Mobile Pet Care Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441510 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Mobile Pet Care Market Size

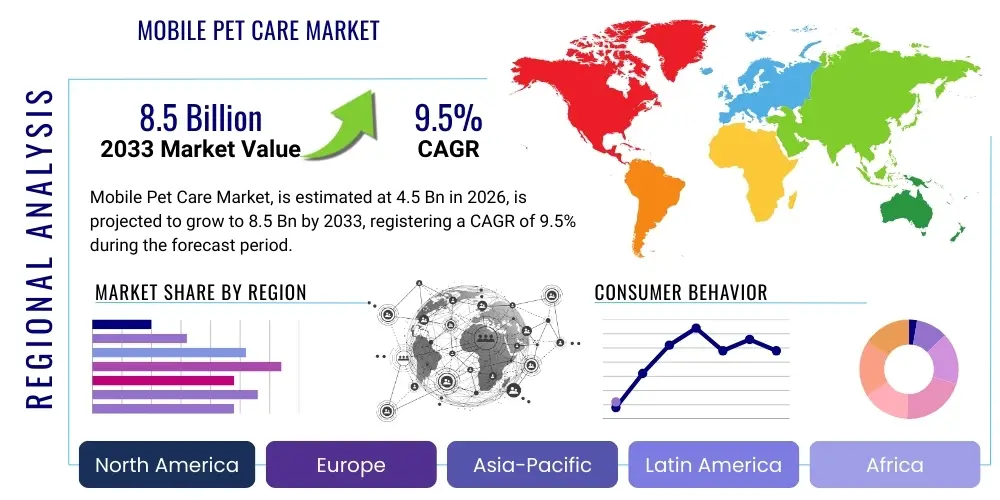

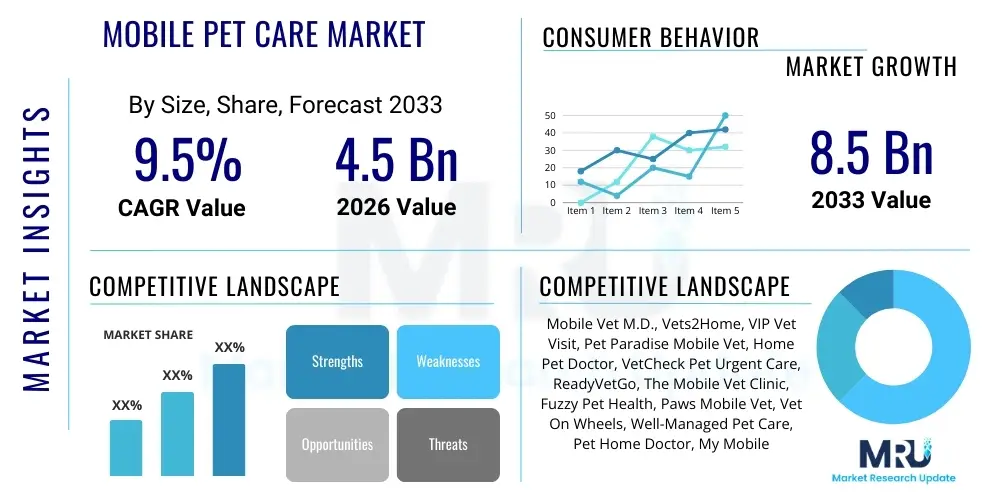

The Mobile Pet Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the increasing trend of pet humanization across developed and developing economies, coupled with growing consumer demand for convenient, personalized, and stress-free veterinary and grooming services delivered directly to their homes. The inherently flexible business model of mobile pet care providers allows them to efficiently serve densely populated urban areas and geographically dispersed rural communities, optimizing operational efficiencies and enhancing customer satisfaction.

Mobile Pet Care Market introduction

The Mobile Pet Care Market encompasses a diverse range of professional services, including veterinary examinations, routine vaccinations, diagnostics, therapeutic treatments, professional grooming, behavior training, and non-emergency procedures, all delivered through specially equipped vehicles. These mobile units function as fully contained clinics or grooming salons, featuring advanced medical equipment, climate control, and sanitation facilities, ensuring the provision of high-quality care equivalent to traditional brick-and-mortar establishments. The core value proposition of mobile pet care lies in eliminating the logistical challenges and stress often associated with transporting pets to traditional clinics, appealing directly to busy working professionals, multi-pet owners, and pet owners whose animals experience severe anxiety in unfamiliar clinical settings. The increasing penetration of technology, particularly in scheduling and communication, further enhances the seamless delivery of these highly personalized services across various geographical areas.

Major applications for mobile pet care services extend beyond basic wellness checks and increasingly include specialized fields such as preventative dental care, minor surgical procedures, senior pet care, and palliative services. The convenience factor is a major driver, allowing pet owners to maintain stricter adherence to vaccination schedules and preventative health regimens without disrupting their daily routines. Furthermore, the ability of mobile veterinarians to conduct thorough home assessments provides a more holistic view of the pet’s environment and lifestyle, leading to more accurate diagnoses and tailored treatment plans, which is a significant advantage over standard clinical settings. This localized approach fosters stronger relationships between practitioners and pet owners, promoting long-term client retention and trust.

Driving factors underpinning the robust growth of this market segment include the global surge in pet ownership post-pandemic, the rising disposable income allocated towards premium pet services, and significant advancements in portable diagnostic technology that allow complex procedures to be performed outside of fixed facilities. Additionally, the aging population of pet owners, who may face mobility challenges, and the increasing trend of pet humanization—where pets are viewed as integral family members deserving of the highest level of care—create sustained demand for convenient, high-touch services. The market is characterized by fragmentation, presenting significant opportunities for standardization, technology integration, and consolidation among key regional service providers aiming to expand their operational footprints.

Mobile Pet Care Market Executive Summary

The Mobile Pet Care Market is experiencing robust acceleration driven by shifts in consumer preferences favoring convenience and personalization, alongside significant technological enablement in portable medical devices and scheduling platforms. Key business trends indicate a movement towards vertically integrated service models, where providers offer comprehensive packages bundling preventative veterinary medicine with high-demand services like grooming and training, maximizing per-visit revenue. Regionally, North America maintains market dominance due to high rates of pet expenditure and established service infrastructure, but the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid urbanization, increasing middle-class disposable income, and emerging digital infrastructure supporting on-demand service delivery. These regional dynamics highlight significant investment opportunities for scaling operations and adapting service models to address varying logistical challenges, particularly traffic congestion in metropolitan areas and connectivity issues in remote zones.

Segment trends reveal a growing prioritization of proactive and preventative care, particularly evident in the high adoption rates of mobile vaccination and wellness clinics designed to improve population health management. The Pet Type segment continues to be dominated by services catering to dogs and cats, reflecting their demographic majority in household ownership; however, specialized mobile care for exotic pets and avian species is emerging as a high-margin niche. Furthermore, there is a distinct segment trend toward utilizing advanced scheduling and routing software that leverages Geographical Information Systems (GIS) to optimize the daily routes of mobile units, thereby reducing fuel costs, minimizing travel time, and increasing the number of appointments served per day. This operational efficiency is crucial for mitigating the inherent high operating costs associated with maintaining a fleet of specialized vehicles and highly skilled professional staff.

The executive outlook suggests that strategic partnerships between mobile service providers and established veterinary hospital networks or pet insurance companies will become increasingly common, enhancing referral systems and improving continuity of care. The convergence of physical mobile service delivery with telehealth capabilities is transforming the market, allowing for remote consultations, prescription renewals, and post-operative monitoring, significantly extending the reach and efficiency of the professional workforce. Investors are keenly focused on firms demonstrating strong digital capabilities, scalable infrastructure, and clear pathways to regulatory compliance, particularly regarding controlled substance handling and data privacy standards for pet medical records. Sustained growth will depend heavily on the continuous professional development of mobile practitioners and the ability of businesses to effectively manage staffing demands in a highly competitive labor market.

AI Impact Analysis on Mobile Pet Care Market

User queries regarding AI’s impact on the Mobile Pet Care Market center predominantly on themes of diagnostic accuracy enhancement, efficiency in service scheduling, and the personalization of preventative health plans. Key concerns often revolve around the initial capital investment required for AI integration, data security protocols for sensitive pet health information, and ensuring that AI tools augment—rather than replace—the critical human-touch aspects of pet care delivery. Users are highly interested in how AI can streamline the administrative burden on mobile veterinarians, enabling them to dedicate more time to hands-on clinical work. There is a clear expectation that AI will deliver sophisticated predictive health analytics, identifying potential health issues before they become acute emergencies, thereby increasing the value proposition of preventative mobile care subscriptions and improving overall quality of life for companion animals. The integration of Natural Language Processing (NLP) in client communication platforms is also a high-interest area, aimed at automating appointment confirmations, providing post-visit instructions, and filtering non-urgent inquiries.

The deployment of Artificial Intelligence and Machine Learning (ML) algorithms is poised to fundamentally revolutionize several core operational and clinical aspects of the Mobile Pet Care Market, driving both efficiency and clinical precision. Clinically, AI-powered diagnostic tools are already being implemented for rapid analysis of digital cytology, radiographic images, and laboratory results directly within the mobile unit, providing near real-time feedback that accelerates treatment protocols. This capability significantly reduces the reliance on external laboratories for initial screening and allows mobile practitioners to make immediate, informed decisions, a crucial advantage given the logistical constraints of a mobile practice. Furthermore, ML models are utilized to analyze large datasets of patient health records to identify high-risk patients for specific conditions based on breed, age, geographic location, and lifestyle factors, enabling proactive outreach programs.

Operationally, AI’s impact is most visible in optimizing complex logistical challenges inherent to the mobile model. Advanced algorithmic routing systems utilize real-time traffic data, appointment density, and geographical constraints to generate the most efficient service routes, minimizing non-billable travel time and maximizing revenue generation potential. Predictive maintenance scheduling for the specialized mobile clinics is another crucial application, where AI monitors vehicle performance and equipment health to forecast potential failures, ensuring maximum uptime and reliability of the service fleet. Finally, sophisticated customer relationship management (CRM) systems powered by AI interpret client communication patterns and purchase history to personalize marketing efforts and proactively suggest relevant follow-up appointments or new services, thereby significantly enhancing client loyalty and lifetime value.

- AI-driven automated routing and scheduling optimization reduces travel time by 15-20%.

- Integration of AI image analysis for rapid, on-site diagnostics (radiography, cytology).

- Predictive modeling for preventative healthcare alerts and customized wellness plans.

- Enhanced client communication via NLP-powered chatbots for 24/7 basic query resolution.

- AI-enabled inventory management ensuring mobile units are stocked optimally based on daily route demands.

- Fraud detection and verification in pet insurance claims processing integrated with mobile service data.

DRO & Impact Forces Of Mobile Pet Care Market

The Mobile Pet Care Market is shaped by a powerful interplay of stimulating drivers, necessary restraints, compelling opportunities, and critical impact forces that collectively dictate its trajectory and scalability. The dominant driver is the profound shift towards convenience and stress-free service delivery, directly addressing the anxiety experienced by many pets and their owners during clinic visits, particularly cats and large, difficult-to-transport dogs. Counterbalancing this strong positive force are significant restraints, notably the inherently higher initial capital expenditure required to equip specialized mobile clinics and the ongoing high operational overheads, including vehicle maintenance, fuel costs, and specialized staffing retention. However, these challenges open up vast opportunities, especially in the development of subscription-based preventative care models and the expansion of geriatric and hospice mobile services, niches that deeply value in-home professional attention. The overall impact forces suggest a market characterized by high consumer acceptance and technological dynamism, balanced by regulatory scrutiny concerning accessibility and safety standards.

Key drivers include the pervasive trend of pet humanization globally, which translates directly into increased spending on premium, personalized health services, viewing high-quality mobile care as a worthy investment in a family member's wellbeing. The accelerating urbanization trend contributes significantly, as densely populated areas face logistical challenges accessing traditional veterinary clinics, making mobile services time-efficient necessities. Furthermore, technological innovation in miniaturized and portable diagnostic equipment, such as handheld ultrasound units and comprehensive blood analyzers, has profoundly enhanced the service scope that can be effectively delivered outside a fixed clinical environment, supporting complex medical interventions. These drivers create a compelling economic justification for mobile operation despite the elevated upfront costs associated with specialized veterinary vehicle customization, insulation, and power generation required for full functionality.

Significant restraints include the fragmented regulatory landscape across different jurisdictions concerning the practice of mobile veterinary medicine, especially regarding the storage and dispensing of controlled pharmaceuticals. Staffing remains a persistent challenge, as recruiting veterinary professionals who are adept at both clinical practice and independent, mobile operations can be difficult, often leading to increased wage competition and labor costs. Conversely, the core opportunities lie in leveraging digital platforms to integrate services seamlessly, offering tele-triage, and expanding into underserved demographic groups such as seniors and individuals with disabilities who highly benefit from at-home services. The main impact force remains centered on consumer perception of value: successful providers must effectively articulate how the added convenience and reduced stress justify the often slightly higher pricing structure associated with premium, individualized mobile service delivery.

Segmentation Analysis

The Mobile Pet Care Market is systematically segmented based on the type of service offered, the specific pet being served, and the nature of the end-user utilizing the service, providing a granular view of market dynamics and consumer behavior. Service-based segmentation helps providers tailor their fleet requirements and staffing models, distinguishing between high-frequency, low-cost services like basic grooming and high-value, specialized services such as advanced veterinary diagnostics. Pet Type segmentation directs marketing and equipment investment, with dogs and cats dominating, while smaller but growing segments like exotic and avian pets require distinct expertise and specialized, often costly, portable equipment. Understanding these segments is crucial for strategic business planning, allowing companies to target specific high-growth areas and develop specialized service packages that maximize operational efficiency and market penetration across diverse geographical areas, from dense urban cores to sprawling suburban communities.

- Service Type:

- Mobile Veterinary Care (Vaccinations, Wellness Exams, Diagnostics, Minor Surgery)

- Mobile Grooming (Bathing, Clipping, Nail Trimming)

- Mobile Pet Training and Behavioral Consultation

- Mobile Pet Sitting and Walking (Often integrated via digital platforms)

- Mobile Specialty Services (Dental, Hospice, Rehabilitation)

- Pet Type:

- Dogs

- Cats

- Exotic Pets (Birds, Reptiles, Small Mammals)

- Others

- End-User:

- Individual Pet Owners (Residential Households)

- Commercial Users (Breeders, Kennels, Shelters, Film/TV Production)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Mobile Pet Care Market

The value chain for the Mobile Pet Care Market begins with robust upstream activities focusing on the procurement of specialized clinical equipment and high-specification vehicle chassis that must be customized to function as sterile, climate-controlled mobile units. Upstream suppliers are critical partners, providing advanced portable diagnostic tools (e.g., blood analyzers, digital radiography systems), inventory management software, and controlled substance storage solutions compliant with strict medical regulations. Efficiency in this stage dictates the reliability and clinical capability of the entire service offering, demanding stringent quality checks and strong vendor relationships to secure reliable supply chains for specialized veterinary drugs and disposables. Effective supply chain management mitigates the risk of service interruptions due to equipment failure or inventory shortages, which is particularly challenging in a distributed service model.

The core activities involve the actual service delivery, which includes route planning, client communication, clinical execution, and digital record keeping, all performed by highly skilled veterinary and grooming professionals. This stage is heavily dependent on sophisticated software for real-time scheduling, GPS tracking, and electronic medical record (EMR) integration, ensuring seamless data transfer between the mobile unit and centralized databases. Distribution channels in this market are predominantly direct, involving direct booking by pet owners through company websites, dedicated mobile applications, or telephonic communication, bypassing traditional intermediaries. However, increasing adoption of third-party platforms for booking and payment processing, particularly in urban areas, introduces an indirect channel that widens market access but may introduce commission costs, necessitating careful margin management.

Downstream activities focus heavily on customer retention, quality assurance, and feedback loop closure, which are paramount in a service industry driven by trust and personalized interaction. Post-service engagement, including automated follow-up calls, reminders for next appointments, and requests for digital feedback, reinforces the relationship and informs continuous service improvement. Successful mobile pet care providers differentiate themselves not only through clinical excellence but also through superior logistical coordination and professional, empathetic client service. The strong reliance on efficient, reliable vehicles and advanced digital tools makes technology investment a sustained competitive imperative across the entire value chain, driving down operational complexities and enhancing the perceived professionalism of the mobile offering.

Mobile Pet Care Market Potential Customers

The primary customer base for the Mobile Pet Care Market comprises affluent, time-constrained individual pet owners residing in urban and suburban areas who prioritize convenience and are willing to pay a premium for personalized, at-home services that minimize stress for their animals. This segment typically includes young professionals, dual-income households without children, and individuals focused on the "humanization" of their pets, viewing routine care as a necessity rather than a luxury. These customers often have two or more pets, making the logistics of transporting multiple animals to a clinic particularly burdensome, rendering the mobile option highly attractive. They are generally digitally savvy, preferring to manage appointments and payments through seamless mobile applications and expecting rapid, professional communication.

A secondary, yet crucial, segment consists of pet owners with specific accessibility needs, including the elderly, individuals with mobility challenges, and owners of pets with severe anxiety issues, particularly those suffering from vet phobia or aggression triggered by clinic environments. For these consumers, mobile services transform pet care from a difficult ordeal into a manageable routine, significantly improving compliance with preventative health schedules. Furthermore, rural and semi-rural households that face long travel times to reach the nearest full-service veterinary clinic represent a substantial opportunity. Mobile clinics effectively bridge this geographical gap, offering critical services that might otherwise be delayed or forgone entirely due to distance, establishing themselves as essential healthcare providers in areas where fixed clinics are sparse.

Finally, commercial establishments, such as professional breeders, animal shelters, rescue organizations, and specialized pet training facilities, constitute the third significant segment. These users require scheduled, bulk care for multiple animals—such as large-scale vaccinations, microchipping, and routine examinations—which are efficiently managed by mobile units that can dedicate specialized staff and equipment for a full day on site. This commercial business-to-business (B2B) application provides consistent, high-volume contracts, offering a stable revenue stream that complements the highly variable residential customer demand. Marketing strategies must be customized for each segment, highlighting convenience and personalized care for individual owners, and emphasizing efficiency, volume capacity, and reliability for commercial clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mobile Vet M.D., Vets2Home, VIP Vet Visit, Pet Paradise Mobile Vet, Home Pet Doctor, VetCheck Pet Urgent Care, ReadyVetGo, The Mobile Vet Clinic, Fuzzy Pet Health, Paws Mobile Vet, Vet On Wheels, Well-Managed Pet Care, Pet Home Doctor, My Mobile Vet, Mobile Pet Hospital, Vet's Best Friend, Happy Paws Mobile Vet, Wag! (Services Division), Vetster (Hybrid Model), BetterVet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Pet Care Market Key Technology Landscape

The operational viability and scalability of the Mobile Pet Care Market are intrinsically linked to continuous technological innovation, particularly the development and refinement of highly portable, durable, and network-enabled equipment. Key technologies center around maximizing clinical capability outside of a fixed facility. This includes next-generation miniaturized diagnostic machinery, such as point-of-care blood chemistry analyzers, portable digital radiography units that offer instant imaging results, and handheld ultrasound devices that allow for sophisticated, real-time internal examinations. The integration of robust, cloud-based Electronic Medical Record (EMR) systems is paramount, ensuring that mobile practitioners have immediate, secure access to comprehensive patient histories, billing information, and centralized scheduling data, irrespective of location or network latency, thereby maintaining data integrity across all service points.

Beyond clinical instruments, crucial advancements are occurring in logistical and administrative technology aimed at improving service efficiency and customer experience. Geographical Information System (GIS) mapping and Artificial Intelligence (AI) powered routing software are indispensable for optimizing travel paths, managing dynamic appointment changes, and ensuring timely service delivery, effectively minimizing non-revenue generating travel time. Furthermore, the adoption of mobile payment processing systems, secure digital prescription management portals, and integrated teleconferencing platforms for remote consultations (telehealth) streamline the client interaction process, reducing administrative overhead and enhancing the professional perception of the service. These tools facilitate the seamless operation of the business, allowing veterinary staff to focus almost entirely on clinical care rather than complex logistical coordination.

The future technology landscape is heavily invested in enhancing connectivity and data security. The implementation of 5G networks and satellite internet solutions for remote locations ensures uninterrupted data flow for EMR updates and real-time telehealth interactions, addressing one of the long-standing limitations of mobile services. Furthermore, there is a growing focus on the Internet of Things (IoT) devices, particularly connected pet wearables, which feed real-time physiological data (e.g., activity levels, temperature, heart rate) directly into the mobile EMR system. This data enables predictive maintenance and personalized preventative medicine strategies, significantly increasing the value proposition of mobile veterinary subscriptions. Providers who effectively integrate these diverse technological stacks gain a significant competitive advantage in terms of efficiency, diagnostic capability, and overall customer loyalty within the rapidly evolving market ecosystem.

Regional Highlights

Regional dynamics play a crucial role in shaping the Mobile Pet Care Market, reflecting differences in pet ownership rates, economic development, regulatory frameworks, and technological adoption. North America, particularly the United States, represents the largest and most mature market, characterized by high consumer spending on pets, robust acceptance of premium mobile services, and a well-established infrastructure of specialized vehicle converters and service providers. The region benefits from strong pet insurance penetration and high technological literacy, fostering rapid adoption of digital scheduling and telehealth services. The competitive landscape here is diverse, featuring both large national chains and numerous independent local operators, driving continuous innovation in service delivery models and pricing strategies. Regulatory compliance, particularly concerning mobile pharmacy operations and medical waste disposal, remains a constant focus for providers.

Europe presents a strong, though more fragmented, market primarily driven by high levels of pet ownership in Western European countries like the UK, Germany, and France. However, stricter regulatory standards regarding animal welfare and clinical practice, along with higher labor costs, can pose entry barriers. Mobile grooming services are particularly popular across European urban centers, while mobile veterinary care faces varying acceptance levels based on national professional body guidelines. The trend towards sustainable and eco-friendly operations is notably strong in this region, influencing vehicle choice (e.g., electric or hybrid mobile units) and waste management practices. Scandinavia and the Netherlands are at the forefront of adopting digital health solutions and integrating remote monitoring into their mobile care offerings.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, fueled by rapid economic expansion, increasing disposable incomes in key markets like China and India, and a burgeoning middle class that is increasingly adopting pets. Urban density in major APAC cities makes mobile services a practical solution to overwhelming traffic and limited parking near traditional clinics. The market is currently less saturated than North America, presenting immense opportunities for expansion, though challenges exist regarding logistical complexities, fragmented supply chains for specialized equipment, and varying levels of digital infrastructure maturity. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, primarily focused on basic mobile veterinary services in major metropolitan hubs, constrained by economic volatility and slower adoption of premium service models.

- North America (NA): Market leader due to high pet expenditure, established service infrastructure, and widespread adoption of mobile diagnostic technology. Focus on subscription wellness plans.

- Europe (EU): Strong growth driven by pet humanization; regulatory complexity impacts cross-border scalability. High demand for specialized mobile grooming and preventive care.

- Asia Pacific (APAC): Highest CAGR expected; growth fueled by urbanization, rising middle class, and necessity of avoiding heavy traffic. Significant investment in localized, scalable mobile fleet operations.

- Latin America (LATAM): Emerging market concentrated in large urban centers like São Paulo and Mexico City, focused on basic vaccination and urgent care services.

- Middle East & Africa (MEA): Nascent growth focused primarily on high-income expatriate communities and large capital cities, characterized by demand for luxury, convenient pet services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Pet Care Market.- Mobile Vet M.D.

- Vets2Home

- VIP Vet Visit

- Pet Paradise Mobile Vet

- Home Pet Doctor

- VetCheck Pet Urgent Care

- ReadyVetGo

- The Mobile Vet Clinic

- Fuzzy Pet Health

- Paws Mobile Vet

- Vet On Wheels

- Well-Managed Pet Care

- Pet Home Doctor

- My Mobile Vet

- Mobile Pet Hospital

- Vet's Best Friend

- Happy Paws Mobile Vet

- Wag! (Services Division)

- BetterVet

- Vetster (Hybrid Model Provider)

Frequently Asked Questions

Analyze common user questions about the Mobile Pet Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Mobile Pet Care Market through 2033?

The Mobile Pet Care Market is forecast to experience a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This growth is driven by increasing consumer demand for convenient, personalized, and stress-reducing veterinary and grooming services delivered directly to the client's residence.

How do mobile pet care services compare in cost to traditional veterinary clinics?

While standard service fees for mobile pet care may be comparable to traditional clinics, mobile providers often charge a convenience fee or travel surcharge to cover operational costs (fuel, vehicle maintenance). However, this premium is often offset by the time savings and reduced stress associated with at-home service, representing superior value for busy or multi-pet households.

What are the primary logistical challenges faced by mobile pet care providers?

Key logistical challenges include optimizing daily service routes in high-traffic urban areas, ensuring stable internet connectivity for electronic medical record (EMR) updates in remote locations, and managing the high initial capital outlay and ongoing maintenance required for specialized, fully equipped mobile clinical vehicles.

Which service segment holds the largest share in the Mobile Pet Care Market?

Mobile Veterinary Care, encompassing preventative health checks, vaccinations, and diagnostics, currently holds the largest revenue share in the market. This segment is bolstered by the rising trend of pet humanization and the subsequent increased investment in preventative, high-quality medical services delivered with maximal convenience.

How is technology, specifically AI, enhancing the operational efficiency of mobile pet care?

AI is significantly improving operational efficiency through the use of sophisticated algorithms for optimized route planning, minimizing non-billable travel time, and increasing appointment density. Furthermore, AI tools are integrated for rapid on-site diagnostic support and personalized client communication management, enhancing service quality and speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager