Miniature Ball Bearings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441186 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Miniature Ball Bearings Market Size

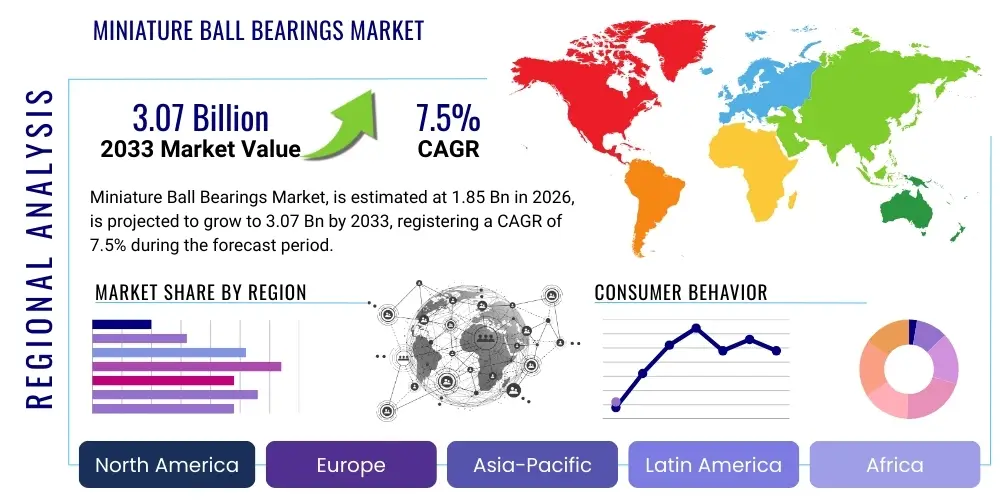

The Miniature Ball Bearings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.07 Billion by the end of the forecast period in 2033.

Miniature Ball Bearings Market introduction

Miniature ball bearings are precision mechanical components designed to handle radial and axial loads efficiently in constrained spaces. These bearings typically feature outer diameters of less than 30mm, though the definition often focuses on those with outer diameters below 10mm, encompassing crucial sizes such as 680 series and 690 series. Their fundamental role is to reduce rotational friction and support loads in high-speed, high-precision applications where size and weight are critical limiting factors. The robust design, often featuring stainless steel or specialized chrome steel races, allows them to maintain high accuracy and reliability even in demanding operational environments, making them indispensable components across various advanced technological sectors requiring miniaturization.

The principal applications of miniature ball bearings span a wide array of sophisticated industries, including medical devices like dental drills and surgical robotics, aerospace instrumentation, high-density consumer electronics (such as micro-motors and specialized cameras), and intricate industrial machinery, including precision tooling and semiconductor manufacturing equipment. The product benefits are substantial, centering on friction reduction, energy efficiency, minimal noise generation, and prolonged service life. Their small size facilitates the design of compact and highly functional devices, meeting the escalating global demand for miniaturized and portable technology across industrial and consumer landscapes. These benefits directly contribute to improved device performance and reduced maintenance costs, fueling their widespread adoption across highly sensitive applications.

The market is predominantly driven by the rapid advancements in automation and robotics, which necessitate high-precision rotary components operating in tight envelopes. Furthermore, the sustained expansion of the medical device industry, particularly in diagnostics and minimally invasive surgical tools, significantly boosts demand. The increasing complexity and miniaturization trends in the aerospace sector, specifically concerning guidance systems and actuators, also contribute heavily. Economic factors, such as rising disposable incomes in emerging economies leading to higher consumer electronics adoption, coupled with the global push for Industry 4.0 standards, solidify the positive trajectory for the Miniature Ball Bearings Market, making it a critical area of growth for precision engineering firms globally.

Miniature Ball Bearings Market Executive Summary

The Miniature Ball Bearings Market exhibits strong growth momentum, primarily influenced by accelerating technological convergence in medical and consumer electronics sectors. Key business trends include the emphasis on specialized materials, such as hybrid ceramic compositions, to enhance performance parameters like rotational speed, thermal resistance, and lifespan in critical applications. Manufacturers are focusing on stringent quality control and achieving zero-defect production standards, which is vital for end-users in aerospace and surgical robotics. Mergers and acquisitions are frequent among specialized bearing manufacturers seeking to consolidate technological capabilities and expand geographic reach, especially in high-growth Asian markets. Furthermore, sustainability and material optimization are becoming central strategic pillars for leading market participants.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by its massive manufacturing capacity in consumer electronics and the burgeoning automotive sector, particularly electric vehicles (EVs), which utilize miniature bearings in various cooling and sensor systems. North America and Europe maintain leading positions in terms of high-value applications, such particularly medical and aerospace, characterized by demand for ultra-precision and highly customized bearing solutions. European manufacturers are distinguished by their high engineering standards and technological innovation, often setting benchmarks for precision and durability globally. The Middle East and Africa (MEA) and Latin America represent nascent, but rapidly developing markets, fueled by increasing infrastructure investment and industrial modernization initiatives requiring reliable mechanical components. This regional disparity reflects varied investment levels in automation and high-tech manufacturing.

Segmentation trends highlight the increasing preference for deep groove ball bearings due to their versatility and cost-effectiveness, although angular contact bearings are gaining traction in high-speed applications where stiffness and axial load capacity are paramount. In terms of size, the micro-bearings segment (less than 10mm outer diameter) is experiencing the fastest growth, directly correlating with the continuous miniaturization across electronic and medical domains. The material segment sees robust demand for specialized stainless steel variants offering superior corrosion resistance, crucial for applications in humid environments or requiring frequent sterilization. The application landscape confirms that medical and aerospace sectors command the highest average selling prices, reflecting the stringent certification and quality demands inherent to these fields.

AI Impact Analysis on Miniature Ball Bearings Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Miniature Ball Bearings Market predominantly focus on its role in enhancing manufacturing efficiency, enabling predictive maintenance, and optimizing supply chain resilience. Users are keen to understand how AI-driven vision systems and machine learning algorithms can improve quality assurance processes, identifying microscopic defects during production that human inspection might miss. A significant concern revolves around the implementation cost and the required digital infrastructure investment needed for small and medium-sized bearing manufacturers to adopt these advanced AI capabilities. Furthermore, expectations are high regarding AI's potential to dramatically extend bearing lifespan estimates and minimize unexpected operational failures in mission-critical applications like aerospace and robotics, transforming the traditional maintenance scheduling approach from reactive or time-based to true condition-based monitoring, thereby maximizing Mean Time Between Failure (MTBF) metrics and reducing total cost of ownership (TCO).

- AI-enhanced Quality Control: Utilizing machine vision for real-time, non-destructive inspection of raceway surfaces and component geometry, drastically reducing defect rates.

- Predictive Maintenance Protocols: Deploying machine learning models on vibration and temperature sensor data to forecast bearing failure with high accuracy, enabling scheduled replacements.

- Optimized Production Planning: AI algorithms streamline material procurement and scheduling, balancing inventory levels while minimizing waste and enhancing manufacturing throughput.

- Design Optimization: Generative design fueled by AI accelerates the iteration process for complex bearing geometries, improving load distribution and speed capabilities.

- Supply Chain Resilience: AI models predict supply chain disruptions, optimizing logistics and inventory buffer stock management for critical raw materials such as specialized steel alloys.

DRO & Impact Forces Of Miniature Ball Bearings Market

The Miniature Ball Bearings Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces shaping its future trajectory. A dominant driver is the pervasive trend of technological miniaturization across nearly all industrial and consumer sectors, necessitating compact, high-performance mechanical components. This is coupled with the rapid global expansion of the robotics and automation industries, particularly in manufacturing and logistics, which rely heavily on precise rotary motion control achieved through miniature bearings. Restraints, however, include the extreme sensitivity of these products to manufacturing contaminants and the intense price competition from mass-market producers, particularly in Asia, pressuring profit margins for high-precision specialists. Furthermore, the reliance on highly specialized raw materials and the complex, capital-intensive manufacturing processes required to achieve micron-level tolerances pose significant entry barriers and operational challenges.

Opportunities for growth are primarily concentrated in the development and commercialization of next-generation materials, specifically ceramic and hybrid ceramic bearings, which offer superior performance characteristics in high-temperature, high-speed, and non-magnetic environments, essential for emerging applications like magnetic resonance imaging (MRI) machines and high-frequency motors. The increasing adoption of electric vehicles (EVs) also presents a massive opportunity, as miniature bearings are crucial in lightweight cooling systems, steering components, and sensor assemblies within these vehicles. Strategic investments in fully automated and AI-integrated manufacturing facilities provide manufacturers the chance to leapfrog competitors in quality and cost efficiency, transforming the traditional manufacturing paradigm and enhancing overall operational visibility, providing measurable advantages.

The resultant impact forces are driving the market towards polarization: high-volume, low-cost producers focusing on standard components for consumer goods, and specialized, high-precision manufacturers commanding premium prices in aerospace, medical, and defense sectors. Regulatory standards regarding quality and traceability in fields like medical devices (e.g., FDA requirements) act as strong positive impact forces favoring established, certified manufacturers. Conversely, economic volatility and global trade disputes, impacting the supply of specialized steel and lubrication, act as restraining impact forces, mandating diversified sourcing strategies and resilient supply chains to mitigate potential disruptions and maintain consistent production schedules globally, demanding continuous risk assessment and management.

Segmentation Analysis

The Miniature Ball Bearings Market is fundamentally segmented based on critical performance attributes, structural design, material composition, and end-user application. This granular segmentation allows market participants to tailor their product offerings and strategic focus towards specific niches where stringent precision or specialized operational characteristics are paramount. The segmentation analysis is essential for understanding the varying demand dynamics, pricing structures, and competitive intensity across different bearing specifications. Deep groove ball bearings dominate the volume market due to their versatility and cost-effectiveness, while the rapid growth observed in the hybrid segment underscores the industry's shift towards maximizing rotational efficiency and longevity under extreme conditions, aligning with Industry 4.0 demands for resilient componentry and long-term asset performance metrics.

Key segment differentiators include the bearing size range, particularly differentiating standard miniature bearings from micro-bearings (those with bore diameters below 3mm), which caters directly to the ultra-miniaturization trend in electronics and delicate surgical instruments. Furthermore, the material used, such as specialized stainless steel alloys (like 440C or high-nitrogen steel) versus conventional chrome steel, dictates the bearing's suitability for environments demanding corrosion resistance, high sterilization cycles, or exposure to harsh chemicals. Understanding these segments is crucial for strategic market positioning, allowing companies to invest precisely in R&D efforts that address high-value, unmet needs, such as developing silent, non-magnetic bearings for specific scientific instrumentation applications, ensuring high accuracy and performance stability under constrained conditions for extended periods of continuous operation.

The application segmentation reveals that the demand profiles differ significantly; for example, aerospace requires compliance with strict operational safety standards (AS9100 certification), prioritizing reliability and specific fatigue life, justifying a high price point. Conversely, the consumer electronics segment is highly sensitive to cost and mass production scalability. Analyzing these segmented requirements ensures effective resource allocation, from optimizing manufacturing yields for high-volume segments to focusing on specialized testing and certification for safety-critical components. This structured approach provides clarity on where the highest revenue potential and future innovation opportunities lie within the highly technical domain of precision ball bearings, ensuring resource maximization and minimizing investment risk across various product lines.

- By Product Type:

- Deep Groove Ball Bearings

- Angular Contact Ball Bearings

- Thrust Ball Bearings

- Self-Aligning Ball Bearings

- By Size (Outer Diameter):

- Under 10 mm (Micro-Bearings)

- 10 mm to 30 mm (Miniature Standard)

- By Material:

- Stainless Steel Bearings

- Chrome Steel Bearings

- Hybrid Ceramic Bearings (Steel Races, Ceramic Balls)

- Full Ceramic Bearings

- By Application:

- Aerospace and Defense (Actuators, Gyroscopes)

- Medical Devices (Dental Drills, Surgical Robotics, Imaging Equipment)

- Automotive (Sensors, Small Motors, Fuel Systems)

- Industrial Machinery (Precision Instruments, Robotics, Machine Tools)

- Consumer Electronics (Micro-Motors, Cameras, Disk Drives)

Value Chain Analysis For Miniature Ball Bearings Market

The value chain for miniature ball bearings is intricate, beginning with the procurement of specialized raw materials, primarily high-grade steel alloys (such as 52100 chrome steel or 440C stainless steel) and specialized ceramics (silicon nitride). The upstream analysis involves critical partnerships with steel mills and materials processors that can guarantee the purity, consistency, and traceability of the alloys, which is fundamental to achieving the high hardness and fatigue resistance required for precision bearings. Flawless raw material quality is non-negotiable, as any microscopic impurity can drastically reduce the bearing's operational life. Effective upstream management involves long-term contracts and strategic partnerships to secure supply stability and control fluctuating commodity prices, crucial for managing the cost of goods sold (COGS) in a highly competitive manufacturing environment, requiring precise forecasting.

The core manufacturing process, or midstream segment, involves highly technical steps: forging, heat treatment, grinding, honing, and superfinishing of races, followed by assembly with retainer cages and highly specialized lubricants. This stage is capital-intensive, requiring specialized, high-precision Computer Numerical Control (CNC) equipment capable of achieving tolerances in the micron range. Quality control is paramount, often integrating advanced optical and measurement systems. The efficiency of the midstream operation dictates the final cost and performance characteristics of the bearing, with leading manufacturers focusing on continuous process improvement and automation to minimize material waste and energy consumption while maximizing output yield for precision components, ensuring scalability without quality degradation.

The downstream analysis focuses on distribution channels, which are typically bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) in aerospace and medical sectors, and indirect sales through specialized industrial distributors for Maintenance, Repair, and Operations (MRO) markets and smaller industrial end-users. Direct channels emphasize technical support, customization, and long-term service agreements, requiring specialized application engineers. Indirect channels rely on efficient warehousing, logistics, and digital platforms to ensure rapid delivery of standardized products. The choice of channel significantly impacts market penetration, pricing strategy, and inventory management, with the shift towards e-commerce platforms increasingly influencing the MRO segment for standardized miniature bearings, requiring manufacturers to enhance their digital interface capabilities and streamline their fulfillment operations for high velocity delivery.

Miniature Ball Bearings Market Potential Customers

Potential customers for miniature ball bearings are diverse, predominantly comprising Original Equipment Manufacturers (OEMs) that integrate these high-precision components into their final products. The primary buyer groups reside within industries that demand high rotational speed, exceptional reliability, minimal friction, and adherence to severe size constraints. This includes the medical device sector, where manufacturers of high-speed dental handpieces, advanced surgical robotics, and specialized diagnostic imaging equipment are continuous, high-volume purchasers of certified, sterile, and often non-magnetic bearings. The stringent regulatory requirements and the necessity for zero-failure performance in these life-critical applications result in high customer loyalty and a willingness to pay a premium for certified quality, making them an extremely valuable customer segment demanding extensive documentation and traceability records throughout the product lifecycle.

Another significant customer base is the aerospace and defense industry, specifically manufacturers of guidance systems, aircraft instrumentation, precision sensors, and miniature actuators used in satellites and drones. These customers require bearings certified to handle extreme temperatures, high vacuum conditions, and specific shock and vibration resistance. Their procurement processes are characterized by long design cycles, stringent technical specifications, and a dependency on specialized suppliers capable of providing custom lubricants and coatings for extended operational lifespan under severe environmental stress. Reliability and compliance with military or aerospace quality standards (e.g., AS9100) are the core purchasing criteria for this highly regulated customer segment, often requiring multi-year qualification processes prior to mass delivery of components.

Furthermore, the high-tech industrial automation and semiconductor manufacturing equipment sectors represent crucial buyers. Companies producing multi-axis robotic arms, precision linear motion stages, measuring equipment, and specialized spindles for micro-machining depend on miniature bearings for movement accuracy and repeatability. These buyers prioritize dynamic load capacity, low noise levels, and long maintenance-free operation to maximize their uptime and overall equipment efficiency (OEE). While consumer electronics OEMs purchase high volumes of standard miniature bearings for micro-motors, fans, and optical assemblies, the industrial segment emphasizes technical performance and durability over sheer price, highlighting the nuanced purchasing requirements across the various end-user industries served by the miniature ball bearing market, thus requiring targeted sales strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.07 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NTN Corporation, NSK Ltd., MinebeaMitsumi Inc., SKF Group, Schaeffler AG, Koyo, GMN Bearing, Thinex Bearing Co. Ltd., AST Bearings, TPI Bearing, Timken Company, Barden Corporation, Pacamor Kubar Bearings, SMT, GRW Bearing, C&U Group, New Hampshire Ball Bearings, Inc., Luoyang Bearing Science & Technology Co., Ltd., JTEKT Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Miniature Ball Bearings Market Key Technology Landscape

The technological landscape of the Miniature Ball Bearings Market is defined by continuous pursuit of higher precision, extended lifespan, and superior operational characteristics under extreme conditions. A foundational technology involves the use of specialized surface treatment and finishing techniques, such as honing and superfinishing, which minimize raceway roughness to atomic levels, drastically reducing friction and noise. This micro-level surface engineering is critical for enabling high rotational speeds required in turbine applications or sensitive medical instruments. Furthermore, the advancements in clean room manufacturing environments (often ISO Class 5 or better) are necessary to prevent contamination from microscopic particles during the assembly phase, which is vital for maintaining the performance integrity of miniature precision bearings and ensuring consistent quality output across all production batches, demanding significant environmental control investments.

Material innovation represents another key technological frontier. The shift from traditional chrome steel to advanced materials, particularly hybrid bearings incorporating ceramic rolling elements (typically silicon nitride, Si3N4) and steel rings, addresses limitations related to speed, heat dissipation, and electrical resistance. Hybrid ceramic bearings are significantly lighter, allowing for higher limiting speeds, and are non-conductive, making them indispensable for applications near electric motors or sensitive electronic components. Alongside this, the development of proprietary specialized coatings, such as thin-film polymers or PVD (Physical Vapor Deposition) coatings, helps to enhance corrosion resistance and reduce wear in applications exposed to harsh fluids or requiring high sterilization cycles, thereby maximizing durability and operational life under challenging conditions, ensuring component longevity.

Beyond the physical product, smart manufacturing technologies are revolutionizing production and monitoring. This includes the integration of advanced sensors directly into the bearing or surrounding components for real-time condition monitoring. These sensors track vibration, temperature, and speed, feeding data into sophisticated AI-driven algorithms for predictive maintenance. Additionally, advanced metrology systems, including high-resolution laser scanning and contact measurement equipment, are essential for ensuring micron-level accuracy throughout the manufacturing cycle. These digital technologies contribute significantly to achieving the highly competitive quality standards required by modern high-tech end-users and ensure traceability from raw material batch to final deployment, establishing a verifiable chain of custody and quality assurance.

Regional Highlights

The global Miniature Ball Bearings Market exhibits distinct regional dynamics driven by varying levels of industrial maturity, technological adoption, and regulatory landscapes. Asia Pacific (APAC) currently holds the largest market share and is projected to maintain the highest growth rate throughout the forecast period. This dominance stems from the region's massive, cost-competitive manufacturing base for consumer electronics, automotive components, and industrial machinery, particularly in countries like China, Japan, South Korea, and India. Japan, in particular, hosts many of the world's leading miniature bearing specialists known for ultra-high precision engineering. The rapid expansion of automation and the accelerating production of electric vehicles across APAC serve as fundamental demand accelerators for miniature bearing components, driving both volume and increasing quality demands.

North America and Europe represent mature markets characterized by high demand for specialized, high-performance, and certified components. In North America, the market is heavily influenced by the aerospace and defense sectors, which prioritize customization, rigorous testing, and extended service life over raw cost. The rapid technological advancement and substantial investment in medical device innovation also anchor strong, stable demand in this region. European demand, particularly driven by Germany's robust industrial machinery and robotics sectors, emphasizes energy efficiency, low friction characteristics, and compliance with strict environmental standards. European manufacturers are often leaders in material science and lubrication technology, catering predominantly to high-value industrial applications demanding long-term reliability and specialized tolerances in challenging operational envelopes.

The remaining regions, including Latin America and the Middle East and Africa (MEA), are emerging markets that show promising growth tied to increasing foreign direct investment in manufacturing and infrastructure development. Latin America’s industrial modernization efforts, particularly in Brazil and Mexico, are boosting demand for imported machinery, consequently increasing the need for miniature replacement and OEM bearings. In MEA, the diversification of economies away from oil dependency is driving investments in industrial automation and technology sectors, creating new, albeit smaller, opportunities for precision bearing suppliers. However, these regions often face challenges related to logistical complexity and the dominance of price sensitivity in procurement decisions, making localized distribution networks and competitive pricing essential for market penetration and sustained growth, requiring adapted business models.

- Asia Pacific (APAC): Dominant market share fueled by mass manufacturing, robust consumer electronics production, and leadership in Electric Vehicle (EV) components, particularly centered in East Asia.

- North America: High-value market focused on highly regulated industries, including aerospace, defense, and specialized medical device manufacturing, demanding ultra-high precision and certification compliance.

- Europe: Strong demand driven by advanced industrial automation, high-end automotive manufacturing, and specialized machine tools, emphasizing performance, durability, and technological innovation in materials.

- Latin America: Emerging market showing growth due to industrial modernization, infrastructure investment, and increased adoption of foreign manufacturing equipment in key economic centers.

- Middle East and Africa (MEA): Nascent growth driven by economic diversification projects and increasing urbanization, leading to higher requirements for industrial maintenance and small-scale automation machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Miniature Ball Bearings Market.- MinebeaMitsumi Inc.

- NSK Ltd.

- NTN Corporation

- SKF Group

- Schaeffler AG

- Koyo (JTEKT Corporation)

- Barden Corporation (A Division of Schaeffler Group)

- Timken Company

- GRW Bearing GmbH (A member of the myonic Group)

- Pacamor Kubar Bearings (PKB)

- GMN Bearing USA Ltd.

- AST Bearings LLC

- TPI Bearing

- New Hampshire Ball Bearings, Inc. (A MinebeaMitsumi Group Company)

- Thinex Bearing Co. Ltd.

- C&U Group

- Luoyang Bearing Science & Technology Co., Ltd. (LYC)

- Kugler Bimetal SA

- SMT - Specialty Motions, Inc.

- HQW Precision GmbH

Frequently Asked Questions

Analyze common user questions about the Miniature Ball Bearings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Miniature Ball Bearings Market?

The central driver is the pervasive trend of technological miniaturization across all high-tech sectors, particularly in advanced robotics, aerospace instrumentation, and portable medical devices, demanding increasingly compact and high-precision rotary components. This demand is further amplified by the global acceleration of industrial automation and the push toward Industry 4.0 standards for enhanced productivity.

Which application segment holds the highest value share in the market?

The Medical Devices and Aerospace and Defense segments typically command the highest average selling prices (ASPs) and value share within the miniature ball bearings market. This is due to the mandatory requirements for ultra-high precision, rigorous quality certification, specialized materials (like non-magnetic or ceramic options), and guaranteed reliability in life-critical and mission-critical systems.

How do hybrid ceramic miniature bearings differ from standard steel bearings?

Hybrid ceramic bearings feature steel rings but use ceramic (typically silicon nitride) rolling balls, offering significant advantages over full steel bearings, including reduced weight, higher limiting speeds, superior rigidity, enhanced resistance to corrosion, and inherent non-conductivity, making them ideal for high-frequency motor and specialized electrical applications where heat generation is a concern.

What are the main regional challenges faced by miniature bearing manufacturers?

Regional challenges include intense price competition from high-volume manufacturers primarily located in the Asia Pacific region, particularly for standard-sized components. Additionally, manufacturers in North America and Europe face stricter regulatory barriers and the constant pressure to innovate new materials to maintain technological competitiveness and meet stringent industry certifications (e.g., AS9100 and ISO 13485) required by specialized OEMs.

What impact does AI have on the manufacturing process of miniature ball bearings?

AI primarily impacts manufacturing through the deployment of advanced machine vision systems for ultra-precise, real-time quality control, ensuring microscopic defects are identified and rejected. Furthermore, AI-driven machine learning algorithms are utilized in predictive maintenance programs to monitor operational health and optimize the scheduling of equipment servicing, dramatically reducing unexpected downtime in capital-intensive production facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager