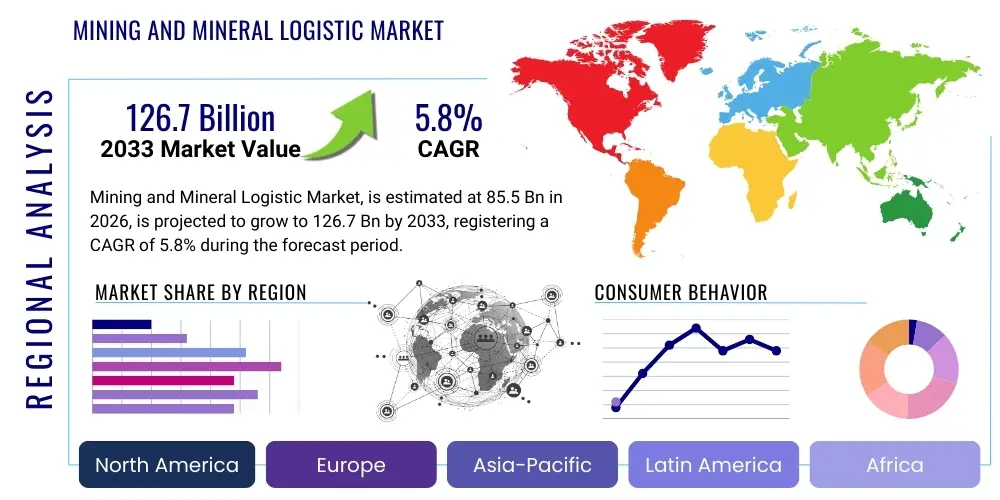

Mining and Mineral Logistic Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442421 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Mining and Mineral Logistic Market Size

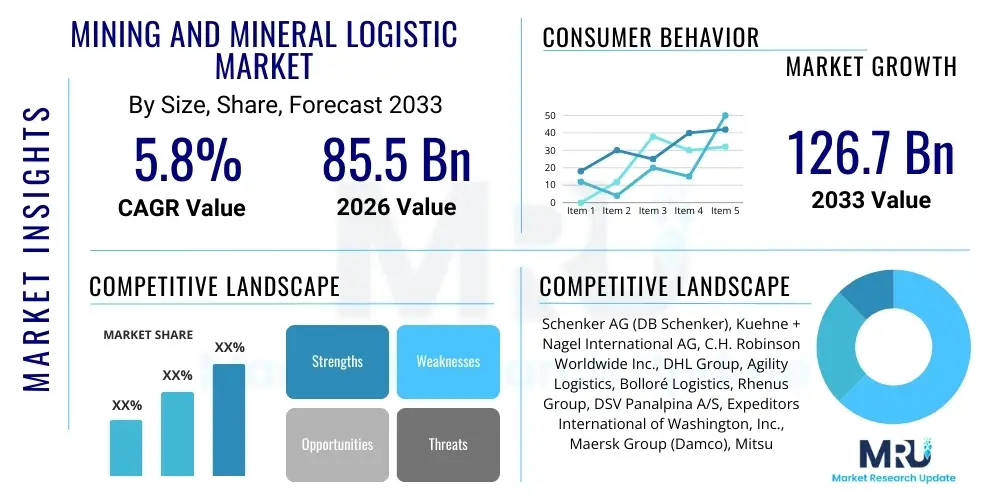

The Mining and Mineral Logistic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 126.7 Billion by the end of the forecast period in 2033.

Mining and Mineral Logistic Market introduction

The Mining and Mineral Logistic Market encompasses the complex network of specialized services essential for the efficient movement of raw mineral resources and processed commodities from extraction sites to global consumption points. This market segment provides end-to-end supply chain solutions, including multimodal transportation (road, heavy-haul rail, maritime bulk carriers), sophisticated material handling at transfer points, warehousing, and inventory management. The inherent nature of mineral commodities—often high volume, geographically dispersed, and subject to intense price volatility—demands robust, resilient, and highly optimized logistical frameworks. The primary scope includes handling traditional bulk materials like iron ore, coal, and bauxite, alongside increasingly critical components such as lithium, cobalt, and rare earth elements vital for modern industrial and energy transitions. The market's growth trajectory is intrinsically linked to global industrial output, urbanization rates, and the substantial investment required for developing the specialized infrastructure necessary to transport immense material volumes across continents.

Product description within this context refers to the logistical service itself, characterized by asset-heavy operations and complex route optimization. Specialized services often include slurry pipeline management, dedicated rail line maintenance, and high-capacity port loading and unloading facilities capable of minimizing dwell time and maximizing vessel utilization. Major applications span the entire mineral value chain: supporting pre-production with equipment and consumables logistics; managing high-volume midstream transport of concentrates and ores; and ensuring timely downstream delivery to smelters, refineries, and manufacturing end-users, particularly those in the construction, automotive, and power generation sectors. The geographical complexity means that logistics providers must navigate diverse regulatory environments, varying infrastructure quality, and stringent customs procedures, especially when moving high-value commodities or materials designated as hazardous.

The market benefits significantly from optimized logistics, realizing enhanced operational uptime, substantial reductions in inventory holding costs, and improved competitive positioning for mining companies. Driving factors include sustained, high global demand for steel and cement precursors due to infrastructure investment, particularly across Asia and developing economies, and the exponential rise in demand for electric vehicle (EV) batteries and renewable energy components, fueling the critical minerals segment. Furthermore, technological advancements, such as the implementation of integrated planning software and telematics, are enabling higher levels of efficiency and real-time visibility across the supply chain, transforming traditionally manual operations into data-driven, automated processes, thus providing a significant impetus for market expansion and modernization.

Mining and Mineral Logistic Market Executive Summary

The global Mining and Mineral Logistic Market is undergoing rapid transformation, propelled by shifts in global commodity demand and technological innovation. Business trends emphasize strategic outsourcing, with mining majors increasingly relying on specialized Third-Party Logistics (3PL) providers to manage complex, multi-jurisdictional supply chains, seeking to mitigate capital expenditure risks and access integrated, scalable transport solutions. Digitalization is a key focus, driving investments in smart port technology, automated warehousing, and the deployment of advanced analytics for predictive maintenance across rail and fleet assets. Sustainability mandates are also reshaping business strategies, requiring providers to transition towards lower-emission transport modes, such as LNG-fueled vessels and electric rail, often driven by investor pressure and regulatory requirements concerning supply chain carbon footprint tracking.

Regional trends distinctly highlight the Asia Pacific (APAC) as the powerhouse of consumption, consuming the largest share of globally traded minerals, which sustains massive import logistics networks dominated by bulk shipping. North America and Australia continue to lead as mature production centers, characterized by highly efficient, high-volume captive and specialized rail systems designed for long-haul transport from remote mines. Latin America and Africa are emerging growth frontiers, necessitating significant greenfield investment in specialized project logistics to overcome infrastructure deficits and unlock vast reserves of base metals and critical minerals. Europe’s regional dynamics are focused on sophisticated import logistics and regulatory compliance, particularly concerning ethically sourced and transparent mineral supply chains for its advanced manufacturing base.

Segment trends reveal that the commodity type segment dedicated to critical minerals (lithium, cobalt, graphite) is forecast to achieve the highest Compound Annual Growth Rate (CAGR), significantly outpacing traditional segments like thermal coal logistics, reflecting the global energy transition. Transportation segmentation is increasingly multimodal, stressing the requirement for seamless transfer points, particularly at ports, where high-speed bulk handling is paramount. Furthermore, the outsourced deployment model is gaining prominence due to its inherent flexibility and cost efficiency, appealing to miners seeking operational agility in response to volatile commodity markets. Overall, the market remains highly competitive, with differentiation achieved through operational safety performance, asset modernization, and the integration of advanced digital tracking capabilities crucial for meeting modern buyer demands.

AI Impact Analysis on Mining and Mineral Logistic Market

Common user questions regarding AI’s influence in mining logistics frequently focus on quantifying efficiency gains and mitigating operational risks associated with remote or harsh environments. Users are particularly interested in how AI facilitates real-time decision-making in complex logistical networks, such as dynamic train scheduling based on weather forecasts, or optimizing vessel loading patterns to minimize ballast time and fuel consumption. Key concerns often revolve around data privacy, the interoperability of AI systems with legacy infrastructure, and the necessity of highly specialized skills needed to manage and interpret the outputs from complex machine learning models. The consensus expectation is that AI will move the industry from optimized logistics planning to truly predictive and autonomous supply chain execution, substantially improving throughput and reducing operational latency across the mineral value chain.

The transformative impact of AI is centered on its ability to synthesize massive, disparate datasets—including sensor readings from heavy machinery, market indices, meteorological data, and geopolitical advisories—to generate highly prescriptive logistical actions. For instance, AI algorithms are deployed to manage complex material blending and stockpiling strategies at mine sites, optimizing the quality of the raw material before transport, which significantly reduces unnecessary costs and improves end-product consistency. In transport planning, AI allows for dynamic rerouting of rail fleets or bulk carriers in real-time, avoiding predicted congestion points or severe weather events, thus safeguarding delivery timelines and minimizing insurance risks associated with delays. This predictive capability translates directly into millions of dollars saved by preventing bottlenecks and ensuring just-in-time delivery for processing facilities globally.

Furthermore, AI is instrumental in enhancing safety and security, critical elements in the high-risk environment of mining logistics. Machine vision systems powered by AI are used for automated integrity checks on rail infrastructure and conveyor belts, identifying wear and tear early to prevent catastrophic failures, thereby minimizing human exposure to hazardous conditions. In administrative logistics, natural language processing (NLP) applications are automating the processing of cross-border customs documentation, drastically reducing the time required for regulatory compliance and lowering the chances of human error that could lead to significant fines or delays. The adoption of AI, therefore, serves as a core competitive differentiator, enabling logistics providers to offer service level agreements (SLAs) with greater reliability and enhanced transparency, particularly appealing to global mining houses committed to strict safety and efficiency standards.

- AI-driven Predictive Maintenance: Utilizing ML models to anticipate failures in heavy haul trucks, trains, and port handling equipment, maximizing asset lifespan and operational uptime.

- Optimized Route and Schedule Planning: Dynamically adjusting multimodal transport routes (rail, sea) based on real-time data inputs (e.g., congestion, bunker fuel prices, weather).

- Automated Resource Allocation: Employing algorithms to manage and assign personnel, vehicles, and storage capacity across multiple mine sites and ports simultaneously.

- Demand Forecasting and Inventory Control: Using sophisticated time-series analysis to predict consumption patterns, optimizing mineral stockpile levels, and reducing working capital requirements.

- Enhanced Safety and Quality Control: Implementing computer vision for real-time monitoring of loading processes, cargo integrity, and compliance with operational safety protocols.

- Intelligent Autonomous Systems: Governing autonomous haulage and loading robotics at mine sites and transfer stations, improving 24/7 efficiency and reducing labor dependency.

DRO & Impact Forces Of Mining and Mineral Logistic Market

The market dynamics are defined by core Drivers, persistent Restraints, and latent Opportunities (DRO). The paramount Driver is the burgeoning global commitment to decarbonization, which necessitates immense quantities of transition minerals (copper, nickel, lithium, rare earths), thereby stressing existing logistics chains and driving investment in specialized handling capabilities. Further propulsion comes from governmental infrastructure spending programs in key developing nations, sustaining high demand for steel and cement inputs. Conversely, significant Restraints include the extremely high capital expenditure required for essential infrastructure upgrades, particularly in regions with limited existing logistics corridors, coupled with severe regulatory barriers related to environmental permitting and land access. Opportunities are substantial, focusing on the strategic deployment of digital technologies (AI, IoT) to leapfrog existing inefficiencies, the development of specialized "green logistics" corridors, and partnerships aimed at vertically integrating supply chain elements for critical mineral flows.

The impact forces influencing the market are multifaceted, creating a complex operational environment. Economically, extreme volatility in commodity prices is a constant impact force; when prices drop sharply, mining companies quickly reduce output, leading to overcapacity in logistics assets (railcars, ships), while price spikes create fierce competition for limited transport capacity, often resulting in severe demurrage charges and logistical bottlenecks. Technologically, the rapid maturation of autonomous systems for haulage and the widespread availability of advanced SCM software exert continuous pressure on logistics firms to modernize or risk obsolescence. Providers who fail to adopt real-time tracking and optimization tools find themselves competitively disadvantaged, particularly when bidding for high-value mineral contracts requiring stringent traceability.

Furthermore, ESG (Environmental, Social, and Governance) impact forces have become non-negotiable, acting as both a restraint and an opportunity. The public and investor demand for carbon-neutral operations is restraining logistics firms by requiring massive investments in clean fuels and electric machinery, increasing operational costs. However, compliance with these high standards creates an opportunity for specialized providers who can demonstrably offer verifiable low-carbon logistics solutions, attracting premium contracts from environmentally conscious mining houses and end-users. Geopolitical impact forces, such as trade disputes and regional conflicts, directly affect supply chain viability, compelling logistics strategies to prioritize redundancy and geopolitical diversification, especially for strategically important resources like rare earth elements, which often originate from regions prone to instability, necessitating robust risk management and insurance frameworks.

Segmentation Analysis

Segmentation analysis reveals the nuanced structure of the Mining and Mineral Logistic Market, which is categorized based on functional service delivery, the nature of the commodity being transported, the dominant mode of carriage, and the operational model employed by the mining organization. This detailed breakdown enables market participants to identify niche specialization opportunities and tailor their asset base accordingly. Given the disparity between high-volume, low-value bulk materials and low-volume, high-value critical concentrates, the type of mineral dictates the specific handling protocols, security requirements, and transport mode selection. For instance, iron ore demands high-capacity bulk carriers and heavy-haul rail, whereas precious metals require armored transport and secure warehousing, illustrating the highly fragmented service requirements across the market.

The segmentation by mode of transport underscores the multimodal necessity inherent in mining logistics. Very few mine sites are directly connected to final consumption points by a single mode; therefore, the seamless and efficient transition between road freight (initial haulage), rail freight (long-distance intermediate transport), and sea freight (intercontinental delivery) is the defining challenge. Multimodal integration services, often provided by specialized 4PL firms, are becoming highly valuable as they optimize these handoffs, minimize delays at transshipment hubs, and manage complex cross-border documentation. This service integration is particularly vital for landlocked mining operations in regions like Central Africa or South America, where reliable road and rail links to coastal ports are sporadic or heavily congested, necessitating sophisticated scheduling.

The deployment model segmentation—Outsourced versus In-House—is pivotal in understanding market expenditure allocation. Large, established mining corporations often maintain extensive captive logistics operations (In-House) for core bulk commodities, controlling dedicated rail lines and port facilities to ensure high utilization and cost control. Conversely, mid-tier miners, junior companies, and those dealing in niche or critical minerals heavily favor the Outsourced model. Leveraging specialized 3PL and 4PL providers allows these firms to rapidly scale operations, access specialized fleets (e.g., cryogenic transport for certain chemicals used in refining), and transfer operational risks, providing financial flexibility that is highly valued in the cyclically volatile commodity market. This trend is strongly favoring the growth of sophisticated outsourced solutions offering full supply chain visibility and risk sharing contracts.

- By Service Type:

- Transportation (Road, Rail, Sea/Ocean, Pipeline, Air)

- Warehousing and Storage (Near-mine, Portside, Destination)

- Value-Added Services (Customs Clearance, Documentation, Insurance, Inventory Management, Primary Processing)

- Project Logistics (Infrastructure Setup and Oversized Cargo Handling)

- By Commodity Type:

- Metal and Mineral Concentrates (Copper, Nickel, Zinc, Lead, Aluminum)

- Bulk Minerals (Iron Ore, Coal - Thermal & Metallurgical, Bauxite, Limestone, Aggregates)

- Precious Metals (Gold, Silver, Platinum Group Metals - PGM)

- Critical Minerals (Lithium, Cobalt, Rare Earth Elements, Graphite)

- Industrial Minerals (Potash, Phosphates, Salt)

- By Transport Mode:

- Road Freight (Heavy and Standard Trucking)

- Rail Freight (Heavy Haul, Dedicated Spur Lines)

- Sea Freight (Capesize, Panamax, Handymax Bulk Carriers, Containerized Freight)

- Multimodal Transport (Integrated land and sea solutions)

- By Deployment Model:

- Outsourced Logistics (Third-Party Logistics - 3PL, Fourth-Party Logistics - 4PL)

- In-House Logistics (Captive Fleet and Infrastructure Operations)

- By End-Use Industry:

- Construction and Infrastructure (Steel, Cement)

- Automotive (Battery and Components)

- Power Generation (Coal, Uranium, Gas)

- Electronics and High-Tech (Semiconductors, Specialty Alloys)

- Fertilizers and Chemicals (Potash, Phosphates)

- Aerospace and Defense

Value Chain Analysis For Mining and Mineral Logistic Market

The value chain commences with upstream analysis focused on the logistical efficiency at the mine site, which includes the mobilization of specialized extraction equipment and the highly technical process of moving freshly extracted material (ore) to the initial processing stage (crushing, screening, concentrating). Logistical considerations here are dominated by optimizing conveyor systems, autonomous vehicle movement, and efficient stockpile management to maintain a consistent feed rate. The upstream segment’s profitability is dictated by minimized waiting times and optimal blending strategies. Crucial distribution channels at this stage are localized, involving high-capacity off-road haulage, often managed by specialized mine contractors or the mining company itself, utilizing sophisticated FMS (Fleet Management Systems) to coordinate movements in high-traffic, regulated mine environments.

Moving into the core midstream logistics, the focus shifts to long-distance, large-volume transportation. This stage involves the key distribution channel decisions: whether to use a direct channel, such as a dedicated, private heavy-haul railway for sustained, high-volume flows (common in iron ore and coal), or an indirect channel, leveraging public rail networks and commercial shipping lines for more flexible or lower-volume commodities. The value addition here is achieved through economies of scale, utilizing the largest possible transport units (Capesize vessels, double-stack trains) and minimizing transshipment steps. Intermediate storage facilities, often located at key rail junctions or inland ports, are critical components, requiring climate-controlled or specialized handling based on the mineral type, particularly for concentrates which may be moisture-sensitive or prone to oxidation.

Downstream analysis centers on port logistics and final-mile delivery. Ports are often the most crucial bottleneck; therefore, advanced technology—including highly automated shiploaders, stacker-reclaimers, and optimized yard management systems—is deployed to ensure vessels spend the minimum possible time docked, thus avoiding millions in demurrage costs. The final distribution channel involves last-mile delivery, typically road or rail, from the destination port or refinery to the end-use manufacturing plant (e.g., delivering steel slabs to an automotive stamping plant). Value chain success relies on flawless integration across these upstream, midstream, and downstream participants, demanding shared digital platforms and high levels of contractual accountability, ensuring the physical flow of materials is matched by a transparent flow of documentation and regulatory compliance information.

Mining and Mineral Logistic Market Potential Customers

The core potential customers for mineral logistics services are large-scale global mining corporations (e.g., diversified majors, precious metal specialists) that require reliable global infrastructure to export their resources from remote production sites in continents like Australia, South America, and Africa to industrial processing hubs in Asia and Europe. These customers demand comprehensive, integrated logistical solutions covering multimodal transport, customs management across multiple jurisdictions, and verifiable tracking systems (often blockchain-enabled) to satisfy investor and consumer demands regarding ethical sourcing and environmental performance. Procurement decisions are heavily weighted towards providers demonstrating a proven safety record, deep asset base, and financial stability to handle large-scale, long-term contracts subject to commodity cycle fluctuations.

A second major customer segment comprises the commodity processing and manufacturing industries. This includes steel producers, aluminum smelters, copper refineries, and, increasingly, gigafactories focused on EV battery production. These end-user buyers primarily purchase downstream logistics services, valuing reliability and precise scheduling above all else to ensure their continuous, capital-intensive operations are not disrupted by material shortages. They often seek logistics partners capable of providing just-in-time inventory management, potentially including consignment stock holding near their facilities, thereby minimizing their own warehousing overheads and ensuring a steady flow of materials tailored to their specific consumption rate and quality requirements, particularly for high-purity concentrates.

Furthermore, government agencies, state-owned enterprises (SOEs), and strategic national resource organizations represent a distinct customer category, particularly prominent in nations seeking to stabilize or expand their domestic resource industries. These entities frequently contract for large-scale project logistics, requiring specialized services for building new railways, pipelines, or export ports necessary to access isolated mineral deposits. These contracts often involve complex public-private partnerships, emphasizing the logistics provider's capacity for long-term infrastructure investment, environmental mitigation planning, and managing large-scale, specialized heavy-lift operations required to deliver industrial equipment to challenging locations. This segment prioritizes stability, local content utilization, and adherence to national development goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 126.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schenker AG (DB Schenker), Kuehne + Nagel International AG, C.H. Robinson Worldwide Inc., DHL Group, Agility Logistics, Bolloré Logistics, Rhenus Group, DSV Panalpina A/S, Expeditors International of Washington, Inc., Maersk Group (Damco), Mitsui O.S.K. Lines (MOL), Nippon Express, Toll Group, Geodis, Sinotrans Limited, Aurizon Holdings Limited, CSX Corporation, Union Pacific Corporation, BNSF Railway, Transnet Freight Rail. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mining and Mineral Logistic Market Key Technology Landscape

The core technology landscape supporting the Mining and Mineral Logistic Market is heavily focused on achieving physical automation and digital integration. For physical logistics, the increasing sophistication of autonomous heavy-haul trucks and trains, guided by precise GPS and sensor arrays, is maximizing productivity while minimizing human risk in operations. At the transfer points, advanced port automation—including remote-controlled shiploaders and automated stacker-reclaimers—ensures high-speed handling of bulk commodities, crucial for meeting tight shipping schedules. Investments in specialized asset technology, such as optimized rail wagon designs for specific mineral weights and densities, and the utilization of larger, more fuel-efficient bulk carrier vessels, underscore the market's continuous drive for operational marginal gains and reduced environmental impact per ton mile.

Digitally, the shift towards hyper-connected supply chains is driven by the deployment of Industrial Internet of Things (IIoT) sensors embedded across mobile assets and static infrastructure. These sensors continuously feed data back to centralized, cloud-based logistic control towers, enabling real-time monitoring of asset health, cargo conditions (e.g., moisture content of concentrates), and security status. The integration of proprietary Machine Learning (ML) algorithms with these data feeds allows for proactive scenario planning, such predictive systems can simulate the impact of adverse events (like port strikes or weather delays) and automatically suggest optimal contingency plans, moving the industry beyond traditional planning software to predictive execution frameworks that are highly resilient to external shocks.

Furthermore, technologies supporting transparency and compliance are rapidly gaining prominence. Blockchain technology provides an immutable digital ledger for tracking high-value or ethically sensitive minerals (e.g., cobalt, tungsten) from the mine gate through all logistical stages to the end-user, satisfying rigorous regulatory and consumer demands for provenance verification. Geographic Information Systems (GIS) and high-resolution satellite mapping are utilized for optimizing route infrastructure planning, especially in greenfield developments in remote regions, ensuring infrastructure build-out is strategically aligned with minimal environmental disruption and maximum logistical efficiency. These technologies collectively form the backbone of modern mineral logistics, offering reliability, traceability, and operational excellence that legacy systems could not achieve.

Regional Highlights

Regional dynamics illustrate the market's duality between major production zones and large consumption hubs, each presenting unique logistical challenges and opportunities.

- Asia Pacific (APAC): Dominates global mineral demand, positioning it as the primary destination for bulk commodity logistics. China and India’s massive consumption for infrastructure and manufacturing underpin the requirement for large-scale, continuous maritime import streams of iron ore, coal, and base metals. The region also hosts key mineral exporters (Australia, Indonesia), driving investment in massive port infrastructure and dedicated heavy-haul rail networks designed for high-tonnage throughput. Future growth is strongly linked to the expansion of regional battery supply chains.

- North America: Characterized by sophisticated and highly efficient logistics centered around extensive, privately owned Class I rail networks that connect inland mines to export ports and domestic processing centers. The market is mature, emphasizing safety, high utilization of intermodal services, and compliance with stringent environmental regulations. Growing domestic focus on rare earth elements and critical mineral extraction is stimulating investment in specialized, high-security logistics capabilities, particularly in the US and Canada.

- Europe: Predominantly a net importer of raw minerals, relying heavily on reliable ocean freight from global sources. Logistics focus is on efficient port operations (e.g., Rotterdam, Antwerp) and integration with dense pan-European rail and inland waterway networks. Regulatory drivers, particularly the EU’s Green Deal and mandates on supply chain transparency, push logistics providers to adopt sustainable practices, favoring providers who can demonstrate low-carbon transport solutions and verifiable ethical sourcing documentation.

- Latin America (LATAM): A crucial global source of high-volume copper, iron ore, and specialized agricultural minerals (potash). Logistics are often hindered by challenging topography (Andes Mountains) and significant infrastructure gaps, leading to high reliance on specialized project logistics for mine connectivity. Major players focus on building dedicated, high-capacity infrastructure (e.g., railways in Brazil and Chile) to secure efficient access to coastal export facilities, often through public-private partnerships aiming to unlock new mining districts.

- Middle East and Africa (MEA): Africa represents significant growth potential due to vast, largely untapped reserves of critical minerals (e.g., cobalt, manganese). Logistics development is capital-intensive, focusing on constructing new rail and port corridors, often financed by international investment. The Middle East leverages its strategic maritime location and modern port facilities to handle industrial minerals, fertilizers, and aluminum exports, focusing on maintaining extremely high throughput efficiency for global trade routes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mining and Mineral Logistic Market.- Schenker AG (DB Schenker)

- Kuehne + Nagel International AG

- C.H. Robinson Worldwide Inc.

- DHL Group

- Agility Logistics

- Bolloré Logistics

- Rhenus Group

- DSV Panalpina A/S

- Expeditors International of Washington, Inc.

- Maersk Group (Damco)

- Mitsui O.S.K. Lines (MOL)

- Nippon Express

- Toll Group

- Geodis

- Sinotrans Limited

- Aurizon Holdings Limited

- CSX Corporation

- Union Pacific Corporation

- BNSF Railway

- Transnet Freight Rail

- Canadian National Railway (CN)

- Kawasaki Kisen Kaisha (K Line)

- COSCO Shipping Holdings Co., Ltd.

- PSA International

- DP World

Frequently Asked Questions

Analyze common user questions about the Mining and Mineral Logistic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Mining and Mineral Logistic Market?

The primary driver is the accelerating global transition to renewable energy technologies, specifically the exponential demand for critical battery minerals (e.g., lithium, nickel, cobalt) required for electric vehicles (EVs) and grid storage systems, necessitating specialized, high-security logistics services.

How is geopolitical risk impacting mineral logistics?

Geopolitical instability, resource nationalism, and trade protectionism are leading to supply chain fragmentation and increased complexity, requiring logistics providers to develop diversified routing strategies, secure trade lanes, and enhanced risk management frameworks to ensure reliable material flow and compliance with sanction regimes.

What role does automation play in port operations for mineral commodities?

Automation, including automated cranes, high-speed bulk handling equipment, and integrated IT systems, significantly increases port throughput capacity, reduces vessel turnaround times (minimizing demurrage), lowers operational costs, and enhances worker safety when handling high-volume, heavy mineral commodities like iron ore and coal.

Which geographical region dominates the consumption of mined materials?

The Asia Pacific (APAC) region, led by China and India, dominates the consumption segment due to large-scale infrastructure projects, rapid urbanization, and massive manufacturing output, requiring continuous, high-volume importation of bulk and base metal minerals, primarily facilitated by sea freight logistics.

What are the benefits of implementing blockchain technology in mineral logistics?

Blockchain provides an immutable digital ledger for tracking mineral provenance, enhancing supply chain transparency, ensuring compliance with ethical sourcing mandates (ESG standards), and reducing documentation fraud, offering verifiable trust from the mine pit to the final manufacturing end-user.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager