Mocktails Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442617 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Mocktails Market Size

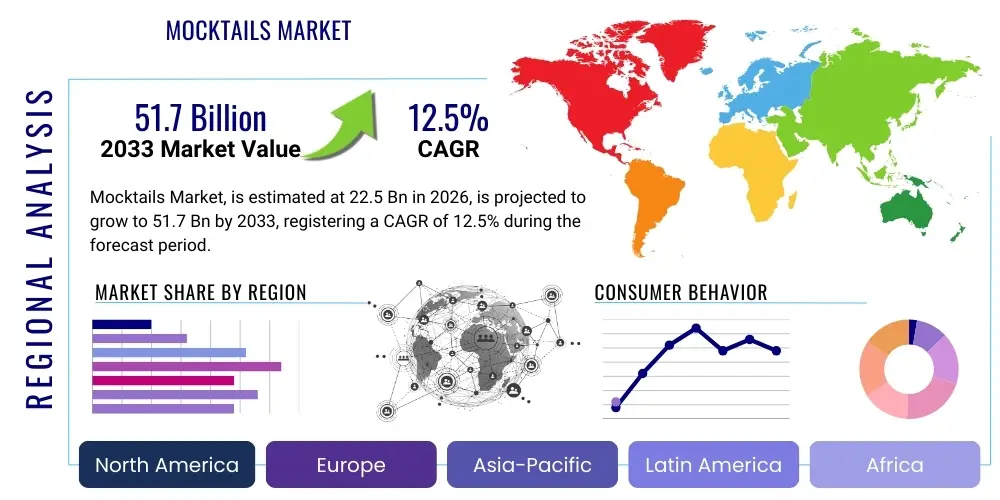

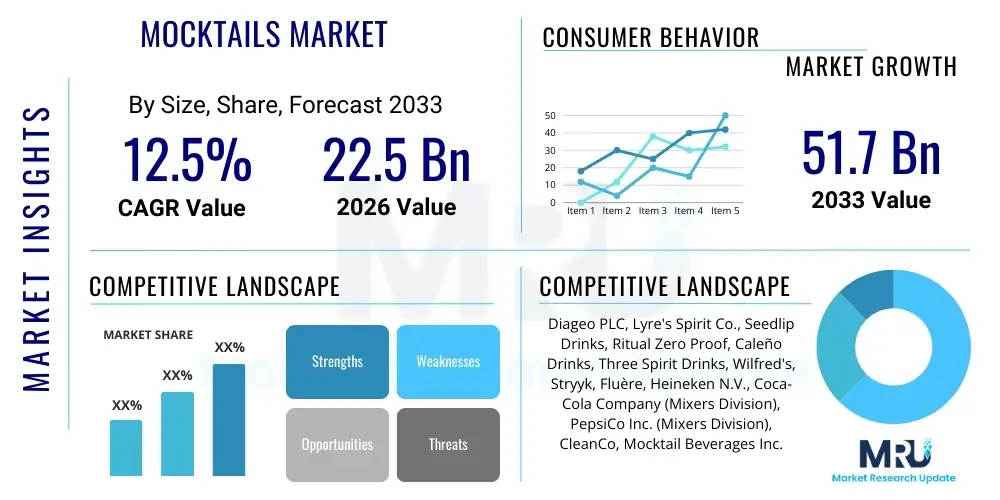

The Mocktails Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $22.5 Billion USD in 2026 and is projected to reach $51.7 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by a global paradigm shift toward healthier lifestyles and an increased acceptance of sophisticated non-alcoholic beverage options, moving mocktails from niche offerings to mainstream consumption staples.

The valuation reflects robust demand across developed economies, particularly North America and Europe, where 'mindful drinking' movements have gained significant traction among Millennials and Gen Z consumers. Furthermore, market expansion is supported by continuous innovation in flavor profiles, functional ingredients, and premium packaging, allowing mocktails to compete effectively with high-end alcoholic cocktails in taste, complexity, and price point. The rise of specialized non-alcoholic bars and the integration of sophisticated mocktail menus into mainstream hospitality sectors further solidify this strong growth trajectory throughout the forecast period.

Mocktails Market introduction

The Mocktails Market encompasses ready-to-drink (RTD) non-alcoholic cocktails, non-alcoholic spirits (NOLO), and high-quality mixers and syrups specifically designed for crafting complex, zero-proof beverages. These products serve as a sophisticated, flavorful alternative to traditional sugary sodas and alcoholic drinks, driven by consumer demand for options that align with wellness goals without sacrificing social enjoyment or taste complexity. Major applications include social gatherings, fine dining, corporate events, and personal consumption by individuals seeking reduced alcohol intake, pregnant women, designated drivers, and those with cultural or religious restrictions against alcohol. Key benefits of these beverages include reduced calorie intake, functional benefits derived from botanicals, and improved social inclusivity in drinking culture. Driving factors include the global health and wellness trend, increased marketing expenditure by large beverage conglomerates entering the NOLO space, and stringent government policies advocating responsible drinking, all converging to elevate mocktails into a critical growth area within the broader beverage industry.

Mocktails Market Executive Summary

The Mocktails Market is experiencing dynamic business trends characterized by rapid product premiumization and strategic acquisitions, as major global beverage companies integrate specialized non-alcoholic brands into their portfolios to capture rising consumer interest. Regional trends indicate North America and Western Europe as primary growth engines, distinguished by mature consumer awareness and high disposable income allocated to premium lifestyle products, whereas Asia Pacific presents the fastest growing opportunity, spurred by younger populations adopting global lifestyle trends and increasing urbanization. Segment trends highlight a significant pivot towards the Ready-to-Drink (RTD) Mocktail format, valued for its convenience and quality consistency, alongside the dramatic proliferation of non-alcoholic spirits that meticulously mimic the sensorial experience of gin, whiskey, or rum. These market shifts collectively underscore a fundamental, lasting change in consumer preferences, positioning mocktails not merely as substitutes but as distinct, desirable beverage categories driving innovation in ingredient sourcing, functional formulation, and environmentally conscious packaging across the entire value chain.

The sustained momentum in the mocktails sector is intrinsically linked to macro-environmental shifts, particularly the widespread adoption of 'Dry January' and 'Sober October' movements, which have normalized abstention and elevated non-alcoholic alternatives beyond temporary lifestyle choices into habitual consumption patterns. Furthermore, the expansion of distribution channels, notably the penetration of specialized non-alcoholic products in mainstream supermarket chains and dedicated online marketplaces, has significantly improved accessibility. This accessibility, combined with sophisticated marketing campaigns that emphasize flavor complexity and social inclusion, ensures robust consumer uptake. The executive summary emphasizes that manufacturers must focus on achieving flavor parity and texture profiles comparable to alcoholic counterparts to maintain competitive advantage, necessitating substantial investment in research and development, particularly in botanical extraction and natural preservation techniques, which is shaping the competitive landscape.

Financial projections suggest that investment in the non-alcoholic segment yields strong returns due to lower taxation and duties compared to alcohol, enhancing profit margins, provided brands can establish strong loyalty through distinct flavor narratives and sustainable sourcing practices. The overall market resilience is also observed in the food service industry, where high-end restaurants and bars now view complex mocktail offerings as essential to their beverage program, catering to a diverse clientele seeking moderation. Successful market participants are those who not only innovate in product form but also leverage data analytics to predict regional flavor preferences and demographic-specific demands, ensuring their product mix remains agile and responsive to the highly fragmented consumer base defined by varying degrees of health consciousness and disposable income.

AI Impact Analysis on Mocktails Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mocktails Market predominantly revolve around three critical areas: personalized flavor development, predictive demand forecasting in supply chain optimization, and the integration of smart retail experiences. Consumers and industry professionals frequently question how AI can rapidly analyze emerging global flavor trends, such as novel botanicals or regional fruit pairings, and translate this data into commercially viable, scalable mocktail recipes, thereby reducing R&D lead times. Another major theme is the expectation that AI should stabilize and refine the complex, often fragile, supply chain for specialty ingredients used in premium mocktails, focusing on inventory management and spoilage reduction. Finally, users anticipate AI-driven personalization in e-commerce, where algorithms suggest mocktail pairings or recipe modifications based on historical purchase data, dietary restrictions, and specific preference profiles, demanding a highly customized shopping journey.

The application of AI is already beginning to revolutionize product development workflows within the beverage sector. AI-driven sensory analysis models are capable of processing vast datasets related to chemical compound interactions, ingredient origins, and consumer feedback, enabling manufacturers to simulate and optimize flavor profiles long before physical testing. This capability drastically improves the chances of successful product launches and allows for rapid iteration based on localized taste preferences. For instance, AI algorithms can predict the consumer acceptance of complex, low-sugar mocktails containing functional adaptogens or nootropics, ensuring that the flavor balance masks any undesirable inherent tastes while maximizing perceived health benefits.

Furthermore, AI plays a pivotal role in optimizing manufacturing efficiency and market responsiveness. Utilizing machine learning, beverage companies can forecast seasonal spikes in demand for specific mocktail formats—such as citrus-based RTDs during summer or spiced, warm profiles in winter—with much greater accuracy than traditional methods. This precision minimizes overstocking or understocking, reducing waste and ensuring fresh products are consistently available across fragmented distribution networks, especially critical for products containing delicate natural ingredients that have shorter shelf lives. The strategic deployment of AI ensures the market maintains its promise of premium quality and freshness, meeting the high expectations set by health-conscious consumers.

- Flavor Formulation & Prediction: AI uses neural networks to analyze thousands of flavor combinations and predict consumer acceptance, significantly accelerating product innovation cycles for complex non-alcoholic profiles.

- Supply Chain Optimization: Machine learning models enhance predictive logistics, optimizing cold chain management and ingredient sourcing based on real-time demand signals, minimizing spoilage of high-value botanicals.

- Personalized Retail Experience: AI algorithms drive targeted marketing and custom product recommendations on e-commerce platforms, tailoring mocktail suggestions to individual dietary needs and preference histories.

- Quality Control Automation: Computer vision and sensory AI systems monitor consistency in production batches, ensuring precise flavor replication and maintaining high quality standards critical for premium branding.

- Market Trend Identification: AI scours social media, news, and search data to identify nascent ingredients, functional benefits (e.g., adaptogens), and global consumption rituals, providing actionable insights for immediate market entry strategies.

DRO & Impact Forces Of Mocktails Market

The dynamics of the Mocktails Market are shaped by powerful Drivers, certain inherent Restraints, and transformative Opportunities, collectively constituting the Impact Forces influencing future growth trajectories. The primary Driver is the overwhelming global movement toward mindful drinking and health consciousness, compelling consumers to seek zero-alcohol options without compromising the ritual and sophistication of beverage consumption. However, the market faces Restraints primarily related to price sensitivity, as premium mocktails often command prices comparable to, or sometimes exceeding, alcoholic counterparts, and challenges associated with the stability and shelf life of natural, complex flavor ingredients. Significant Opportunities arise from the introduction of functional mocktails enriched with vitamins, adaptogens, or gut-health ingredients, and the expansive potential of emerging markets in Asia and Latin America. These forces collectively propel the market forward, dictating strategic focus on innovation, distribution efficiency, and educational marketing to overcome resistance and fully capitalize on the burgeoning consumer base seeking healthier alternatives.

The Drivers section highlights the increasing cultural acceptance of sobriety and moderation, particularly among younger generations who prioritize well-being and transparency in ingredient labeling. Regulatory environments also act as a crucial driver; lower excise duties and easier permitting for non-alcoholic drinks compared to spirits encourage entrepreneurial entry and investment from established players. Furthermore, the gastronomic revolution, where mocktails are treated with the same culinary respect as cocktails, elevates their perceived value and necessitates greater innovation. This demand pushes manufacturers to invest heavily in techniques like hydro distillation, cold brewing, and vacuum extraction to achieve complex flavor notes and robust mouthfeel, directly addressing the sophisticated palate of the modern consumer who expects a layered, memorable drinking experience that justifies the premium price point, positioning the category as an aspirational lifestyle choice.

Conversely, the Restraints include the persistent challenge of establishing shelf stability for natural, preservative-free formulations, particularly in global supply chains characterized by varying temperature and humidity conditions. Another significant restraint is brand differentiation in a rapidly saturating market; as numerous artisanal brands enter, maintaining clarity, market positioning, and consumer trust becomes complex. The Opportunity landscape is vast, primarily fueled by the potential for cross-category integration, such as combining mocktails with cannabis/CBD, functional teas, or sports recovery drinks, creating unique hybrid beverages that tap into multiple wellness trends. Expansion into underdeveloped distribution channels, such as quick-service restaurants and specialized subscription boxes, further presents clear pathways for exponential growth, enabling brands to reach highly targeted consumer demographics seeking specific health or convenience outcomes.

Segmentation Analysis

The Mocktails Market is segmented based on rigorous criteria including product type, flavor profile, distribution channel, and end-user demographics, reflecting the diversity and sophistication of consumer demands. Product segmentation distinguishes between ready-to-drink (RTD) convenience, which currently holds the dominant market share due to its ease of consumption and standardized quality, and non-alcoholic spirits (NOLO), which are the fastest-growing segment driven by their versatility in home mixology and high-end positioning. Flavor profiles are increasingly moving beyond traditional fruit bases toward complex, layered botanicals, spicy infusions, and accurate imitation of classic spirit tastes. Analysis across these segments is crucial for brands to effectively tailor their marketing, product development, and supply chain strategies to target the most profitable consumer niches and distribution points.

Analyzing the Distribution Channel segmentation reveals a critical dichotomy: the On-Trade segment (bars, restaurants, hotels) is vital for brand building, consumer education, and premium positioning, offering an environment where high-quality mocktails can command elevated prices and professional preparation. In contrast, the Off-Trade segment (supermarkets, hypermarkets, online retail) drives volume and accessibility. The explosive growth of Online Retail is redefining market dynamics, offering brands direct-to-consumer relationships, facilitating rapid flavor launches, and enabling personalized marketing based on granular purchase data. This channel efficiency bypasses traditional shelf space constraints, allowing smaller, innovative brands to compete effectively with established beverage giants by focusing purely on digital engagement and rapid fulfillment.

The End-User segmentation highlights the shifting consumer base beyond designated drivers and pregnant women. The largest and most influential segment now comprises health-conscious adults (Millennials and Gen Z) actively practicing moderation or full sobriety as a lifestyle choice. This group seeks premiumization, sustainability credentials, and functional benefits. The segmentation ensures that market players understand whether to prioritize convenience (RTD for busy lifestyles), experiential complexity (NOLO for home entertaining), or specific functional attributes (e.g., stress reduction, enhanced focus) when designing product portfolios and determining optimal pricing strategies, which vary widely depending on the intended user's disposable income and willingness to pay for perceived health benefits or ingredient rarity.

- By Product Type:

- Ready-to-Drink (RTD) Mocktails

- Non-Alcoholic Spirits (NOLO)

- Non-Alcoholic Wine Alternatives

- Syrups, Mixers, and Concentrates

- By Flavor Profile:

- Fruity (Tropical, Berry, Citrus)

- Spicy & Botanical (Ginger, Cinnamon, Rosemary)

- Classic Imitation (Gin, Rum, Whiskey, Aperitif Styles)

- Herbaceous & Savory

- By Distribution Channel:

- Off-Trade (Supermarkets/Hypermarkets, Convenience Stores, Specialized Retail)

- On-Trade (Restaurants, Bars, Hotels, Cafes)

- Online Retail (E-commerce Platforms, Direct-to-Consumer)

- By End-User:

- Adults (25-45, Mindful Drinkers)

- Younger Consumers (Gen Z, Lifestyle Focus)

- Individuals with Health Restrictions

Value Chain Analysis For Mocktails Market

The Mocktails Market value chain begins with sophisticated Upstream Analysis centered on sourcing high-quality, often rare, botanical ingredients, specialized distillates, and natural sweeteners, requiring robust supply chain integrity to ensure purity and sustainable cultivation practices. Unlike traditional sodas, premium mocktails rely heavily on expensive extraction technologies—such as cold-press, vacuum distillation, and CO2 extraction—to capture volatile flavor compounds without heat degradation, thus minimizing the need for synthetic additives. Downstream analysis focuses on efficient and temperature-controlled logistics, critical for maintaining the stability of natural ingredients, particularly within the RTD segment which demands high volume and rapid turnaround. Distribution channels are bifurcated between direct sales through specialized non-alcoholic retailers and e-commerce (Direct) and indirect routes through major beverage distributors supplying hypermarkets, bars, and hospitality venues, necessitating distinct marketing and inventory strategies tailored to each segment.

The complexity in the upstream segment arises from the need for ingredients that provide structure, aroma, and mouthfeel typically imparted by alcohol. Manufacturers often partner directly with specialized farms or extract houses to secure adaptogens, rare spices, and zero-proof distillates (e.g., juniper, bitter citrus peels) under stringent quality control protocols. This focus on premium, traceable raw materials contributes significantly to the final product cost and brand narrative, emphasizing natural origin and high functional efficacy. Furthermore, packaging innovation, including specialized glass bottling and sustainable, recyclable aluminum cans, is integrated early in the value chain planning to align with consumer environmental expectations and ensure product integrity during transit.

In the downstream segment, the role of specialized distributors and logistics providers is paramount, particularly concerning chilled distribution requirements for certain high-end, preservative-free mocktails. The shift toward Online Retail dictates that companies invest heavily in optimizing last-mile delivery and protecting delicate glass bottles. For the Indirect distribution channel serving the On-Trade sector, comprehensive staff training and promotional programs are essential to ensure bartenders and mixologists understand how to properly serve and market the mocktails, translating the brand's premium positioning into the consumer experience. The efficiency of this value chain is continuously optimized through data analytics to predict regional consumption patterns, minimizing inventory holding costs while maximizing market penetration across diverse geographical areas, ranging from dense urban centers to less accessible rural markets.

Mocktails Market Potential Customers

The primary End-User/Buyers of mocktails are rapidly evolving, extending far beyond traditional non-drinkers to encompass a vast, heterogeneous group defined as "Mindful Drinkers"—individuals who actively seek reduced or zero alcohol consumption as part of a conscious lifestyle choice. This core demographic includes highly educated Millennials and Generation Z consumers (aged 20-45) residing in urban and suburban areas, characterized by higher disposable income and a strong propensity to spend on premium, health-oriented products that align with personal values, such as sustainability and clean labeling. Additionally, a significant customer base exists within the corporate and wellness sectors, including those participating in social events, business lunches, or seeking post-exercise hydration and functional benefits, such as adaptogenic stress relief or cognitive enhancement, positioning mocktails as a legitimate functional beverage category for daily use.

A crucial secondary customer segment includes health enthusiasts, athletes, and individuals committed to specific dietary regimes (e.g., keto, vegan, gluten-free), for whom traditional alcoholic beverages pose obstacles due to high sugar content or specific fermentation processes. These buyers prioritize ingredient transparency, natural sourcing, and low or zero-calorie formulations. The appeal of mocktails to this group stems from the ability to offer a complex, celebratory beverage experience without the negative side effects of alcohol or artificial ingredients. Furthermore, the global hospitality industry—hotels, high-end restaurants, and corporate catering services—serves as a massive institutional buyer, integrating sophisticated mocktail programs to enhance their service offerings and cater to the rising demand for inclusive beverage menus, ensuring that every guest has a high-quality, non-alcoholic pairing option for their meals or functions.

Market segmentation also identifies the emerging consumer in Asian and Latin American markets, where rising middle-class disposable income and increasing Western lifestyle adoption are driving curiosity and demand for sophisticated non-alcoholic alternatives. While culturally rooted drinking habits remain strong, the younger demographic in these regions is increasingly receptive to global health trends. Manufacturers specifically targeting these emerging markets must adapt flavor profiles to local palates (e.g., incorporating unique regional spices or less saccharine sweetness) and utilize digital marketing channels effectively to build brand awareness in regions where distribution infrastructure for niche premium products is still developing. Successful targeting involves continuous consumer research to track the nuanced preferences of these diverse buyer groups, ensuring product innovation remains ahead of curve.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $22.5 Billion USD |

| Market Forecast in 2033 | $51.7 Billion USD |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diageo PLC, Lyre's Spirit Co., Seedlip Drinks, Ritual Zero Proof, Caleño Drinks, Three Spirit Drinks, Wilfred's, Stryyk, Fluère, Heineken N.V., Coca-Cola Company (Mixers Division), PepsiCo Inc. (Mixers Division), CleanCo, Mocktail Beverages Inc., Monday Distillery, Everleaf Drinks, ArKay Beverages, Celtic Spirit Company Ltd., Pernod Ricard (Non-Alc Portfolio), Damrak Virgin Gin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mocktails Market Key Technology Landscape

The technological landscape of the Mocktails Market is defined by advanced methods aimed at flavor preservation, alcohol removal, and functional ingredient integration, ensuring that non-alcoholic alternatives deliver a complex and authentic sensory experience. Vacuum Distillation, a core technology, allows volatile aromatic compounds to be separated from liquids at significantly reduced temperatures, preventing the development of cooked or burnt notes often associated with traditional pasteurization or boiling methods. This technique is critical in the production of high-quality non-alcoholic spirits (NOLO) to retain the delicate botanical profile and complex 'spirit' character. Furthermore, advanced blending and homogenization technologies are essential to achieve the desired mouthfeel and textural similarity to alcoholic drinks, often utilizing natural thickeners or specialized mouthfeel agents derived from starches or gums to mimic the viscosity and 'heat' of alcohol, a major challenge in zero-proof formulation.

Beyond distillation, novel preservation and stabilization technologies are paramount due to the industry’s strong pivot towards natural and clean-label ingredients, which typically possess a shorter shelf life. High-Pressure Processing (HPP) is increasingly adopted, using intense pressure rather than heat to inactivate pathogens and extend shelf life while maintaining the nutritional and flavor integrity of fresh ingredients. This is especially crucial for premium, juice-based RTD mocktails. Concurrently, micro-dosing and precision blending equipment leveraging robotic automation ensure extremely accurate incorporation of expensive functional ingredients, such as adaptogens (e.g., ashwagandha, reishi mushrooms) and nootropics, guaranteeing consistent potency and efficacy across mass-produced batches, which is vital for consumer trust in the functional mocktails sub-segment.

Finally, data science and flavor mapping technology, often utilizing AI, are emerging as critical tools in the R&D phase. Spectrometry and gas chromatography technologies are employed to break down the chemical composition of desirable alcoholic spirits, providing a blueprint for non-alcoholic formulation teams to chemically replicate the flavor and aroma structure. This reverse-engineering capability, coupled with AI analytics predicting compound interactions, dramatically reduces the time and cost associated with recipe development. These technological advancements collectively drive the mocktails market's ability to offer products that are not only safer and healthier but also indistinguishable in quality and complexity from their alcoholic counterparts, sustaining the premiumization trend and justifying higher price points in the competitive beverage landscape.

Regional Highlights

- North America: This region stands as a dominant force in the Mocktails Market, characterized by high consumer awareness regarding health and wellness, particularly in the United States and Canada. The market maturity is evident in the widespread availability of specialized non-alcoholic retailers and dedicated shelf space in major grocery chains, signifying mainstream acceptance. The robust growth is fueled by sophisticated marketing targeting urban Millennials and Gen Z who are defining new social norms around moderated consumption. Innovation here centers on high-end non-alcoholic spirits and functional RTD mocktails, often incorporating CBD, adaptogens, or electrolytes. Strategic partnerships between established distributors and emerging artisanal mocktail brands are accelerating market penetration, particularly within the lucrative hospitality sector where creative, zero-proof menus are becoming standard expected features.

- Europe: Europe represents the epicenter of the mindful drinking movement, strongly influenced by cultural habits like 'Dry January' in the UK and Northern European countries, which have normalized non-alcoholic options. The region boasts significant market penetration, driven primarily by the strong performance of non-alcoholic beer and wine alternatives, providing a springboard for the mocktails category. Western Europe, notably the UK, Germany, and the Netherlands, leads in NOLO spirit innovation, supported by favorable regulatory environments regarding labeling and lower taxation compared to alcohol. The European consumer demands high quality and sustainable sourcing, pushing manufacturers to invest heavily in organic and locally sourced botanicals. Distribution in Europe is mature, with strong e-commerce platforms specializing in niche zero-proof products, enabling rapid scaling for innovative, small-batch producers focused on highly refined, complex flavor profiles.

- Asia Pacific (APAC): APAC is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing Western influence on lifestyle, and rising disposable incomes across countries like China, India, and Australia. While traditional beverage markets remain strong, the younger, cosmopolitan population in major cities is increasingly adopting healthier consumption patterns and embracing global trends. The market is currently fragmented, presenting significant opportunity for early movers. Australia and New Zealand show advanced market development, mirroring European trends, while emerging Asian economies are adapting existing RTD infrastructure to introduce localized mocktail flavors. Challenges include adapting product sweetness and flavor profiles to regional palates and navigating complex distribution networks outside of major metropolitan hubs, requiring investment in robust local partnerships and localized digital marketing strategies focused on ingredient education and taste experience.

- Latin America (LATAM): The Mocktails Market in LATAM is in an nascent stage but is experiencing swift uptake, particularly in urban centers of Brazil and Mexico. Economic stabilization and growing health awareness are key drivers. The demand is often focused on refreshing, tropical fruit-based RTD mocktails, leveraging the region's abundant natural fruit resources. The market is primarily dominated by larger international players introducing their zero-proof portfolios. Significant opportunities exist for brands that can effectively integrate local, traditional ingredients (e.g., unique chiles, rare berries, indigenous herbs) into sophisticated mocktail formulations, appealing to both local consumers seeking premium versions of familiar flavors and tourists seeking authentic experiences.

- Middle East and Africa (MEA): The MEA region presents a uniquely compelling market due to religious and cultural restrictions on alcohol consumption, making non-alcoholic beverages a societal necessity rather than merely a lifestyle choice. Consequently, demand for sophisticated, premium non-alcoholic options has always been high. Growth is driven by luxury hospitality sectors in the UAE and Saudi Arabia, which demand complex, high-quality, and visually appealing mocktails for their high-net-worth clientele. Innovation often focuses on replicating high-end wine and champagne experiences in non-alcoholic formats. Distribution requires navigating varied regulatory frameworks, but strong consumer acceptance ensures high volume sales for brands that successfully establish trust and premium positioning, often linking product experience directly to luxury dining and social status.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mocktails Market.- Diageo PLC (via Seedlip and other non-alc offerings)

- Lyre's Spirit Co.

- Ritual Zero Proof

- Caleño Drinks

- Three Spirit Drinks

- Wilfred's Non-Alcoholic

- Stryyk (Elegance Brands Inc.)

- Fluère

- Heineken N.V. (related non-alc product extensions)

- The Coca-Cola Company (Mixers and soft drink extensions)

- PepsiCo Inc. (Mixers and soft drink extensions)

- CleanCo

- Mocktail Beverages Inc.

- Monday Distillery

- Everleaf Drinks

- ArKay Beverages

- Celtic Spirit Company Ltd.

- Pernod Ricard (Non-Alc Portfolio)

- Damrak Virgin Gin

- ISH Spirits

Frequently Asked Questions

Analyze common user questions about the Mocktails market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the substantial growth of the Mocktails Market?

The Mocktails Market growth is primarily driven by the global health and wellness trend, particularly the 'mindful drinking' movement among Millennials and Gen Z consumers seeking reduced alcohol intake. Factors include increased consumer demand for sophisticated, complex flavor profiles, greater social inclusivity, and the widespread availability of high-quality non-alcoholic spirits and ready-to-drink options that mimic traditional cocktails without compromising the sensory experience.

How do ready-to-drink (RTD) mocktails compare to non-alcoholic spirits (NOLO) in terms of market share?

Currently, the Ready-to-Drink (RTD) mocktail segment holds a larger volume market share due to its convenience and accessibility in retail settings, requiring no preparation. However, Non-Alcoholic Spirits (NOLO) represent the fastest-growing segment, driven by their premium positioning, versatility for home mixology, and success in meticulously replicating the sensory profiles of classic alcoholic bases like gin and whiskey.

What key technological innovations are enhancing the flavor and quality of mocktails?

Key technological innovations include Vacuum Distillation, which preserves delicate botanical flavors by removing alcohol at low temperatures, preventing 'cooked' notes. High-Pressure Processing (HPP) extends shelf life for natural, preservative-free ingredients, while AI-driven flavor mapping and specialized blending technologies ensure accurate replication of complex aroma profiles and consistent texture/mouthfeel, crucial for premium products.

Which geographical region exhibits the most significant potential for market expansion?

While North America and Europe currently dominate the market in value, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This expansion is fueled by rising disposable income, rapid urbanization, increasing Westernization of consumption habits, and a growing younger demographic actively adopting healthier, sophisticated non-alcoholic lifestyle choices, creating vast untapped market opportunities.

Are mocktails considered functional beverages, and what functional ingredients are common?

Yes, premium mocktails are increasingly viewed as functional beverages. Many brands are incorporating ingredients that offer specific health benefits beyond simple hydration. Common functional ingredients include adaptogens (like ashwagandha or ginseng for stress reduction), nootropics (for cognitive focus), prebiotics (for gut health), and essential vitamins/electrolytes, catering directly to the holistic wellness goals of the modern consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager