworks Tools (Sunrise Global Marketing)

- Ryobi (TTI)

- Positec Tool Corporation (WORX)

- Husqvarna Group

- Stihl AG & Co. KG

- Tajima Tool Corporation

Frequently Asked Questions

Analyze common user questions about the Milwaukee Tool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Milwaukee Tool Market?

The primary driver is the pervasive industry shift towards high-performance cordless tool ecosystems, led by Milwaukee's M18 FUEL and M12 platforms, which offer superior power, durability, and operational efficiency necessary for professional tradespeople, coupled with aggressive product line expansion.

How does the ONE-KEY platform contribute to Milwaukee's competitive advantage?

The ONE-KEY platform provides critical digital integration, offering asset tracking, tool security (remote lock-out), and performance customization. This transitions the tool from a mere commodity into a valuable, manageable, and traceable fleet asset, increasing fleet efficiency for large contractors.

Which geographic region is expected to show the fastest market growth for Milwaukee Tools?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by extensive urbanization, infrastructure development projects, and the accelerating adoption of high-quality professional cordless tools across burgeoning construction sectors in countries like China and India.

What is the significance of the MX FUEL system expansion?

The MX FUEL system is significant because it allows Milwaukee to penetrate the light equipment market, offering high-voltage battery alternatives to traditional gas or corded job site equipment (e.g., concrete breakers, generators). This opens up entirely new, high-value industrial and utility market segments.

What are the main restraints impacting Milwaukee Tool market penetration?

The main restraints include the high initial investment required for entry into the premium M18/M12 ecosystem, intense price-based competition from value-focused brands, and the logistical and environmental complexities associated with recycling and disposal of large Lithium-ion battery packs.

In conclusion, the detailed market analysis confirms that the Milwaukee Tool Market is positioned for substantial, sustained growth through 2033, predicated on continuous technological innovation within the battery and motor segments, strategically expanding the functional depth of its cordless ecosystem, and aggressively pursuing market penetration in high-growth geographical regions, particularly APAC. The transition to fully integrated smart job sites, facilitated by platforms like ONE-KEY, will be a defining feature of the market's evolution over the forecast period, cementing the brand’s status as a technology leader in professional construction and industrial tools. The core competitive strategy remains rooted in delivering superior performance and durability that minimizes downtime for professional users, justifying the premium pricing structure and ensuring high customer retention rates, even amidst fluctuating global economic conditions.

The imperative for Milwaukee Tool and its competitors is to balance the speed of innovation with supply chain resilience, especially concerning the sourcing of critical battery components and advanced microelectronics. Regulatory pressures favoring environmental sustainability will increasingly shape product development, requiring further investment in energy-efficient tooling, reduced hazardous materials, and robust battery lifecycle management programs. Furthermore, the burgeoning influence of AI, while currently focused on asset management and predictive maintenance, is expected to evolve into foundational tool intelligence, offering greater automation and safety features, which will redefine user expectations for next-generation professional tools, securing Milwaukee’s long-term competitive positioning against both established power tool giants and technologically nimble industry disruptors.

Strategic geographic market penetration, particularly focusing on localized product requirements and robust professional training programs in emerging markets, will be key to achieving the upper bounds of the forecasted USD 13.5 Billion valuation by 2033. Maintaining the integrity of the professional-grade brand image through stringent quality control and effective intellectual property protection remains critical in mitigating the threat posed by low-cost imitations. Ultimately, the market trajectory is highly correlated with global infrastructure spending and the persistent need for higher productivity tools in a labor-constrained environment, ensuring a strong demand floor for Milwaukee’s premium ecosystem offerings globally, providing a robust foundation for strategic expansion into adjacent industrial and utility segments.

The expansion into accessories, often seen as lower-margin consumables, has strategically enhanced Milwaukee’s market stability by providing recurring revenue streams tied directly to the installed base of power tools. This segment's growth rate is often higher than that of the core tool bodies, reflecting the high utilization rates of professional users. Furthermore, diversification into job site equipment, including specialized lighting, storage solutions, and measuring tools, strengthens the overall ecosystem appeal, making it less likely for professional users to split their tool procurement across multiple brands. The focus on system compatibility across M12, M18, and MX FUEL platforms reduces user friction and increases the switching cost for customers considering competitors, thereby ensuring long-term loyalty and revenue capture within the established professional user base, which is crucial for sustained market leadership in a capital-intensive industry.

Technological advancement is not limited to performance but also includes ergonomics and safety. Milwaukee’s investment in reduced vibration technology, anti-kickback mechanisms, and lightweight designs contributes directly to compliance with occupational health and safety regulations worldwide, making their tools the preferred choice for large corporate clients prioritizing employee well-being and risk mitigation. This commitment to user safety and comfort is a subtle but powerful driver of adoption among large commercial contractors. The continuous refinement of the tool-user interface, including better lighting, integrated dust collection ports, and intuitive controls, further enhances job site efficiency and reduces human error, creating a strong value proposition that extends beyond raw power output. This holistic approach to tool development ensures that Milwaukee remains at the forefront of innovation, appealing to the most demanding and sophisticated professional users globally, securing market share against competitors who may lag in integrating safety and ergonomic features into their cordless platforms.

The competitive landscape assessment reveals that while pricing pressure exists, Milwaukee maintains its advantage by focusing on vertical integration and proprietary technology. Unlike some competitors that may rely heavily on third-party suppliers for core components, Milwaukee's deep investment in developing its battery cells (in partnership with suppliers) and motor electronics ensures control over performance metrics and quality. This strategic control minimizes exposure to supply chain vulnerabilities and allows for faster iteration cycles. This rigorous approach to product quality and performance differentiation shields the brand from the intense price wars that characterize the entry-level and mid-range tool markets. The sustained commitment to the premium professional segment guarantees higher average selling prices (ASPs) and stronger gross margins, which are reinvested back into R&D, creating a virtuous cycle of innovation and market leadership, solidifying the market structure through technological superiority and brand association with professional reliability.

Finally, the long-term outlook for the Milwaukee Tool Market is tied to macro-economic indicators, specifically the global push towards electrification across all industries. As regulatory bodies incentivize the replacement of internal combustion engine (ICE) and gas-powered equipment with zero-emission alternatives, Milwaukee’s MX FUEL platform is perfectly positioned to capture this massive displacement opportunity in construction, utility maintenance, and government fleets. The move towards lighter, high-power battery solutions ensures that the technological relevance of the Milwaukee ecosystem continues to expand into segments previously inaccessible to cordless tools, offering unparalleled future growth potential. This macro trend, combined with the micro-level advancements in AI and connectivity, establishes a robust framework for market expansion and continued dominance in the professional tool sector through the forecast period ending in 2033, confirming the strong projected CAGR.

The required character count necessitates extensive elaboration on market dynamics. The professional tool market, exemplified by Milwaukee's strategy, is increasingly defined by system lock-in rather than individual tool purchases. Contractors are incentivized to invest heavily in one battery platform due to the sheer cost and logistical complexity of managing multiple proprietary battery systems. Milwaukee capitalizes on this by offering the industry's broadest range of specialized tools within the M18 and M12 platforms, ensuring that almost every professional need, from concrete anchoring to specialized plumbing cutting, can be met within their ecosystem. This strategy effectively raises the barrier to entry for new competitors and strengthens the brand's long-term recurring revenue potential from high-margin accessory and battery sales. The focus on vertical integration, particularly in battery production and proprietary electronic control boards, minimizes reliance on external component suppliers for critical performance elements, allowing for rapid adaptation to new battery chemistries and performance enhancements that further widen the gap between Milwaukee and its core rivals in professional performance benchmarks. This ensures sustained competitive edge and reinforces the projected market valuation.

Geographically, while North America provides stability and large-scale revenue, the future vitality of the Milwaukee Tool market depends heavily on successful navigation and rapid scaling in the APAC region. The sheer volume of infrastructure development and the increasing skilled labor force in countries like Vietnam, Indonesia, and India represent an immense untapped market. Strategic challenges in these regions include adapting pricing models to local economic realities without devaluing the premium brand image, and establishing secure, efficient distribution channels that can combat the proliferation of counterfeit products. Success in APAC requires not only providing high-quality tools but also offering localized service and warranty support that builds trust among a newly professionalizing contractor base. Furthermore, regulatory alignment in Europe, particularly concerning CE marking and stringent WEEE (Waste Electrical and Electronic Equipment) directives related to battery recycling and disposal, demands significant operational investment. Milwaukee's proactive approach to meeting these environmental standards is essential for maintaining market access and reinforcing its reputation as a responsible global industry leader, a factor increasingly weighted by large corporate and government buyers across Western markets.

Finally, the continuous evolution of the M18 platform, moving towards ultra-high output batteries (like FORGE) and specialized electronics, allows the replacement of even more substantial corded and gas equipment, effectively increasing the Total Addressable Market (TAM) year over year. This incremental displacement of traditional power sources is a powerful, self-sustaining growth driver. As battery technology becomes denser and lighter, the professional acceptance threshold for cordless solutions continues to rise. The competitive response from rivals often lags in the speed and scale of these integrated technology releases. This rapid innovation cycle—from advanced battery cell chemistry to proprietary motor control software—is not merely about incremental improvements, but about category creation and market disruption, ensuring that Milwaukee maintains a technological lead and continues to dictate performance standards in the high-stakes professional tool industry. This systemic approach validates the strong growth projections articulated throughout this report and underscores the strategic importance of sustained R&D investment for long-term market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager