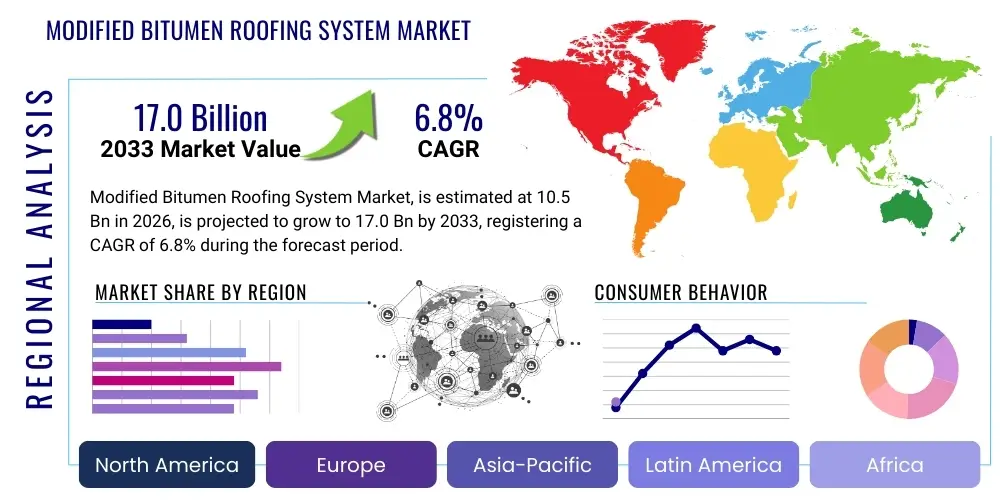

Modified Bitumen Roofing System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440858 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Modified Bitumen Roofing System Market Size

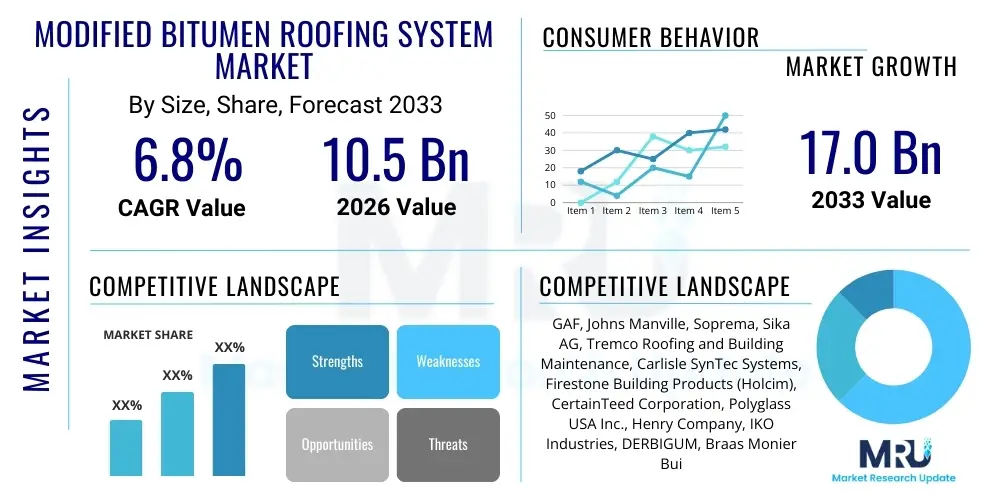

The Modified Bitumen Roofing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 10.5 billion in 2026 and is projected to reach USD 17.0 billion by the end of the forecast period in 2033.

Modified Bitumen Roofing System Market introduction

The Modified Bitumen (MB) roofing system market represents a pivotal segment within the global commercial and industrial roofing sector, distinguished by its robust performance characteristics tailored for low-slope and flat roof applications. Modified bitumen is a sophisticated evolution of traditional asphalt roofing, meticulously engineered by blending standard asphalt with polymer modifiers. The most prevalent polymer types include Atactic Polypropylene (APP) and Styrene Butadiene Styrene (SBS). This polymer integration imparts enhanced physical properties to the asphalt, transforming it into a more durable, flexible, and resilient material. Furthermore, these modified asphalt compounds are typically reinforced with high-strength fabric backings, such as polyester or fiberglass mats, which contribute significantly to the membrane's tensile strength, puncture resistance, and dimensional stability. This synergistic combination of asphalt, polymers, and reinforcement creates a high-performance roofing membrane capable of withstanding severe environmental stresses.

The extensive range of applications for Modified Bitumen roofing systems spans across diverse building categories, making it a highly versatile choice for various construction and renovation projects. Major applications include large-scale commercial buildings like shopping malls, office complexes, and convention centers, where expansive, low-slope roofs are common. Industrial facilities, such as manufacturing plants, warehouses, and distribution centers, also heavily rely on MB systems due to their exceptional durability and resistance to harsh operational conditions. Beyond these, the market extends to institutional buildings including schools, universities, and hospitals, as well as multi-family residential structures and select public infrastructure projects. The adaptability of MB systems is further highlighted by their diverse installation methods, which include traditional torch-applied and hot-mopped techniques, alongside safer, more efficient cold-applied and self-adhering options. This versatility allows building owners, architects, and contractors to select the most appropriate system based on specific project requirements, budget, and safety considerations.

Several critical factors are actively driving the sustained growth and expansion of the Modified Bitumen roofing market globally. A primary driver is the increasing demand for high-performance roofing solutions that offer superior waterproofing capabilities and exceptional longevity, particularly in regions experiencing unpredictable and extreme weather patterns. Building owners and facility managers are increasingly seeking roofing systems that can provide reliable protection against heavy rainfall, high winds, intense UV radiation, and significant temperature fluctuations. Furthermore, the global push towards greater energy efficiency and sustainability in building construction and renovation plays a crucial role. Modified Bitumen roofs can be integrated with reflective coatings or serve as robust foundations for vegetated green roof systems, contributing to reduced cooling costs and compliance with evolving green building standards. The ongoing need for roof repair, replacement, and refurbishment of aging infrastructure worldwide also generates consistent demand, positioning Modified Bitumen roofing as a preferred long-term investment due to its proven performance and cost-effectiveness over its extended service life.

Modified Bitumen Roofing System Market Executive Summary

The Modified Bitumen Roofing System Market is currently undergoing significant transformation, influenced by dynamic business trends, distinct regional growth patterns, and continuous advancements across its various product and application segments. A prominent business trend is the accelerating adoption of sustainable and energy-efficient roofing solutions. This encompasses the widespread integration of cool roof technologies, which involve applying highly reflective coatings to MB membranes to mitigate urban heat island effects and significantly reduce building cooling loads. Another key trend is the growing preference for prefabricated and self-adhering MB systems. These innovations offer substantial advantages in terms of reduced installation time, lower labor costs, enhanced quality control through factory production, and improved job site safety, directly addressing skilled labor shortages and increasing operational efficiency for contractors. The market is also witnessing a demand for more sophisticated, multi-layered roofing assemblies that integrate MB systems with advanced insulation and vapor barriers, designed to meet increasingly stringent thermal performance and building envelope integrity requirements, signaling a shift towards holistic and performance-driven roofing solutions.

From a geographical standpoint, the Modified Bitumen roofing market exhibits diverse growth dynamics across different regions. North America and Europe, as established and mature markets, demonstrate stable and steady demand primarily fueled by extensive renovation, re-roofing, and maintenance projects on existing commercial and industrial building stock. These regions are also leading in the adoption of advanced, high-performance MB systems that comply with rigorous environmental regulations and sophisticated building codes focused on energy efficiency and climate resilience. In contrast, the Asia Pacific (APAC) region stands out as a high-growth market, propelled by rapid urbanization, large-scale infrastructure development initiatives, and burgeoning industrialization in key economies such as China, India, and Southeast Asian countries. The burgeoning construction sector in APAC, driven by economic expansion and population growth, creates substantial opportunities for both new construction and refurbishment projects utilizing durable MB roofing solutions. Latin America and the Middle East & Africa (MEA) regions are also poised for considerable expansion, benefiting from ongoing economic development and increasing investments in commercial and industrial construction.

Segment-wise, the Modified Bitumen market is experiencing notable evolution. The Styrene Butadiene Styrene (SBS) modified bitumen segment continues to maintain a significant market share, primarily due to its superior flexibility, exceptional elasticity, and robust performance in cold weather conditions, making it a preferred choice for a wide array of applications where thermal cycling is a concern. Simultaneously, the Atactic Polypropylene (APP) modified bitumen segment shows consistent demand, particularly in regions characterized by high ambient temperatures and intense UV radiation, where its plastic-like properties and enhanced resistance to weathering are highly valued. A significant overarching trend within these segments is the pronounced shift towards self-adhered (SA) modified bitumen membranes. These systems eliminate the necessity for torches or hot asphalt during installation, thereby significantly mitigating fire risks, reducing labor intensity, and offering a cleaner, safer, and more streamlined application process. This technological shift is a direct response to industry challenges such as labor skill gaps and the drive for increased project efficiency and safety, firmly embedding SA membranes as a key growth catalyst in the market.

AI Impact Analysis on Modified Bitumen Roofing System Market

User questions regarding the influence of Artificial Intelligence (AI) on the Modified Bitumen Roofing System Market predominantly center on how AI can introduce efficiencies, enhance safety protocols, and enable superior predictive capabilities throughout the entire product lifecycle. Common inquiries reveal user expectations for AI-driven advancements in material science, focusing on the potential for developing more durable, sustainable, and customizable MB formulations through sophisticated data analysis of material properties and performance. There is also significant interest in AI's role in optimizing manufacturing processes, with questions about how machine learning can streamline production, reduce waste, ensure consistent product quality, and potentially lower overall costs. Furthermore, users frequently explore the application of AI and machine vision for advanced inspection techniques, seeking to understand how these technologies can enable real-time defect detection during installation, monitor roof health over time for predictive maintenance, and facilitate more accurate damage assessments post-event. These themes underscore a collective anticipation for AI to drive transformative improvements in product innovation, operational excellence, risk management, and long-term asset value within the modified bitumen roofing domain.

- AI-driven optimization algorithms can significantly enhance the efficiency of manufacturing processes for modified bitumen membranes, leading to reduced material waste, lower energy consumption, and improved consistency in product quality by dynamically adjusting production parameters.

- Predictive analytics, powered by machine learning, can analyze vast economic datasets to forecast fluctuations in raw material prices for asphalt and polymers, enabling manufacturers to implement more strategic procurement decisions and better manage cost volatilities.

- Machine learning models can analyze extensive datasets comprising roofing performance under diverse climatic conditions, material degradation patterns, and field failures, providing crucial insights that inform the research and development of more resilient and longer-lasting MB formulations.

- AI-enabled drone inspections, equipped with high-resolution cameras and computer vision algorithms, can autonomously survey large MB roof areas to detect subtle defects, early signs of moisture ingress, ponding water, or wear patterns that might be missed by human inspection, thereby facilitating proactive maintenance and extending roof lifespan.

- Intelligent project management software leveraging AI can optimize complex MB roofing installation schedules, efficiently allocate skilled labor resources, manage material inventory, and predict potential delays, leading to improved project timelines and overall operational efficiency on construction sites.

- Virtual reality (VR) and augmented reality (AR) platforms, often integrated with AI, can provide highly immersive and interactive training simulations for MB installers. This technology allows trainees to practice complex installation techniques in a controlled environment, significantly improving safety compliance and application quality before real-world deployment.

- The deployment of AI-enabled sensors embedded within modified bitumen roofing systems could offer real-time, continuous monitoring of critical parameters such as temperature differentials, humidity levels, and structural stress. This real-time data allows for immediate alerts regarding potential issues, enabling proactive maintenance interventions and enhancing the overall integrity and longevity of the roofing asset.

DRO & Impact Forces Of Modified Bitumen Roofing System Market

The Modified Bitumen Roofing System Market operates under a dynamic confluence of drivers, restraints, opportunities, and broader impact forces that collectively shape its growth trajectory and competitive landscape. A primary driver is the escalating global demand for highly durable and weather-resistant roofing materials, particularly pertinent in an era of increasing climate volatility and extreme weather events. Modified Bitumen roofs, with their proven ability to withstand high winds, hailstorms, heavy precipitation, and wide temperature fluctuations, offer a critical solution for protecting commercial and industrial assets. Furthermore, the growing emphasis on energy efficiency and sustainable building practices, enshrined in evolving building codes and green certification programs, significantly propels market growth. MB systems can be readily integrated with highly reflective cool roof coatings or serve as robust substrates for vegetated green roofs, contributing to reduced energy consumption and lower carbon footprints. The long service life, typically exceeding 20-30 years, coupled with relatively low maintenance requirements, also positions MB roofing as an attractive long-term investment for building owners, stimulating consistent demand in the replacement and renovation segments.

Despite these robust drivers, the Modified Bitumen market contends with several inherent restraints that pose challenges to its unbridled expansion. The significant volatility in the prices of key raw materials, namely crude oil-derived asphalt and various polymers (SBS, APP), introduces considerable uncertainty into manufacturing costs. These unpredictable fluctuations can directly impact product pricing, potentially compressing profit margins for manufacturers and increasing overall project costs for end-users. Another significant restraint is the complexity and specialized skill set required for certain traditional MB installation methods, particularly torch-applied systems. This can lead to skilled labor shortages, higher labor costs, and elevated safety concerns on job sites, steering some project managers towards alternative roofing solutions that promise simpler or quicker application. Furthermore, intense competition from a burgeoning array of alternative low-slope roofing materials, such as single-ply membranes (TPO, EPDM, PVC) and advanced built-up roofing (BUR) systems, presents a formidable challenge, as these options often compete on aspects like initial cost, ease of installation, or specific performance characteristics for niche applications.

Conversely, the Modified Bitumen market is rich with opportunities for innovation and strategic growth. A compelling opportunity lies in the continuous development of more sustainable and environmentally friendly MB solutions. This includes the integration of recycled content into membranes, the formulation of bio-based asphalt modifiers, and the widespread adoption of non-VOC (volatile organic compound) adhesives and coatings, aligning with global environmental objectives and stricter regulations. Emerging markets, particularly within the Asia Pacific, Latin America, and Middle East & Africa regions, offer immense untapped potential. Rapid urbanization, significant industrial expansion, and large-scale infrastructure projects in these developing economies are creating new construction demand for durable and reliable roofing systems. Additionally, the increasing integration of digital construction technologies, such as Building Information Modeling (BIM) and advanced project management software, can streamline the design, planning, and installation of MB systems, enhancing efficiency, reducing errors, and improving project predictability. The trend towards integrated roofing solutions, combining MB with solar photovoltaic panels, rainwater harvesting systems, or advanced insulation layers, also presents a substantial opportunity to deliver holistic building performance solutions that cater to multifaceted client needs.

Segmentation Analysis

The Modified Bitumen Roofing System market is comprehensively segmented to provide granular insights into its multifaceted structure, enabling a detailed examination of market dynamics, consumer preferences, and technological adoption across various dimensions. This meticulous segmentation is indispensable for stakeholders, including manufacturers, distributors, and specifiers, as it allows for the identification of specific growth avenues, competitive landscapes, and unmet market needs. By dissecting the market into distinct categories based on product type, reinforcement, application method, and end-use sector, a clearer understanding emerges regarding which solutions are gaining traction, where investment opportunities lie, and how market forces are shaping demand. This analytical approach empowers businesses to refine their product portfolios, tailor marketing strategies, and optimize distribution channels to effectively target specific customer segments and achieve sustained growth within the complex global roofing industry.

- By Type: This segmentation differentiates Modified Bitumen membranes based on the specific polymer used to modify the asphalt, influencing their physical characteristics and performance profiles.

- Styrene Butadiene Styrene (SBS) Modified Bitumen: These membranes incorporate a rubberized polymer, endowing them with superior flexibility, elasticity, and crack resistance, particularly at low temperatures. SBS is highly favored for its ability to accommodate building movement and its ease of application through hot-mopped or cold-applied adhesives, or self-adhering technologies.

- Atactic Polypropylene (APP) Modified Bitumen: These membranes are modified with a plasticized polymer, providing them with enhanced resistance to high temperatures, UV radiation, and asphalt flow. APP is predominantly associated with torch-applied installation methods, where its thermoplastic properties allow the seams to be easily fused together, creating a monolithic, highly durable surface.

- By Reinforcement Type: The type of internal reinforcement greatly impacts the membrane's strength, dimensional stability, and overall integrity.

- Polyester: Offers excellent elongation, high tear strength, and superior conformability to various roof deck irregularities, making it highly resistant to punctures and fatigue caused by building movement.

- Fiberglass: Provides high tensile strength, exceptional dimensional stability (minimal expansion or contraction), and good fire resistance, making it suitable for applications where a rigid, stable membrane is critical.

- Composite: Combines the beneficial properties of both polyester and fiberglass, offering a balanced profile of strength, flexibility, tear resistance, and dimensional stability, designed for enhanced overall performance in demanding applications.

- By Application Method: This segment highlights the diverse techniques employed for installing Modified Bitumen roofing systems, each with distinct advantages and safety considerations.

- Torch-Applied: A traditional method where an open-flame propane torch is used to melt the underside of the MB membrane, creating a molten asphalt bond with the substrate or underlying ply. It is known for creating strong, monolithic seams.

- Self-Adhered (SA): Features factory-applied, pressure-sensitive adhesive layers on the underside, protected by a release film. Installation involves peeling off the film and pressing the membrane into place, eliminating the need for heat or hot asphalt, significantly improving safety and speed.

- Hot-Mopped: Involves applying hot asphalt to adhere the MB membrane, similar to traditional built-up roofing. This method requires specialized equipment and safety precautions due to the high temperatures of the asphalt.

- Cold-Applied: Utilizes solvent-based or water-based cold adhesives to bond the MB membrane to the substrate. This method offers a flameless alternative to torching and hot-mopping, reducing safety risks and typically having lower VOC options.

- By End-Use Sector: This segmentation categorizes the market based on the primary type of building or industry where Modified Bitumen roofing systems are installed.

- Commercial: Includes a broad range of buildings such as office complexes, retail stores, shopping malls, hotels, restaurants, and recreational facilities, where aesthetic appeal and long-term durability are key considerations.

- Industrial: Encompasses manufacturing plants, warehouses, distribution centers, power generation facilities, and petrochemical complexes, where robust, chemical-resistant, and high-performance roofing is critical for protecting assets and operations.

- Residential: Primarily focuses on multi-family housing units, apartment buildings, condominiums, and sometimes low-slope residential extensions, where cost-effectiveness, ease of maintenance, and reliable waterproofing are important for property owners and managers.

Value Chain Analysis For Modified Bitumen Roofing System Market

The value chain for the Modified Bitumen Roofing System Market is an intricate and multi-layered ecosystem, meticulously orchestrated from the initial sourcing of raw materials to the final installation and long-term maintenance of the roofing system. This comprehensive chain highlights the sequential activities that add value to the end product and the critical interdependencies among various stakeholders. The upstream segment of the value chain is primarily concerned with the extraction, refining, and processing of fundamental raw materials. This includes crude oil, from which asphalt is derived as a key component, alongside the sophisticated chemical manufacturing of polymer modifiers such as Styrene Butadiene Styrene (SBS) and Atactic Polypropylene (APP). Additionally, the production of high-strength reinforcement fabrics like polyester and fiberglass mats is crucial. Suppliers at this foundational stage are pivotal for ensuring the consistent quality, reliable supply, and cost-effectiveness of these essential inputs. Fluctuations in global crude oil prices, for instance, directly ripple through the entire chain, impacting the cost of asphalt and subsequently influencing the pricing strategies and profit margins of downstream manufacturers and installers.

Progressing further down the value chain, the intermediate stage involves the specialized manufacturing of Modified Bitumen membranes and related accessories. Leading manufacturers integrate the refined asphalt with polymer modifiers, impregnate the reinforcement fabrics, and engineer the final membrane sheets, often incorporating various surface finishes, reflective coatings, and adhesive backings for self-adhering systems. This phase also includes the production of complementary roofing components such as primers, flashing materials, sealants, and insulation boards, all designed to work synergistically with the MB membranes to form a complete roofing system. The downstream segment of the value chain focuses on the distribution and installation of these finished products. Distribution channels are varied and strategically deployed to maximize market reach. These typically include large national and regional wholesale distributors of building materials, specialized roofing distributors, and in some cases, direct sales from manufacturers to major commercial contractors or large-scale institutional clients. These distributors play a crucial logistical role, managing inventory, warehousing products, and ensuring timely delivery to job sites, thereby supporting the widespread availability of MB roofing solutions.

The interplay between direct and indirect distribution channels is a defining characteristic of market penetration strategies. Direct distribution allows large manufacturers to establish strong relationships with key customers, exercise greater control over pricing, and maintain brand consistency for high-volume projects. This approach is often favored for large commercial or industrial contracts where bespoke solutions or extensive technical support are required. Conversely, indirect distribution, primarily through a network of independent distributors and retailers, enables broader market access, particularly to smaller contractors, local construction firms, and geographically dispersed projects. These intermediaries leverage their established logistical networks, local market knowledge, and customer relationships to effectively serve a diverse client base. The ultimate installation of Modified Bitumen roofing systems is predominantly performed by professional roofing contractors, who possess the specialized skills and equipment necessary for proper application, ensuring the longevity and performance of the roof. These contractors are the direct interface with the end-users—building owners, facility managers, and property developers—providing crucial on-site expertise, project management, and post-installation support. The efficiency and success of the entire MB roofing market value chain are therefore highly dependent on robust collaboration, effective communication, and stringent quality control at every stage, from material sourcing to final project handover.

Modified Bitumen Roofing System Market Potential Customers

The Modified Bitumen Roofing System Market targets a broad and diverse spectrum of potential customers, primarily comprising entities responsible for the development, construction, maintenance, and renovation of commercial, industrial, and multi-family residential properties. These end-users are consistently driven by a critical need for roofing solutions that offer exceptional durability, reliable waterproofing, long-term performance, and a favorable return on investment over the lifecycle of their assets. A significant segment of potential customers includes commercial property owners and real estate developers. These stakeholders prioritize the longevity and integrity of their buildings, seeking roofing systems that can provide robust protection against environmental elements, contribute to lower operational costs through energy efficiency, and require minimal maintenance. For this segment, Modified Bitumen systems represent a strategic investment that safeguards their real estate portfolios while ensuring the comfort and safety of building occupants, directly impacting asset valuation and tenant satisfaction.

Industrial facility managers and operators constitute another crucial customer base within the Modified Bitumen roofing market. Entities managing manufacturing plants, large warehouses, logistics hubs, chemical processing units, and other industrial complexes demand roofing systems capable of withstanding harsh operational environments. These conditions often include exposure to extreme temperatures, potential chemical spills, heavy equipment traffic for maintenance, and stringent safety regulations. The inherent strength, puncture resistance, and adaptability of Modified Bitumen roofs make them exceptionally well-suited for these demanding industrial applications, offering robust protection for valuable equipment and critical operations. Furthermore, general contractors and specialized roofing contractors play an indispensable role as key intermediaries in the purchasing and specification process. They often advise building owners on the most appropriate roofing materials, manage the procurement, and oversee the installation. Their deep technical expertise in evaluating different roofing options, understanding project-specific requirements, and ensuring proper application positions them as pivotal influencers in the widespread adoption of MB systems for both new construction and extensive re-roofing projects.

Beyond the core commercial and industrial sectors, institutional clients also represent a vital segment of potential customers. This includes public and private entities such as educational institutions (schools, universities), healthcare facilities (hospitals, clinics), and various government agencies (municipal buildings, military installations). These organizations typically manage extensive property portfolios and are driven by the need for roofing solutions that meet rigorous safety standards, comply with public procurement guidelines, offer exceptional durability for high-traffic maintenance, and provide long-term cost-effectiveness. Their decision-making processes often weigh initial investment against lifecycle costs, ease of maintenance, and the ability of roofing systems to contribute to sustainable building practices and energy conservation mandates. Similarly, property management companies overseeing multi-family residential complexes (apartments, condominiums) are significant buyers, seeking reliable, weather-resistant, and low-maintenance roofing solutions that provide peace of mind for both tenants and property owners, effectively broadening the applicability and enduring appeal of Modified Bitumen roofing solutions across a wide range of building sectors and management priorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 billion |

| Market Forecast in 2033 | USD 17.0 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GAF, Johns Manville, Soprema, Sika AG, Tremco Roofing and Building Maintenance, Carlisle SynTec Systems, Firestone Building Products (Holcim), CertainTeed Corporation, Polyglass USA Inc., Henry Company, IKO Industries, DERBIGUM, Braas Monier Building Group (BMI Group), Owens Corning, Malarkey Roofing Products, Atlas Roofing Corporation, TAMKO Building Products, Siplast (part of Sika), Boral Roofing, Kemper System America Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modified Bitumen Roofing System Market Key Technology Landscape

The Modified Bitumen Roofing System market is characterized by a dynamic and continuously evolving technology landscape, driven by persistent innovation aimed at enhancing product performance, improving sustainability metrics, and streamlining installation processes. A foundational technological pillar revolves around the advanced polymer modification of asphalt, primarily through the integration of Styrene Butadiene Styrene (SBS) and Atactic Polypropylene (APP) polymers. SBS modification introduces a rubber-like elasticity and flexibility to the asphalt, critical for resisting fatigue, thermal shock, and cracking in cold weather conditions, making the membranes exceptionally pliable and resilient to building movement. Conversely, APP modification imparts plastic-like characteristics, offering superior resistance to intense UV radiation, high ambient temperatures, and general weathering, which is particularly beneficial for torch-applied systems as it allows for easier heat welding of seams. These polymer modifications are instrumental in extending the service life and performance envelope of MB membranes significantly beyond that of traditional asphalt-based roofing systems, ensuring robust protection across diverse climatic regions.

Beyond the fundamental polymer chemistry, substantial technological advancements have been made in the reinforcement materials embedded within the modified bitumen sheets, which are crucial for the membrane’s structural integrity and dimensional stability. High-strength polyester fabrics, for example, offer exceptional elongation, tear resistance, and superb conformability to various roof deck irregularities, providing robust protection against punctures and stresses caused by structural shifts. Fiberglass reinforcements, on the other hand, contribute superior tensile strength, excellent dimensional stability (minimizing expansion and contraction), and enhanced fire resistance, bolstering the overall robustness and safety profile of the roofing system. Furthermore, the development of sophisticated composite reinforcements, which combine the advantages of both polyester and fiberglass, represents a cutting-edge approach to engineering membranes with a balanced profile of strength, flexibility, and dimensional stability, tailored for the most demanding applications. These advancements in reinforcement technology ensure that MB membranes maintain their structural integrity and performance under challenging environmental and operational conditions.

The contemporary technology landscape also encompasses significant innovations in adhesive technologies and integrated system components that profoundly impact installation efficiency and long-term performance. The proliferation of self-adhered (SA) Modified Bitumen membranes, featuring factory-applied pressure-sensitive adhesive layers protected by a release film, has revolutionized installation. This technology eliminates the need for open flames (torches) or hot asphalt, drastically reducing installation time, labor costs, and, critically, enhancing job site safety by mitigating fire hazards. This shift aligns with growing industry demands for safer, cleaner, and more efficient application processes. Moreover, the integration of highly reflective cool roof coatings, typically formulated from advanced acrylics or silicones, onto MB membranes is a key technological trend. These coatings significantly enhance energy efficiency by reducing solar heat gain, thereby lowering cooling costs for buildings and mitigating the urban heat island effect, aligning with increasingly stringent green building certifications and energy conservation mandates. The emerging trend of incorporating smart roofing technologies, such as embedded sensors for real-time monitoring of moisture, temperature, and structural integrity (leveraging IoT and data analytics), further exemplifies the market's trajectory towards higher performance, greater sustainability, and intelligent operational management, cementing Modified Bitumen's relevance in the modern construction paradigm.

Regional Highlights

- North America: This region stands as a mature and significant market for Modified Bitumen roofing systems, characterized by a substantial volume of renovation and re-roofing projects. Demand is primarily driven by the need for durable, long-lasting, and energy-efficient solutions to comply with stringent building codes and evolving environmental regulations. There is a strong preference for advanced SBS modified bitumen systems and a growing adoption of self-adhered membranes, fueled by concerns over labor availability, installation efficiency, and job site safety. Continued investment in commercial and industrial infrastructure, particularly in the US and Canada, sustains consistent market growth and innovation.

- Europe: The European market for Modified Bitumen roofing systems is highly influenced by a robust emphasis on sustainability, stringent energy performance directives, and comprehensive regulatory compliance. European nations, especially in Western Europe (Germany, France, UK), are at the forefront of adopting eco-friendly MB solutions, including advanced cool roofs and membranes specifically designed to integrate with vegetated green roof systems. Extensive renovation activities targeting the region's aging building stock, coupled with increasingly stringent thermal insulation requirements and carbon reduction targets, significantly stimulate demand for high-performance MB solutions that contribute to energy savings and environmental goals.

- Asia Pacific (APAC): Emerging as the fastest-growing market globally, the APAC region is experiencing unparalleled expansion in the Modified Bitumen roofing sector. This robust growth is primarily attributable to rapid urbanization, massive infrastructure development projects, and escalating industrialization across key economies such as China, India, and the Southeast Asian nations. The burgeoning construction of commercial complexes, industrial facilities, and multi-family residential units, driven by strong economic growth and population expansion, generates immense demand for reliable, cost-effective, and high-performance roofing materials, making MB systems a preferred choice for large-scale projects.

- Latin America: This region presents substantial growth potential for the Modified Bitumen roofing market, spurred by ongoing economic development, increasing foreign direct investment in infrastructure, and a burgeoning middle class that drives commercial and multi-family residential construction. There is a growing awareness and adoption of modern, durable roofing technologies, including Modified Bitumen, as countries in this region seek to upgrade their building stock and infrastructure to more resilient and long-lasting standards, capable of withstanding local climatic challenges and reducing maintenance burdens.

- Middle East and Africa (MEA): The MEA region is projected to witness steady growth in the Modified Bitumen roofing market, particularly within the Gulf Cooperation Council (GCC) countries due to ambitious megaprojects associated with national development visions (e.g., Saudi Vision 2030, UAE Vision 2021) and economic diversification efforts away from oil. The region's predominantly hot and arid climatic conditions drive a significant demand for roofing systems with exceptional UV resistance, heat reflectivity, and thermal stability, making APP modified bitumen and cool roof-integrated MB systems particularly well-suited and highly sought after. Africa's expanding construction sector, fueled by population growth and infrastructure investment, also contributes to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modified Bitumen Roofing System Market.- GAF

- Johns Manville

- Soprema

- Sika AG

- Tremco Roofing and Building Maintenance

- Carlisle SynTec Systems

- Firestone Building Products (Holcim)

- CertainTeed Corporation

- Polyglass USA Inc.

- Henry Company

- IKO Industries

- DERBIGUM

- Braas Monier Building Group (BMI Group)

- Owens Corning

- Malarkey Roofing Products

- Atlas Roofing Corporation

- TAMKO Building Products

- Siplast (part of Sika)

- Boral Roofing

- Kemper System America Inc.

Frequently Asked Questions

What is a Modified Bitumen Roofing System?

A Modified Bitumen (MB) roofing system is an advanced asphalt-based roofing material specifically engineered for low-slope or flat roofs. It integrates conventional asphalt with polymer modifiers, such as Styrene Butadiene Styrene (SBS) or Atactic Polypropylene (APP), and is reinforced with high-strength fabrics like polyester or fiberglass, resulting in a highly durable, flexible, and waterproof membrane that offers superior performance compared to traditional asphalt roofs.

What are the main types of Modified Bitumen and their key differences?

The two primary types are SBS (Styrene Butadiene Styrene) and APP (Atactic Polypropylene). SBS modified bitumen is rubber-like, providing excellent flexibility and elasticity in colder temperatures, often applied with adhesives or as self-adhering membranes. APP modified bitumen is plastic-like, offering superior resistance to high temperatures and UV radiation, making it well-suited for torch-applied installations due to its thermoplastic properties.

What are the primary advantages of choosing Modified Bitumen roofing for commercial buildings?

Modified Bitumen roofing offers several significant advantages for commercial properties, including exceptional durability, superior resistance to severe weather conditions (UV, heat, cold, hail), robust waterproofing capabilities, excellent flexibility to accommodate building movement, relatively low maintenance requirements, and a long service life, typically ranging from 20 to 30 years or more with proper care, providing a cost-effective long-term solution.

How are Modified Bitumen roofing systems typically installed, and what are the safer options?

MB roofing systems can be installed using various methods: torch-applied (using an open flame), hot-mopped (with hot asphalt), cold-applied (using adhesives), or self-adhered (peel-and-stick) systems. Self-adhered (SA) membranes are increasingly popular as they eliminate the need for torches or hot asphalt, significantly reducing fire risks, labor time, and offering a safer, cleaner, and more efficient installation process on job sites.

What is the expected lifespan of a Modified Bitumen roof, and how can it be maximized?

A properly installed Modified Bitumen roof can typically last between 20 to 30 years, and often longer, depending on the specific product, environmental exposure, and quality of installation. Maximizing its lifespan involves regular maintenance, including biannual inspections, prompt repair of any minor damage, keeping the roof clear of debris, ensuring proper drainage to prevent ponding water, and potentially applying protective coatings to enhance UV resistance over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager