Miniature Ballscrews Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442849 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Miniature Ballscrews Market Size

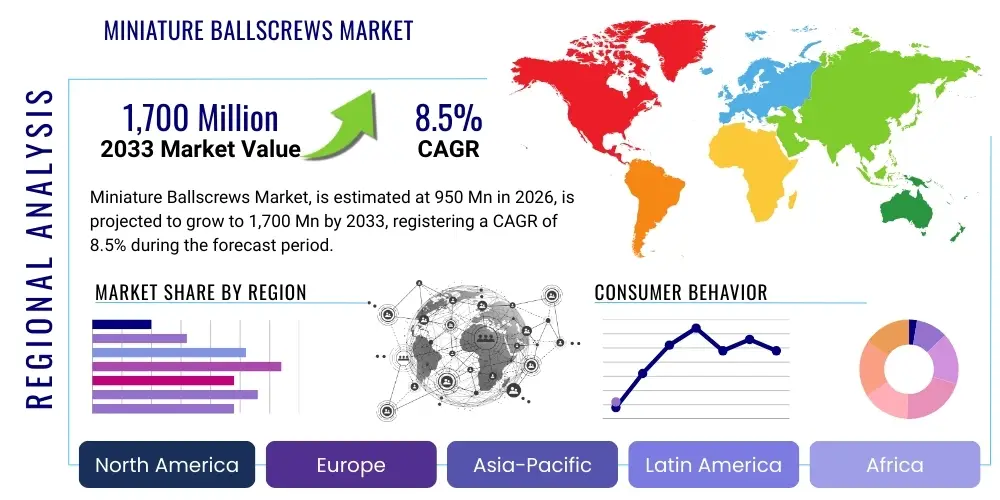

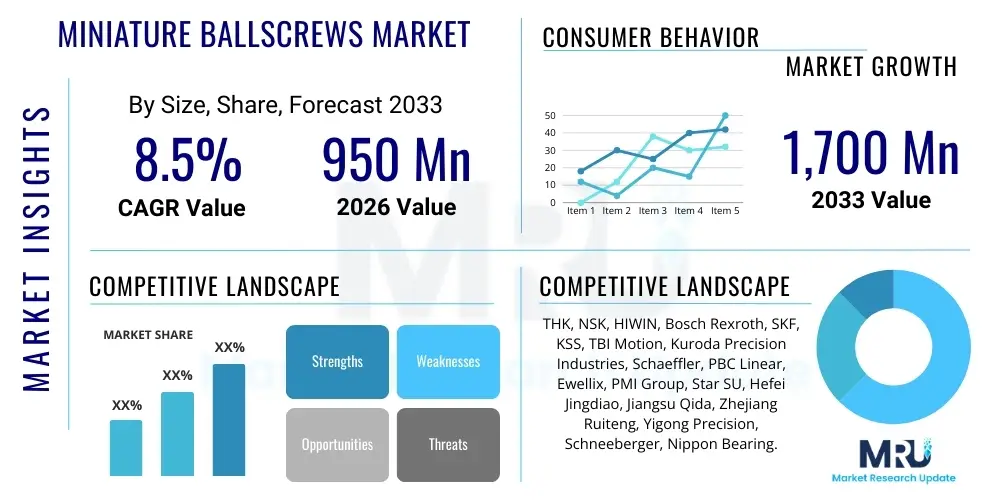

The Miniature Ballscrews Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 950 Million in 2026 and is projected to reach USD 1,700 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for ultra-precise motion control systems across burgeoning high-technology sectors such as medical devices, advanced robotics, and semiconductor manufacturing equipment. Miniaturization trends in electronics and mechanical assemblies necessitate components that offer high efficiency, repeatability, and compact size, positioning miniature ballscrews as critical enabling technology for next-generation automated systems. The market valuation reflects sustained investment in automated industrial processes globally, particularly in Asian economies which lead manufacturing output.

Miniature Ballscrews Market introduction

Miniature ballscrews are precision mechanical components designed to convert rotational motion into linear motion with minimal friction, characterized by screw diameters typically ranging from 3 mm up to 16 mm. These devices are essential for achieving high accuracy, speed, and rigidity in space-constrained applications. The core product function involves a screw shaft, a nut, and recirculating balls that reduce kinetic friction significantly compared to traditional lead screws, thereby enhancing energy efficiency and reducing wear. Major applications span sophisticated medical diagnostic equipment, where precise fluid delivery or positioning is critical; semiconductor wafer handling systems requiring nanometer-level accuracy; and compact robotic actuators used in intricate assembly tasks. The primary benefits include superior positioning accuracy, high load capacity relative to size, long operational lifespan, and smooth, consistent operation. Driving factors fueling market growth include the global push toward Industry 4.0, the rapid scaling of automated laboratories, and the perpetual need for smaller, faster, and more precise manufacturing tools. Furthermore, advancements in materials science allowing for lighter and stronger screws are continuously improving product performance parameters, broadening the potential application spectrum across specialized industries seeking competitive operational advantages through automation.

Miniature Ballscrews Market Executive Summary

The Miniature Ballscrews Market is characterized by intense competition among established precision engineering firms, coupled with notable innovations targeting improved accuracy (down to sub-micron levels) and enhanced durability for sterile environments, particularly in the life sciences sector. Current business trends indicate a shift towards customized, application-specific solutions, moving away from standardized components. Manufacturers are increasingly integrating smart monitoring capabilities into screw systems—leveraging sensors and IoT platforms—to enable predictive maintenance and real-time performance optimization, which serves as a major differentiator. Supply chain resilience has become a focal point following global disruptions, prompting strategic localized production efforts among key players to secure component availability for critical high-demand sectors like aerospace and optics. These strategic maneuvers underscore a commitment to reliability and high-quality assurance necessary for components operating in mission-critical machinery.

Regionally, Asia Pacific (APAC) dominates the market share, predominantly due to the heavy concentration of semiconductor foundries, advanced electronics manufacturing hubs, and large-scale industrial automation adoption in countries like China, Japan, South Korea, and Taiwan. These nations represent both significant consumption centers and major production bases for high-precision machinery, driving robust demand for miniature ballscrews. North America and Europe follow, characterized by high-value applications in medical technology, research laboratories, and aerospace systems, which demand the highest accuracy classes (C0, C1). While APAC focuses heavily on volume manufacturing efficiency, Western markets prioritize system integration, sophisticated regulatory compliance, and customized, low-volume, ultra-high-precision components. The market dynamics thus reflect a dual growth strategy: volume-driven expansion in the East and value-driven technological leadership in the West.

Segment trends reveal that the Ground Ballscrews segment, despite higher manufacturing costs, maintains strong momentum due to their superior precision, making them indispensable in applications like computerized numerical control (CNC) machines and precision optics alignment systems. Conversely, the Rolled Ballscrews segment provides a cost-effective alternative for less stringent applications while still offering substantial performance improvements over traditional screws, finding wide adoption in general industrial automation and robotics. The fastest-growing application segment is Semiconductor Manufacturing Equipment, driven by the intense global investment in scaling wafer production and developing smaller process nodes, which require exceptionally precise handling and positioning stages that rely heavily on miniature ballscrews for high throughput and reliability. Furthermore, the increasing complexity of minimally invasive surgical robots is rapidly propelling the demand for highly specialized miniature ballscrews within the medical application segment.

AI Impact Analysis on Miniature Ballscrews Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration influences the design, manufacturing efficiency, and predictive maintenance of miniature ballscrews. Key themes include the feasibility of using AI to optimize the grinding or rolling process for sub-micron precision, how sensor data integrated with AI can preemptively detect minor wear or failures in high-speed applications, and whether generative AI can speed up the customization cycle for application-specific ballscrew designs. There are also concerns regarding the data infrastructure required to support effective AI-driven quality control and the necessary standardization protocols for ballscrews operating within smart, interconnected industrial ecosystems. The general expectation is that AI will transform quality assurance from reactive inspection to proactive, real-time error correction during the manufacturing phase, potentially leading to unprecedented levels of reliability and consistency in miniature ballscrew production.

The immediate impact of AI is most evident in enhancing operational longevity and predictability. Machine learning algorithms, trained on vast datasets of vibration, temperature, and torque profiles captured during ballscrew operation, can identify subtle anomalies indicative of future failure far earlier than traditional condition monitoring methods. This proactive approach significantly reduces unexpected downtime in high-stakes environments, such as aerospace assemblies or 24/7 automated pharmaceutical production lines. Furthermore, AI is being utilized in the design phase to run complex simulations, evaluating performance characteristics under diverse load and speed conditions rapidly, thus accelerating the iteration cycle for new miniature ballscrew variants tailored to unique robotic or machine tool requirements. This optimization capability allows manufacturers to achieve the perfect balance between material selection, helix angle, and ball circulation design, optimizing performance parameters without extensive physical prototyping.

- AI-driven Predictive Maintenance: Utilizing ML models on real-time sensor data (vibration, temperature) to anticipate component failure, extending ballscrew lifespan, and minimizing unplanned stoppages in critical machinery.

- Manufacturing Process Optimization: AI algorithms adjust machining parameters (e.g., grinding speed, pressure) dynamically to maintain ultra-tight tolerances and improve surface finish, thereby enhancing product accuracy and consistency.

- Generative Design Acceleration: AI assists engineers in rapidly iterating on ballscrew designs based on required performance metrics (load capacity, speed, stiffness) and size constraints, shortening the customization timeline for OEMs.

- Enhanced Quality Control (QC): Implementing AI visual inspection systems for defect detection, achieving higher sensitivity and speed than human inspection, ensuring every component meets stringent precision standards.

- Supply Chain Forecasting: ML models analyze demand patterns across diverse application segments (medical, semiconductor) to optimize inventory levels and material procurement for critical components like specialty steel alloys.

DRO & Impact Forces Of Miniature Ballscrews Market

The Miniature Ballscrews Market is propelled by significant Drivers (D), constrained by key Restraints (R), and offers compelling Opportunities (O), all of which are subjected to influential Impact Forces. The primary drivers include the relentless technological advancements in medical robotics and laboratory automation, demanding increasingly smaller and more precise linear motion components. The global expansion of the semiconductor industry, characterized by continuous capital expenditure in complex lithography and inspection equipment, acts as a foundational demand generator. Simultaneously, the restraints revolve around the high initial investment required for ultra-precision manufacturing facilities necessary to produce C0 and C1 class ballscrews, coupled with the critical shortage of highly skilled technicians capable of executing the demanding assembly and quality assurance processes for these intricate mechanical systems. Opportunities lie in expanding into emerging industrial automation applications in fields such as 3D printing of high-resolution metal parts and advanced inspection systems for batteries and electric vehicle components, sectors previously less reliant on sub-micron precision motion control. The overall impact forces underscore the persistent demand for miniaturization coupled with maximized performance, forcing manufacturers into continuous innovation cycles concerning metallurgy and manufacturing tolerance management to maintain competitive relevance.

A major driver is the accelerating trend toward micro-automation across various industries. As product features shrink—from microchips to minimally invasive surgical tools—the machinery fabricating or manipulating them must achieve corresponding levels of precision and scale. Miniature ballscrews provide the ideal combination of stiffness, zero backlash, and high speed necessary for these tasks. However, the market faces constraints related to material science limitations, particularly concerning high-temperature or corrosive operating environments where standard materials degrade rapidly. Developing specialized coatings and exotic metal alloys that can withstand extreme conditions while maintaining structural integrity presents a significant cost and technological barrier. Furthermore, the intellectual property landscape surrounding patented ball recirculation systems and specialized grinding techniques creates significant entry barriers for new competitors, concentrating production expertise within a few established global leaders, which can impact supply diversification.

Opportunities for expansion are particularly robust within emerging economies that are rapidly industrializing and adopting automation for the first time, seeking to leapfrog older manufacturing methodologies directly to Industry 4.0 standards. Developing localized service and customization capabilities in these regions, specifically targeting local machine builders, represents a major growth path. The reliance of high-technology industries on just-in-time delivery models for specialized components further amplifies the impact force of supply chain reliability; any disruption to the specialized manufacturing process of these components can have cascading effects on global semiconductor or medical device production. Therefore, market players must strategically balance technological complexity, cost efficiency, and geographical diversification to capitalize on opportunities while mitigating supply chain risks inherent to high-precision manufacturing.

- Drivers:

- Rapid growth of semiconductor manufacturing (sub-micron lithography and inspection).

- Increasing adoption of high-precision medical robotics and laboratory automation equipment.

- Global Industry 4.0 initiatives driving demand for compact, efficient automation tools.

- Restraints:

- High capital expenditure required for ultra-precision grinding and assembly infrastructure.

- Strict material specifications and complexity of manufacturing high-accuracy (C0/C1) classes.

- Vulnerability to global supply chain disruptions impacting specialty steel and raw material sourcing.

- Opportunities:

- Expansion into new applications like high-resolution additive manufacturing (3D printing) and high-speed inspection systems.

- Development of smart ballscrew systems with integrated sensors for IoT and condition monitoring.

- Growth in customized, small-batch manufacturing solutions for specialized aerospace and defense applications.

- Impact Forces:

- Technological Obsolescence Risk: Constant pressure to improve accuracy and speed driven by semiconductor Moore's Law.

- Standardization Pressure: Need for standardized interfaces and performance metrics across different OEM platforms.

- Sustainability Requirements: Increasing demand for energy-efficient motion control solutions to reduce operational power consumption.

Segmentation Analysis

The Miniature Ballscrews Market segmentation provides critical insights into the varied demands across distinct application fields and performance requirements, primarily categorized by type (rolled vs. ground), diameter, and specific application sectors. The distinction between ground and rolled ballscrews is fundamental, reflecting a trade-off between cost and ultimate precision, where ground screws are necessary for the highest end of positioning accuracy required in scientific instrumentation and sophisticated CNC tooling. Diameter segmentation is crucial as it directly relates to the load capacity and speed handling capabilities, with smaller diameters (< 10mm) typically serving highly constrained environments like portable medical devices, while slightly larger miniature sizes (10mm to 16mm) are common in light industrial automation and medium-sized robotics. Analyzing these segments helps manufacturers tailor production capabilities and sales strategies to address specific market niches effectively, capitalizing on the differential growth rates observed across these specialized sub-markets.

Application-based segmentation highlights where the core value and innovation efforts are concentrated. The Semiconductor and Electronics segment remains the most lucrative due to its stringent requirements for cleanliness, vacuum compatibility, and extremely high positional repeatability, often necessitating bespoke ballscrew designs. Conversely, the Robotics and Automation segment is growing rapidly, driven by the mass deployment of collaborative robots (cobots) and automated guided vehicles (AGVs), which require reliable, maintenance-free miniature ballscrews capable of handling dynamic loads. The Medical Devices segment, covering everything from CT scanners to lab-on-a-chip systems, demands specialized, non-magnetic, and corrosion-resistant materials, representing a high-barrier, high-margin niche. Understanding the diverse performance envelopes demanded by each application is essential for strategic planning, influencing investment decisions regarding R&D into specialized coatings, materials, and assembly technologies required for market leadership.

- By Product Type:

- Ground Ballscrews (High precision, superior linearity, higher cost, used in C0-C3 classes)

- Rolled Ballscrews (Cost-effective, good performance, used in C5-C7 classes)

- By Diameter:

- Under 10mm

- 10mm to 16mm

- By Accuracy Class:

- Precision Class (C0, C1, C3)

- General Class (C5, C7)

- By Application:

- Semiconductor Manufacturing Equipment (Wafer handling, inspection systems)

- Medical Devices (Diagnostic imaging, fluid handling, surgical robotics)

- Precision Measuring Instruments and Optical Equipment

- Robotics and Automation (Light assembly robots, AGVs, machine tools)

- Aerospace and Defense (Actuators, sensor positioning)

Value Chain Analysis For Miniature Ballscrews Market

The value chain for the Miniature Ballscrews Market is intricate and highly reliant on specialized expertise at the upstream level. Upstream analysis begins with the sourcing of high-grade steel alloys, predominantly chromium-molybdenum steel or stainless steel, which must meet exacting metallurgical standards for hardness, fatigue life, and dimensional stability. Raw material suppliers must guarantee extremely low impurity levels and consistent quality, making material sourcing a critical bottleneck and a point of high leverage. Following material sourcing, primary manufacturing involves specialized processes such as cold rolling or high-precision grinding, heat treatment, and surface finishing. This upstream process requires substantial capital investment in sophisticated machinery, including multi-axis CNC grinders and specialized induction hardening equipment, which contribute significantly to the final product cost and define the component's accuracy rating (C0, C1, etc.). Maintaining high cleanliness standards throughout manufacturing is non-negotiable, particularly for components destined for vacuum or sterile environments.

The distribution channel encompasses both direct sales and indirect routes through specialized industrial distributors and system integrators. Direct sales are typically favored for high-volume, highly customized orders from large Original Equipment Manufacturers (OEMs) in the semiconductor and medical industries, allowing for close technical collaboration during the design phase. This direct model ensures intellectual property protection and precise alignment with specific application needs. Conversely, indirect distribution utilizes authorized technical distributors who maintain inventory, provide localized support, and service smaller machine builders or research institutions requiring standardized components quickly. System integrators play a crucial role by packaging the ballscrews with other linear components, such as linear guides and servo motors, providing complete motion control subsystems to end-users, thus adding significant value through integration expertise and localized technical service capabilities.

Downstream analysis focuses on the end-user applications where the miniature ballscrews are integrated. This integration necessitates extensive collaboration between the ballscrew manufacturer and the OEM to ensure proper alignment, lubrication, and mounting specifications are met, as even minor misalignment can drastically reduce accuracy and lifespan. The performance of the ballscrew directly influences the overall reliability and precision of the final machinery—be it a multi-million dollar wafer steppers or a delicate surgical robot. Post-sales service, including lubrication recommendations, maintenance scheduling, and replacement part supply, forms an important part of the downstream value proposition. The trend toward smart factories emphasizes the importance of digital connectivity, requiring ballscrew manufacturers to provide digital performance models and data outputs to facilitate the optimization of the entire machine lifecycle. This comprehensive support from sourcing specialty metals to providing end-of-life maintenance advice defines the high-value nature of the miniature ballscrews ecosystem.

Miniature Ballscrews Market Potential Customers

The primary consumers and end-users of miniature ballscrews are organizations operating in high-precision, high-stakes manufacturing and research environments where positional accuracy and reliability are paramount. These buyers fall mainly into several distinct industrial categories, most notably OEMs specializing in advanced machinery. Semiconductor equipment manufacturers, who build tools for photolithography, deposition, and inspection (e.g., ASML, KLA, Applied Materials), are key customers, demanding the highest possible accuracy classes (C0) due to the necessity of nanometer-level alignment on silicon wafers. Medical device companies are also major purchasers, integrating these components into diagnostic imaging systems (MRI, CT), surgical robots (Da Vinci systems), and laboratory automation platforms (high-throughput screening systems), where sterile operation and extreme reliability are regulatory requirements. The criticality of these applications means that purchasing decisions are heavily weighted towards supplier reputation, certification, and proven field reliability rather than solely on cost, ensuring a demand for premium, high-quality components.

Another significant segment comprises manufacturers in the precision machine tool and industrial robotics sectors. Companies producing micro-machining centers, high-speed engraving machines, and specialized automation cells for electronics assembly rely on miniature ballscrews to achieve the rapid, repetitive, and accurate movements essential for maximizing production throughput and part quality. These customers often seek a balance between precision (typically C3 or C5 class) and competitive pricing, favoring suppliers who can provide customized lengths and end-machining services quickly. Furthermore, aerospace and defense contractors constitute a specialized, high-barrier entry segment, utilizing miniature ballscrews in critical actuation systems, sensor positioning platforms, and optical alignment modules for satellites and precision guidance systems. These contracts demand rigorous quality documentation and traceability, making long-term strategic partnerships with certified suppliers essential for securing continuous supply for long-lifecycle projects.

Beyond traditional industrial applications, a rapidly growing customer base includes manufacturers in emerging technology fields such as advanced additive manufacturing (metal and polymer 3D printing requiring precise layer deposition) and specialized battery manufacturing equipment, particularly for electric vehicles, where cathode and anode material handling requires precise linear movement. Research institutions, universities, and national laboratories also purchase miniature ballscrews for experimental setups, advanced microscopy stages, and particle accelerator components, often requiring custom, low-volume components with extreme performance characteristics. The purchasing criteria across this diverse customer landscape vary widely, from requiring ultra-low particle generation for cleanroom environments to needing specific corrosion resistance for chemical processing apparatus, demonstrating the breadth of material science and design challenges manufacturers must address to serve the market effectively and maintain their competitive edge through specialized product offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Million |

| Market Forecast in 2033 | USD 1,700 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | THK, NSK, HIWIN, Bosch Rexroth, SKF, KSS, TBI Motion, Kuroda Precision Industries, Schaeffler, PBC Linear, Ewellix, PMI Group, Star SU, Hefei Jingdiao, Jiangsu Qida, Zhejiang Ruiteng, Yigong Precision, Schneeberger, Nippon Bearing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Miniature Ballscrews Market Key Technology Landscape

The technological landscape of the Miniature Ballscrews Market is defined by continuous improvements in manufacturing precision, material science, and integration capabilities aimed at meeting the ever-increasing demand for greater accuracy, speed, and durability within compact form factors. A core technological focus remains on ultra-precision grinding techniques, specifically the optimization of the grinding wheel profile and coolant delivery systems, which are crucial for achieving the C0 (sub-micron) accuracy classes required by advanced semiconductor and optical equipment. Manufacturers are leveraging advanced metrology systems, including laser interferometers and non-contact profilometers, for real-time quality verification during the grinding process, ensuring that the critical pitch accuracy and lead deviation tolerances are maintained consistently across long production runs. Furthermore, advancements in specialized thermal stabilization of machining environments are critical, as even minute temperature fluctuations can compromise the precision required for miniature components, pushing the limits of current manufacturing technology and demanding specialized cleanroom operations.

Material innovation represents another key technological frontier. The use of specialized stainless steels, ceramic balls, and advanced proprietary coatings (such as DLC - Diamond-Like Carbon) is becoming more prevalent to enhance performance characteristics. These innovations address specific application challenges: stainless steel and specialized coatings provide corrosion resistance crucial for medical sterilization environments and cleanroom applications, while ceramic balls offer superior stiffness, reduced weight, and lower noise generation, which is beneficial for high-speed robotic applications. The development of high-performance lubrication technologies, including specialized solid lubricants and low-vapor pressure greases for vacuum applications, is also vital. The ability to minimize friction and wear over millions of cycles without external maintenance is a significant competitive differentiator, often requiring manufacturers to collaborate closely with chemical and material science experts to formulate optimal lubrication solutions that maintain performance integrity across extreme temperature and load variations.

Integration technology, driven by Industry 4.0 paradigms, is transforming ballscrews from passive mechanical components into smart, connected systems. This involves embedding or integrating micro-sensors (e.g., accelerometers, temperature sensors) directly into the ballscrew assembly or surrounding nut housing. These sensors feed continuous performance data into edge computing devices, allowing AI algorithms to monitor operational health, detect early signs of wear (such as increased vibration or temperature spikes), and predict the remaining useful life (RUL) of the component. This shift towards 'Condition Monitoring Ballscrews' enables preventative maintenance scheduling and ensures maximum uptime for high-value machinery. Future technological development is centered on magnetic levitation or non-contact linear motion alternatives for ultra-high speeds and cleanliness, although miniature ballscrews, due to their superior rigidity and load capacity, are expected to remain the dominant solution for high-force, high-precision applications for the foreseeable future, driving continued refinement in recirculation system design to enhance smoothness and reduce noise profiles.

Regional Highlights

The global Miniature Ballscrews Market exhibits distinct geographical consumption and manufacturing patterns, reflecting the differential concentration of high-technology industries. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share of both production volume and consumption value. This dominance is intrinsically linked to the region’s massive investments in semiconductor fabrication plants (fabs), consumer electronics assembly, and general industrial automation expansion, particularly in mainland China, South Korea, Japan, and Taiwan. Japanese manufacturers, such as THK and NSK, are global pioneers, holding significant intellectual property and expertise in ultra-precision manufacturing, setting the standard for C0 and C1 class components. China’s rapid internal automation drive and increasing focus on domestic high-tech machinery production are fueling substantial localized demand, though often centered on the C3 and C5 precision classes, driving volume growth for rolled ballscrews and mid-range precision ground screws.

North America is characterized by high-value, stringent demand from the aerospace, defense, and advanced medical device sectors. The market here prioritizes bespoke, high-performance solutions where failure tolerance is extremely low, thus favoring suppliers capable of providing extensive application engineering support and highly customized components with guaranteed traceability. The US concentration of advanced robotics companies and specialized R&D facilities ensures a steady, albeit often lower volume, demand for the highest accuracy miniature ballscrews used in experimental setups and specialized manufacturing equipment. The purchasing landscape is dictated by rigorous military and FDA regulatory compliance, often necessitating specific material certifications and extensive testing protocols, translating into premium pricing for specialized miniature ballscrews in these vertical markets.

Europe represents a mature market driven by the German machine tool industry, precision instrumentation (e.g., optical devices, microscopes), and major automotive manufacturing automation upgrades. European companies like Bosch Rexroth and SKF leverage long histories in precision engineering to cater to these demanding sectors. The emphasis in Europe is strongly placed on energy efficiency, longevity, and standardization (e.g., adherence to DIN and ISO standards), often integrating miniature ballscrews into complete motion modules sold to OEMs across the continent. Eastern and Central European countries are experiencing accelerated industrial modernization, creating opportunities for mid-range ballscrew suppliers, focusing on cost-effective automation solutions for emerging manufacturing bases in the automotive supply chain and general industrial machinery sectors.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are poised for gradual growth, primarily centered on critical infrastructure projects, localized industrial automation in energy sectors, and essential medical equipment imports. Growth in these regions is heavily dependent on foreign direct investment (FDI) and technology transfer, creating demand primarily for reliable, standardized ballscrew products (C5-C7) required for general industrial maintenance and basic manufacturing automation. As these regions continue to diversify their economies and build out domestic manufacturing capabilities, the need for precision components will increase, opening up opportunities for global suppliers to establish localized sales and service networks focusing initially on agricultural machinery, mining equipment, and basic assembly lines.

- Asia Pacific (APAC): Dominates due to semiconductor manufacturing (China, Taiwan, South Korea) and electronics assembly; high demand across all precision classes, leading in volume production and consumption.

- North America: Focuses on high-value applications in Medical Devices, Aerospace & Defense; characterized by demand for ultra-high precision (C0/C1) and highly customized components.

- Europe: Driven by advanced Machine Tools (Germany), Robotics, and Precision Optics; emphasizes standardization, energy efficiency, and systems integration expertise.

- Latin America (LATAM) & Middle East & Africa (MEA): Emerging markets showing gradual adoption in localized general manufacturing, energy infrastructure, and imported automation equipment; focusing on reliable, standardized components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Miniature Ballscrews Market.- THK Co., Ltd.

- NSK Ltd.

- HIWIN Corporation

- Bosch Rexroth AG

- SKF Group

- KSS Co., Ltd. (Kuroda Seiko)

- TBI Motion Technology Co., Ltd.

- Kuroda Precision Industries Ltd.

- Schaeffler Group

- PBC Linear (Pacific Bearing Company)

- Ewellix (formerly SKF Linear Motion)

- PMI Group

- Star SU, LLC

- Hefei Jingdiao Precision Engineering Co., Ltd.

- Jiangsu Qida CNC Technology Co., Ltd.

- Zhejiang Ruiteng Machinery Co., Ltd.

- Yigong Precision Technology Co., Ltd.

- Schneeberger AG

- Nippon Bearing Co., Ltd. (NB)

- IKO International, Inc.

Frequently Asked Questions

Analyze common user questions about the Miniature Ballscrews market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for miniature ballscrews in the next five years?

The predominant driver is the exponential growth and continuous scaling of the global semiconductor manufacturing industry, particularly the need for ultra-precise linear stages in photolithography, inspection, and wafer handling equipment, requiring C0 and C1 class miniature ballscrews for sustained operational accuracy.

How do ground ballscrews differ from rolled ballscrews, and which applications demand the highest precision type?

Ground ballscrews are manufactured using high-precision grinding processes post-heat treatment, offering superior accuracy (C0-C3 classes) and smoother operation, essential for high-end applications like precision CNC machine tools and sophisticated medical robotics. Rolled ballscrews are cold-rolled, offering adequate precision (C5-C7) at a lower cost for general industrial automation and standard robotics.

What role does material science play in miniature ballscrew performance, especially for medical or vacuum environments?

Material science is critical for specialized applications. For medical environments, stainless steel and proprietary non-corrosive coatings are necessary for sterilization compatibility. In high-vacuum environments (common in semiconductor processing), specialized low-vapor pressure greases and materials that minimize outgassing are mandatory to prevent contamination and maintain operational integrity, often requiring ceramic balls for superior performance.

Which geographical region holds the largest market share, and why is this region dominant in miniature ballscrew consumption?

Asia Pacific (APAC), particularly Northeast Asia (Japan, South Korea, Taiwan) and China, holds the largest market share. This dominance stems from the region's massive manufacturing base for consumer electronics, industrial robotics, and its foundational position as the global hub for advanced semiconductor fabrication plants, creating sustained, high-volume demand for precision motion components.

How is AI integrating into the miniature ballscrews ecosystem to improve reliability?

AI is primarily integrated through predictive maintenance systems. Machine Learning algorithms analyze real-time sensor data (vibration, temperature) captured from smart ballscrew assemblies to predict wear patterns and anticipate failures before they occur, maximizing machine uptime and extending the component's operational life in mission-critical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager