MMORPG Gaming Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442286 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

MMORPG Gaming Market Size

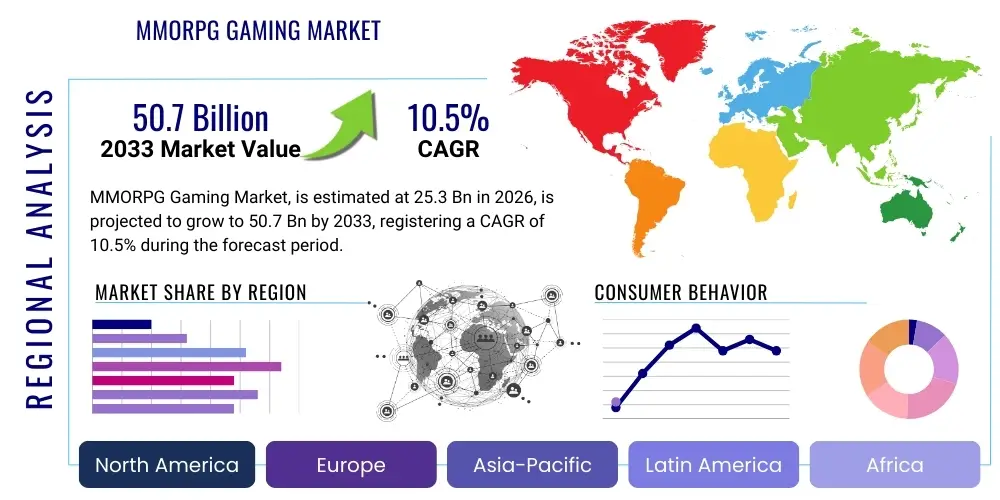

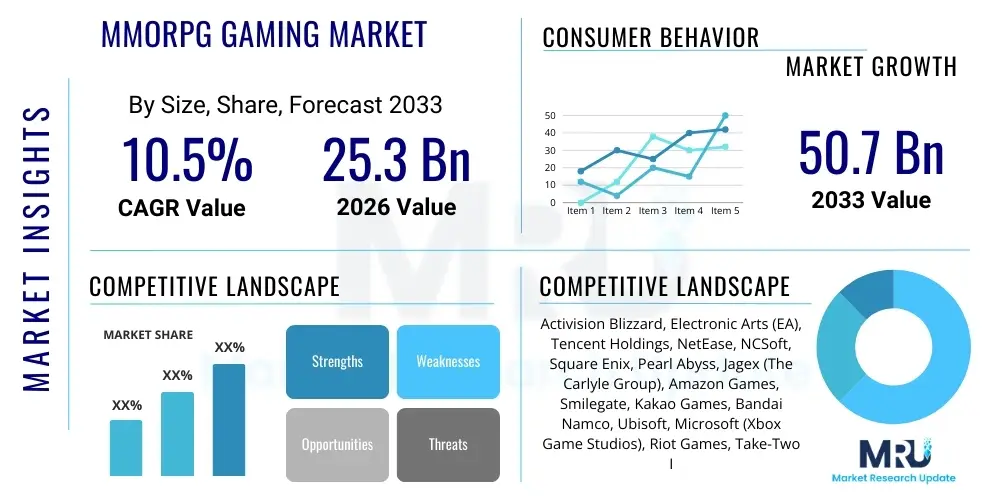

The MMORPG Gaming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 25.3 Billion in 2026 and is projected to reach USD 50.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating globalization of high-speed internet infrastructure, the increasing proliferation of sophisticated mobile gaming devices capable of handling complex graphical environments, and the continued shift towards digital distribution models which lowers the barrier to entry for both developers and consumers worldwide. The integration of competitive esports formats and community-driven content generation further sustains user engagement, ensuring consistent revenue streams through sustained player bases and recurring microtransaction models.

Market expansion is also intrinsically linked to technological advancements in cloud gaming and cross-platform compatibility. Cloud gaming services are mitigating the traditional high upfront hardware investment required for playing high-fidelity MMORPGs, democratizing access across varied devices. Furthermore, the development cycles are increasingly focusing on delivering seamless experiences across PC, console, and mobile platforms, capturing larger demographic pools and maximizing the lifetime value of intellectual properties (IPs). This multi-platform approach not only widens the market reach but also necessitates substantial backend infrastructure investment, which large industry players are readily undertaking to solidify their competitive positions.

Regional dynamics play a significant role in determining market scale, with the Asia Pacific region, particularly China, South Korea, and Japan, representing the largest revenue contributors due to deeply entrenched gaming cultures and early adoption of mobile MMORPGs (MMOs). However, North America and Europe are exhibiting accelerating growth, driven by renewed interest in high-production value Western-developed titles and the incorporation of innovative features like non-fungible tokens (NFTs) and blockchain technology, particularly within the nascent GameFi sector. The long-term forecast suggests sustained growth driven by continuous content updates and the launch of high-budget AAA titles designed to maintain substantial long-term player engagement.

MMORPG Gaming Market introduction

The Massively Multiplayer Online Role-Playing Game (MMORPG) Market encompasses video games where thousands of players interact simultaneously within a persistent virtual world. These games are defined by their expansive scope, continuous social interaction, character progression systems, and typically require a sustained connection to the internet for gameplay. Key products within this market range from classic PC titles with subscription models to modern Free-to-Play (F2P) mobile titles heavily reliant on in-app purchases and cosmetic microtransactions. The primary applications span entertainment, social networking, and increasingly, competitive esports and virtual economies. The significant benefits include high replayability, strong community building, and the creation of valuable virtual assets.

Major driving factors sustaining the MMORPG market include rising global disposable incomes, particularly in emerging economies, the consistent improvement in mobile hardware performance, and the exponential growth of gaming viewership facilitated by platforms like Twitch and YouTube. Furthermore, the industry is witnessing a significant shift towards "games as a service," where consistent content drops and live events ensure that established titles maintain relevance over decades, rather than relying solely on initial sales. The inherently social nature of MMORPGs also acts as a powerful driver, as players seek communal experiences and opportunities for collaborative achievement in complex virtual environments.

The modern MMORPG ecosystem is highly dynamic, often integrating complex virtual economies that mirror real-world financial activities. This intersection of entertainment and economic incentive attracts both casual and dedicated players. Product development has shifted towards maximizing player retention through sophisticated matchmaking algorithms, personalized content delivery, and the seamless integration of cross-platform play, ensuring that a player’s progress is synchronized regardless of the device used. This commitment to accessibility and long-term engagement is crucial for maintaining the market’s projected double-digit growth rate through 2033.

MMORPG Gaming Market Executive Summary

The MMORPG Gaming Market is characterized by robust commercial trends, primarily dominated by the transition from traditional pay-to-play models towards sophisticated F2P frameworks supported by highly optimized microtransaction ecosystems, generating substantial recurring revenue. Business trends indicate increasing mergers and acquisitions (M&A) activity among major publishers seeking to acquire established IPs or bolster technological capabilities, especially in cloud infrastructure and mobile development studios. Furthermore, there is a pronounced focus on leveraging blockchain technology to introduce digital ownership (NFTs) for in-game assets, although this trend remains volatile and subject to regulatory scrutiny. Successful companies are those that prioritize continuous live service updates and foster strong player-developer communication to maintain long-term community loyalty and minimize player churn.

Regionally, the Asia Pacific (APAC) market remains the undeniable powerhouse, driven by massive mobile adoption and cultural preferences for social, grind-heavy MMOs, particularly in Southeast Asia and Greater China. South Korea continues its dominance in exports of high-quality titles with competitive esports potential. North America and Europe exhibit strong demand for high-fidelity PC and console MMOs, often characterized by strong narrative design and complex raid mechanics, alongside a rapidly growing mobile segment influenced by Asian design paradigms. Latin America and the Middle East and Africa (MEA) represent significant emerging markets, benefiting from increased internet penetration and expanding digital payments infrastructure, positioning them as key growth vectors for the latter half of the forecast period.

Segment trends reveal that the Mobile segment is the fastest-growing platform, eclipsing PC and console revenue share, necessitating developer focus on optimization for smaller screens and casual play sessions, while maintaining the depth expected of an MMORPG. Within the revenue model segmentation, the F2P model combined with strategic cosmetic and convenience microtransactions reigns supreme, demonstrating superior scalability and market reach compared to traditional subscription models, which now primarily cater to niche, established core audiences. Genre-wise, high fantasy remains the foundation, but blending traditional RPG elements with open-world survival and sandbox features is a key innovation trend driving new player engagement.

AI Impact Analysis on MMORPG Gaming Market

User inquiries concerning AI's influence on the MMORPG Gaming Market frequently center on concerns regarding job displacement for human developers (specifically in asset creation and QA), the potential for hyper-realistic and personalized non-player characters (NPCs), and the ethics surrounding AI-driven cheating detection mechanisms. Key themes revolve around enhanced personalization—how AI can generate dynamic storylines and quests tailored to individual player choices—and operational efficiency, particularly how generative AI can rapidly prototype new content, potentially lowering content production costs and frequency. There is also significant anticipation regarding AI's ability to create more believable, complex social ecosystems within the game, moving beyond scripted dialogue and static behavior, thereby increasing immersion and long-term game longevity.

The integration of advanced AI and Machine Learning (ML) is fundamentally changing the development and operational landscape of MMORPGs. In development, AI is accelerating the creation of vast virtual worlds through procedural generation of terrain, architecture, and even preliminary quest chains, dramatically reducing the time-to-market for expansive content updates. Operationally, AI is crucial for maintaining game integrity, employed in sophisticated anti-cheat systems that analyze player behavior anomalies in real-time. Furthermore, AI-driven customer support chatbots and personalized marketing recommendations enhance user experience and engagement, ensuring players receive relevant content suggestions based on their historical gameplay patterns.

However, the ethical implementation of AI remains a critical concern. While AI can create personalized content, developers must ensure that it does not lead to unwanted grind loops or manipulative monetization tactics driven by sophisticated behavioral profiling. The risk of creating sophisticated AI 'bots' that simulate human players, thereby degrading the authentic social experience which is core to the MMORPG genre, is a persistent threat that requires continuous innovation in detection and prevention methods. Balancing the efficiencies provided by AI with the need to maintain genuine player interaction and fair economic practices will be paramount for market sustainability.

- Accelerated Content Generation: Generative AI assists in procedural world building, environmental asset creation, and basic quest design, speeding up live service cycles.

- Dynamic NPC Behavior: ML algorithms power NPCs with adaptive dialogue, memory of player interactions, and complex social graphs, enhancing immersion and realism.

- Enhanced Anti-Cheat Systems: AI/ML detects complex behavioral patterns indicative of hacking, scripting, or botting, improving competitive fairness and game integrity.

- Personalized Player Experiences: AI customizes quest progression, difficulty scaling, and in-game recommendations based on individual player performance and preferences.

- Optimized Resource Management: AI handles sophisticated load balancing, server optimization, and resource allocation in massive virtual environments.

- Automated Quality Assurance (QA): AI assists in testing large-scale patches and updates by simulating thousands of simultaneous users, identifying bugs before official release.

DRO & Impact Forces Of MMORPG Gaming Market

The MMORPG Gaming Market is propelled by robust Drivers, mitigated by specific Restraints, and presents significant Opportunities, all shaping the Impact Forces that define competitive strategy. Key drivers include the exponential growth in mobile device penetration capable of high-fidelity graphics, the rising acceptance of microtransaction models generating sustainable revenue, and the increasing global appeal of video game cultural phenomena reinforced by streaming and esports. Conversely, the market faces significant restraints such as the lengthy and expensive development cycles required for AAA MMORPGs, the intense competition and market saturation leading to high marketing costs, and persistent issues related to server stability, latency, and sophisticated anti-cheat management. These countervailing forces establish a high barrier to entry for new competitors.

Significant opportunities exist in emerging technological domains, notably the integration of decentralized technologies. The adoption of blockchain and NFTs promises to create verifiable digital ownership for in-game assets, potentially transforming the player base into stakeholders and unlocking new "Play-to-Earn" (P2E) revenue streams, fundamentally altering the relationship between game time and economic value. Furthermore, the expansion of cloud gaming services (e.g., NVIDIA GeForce Now, Xbox Cloud Gaming) represents a powerful opportunity to reach hardware-constrained demographics, drastically expanding the accessible market size, particularly in regions with high bandwidth but low consumer purchasing power for dedicated gaming rigs.

The resultant impact forces are complex: intense competition drives constant innovation in graphics and social features, forcing developers to invest heavily in perpetually evolving technology stacks. The power of distribution shifts toward platforms capable of supporting cross-play, maximizing user liquidity. Furthermore, the high development cost acts as a concentrating force, favoring large publishers with extensive financial resources and established IP libraries. Ultimately, success hinges on the ability to manage live service engagement effectively, converting high initial interest into sustainable long-term participation through continuous, high-quality content delivery, effectively countering the restraint of player fatigue and market saturation.

Segmentation Analysis

The MMORPG Gaming Market is systematically segmented across Type, Platform, Genre, and Geography, providing a granular view of revenue distribution and growth potential. Analyzing these segments is critical for stakeholders to tailor their product development, monetization strategies, and regional marketing efforts. The segmentation highlights the underlying industry shift, showing a clear migration of player engagement and revenue from traditional PC-centric models towards the highly accessible and frequent-use Mobile segment. Understanding these distinctions allows developers to optimize resource allocation, for example, focusing high-fidelity graphic resources on the PC/Console segment while emphasizing convenience and social integration for the burgeoning Mobile consumer base.

Revenue model segmentation is particularly vital, delineating the commercial success of F2P versus Subscription models. While subscriptions guarantee reliable recurring revenue from core users, the F2P model, leveraged with sophisticated microtransaction design, captures a significantly larger volume of players globally, proving to be the dominant growth driver. Platform segmentation reinforces this trend, with mobile commanding the largest share in terms of raw user count and demonstrating rapid revenue acceleration, although PC still maintains supremacy in terms of per-user average spending (ARPU) for high-end cosmetic items and premium subscriptions among dedicated players.

Genre segmentation provides insights into player preferences, revealing the timeless appeal of high fantasy but also indicating emerging demand for titles that incorporate elements of Sci-Fi, survival mechanics, and sandbox features, offering players greater agency and emergent gameplay opportunities. Geographically, segmentation underscores the market's reliance on APAC but forecasts strong diversification into high-growth potential markets in LATAM and MEA, driven by infrastructure investments and increased affordability of smartphones. These strategic segmentation insights are indispensable for generating targeted investment strategies and product diversification plans.

- By Type/Revenue Model:

- Subscription-based (Pay-to-Play)

- Free-to-Play (F2P) with Microtransactions

- Buy-to-Play (with optional subscriptions/MTX)

- By Platform:

- PC (Desktop/Laptop)

- Console (PlayStation, Xbox, Nintendo)

- Mobile (iOS, Android)

- By Genre:

- Fantasy (High Fantasy, Dark Fantasy)

- Sci-Fi / Futuristic

- Action/Adventure RPG

- Sandbox / Survival MMO

- Casual/Hybrid MMO

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For MMORPG Gaming Market

The value chain of the MMORPG Gaming Market is intricate, involving multiple specialized stages starting from Intellectual Property (IP) creation and extending through development, distribution, and critical post-launch live services. The upstream analysis focuses heavily on technological infrastructure and content creation, including the development of advanced proprietary or licensed game engines (e.g., Unreal Engine, Unity), high-fidelity graphic asset creation, and the design of complex, scalable server architectures necessary to support thousands of concurrent users globally. Key upstream participants include engine providers, middleware companies specializing in networking and physics, and third-party art and animation outsourcing studios. The quality and efficiency of the upstream stages directly determine the technical capabilities and visual fidelity of the final product, influencing initial consumer adoption rates.

The midstream segment is dominated by the developers and publishers themselves. Developers are responsible for coding, design, integration, and iterative testing, often involving extensive quality assurance cycles due to the massive scale of the virtual worlds. Publishers assume the critical roles of funding, risk management, global marketing, and securing distribution deals. Successful midstream operations require efficient project management, particularly the ability to manage large, international development teams and maintain consistent content pipelines crucial for live service longevity. Distribution channels are increasingly digital and direct, minimizing reliance on physical retail stores, thus capturing higher margins.

Downstream analysis involves player interaction and monetization. Direct distribution channels primarily include proprietary launchers (e.g., Steam, Epic Games Store, Battle.net) and platform-specific stores (Google Play, Apple App Store, Xbox/PlayStation Stores). Indirect distribution often involves third-party key sellers or regional partners managing localization and specific territory compliance. The core downstream activity is live service operation, which involves hosting massive servers, deploying continuous content updates, managing community relations, and implementing sophisticated monetization systems (microtransactions, seasonal passes). Customer relationship management and community feedback integration are essential for maintaining player retention and maximizing the lifetime value of the player base.

MMORPG Gaming Market Potential Customers

Potential customers in the MMORPG Gaming Market are highly diverse, encompassing a wide demographic spectrum defined less by traditional age groups and more by psychological profiles, engagement preferences, and disposable income dedicated to entertainment. The primary end-users can be broadly categorized into three segments: Core Hardcore Gamers, Social/Casual Players, and Emerging Market Users. Core Hardcore Gamers, typically aged 18-35, are highly invested individuals seeking deep mechanics, competitive raiding, PvP (Player versus Player) challenges, and often form the backbone of the subscription model and drive high microtransaction spending on power/convenience items. They prioritize complex narrative and system mastery.

Social/Casual Players, spanning a broader age range, are attracted primarily by the communal aspect of MMORPGs. They value cooperation, crafting, housing systems, and lighthearted content. They are highly responsive to cosmetic items and seasonal events, forming the volume base for Free-to-Play models. This group often utilizes mobile platforms due to accessibility and ease of quick, frequent engagement. Their purchasing behavior is often event-driven, spending small amounts consistently across longer durations rather than large initial investments.

Emerging Market Users (predominantly APAC, LATAM, MEA) represent a high-growth segment, characterized by high mobile phone penetration and increasing disposable income. These users are typically highly price-sensitive but respond exceptionally well to F2P models and strong localized content. Potential buyers include not only individual players but also institutional entities involved in esports organizations (sponsoring competitive teams) and increasingly, cryptocurrency investors attracted by Play-to-Earn (P2E) economies built within certain MMO titles, treating virtual assets as tradable commodities. Targeting success involves deep cultural localization and optimized mobile performance across all platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.3 Billion |

| Market Forecast in 2033 | USD 50.7 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Activision Blizzard, Electronic Arts (EA), Tencent Holdings, NetEase, NCSoft, Square Enix, Pearl Abyss, Jagex (The Carlyle Group), Amazon Games, Smilegate, Kakao Games, Bandai Namco, Ubisoft, Microsoft (Xbox Game Studios), Riot Games, Take-Two Interactive, Epic Games, Garena, Perfect World, Daybreak Game Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MMORPG Gaming Market Key Technology Landscape

The technology landscape underpinning the MMORPG Gaming Market is characterized by continuous innovation aimed at enhancing scalability, visual fidelity, and accessibility. High-performance game engines, such as Unreal Engine 5 and proprietary in-house engines developed by major publishers like NCSoft and Square Enix, are crucial for rendering massive, complex virtual environments with high polygon counts and sophisticated lighting effects. Network infrastructure relies heavily on distributed computing and cloud services (e.g., AWS, Azure) to manage the enormous server loads and data traffic generated by thousands of concurrent players interacting in real-time, focusing on minimizing latency, particularly for global cross-region play.

A significant technological focus is placed on cross-platform compatibility and seamless data synchronization. Developers utilize standardized APIs and cloud storage solutions to ensure that a player’s progress is instantly accessible across PC, console, and mobile devices, enhancing the overall player retention rate and maximizing playtime. Furthermore, advancements in Artificial Intelligence (AI) and Machine Learning (ML) are being deployed not only for sophisticated anti-cheat monitoring but also for generating dynamic, personalized content, managing in-game economies, and optimizing server load balancing based on predictive usage patterns, leading to more stable and evolving game worlds.

Emerging technologies like Virtual Reality (VR) and Augmented Reality (AR) are beginning to influence niche segments, offering enhanced immersion, though widespread adoption remains constrained by hardware costs and accessibility. More immediately impactful is the rise of blockchain technology, which introduces decentralized asset management and smart contracts to facilitate verifiable digital ownership (NFTs) and the P2E economic model. While technically complex and requiring specialized development expertise, these decentralized technologies are being strategically explored by large publishers as potential next-generation monetization mechanisms and player engagement boosters, promising to reshape how virtual goods are valued and traded globally.

Regional Highlights

The regional analysis of the MMORPG Gaming Market reveals significant disparities in consumption patterns, technological maturity, and revenue models. Asia Pacific (APAC) stands as the dominant market, driven overwhelmingly by high mobile penetration, a cultural affinity for highly social and community-oriented MMOs, and the presence of industry giants like Tencent and NetEase. Countries such as China, South Korea, and Japan lead in both development and consumption. South Korea, in particular, remains the global benchmark for high-quality MMORPGs and competitive esports integration. The APAC market's success is deeply intertwined with the Free-to-Play model, where high volume user bases generate substantial revenue through cosmetic and convenience microtransactions, supported by robust mobile payment infrastructures.

North America and Europe (NA/EU) together form the second major market block, characterized by higher average revenue per user (ARPU) compared to APAC, although with a smaller overall user volume. This region shows a greater preference for high-fidelity graphics, deep narrative content, and PC/Console platforms, though mobile adoption is rapidly accelerating. Western developers often focus on Buy-to-Play or hybrid Subscription/Microtransaction models, catering to a historically strong PC gaming culture. The driving forces in NA/EU include the widespread adoption of high-bandwidth internet necessary for smooth gameplay and the continuous introduction of established fantasy IPs onto modern platforms, sustaining high-demand in the core gaming demographics.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as critical high-growth regions. While previously hindered by infrastructural limitations and lower disposable income, rapid digitalization, improved internet connectivity, and the increasing affordability of mid-range smartphones are unlocking significant player pools. These regions are highly receptive to localized F2P mobile titles. Investment in localized servers, region-specific content, and tailored payment methods (e.g., supporting local currencies and alternative payment gateways) is crucial for capitalizing on the burgeoning demand within LATAM and MEA, positioning them as essential battlegrounds for market share acquisition during the forecast period.

- Asia Pacific (APAC): Dominates revenue and user base, led by China, South Korea, and Japan; strong preference for Mobile and F2P models; hub for competitive esports.

- North America (NA): High ARPU; strong core PC/Console market; early adopter of hybrid and B2P models; significant influence on Western AAA development standards.

- Europe (EU): Diverse market with strong PC gaming traditions (especially in Central/Eastern Europe); rapidly increasing mobile engagement; high demand for diverse genre offerings.

- Latin America (LATAM): Fastest growing emerging market; high mobile dependency; growth driven by improved internet access and localization efforts.

- Middle East and Africa (MEA): Growing mobile segment; highly receptive to global IPs; infrastructure improvement is key driver; market penetration reliant on localized payment solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MMORPG Gaming Market, covering their strategic initiatives, product portfolios, recent developments, and market positioning. These companies represent the vanguard of technological innovation and market consolidation in the sector.- Activision Blizzard

- Electronic Arts (EA)

- Tencent Holdings

- NetEase

- NCSoft

- Square Enix

- Pearl Abyss

- Jagex (The Carlyle Group)

- Amazon Games

- Smilegate

- Kakao Games

- Bandai Namco

- Ubisoft

- Microsoft (Xbox Game Studios)

- Riot Games

- Take-Two Interactive

- Epic Games

- Garena

- Perfect World

- Daybreak Game Company

Frequently Asked Questions

Analyze common user questions about the MMORPG Gaming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Mobile MMORPG segment?

The Mobile MMORPG segment is primarily driven by widespread accessibility due to affordable smartphones, improved mobile hardware performance allowing for console-quality graphics, and the global success of the Free-to-Play monetization model supported by robust microtransaction economies, especially in the APAC region.

How is blockchain technology impacting the future of MMORPGs?

Blockchain technology facilitates the creation of verifiable digital ownership of in-game assets through Non-Fungible Tokens (NFTs), enabling Play-to-Earn (P2E) models. This potentially transforms virtual goods into real-world tradable assets, enhancing player economic engagement and creating new revenue streams for developers.

Which region holds the largest market share for MMORPGs?

The Asia Pacific (APAC) region currently holds the largest market share, driven by massive user populations in China and South Korea, deeply embedded gaming culture, and early, widespread adoption of mobile MMORPG titles and live service monetization strategies.

What are the primary restraints affecting market expansion?

Key restraints include the extremely high capital investment and multi-year development cycles required for AAA titles, intense market saturation leading to increased competition for player retention, and persistent technical challenges related to maintaining server stability and combating sophisticated in-game cheating (botting).

What role does Artificial Intelligence play in MMORPG development?

AI is increasingly crucial for accelerating content creation through procedural generation of environments, powering highly dynamic and adaptive Non-Player Characters (NPCs), optimizing network traffic and server load management, and enhancing anti-cheat detection systems to ensure game integrity and fairness.

The MMORPG Gaming Market continues its trajectory as one of the most dynamic and financially lucrative sectors within the global video game industry. Characterized by long content lifecycles and highly engaged communities, its sustained success relies on the delicate balance between technological innovation and community-centric design. The transition to cross-platform compatibility, particularly the dominance of mobile platforms, necessitates continuous adaptation in development pipelines. Furthermore, the burgeoning influence of decentralized technologies—specifically the integration of blockchain—presents a profound commercial pivot, offering opportunities for novel ownership models and player-driven economies, though these elements introduce new regulatory and operational complexities that stakeholders must navigate carefully. Future growth is inextricably tied to the continued development of high-speed internet infrastructure in emerging economies and the effective deployment of AI to manage the scale and complexity of persistent virtual worlds. Companies that successfully leverage data analytics to personalize content and maintain robust, continuous live service updates are strategically positioned to capture the largest share of the projected growth towards the 2033 forecast horizon. The regional dynamics underscore the essential need for localized content and monetization strategies, acknowledging the cultural and platform variances between the established APAC powerhouse, the high-ARPU Western markets, and the rapidly accelerating emerging markets in LATAM and MEA, all contributing to a rich and intensely competitive global landscape.

The focus on environmental storytelling, coupled with sophisticated graphical fidelity, remains a key differentiator for attracting and retaining the core PC and Console audiences. Developers are increasingly utilizing advanced rendering techniques, such as ray tracing and highly optimized engine architectures, to deliver immersive experiences that justify high playtime commitment. Moreover, the integration of robust modding tools and player creation systems within sandbox MMORPGs is fostering emergent gameplay, where the community itself generates valuable content, mitigating some of the restraints associated with developer-led content fatigue. This trend transforms players from mere consumers into active contributors, deepening loyalty and extending the effective lifespan of the game IP substantially. Financial models are evolving; while F2P dominates, there is growing interest in 'battle pass' systems and seasonal content packages that provide recurring revenue without the commitment of a traditional monthly subscription, thereby capturing a wider segment of fluctuating player engagement.

In terms of operational technology, cloud infrastructure is no longer an optional component but a foundational necessity. Leading MMORPGs require global, low-latency deployment capabilities, and major companies are investing heavily in proprietary or dedicated cloud solutions to handle peak loads during major content releases and international events. Security remains paramount; the rise of in-game economies, especially those involving tradable P2E assets, has amplified the necessity for cutting-edge security protocols to prevent hacking, fraud, and duplication of digital assets. The ethical use of player data, managed through stringent compliance with regional regulations such as GDPR, is also a growing concern, impacting how user engagement is tracked and personalized. The long-term success of any new IP launched during the forecast period will heavily depend on its technical resilience, its capacity for global scalability, and its ability to foster an authentic, engaged social environment that differentiates it from the saturated competitive field. This requires not only excellent initial design but a commitment to an evolving, long-term content roadmap driven by continuous technological refinement and community input, ensuring that the MMORPG market remains vibrant and achieves its projected growth targets.

The competitive environment is seeing increased convergence between traditional gaming giants and technology firms. Companies like Amazon Games, leveraging extensive cloud resources (AWS), are entering the development space, signaling a strategic focus on the inherently scalable nature of MMORPGs. This convergence drives up the production standard, demanding higher investment in talent and technology across the board. Furthermore, the role of Intellectual Property (IP) legacy is crucial; established franchises often provide a reliable foundation for launching new titles or rebooting existing ones, capitalizing on nostalgia and pre-existing fan bases, which significantly lowers initial marketing risk and accelerates user acquisition compared to entirely new IPs. Consequently, M&A activity is expected to continue focusing on acquiring high-value game studios with deep experience in live service operations and proven IP track records.

From a consumer behavior perspective, the pandemic era significantly boosted player engagement and time spent in virtual worlds, a behavioral shift that has largely persisted post-lockdown, embedding MMORPGs as a consistent form of social entertainment. This increased engagement has also normalized the concept of spending within the game environment, shifting microtransaction acceptance from perceived predatory behavior to an established mechanism for funding continuous content creation and supporting server upkeep. The cultural influence of streaming platforms, where top players and influencers showcase high-level gameplay and communal activities, acts as a powerful, non-traditional marketing funnel, directly influencing purchasing decisions and player influx into popular titles. The market’s resilience is demonstrated by the sustained performance of decades-old titles, provided they receive consistent technological updates and new storyline expansions, highlighting the enduring value of persistent virtual worlds and deeply intertwined player communities.

In summary, the MMORPG market’s evolution is characterized by technological maturity meeting broad consumer accessibility. The ability of developers to integrate complex systems—from scalable global servers and AI-driven content to decentralized P2E economies—while maintaining the essential social and cooperative elements that define the genre, will dictate market leadership through 2033. The segmentation analysis underscores the need for platform-specific optimization and geographically sensitive monetization strategies to harness growth across diverse global demographics, ultimately ensuring the MMORPG genre remains a cornerstone of the interactive entertainment industry.

The strategic deployment of data analytics is now foundational to managing MMORPG economies and player churn. Sophisticated tools monitor billions of data points related to player engagement, item inflation, transaction frequency, and pathing efficiency. This data enables developers to tune difficulty curves, adjust item drop rates, and modify monetization efforts in real-time, maximizing player satisfaction while ensuring the health of the virtual economy. For F2P models, effective data utilization is directly correlated with revenue stability, allowing for precise identification of high-value players and optimization of conversion funnels for cosmetic and convenience items. This move towards data-driven live operations distinguishes modern MMORPG management from previous static content delivery models, demanding expertise in big data processing and predictive modeling within game development studios.

The regulatory environment, though currently permissive, presents a potential threat, especially regarding loot boxes and virtual asset ownership. As governments globally increasingly scrutinize monetization practices that resemble gambling, developers are preemptively designing systems with greater transparency and fairness. Furthermore, the global proliferation of P2E elements necessitates engagement with complex international financial regulations, particularly concerning cross-border virtual currency transactions and taxation. Navigating this evolving legal landscape without stifling innovation is a critical operational challenge for multinational MMORPG publishers, especially those integrating blockchain technologies that inherently decentralize control and asset management. Successfully future-proofing market position requires proactive legal compliance alongside technical advancement.

Finally, the talent landscape plays a crucial role in maintaining competitive advantage. The demand for highly specialized developers skilled in scalable backend architecture, advanced graphics programming, and live service game design significantly exceeds supply. Companies must invest heavily in talent acquisition, retention, and continuous training. The adoption of new technologies like AI and blockchain requires new skill sets, creating intense competition for expert engineers and economists capable of designing complex, stable virtual economies. The capacity of a publisher to rapidly deploy high-quality content updates hinges directly on the strength and efficiency of its development teams, making human capital management a primary competitive factor in this capital-intensive market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager