MLCC Electrode Pastes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442185 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

MLCC Electrode Pastes Market Size

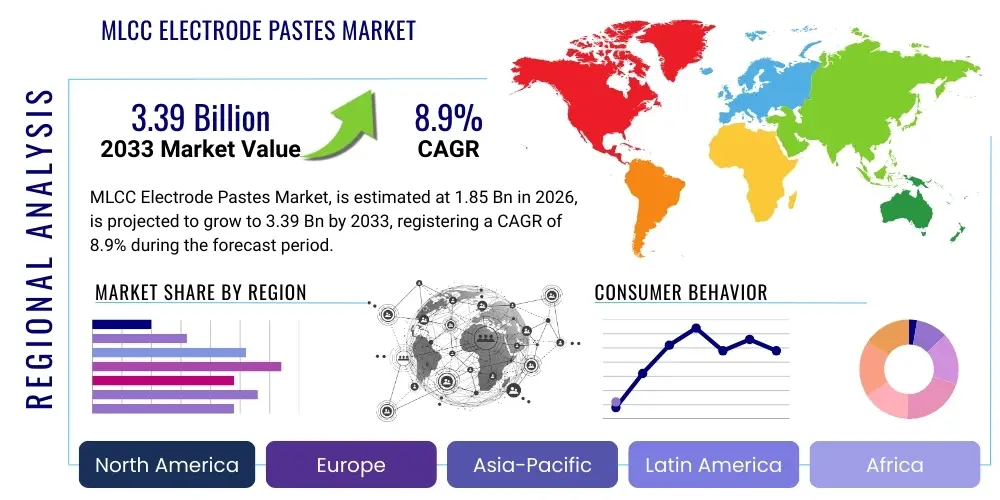

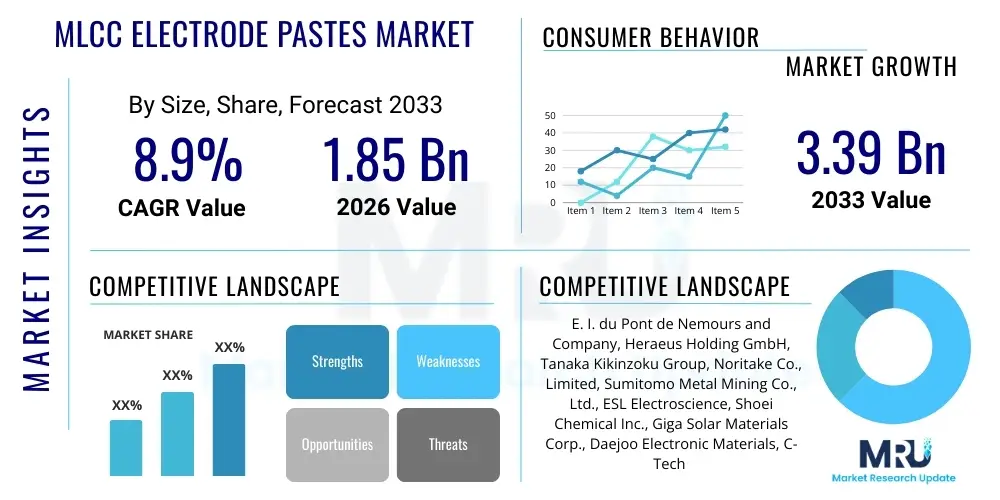

The MLCC Electrode Pastes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.39 Billion by the end of the forecast period in 2033.

MLCC Electrode Pastes Market introduction

The Multilayer Ceramic Capacitor (MLCC) Electrode Pastes Market encompasses the highly specialized conductive materials essential for manufacturing MLCCs, which are indispensable components in modern electronic circuits. MLCCs serve critical functions such as decoupling, filtering, and energy storage across a vast spectrum of devices. Electrode pastes, comprising metal powders (Nickel, Copper, Palladium, Silver), glass frits, and organic vehicles, are screen-printed onto ceramic sheets to form the internal and external electrodes. These pastes must exhibit extremely precise rheological properties and particle size distribution to enable the production of ultra-thin dielectric layers, crucial for achieving high capacitance and miniaturization in advanced MLCCs.

The primary function of internal electrode pastes is to establish high-density conductive layers within the stacked ceramic structure. As electronic devices become smaller and require greater power efficiency, the demand for high-capacitance MLCCs (often referred to as 'X7R' or 'X5R' types) has surged. This transition necessitates the adoption of Nickel (Ni) as the primary internal electrode material, replacing expensive Palladium (Pd) alloys, particularly in Base Metal Electrode (BME) MLCC systems. The external electrode pastes, usually silver or copper-based, provide reliable electrical connection points for surface mounting, demanding excellent adhesion to both the ceramic body and the external circuit board.

Major applications driving the demand for MLCC electrode pastes include the automotive sector (especially Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS)), 5G telecommunication infrastructure, data centers, and high-performance consumer electronics (smartphones, wearables). The key driving factor is the increasing component density (number of MLCCs per device) and the continuous trend toward component miniaturization (0402, 0201, and 01005 chip sizes), which mandates the use of ultra-fine, highly pure metal powders in paste formulation. This technological push ensures that MLCCs can handle high frequencies and maintain reliability under challenging operating conditions.

MLCC Electrode Pastes Market Executive Summary

The MLCC Electrode Pastes market is characterized by intense technological focus on material science, driven predominantly by the escalating demand for high-capacitance, ultra-miniature components required for 5G infrastructure, electric vehicles, and AI processing hardware. Business trends indicate a robust shift towards Base Metal Electrode (BME) systems, specifically utilizing nickel internal electrode pastes, due to the need for cost optimization and enhanced performance characteristics suitable for thinner film layers. Key market players are investing heavily in R&D to develop pastes with superior dispersion properties and lower sintering temperatures, enabling the efficient production of MLCCs with several hundred stacked layers and thicknesses below 1 micron per layer.

Regionally, the Asia Pacific (APAC) territory maintains its overwhelming dominance in the consumption and production of MLCC electrode pastes, largely attributable to the concentrated presence of major global MLCC manufacturers (Japan, South Korea, China, Taiwan). This region benefits from established supply chains and governmental support for electronics manufacturing. However, increasing regulatory requirements in Europe regarding automotive electronics and the rapid expansion of data centers and specialized computing in North America are creating pockets of significant growth, driving localized demand for high-reliability, specialty pastes.

Segment trends highlight the critical evolution within the internal electrode segment, where nickel powder pastes are witnessing the highest growth rate, displacing noble metal-based pastes in mainstream applications. The application segment sees the automotive electronics sector emerging as the most lucrative and demanding end-use market, requiring pastes capable of withstanding extreme temperatures and mechanical stresses, surpassing the growth seen in traditional consumer electronics segments. Consolidation among raw material suppliers and strategic partnerships between paste manufacturers and MLCC producers are defining the competitive landscape, focused on securing stable supplies of ultra-fine nickel and copper powders.

AI Impact Analysis on MLCC Electrode Pastes Market

User inquiries regarding AI's influence on the MLCC Electrode Pastes market center around two main areas: optimizing the manufacturing process and driving component demand through advanced hardware requirements. Users frequently ask if AI algorithms can enhance paste formulation accuracy, predict sintering outcomes, and optimize screen-printing parameters for ultra-thin layers, thereby reducing defects and material waste. Simultaneously, there is significant interest in how the massive computational needs of AI and machine learning (ML) hardware—such as specialized GPUs, high-speed memory systems, and advanced neural processors—translate into specific demands for high-density, low-Equivalent Series Resistance (ESR) MLCCs. This demand requires pastes that facilitate higher layer counts and superior electrical characteristics to manage complex power delivery networks essential for AI systems.

- AI drives demand for ultra-high capacitance MLCCs needed for sophisticated power management in AI processors and data centers.

- Predictive analytics and ML models optimize the chemical composition and rheology of electrode pastes, ensuring consistency across high-volume batches.

- AI-powered visual inspection systems enhance quality control during the screen-printing and stacking phases, immediately detecting defects in ultra-thin paste layers.

- Supply chain optimization using AI improves inventory management for critical raw materials (e.g., ultra-fine nickel powder), stabilizing procurement costs.

- Simulation tools powered by AI accelerate the development cycle of new paste formulations tailored for emerging high-frequency and high-temperature applications.

DRO & Impact Forces Of MLCC Electrode Pastes Market

The MLCC Electrode Pastes market is fundamentally driven by the accelerated pace of electronic miniaturization and the pervasive adoption of high-performance computing technologies across all sectors. The primary drivers include the global rollout of 5G networks, which require vast quantities of high-frequency components, and the electrification of the automotive industry (EVs/HEVs), where safety-critical systems necessitate highly reliable MLCCs capable of operating under harsh conditions. However, the market faces significant restraints, most notably the intense volatility and rising costs associated with critical raw materials, particularly ultra-fine metal powders (nickel, copper), whose price fluctuations directly impact manufacturing costs and profitability. Furthermore, the technical complexity involved in formulating pastes for sub-micron layer MLCCs presents a high barrier to entry and a continuous challenge for existing manufacturers.

Opportunities for market expansion are centered around the development of innovative materials and processes. Key opportunities include pioneering low-temperature co-fired ceramic (LTCC) compatible pastes, crucial for specialized module integration, and the refinement of dispersion technologies to handle even finer metal particles, enabling MLCCs with thousands of layers. The impact forces are currently skewed toward the side of the drivers, as the societal reliance on complex electronics ensures sustained, high-volume demand. Regulatory pressures regarding environmental sustainability and material toxicity are also emerging as influencing factors, pushing R&D towards greener solvent systems and safer material handling practices within paste manufacturing.

The inherent dependency of the MLCC industry on global semiconductor cycles acts as a strong impact force, causing periodic swings in demand for electrode pastes. When semiconductor demand is high, MLCC production bottlenecks occur, increasing the strain on paste supply. Conversely, market oversupply can lead to reduced profitability. The intense competition among Asian manufacturers necessitates continuous improvement in paste performance while simultaneously driving down material costs, making technological innovation an existential requirement rather than merely a competitive advantage. The shift away from noble metals (Palladium) to base metals (Nickel) represents the most significant disruptive impact force in the material segment over the past decade.

Segmentation Analysis

The MLCC Electrode Pastes market is segmented based on the type of electrode, the primary conductive material used in the paste, and the major end-user application. This segmentation provides a granular view of demand dynamics, reflecting the highly specific material requirements dictated by component function and size. The most critical segmentation lies in distinguishing between internal and external electrodes, as their chemical compositions, firing temperatures, and rheological properties differ significantly. Internal electrode pastes, particularly those using ultra-fine nickel, dominate the volume market due to their use in high-capacitance BME MLCCs, while external electrode pastes provide crucial mechanical strength and solderability.

- By Electrode Type:

- Internal Electrode Pastes

- External Electrode Pastes

- By Material:

- Nickel (Ni) Pastes

- Copper (Cu) Pastes

- Silver (Ag) Pastes

- Silver/Palladium (Ag/Pd) Pastes

- Others (Gold, Platinum)

- By Application:

- Automotive Electronics (ADAS, Powertrain, Infotainment)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Telecommunications (5G Base Stations, Network Infrastructure)

- Industrial Equipment

- Aerospace and Defense

Value Chain Analysis For MLCC Electrode Pastes Market

The MLCC Electrode Pastes value chain commences with the upstream supply of highly specialized raw materials. This segment is characterized by a limited number of global suppliers proficient in producing ultra-fine metal powders (nickel, copper) with particle sizes often below 100 nanometers and extremely tight purity specifications. These raw material quality levels are paramount, as defects in the metal powder translate directly into reliability issues in the final MLCC component. The upstream process also involves the supply of glass frits (ceramic components for adhesion) and sophisticated organic vehicles (solvents, binders, surfactants) that control the paste's viscosity and printability during the demanding screen-printing process.

The middle segment of the chain involves the paste formulators and manufacturers. These companies combine the raw materials, using proprietary mixing and dispersion technologies, to create the final electrode paste tailored to specific MLCC firing requirements (e.g., low-oxygen environments for BME pastes). This stage adds significant intellectual property value, as paste formulation requires deep chemical and engineering expertise to achieve optimal performance for ultra-thin layer deposition. The distribution channel is primarily direct, with paste manufacturers maintaining close technical relationships with large-scale MLCC producers to ensure product compatibility and customized supply solutions, minimizing the role of broad indirect distributors.

The downstream segment includes the major MLCC manufacturers (e.g., Murata, TDK, Samsung Electro-Mechanics, Yageo), which are the direct buyers and processors of the electrode pastes. The manufactured MLCCs are then sold to original equipment manufacturers (OEMs) and electronic manufacturing services (EMS) providers across critical industries like automotive, telecom, and consumer electronics. The influence of the downstream MLCC manufacturers is substantial; their technical specifications and miniaturization roadmap directly dictate the required properties and innovation trajectory for the upstream paste manufacturers. Successful engagement in this market hinges on efficient integration between paste formulation capabilities and the high-volume production demands of Tier 1 MLCC producers.

MLCC Electrode Pastes Market Potential Customers

The primary and most significant potential customers for MLCC electrode pastes are the world’s leading manufacturers of Multilayer Ceramic Capacitors. These companies operate sophisticated, high-volume production lines that consume vast quantities of specialized pastes annually. Success in penetrating this market requires paste manufacturers to secure long-term contracts with these major MLCC producers, demonstrating consistency, reliability, and the ability to meet exacting performance standards related to layer thickness, sintering temperature, and electrical performance (Q factor, ESR). This concentrated customer base means that technical partnership and qualification are crucial prerequisites for market entry.

Secondary potential customers include smaller, specialized MLCC manufacturers focusing on niche applications, such as high-reliability components for aerospace and medical devices, or manufacturers focused on specific types of capacitors like ceramic chip varistors or multilayer inductors that share similar paste deposition technologies. Beyond the core component manufacturers, indirect customers—who influence purchasing decisions—are the Tier 1 automotive suppliers (e.g., Bosch, Continental) and major OEMs (e.g., Apple, Tesla). These companies set the performance requirements and reliability standards for the final electronic modules, indirectly driving the material specifications required from the MLCC electrode paste suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.39 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | E. I. du Pont de Nemours and Company, Heraeus Holding GmbH, Tanaka Kikinzoku Group, Noritake Co., Limited, Sumitomo Metal Mining Co., Ltd., ESL Electroscience, Shoei Chemical Inc., Giga Solar Materials Corp., Daejoo Electronic Materials, C-Tech Co., Ltd., Kunshan Kuancheng Electronic Materials Co., Ltd., Sino-American Technology, Mitsuboshi Diamond Industrial Co., Ltd., Tatsuta Electric Wire and Cable Co., Ltd., Agfa-Gevaert NV, Ferro Corporation, Johnson Matthey, Toyo Ink SC Holdings Co., Ltd., Cerac Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MLCC Electrode Pastes Market Key Technology Landscape

The technological landscape of the MLCC Electrode Pastes market is fundamentally dictated by the physical constraints of ultra-miniaturization, specifically the imperative to reduce the dielectric layer thickness below 1 micron while maintaining high component reliability. This demands significant innovation in material science and processing techniques. A key technology is the development and commercialization of ultra-fine metal powders, particularly nanometer-scale nickel, which requires stringent control over particle size distribution, morphology, and purity. Advancements in powder synthesis, such as chemical precipitation methods, are crucial for achieving the necessary characteristics for integration into BME systems.

Another critical area of technological focus is rheology control and dispersion optimization. Electrode pastes must maintain extremely precise viscosity and thixotropy (shear-thinning behavior) to ensure uniform, defect-free printing onto ceramic sheets at high speeds, often using high-precision gravure or screen printing. Paste manufacturers employ proprietary organic vehicle systems—comprising advanced binders, solvents, and dispersants—to prevent the aggregation of nano-sized metal particles and ensure homogeneous layer formation. Failure to maintain perfect dispersion can lead to short circuits or poor electrical performance in the finished MLCC.

Furthermore, technological progress is concentrated on developing low-temperature co-firing (LTC) capabilities. While BME MLCCs typically require firing in a reducing atmosphere at high temperatures, which adds process complexity, there is a push for pastes that can achieve optimal density and adhesion at lower temperatures. This is vital for integrating MLCCs into specialized modules (like LTCC modules) that require lower thermal budgets. Innovations in glass frit composition and specialized sintering aids are integral to this effort, allowing for robust component formation while minimizing energy consumption and improving throughput efficiency in high-volume manufacturing environments. The integration of advanced quality control methods, often leveraging machine vision and statistical process control (SPC), ensures that the highly sensitive and complex paste formulations perform consistently on the production line.

Regional Highlights

The global MLCC Electrode Pastes market exhibits profound geographical segmentation, largely reflecting the concentration of the world’s major electronics manufacturing centers.

- Asia Pacific (APAC): This region is the undisputed leader in both consumption and production, driven by manufacturing powerhouses such as China, Japan, South Korea, and Taiwan. These nations host the largest MLCC producers (e.g., Murata, Samsung Electro-Mechanics, TDK, Yageo). The substantial demand is fueled by high-volume production of consumer electronics, automotive parts, and vast investment in 5G infrastructure deployment. APAC is the epicenter of technological innovation in BME MLCCs, driving the highest demand for specialized Ni pastes.

- North America: Characterized by high R&D activity and a robust market for high-performance computing (HPC), data centers, and specialized defense applications. Demand here focuses heavily on high-reliability, performance-critical MLCCs, driving the need for premium, often custom-formulated, electrode pastes, particularly for electric vehicle platforms and advanced telecommunications equipment.

- Europe: The European market is characterized by stringent quality and safety standards, particularly within the automotive sector. The region's pivot towards electric mobility and sustainable energy solutions creates sustained demand for high-voltage and high-temperature stable MLCCs. This necessitates the adoption of specialized external electrode pastes capable of mitigating thermal stress and ensuring long-term reliability in harsh operating environments.

- Latin America & Middle East/Africa (LAMEA): These regions represent emerging markets with growth tied to increasing regional industrialization, infrastructure development, and rising consumer electronics penetration. While smaller in scale, the growth in local assembly operations provides targeted opportunities for external electrode paste suppliers focused on cost-effective, high-yield formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MLCC Electrode Pastes Market.- E. I. du Pont de Nemours and Company

- Heraeus Holding GmbH

- Tanaka Kikinzoku Group

- Noritake Co., Limited

- Sumitomo Metal Mining Co., Ltd.

- ESL Electroscience

- Shoei Chemical Inc.

- Giga Solar Materials Corp.

- Daejoo Electronic Materials

- C-Tech Co., Ltd.

- Kunshan Kuancheng Electronic Materials Co., Ltd.

- Sino-American Technology

- Mitsuboshi Diamond Industrial Co., Ltd.

- Tatsuta Electric Wire and Cable Co., Ltd.

- Agfa-Gevaert NV

- Ferro Corporation

- Johnson Matthey

- Toyo Ink SC Holdings Co., Ltd.

- Cerac Inc.

- Potter Industries LLC

Frequently Asked Questions

Analyze common user questions about the MLCC Electrode Pastes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material shift impacting the MLCC electrode pastes market?

The primary shift is the transition from noble metal electrodes (Silver/Palladium, Ag/Pd) to Base Metal Electrodes (BME), primarily utilizing ultra-fine Nickel (Ni) powder pastes for internal electrodes. This change is driven by the necessity for cost reduction and the ability to achieve significantly higher capacitance density in miniaturized components required by modern electronics.

How does the demand for 5G technology influence the market for MLCC electrode pastes?

5G technology mandates higher frequency operation and denser component integration, requiring MLCCs with lower Equivalent Series Resistance (ESR) and exceptional reliability. This increases the demand for specialized internal pastes that can support extremely thin layers and high-quality external pastes that ensure robust high-frequency signal integrity and thermal stability.

What are the key technical challenges in developing pastes for ultra-miniaturized MLCCs?

The central technical challenge is achieving stable dispersion of nano-sized metal powders (often less than 100nm) to print uniform layers thinner than 1 micron without defects. Manufacturers must overcome issues related to nanoparticle agglomeration and ensure perfect rheological properties for high-speed, high-precision screen-printing processes.

Which application segment is expected to show the highest growth in paste consumption?

The Automotive Electronics segment, particularly driven by the rapid growth of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), is projected to exhibit the highest growth rate. These applications demand large volumes of high-reliability, high-voltage MLCCs capable of enduring harsh temperature and vibration environments, increasing consumption of specialized electrode materials.

What role do organic vehicles play in MLCC electrode paste performance?

Organic vehicles (binders, solvents, and dispersants) are essential for controlling the paste's rheology, ensuring smooth, defect-free printing, and providing temporary mechanical strength before firing. They must burn out completely during the sintering process without leaving carbon residue, which could compromise the electrical properties of the final MLCC component.

The MLCC Electrode Pastes Market is intrinsically linked to global advancements in microelectronics and electrification. The shift toward ultra-fine Ni pastes and continuous process optimization through technological integration remains paramount for market players seeking long-term competitive advantage. Robust growth is anticipated throughout the forecast period, reflecting sustained demand from high-growth sectors such as Automotive and 5G/AI infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager