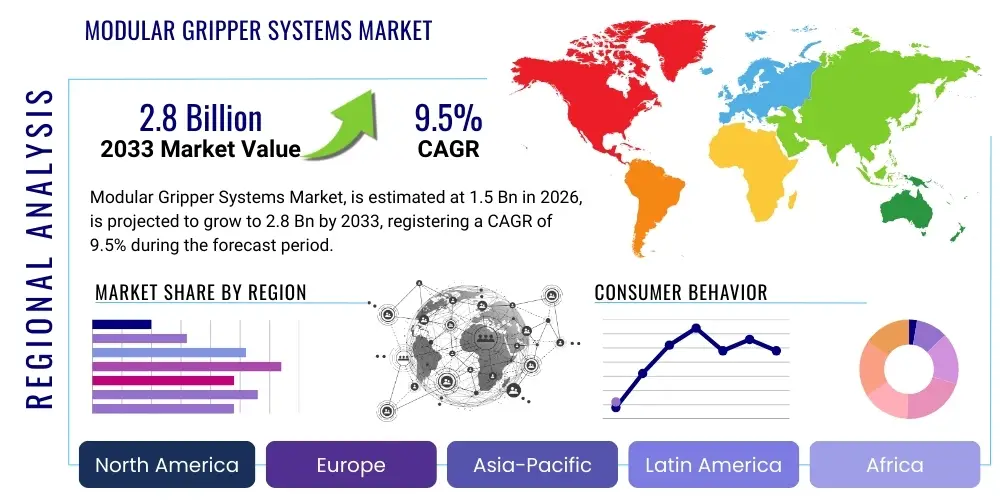

Modular Gripper Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441931 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Modular Gripper Systems Market Size

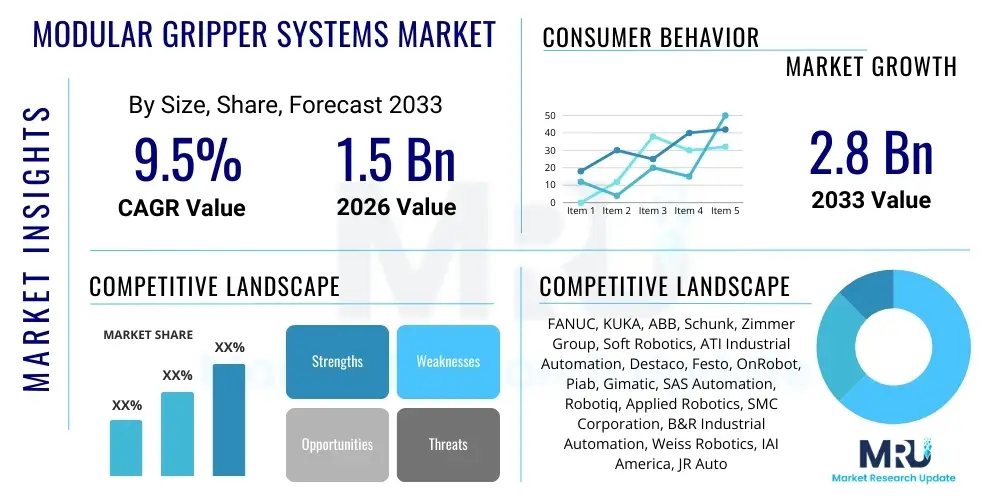

The Modular Gripper Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global shift toward industrial automation, particularly in high-precision manufacturing sectors where flexibility and quick changeover capabilities are paramount. The inherent advantages of modular systems—allowing for easy customization, reconfiguration, and maintenance—position them as critical enablers for Industry 4.0 initiatives across diversified industrial landscapes, spanning from automotive assembly to pharmaceutical packaging.

Modular Gripper Systems Market introduction

The Modular Gripper Systems Market encompasses robotic end-of-arm tooling (EOAT) solutions characterized by interchangeable components that allow users to quickly adapt the gripper configuration to handle diverse geometries, sizes, and materials with minimal downtime. These systems provide superior flexibility compared to fixed-purpose grippers, making them indispensable in environments requiring high mix, low volume production or frequent product changeovers. Modular grippers typically integrate components such as fingers, jaws, sensors, and connecting interfaces that can be assembled in various configurations, optimized for specific tasks like picking, placing, assembly, or sorting.

Major applications of modular gripper technology span the entire spectrum of automated manufacturing, including the material handling processes in automotive production, the delicate component manipulation within electronics and semiconductor fabrication, and the sterile packaging and sorting tasks within the life sciences and food and beverage industries. The primary product description centers on highly versatile mechanical or vacuum-based devices that interface seamlessly with industrial robots and collaborative robots (cobots). Their design emphasizes compatibility, precision, and durability, enabling reliable operation in rigorous industrial settings while maintaining the ability to swap components rapidly when manufacturing requirements evolve.

The core benefit driving market adoption is enhanced operational efficiency and reduced total cost of ownership (TCO) resulting from decreased setup times and the capacity to reuse core components across different production lines. Key driving factors include the persistent global labor shortage in skilled manufacturing roles, the intensifying demand for personalized products requiring agile manufacturing processes, and continuous technological advancements in robotics, sensing capabilities, and lightweight composite materials used in gripper fabrication. Furthermore, the increasing affordability and ease of integration of collaborative robotics inherently boost the demand for highly flexible, modular EOAT solutions that complement the dexterity of these machines.

- Market Intro: Systems comprising interchangeable end-of-arm tooling components for robotic applications.

- Product Description: Versatile mechanical, pneumatic, or electric devices offering rapid reconfiguration and high precision.

- Major Applications: Automotive, Electronics, Logistics, Food and Beverage, Pharmaceuticals.

- Benefits: Reduced downtime, increased flexibility, lower TCO, optimized inventory management.

- Driving Factors: Expansion of industrial automation, rise of collaborative robotics (cobots), and demand for mass customization.

Modular Gripper Systems Market Executive Summary

The Modular Gripper Systems Market is experiencing robust growth fueled by transformative business trends, most notably the widespread adoption of flexible automation strategies designed to cope with complex supply chains and unpredictable demand fluctuations. Companies are moving away from dedicated machinery towards adaptive manufacturing cells, where modular grippers play a crucial role in enabling robots to perform a diverse array of tasks without extensive hardware modifications. This strategic shift towards agility is particularly evident in regions with high labor costs and advanced manufacturing infrastructure, necessitating investments in systems that maximize operational throughput and minimize manual intervention.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to massive governmental and private sector investments in manufacturing modernization, especially within China, South Korea, and Japan. North America and Europe, while being mature markets, continue to contribute significant revenue, driven by sophisticated applications in aerospace, medical devices, and electric vehicle (EV) production. European market growth is particularly supported by strict regulatory standards favoring high-quality, precise automation solutions, while North America benefits from reshoring initiatives demanding highly adaptable automated systems.

Segment trends highlight the dominance of electric modular grippers, favored for their precision, energy efficiency, and ease of digital integration with supervisory control systems (SCADA/MES). However, pneumatic grippers maintain a strong position in high-force, high-speed applications where simplicity and robustness are prioritized. By application, the electronics and semiconductor industry represents a high-growth segment, requiring extremely fine manipulation capabilities that modular systems deliver through specialized, small-format components. Furthermore, the trend toward heavier payloads in logistics and warehousing operations is boosting demand for robust, high-capacity modular components, diversifying the product portfolio offered by market leaders.

AI Impact Analysis on Modular Gripper Systems Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the design, selection, and operation of modular gripper systems, focusing heavily on issues like "Can AI automatically select the best gripper configuration for a new task?" and "How does machine learning improve gripping reliability on irregular objects?" Key concerns revolve around the integration complexity of advanced vision systems and AI algorithms into existing PLC-based automation infrastructure, and the capability of AI to manage highly variable pick-and-place scenarios currently requiring human dexterity. The consensus expectation is that AI will move gripper systems beyond simple predefined kinematics to truly adaptive, intelligent tools capable of real-time trajectory correction, force sensing optimization, and autonomous configuration management based on sensor input, thereby maximizing operational throughput and minimizing component damage.

The integration of AI, particularly through deep learning and computer vision, is revolutionizing the functional capabilities of modular gripper systems. AI algorithms can process complex visual and tactile sensor data instantaneously, allowing the gripper to accurately identify irregularly shaped or inconsistently positioned parts. This capability drastically reduces the need for costly and time-consuming custom tooling or fixture design, enabling "no-touch" programming for new tasks. This predictive intelligence not only enhances the success rate of complex gripping operations but also provides predictive maintenance alerts by analyzing subtle changes in actuator performance or grip force signatures, extending the lifespan of the physical components.

Moreover, AI facilitates the rapid deployment and redeployment of modular systems. Through reinforcement learning, a robotic cell equipped with a modular gripper can learn the optimal gripping strategy for an entirely new product or material directly in the operational environment, significantly compressing integration timelines. This level of autonomy is critical for achieving the operational flexibility demanded by mass customization models. The computational intelligence inherent in AI-driven systems ensures that the modularity of the hardware is fully leveraged by software capable of intelligently selecting and adjusting components based on environmental parameters and task requirements, elevating the modular gripper from a mechanical tool to a smart, cognitive component of the robotic cell.

- AI enables autonomous configuration selection and optimization based on task requirements.

- Machine Learning enhances gripping reliability for irregularly shaped or inconsistent objects.

- Deep learning algorithms process complex sensor data (vision, tactile) for real-time adjustments.

- Predictive maintenance driven by AI analyzing force feedback and operational parameters.

- Reinforcement learning accelerates deployment and programming for new products and materials.

- AI improves path planning and collision avoidance during high-speed manipulation tasks.

DRO & Impact Forces Of Modular Gripper Systems Market

The Modular Gripper Systems Market is primarily driven by the imperative for flexible automation, restraints posed by initial investment costs and complexity, and significant opportunities arising from emerging markets and advanced manufacturing techniques. The primary driver is the accelerating trend of Industry 4.0 adoption, pushing manufacturers to utilize versatile robotic tools that maximize asset utilization across various production runs. Restraints include the high upfront capital expenditure required for integrating sophisticated modular systems and the necessary training for personnel to manage their complex configuration changes and maintenance routines. Opportunities are abundant in the rapid expansion of collaborative robotics (cobots), which rely heavily on lightweight, modular EOAT for safe and flexible human-robot interaction, alongside penetration into niche markets like biomedical engineering and additive manufacturing post-processing. These forces combine to create a dynamic market environment where technological advancement is critical for overcoming cost barriers and capitalizing on widespread automation needs.

Segmentation Analysis

The Modular Gripper Systems Market is extensively segmented based on the mechanism of actuation, the type of components utilized, the primary application industry, and the payload capacity the system is designed to handle. This multi-faceted segmentation allows stakeholders to analyze market dynamics specific to their technological focus or end-user concentration. The key segments reflect the technological maturity and operational requirements across diverse manufacturing environments, ranging from high-precision, low-force handling in semiconductor manufacturing to robust, high-force applications in heavy machinery assembly, with electric and pneumatic actuation systems dominating current market share due to their widespread acceptance and reliability.

- By Type:

- Electric Modular Grippers

- Pneumatic Modular Grippers

- Hydraulic Modular Grippers

- Vacuum Modular Grippers

- By Component:

- Fingers/Jaws

- Quick-Change Adapters

- Sensors and Feedback Systems

- Actuators and Mountings

- By Application/End-User Industry:

- Automotive and Transportation

- Electronics and Semiconductor

- Food and Beverage

- Pharmaceuticals and Cosmetics

- Logistics and Warehousing

- Machine Tools and Metalworking

- By Payload Capacity:

- Light Payload (Under 5 kg)

- Medium Payload (5 kg to 25 kg)

- Heavy Payload (Above 25 kg)

Value Chain Analysis For Modular Gripper Systems Market

The value chain for the Modular Gripper Systems Market begins with upstream activities involving raw material procurement (specialty alloys, lightweight composites, advanced polymers) and the manufacturing of high-precision components like sensors, micro-actuators, and quick-change couplings. Key upstream suppliers include specialized manufacturers of servo motors, solenoid valves, and advanced material producers. The technological complexity here demands strong quality control and reliable sourcing, as the performance and longevity of the modular system are directly dependent on the quality of these core elements. Manufacturers often engage in vertical integration or secure long-term contracts with specialized component suppliers to maintain a competitive edge and ensure supply chain stability, especially regarding sophisticated sensor technologies vital for adaptive gripping.

The midstream stage centers on the design, assembly, and testing of the complete modular gripper system. Leading players differentiate themselves through proprietary design interfaces, software integration capabilities, and the breadth of their modular component libraries. This stage involves rigorous engineering to ensure components are easily interchangeable, precise, and durable under constant operational stress. Distribution channels play a critical role in reaching end-users; these channels are broadly categorized into direct sales and indirect sales. Direct channels are typically utilized for large-scale enterprise clients or highly customized, complex systems requiring specialized technical support and integration services. This approach allows manufacturers to maintain tight control over product installation and customer relationship management.

Indirect distribution relies heavily on global networks of industrial distributors, system integrators, and value-added resellers (VARs). System integrators are particularly important downstream, as they combine the modular gripper systems with industrial robots, vision systems, and PLCs to create complete automation cells tailored to the end-user's specific manufacturing requirements. The end of the value chain involves after-sales support, maintenance, spare parts supply, and software updates. Given the high-tech nature and continuous operation of these systems, robust support services and readily available replacement modules are essential for minimizing downtime and maximizing customer satisfaction. This downstream support frequently determines the overall attractiveness of a vendor's offering.

Modular Gripper Systems Market Potential Customers

Potential customers for Modular Gripper Systems are primarily concentrated within industries undergoing intensive automation and requiring high levels of production flexibility. These end-users, or buyers, range from large multinational automotive manufacturers implementing flexible body-in-white assembly lines to small and medium enterprises (SMEs) adopting collaborative robots for simple yet diverse pick-and-place tasks. The key appeal lies in the ability to quickly retool production assets without significant capital reinvestment in new dedicated hardware, making the systems highly attractive to companies operating in environments characterized by short product lifecycles and highly customized orders, such as high-end consumer electronics assembly or specialized pharmaceutical packaging.

The logistics and warehousing sector represents a rapidly expanding buyer base, driven by the explosive growth of e-commerce. Distribution centers require automated solutions capable of handling an enormous variety of package shapes, sizes, and weights instantaneously. Modular vacuum and mechanical grippers, often paired with rapid changeover mechanisms, are ideal for these highly variable sorting and fulfillment operations. Furthermore, the healthcare and medical device manufacturing sector serves as a high-value customer group, where the need for sterile, precise, and easily validated gripping tools for handling delicate components or performing intricate assembly tasks mandates the use of highly configurable, hygienic modular EOAT.

In summary, the purchasing decisions are often driven by metrics such as production changeover time, adaptability to future product designs, and overall ROI derived from increased operational flexibility. Buyers typically include automation engineers, production managers, and capital expenditure decision-makers seeking scalable, future-proof automation investments. Their requirements often focus on seamless integration with existing robotic platforms, robust software support for configuration management, and documented reliability metrics under sustained high-speed operation across different components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FANUC, KUKA, ABB, Schunk, Zimmer Group, Soft Robotics, ATI Industrial Automation, Destaco, Festo, OnRobot, Piab, Gimatic, SAS Automation, Robotiq, Applied Robotics, SMC Corporation, B&R Industrial Automation, Weiss Robotics, IAI America, JR Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Gripper Systems Market Key Technology Landscape

The technological landscape of the Modular Gripper Systems Market is rapidly evolving, driven by advancements in smart sensing, actuation mechanics, and standardized interfacing protocols. A critical technology is the development of lightweight, high-strength materials, such as carbon fiber and advanced aluminum alloys, which reduce the overall mass of the End-of-Arm Tooling (EOAT), thereby maximizing the payload capacity and speed capabilities of the host robot, particularly relevant for collaborative robotics. Concurrently, the proliferation of integrated smart sensors—including force-torque sensors, proximity sensors, and advanced 3D vision systems—allows modular grippers to operate with unprecedented levels of dexterity and adaptivity, providing instantaneous feedback for real-time adjustments to gripping force and position, ensuring successful handling of highly fragile or geometrically complex parts.

Actuation technology is heavily influenced by the transition from purely pneumatic to electric servo-driven modules. Electric grippers offer superior control, repeatability, and energy efficiency, and are inherently easier to integrate into digital factory networks using communication protocols like EtherCAT or PROFINET. The key innovation here is the standardization of modular interfaces (e.g., ISO-standard tooling plates and quick-change systems) which minimizes the time required for tool swapping, often reducing changeover from minutes to seconds. Furthermore, soft robotics technology is emerging, utilizing compliant materials and pneumatic actuation to create gentle, adaptive grippers ideal for food, textile, and delicate component handling, expanding the applicability of modular systems into previously challenging sectors.

Software and digital twin technologies are increasingly crucial components of the modular gripper offering. Modern systems utilize advanced software platforms that allow operators to simulate and optimize complex gripping sequences and configurations in a virtual environment before deployment. This not only reduces commissioning time but also aids in predictive maintenance by modeling component wear and tear under various load conditions. The shift towards "plug-and-play" compatibility, coupled with AI-driven parameter selection, signifies a fundamental technological shift where the intelligence of the system matches the physical flexibility of the modular hardware, making the entire solution accessible to a wider range of technical skill levels and production scales.

- Integrated Smart Sensing: Use of high-resolution force-torque sensors and 3D vision systems for adaptive gripping.

- Electric Actuation: Shift towards high-precision, servo-driven electric modules for better control and energy efficiency.

- Quick-Change Standardization: Adoption of industry-standard quick-change adapters (e.g., ISO, proprietary magnetic coupling) to minimize downtime.

- Soft Robotics: Development of compliant, material-based modular components for delicate and varied product handling.

- Digital Twin Simulation: Software tools for virtual testing, optimization, and predictive maintenance of gripper configurations.

- Advanced Materials: Utilization of lightweight composites (carbon fiber, advanced polymers) to reduce EOAT mass.

Regional Highlights

The market dynamics for Modular Gripper Systems exhibit significant regional variations, reflecting the differential pace of industrial automation adoption and the composition of local manufacturing economies. Asia Pacific (APAC) currently dominates the market share in terms of volume and is expected to record the highest CAGR during the forecast period. This rapid expansion is fundamentally propelled by the massive manufacturing base in countries like China, where aggressive implementation of robotic systems across automotive, electronics, and general manufacturing sectors drives substantial demand for adaptable EOAT solutions. Furthermore, government initiatives aimed at upgrading factory intelligence in countries such as Japan and South Korea, coupled with the rapid expansion of logistics automation, solidify APAC's leading position.

North America holds a significant portion of the market revenue, characterized by a high adoption rate of advanced, high-value modular systems, particularly within the aerospace, medical device, and complex assembly segments. The region places a strong emphasis on automation solutions that enhance precision and traceability, favoring electric and sensor-rich modular grippers integrated with sophisticated control systems. The ongoing trend of manufacturing reshoring, especially in the automotive sector related to electric vehicle battery production and assembly, necessitates flexible, high-throughput robotic cells, consistently boosting the demand for modular EOAT solutions that can handle diverse components with minimal retooling.

Europe represents a mature but highly sophisticated market, driven by stringent quality standards and a strong focus on sustainable and efficient manufacturing practices. Germany, Italy, and the Scandinavian countries are key contributors, driven by their leading roles in machine tools, automotive components, and pharmaceutical manufacturing. The proliferation of collaborative robot applications in Europe is a key growth driver, as cobots require inherently safe, lightweight, and rapidly configurable modular grippers. The European market prioritizes standardization and interoperability, favoring suppliers who offer robust component libraries and seamless integration capabilities with established industrial communication standards. Meanwhile, Latin America and the Middle East & Africa (MEA) are emerging markets, showing increasing adoption linked to targeted infrastructure investments and diversification away from primary resource extraction into light manufacturing and assembly, presenting long-term growth opportunities.

- Asia Pacific (APAC): Highest growth region driven by electronics manufacturing, automotive production volume, and substantial industrial modernization efforts in China and Korea.

- North America: Strong revenue market focused on high-precision applications, aerospace, medical devices, and EV supply chain automation; emphasis on technological sophistication.

- Europe: Mature market characterized by high quality standards, strong demand for collaborative robot EOAT, and leadership in machine tools and pharmaceutical sectors.

- Latin America: Emerging market with increasing automation investments in Brazil and Mexico, particularly in automotive and consumer goods manufacturing.

- Middle East & Africa (MEA): Growth driven by diversification strategies and investments in logistics infrastructure and light assembly industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Gripper Systems Market.- Schunk GmbH & Co. KG

- Festo SE & Co. KG

- SMC Corporation

- ABB Robotics

- FANUC Corporation

- KUKA AG (Midea Group)

- Zimmer Group

- Destaco (Dover Corporation)

- ATI Industrial Automation

- OnRobot A/S

- Robotiq Inc.

- Piab AB

- Gimatic S.p.A.

- Soft Robotics Inc.

- SAS Automation LLC

- Applied Robotics, Inc.

- IAI America, Inc.

- B&R Industrial Automation GmbH

- Weiss Robotics GmbH & Co. KG

- Empire Robotics

Frequently Asked Questions

Analyze common user questions about the Modular Gripper Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of modular grippers over traditional fixed grippers?

Modular gripper systems offer unparalleled flexibility, allowing quick reconfiguration for diverse products, significantly reducing setup time, minimizing inventory of dedicated tools, and providing a lower total cost of ownership (TCO) over the long term through component reuse.

How is AI impacting the selection and configuration of modular gripper systems?

AI, particularly through machine vision and deep learning, enables modular grippers to autonomously identify irregular objects, optimize gripping force in real-time, and suggest the most efficient component configuration, thereby improving reliability and accelerating automation programming.

Which industry segment drives the highest demand for modular gripper components?

The Automotive and Electronics manufacturing sectors are the largest consumers, primarily due to their need for high-speed, high-precision handling of various component geometries on rapidly changing assembly lines, which is ideally suited for modular, adaptable robotic tooling.

What is the current market trend regarding electric versus pneumatic modular grippers?

While pneumatic grippers remain dominant for high-speed, high-force tasks, the market exhibits a strong trend towards electric modular grippers, favored for their superior digital integration, precision, energy efficiency, and easier integration with modern Industry 4.0 control systems.

What role do quick-change mechanisms play in the efficiency of modular gripper systems?

Quick-change mechanisms are crucial, enabling automated or near-instantaneous swapping of the entire end-effector or individual components. This capability maximizes robot utilization rates by drastically reducing non-productive downtime during product changeovers, essential for flexible manufacturing.

This market analysis provides deep insights into the structure, growth drivers, technological advancements, and competitive landscape of the global Modular Gripper Systems Market. The continued adoption of advanced automation solutions globally, particularly the deployment of collaborative robotics and sophisticated material handling systems, ensures sustained high demand for flexible, modular end-of-arm tooling. The strategic shift towards smart factories and the integration of artificial intelligence for autonomous task execution further validates the long-term growth trajectory outlined in this report, positioning modular gripper systems as essential components of future manufacturing infrastructure. Detailed examination of regional dynamics reveals that Asia Pacific will be the epicenter of volume growth, while North America and Europe maintain technological leadership and high-value application adoption, reinforcing the competitive necessity for vendors to focus on standardization, connectivity, and adaptive intelligence in their product offerings. Future growth is inextricably linked to the ability of manufacturers to deliver highly configurable, durable, and easily integrable solutions that minimize operational complexity for the end-user.

The segmentation analysis highlights the increasing relevance of electric and vacuum gripping technologies, reflecting industry priorities of precision and handling versatility across delicate materials. Value chain scrutiny confirms the increasing reliance on specialized component suppliers for sensors and advanced actuators, critical elements that determine the performance characteristics of the final modular system. The ongoing emphasis on reducing total cost of ownership (TCO) and increasing manufacturing agility continues to shape product development priorities, compelling key market players to invest heavily in R&D aimed at developing lighter, faster, and more cognitively advanced modular solutions. The integration of Industry 4.0 principles, including cloud connectivity and real-time performance monitoring, is transitioning the modular gripper from a purely mechanical device into a digitally interconnected smart tool. This transformation supports the global manufacturing shift towards highly customized and adaptable production environments, ensuring the market's robust expansion throughout the forecast period. Understanding the interplay between technological drivers and regional market maturity is vital for strategic planning in this dynamic sector.

The rapid advancements in robotics technology, coupled with the decreasing cost of robotic deployment, particularly collaborative robots, are making modular gripper systems accessible to a broader base of small and medium-sized enterprises (SMEs). This democratization of high-end automation technology is a crucial factor in achieving the projected CAGR. The report underscores the importance of standardization in components and interfaces, as this directly reduces integration complexity and costs, accelerating market adoption. Furthermore, the specialized needs of industries such as life sciences—where hygiene and contamination control are paramount—are driving innovation in specialized modular materials and sealed designs. The comprehensive analysis of the DRO (Drivers, Restraints, Opportunities) forces clearly indicates that while initial capital outlay poses a challenge, the compelling long-term economic benefits derived from enhanced flexibility and reduced changeover times overwhelmingly favor continued market expansion. Manufacturers must strategically position themselves by focusing on user-friendly software interfaces and robust component libraries to capture market share effectively against the backdrop of intense competition among global automation leaders.

The modular gripper systems market is highly competitive, dominated by established automation giants and specialized EOAT providers. Competitive strategy focuses on product differentiation through technological superiority, system integration capabilities, and the provision of extensive component libraries. Geographical expansion, particularly into emerging Asian markets, remains a key strategic objective for many Western market leaders. Mergers and acquisitions are common as companies seek to consolidate technological expertise, especially in areas like soft robotics and advanced sensing. The growing complexity of manufacturing tasks means that simple solutions are often insufficient; thus, the ability to provide complete, integrated robotic workcell solutions that include vision, controls, and modular EOAT is becoming a critical success factor. Continuous innovation in lightweighting materials and optimizing pneumatic and electric actuation systems ensures that the modular systems keep pace with the increasing speed and precision demands of modern automated factories. The increasing focus on predictive maintenance, powered by integrated sensors and AI, is enhancing the value proposition, minimizing unscheduled downtime, and optimizing operational continuity, providing a clear return on investment for end-users deploying these advanced tools in high-stakes production environments.

The Modular Gripper Systems Market will continue its upward trajectory, driven by macroeconomic factors like industrialization, urbanization, and technological convergence between IT and operational technologies. The emphasis on supply chain resilience following recent global disruptions further promotes the need for flexible automation that can quickly pivot production lines. The shift towards electrification in vehicles and the massive investment in semiconductor fabrication facilities worldwide create inherent high-demand pockets for specialized modular EOAT solutions capable of handling sensitive, heavy, or non-standard components. Successful market participants must demonstrate expertise in both hardware mechanical engineering and advanced software integration, providing platforms that simplify the process of configuring, simulating, and deploying complex robotic tasks. The regulatory environment, particularly concerning worker safety and ergonomic standards in developed economies, contributes significantly to the demand for collaborative robot-compatible modular grippers, emphasizing lightweight design and inherent safety features. The formalized analysis within this report provides stakeholders with the necessary data to make informed investment and strategic decisions regarding technological partnerships and market entry points within this rapidly evolving industrial automation segment, validating the strong growth forecasts.

The adoption curve of modular gripper systems is closely tied to the broader trend of robotics-as-a-service (RaaS) models, which lower the entry barrier for SMEs. RaaS providers frequently utilize modular components to ensure their leased robot assets can be quickly redeployed between customers and varied tasks, maximizing their utilization rates. This dynamic creates a secondary, indirect driver for the modular market. Furthermore, sustainability considerations are increasingly influencing component material selection and operational efficiency. Electric modular grippers, due to their lower energy consumption compared to continuously running pneumatic systems, align better with corporate sustainability goals, reinforcing the shift towards electric actuation highlighted in the technology landscape analysis. The geographical disparity in market maturity necessitates tailored marketing and distribution strategies. In mature markets like Germany and the US, the focus is on highly specialized, high-performance modular solutions, while in emerging economies, the emphasis remains on cost-effectiveness, robustness, and ease of initial integration. This dual market approach is crucial for optimizing global revenue streams and capitalizing on heterogeneous industrial requirements, further detailing the complexity and breadth of the modular gripper market ecosystem.

Technological convergence, specifically the merging of modular mechanical systems with sophisticated sensor feedback and AI-driven control, defines the future competitive landscape. Manufacturers who succeed will be those that offer highly interconnected ecosystems rather than just standalone hardware. The development of standardized digital interfaces that allow modular grippers from different manufacturers to communicate and integrate seamlessly with various robot brands and control systems will be a key differentiator. This push for open standards addresses a major restraint—the complexity of integration—and unlocks greater market potential. The ongoing refinement of tactile sensing technology within modular fingers is enhancing the robot's ability to "feel" objects, crucial for handling soft or fragile items and performing complex assembly tasks requiring nuanced force control. Ultimately, the modularity principle is being extended not only to the physical components but also to the software functionalities, allowing users to customize and upgrade their systems digitally, ensuring long-term adaptability and protecting capital investment in automated manufacturing infrastructure.

The Modular Gripper Systems Market segmentation by payload capacity underscores the market's adaptability across industrial scales. Light payload systems are critical for electronics, pharmaceuticals, and cobot applications, demanding extreme precision and fast cycling. Medium payload systems serve general assembly and automotive parts handling, balancing speed and force. Heavy payload systems, essential for logistics, metalworking, and aerospace, emphasize robustness and high gripping force capacity, often utilizing hydraulic or heavy-duty electric actuation. This detailed segmentation allows manufacturers to tailor their R&D efforts and marketing messages precisely to the specific operational constraints and performance expectations of each end-user segment. The report confirms that continuous innovation across all payload segments is necessary to meet the diversifying needs of global manufacturers striving for flexible, automated operations. The market's dynamism is rooted in its ability to provide scalable and tailored automation solutions for a vast array of industrial manipulation challenges.

The competitive analysis highlights the ongoing importance of patent protection and proprietary design in maintaining market leadership. Key players are investing heavily not just in the mechanical design of the components but also in the proprietary software that manages the configuration and operation of the modular systems. This software lock-in strategy ensures customer loyalty and facilitates easier upgrades and expansion within a specific vendor's ecosystem. The long-term forecast for the Modular Gripper Systems Market remains exceptionally positive, strongly supported by global macroeconomic shifts toward automation and the continuous technological refinement that lowers barriers to entry and enhances operational performance across all major manufacturing sectors. Strategic alliances between robot manufacturers and dedicated EOAT providers are becoming increasingly common, streamlining the procurement and integration process for end-users and accelerating the market penetration of advanced modular solutions worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager