Miniature Atomic Clock Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441611 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Miniature Atomic Clock Market Size

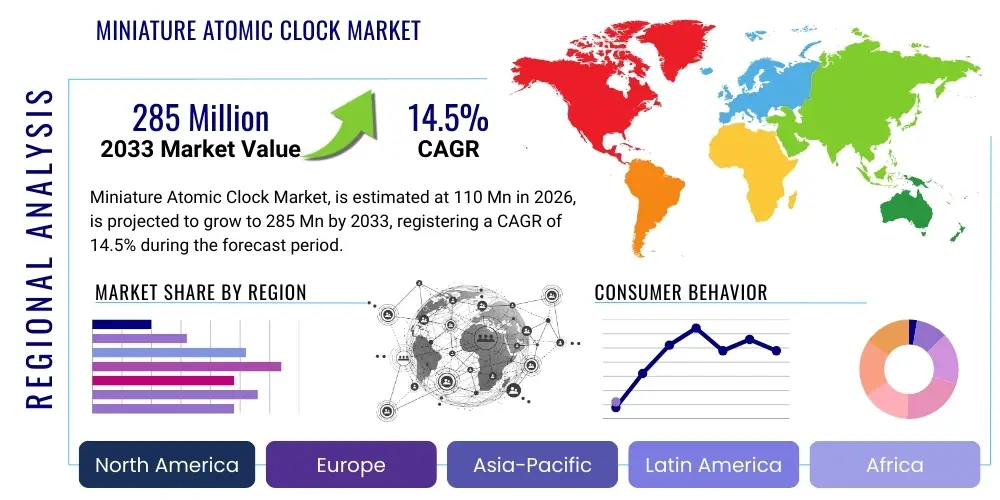

The Miniature Atomic Clock Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $110 Million in 2026 and is projected to reach $285 Million by the end of the forecast period in 2033.

Miniature Atomic Clock Market introduction

The Miniature Atomic Clock (MAC) Market encompasses highly precise, compact, and low-power timing devices utilized across mission-critical applications where reliable synchronization is paramount. MACs, often including Chip-Scale Atomic Clocks (CSACs) and miniaturized Rubidium standards, offer superior frequency stability compared to traditional quartz oscillators, making them indispensable for modern technological infrastructure. These devices translate fundamental atomic transitions into highly accurate timekeeping references. The market is characterized by stringent performance requirements, rapid technological advancements focused on reducing size, weight, and power (SWaP), and heavy reliance on government and defense contracts for initial development and large-scale deployment.

The primary applications driving the adoption of Miniature Atomic Clocks include military positioning, navigation, and timing (PNT) systems, synchronization in 5G and 6G telecommunications infrastructure, secure communications, and deep space exploration. For PNT, MACs provide crucial holdover capabilities when Global Navigation Satellite System (GNSS) signals are denied or jammed, maintaining precise location and time data essential for autonomous operations and national security. In telecommunications, the increasing density of base stations and the need for femtocell synchronization in dense urban environments necessitate the use of stable, small-footprint atomic clocks to ensure seamless data transfer and network integrity, directly supporting high-bandwidth applications.

Key benefits of MACs include their extreme frequency stability (often measured in parts per 1012 or better), significantly reduced physical size and power consumption compared to laboratory-grade atomic clocks, and robust performance under extreme environmental conditions (vibration, temperature variation). The market growth is fundamentally driven by the global digitalization trend, the expansion of commercial space activities (including low Earth orbit satellite constellations), and persistent military modernization efforts focused on resilient PNT solutions. The convergence of these factors positions the MAC market as a high-value, high-growth segment within the broader precision timing industry, necessitating continuous investment in quantum physics research and advanced manufacturing techniques.

Miniature Atomic Clock Market Executive Summary

The Miniature Atomic Clock Market is poised for substantial expansion, underpinned by critical business trends such as aggressive miniaturization strategies by key players and increased capital expenditure in resilient infrastructure across both public and private sectors. Technology leaders are prioritizing the commercialization of Chip-Scale Atomic Clocks (CSACs) to access high-volume markets like mobile telecommunications and Internet of Things (IoT) applications requiring edge computing synchronization. Furthermore, strategic alliances between defense contractors and quantum physics research institutes are accelerating the transition from laboratory prototypes to deployable, ruggedized MAC units. This dynamic environment is fostering intense competition focused on power efficiency and long-term stability, driving down the overall cost of ownership for end-users and expanding market accessibility beyond traditional military buyers.

Regional trends indicate North America maintaining market dominance, largely due to extensive defense budgets allocated to PNT resilience, robust presence of major aerospace and defense primes, and significant investment in early-stage quantum technology research by government agencies like DARPA. Asia Pacific, however, is projected to exhibit the highest growth rate, primarily fueled by massive infrastructure build-outs related to 5G deployment in countries like China, Japan, and South Korea, coupled with rapidly expanding indigenous space programs. Europe remains a strong market, driven by collaborative defense initiatives (e.g., Galileo satellite system components) and stringent regulatory requirements for network synchronization accuracy within the telecommunications sector, promoting the integration of MAC technology into critical communication nodes.

Segmentation trends highlight the increasing demand for Rubidium Atomic Clocks in high-performance synchronization tasks requiring better holdover stability over longer periods, particularly in core networking infrastructure and advanced radar systems. Conversely, the CSAC segment is projected to grow fastest by volume, capitalizing on the demand for highly embedded, low-SWaP solutions suitable for unmanned aerial vehicles (UAVs), soldier-worn equipment, and portable field calibration devices. The defense and aerospace application segment will continue to dominate revenue share due to the high unit cost and critical nature of deployment, but the rapid proliferation of commercial applications in telecommunications and enterprise networking represents the strongest growth opportunity for volume sales in the forecast period.

AI Impact Analysis on Miniature Atomic Clock Market

User inquiries frequently center on how artificial intelligence (AI) can enhance the already high precision of Miniature Atomic Clocks (MACs), particularly regarding calibration, drift prediction, and integration into complex, distributed sensor networks. Key concerns often revolve around whether AI algorithms can compensate for physical limitations or environmental effects (like temperature and aging) that cause minor frequency drift over time, thereby extending the utility and lifespan of MACs without manual intervention. Users also express interest in AI’s role in optimizing the power consumption of MACs in power-constrained environments (such as satellites or remote IoT nodes) and utilizing machine learning for predictive maintenance to ensure system uptime. The overarching theme is the expectation that AI will transform MACs from static, high-precision instruments into dynamically managed, network-aware timing assets, crucial for the synchronization of emerging AI-driven decentralized computing clusters.

AI's influence is multidimensional, starting with the optimization of the clock’s performance parameters. Machine learning models can analyze long-term operational data, including temperature fluctuations, pressure changes, and output frequency variations, to build highly accurate predictive models for clock drift. This predictive capability allows host systems to apply real-time frequency corrections far more effectively than traditional filtering techniques, essentially extending the effective holdover time and accuracy of the clock, particularly in GNSS-denied environments. Furthermore, AI facilitates the sophisticated cross-correlation of timing data from multiple MACs within a network, creating a highly resilient synthetic timing source that mitigates the potential failure or degradation of any single unit.

Beyond performance enhancement, AI plays a critical role in the manufacturing and quality assurance of MACs. Generative AI and advanced machine vision systems are being deployed to inspect micro-fabricated components, such as the physics package (the core atomic cell), ensuring higher yields and consistent quality control, which is crucial given the complexity and precision required for CSAC manufacturing. For system integrators, AI-powered PNT assurance systems use MAC outputs as ground truth data, combined with inputs from inertial sensors and other sources, to filter out malicious spoofing or interference, solidifying the MAC’s role as the definitive local timing reference in resilient networking and defense applications.

- AI-driven frequency stabilization algorithms enhance long-term clock holdover capability.

- Machine learning optimizes power management profiles for MACs in constrained environments (low-SWaP optimization).

- Predictive maintenance models forecast component aging and drift, minimizing downtime and calibration cycles.

- AI facilitates robust timing fusion, integrating MAC data with GNSS and inertial sensors for resilient PNT solutions.

- Advanced computer vision and ML models improve quality control and manufacturing yields for Chip-Scale Atomic Clocks (CSACs).

- AI-enabled network synchronization protocols utilize high-precision MAC timing to manage distributed computing and 5G/6G network traffic.

DRO & Impact Forces Of Miniature Atomic Clock Market

The Miniature Atomic Clock (MAC) market is primarily driven by the escalating demand for resilient Positioning, Navigation, and Timing (PNT) capabilities in military and civil infrastructure, counterbalancing significant technological restraints and focusing on substantial opportunities in emerging sectors. The primary driver is the critical vulnerability of traditional timing systems (e.g., GNSS dependency) to jamming and spoofing, necessitating on-board, independent timing sources like MACs. Opportunities arise largely from the shift toward Chip-Scale Atomic Clocks (CSACs), which are making high precision timing accessible for smaller platforms and commercial applications such as autonomous vehicles and quantum computing synchronization, significantly expanding the total addressable market beyond defense procurement. These market dynamics are shaped by high impact forces related to geopolitical instability influencing defense spending and rapid technological scaling of quantum technologies.

Major market restraints center around the complexity and high initial cost associated with manufacturing MACs, particularly the physics package (the atomic cell and laser components), which requires specialized facilities and highly skilled labor, limiting production scale and increasing unit price. Furthermore, the stringent export controls (e.g., ITAR regulations in the US) placed on advanced atomic timing devices restrict international commercial sales and collaboration, primarily affecting non-NATO and emerging economies. The impact forces are currently dominated by government investment in infrastructure resilience and defense modernization, where the need for absolute reliability outweighs cost constraints. However, as CSAC technology matures and component commonality increases, the balance is shifting towards commercial viability, potentially reducing reliance on high-cost, specialized manufacturing techniques over the forecast period.

The convergence of PNT requirements across defense, space, and telecommunications creates synergistic opportunities. For instance, the demand for highly synchronized, low-latency 5G/6G networks mirrors the military requirement for reliable clock holdover. This convergence encourages manufacturers to invest in dual-use technologies, driving down costs through increased volume. Potential risks include rapid obsolescence if alternative, non-atomic timing technologies (such as high-stability optical clocks or advanced MEMS oscillators) achieve comparable performance metrics at significantly lower SWaP. However, the unique, fundamental accuracy derived from atomic transitions secures the MAC market's strategic position for the foreseeable future, making the impact of technological advancement in miniaturization the most significant positive force propelling the market forward.

Segmentation Analysis

The Miniature Atomic Clock market is systematically segmented based on clock type, application, and end-user, reflecting the diverse and specialized requirements across different industries. Segmentation by clock type is crucial as it defines the level of stability, size, power consumption, and resulting unit cost. Rubidium clocks currently dominate the revenue landscape due to their established reliability and superior holdover performance, while the fastest growth is observed in the Chip-Scale Atomic Clock (CSAC) category, driven by the intense focus on miniaturization for highly integrated electronic systems. Understanding these segments is vital for manufacturers to tailor their R&D investments and marketing strategies, ensuring alignment with the specific performance needs of defense, telecommunications, and emerging commercial sectors.

- By Type:

- Rubidium Atomic Clocks (RACs)

- Chip-Scale Atomic Clocks (CSACs)

- Cesium Beam Atomic Clocks (Miniature/Portable Standards)

- By Application:

- Defense and Aerospace (PNT, Radar, Secure Communications)

- Telecommunications (5G/6G Synchronization, Network Backbone)

- Space Applications (Satellites, Deep Space Missions, Ground Stations)

- Metrology and Test Equipment

- Financial Trading and Data Centers

- By End-User:

- Government and Military Agencies

- Telecommunication Service Providers

- Aerospace and Satellite Manufacturers

- Research and Academic Institutions

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Miniature Atomic Clock Market

The value chain for the Miniature Atomic Clock market is highly specialized and relies on deep technical expertise spanning quantum physics and advanced micro-fabrication. The upstream segment involves the production of highly critical, proprietary components, including the physics package (atomic vapor cell, micro-heater, laser diode), control electronics (ASICs for frequency locking and synthesis), and highly stable quartz reference oscillators. Sourcing these components is challenging, as the laser diodes and atomic cells require extremely tight manufacturing tolerances, often necessitating vertical integration or exclusive supplier relationships to ensure quality and supply chain security, especially for high-reliability military-grade MACs.

Midstream activities involve the complex integration, calibration, and ruggedization of the clocks. The manufacturing process includes meticulous assembly in cleanroom environments, followed by extensive thermal and vibration testing to ensure stability across operational environments (e.g., space vacuum, extreme temperatures). Direct and indirect distribution channels play a distinct role. Direct distribution is common for high-value defense contracts and specific aerospace customers, involving long sales cycles, rigorous compliance checks, and highly specialized technical support. Indirect distribution, often through specialized electronics distributors or system integrators, handles the growing commercial segment, such as telecommunications infrastructure providers and metrology equipment manufacturers, demanding standardized products and scalable volume.

The downstream segment is defined by the integration of MACs into larger PNT systems or network hardware. End-users require extensive post-sale support for long-term calibration and maintenance. The transition to CSACs is simplifying the integration process, allowing these clocks to be treated more like standard electronic components, potentially streamlining indirect channels. However, due to the strategic importance of precise timing, robust cybersecurity features and long-term supply agreements are essential components of the downstream relationship, underscoring the necessity for tight collaboration between MAC manufacturers and prime system integrators throughout the product lifecycle.

Miniature Atomic Clock Market Potential Customers

Potential customers for Miniature Atomic Clocks are organizations that require exceptionally precise and reliable timing sources where size, weight, and power consumption are critical limiting factors, often operating in environments where GNSS signals are unavailable or compromised. The largest and most demanding customer segment remains governmental and military entities across all major geographies. These agencies procure MACs for next-generation weapons systems, military vehicle synchronization, battlefield communication networks, and secure navigation systems that must operate reliably despite sophisticated electronic warfare threats. Procurement decisions in this sector are driven by mission criticality, adherence to military specifications (Mil-Spec), and domestic supply chain reliability, often outweighing cost considerations.

The rapidly growing commercial segment includes telecommunication providers and satellite operators. Telecom carriers are high-volume buyers of MACs (especially CSACs) for deployment in distributed 5G/6G small cell base stations and core network synchronization units, ensuring the high throughput and low latency required for time-sensitive applications. Satellite manufacturers, particularly those deploying large Low Earth Orbit (LEO) constellations, are adopting MACs for on-board timing and inter-satellite communication synchronization. Additionally, financial institutions that engage in high-frequency trading rely on MACs for timestamping transactions with microsecond accuracy to comply with regulatory requirements and ensure market fairness, representing a niche but high-value customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $110 Million |

| Market Forecast in 2033 | $285 Million |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microchip Technology Inc., Spectracom (Orolia/Safran), Leonardo DRS, AccuBeat Ltd., Excelitas Technologies Corp., Frequency Electronics, Inc., Timing & Sync (Spectratime), IQD Frequency Products, RITM, Seiko Epson Corporation, Stanford Research Systems, Chronos Technology, Chengdu Spaceon Electronics Co., Ltd., AOSense, Inc., Vescent Photonics, Inc., TRAK Microwave, Chengdu Xinzhou Precision Clock and Synchronization Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Miniature Atomic Clock Market Key Technology Landscape

The technology landscape for Miniature Atomic Clocks is defined by continuous innovation in quantum physics applied to miniaturized electronic systems, primarily focusing on reducing the Size, Weight, and Power (SWaP) footprint while maintaining or improving frequency stability. The core technology involves the physics package—a vacuum-sealed cell containing an alkali metal (usually Rubidium or Cesium) and associated optical components (laser, optics, photodetector). Recent technological breakthroughs are centered on utilizing micro-electromechanical systems (MEMS) fabrication techniques to significantly shrink these packages, leading directly to the commercial viability of Chip-Scale Atomic Clocks (CSACs). These advancements necessitate the use of highly precise micro-lasers and advanced ASIC design for closed-loop frequency locking mechanisms, which are crucial for rapid lock time and maintaining long-term stability under dynamic conditions.

A critical area of technological differentiation lies in the development of low-power control electronics. Traditional MACs consume substantial power for heating the atomic cell and operating the laser. Manufacturers are leveraging highly integrated CMOS technologies and specialized algorithms to minimize thermal management requirements and optimize the laser driving circuitry. Furthermore, the integration of advanced anti-jamming and anti-spoofing techniques directly into the MAC module is becoming essential, positioning the clock not just as a timing source, but as a resilient timing system capable of validating external synchronization inputs. Research is also accelerating in pulsed optical pumping techniques and advanced magnetic shielding to enhance short-term stability and resilience against electromagnetic interference (EMI), a common challenge in dense electronic environments.

Looking forward, the technology landscape is being influenced by next-generation quantum sensing and timing research, notably the transition towards optical clocks, though their full miniaturization for field deployment remains a challenge. Current commercial focus, however, remains firmly on improving CSAC performance, specifically pushing stability closer to that of traditional Rubidium clocks while maintaining the low-SWaP advantage. Innovations in non-magnetic physics packages and improved environmental isolation techniques are key competitive technologies. Successful market participants are those who can master the integration of heterogeneous technologies—combining quantum physics, semiconductor manufacturing, and advanced thermal engineering—to deliver robust, production-ready MACs at scale.

Regional Highlights

- North America: This region holds the largest market share, driven primarily by extensive defense spending, particularly in the United States, focused on developing resilient PNT systems for military aircraft, ground vehicles, and missile guidance. Major R&D initiatives funded by organizations like DARPA (Defense Advanced Research Projects Agency) and the presence of leading defense contractors (e.g., Leonardo DRS, Microchip) solidify its dominance. The early adoption of CSAC technology for military applications provides a significant commercial advantage, leading the world in technology readiness and deployment volume.

- Europe: The European market is characterized by strong civil and military cooperation, exemplified by its involvement in the Galileo GNSS program, which requires highly reliable atomic timing for both ground and space segments. Key drivers include stringent EU regulations for network synchronization in telecom (e.g., e-PTP standards) and robust aerospace manufacturing sectors in countries like France and Germany. Growth is steady, focused on reliable Rubidium standards for long-term infrastructure stability and modernization of existing defense platforms.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive 5G/6G network deployments, particularly in China and South Korea, where the density of required synchronization points drives high demand for cost-effective, high-volume CSAC units. Furthermore, aggressive government investment in indigenous space programs (e.g., China's BeiDou and India's NavIC) and increasing defense budgets contribute significantly to the adoption of both miniaturized Cesium and Rubidium standards for high-precision navigation and reconnaissance assets.

- Latin America, Middle East, and Africa (MEA): This combined region represents a smaller but emerging market, primarily driven by critical infrastructure projects and national defense modernization efforts. Demand is concentrated in countries investing heavily in secure communications, resource exploration mapping, and establishing independent timing infrastructure to reduce reliance on foreign satellite systems. Growth is highly dependent on technology transfer agreements and direct government-to-government procurement channels for advanced PNT technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Miniature Atomic Clock Market.- Microchip Technology Inc.

- Spectracom (Orolia/Safran)

- Leonardo DRS

- AccuBeat Ltd.

- Frequency Electronics, Inc.

- Excelitas Technologies Corp.

- Timing & Sync (Spectratime)

- IQD Frequency Products

- RITM

- Seiko Epson Corporation

- Stanford Research Systems

- Chronos Technology

- Chengdu Spaceon Electronics Co., Ltd.

- AOSense, Inc.

- Vescent Photonics, Inc.

- TRAK Microwave

- EFRATOM

- Oscilloquartz (ADVA Optical Networking)

- Symmetricom (Microsemi/Microchip)

- Chengdu Xinzhou Precision Clock and Synchronization Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Miniature Atomic Clock market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a CSAC and a standard Rubidium MAC?

The primary difference lies in Size, Weight, and Power (SWaP) consumption. Chip-Scale Atomic Clocks (CSACs) are miniaturized using MEMS technology, consuming significantly less power (often less than 150 mW) and occupying a smaller volume, making them ideal for portable and embedded systems, though standard Rubidium MACs typically offer slightly better long-term frequency stability and holdover performance.

Which applications are driving the highest demand for Miniature Atomic Clocks?

The highest demand is driven by military Positioning, Navigation, and Timing (PNT) systems requiring resilient holdover capabilities against GNSS denial, followed closely by the global deployment of 5G/6G telecommunication infrastructure which demands precise network synchronization for low-latency performance.

How is the reliance on GNSS influencing the MAC market growth?

Increased vulnerability of GNSS signals to jamming and spoofing is the single largest driver for MAC growth. MACs provide an independent, stable, on-board timing reference that allows systems to maintain precise synchronization and navigation accuracy when satellite signals are compromised or unavailable, ensuring mission continuity.

What are the main technological restraints affecting the mass production of MACs?

The main restraints involve the technical complexity and high cost of producing the core physics package, specifically the atomic vapor cell and miniaturized laser components, which require highly specialized micro-fabrication techniques and cleanroom conditions, limiting scalability and increasing the unit price compared to quartz oscillators.

Which region currently leads the Miniature Atomic Clock market?

North America currently leads the Miniature Atomic Clock market in terms of revenue share, primarily due to the extensive defense expenditure in the United States dedicated to advanced PNT modernization and the strong established presence of key market manufacturers and aerospace contractors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Miniature Atomic Clock Market Statistics 2025 Analysis By Application (Navigation, Military/Aerospace, Telecom/Broadcasting), By Type (Production Frequency: below 5MHz, Production Frequency: 5-10MHz, Production Frequency: >10MHz), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Military Miniature Atomic Clock Market Statistics 2025 Analysis By Application (Land Army, Navy, Air Force), By Type (Production Frequency: 10MHz), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager