Mobile Sandblaster Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443596 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mobile Sandblaster Market Size

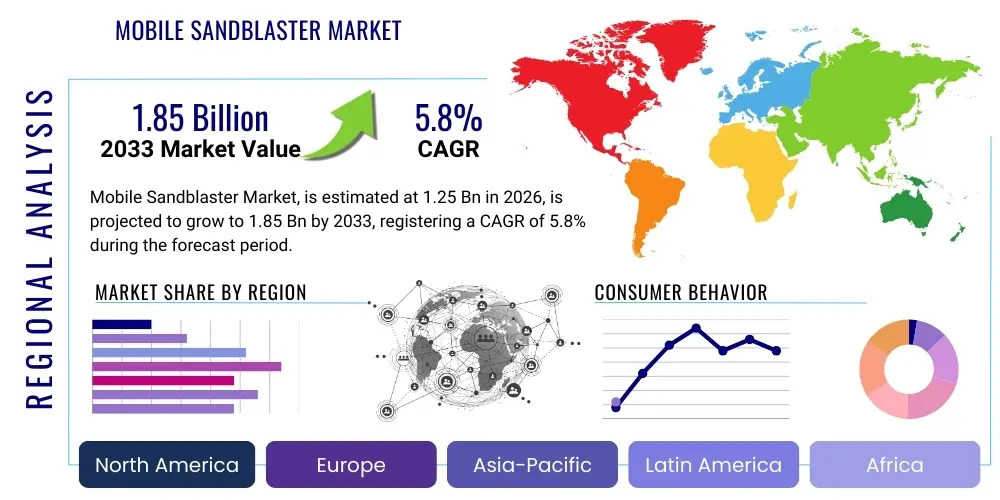

The Mobile Sandblaster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by escalating global infrastructure spending, particularly in emerging economies, coupled with stringent regulatory requirements concerning maintenance and anti-corrosion applications across various industrial sectors. The inherent flexibility and capability of mobile units to address on-site cleaning, preparation, and restoration tasks without the need for fixed facilities are key accelerators of demand, making them indispensable tools in construction, maritime, and oil and gas industries.

Market size expansion is further underpinned by technological advancements focusing on dust suppression and abrasive media efficiency. The transition towards high-performance abrasive materials, such as garnet and specialized synthetic media, alongside the development of vacuum blast systems that minimize environmental fallout, contributes significantly to the market valuation. Furthermore, the increasing refurbishment and renovation activities in aging infrastructure—bridges, pipelines, and historical buildings—demand efficient surface preparation methods, which mobile sandblasters uniquely provide, thereby ensuring robust market growth metrics throughout the forecast horizon.

Mobile Sandblaster Market introduction

The Mobile Sandblaster Market encompasses the manufacturing, distribution, and utilization of portable equipment designed for surface preparation and finishing using abrasive media propelled at high velocity. These units, characterized by their maneuverability and self-contained operation, are critical assets used to remove rust, paint, scale, and contaminants from various surfaces, preparing them for protective coatings or restoration. The core technology revolves around pressurized air or mechanical systems used to accelerate materials like sand, glass beads, steel grit, or specialized non-toxic abrasives towards the target substrate. Key products range from small, trolley-mounted units used for intricate detail work to large, trailer-mounted systems capable of large-scale industrial cleaning, offering flexibility across diverse operational requirements.

Major applications of mobile sandblasters span infrastructure maintenance, including bridge and road surface preparation; maritime uses for hull cleaning and shipyard operations; aerospace for component refurbishment; and general construction for cleaning concrete, masonry, and steel structures. The primary benefit derived from these systems is unparalleled efficiency in achieving required surface cleanliness profiles (e.g., SSPC standards), which is essential for maximizing the longevity and adhesion of subsequently applied protective coatings. Furthermore, the mobility factor allows contractors to deploy high-capacity blasting capabilities directly to remote or decentralized worksites, dramatically reducing logistical costs and project timelines.

Driving factors in this market include heightened emphasis on asset lifespan extension through superior surface preparation, stricter environmental regulations pushing the adoption of dust-free or wet blasting solutions, and rapid urbanization leading to continuous demands for repair and construction activities. The ability of mobile units to adapt quickly to changing site conditions and specialized media requirements ensures their sustained market relevance, solidifying their role as essential equipment in sectors prioritizing safety, speed, and durability in their maintenance processes.

Mobile Sandblaster Market Executive Summary

The Mobile Sandblaster Market exhibits strong growth momentum, primarily driven by robust global trends in infrastructure development and industrial maintenance cycles. Business trends indicate a shift towards technologically advanced, automated, and environmentally compliant equipment, with manufacturers prioritizing vacuum blasting and vapor abrasive technologies to minimize environmental impact and maximize worker safety. Strategic mergers, acquisitions, and partnerships are prevalent as companies seek to expand their geographical footprint and incorporate specialized abrasive media handling capabilities. The market is witnessing increasing customization, catering to niche applications such as specialized oil and gas pipeline internal cleaning and historical building restoration, demanding higher precision and lower impact equipment.

Regionally, Asia Pacific (APAC) dominates market growth projections due to massive governmental investments in transportation networks and industrial facilities, particularly in China and India. North America and Europe, while mature, remain critical markets characterized by the adoption of premium, sophisticated equipment required for rigorous compliance with occupational safety and environmental standards (OSHA, EPA). These developed regions focus heavily on efficiency gains and labor cost reduction through automation integration in mobile units. Meanwhile, Latin America and the Middle East & Africa (MEA) represent significant opportunities, spurred by burgeoning energy projects and rapid infrastructural modernization efforts.

Segment trends underscore the dominance of the abrasive blasting media segment, especially garnet and crushed glass, due to their efficacy and reduced silica content compared to traditional sand. In terms of product type, trailer-mounted systems account for the largest market share owing to their high capacity and suitability for heavy-duty industrial applications, although smaller, portable units are gaining traction in general contracting and DIY applications. The rising cost of skilled labor is accelerating the demand for semi-automatic mobile blasting solutions that require less operator intervention and provide consistent quality control.

AI Impact Analysis on Mobile Sandblaster Market

User inquiries regarding AI's impact on mobile sandblasting frequently center on how automation can improve efficiency, safety, and operational consistency, particularly in hazardous environments. Key themes include the feasibility of integrating computer vision and machine learning for precise contaminant detection and selective blasting, thereby reducing media consumption and labor costs. Users are highly interested in predictive maintenance models for complex mobile compressor and blasting systems, ensuring minimal downtime. Furthermore, concerns revolve around the initial investment required for AI retrofitting, the need for new operator skill sets to manage sophisticated automated systems, and how AI can aid in real-time documentation and adherence to stringent surface preparation standards (e.g., SA 2.5 or NACE requirements). The consensus points toward AI fundamentally transforming quality control and operational logistics rather than replacing the core blasting process itself.

- AI-driven predictive maintenance optimizes mobile sandblaster operational uptime and lifecycle.

- Computer vision and machine learning enable automated defect identification and selective, optimized blasting paths, reducing abrasive media waste.

- Integration of robotics and AI facilitates fully autonomous blasting operations in high-risk or confined spaces, significantly enhancing worker safety.

- Machine learning algorithms analyze operational data (pressure, flow rate, abrasive type) to recommend optimal settings for achieving specified surface profiles efficiently.

- AI assists in real-time quality assurance and digital reporting, ensuring strict compliance with industry specifications (e.g., blast profile mapping).

DRO & Impact Forces Of Mobile Sandblaster Market

The Mobile Sandblaster Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. Key drivers include the global mandate for maintaining critical infrastructure, which requires periodic and thorough surface refurbishment using mobile equipment. Additionally, the proliferation of strict regulatory mandates regarding worker safety (silicosis prevention) and environmental protection heavily drives the adoption of advanced, dust-suppressed blasting technologies such as vapor abrasive and wet blasting systems. The increasing utilization of high-strength protective coatings, which necessitate precise surface preparation standards, further amplifies the demand for reliable mobile sandblasters capable of achieving specific surface profiles consistently.

Conversely, significant restraints hinder market potential, primarily stemming from the high initial capital investment required for sophisticated, compliant mobile blasting units and the ongoing operational costs associated with abrasive media disposal and maintenance. The scarcity of highly trained and certified mobile blasting technicians, particularly in developing regions, poses a major challenge to operational efficiency and quality control. Furthermore, public perception and nuisance issues related to noise and dust generation during traditional dry blasting operations continue to restrict adoption in urban and densely populated areas, pushing demand towards expensive, quieter vacuum recovery systems.

Opportunities for market growth lie in the development and commercialization of eco-friendly, recyclable abrasive media and the integration of IoT and telematics into mobile units for remote monitoring and diagnostics. The expanding industrial application base, particularly in offshore wind energy infrastructure and advanced manufacturing sectors requiring specialized surface finishes, presents substantial avenues for market penetration. The overall impact forces suggest a moderate to high growth trajectory, favoring companies that can successfully navigate the regulatory landscape by offering safe, efficient, and technologically integrated mobile blasting solutions, effectively overcoming the restraints imposed by environmental sensitivity and labor costs.

Segmentation Analysis

The Mobile Sandblaster Market is comprehensively segmented based on Type, Media Used, End-User Industry, and Technology, offering a nuanced view of demand drivers across various applications. Segmentation by Type predominantly separates fixed-facility systems from highly portable units, with mobile systems including trolley-mounted, trailer-mounted, and skid-mounted options, each designed for varying levels of capacity and mobility requirements. The differentiation between product types helps end-users match equipment capabilities with project scope, ranging from localized maintenance tasks to large-scale infrastructure projects requiring high throughput.

Segmentation by Media Used is critical as it dictates the effectiveness of the blast, surface finish achieved, and environmental compliance obligations. This includes traditional silica sand, metallic abrasives (steel grit/shot), organic materials (walnut shells), and high-performance, environmentally friendly options like garnet and crushed glass. The trend toward non-silica, low-dust media is accelerating due to health regulations. The End-User Industry segmentation highlights the dependence of the market on Construction, Aerospace, Automotive, Maritime, Oil & Gas, and Heavy Industrial sectors, with infrastructure maintenance being the largest consumer of mobile blasting services globally. This detailed segmentation allows manufacturers to tailor marketing and product development strategies to specific industry needs, addressing unique challenges such as surface preparation in highly corrosive environments (maritime/O&G).

- Type:

- Portable Systems (Trolley Mounted)

- Trailer Mounted Systems (High Capacity)

- Skid Mounted Systems (Semi-permanent Mobile)

- Media Used:

- Silica Sand (Declining due to regulations)

- Garnet Abrasives

- Steel Grit and Shot

- Crushed Glass and Slag

- Organic Media (e.g., Walnut Shells)

- Specialty Media (e.g., Plastic Abrasives)

- Technology:

- Dry Blasting

- Wet Blasting/Vapor Abrasive Blasting

- Vacuum Blasting (Dustless)

- Centrifugal Blasting (Wheel Blast)

- End-User Industry:

- Construction and Infrastructure

- Oil & Gas and Energy

- Maritime and Shipbuilding

- Automotive and Aerospace

- General Fabrication and Maintenance

Value Chain Analysis For Mobile Sandblaster Market

The value chain for the Mobile Sandblaster Market begins with the upstream suppliers of raw materials, predominantly encompassing steel and specialty metals for manufacturing the blast pots, nozzles, compressors, and trailer chassis, alongside the critical supply of abrasive media itself. Upstream activities also include the manufacturing of high-pressure air compressors and specialized dust collection systems, which are integral components of any mobile unit. Innovation at this stage focuses on developing lighter, more durable materials for blast equipment and sourcing high-efficiency, eco-friendly abrasive materials (e.g., high-quality garnet). Efficiency in the upstream supply chain directly impacts the manufacturing cost and the environmental footprint of the final mobile product.

The core of the value chain involves the manufacturing and assembly of the mobile sandblasting systems. Manufacturers acquire components and integrate them into complete, often customized, mobile units, ensuring compliance with diverse international safety standards (e.g., ASME, PED). Post-manufacturing, the products move through distribution channels. Direct channels involve sales teams selling large, specialized units directly to major industrial contractors and government agencies. Indirect channels involve a network of authorized distributors, dealers, and rental companies that provide equipment, parts, and consumable media to a wider, fragmented base of small to medium-sized contractors and maintenance companies. Rental fleets play a crucial role in providing flexible access to expensive equipment, smoothing demand volatility.

Downstream activities center on service provision, maintenance, and the supply of consumables. The aftermarket segment, focusing on replacement nozzles, hoses, filters, and continuous media supply, generates significant recurring revenue. End-users (contractors, shipyards, energy firms) utilize these mobile systems for surface preparation tasks. The feedback loop from end-users regarding equipment performance, reliability, and regulatory compliance heavily influences future product design and upstream material sourcing. The value chain is constantly optimized for logistics efficiency, as the prompt delivery of mobile units and media to remote sites is paramount to the operational success of service providers.

Mobile Sandblaster Market Potential Customers

The primary customers for the Mobile Sandblaster Market are entities requiring rigorous, high-quality surface preparation outside of a fixed manufacturing facility. This includes large-scale infrastructure construction and maintenance companies responsible for bridges, pipelines, water tanks, and road surfaces, where mobile units are essential for removing old coatings and ensuring adherence for new protective systems. These buyers prioritize high throughput, durability, and compliance with strict engineering specifications regarding blast profile and cleanliness. Their purchasing decisions are often based on total cost of ownership (TCO) and the reliability of the equipment under continuous, harsh operating conditions.

Another major segment includes the marine and offshore energy industries, specifically shipyards, oil rig maintenance companies, and wind farm operators. These environments demand highly specialized mobile blasting equipment capable of handling corrosive salt air, often utilizing wet or vapor abrasive systems to suppress sparks and dust in volatile areas. For these customers, safety certifications and the ability to operate effectively in challenging, sometimes hazardous, confined spaces are non-negotiable requirements, driving demand for technologically advanced, automated, and remote-controlled mobile solutions.

Furthermore, general contractors, facilities management firms, and specialized restoration companies represent a significant customer base. These users require smaller, highly versatile, and dust-minimized systems for tasks ranging from graffiti removal and concrete preparation to the delicate restoration of historical masonry and metalwork. Rental companies also serve as substantial indirect customers, purchasing fleets of mobile units to provide flexible access to smaller contractors who cannot justify the large capital expenditure of purchasing equipment outright. This diverse customer base ensures market stability across economic cycles, as maintenance needs persist even when new construction slows.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graco Inc., Clemco Industries Corp., BlastOne International, Empire Abrasive Equipment, AB Shot Tecnics, Sponge-Jet, Inc., Torbo Gmbh, Marco Group International, Schmidt (Division of Axxiom Manufacturing), Titan Abrasive Systems, Van Air Systems, Airblast B.V., Surface Preparation Technologies, Progressive Surface Inc., Inventure International, Industrial Air Power, R. J. Buckley, Trinity Tool Company, Kennametal Stellite, A-to-Z Equipment Rental |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mobile Sandblaster Market Key Technology Landscape

The technological landscape of the Mobile Sandblaster Market is rapidly evolving, driven primarily by the twin goals of minimizing environmental impact and maximizing operational safety. The shift from traditional dry blasting towards advanced containment and abatement technologies is the most prominent trend. Vapor Abrasive Blasting (VAB) systems, which introduce a small amount of water into the abrasive stream, are gaining immense traction as they suppress up to 92% of fugitive dust and significantly reduce the potential for static electricity and sparks, making them ideal for sensitive or explosion-prone environments like oil refineries. Similarly, vacuum blasting technology is growing, utilizing specialized suction heads to immediately capture spent abrasive and dust at the source, effectively creating a "dustless" operation crucial for urban and enclosed space applications.

Integration of IoT and telematics represents another pivotal technological advancement. Modern mobile sandblasters are increasingly equipped with sensors and connectivity modules that monitor key performance indicators such as blast pressure consistency, media flow rate, compressor health, and operational hours in real-time. This connectivity facilitates predictive maintenance schedules, optimizing component lifespan and minimizing expensive unexpected breakdowns on remote job sites. Furthermore, advanced nozzle designs, utilizing durable materials like tungsten carbide and boron carbide, contribute to improved efficiency by ensuring a more consistent and focused blast pattern, thereby reducing abrasive consumption and overall project time.

The development of mobile robotic and semi-automated blasting carriages is transforming large-scale infrastructure maintenance. These robotic systems, often controlled remotely, offer superior consistency and allow operators to remain safely distanced from high-pressure blasting zones and toxic removed coatings. This is crucial for applications like tank interior cleaning or complex structural steel preparation. Coupled with sophisticated air filtration and dehumidification systems integrated into the mobile units, these technologies ensure that equipment can operate effectively in varying climatic conditions, maintaining media integrity and preventing surface flash rust, thereby guaranteeing superior quality surface preparation irrespective of the external environment.

Regional Highlights

The global Mobile Sandblaster Market demonstrates highly differentiated growth patterns across major geographical regions, influenced by localized regulatory frameworks, infrastructure maturity, and industrial concentration. Asia Pacific (APAC) stands out as the highest-growth region, propelled by massive government initiatives in building ports, bridges, roads, and manufacturing facilities across countries like China, India, and Southeast Asian nations. The high volume of both new construction and ongoing maintenance requirements in this region creates substantial demand for large-capacity, trailer-mounted mobile units. While cost sensitivity remains a factor, increasing awareness of worker health standards is starting to drive adoption of more advanced, dust-suppressed technologies in major metropolitan areas.

North America (NA) and Europe represent mature markets characterized by stringent environmental and occupational safety regulations (e.g., OSHA, REACH). Demand in these regions is heavily focused on premium, sophisticated mobile solutions, particularly vacuum blasting and VAB systems, to ensure compliance and minimize liability. The need for specialized surface preparation in the aging infrastructure sector (e.g., steel bridge refurbishment) and the high penetration of industrial automation drive stable market valuation, with emphasis placed on efficiency and labor savings through technological enhancements rather than sheer volume growth.

The Middle East & Africa (MEA) and Latin America (LATAM) exhibit dynamic growth potential, largely fueled by investment in the Oil & Gas, petrochemical, and mining sectors. The harsh operating environments in the MEA region necessitate robust, durable mobile equipment for corrosion control in pipelines, refineries, and offshore structures. LATAM's expanding manufacturing base and energy sector also contribute significantly to the demand for reliable mobile sandblasting services. Market success in these regions is highly dependent on establishing robust local distribution and service networks capable of supporting remote operations and providing immediate access to consumables and technical expertise.

- Asia Pacific (APAC): Dominates market volume due to rapid urbanization, immense infrastructure spending, and expansion of shipbuilding and manufacturing sectors, driving high demand for conventional and vapor blasting mobile units.

- North America: Focuses on advanced, compliance-driven technologies (vacuum blasting, VAB) driven by stringent EPA and OSHA regulations; stable demand fueled by critical infrastructure maintenance (bridges, pipelines).

- Europe: High adoption of premium, eco-friendly mobile equipment, emphasizing energy efficiency and dust containment systems; stable growth centered around high-value restoration and automotive manufacturing preparation.

- Middle East & Africa (MEA): Strong growth linked to the Oil & Gas industry and large energy infrastructure projects requiring robust mobile solutions for severe anti-corrosion applications in challenging climates.

- Latin America (LATAM): Emerging market growth driven by mining, petrochemical investment, and expanding transportation networks; increasing focus on durable, easily maintainable mobile equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mobile Sandblaster Market.- Graco Inc.

- Clemco Industries Corp.

- BlastOne International

- Empire Abrasive Equipment

- AB Shot Tecnics

- Sponge-Jet, Inc.

- Torbo Gmbh (part of the CTT Group)

- Marco Group International

- Schmidt (Division of Axxiom Manufacturing)

- Titan Abrasive Systems

- Van Air Systems

- Airblast B.V.

- Surface Preparation Technologies

- Progressive Surface Inc.

- Inventure International

- Industrial Air Power

- R. J. Buckley & Co.

- Trinity Tool Company

- Kennametal Stellite

- A-to-Z Equipment Rental

Frequently Asked Questions

Analyze common user questions about the Mobile Sandblaster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most environmentally compliant mobile sandblasting technology available?

The most environmentally compliant technology is Vacuum Blasting (dustless blasting), which uses immediate containment and recovery systems. Vapor Abrasive Blasting (VAB) is also highly compliant as it uses water injection to suppress up to 92% of airborne dust and minimize media fragmentation, greatly reducing fugitive emissions and health hazards associated with silica.

How do abrasive media choices affect surface preparation quality and project cost?

Media choice is critical; hard media like garnet or steel grit achieve a deep profile (anchor pattern) required for thick coatings, but increase equipment wear. Softer media (e.g., plastic or organic) are used for delicate cleaning but are less effective for rust removal. Project cost is influenced by media recyclability and disposal fees, making highly recyclable media like steel shot cost-effective for long-term use.

What are the primary factors driving the adoption of trailer-mounted mobile sandblasters?

Trailer-mounted systems are preferred for large-scale industrial and infrastructure projects due to their superior capacity, allowing them to carry larger volumes of abrasive media and housing powerful, dedicated diesel compressors. Their robust design ensures durability for continuous high-production operations in remote or challenging field environments.

How does the integration of IoT impact the maintenance and operational efficiency of mobile blasting equipment?

IoT integration allows for real-time monitoring of pressure, temperature, and wear parts, enabling predictive maintenance rather than reactive repairs. This minimizes unplanned downtime, optimizes media flow rates for better quality control, and provides digital records necessary for operational compliance and warranty tracking, significantly increasing asset utilization.

Which end-user segment exhibits the highest growth potential for mobile sandblasters globally?

The Construction and Infrastructure maintenance segment, particularly in the Asia Pacific region, exhibits the highest growth potential. This growth is directly linked to the massive government expenditure on renewing and expanding critical transportation networks, marine structures, and utility assets, all of which require efficient, on-site surface preparation capabilities provided by mobile units.

What safety standards must mobile sandblasting operators adhere to?

Operators must adhere strictly to occupational safety standards such as OSHA (in the U.S.) or equivalent international bodies, focusing on mitigating hazards related to high pressure, noise exposure, and dust inhalation, especially regarding crystalline silica exposure limits. Proper ventilation, use of supplied-air respirators, and training on safe rigging and media handling procedures are mandatory for compliance.

Are mobile sandblasting systems suitable for historical building restoration?

Yes, but specialized methods must be used. Systems employing soft, finely controlled abrasive media (like crushed walnut shells, fine glass beads, or low-pressure vapor blasting) are utilized to remove surface contaminants and grime without damaging the underlying historical masonry or delicate stone carvings. Precision control over blast pressure is paramount in these restoration applications.

How do manufacturers address the high noise levels produced by mobile compressors and blasting operations?

Manufacturers address noise pollution by incorporating advanced sound attenuation enclosures for high-powered air compressors and integrating muffler systems within the blast pot components. Furthermore, the increasing market demand for wet and vapor abrasive systems naturally lowers operational noise compared to traditional dry blasting methods, making them more suitable for urban environments.

What is the primary technical challenge in designing high-capacity mobile sandblasters?

The primary technical challenge is balancing high capacity (large blast pots and powerful compressors) with regulatory requirements for road legality, weight distribution, and maneuverability. Engineers must optimize chassis design and component layout to maintain portability and roadworthiness while ensuring sufficient air supply to support multiple nozzles and continuous, high-volume blasting output.

Is there a trend toward automated or robotic mobile sandblasting?

Yes, there is a distinct trend towards semi-automated and robotic mobile blasting systems, particularly for large, uniform structures like ship hulls, storage tanks, and large steel beams. Automation ensures uniform surface profile consistency, reduces dependency on manual labor in hazardous conditions, and significantly speeds up project timelines compared to traditional manual operations.

What are the cost implications of using garnet versus steel shot media in mobile blasting?

Garnet is typically more expensive per pound but is non-toxic, provides an excellent surface profile, and offers limited recyclability (a few cycles). Steel shot is significantly cheaper initially and highly recyclable (hundreds of cycles), but requires specialized containment (often vacuum systems) and is heavier, primarily suited for applications where deep anchor profiles are mandatory.

How important is the air drying and filtration component in a mobile sandblaster setup?

Air drying and filtration are critically important. If compressed air contains moisture or oil contaminants, it can lead to immediate flash rusting on the prepared substrate or cause clogging and inconsistent flow of the abrasive media. High-quality air dryers and aftercoolers ensure dry, clean air, which is essential for maximizing coating adhesion and equipment reliability.

What role does the rental market play in the Mobile Sandblaster industry?

The rental market is crucial, especially for small to medium-sized contractors and those undertaking specialized, intermittent projects. Rental companies allow users to access high-value, high-capacity mobile equipment without incurring the significant capital expenditure and long-term maintenance costs, thereby increasing market accessibility and equipment utilization rates.

Which regions are leading in the adoption of wet blasting technology and why?

North America and Europe are leading the adoption of wet blasting and vapor abrasive technology due to stricter mandates regarding worker health and safety, specifically targeting the suppression of respirable crystalline silica (RCS) dust. Wet blasting significantly reduces dust plumes, making it the preferred method for projects in populated or environmentally sensitive areas.

What future innovations are expected to reshape the mobile sandblaster market?

Future innovations will focus on highly sustainable abrasive media alternatives, increased autonomy through AI-driven robotics for surface scanning and blasting optimization, and the development of lightweight, composite materials for blast pots and hoses to enhance the portability and fuel efficiency of mobile systems without compromising durability.

What distinguishes skid-mounted mobile systems from trailer-mounted units?

Trailer-mounted systems are designed for road travel and quick deployment to various sites. Skid-mounted systems, while still mobile, are designed for easier lifting and placement (e.g., onto truck beds or barges) and are often integrated into semi-permanent field setups or specialized service vehicles where road registration and high-speed transport are not primary requirements.

How does anti-corrosion maintenance influence the demand for mobile sandblasters?

Anti-corrosion maintenance is the single largest demand driver. The longevity and effectiveness of protective coatings applied to steel structures (like pipelines and bridges) are directly proportional to the quality of the surface preparation, which mobile sandblasters are uniquely equipped to deliver, driving continuous demand across all industrial sectors globally.

What governmental regulations primarily affect the sales and use of mobile sandblasters?

Regulations primarily affecting the market include environmental protection laws governing dust and waste disposal (e.g., EPA), occupational health and safety standards related to noise exposure and silica limits (e.g., OSHA, EU directives), and transportation regulations governing the weight and dimensions of trailer-mounted equipment on public roads.

How is the aerospace industry utilizing specialized mobile sandblasting equipment?

The aerospace industry utilizes mobile blasting systems for highly controlled removal of old paint and surface treatments from aircraft components, often employing very fine media (e.g., plastic or specialized glass beads) at low pressure. These applications require precise, gentle methods to avoid altering the structural integrity or dimensional tolerances of sensitive aluminum and composite parts.

What is the current market trend regarding the capacity of mobile sandblasting pots?

The current market trend shows dual demands: high-capacity blast pots (600 lbs+) for major infrastructure and continuous industrial applications to minimize media reloading downtime, and a concurrent rise in demand for smaller, highly portable units (100 lbs or less) for specialized cleaning, localized repair, and intricate architectural restoration projects.

Why is the disposal of spent abrasive media a growing constraint in the market?

Spent media disposal is a significant restraint because it can become contaminated with hazardous substances (e.g., lead paint, heavy metals, industrial toxins) removed from the blasted surface. Regulatory bodies require testing and safe disposal of this waste, adding substantial cost and logistical complexity to projects, particularly when using non-recyclable media.

What constitutes the aftermarket segment of the mobile sandblaster market?

The aftermarket segment includes the sale of essential consumables and replacement parts, such as various abrasive media, nozzles (venturi, straight bore), blast hose, coupling systems, protective clothing, air filters, dehumidifier components, and routine maintenance kits for compressors and blast pots. This segment generates continuous, stable revenue for manufacturers and distributors.

How are advancements in compressor technology influencing mobile sandblaster performance?

Advancements in mobile compressor technology, particularly in variable speed drives (VSD) and enhanced air filtration systems, allow mobile sandblasters to operate more fuel-efficiently while delivering consistently high volumes of clean, dry air. This optimized air delivery is crucial for maintaining effective blast pressure and maximizing media flow consistency, directly improving output quality.

What are the key differentiating factors between traditional dry blasting and vapor abrasive blasting in mobile units?

The key difference is the introduction of water. Dry blasting creates a large dust cloud and poses high silica risks. Vapor abrasive blasting uses minimal water to suppress dust, significantly reducing health hazards, lowering containment requirements, and utilizing less media while still providing an effective blast profile, although it requires protection against flash rusting.

How does customization affect the purchasing decision for large industrial buyers?

Customization is paramount for large industrial buyers (e.g., Oil & Gas, Maritime) who often require mobile units tailored for specific environments (e.g., explosion-proof components, specialized coatings, extreme climate packages). Customization ensures the equipment meets proprietary operational procedures, rigorous safety standards, and specific project scope requirements, justifying the higher purchase price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager