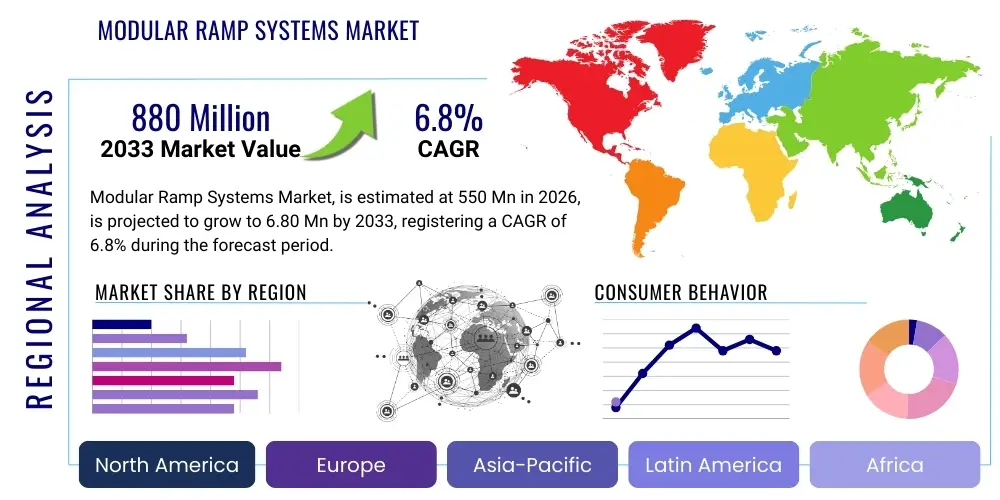

Modular Ramp Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442588 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Modular Ramp Systems Market Size

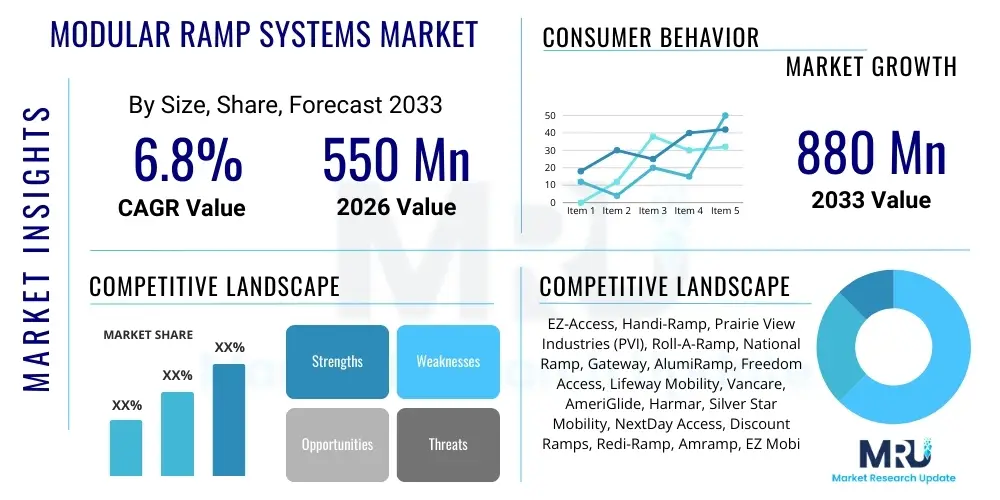

The Modular Ramp Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $880 Million by the end of the forecast period in 2033.

Modular Ramp Systems Market introduction

The Modular Ramp Systems Market encompasses the design, manufacture, and deployment of prefabricated, customizable, and temporary or permanent ramping solutions primarily used for improving accessibility for individuals using wheelchairs, scooters, or those with mobility challenges. These systems are distinct from fixed, custom-built ramps as they utilize interlocking components that allow for rapid installation, easy modification, relocation, and removal. The primary appeal lies in their flexibility, durability, and compliance with stringent accessibility standards, such as the Americans with Disabilities Act (ADA) in the US and similar regulations internationally. The materials commonly employed include high-grade aluminum, lightweight steel, and increasingly, advanced composite materials, offering varying degrees of load-bearing capacity and weather resistance crucial for diverse applications.

Major applications of modular ramp systems span across residential, commercial, and institutional settings. In the residential sector, they provide essential access to homes, especially where architectural barriers exist, enabling elderly individuals or those recovering from injuries to maintain independence. Commercially and institutionally, they are vital for ensuring public facilities, retail spaces, schools, and temporary event venues meet universal design principles and legal accessibility requirements. The inherent versatility allows these systems to accommodate various entry heights and configurations, including straight runs, turns, and landings, ensuring seamless integration into existing structures without requiring major construction modifications. The increasing global focus on aging populations and mandatory accessibility legislation acts as a fundamental impetus for market expansion.

The benefits associated with adopting modular ramp systems are manifold, including cost-effectiveness compared to traditional concrete construction, speed of deployment, and minimal disruption to the surrounding environment. Furthermore, the robust nature of materials like anodized aluminum ensures longevity and low maintenance over the product lifecycle, which is highly valued by property owners and facility managers. Driving factors include the escalating prevalence of chronic conditions leading to mobility impairment, rising disposable incomes in developed economies allowing for home accessibility modifications, and significant governmental investments aimed at enhancing public infrastructure accessibility. The growing emphasis on inclusive design principles in urban planning further cements the market’s trajectory.

Modular Ramp Systems Market Executive Summary

The Modular Ramp Systems Market is witnessing robust expansion, driven primarily by favorable demographic trends, particularly the rapid growth of the global elderly population demanding accessible living solutions, and stricter regulatory frameworks mandating universal access in public and commercial spaces. Business trends indicate a strong move toward lightweight yet high-strength materials, with aluminum remaining the dominant choice due to its corrosion resistance and ease of assembly. Key industry participants are focusing intensely on enhancing modularity and optimizing design for quick setup, often leveraging 3D modeling and simulation during the planning phase to ensure compliance and optimal fit. Furthermore, rental models, especially for short-term medical needs or temporary events, are contributing substantially to market revenue, diversifying the revenue streams beyond outright sales.

Regional trends highlight North America and Europe as established markets characterized by mature accessibility legislation and high consumer awareness, presenting significant opportunities for premium, highly customized systems. The Asia Pacific (APAC) region, however, is projected to register the highest growth rate during the forecast period, fueled by rapid urbanization, increasing governmental focus on public health infrastructure, and nascent but strengthening accessibility laws in major economies like China and India. The market in Latin America and the Middle East and Africa (MEA) is still relatively nascent, focusing primarily on essential public infrastructure projects, yet showing promising potential as disposable incomes rise and urbanization accelerates, driving the need for sophisticated access solutions.

Segment trends underscore the dominance of the residential segment, attributed to the desire for 'aging in place' solutions where homeowners invest in modifications to maintain independence. Within the material segment, while aluminum systems hold the largest share due to their balance of weight, strength, and durability, composite ramps are gaining traction, especially in applications requiring aesthetic integration or where extreme temperature fluctuations are a concern. The healthcare sector, encompassing hospitals, rehabilitation centers, and long-term care facilities, represents a crucial growth vector, demanding high-capacity, multi-configuration systems that can manage frequent use and stringent sanitation requirements. Strategic alliances between manufacturers and mobility equipment distributors are becoming pivotal for market penetration.

AI Impact Analysis on Modular Ramp Systems Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Modular Ramp Systems Market revolve around automation in design, predictive maintenance capabilities, and optimization of installation logistics. Users frequently inquire if AI can streamline the complex process of site measurement and compliance checking, asking whether algorithms can instantly generate ADA-compliant ramp configurations based on simple photographic input or LiDAR scans. There is also significant interest in using AI-driven systems to predict wear and tear on high-traffic modular ramps, ensuring proactive replacement and enhancing safety protocols, particularly in commercial environments. Expectations are high that AI integration will drastically reduce measurement errors, decrease installation time, and ultimately lower the total cost of ownership (TCO) by optimizing material usage and logistics planning across large-scale deployment projects.

- AI-Enhanced Design Configuration: Utilizing machine learning algorithms to process site dimensions, elevation data, and regulatory standards, automatically generating optimized, compliant ramp layouts, minimizing human error in design and reducing lead times.

- Predictive Maintenance: Deployment of IoT sensors embedded in modular components, coupled with AI analytics, to monitor structural stress, material fatigue, and traffic patterns, flagging potential failure points before they become safety hazards.

- Optimized Inventory and Supply Chain: AI-driven forecasting models to manage component inventory based on anticipated regional demand, seasonality, and project complexity, ensuring the right parts are available promptly for modular assembly.

- Automated Compliance Verification: Integrating computer vision and AI tools during the installation phase to perform real-time checks on slope ratios, landing sizes, and railing heights against local building codes and accessibility standards.

- Logistics Route Optimization: Employing AI to plan the most efficient delivery and deployment routes for bulky modular components, especially critical for national distributors managing geographically dispersed installation teams.

DRO & Impact Forces Of Modular Ramp Systems Market

The dynamics of the Modular Ramp Systems Market are fundamentally shaped by a confluence of accelerating demographic shifts, rigorous regulatory enforcement, material innovation, and logistical challenges. Key drivers include the global aging phenomenon, where the segment of the population aged 65 and above is growing exponentially, directly increasing the demand for accessible home modifications and healthcare facility enhancements. Simultaneously, the persistent and tightening enforcement of accessibility legislation, such as updated building codes requiring universal access in public and private facilities, creates a non-negotiable demand floor for modular ramp solutions. Opportunities arise from the developing market saturation, specifically in emerging economies where infrastructure development is accelerating, opening new avenues for large-scale governmental and institutional procurement. However, the market faces restraints primarily related to the initial high capital investment required for high-quality modular systems compared to permanent, less flexible alternatives, alongside a shortage of specialized, certified installers in certain geographies.

Drivers: The increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, contributes significantly to long-term mobility impairment, consequently driving the need for reliable access solutions both residentially and institutionally. Furthermore, the inherent ease of installation and ability to be quickly modified or relocated positions modular ramps as the preferred solution for temporary access needs, such as construction site entrances, emergency medical facilities, and short-term event accessibility requirements. The ongoing push for standardization in module dimensions and interface compatibility across different manufacturers, while challenging, is expected to accelerate adoption by simplifying the purchasing and configuration process for end-users and contractors. The clear environmental benefit of modular systems—which can be reused, recycled, or relocated, reducing construction waste—also appeals to increasingly sustainability-conscious corporate and governmental buyers.

Restraints: Despite technological advancements, one major restraint remains the perceived aesthetic disadvantage of modular systems when compared to custom-built architectural ramps, particularly in high-end residential or heritage settings where visual integration is paramount. Regulatory fragmentation across international boundaries, where slope requirements, landing dimensions, and material fire ratings vary considerably, complicates large-scale manufacturing and distribution efforts, requiring manufacturers to maintain numerous regional product variants. Economically, intense competition from low-cost, non-certified ramp solutions, particularly those imported without rigorous safety testing, poses a challenge to established, quality-focused manufacturers. Furthermore, fluctuations in raw material prices, notably aluminum and steel, directly impact production costs and retail pricing, introducing volatility and potentially deterring price-sensitive consumers and institutions.

Opportunities: A significant untapped opportunity lies in the integration of smart technology into modular ramp systems, including embedded sensors for load monitoring, LED guidance lighting for enhanced night-time safety, and self-leveling capabilities for uneven terrain applications. The expansion of rental and leasing services, particularly targeted at the temporary access market and short-term rehabilitation needs, represents a scalable business model that lowers the barrier to entry for end-users. Geographically, substantial growth is anticipated in areas undergoing major infrastructure development, where modular systems offer rapid compliance solutions for new public transit hubs, schools, and governmental offices. Strategic collaborations with home modification contractors and geriatric care service providers can unlock direct access to the fastest-growing end-user demographic—the aging-in-place population. The development of ultra-lightweight, high-strength composite materials also presents an opportunity to broaden the use of modular ramps in highly portable and mobile applications.

- Drivers: Global aging demographics; Strict accessibility legislation (e.g., ADA compliance); Demand for temporary access solutions; Cost-effectiveness over custom construction.

- Restraints: High initial capital outlay compared to fixed alternatives; Aesthetic concerns in architectural settings; Regulatory variances across regions; Raw material price volatility.

- Opportunities: Integration of smart monitoring and IoT sensors; Expansion of rental and leasing business models; Penetration of high-growth emerging economies; Development of advanced, lightweight composite materials.

- Impact Forces: High regulatory pressure mandates adoption (Push factor); Technological advancements in materials improve durability and ease of use (Enabling factor); Increased consumer awareness regarding mobility solutions (Demand pull).

Segmentation Analysis

The Modular Ramp Systems Market is rigorously segmented based on material, application, and end-user, reflecting the diverse requirements and purchasing behaviors across the industry landscape. The segmentation ensures that manufacturers can tailor product specifications, marketing strategies, and distribution channels to effectively meet the highly specific needs of various consumer and institutional groups. The Material segment, comprising aluminum, steel, and composite options, is pivotal as material choice dictates factors like system weight, load capacity, longevity, and price point. Aluminum dominates due to its superior strength-to-weight ratio and resistance to corrosion, essential for outdoor and high-traffic installations. However, composite ramps are carving out a niche in residential settings where aesthetics and thermal properties are prioritized, offering a non-slip, non-conductive surface.

Application-based segmentation divides the market into residential, commercial, and healthcare sectors. The residential application currently holds the largest market share, driven by increasing efforts globally to modify existing homes to facilitate aging in place. This segment typically demands customization for varying porch heights and restrictive footprints. The commercial segment, covering retail, hospitality, and general public access, requires solutions focused on high durability, compliance with public safety standards, and often, high-capacity systems for heavy pedestrian traffic. The healthcare segment represents the fastest-growing application area, necessitated by the continuous expansion of hospitals, clinics, and long-term care facilities which rely heavily on flexible access systems for patient transport and regulatory adherence.

The End-User categorization provides deeper insight into purchasing power and volume demand, differentiating between private residences, hospitals, nursing homes, schools, and government buildings. Hospitals and nursing homes are institutional buyers that prioritize safety certifications, ease of cleaning, and high load ratings for heavy medical equipment. Government buildings and public schools are driven by strict procurement processes centered on maximizing longevity and regulatory compliance across diverse public properties. Analyzing these segments is crucial for strategic planning, allowing companies to focus R&D efforts on, for example, developing highly durable, multi-configuration systems tailored for institutional use, or aesthetically pleasing, low-profile options for private residential consumers.

- By Material:

- Aluminum

- Steel

- Composite

- Wood and Other Materials

- By Application:

- Residential

- Commercial & Industrial

- Healthcare & Institutional

- Temporary/Event Accessibility

- By End-User:

- Private Residences

- Hospitals and Clinics

- Nursing Homes and Assisted Living Facilities

- Educational Institutions (Schools, Universities)

- Government and Municipal Buildings

Value Chain Analysis For Modular Ramp Systems Market

The value chain for the Modular Ramp Systems Market commences with the upstream segment involving raw material sourcing, primarily high-grade aluminum billets, steel sheets, and specialized composite resins. This stage is highly sensitive to global commodity market fluctuations, requiring sophisticated supply chain management to ensure cost stability and material quality compliance. Key upstream activities include material processing (e.g., extrusion for aluminum components, galvanization for steel), which focuses on precision engineering to ensure modular components fit seamlessly and maintain structural integrity under load. Relationships with certified material suppliers that can guarantee adherence to international standards (e.g., ISO, ASTM) are critical to mitigating manufacturing risks and ensuring the final product's durability and safety certifications. Optimization at this stage directly influences the final pricing and product differentiation in the highly competitive downstream market.

The midstream segment involves design, manufacturing, and assembly. Design incorporates advanced CAD modeling and simulation tools to develop universal, interlocking components that meet stringent accessibility standards regarding slope, rise, and width. Manufacturing is characterized by precision cutting, welding, and finishing (such as powder coating or anodizing) to ensure components are weather-resistant and aesthetically acceptable. Efficiency in lean manufacturing processes is vital for managing the variety of required components—ramps, landings, handrails, and supports—across different product lines. Quality control is paramount in this stage, involving rigorous testing for load-bearing capacity and fatigue resistance to secure safety certifications required for both institutional and residential use. Manufacturers often differentiate themselves by offering proprietary connection mechanisms that simplify installation.

The downstream segment encompasses distribution, installation, and after-sales service. The distribution channel is multifaceted, utilizing direct sales to large institutional buyers (hospitals, government), specialized medical equipment dealers (DME providers), and a strong network of certified, independent contractors and home modification specialists. Indirect sales via e-commerce platforms and online ramp retailers are increasingly significant for the residential segment, offering consumers ease of access to standardized kits. Installation is a crucial service component, often performed by manufacturer-certified technicians or dedicated contractors to ensure the system is correctly assembled, adjusted to site conditions, and complies fully with local building codes. Post-sale, companies provide warranty services and maintenance contracts, emphasizing the long-term nature of the investment and the necessary focus on ongoing safety assurance.

Modular Ramp Systems Market Potential Customers

The potential customer base for Modular Ramp Systems is highly diverse, spanning individual consumers seeking improved personal accessibility to large governmental organizations focused on public infrastructure upgrades. The primary end-users are individuals requiring mobility assistance, including the elderly population desiring to age in place safely, individuals with permanent disabilities, and patients undergoing temporary rehabilitation following surgery or injury. These private residential buyers prioritize ease of use, non-obtrusive design, and value, often relying on recommendations from occupational therapists or specialized medical equipment suppliers when making purchasing decisions. The necessity for reliable, code-compliant access drives purchasing behavior in this large consumer segment.

The institutional sector represents a high-volume, continuous demand segment. Hospitals and long-term care facilities are continuous buyers, requiring modular solutions for temporary construction access, internal facility level transitions, and exterior entrance modifications that must withstand constant sanitization and heavy wheeled traffic (beds, gurneys, equipment). Furthermore, public institutions such as municipal governments, school boards, and universities represent significant purchasers, driven by legal mandates to ensure all public access points are compliant with universal accessibility laws. These buyers focus intensely on durability, long-term maintenance costs, and vendor stability, often requiring large-scale competitive tenders for procurement.

A rapidly growing customer segment includes commercial entities such as retail chains, hospitality venues, and event organizers. Retail businesses utilize modular ramps to ensure compliance and enhance customer inclusivity, often requiring systems that can be quickly installed and removed with minimal structural alteration to leased properties. Event organizers, particularly for sports events, concerts, and temporary exhibitions, represent a key market for rental systems, needing high-capacity, temporary access solutions that can be rapidly deployed and dismantled. Understanding the specific compliance pressures and logistical timelines of each end-user group is essential for successful market penetration and tailored product offerings, such as renting versus outright selling the modular solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $880 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EZ-Access, Handi-Ramp, Prairie View Industries (PVI), Roll-A-Ramp, National Ramp, Gateway, AlumiRamp, Freedom Access, Lifeway Mobility, Vancare, AmeriGlide, Harmar, Silver Star Mobility, NextDay Access, Discount Ramps, Redi-Ramp, Amramp, EZ Mobility, Ramps.com, Mobility Access. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Modular Ramp Systems Market Key Technology Landscape

The technology landscape for Modular Ramp Systems is increasingly focused on materials science, digital measurement technologies, and integration standards to enhance both the user experience and the ease of installation. Advancements in aluminum alloy compositions, specifically high-strength, lightweight marine-grade alloys, are critical for producing robust systems that resist corrosion in diverse climates while minimizing the weight handled by installers. Similarly, composite material technology is evolving rapidly, offering aesthetically superior, non-slip surfaces with improved fire ratings, making them viable alternatives to traditional metal ramps in sensitive environments. Furthermore, proprietary locking mechanisms and quick-connect systems are key technological differentiators, allowing for tool-less or minimal-tool assembly, significantly reducing the labor time and complexity required on site, a major selling point for contractors and rental companies.

Digital technology integration is transforming the initial stages of modular ramp deployment. The use of LiDAR scanning and high-accuracy laser measurement tools has replaced traditional tape measures, enabling precise three-dimensional mapping of site elevation changes and existing structural interfaces. This data is fed directly into specialized software that utilizes parametric design principles to auto-generate the optimal Bill of Materials (BOM) and configuration layout, guaranteeing compliance with precise slope requirements (e.g., 1:12 ratio). This digital thread minimizes rework, ensures regulatory adherence from the outset, and provides the end-user with detailed pre-visualization, significantly streamlining the complex planning phase, particularly for multi-level, extensive institutional installations where margin for error is minimal.

Beyond physical design and measurement, the adoption of IoT (Internet of Things) technology is a nascent but high-potential trend. Integrating low-cost sensors into high-traffic modular ramps allows for continuous monitoring of environmental factors, such as temperature and moisture, and structural parameters like vibration and load stress. This data is essential for implementing the aforementioned predictive maintenance models, transitioning the industry from reactive repairs to proactive safety assurance. Furthermore, advancements in specialized coatings, including highly durable non-slip finishes and self-cleaning nanotechnology coatings, are improving safety and reducing long-term maintenance needs, ensuring that the modular systems maintain optimal performance and visual appeal throughout their extended lifecycle in often harsh outdoor environments.

Regional Highlights

- North America: Dominates the global market share, largely due to the rigorous enforcement of the Americans with Disabilities Act (ADA) and similar provincial/state-level regulations. The region benefits from high consumer awareness regarding accessibility rights and a strong presence of established manufacturers and dedicated specialized distributors. High disposable income facilitates extensive residential modifications for aging in place. Canada and the United States are the primary revenue generators, characterized by mature rental markets for temporary ramp solutions.

- Europe: Represents a highly developed and stringent market, driven by European Union directives promoting universal design and specific national legislation (e.g., UK’s Equality Act). Western European nations, especially Germany, France, and the Nordic countries, exhibit high adoption rates, supported by robust social welfare systems and public funding for home accessibility modifications. Innovation focuses on aesthetic integration and adherence to complex historical building codes, often requiring highly customized modular solutions.

- Asia Pacific (APAC): Positioned as the fastest-growing regional market. This growth is underpinned by rapid infrastructure development, increasing urbanization, and a surging elderly population in countries like Japan, South Korea, and increasingly China and India. While regulatory frameworks are less mature than in the West, governmental initiatives to upgrade public transportation and healthcare facilities are accelerating demand. Cost-effectiveness and rapid deployment capabilities of modular systems are key adoption drivers in this region.

- Latin America (LATAM): The market is emerging, with demand concentrated in major urban centers and primarily driven by commercial and public sector construction projects aimed at meeting basic international accessibility standards. Economic stability and governmental investment in public services are key determinants of market growth. Brazil and Mexico are the most active markets, showing potential for increased residential demand as consumer purchasing power grows and specialized distributors expand their reach.

- Middle East and Africa (MEA): Currently holds the smallest market share but offers long-term potential, particularly in the Gulf Cooperation Council (GCC) states. Market growth is tied to large-scale infrastructure projects (e.g., Expo sites, new cities) and the expansion of modern healthcare facilities, often leveraging international standards (e.g., JCI accreditation) which necessitate robust accessibility solutions. The hot and often corrosive climate necessitates a strong focus on highly durable, specialized material systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Modular Ramp Systems Market.- EZ-Access

- Handi-Ramp

- Prairie View Industries (PVI)

- Roll-A-Ramp

- National Ramp

- Gateway

- AlumiRamp

- Freedom Access

- Lifeway Mobility

- Vancare

- AmeriGlide

- Harmar

- Silver Star Mobility

- NextDay Access

- Discount Ramps

- Redi-Ramp

- Amramp

- EZ Mobility

- Ramps.com

- Mobility Access

Frequently Asked Questions

Analyze common user questions about the Modular Ramp Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of modular ramps over custom-built ramps?

Modular ramp systems offer superior flexibility, quick installation and removal, portability, and cost-effectiveness compared to permanent, custom-built structures like concrete ramps. They are easily configured to different site conditions, can be reused or resold, and minimize property disruption. Key advantages include immediate compliance with accessibility standards and the ability to adapt to temporary access needs, making them ideal for both residential and commercial applications.

Which material segment holds the largest market share and why is aluminum preferred?

The aluminum segment currently holds the largest market share due to its excellent balance of features essential for modular ramp design. Aluminum is lightweight, facilitating easy installation and handling, yet possesses high tensile strength and load capacity. Crucially, it exhibits superior corrosion resistance compared to steel, requiring minimal maintenance, which is vital for long-term outdoor installations in diverse climates while maintaining compliance with safety certifications.

How do regulatory standards, such as the ADA, influence market growth?

Regulatory standards, particularly the Americans with Disabilities Act (ADA) in the US and similar comprehensive legislation globally, serve as a fundamental driver for market growth. These laws mandate minimum requirements for public and commercial accessibility, compelling businesses, institutions, and government bodies to invest in compliant access solutions. Modular systems offer a reliable, verifiable, and often preferred method for rapid regulatory compliance, creating constant, non-negotiable demand across all major geographies.

What role does the 'Aging in Place' trend play in the Modular Ramp Systems residential segment?

The 'Aging in Place' trend is a dominant force driving the residential segment. As the global population ages, a large number of seniors express a desire to remain in their homes rather than relocate to assisted living facilities. Modular ramps are essential for adapting existing residential structures—such as porches and elevated entryways—to ensure safe, independent access, directly supporting the seniors' ability to age comfortably and securely within their established communities.

What emerging technologies are expected to impact the manufacturing and installation process?

Emerging technologies primarily impacting this market include the adoption of LiDAR and high-accuracy laser scanning for precise site measurement, which feeds data into AI-enhanced parametric design software to automate and optimize ramp configuration for compliance. Furthermore, the integration of IoT sensors for structural health monitoring (predictive maintenance) and the use of advanced composite materials are enhancing safety, durability, and ease of deployment, significantly improving overall system lifecycle management and user confidence in the product's longevity and structural integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager