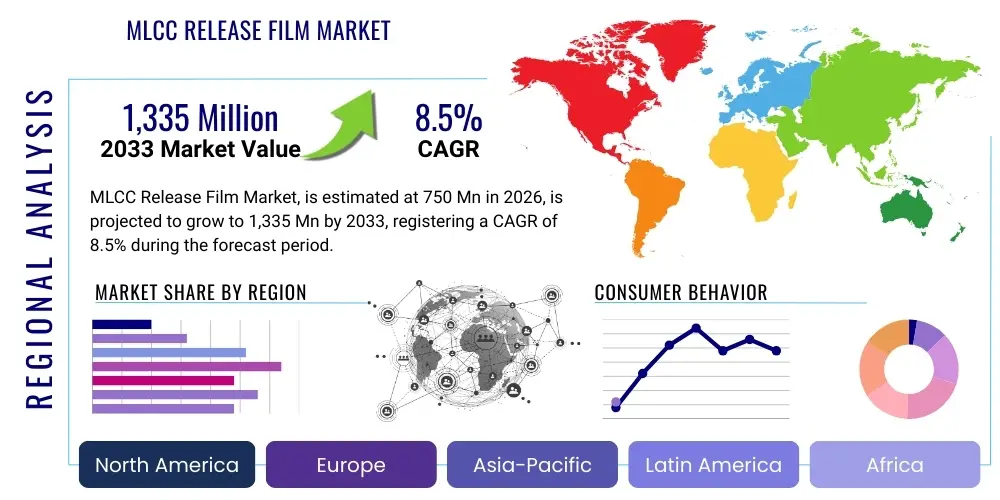

MLCC Release Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443370 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

MLCC Release Film Market Size

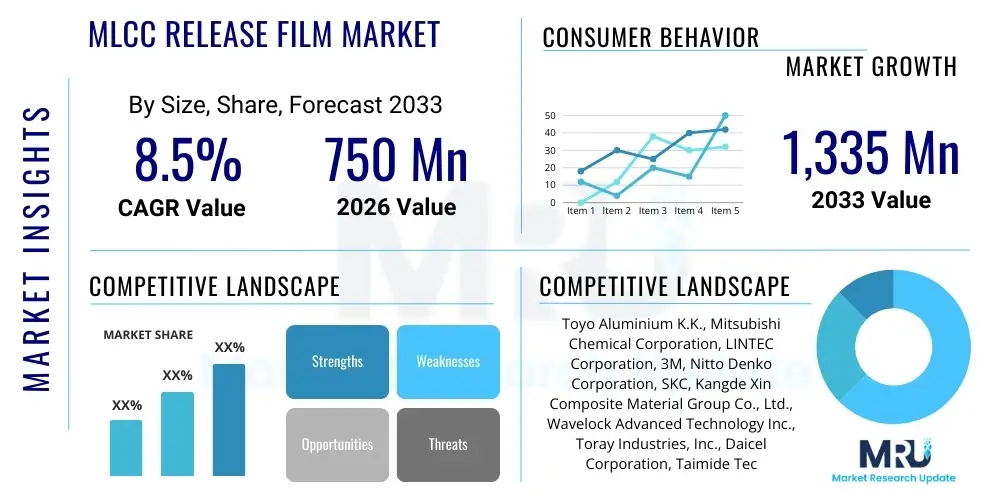

The MLCC Release Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This essential industrial material market is estimated at USD 750 Million in 2026, reflecting the growing global demand for miniaturized electronic components, particularly in the consumer electronics and automotive sectors. The consistent escalation in the complexity and density of printed circuit boards necessitates high-quality, defect-free Multi-Layer Ceramic Capacitor (MLCC) production, directly driving the valuation of the specialized release film sector.

The market is projected to reach USD 1,335 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by several macro-economic and technological shifts, including the pervasive rollout of 5G technology, which demands higher capacitance and smaller-sized MLCCs, thereby increasing the stringent requirements for the film used during the ceramic sheet casting process. Furthermore, the robust investment globally in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which utilize thousands of MLCCs per vehicle, guarantees sustained demand for high-performance release films.

MLCC Release Film Market introduction

The MLCC Release Film Market encompasses specialized polymeric films crucial for the manufacturing process of Multi-Layer Ceramic Capacitors (MLCCs). MLCCs are indispensable components in nearly all modern electronic devices, serving functions such related to filtering, bypassing, and energy storage. The release film acts as a substrate during the tape casting of ceramic slurry, ensuring uniform thickness and smoothness of the ceramic green sheets. Its primary function is to allow for the clean and residue-free separation of the dried ceramic sheet, which prevents defects and ensures the high yield necessary for mass production.

MLCC Release Films are predominantly manufactured using materials such as Polyethylene Terephthalate (PET) and Polypropylene (PP), often engineered with specific surface treatments or silicone coatings to achieve optimal release characteristics and thermal stability. The performance of this film is directly correlated with the quality and reliability of the final MLCC component. Major applications span across the entire electronics ecosystem, including consumer electronics (smartphones, laptops, tablets), industrial equipment, telecommunications infrastructure (5G base stations), and increasingly, the high-growth automotive sector, particularly in electric and hybrid vehicle powertrains and safety systems where thermal resistance and high reliability are paramount.

The core benefits driving the adoption of high-performance MLCC release films include enhanced manufacturing precision, reduced material waste, and increased throughput in MLCC production lines. Key driving factors include the relentless push toward device miniaturization, the escalating complexity of electronic circuits demanding smaller and higher-capacitance MLCCs, and the global proliferation of IoT devices. The shift towards higher voltage and temperature applications in automotive and industrial environments also necessitates continuous innovation in film material technology to maintain structural integrity during the demanding ceramic casting process, ensuring the overall efficiency of the MLCC manufacturing supply chain.

MLCC Release Film Market Executive Summary

The MLCC Release Film Market is characterized by intense technological competition focused on achieving ultra-low defect rates and superior thermal resilience, reflecting major business trends centered on quality assurance and supply chain stability within the global electronics industry. Regional trends indicate that the Asia Pacific (APAC) region, driven by dominant MLCC manufacturing hubs in China, Japan, South Korea, and Taiwan, maintains the overwhelming majority share of consumption and production. Strategic investments are increasing in European and North American manufacturing bases, largely catalyzed by geopolitical pressures and desires for regional supply chain diversification, though APAC remains the epicenter of both demand and innovation for these films.

Segment trends reveal that the Polyethylene Terephthalate (PET) based films continue to dominate the market owing to their excellent dimensional stability, cost-effectiveness, and adequate thermal properties suitable for standard MLCC production. However, higher-end applications, especially those requiring extreme thermal resistance, are seeing growing adoption of specialized films, including those based on proprietary compounds or highly specialized coatings designed to minimize contamination and ensure dimensional accuracy during high-speed casting. The increasing sophistication of MLCC designs, which often involve ultra-thin layers (less than 1 micron), demands release films with near-perfect surface flatness and consistency, driving innovation toward advanced coating technologies.

The competitive landscape is moderately consolidated, with major chemical and specialty materials manufacturers focusing on optimizing coating formulations and substrate film thickness to meet evolving MLCC requirements. The market is increasingly influenced by macro trends such as automotive electrification and 5G deployment, which elevate the demand for high-reliability MLCCs and, consequently, premium release films. Successful market navigation requires suppliers to forge robust partnerships with leading MLCC manufacturers, ensuring their product specifications meet the increasingly rigorous standards for cleanliness and release properties required in cutting-edge electronics manufacturing environments.

AI Impact Analysis on MLCC Release Film Market

Common user questions regarding AI's impact on the MLCC Release Film Market typically revolve around operational efficiency, quality control, and predictive maintenance within the highly sensitive manufacturing environment. Users frequently inquire how AI-driven vision systems can detect microscopic defects in the film surface that current manual or standard optical inspection systems might miss, thereby reducing yield loss for MLCC producers. Furthermore, questions center on the application of machine learning algorithms to optimize the release coating deposition process, ensuring minimal thickness variation and consistent adhesion/release force across large film batches. Key themes include predictive failure analysis for film degradation during storage or use, and using deep learning to correlate film characteristics with final MLCC quality metrics, enabling proactive adjustments to raw material specifications and production parameters.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) platforms is fundamentally transforming the quality control paradigm in the production and utilization of MLCC release films. In manufacturing plants, AI-powered systems are being integrated into inline inspection processes to analyze vast streams of visual data in real-time, identifying subtle inconsistencies, scratches, or particulate contamination on the film surface with precision far exceeding human capability. This proactive defect detection minimizes the risk of introducing flaws into the delicate ceramic green sheet during the casting process, significantly boosting the overall yield rate for MLCC manufacturers and ultimately reducing operational costs.

Beyond quality inspection, AI algorithms are playing a crucial role in optimizing the production process of the release film itself. Machine learning models can analyze complex variables, such as temperature, humidity, coating speed, and chemical composition, to predict and control the final release force and dimensional stability of the film product. This enables film manufacturers to rapidly adjust parameters to meet stringent customer specifications for next-generation MLCCs, which require ultra-thin, highly uniform ceramic layers. The integration of these intelligent systems ensures higher product consistency, faster time-to-market for new film innovations, and allows MLCC producers to run their casting machines at optimized speeds while maintaining high quality output.

- Enhanced Defect Detection: AI-powered vision systems identify microscopic film anomalies, reducing contamination risks in MLCC casting.

- Predictive Maintenance: ML algorithms forecast potential failures in film coating machinery, minimizing downtime and ensuring production continuity.

- Process Optimization: AI models fine-tune coating thickness and chemical composition parameters for optimal release characteristics and dimensional stability.

- Supply Chain Transparency: Increased use of data analytics for tracking raw material quality and film performance correlations, improving sourcing decisions.

- Automated Yield Improvement: Real-time analysis of film usage data to automatically adjust casting speeds and temperatures, maximizing ceramic sheet output.

- New Material Discovery: AI accelerates the research and development of novel high-temperature, high-stability release film materials necessary for advanced automotive MLCCs.

DRO & Impact Forces Of MLCC Release Film Market

The dynamics of the MLCC Release Film Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces influencing strategic decision-making. The primary driver is the accelerating demand for Multi-Layer Ceramic Capacitors across high-growth electronic sectors, particularly the global transition toward electric vehicles (EVs), which require substantially more MLCCs than traditional internal combustion engine vehicles, and the continuous expansion of 5G infrastructure. These applications demand higher volumetric efficiency and reliability from MLCCs, directly mandating superior performance characteristics from the release films used in their manufacture. The continuous miniaturization trend in consumer electronics further fuels the need for ultra-thin, highly consistent films capable of supporting extremely precise ceramic sheet casting.

However, the market faces significant Restraints, notably the extreme sensitivity to contamination and the high cost associated with developing and manufacturing ultra-clean, defect-free specialty release films. The production environment must maintain stringent cleanliness standards (often cleanroom specifications), increasing operational complexity and capital expenditure for film manufacturers. Furthermore, the volatility in raw material prices, particularly for petrochemical-derived polymers like PET and coating chemicals, poses a persistent financial challenge. The highly consolidated nature of the MLCC manufacturing industry means that film suppliers face intense pricing pressure while needing to consistently meet increasingly demanding technical specifications, which acts as a barrier to entry for new competitors.

Significant Opportunities for growth lie in the development of environmentally sustainable films, driven by global mandates for greener manufacturing practices, such as bio-degradable or easily recyclable polymer substrates. Another major opportunity is the expansion into advanced packaging technologies and high-frequency MLCCs, which require films capable of withstanding higher temperatures and chemical exposure during complex processing steps. The ability to supply films compatible with advanced sintering processes or specific slurry formulations represents a key strategic advantage. These Impact Forces compel continuous innovation in coating technology and material science, pushing the market toward specialized, high-margin products that address specific pain points in next-generation electronic component manufacturing.

Segmentation Analysis

The MLCC Release Film Market is comprehensively segmented based on material type, film thickness, end-use application, and geographical region, providing a detailed framework for understanding market structure and identifying niche growth areas. This segmentation is crucial because the performance requirements for the release film vary dramatically depending on the specific type of MLCC being produced—for instance, high-capacitance MLCCs for automotive applications require films with higher thermal stability and mechanical strength compared to standard MLCCs used in simple consumer devices. The differentiation by material type, primarily between Polyethylene Terephthalate (PET), Polypropylene (PP), and other specialized polymer films, dictates the thermal budget and surface energy characteristics essential for optimal ceramic tape casting.

Analyzing the market by film thickness allows stakeholders to understand the shift toward ultra-thin films necessary for manufacturing smaller, higher-layer count MLCCs, a fundamental trend driving the industry toward miniaturization. The end-use application segmentation—covering automotive, consumer electronics, industrial, and telecommunications—highlights the varying demand stability and reliability requirements across sectors. The automotive segment, for example, demands zero-defect tolerance and long-term thermal stability, translating into a preference for premium, high-specification release films. Conversely, high-volume consumer electronics benefit from cost-effective films that still maintain acceptable defect rates for mass production efficiency.

This structured analysis provides MLCC film manufacturers with strategic insights into optimizing their product portfolio, enabling targeted R&D investment towards materials and technologies that meet the most stringent demands of high-growth segments like automotive and 5G infrastructure. Understanding regional segmentation is paramount for logistics and capacity planning, given that manufacturing centers for MLCCs are heavily concentrated in specific Asia Pacific nations. The segmentation structure reflects the technical complexity and functional criticality of the release film in the semiconductor and passive component supply chain, ensuring granular market assessment.

- By Material Type:

- Polyethylene Terephthalate (PET) Release Film

- Polypropylene (PP) Release Film

- Polyimide (PI) Release Film (for high-temperature applications)

- Specialty Polymer Films

- By Film Thickness:

- Below 50 µm

- 50 µm to 100 µm

- Above 100 µm

- By Application:

- Automotive Electronics (EVs, ADAS)

- Consumer Electronics (Smartphones, Wearables)

- Telecommunications (5G Infrastructure, Base Stations)

- Industrial & Others (Medical Devices, Aerospace)

- By Coating Type:

- Silicone Coated

- Non-Silicone Coated (e.g., Fluoropolymer)

Value Chain Analysis For MLCC Release Film Market

The Value Chain for the MLCC Release Film Market begins with Upstream Analysis, focusing on the procurement of core raw materials—primarily petrochemical-derived polymers suchates as PET, PP, and specialized monomers—and the various chemical components required for the proprietary release coatings (such as silicone compounds, fluoropolymers, and cross-linking agents). This stage is heavily influenced by global crude oil prices and the capacity utilization of major chemical producers, which directly impacts the cost structure for film manufacturers. Key upstream participants include large integrated chemical companies and specialized coating material suppliers who provide the necessary high-purity inputs crucial for producing defect-free film substrates. Securing consistent, high-quality raw materials is a critical competitive factor due to the non-negotiable cleanliness and performance requirements of the final film product.

The midstream segment involves the core manufacturing process of the MLCC release film, encompassing substrate production (extrusion or casting), precise coating application, curing, and rigorous quality inspection. Film manufacturers invest heavily in cleanroom facilities and sophisticated coating equipment to ensure ultra-uniform thickness and consistent release properties. Efficiency and technological differentiation at this stage, particularly in developing unique coating formulations that offer customized release forces without residual transfer, determine the manufacturer's profitability and market access. Direct and indirect distribution channels facilitate the movement of the finished films to the MLCC manufacturers.

Downstream Analysis focuses on the direct consumers of the film: the Multi-Layer Ceramic Capacitor manufacturers, such as Murata, Samsung Electro-Mechanics, TDK, and Taiyo Yuden. These customers integrate the film into their tape casting machines to create ceramic green sheets. The performance of the film directly affects the MLCC yield rate and quality, making purchasing decisions highly technical and often based on long-term supplier qualification. Distribution primarily occurs directly from film manufacturers to large MLCC producers, especially for highly customized, specialty films, ensuring tight quality control and technical support. However, smaller or regional MLCC producers might utilize indirect channels, relying on specialized distributors or agents who manage inventory and logistical complexities, particularly in fragmented regional markets. Successful engagement in the downstream market requires deep technical collaboration and a global supply footprint to support the geographically dispersed MLCC production hubs.

MLCC Release Film Market Potential Customers

The primary potential customers and end-users of the MLCC Release Film Market are the global manufacturers of Multi-Layer Ceramic Capacitors (MLCCs). These entities, which include major passive component suppliers and smaller regional specialized producers, utilize the release film as a critical consumable during the precise tape casting process of the ceramic slurry. The procurement decision is highly technical and involves rigorous qualification processes, making the MLCC manufacturer the immediate and most critical buyer. The demand from these manufacturers is directly influenced by the final applications of the capacitors they produce, creating secondary demand drivers rooted in major electronics trends.

Further down the value chain, the ultimate buyers whose product designs dictate the demand for MLCCs and, subsequently, the films, include major Original Equipment Manufacturers (OEMs) in high-growth sectors. Automotive Tier 1 suppliers and OEMs, particularly those focused on electric powertrains, battery management systems (BMS), and Advanced Driver-Assistance Systems (ADAS), represent a rapidly expanding customer base. The sheer volume and high reliability required for automotive-grade MLCCs translate into consistent, high-specification demand for release films. Similarly, telecommunications equipment manufacturers, driven by the massive deployment of 5G infrastructure requiring high-frequency, high-stability passive components, are crucial indirect customers whose stringent performance metrics cascade back to film specifications.

The industrial and medical device sectors also represent important niche customers. Industrial electronics demand MLCCs that can operate reliably in harsh environments and elevated temperatures, requiring specialized films for their production. Manufacturers of advanced diagnostic equipment and precision machinery, while perhaps smaller in volume than consumer electronics, often necessitate the highest-grade, lowest-defect films due to the criticality of their final product reliability. Therefore, film suppliers must tailor their sales strategies to address both the high-volume needs of consumer and automotive giants and the ultra-high-quality requirements of specialized industrial buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,335 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyo Aluminium K.K., Mitsubishi Chemical Corporation, LINTEC Corporation, 3M, Nitto Denko Corporation, SKC, Kangde Xin Composite Material Group Co., Ltd., Wavelock Advanced Technology Inc., Toray Industries, Inc., Daicel Corporation, Taimide Technology Co., Ltd., Shin-Etsu Chemical Co., Ltd., Sumitomo Bakelite Co., Ltd., DuPont, FUJIFILM Corporation, Sanwa Co., Ltd., Nippon Kayaku Co., Ltd., Dai Nippon Printing Co., Ltd., S-Kon Electric Co., Ltd., Lotte Chemical Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MLCC Release Film Market Key Technology Landscape

The technology landscape of the MLCC Release Film market is centered on achieving ultra-precision in film substrate manufacturing and advanced chemical engineering of the release coating layer. The substrate material technology primarily involves highly sophisticated extrusion and stretching processes for PET and PP films to ensure exceptional dimensional stability, low thermal shrinkage, and superior flatness, which are non-negotiable prerequisites for the successful casting of ultra-thin ceramic sheets. Innovations in film substrate manufacturing are increasingly focused on reducing residual stress and enhancing the mechanical strength of thinner films, enabling MLCC producers to stack more ceramic layers for higher capacitance components without compromising structural integrity during the handling and stacking phases. The dimensional integrity of the film directly dictates the final quality of the MLCC, driving continuous refinement in polymer purification and film handling within cleanroom environments.

Crucially, the release coating technology represents the core competitive differentiator. While traditional silicone coatings offer reliable release properties, the industry is seeing a shift toward advanced, non-silicone coatings, such as fluoropolymers or proprietary organic formulations, particularly for high-end MLCCs where even trace amounts of silicone residue can interfere with subsequent processing steps or component performance. These advanced coatings must achieve the required release force—strong enough to hold the ceramic slurry during drying but weak enough to separate cleanly—with near-perfect uniformity and minimal particle shedding. Technological advancements focus on applying these coatings via highly controlled processes like gravure coating or slot die coating, followed by precise curing techniques to lock in the desired surface chemistry and morphology.

Furthermore, technology development is heavily invested in improving the thermal resistance of the entire film system. As MLCC manufacturing moves towards faster production cycles and higher firing temperatures, the release film must maintain its structural and dimensional properties without decomposition or excessive shrinkage. This is leading to the exploration of higher-performance base polymers like Polyimide (PI) for niche, extreme-temperature applications, though PET remains the mainstream choice due to its balance of performance and cost. Automated, high-resolution inspection technologies, often leveraging AI, are also integral to the technology landscape, ensuring that the increasingly complex, multi-layered films meet the zero-defect standards demanded by leading MLCC manufacturers globally. The synthesis of material science, chemical engineering, and precision manufacturing defines the technological frontier of this specialized market.

Regional Highlights

The regional dynamics of the MLCC Release Film Market are overwhelmingly dominated by Asia Pacific (APAC), which is the undisputed global hub for both MLCC production and sophisticated electronics manufacturing, commanding the largest market share globally.

- Asia Pacific (APAC): This region is the engine of the MLCC Release Film market, driven by the presence of major MLCC producers (Murata, Samsung Electro-Mechanics, TDK, etc.) located primarily in Japan, South Korea, China, and Taiwan. The robust manufacturing ecosystem, government support for electronics production, and high domestic demand for consumer electronics and automotive components ensure that APAC not only consumes the majority of the films but also drives technological requirements and innovation speed. China's growing domestic MLCC production capacity, coupled with its enormous consumer electronics market, guarantees sustained, high-volume demand.

- North America: The market in North America is characterized by specialized, high-reliability applications, particularly in aerospace, defense, and high-performance computing. While the volume of MLCC manufacturing is lower than in APAC, the demand is concentrated on ultra-premium, zero-defect release films used in specialized capacitor production. Growth is also supported by R&D activities and the increasing adoption of electric vehicle technology and advanced industrial automation, requiring local sourcing flexibility and stringent quality assurance processes.

- Europe: The European market demonstrates steady growth, primarily fueled by the strong automotive industry, particularly in Germany and France, focusing on EV technology and ADAS integration. European demand leans towards high-specification, temperature-resistant MLCCs, driving the need for sophisticated release films. Additionally, regulatory pressures regarding environmental sustainability are fostering increased demand for recyclable or bio-based film solutions in this region, creating a unique growth segment focused on eco-friendly materials.

- Latin America (LATAM): The LATAM region represents a nascent market, heavily dependent on imported MLCCs and electronics manufacturing components. Demand for MLCC release films is limited to localized assembly operations and smaller electronic component production facilities. Growth is tied to regional economic stability and gradual investment in domestic electronics manufacturing capabilities, though its overall contribution to the global market remains relatively small and focused on standard-grade film products.

- Middle East and Africa (MEA): Similar to LATAM, the MEA market for MLCC release films is highly fragmented and generally relies on global supply chains. Demand is primarily influenced by investments in telecommunications infrastructure (e.g., mobile network expansion) and large-scale industrial projects, which require associated electronic controls. Future growth potential is linked to regional efforts to diversify economies away from oil and establish localized technology manufacturing hubs, thereby slowly increasing the need for specialized component materials like release films.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MLCC Release Film Market, encompassing companies that excel in material science, precision coating, and substrate manufacturing.- Toyo Aluminium K.K.

- Mitsubishi Chemical Corporation

- LINTEC Corporation

- 3M

- Nitto Denko Corporation

- SKC

- Wavelock Advanced Technology Inc.

- Toray Industries, Inc.

- Daicel Corporation

- Taimide Technology Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- DuPont

- FUJIFILM Corporation

- Sanwa Co., Ltd.

- Nippon Kayaku Co., Ltd.

- Dai Nippon Printing Co., Ltd.

- S-Kon Electric Co., Ltd.

- Kangde Xin Composite Material Group Co., Ltd.

- Lotte Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the MLCC Release Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of MLCC Release Film in electronics manufacturing?

The MLCC Release Film serves as a precision casting substrate during the manufacturing of Multi-Layer Ceramic Capacitors. Its critical function is to provide a perfectly flat, contaminant-free surface upon which ceramic slurry is cast and dried, enabling the subsequent clean, precise separation of the ultra-thin ceramic green sheet required for stacking, thereby ensuring high MLCC production yield and quality.

How does the shift to electric vehicles (EVs) impact the demand for MLCC Release Films?

The proliferation of EVs significantly increases demand because modern electric vehicles require up to 10,000 to 15,000 MLCCs per vehicle, far surpassing traditional internal combustion engines. This heightened demand, coupled with the need for high-reliability, high-temperature MLCCs for power electronics, drives the market toward high-specification, defect-free release films suitable for rigorous automotive-grade production standards.

What are the key technical differences between silicone and non-silicone coated MLCC Release Films?

Silicone-coated films offer reliable, consistent release at a lower cost and are suitable for general-purpose MLCCs. Non-silicone coated films (often using fluoropolymers or specialized organic compounds) are preferred for high-end applications, especially those sensitive to potential silicone contamination during subsequent processes, such as thin-film semiconductors or specific high-frequency MLCCs where residue interference must be eliminated.

Which geographical region dominates the global MLCC Release Film Market?

The Asia Pacific (APAC) region overwhelmingly dominates the global market, accounting for the largest share in terms of both consumption and production capacity. This dominance is due to the deep concentration of major global MLCC manufacturers and the robust electronics supply chain ecosystem present in countries like Japan, South Korea, China, and Taiwan.

What role does film thickness play in MLCC production?

Film thickness is crucial for dimensional stability and handling. As MLCCs become smaller and require more stacked layers (miniaturization trend), the demand for thinner (sub-50 µm) and more dimensionally stable release films increases. Thinner films facilitate the precise casting of ultra-thin ceramic sheets, directly impacting the final capacitance and size of the electronic component.

What impact does raw material volatility have on the market pricing?

Raw material volatility, particularly in the pricing of petrochemical derivatives (like PET and PP) and specialized coating chemicals, directly pressures the operational costs of film manufacturers. Since high purity and quality are non-negotiable, manufacturers often absorb some cost fluctuations or pass them along, leading to moderate price instability in the final release film product, especially for highly customized specifications.

How are environmental sustainability concerns affecting the MLCC Release Film industry?

Growing sustainability mandates are driving research into developing bio-based polymers, readily recyclable substrates, and solvent-free coating processes for MLCC release films. While performance remains paramount, the ability to offer environmentally friendlier films is becoming a significant competitive advantage, particularly in regulated markets like Europe and among global corporations prioritizing green supply chains.

What are the primary segments driving future market growth beyond consumer electronics?

Future market growth is primarily driven by the Automotive Electronics segment (especially autonomous driving and power management systems in EVs) and the Telecommunications sector, fueled by the global rollout and expansion of 5G and 6G infrastructure, both of which require an immense volume of high-performance, high-reliability MLCCs.

Why is dimensional stability a critical technical requirement for MLCC Release Films?

Dimensional stability—the film's ability to resist change in size or shape under processing temperatures and tension—is critical because it directly ensures the uniform thickness and precise alignment of the ceramic green sheets. Any shrinkage or warping during the casting and drying process would introduce defects, leading to catastrophic yield loss in the final multi-layered component.

How do MLCC film suppliers maintain zero-defect standards required by component manufacturers?

Suppliers maintain zero-defect standards through stringent cleanroom manufacturing environments (Class 100 or better), advanced inline quality control systems (often leveraging AI vision inspection), and rigorous incoming quality checks of raw materials. They also utilize specialized surface treatments and anti-static properties to prevent particle attraction and contamination during handling and transport.

Which technology is currently the focus of competitive differentiation in the MLCC film sector?

The primary technological focus for competitive differentiation lies in proprietary, highly customized non-silicone release coatings. These coatings must deliver precise and tunable release forces while completely eliminating the risk of residue transfer, addressing the strict contamination requirements of advanced, high-performance MLCC lines.

What is the significance of the Value Chain Analysis for MLCC Release Film producers?

The Value Chain Analysis helps producers identify high-leverage points, primarily upstream procurement stability (raw material costs) and downstream engagement (technical collaboration with MLCC manufacturers). Understanding these points allows companies to mitigate risk, optimize production efficiency, and ensure their film specifications align perfectly with the evolving requirements of major component buyers.

Does the introduction of solid-state batteries (SSBs) pose a threat to MLCC Release Film demand?

While the long-term shift toward SSBs may influence overall battery component demand, it does not pose a direct immediate threat to MLCC release films. MLCCs are passive components used for filtering and decoupling throughout the circuit board, a necessity that remains regardless of the specific power source technology (like SSBs or traditional lithium-ion batteries). The continued complexity of electronic control units ensures sustained MLCC demand.

How do MLCC manufacturers typically qualify new release film suppliers?

Qualification involves extensive, multi-phase testing focused on dimensional stability, surface smoothness, thermal performance, and most critically, the precise release force and absence of transferable residue. This rigorous process often requires pilot batch testing over several months to ensure the film performs reliably under high-speed, mass-production conditions without compromising the ceramic sheets.

What are the implications of 5G technology adoption on film specifications?

5G technology requires MLCCs capable of handling high frequencies and high data rates, often necessitating smaller, high-capacitance components. This pushes film specifications toward tighter tolerances for thickness uniformity and dimensional accuracy, as the manufacturing of these highly complex, miniature MLCCs demands exceptional precision from the casting substrate.

How is the industrial segment influencing the film market?

The industrial segment, encompassing specialized machinery and automation equipment, demands extremely robust and reliable MLCCs that can withstand harsh environments and long operating lifecycles. This requirement mandates high-quality, thermally resistant MLCC release films, driving innovation toward specialized substrates and coatings that ensure the flawless production of these high-durability components.

What is the current trend regarding film thickness in the MLCC industry?

The predominant trend is toward the continuous reduction of film thickness. As MLCC designs evolve to maximize capacitance in smaller footprints, the need for ultra-thin ceramic green sheets drives film manufacturers to produce specialized release films well below 50 µm, which requires significant technological investment in handling and dimensional stability control during manufacturing.

How do market restraints, such as high production costs, affect the competitive landscape?

High production costs, driven by the necessity for cleanroom environments and complex coating processes, tend to restrict market entry for smaller players. This restraint favors large, established chemical and material science companies that possess the necessary capital investment and technical expertise to consistently meet the demanding quality standards of leading MLCC manufacturers, leading to a moderately consolidated competitive landscape.

What considerations must be made when selecting a release film for high-temperature MLCC processes?

For high-temperature MLCC processes (e.g., specific co-firing stages or demanding application environments like automotive under-hood electronics), the release film must exhibit superior thermal stability, low thermal shrinkage, and maintained dimensional integrity at elevated temperatures. Materials like Polyimide (PI) or highly stabilized PET variants with specialized coatings are often required to prevent material failure or dimensional inaccuracies.

Beyond MLCCs, what other component markets utilize similar release film technology?

Similar precision release film technologies are utilized in the manufacturing of other advanced electronic components, including thick-film integrated circuits, specific types of laminated electronic substrates, thin-film batteries, and various composite material fabrication processes that require a temporary, non-contaminating substrate for high-precision deposition or casting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager