MIPI Camera Module Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441792 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

MIPI Camera Module Market Size

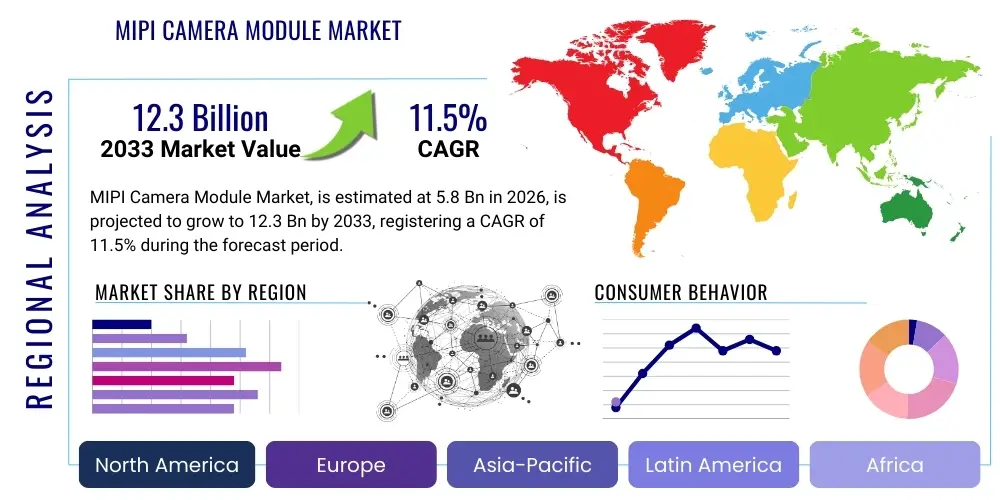

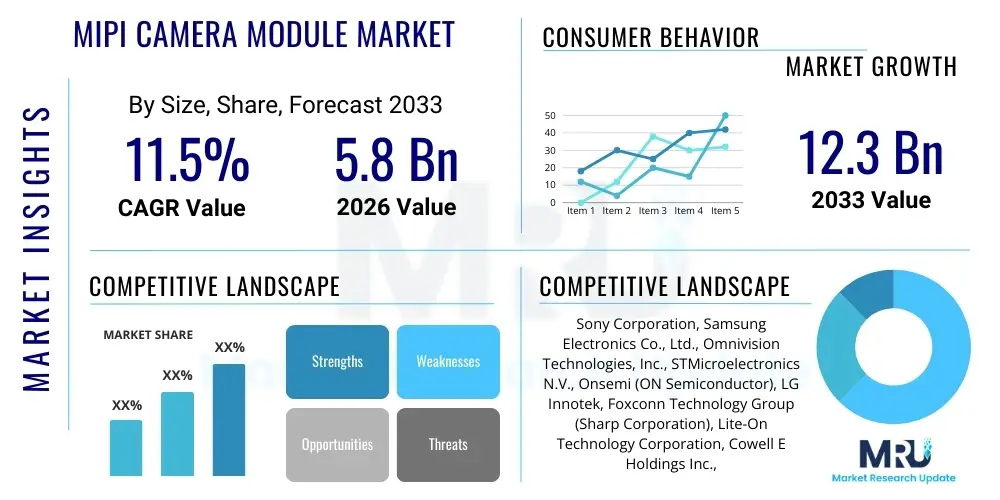

The MIPI Camera Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $12.3 Billion by the end of the forecast period in 2033.

MIPI Camera Module Market introduction

The MIPI Camera Module Market encompasses integrated imaging systems designed around the Mobile Industry Processor Interface (MIPI) standards, predominantly the Camera Serial Interface (CSI). These modules integrate key components such as image sensors, lenses, Digital Signal Processors (DSPs), and interface circuitry, providing a streamlined, high-speed, and low-power solution for capturing and transmitting image data. The adoption of MIPI standards is driven by the necessity for standardized, robust communication protocols that can handle the escalating data rates generated by high-resolution sensors across various portable and embedded devices. This standardized approach significantly simplifies system integration and ensures interoperability, which are crucial factors accelerating market expansion across diversified industries.

MIPI camera modules find major applications in sophisticated consumer electronics, particularly smartphones, tablets, and wearable devices, where high-definition video capture and complex computational photography capabilities are essential. Beyond consumer applications, their robustness and high performance are increasingly leveraged in emerging sectors, including automotive advanced driver-assistance systems (ADAS), industrial automation, medical imaging, and the rapidly growing Internet of Things (IoT) ecosystem. The inherent benefits of MIPI interfaces—such as low electromagnetic interference (EMI), reduced pin count, and optimized power consumption—make them highly suitable for battery-operated and space-constrained devices. The continued miniaturization of components and improvements in image sensor technology further enhance the performance and applicability of these modules, driving sustained market demand.

The market is significantly driven by the continuous demand for higher resolution and faster frame rates in consumer devices, coupled with the rapid integration of advanced sensing technologies in automotive and industrial contexts. For instance, the transition towards fully autonomous vehicles necessitates multiple high-performance camera modules using robust MIPI interfaces for real-time perception and safety-critical functions. Additionally, the proliferation of smart home devices, security cameras, and drones, all requiring efficient and reliable imaging capabilities, provides a vast and expanding application base for MIPI camera modules, solidifying their critical role in the contemporary digital landscape.

MIPI Camera Module Market Executive Summary

The MIPI Camera Module Market is characterized by vigorous growth, primarily fueled by technological convergence and the pervasive integration of vision systems across multiple end-user industries. Key business trends indicate a strong focus on developing compact modules capable of supporting high-resolution specifications (108MP and above) and complex multi-camera arrays, particularly for flagship smartphones and high-end automotive applications. Manufacturers are heavily investing in integrating advanced computational imaging features directly within the module’s DSP, reducing reliance on the host processor and improving overall system efficiency. Furthermore, supply chain resilience and diversification, especially regarding the sourcing of specialized image sensors and optical components, remain a central strategic priority for market leaders, aiming to mitigate potential geopolitical and logistical disruptions while ensuring competitive pricing and scale.

Regional trends highlight Asia Pacific (APAC) as the dominant market, driven by its unparalleled concentration of semiconductor manufacturing, consumer electronics assembly hubs, and a large consumer base rapidly adopting advanced mobile devices. China, South Korea, and Japan lead in innovation and production capacity for high-performance modules. North America and Europe demonstrate strong growth in specialized, high-margin segments such as automotive ADAS, machine vision, and sophisticated medical devices, where stringent quality standards and regulatory compliance necessitate cutting-edge MIPI module integration. Investment in R&D, particularly concerning higher MIPI standards like C-PHY and D-PHY to handle extreme bandwidth requirements, is concentrated in these advanced economies.

Segment trends underscore the supremacy of the Smartphones segment in terms of revenue volume, although Automotive is projected to exhibit the highest CAGR due to the mandatory inclusion of surround-view systems, driver monitoring systems (DMS), and advanced sensing suites. Component segmentation shows that Image Sensors, particularly CMOS Image Sensors (CIS), hold the largest market share, with technological advancements focusing on smaller pixel sizes, improved low-light performance, and global shutter capabilities essential for industrial and automotive capture. Interface Type analysis confirms that CSI-2 remains the prevailing standard due to its maturity and widespread adoption, but newer, higher-speed protocols are gaining traction to support the next generation of ultra-high-definition imaging.

AI Impact Analysis on MIPI Camera Module Market

Common user questions regarding AI’s influence on the MIPI Camera Module Market often revolve around two key areas: first, how AI processing affects module requirements (e.g., need for higher bandwidth and integrated processing power); and second, the direct use case enhancement provided by on-device AI, such as edge computing for real-time object detection and facial recognition. Users are concerned about thermal management, latency, and the integration complexity when embedding specialized AI accelerators alongside standard MIPI components. They anticipate that AI will necessitate a move towards smart modules capable of pre-processing complex data before transmission, thereby optimizing system power consumption and data load. The consensus expects AI to transition the MIPI camera module from a mere data capture device to an intelligent, data-interpreting subsystem within the larger ecosystem.

The integration of Artificial Intelligence fundamentally transforms the functional requirements of MIPI camera modules. AI algorithms, especially those utilized for tasks like image stabilization, semantic segmentation, and advanced computer vision in real-time, demand exceptionally clean, high-fidelity input data, pushing the boundaries of sensor resolution and dynamic range. Consequently, AI applications drive the demand for premium MIPI modules with enhanced low-noise characteristics and advanced calibration features. Furthermore, the shift towards edge AI processing requires the inclusion of dedicated hardware acceleration (like Neural Processing Units or NPUs) either adjacent to or integrated within the module’s DSP. This integration minimizes data transfer latency and protects user privacy by processing sensitive information locally, making the MIPI module an increasingly intelligent component.

This evolving landscape creates significant opportunities for manufacturers specializing in optimized hardware-software co-design. The necessity for high-speed, low-power interfaces capable of handling the bandwidth generated by AI-driven vision systems further reinforces the value proposition of the MIPI standards (CSI-2 and potentially the emerging CSI-3). AI also fuels innovation in specialized modules tailored for specific applications, such as high-frame-rate modules for industrial inspection or ultra-low-power modules for battery-constrained IoT devices performing continuous environmental monitoring and anomaly detection. This specialization ensures that the MIPI interface remains central to connecting advanced sensing capabilities with sophisticated computational intelligence across virtually all emerging technology sectors.

- Increased demand for integrated Neural Processing Units (NPUs) within or adjacent to the module.

- Requirement for higher MIPI interface bandwidth (C-PHY/D-PHY) to transmit pre-processed or raw data for complex AI models.

- Acceleration of computational photography features (e.g., real-time bokeh, super-resolution) running locally on the module.

- Enhanced market growth in edge computing applications (surveillance, robotics, automotive ADAS).

- Focus on specialized AI-optimized sensors featuring global shutter for accurate machine vision data capture.

- Development of smart vision modules capable of power-efficient, always-on sensing and interpretation.

DRO & Impact Forces Of MIPI Camera Module Market

The dynamics of the MIPI Camera Module Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. Key drivers include the pervasive proliferation of multi-camera systems in consumer electronics and the stringent safety requirements mandating advanced vision systems in the automotive sector, demanding high-speed, standardized data transfer protocols like MIPI. Restraints predominantly center on the high initial investment required for fabricating advanced CMOS Image Sensors (CIS) and the intricate challenges associated with maintaining signal integrity at extremely high data rates, particularly in environments susceptible to high electromagnetic interference (EMI). Opportunities arise from the untapped potential in non-traditional markets such as specialized medical diagnostics (endoscopy), augmented reality (AR) devices, and sophisticated industrial automation systems requiring precise machine vision, all benefiting from the MIPI ecosystem's efficiency and maturity. The combined weight of these factors—technological acceleration, cost pressures, and emerging application diversity—constitutes the significant impact forces shaping competitive intensity and market penetration rates.

Specific market drivers contributing to expansion involve the accelerating transition from traditional surveillance systems to smart security cameras integrated with AI capabilities for intelligent monitoring, relying heavily on reliable MIPI modules. Additionally, the constant competition among smartphone manufacturers to offer superior imaging quality necessitates continuous upgrades to image sensor resolution, lens quality, and the underlying MIPI interface to handle the resultant data load efficiently. The global push for autonomous driving technology acts as a powerful demand generator, where MIPI modules are foundational components for perception stacks, including LIDAR synchronization and camera fusion. These drivers create a sustained, high-volume requirement across both high-volume consumer and high-reliability industrial segments, reinforcing market stability and growth projections.

Conversely, the market faces significant restraints related to standardization and supply chain vulnerabilities. While MIPI provides an interface standard, the proprietary nature of sensor-specific drivers and the complexity of integration across diverse operating systems can introduce development hurdles and extend time-to-market. Furthermore, the global semiconductor shortage, although easing, highlighted the risk associated with relying on a limited number of high-end image sensor manufacturers, leading to potential price volatility and production delays. Despite these challenges, the dominant opportunity remains the expansion into high-growth, non-mobile segments like robotics and specialized professional drones, where the low latency and power efficiency of MIPI-based modules offer a clear competitive advantage over older, bulky interface standards, paving the way for differentiated product development and market diversification.

Segmentation Analysis

The MIPI Camera Module Market is comprehensively segmented based on interface type, component, and primary application, providing a nuanced view of market dynamics and targeted growth areas. Segmentation analysis is crucial for identifying specialized demand pockets and tailoring product development to specific industry requirements, such as optimizing for low-power consumption in IoT versus ensuring functional safety in automotive applications. The component breakdown reveals the criticality of image sensor technology, while application categorization clearly delineates the high-volume consumer markets from the specialized, high-reliability industrial and medical sectors. Understanding these segments is vital for stakeholders to allocate resources effectively, navigate competitive pressures, and capitalize on emerging technological shifts within the imaging ecosystem.

- By Interface Type:

- CSI-2 (Camera Serial Interface 2)

- CSI-3 (Camera Serial Interface 3)

- D-PHY

- C-PHY

- By Component:

- Image Sensors (CMOS Image Sensors dominate)

- Lenses and Optics

- Digital Signal Processors (DSPs)

- Flex PCBs and Connectors

- By Application:

- Smartphones and Tablets

- Automotive (ADAS, DMS, Rear-view)

- Industrial and Machine Vision

- Security and Surveillance

- Medical and Healthcare

- IoT and Wearables

Value Chain Analysis For MIPI Camera Module Market

The value chain of the MIPI Camera Module Market is characterized by highly specialized stages, beginning with the complex design and manufacturing of critical upstream components. This stage involves semiconductor firms that design and fabricate high-performance CMOS Image Sensors (CIS) and dedicated MIPI interface chipsets (PHYs). These raw component providers hold significant leverage due to the high technological barriers and substantial capital investment required for fabrication plants (fabs). Following sensor production, specialized optics companies design and manufacture complex multi-element lens assemblies, which must meet stringent quality standards for high-resolution imaging. The integration of these components requires precision assembly and calibration, primarily handled by Original Design Manufacturers (ODMs) and module assemblers, often located in APAC, defining the midstream manufacturing phase.

The distribution channel for MIPI camera modules is multi-faceted, involving both direct and indirect routes. Direct distribution is common when dealing with large, tier-one customers, such as major smartphone Original Equipment Manufacturers (OEMs) and leading automotive suppliers, who negotiate high-volume contracts directly with module integrators or image sensor giants. This direct approach allows for customized specifications and closer collaboration on technical integration. Conversely, indirect channels, involving authorized distributors and specialized industrial electronics resellers, serve smaller customers, niche market applications (e.g., specialized medical devices or industrial robotics integrators), and the vast long-tail of the IoT ecosystem, ensuring broader market accessibility and localized technical support.

The downstream analysis focuses on the final integration of the camera modules into end-user products. Major customers include technology conglomerates, automotive tier-one suppliers (like Continental or Bosch), and industrial automation specialists. The success at this stage depends on the module's compatibility, performance metrics (latency, power, image quality), and reliability. Given the critical role of imaging in modern devices, the integration process often involves intensive testing and validation, driven by the end-product's requirements. The feedback loop from these downstream integrators to upstream component manufacturers is crucial for continuous product improvement, particularly regarding size reduction, power efficiency, and compliance with specific industry standards (e.g., AEC-Q100 for automotive components).

MIPI Camera Module Market Potential Customers

Potential customers for MIPI Camera Modules span a wide array of high-technology industries, fundamentally encompassing any entity requiring efficient, high-speed vision systems integrated into embedded or mobile platforms. The primary customer base includes global smartphone manufacturers (Apple, Samsung, Xiaomi) who continuously drive volume and demand for feature-rich, multi-sensor arrays. Beyond consumer electronics, the automotive sector represents a rapidly expanding and high-value customer group, comprising major automotive OEMs and Tier 1 suppliers focused on safety and autonomous driving systems. These customers require modules that meet strict functional safety standards (ISO 26262) and withstand harsh operating environments, leveraging MIPI for its low EMI characteristics.

The industrial and manufacturing sectors are increasingly vital customers, particularly enterprises involved in quality control, robotics, and logistics. These customers utilize MIPI camera modules for precise machine vision tasks, such as automated optical inspection (AOI) and high-speed sorting, demanding modules with global shutter sensors and high frame rates connected via robust MIPI protocols. Furthermore, the burgeoning Internet of Things (IoT) segment, including developers of smart home security devices, action cameras, and specialized industrial monitoring tools, constitutes a vast and fragmented customer base, valuing the low power consumption and compact size inherent to MIPI solutions. This diversity of end-users ensures a resilient and broadly distributed revenue stream for the MIPI camera module ecosystem.

Finally, emerging niche markets present substantial growth opportunities. Healthcare customers, specifically manufacturers of minimally invasive surgical robots and diagnostic endoscopy equipment, require highly miniaturized, high-resolution MIPI modules to deliver critical internal imaging data. Military and defense applications also seek customized, ruggedized MIPI camera systems for surveillance, reconnaissance, and specialized weapon systems. Targeting these customers requires specialized certifications, customized design consultation, and adherence to stringent industry-specific regulatory frameworks, showcasing the MIPI standard’s adaptability across professional and critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $12.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Corporation, Samsung Electronics Co., Ltd., Omnivision Technologies, Inc., STMicroelectronics N.V., Onsemi (ON Semiconductor), LG Innotek, Foxconn Technology Group (Sharp Corporation), Lite-On Technology Corporation, Cowell E Holdings Inc., Sunny Optical Technology (Group) Company Limited, Largan Precision Co., Ltd., OFILM Group Co., Ltd., Truly International Holdings Limited, Himax Technologies, Inc., Continental AG, Bosch GmbH, Aptina Imaging Corporation, Panasonic Corporation, Toshiba Corporation, Hynix Semiconductor Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MIPI Camera Module Market Key Technology Landscape

The technology landscape of the MIPI Camera Module Market is primarily centered around the evolution of the MIPI standards themselves, specifically the Camera Serial Interface (CSI) and the associated physical layer (PHY) specifications. The dominant technology remains CSI-2 (using D-PHY), offering a robust, proven method for high-speed data transfer necessary for imaging up to 4K resolution. However, the continuous push for ultra-high-resolution sensors (e.g., 100MP+) and multi-camera arrays demands significantly higher bandwidth. This necessity is driving the transition towards C-PHY, which utilizes a three-wire differential signaling scheme to achieve higher throughput per pin while reducing power consumption compared to D-PHY. C-PHY is particularly crucial for sophisticated applications like high-end smartphone video and automotive perception systems that require lossless transmission of massive data streams.

Beyond the interface, technological advancements in the core components dictate performance improvements. CMOS Image Sensor (CIS) technology is rapidly advancing, focusing on stacked architectures (Stacking of logic and pixel layers) to minimize module size while maximizing features like on-chip memory and high-speed processing capabilities. Key innovations include back-side illumination (BSI) and advanced deep trench isolation (DTI) techniques to improve light sensitivity and reduce color cross-talk, crucial for superior low-light performance. Furthermore, the integration of dedicated DSPs and increasingly, NPUs, within the module, enables sophisticated computational photography and edge AI capabilities directly at the source, transforming the module into an intelligent sensing unit rather than just a data pipe. This co-integration minimizes overall system latency and power overhead.

The manufacturing process itself is undergoing technological refinement, particularly concerning micro-optics and active alignment systems. Producing the complex, multi-element lenses required for current generation cameras necessitates extremely high-precision active alignment methods to ensure focal accuracy and minimal distortion across the entire field of view. These processes are vital for achieving the sharp image quality expected by consumers and the spatial accuracy required by industrial machine vision. Material science innovations are also playing a role, with the development of lighter, more durable lens materials and specialized flexible PCBs designed to handle high-speed MIPI signaling efficiently, ensuring reliability across diverse operating temperatures and environmental conditions.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the MIPI Camera Module Market, both in terms of consumption volume and production capacity. This supremacy is rooted in the region's concentration of leading consumer electronics manufacturers (South Korea, China, Taiwan) and semiconductor fabrication hubs. China, specifically, represents the largest single market, driven by its massive domestic smartphone market, aggressive adoption of surveillance technology, and expanding presence in electric and autonomous vehicle manufacturing. The region benefits from robust supply chain infrastructure, economies of scale, and highly competitive pricing, making it the global epicenter for both high-volume and technologically advanced module production. Continuous investment in 5G infrastructure and AI integration further solidifies APAC's leading position, driving demand for high-bandwidth MIPI solutions.

- North America: North America is characterized by high adoption rates of cutting-edge technology and a strong focus on high-margin, specialized applications. The market is primarily driven by innovation in automotive ADAS development, advanced medical diagnostics, and the development of sophisticated Augmented Reality (AR) and Virtual Reality (VR) platforms, which rely heavily on precise, low-latency MIPI camera modules. While manufacturing volume is lower than in APAC, North America leads in R&D expenditure related to advanced vision processing and AI integration, focusing on software-defined camera capabilities and developing proprietary high-speed MIPI derivatives for specialized computing platforms. Strict regulatory environments for medical and automotive devices necessitate high-reliability, premium modules.

- Europe: The European market demonstrates steady growth, strongly supported by the robust presence of established automotive industry giants and a strong emphasis on industrial automation (Industry 4.0). Demand here is concentrated on high-quality, certified MIPI modules meeting stringent quality and functional safety standards, particularly for vehicle vision systems, industrial inspection, and robotics. Europe is a significant consumer of specialized industrial cameras using MIPI interfaces for precision manufacturing and quality assurance. Furthermore, European regulatory initiatives concerning data privacy and autonomous vehicle safety drive requirements for sophisticated on-device processing capabilities, increasing the complexity and value of integrated MIPI solutions deployed across the region.

- Latin America, Middle East, and Africa (LAMEA): This combined region represents an emerging market with significant growth potential, albeit starting from a smaller base. Growth is closely tied to increasing smartphone penetration rates and infrastructural investments in security and surveillance systems, especially in densely populated urban centers. Economic development and urbanization in key countries drive the adoption of smart city technologies, which utilize networked MIPI cameras for monitoring and traffic control. While dependent on imported modules from APAC, the region is seeing increasing localized assembly and integration efforts, particularly for lower-to-mid-range consumer devices and specialized governmental security installations, promoting gradual but consistent market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MIPI Camera Module Market.- Sony Corporation

- Samsung Electronics Co., Ltd.

- Omnivision Technologies, Inc.

- STMicroelectronics N.V.

- Onsemi (ON Semiconductor)

- LG Innotek

- Foxconn Technology Group (Sharp Corporation)

- Lite-On Technology Corporation

- Cowell E Holdings Inc.

- Sunny Optical Technology (Group) Company Limited

- Largan Precision Co., Ltd.

- OFILM Group Co., Ltd.

- Truly International Holdings Limited

- Himax Technologies, Inc.

- Continental AG

- Bosch GmbH

- Aptina Imaging Corporation

- Panasonic Corporation

- Toshiba Corporation

- Hynix Semiconductor Inc.

Frequently Asked Questions

Analyze common user questions about the MIPI Camera Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the MIPI Camera Module Market?

The primary driving factor is the pervasive adoption of multi-camera arrays in smartphones, coupled with the mandatory integration of high-resolution, reliable vision systems (ADAS and DMS) in the rapidly expanding automotive sector, necessitating high-speed, standardized MIPI interfaces.

How does the MIPI CSI standard improve embedded vision systems?

MIPI CSI (Camera Serial Interface) provides a standardized, high-speed, and power-efficient communication protocol that reduces pin count and EMI, simplifying the integration of advanced image sensors into space-constrained, battery-operated devices like mobile phones and IoT products.

Which segment is expected to show the highest CAGR in the MIPI Camera Module Market?

The Automotive application segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the transition towards semi-autonomous and fully autonomous vehicles requiring numerous high-performance MIPI camera modules for real-time perception and safety functions.

What role does AI play in the future development of MIPI Camera Modules?

AI drives the demand for intelligent MIPI modules capable of edge computing, requiring integrated Neural Processing Units (NPUs) and higher bandwidth interfaces (C-PHY) to support real-time tasks like object detection and computational photography with minimal latency and improved power efficiency.

Which geographical region dominates the global MIPI Camera Module Market?

The Asia Pacific (APAC) region dominates the market due to its concentration of major consumer electronics manufacturing facilities, a vast user base, and robust supply chain infrastructure, particularly led by production and consumption in China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager