Moissanite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442660 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Moissanite Market Size

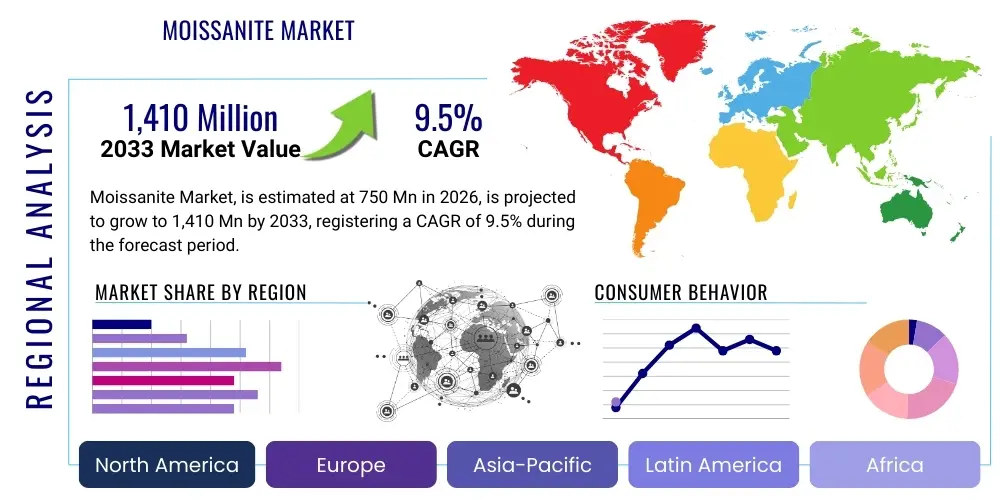

The Moissanite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $750 million in 2026 and is projected to reach $1,410 million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing consumer awareness regarding sustainable and ethically sourced alternatives to traditional diamonds, coupled with the superior brilliance and durability offered by Moissanite gems. The market expansion is further fueled by robust e-commerce penetration and effective digital marketing strategies employed by key industry players.

Moissanite Market introduction

The Moissanite Market encompasses the global trade of synthetic silicon carbide (SiC) gemstones, known scientifically as carborundum, which possess exceptional optical properties closely mimicking those of natural diamonds, often exceeding them in fire and brilliance. Developed initially for industrial applications requiring extreme hardness and thermal resistance, Moissanite found significant commercial success in the jewelry sector, where it serves as a highly popular and cost-effective diamond alternative. The product is primarily utilized in high-end jewelry, including engagement rings, wedding bands, necklaces, and earrings, owing to its remarkable durability (9.25 on the Mohs scale) and strong ethical sourcing narrative.

Major applications of Moissanite span both consumer and industrial domains. In the consumer sector, jewelry dominates, driven by millennials and Gen Z consumers prioritizing value and ethical production over historical diamond market status. Industrial applications, although smaller in market share, leverage Moissanite’s superior thermal conductivity and hardness in sectors like electronics, abrasives, and high-performance semiconductors. The key benefits driving adoption include significantly lower cost relative to comparable diamonds, exceptional brilliance (refractive index higher than diamond), and a guaranteed conflict-free origin.

Key driving factors accelerating the market growth include the rising disposable income in emerging economies, the shifting perception of lab-created gems from novelty to preferred choice, and intensive marketing campaigns focusing on the gemstone’s optical superiority. Furthermore, environmental and social governance (ESG) considerations are playing a critical role, as modern consumers increasingly seek out luxury goods that align with their values, making Moissanite a prime beneficiary of these ethical consumption trends.

Moissanite Market Executive Summary

The Moissanite Market is poised for substantial expansion, largely driven by fundamental business trends centered on digitalization and ethical sourcing transparency. Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, capitalizing on rapid urbanization, increased purchasing power, and a cultural shift toward modern, value-driven jewelry choices. North America and Europe, while mature, continue to hold significant market share due to established distribution channels and high consumer acceptance of lab-created alternatives. Business strategies across the industry are consolidating towards vertical integration, with manufacturers increasingly controlling the cutting and polishing processes to ensure quality consistency and brand integrity.

Segment-wise, the jewelry application segment remains the dominant revenue generator, particularly within the bridal wear category, which consistently demonstrates resilience against economic fluctuations. Within the product type segmentation, near-colorless Moissanite (falling within the DEF color grading) commands the highest market value, reflecting consumer desire for stones that are visually indistinguishable from high-grade diamonds. Distribution trends emphasize the pivot towards online retail and brand-specific e-commerce platforms, offering greater transparency and reduced overheads compared to traditional brick-and-mortar jewelry stores, thereby improving accessibility for a global consumer base.

Market challenges persist, primarily related to the robust marketing budgets of the traditional diamond industry and the necessity for continued consumer education to differentiate high-quality Moissanite from inferior simulants. Nevertheless, technological advancements in silicon carbide synthesis are continuously improving gem quality and increasing yield rates, thus lowering production costs and reinforcing Moissanite’s competitive edge. Strategic partnerships between raw material suppliers, cutting houses, and high-street jewelry retailers are crucial for maintaining the market’s positive momentum and ensuring widespread availability across diverse demographic segments.

AI Impact Analysis on Moissanite Market

User queries regarding the impact of Artificial Intelligence (AI) on the Moissanite market frequently revolve around its application in quality grading, supply chain optimization, and personalized consumer experiences. Consumers and industry stakeholders are keen to understand how AI-driven algorithms can ensure objective, standardized grading of Moissanite stones, traditionally a manual and subjective process, thereby enhancing consumer trust. Furthermore, significant interest lies in utilizing AI for demand forecasting and inventory management, optimizing the capital-intensive synthesis and cutting operations. The core theme is the expectation that AI will deliver higher efficiency, greater transparency, and hyper-personalized retail interactions, ultimately reducing operational costs and improving the final consumer proposition.

The application of sophisticated machine learning models is transforming the crucial cutting and polishing stages of Moissanite production. AI algorithms are used to analyze the raw silicon carbide crystal structure, identifying optimal cutting planes to maximize brilliance, yield, and minimize internal stress, thereby reducing material wastage and ensuring maximum optical performance. This precision engineering, unattainable through traditional methods, allows manufacturers to consistently produce stones meeting the highest clarity and cut specifications (often equivalent to 'Ideal' or 'Hearts and Arrows' diamond cuts), reinforcing Moissanite’s premium positioning as a scientifically superior gemstone alternative.

In the downstream market, AI is revolutionizing personalized marketing and customer engagement. Through the analysis of vast datasets on consumer preferences, purchase history, and aesthetic trends, AI systems assist retailers in recommending specific cuts, settings, and designs, accelerating the purchasing journey. Additionally, AI-powered chatbots and virtual try-on experiences on e-commerce platforms provide 24/7 customer service and immersive shopping environments, dramatically improving conversion rates and brand loyalty, which is critical for a digitally focused product like Moissanite.

- AI enhances synthetic crystal growth monitoring, leading to higher quality silicon carbide yields.

- Machine learning algorithms optimize cutting plans, maximizing brilliance and minimizing material waste during polishing.

- AI-powered spectral analysis systems provide objective, standardized grading for color and clarity, boosting consumer confidence.

- Predictive analytics improve inventory management and demand forecasting for specific cuts and sizes globally.

- Personalized recommendation engines driven by AI boost e-commerce conversion rates for online Moissanite retailers.

- Automation of robotic setting and quality control processes reduces human error and labor costs in manufacturing.

DRO & Impact Forces Of Moissanite Market

The Moissanite Market is propelled by a confluence of strong market drivers, notably the increasing emphasis on ethical and sustainable luxury consumption, particularly among younger demographics who are rejecting the social and environmental costs associated with mined diamonds. This strong ethical pull, combined with the significant cost advantage and the superior optical properties (higher refractive index and dispersion) of Moissanite compared to traditional alternatives, provides substantial growth momentum. However, growth is tempered by critical restraints, primarily the ingrained brand loyalty and pervasive marketing dominance of the established diamond industry, alongside the persistent challenge of overcoming initial consumer skepticism towards lab-created gems in certain traditional markets.

Opportunities for exponential market expansion exist through strategic geographical penetration, especially in high-growth regions like Southeast Asia and Latin America, where the luxury market is expanding rapidly but remains price-sensitive. Furthermore, technological leaps in advanced production techniques continue to unlock opportunities for producing larger, purer crystals with unprecedented speed and consistency, decreasing the time-to-market and further lowering per-carat costs. Key impact forces shaping the market include rapidly evolving consumer values that prioritize transparency (a positive force) and intense competitive pressure from other diamond simulants and lab-grown diamonds (a balancing force).

The net impact of these forces remains strongly positive, tilting the market equilibrium in favor of Moissanite. Drivers such as robust e-commerce growth and favorable economic conditions outweigh restraints such as market misinformation and existing traditional preferences. The long-term growth trajectory will depend heavily on the continuous ability of key players to innovate in cutting technology and marketing narratives, effectively leveraging the inherent quality and ethical provenance of the gemstone to capture a larger share of the global bridal and fashion jewelry segments.

Segmentation Analysis

The Moissanite Market segmentation provides a granular view of market dynamics based on Product Type, Application, Cut, and Distribution Channel, allowing stakeholders to strategically target high-growth areas. The dominance of the Jewelry application segment highlights the gemstone's primary consumer appeal as an affordable luxury item. Within product types, the 'Near-Colorless' category dictates market valuation, as it aligns most closely with consumer expectations for premium jewelry. Understanding these segments is crucial for manufacturers to tailor production capabilities and for retailers to optimize inventory and marketing efforts effectively across diverse geographies and consumer preferences.

- Product Type:

- Near-Colorless (DEF Color Grade)

- Faintly Colored (G-I Color Grade)

- Fancy Colors (Blue, Green, Yellow)

- Application:

- Jewelry (Rings, Earrings, Pendants, Bracelets)

- Industrial Use (Abrasives, Electronics)

- Cut:

- Round Brilliant

- Princess Cut

- Cushion Cut

- Emerald Cut

- Marquise Cut

- Other Fancy Cuts

- Distribution Channel:

- Online Stores (E-commerce Platforms and Brand Websites)

- Retail Stores (Specialty Jewelry Chains, Independent Retailers)

- Wholesale & Distributors

Value Chain Analysis For Moissanite Market

The value chain of the Moissanite Market begins with highly specialized upstream processes focused on the synthesis of high-purity Silicon Carbide (SiC) crystals, primarily via proprietary modifications of the Lely method (sublimation growth). This upstream segment is capital-intensive, requiring advanced high-pressure, high-temperature (HPHT) or chemical vapor deposition (CVD) reactors, and represents a significant barrier to entry, concentrating manufacturing expertise among a few established companies. Key activities involve precursor material sourcing (silicon and carbon), precise temperature control, and optimizing crystal growth conditions to ensure large, gem-quality single crystals, which dictates the fundamental quality and yield of the final product.

Midstream activities involve the highly skilled processes of cutting, polishing, and grading the rough Moissanite crystals. Due to the extreme hardness of SiC (9.25 Mohs), specialized diamond-coated tools and advanced Computer-Aided Design (CAD) systems are essential to achieve precise faceting and maximize brilliance. Grading standards, often proprietary but generally mirroring GIA standards for diamonds (4Cs: Cut, Clarity, Color, Carat), are crucial for certifying the quality and establishing pricing. Companies like Charles & Colvard invest heavily in proprietary grading technologies to establish premium product lines (e.g., Forever One), ensuring differentiation in the competitive downstream market.

The downstream sector is dominated by diverse distribution channels, connecting the cut stones to end consumers. Direct channels, primarily through branded e-commerce platforms (e.g., Brilliant Earth, MiaDonna featuring Moissanite), offer significant margin control and brand storytelling opportunities. Indirect channels involve wholesale to specialty jewelry retailers, department stores, and international distributors. The shift towards online retail has minimized the need for traditional middlemen, increasing price transparency for the consumer. Effective marketing emphasizing ethical sourcing and superior optics is paramount at this stage to convert consumer interest into sales, often involving sophisticated digital campaigns and influencer endorsements to penetrate new customer segments.

Moissanite Market Potential Customers

The primary target customers for the Moissanite market are ethically conscious Millennials and Gen Z consumers seeking high-quality, durable, and visually stunning jewelry at a fraction of the cost of natural diamonds. This demographic is characterized by digital literacy, a strong preference for transparent supply chains, and a tendency to prioritize value and responsible consumption over traditional status symbols. Bridal wear remains the most significant purchasing event, with engagement rings representing the highest volume and value segment due to Moissanite’s practical advantages and aesthetic appeal.

Beyond the primary bridal market, potential customers include buyers in the fashion jewelry segment who seek large, impactful stones for earrings, pendants, and bracelets without the associated ethical concerns or financial strain of large diamonds. Secondary customers include industrial buyers, though they prioritize the material's thermal and abrasive properties rather than optical quality. Geographically, emerging middle-class populations in APAC and Latin America, who desire luxury goods but operate within tighter budget constraints, represent a rapidly expanding customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 million |

| Market Forecast in 2033 | $1,410 million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Charles & Colvard, Moissanite International, C3 International, Pure Grown Diamonds, Swarovski, Brilliant Earth, Takara, MiaDonna, GRA, Novo Gems, Stuller, Helzberg Diamonds, Fire & Ice Moissanite, A.Jaffe, Rosado's Box, Gemesis, CaratLane, Tiffany & Co. (Lab Grown Segment), Diamond Nexus, Forever Moissanite |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Moissanite Market Key Technology Landscape

The technological core of the Moissanite market is centered around advanced material science, specifically the controlled synthesis of large, pure silicon carbide (SiC) single crystals suitable for gemstone quality. The proprietary sublimation process, often involving highly specialized high-pressure and high-temperature (HPHT) furnaces, remains the most prevalent method for manufacturing. Continuous research and development efforts focus on refining crystal growth parameters—such as minimizing nitrogen impurities (which affect color) and maximizing crystal size—to achieve ‘super-premium’ colorless grades like DEF (Forever One). These technological improvements are crucial for maintaining the quality advantage and reducing production cycle times, thereby boosting market competitiveness against both natural and lab-grown diamonds.

In addition to foundational synthesis technology, the downstream process relies heavily on precision engineering and advanced metrology. State-of-the-art cutting and polishing techniques utilize specialized lasers and Computer Numerical Control (CNC) machinery to ensure every facet is mathematically perfect, optimizing light return and dispersion. The material’s high hardness necessitates these specialized tools, differentiating the manufacturing process from softer gemstones. Furthermore, advancements in spectroscopic analysis are being implemented for rapid and objective quality control, ensuring consistent grading across large batches and reinforcing product trust, particularly important for online sales where customers rely on certified specifications.

Beyond the gemological domain, the utilization of Moissanite in industrial technology, particularly in wide-bandgap semiconductors (SiC power electronics), represents a parallel technological landscape. While distinct from the jewelry market, advancements in high-purity SiC wafer production for semiconductors often cross-pollinate, leading to improvements in the foundational material purity used for gemstones. This symbiotic relationship ensures sustained investment in SiC research, which ultimately benefits the Moissanite gemstone market by providing access to increasingly higher-quality, colorless rough crystals, enabling manufacturers to deliver products with flawless clarity and color consistency required by the demanding luxury segment.

Regional Highlights

- North America: North America is the leading market for Moissanite, characterized by high consumer acceptance of lab-created gems and strong brand presence of key players like Charles & Colvard and Brilliant Earth. The region benefits from a robust e-commerce infrastructure, enabling efficient D2C sales. Consumer demand is heavily concentrated in the bridal jewelry segment, driven by affordability and ethical sourcing trends.

- Europe: The European market is growing steadily, with strong demand emanating from Western European countries (UK, Germany, France). Consumers here prioritize sustainability and guaranteed ethical origins. Regulatory environments concerning labeling and disclosure for lab-created stones are mature, fostering greater consumer trust and integration into mainstream jewelry retail channels.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by expanding middle-class populations, rapid economic development, and increasing influence of Western bridal traditions. Countries like India, China, and Southeast Asian nations offer massive potential due to their high volume jewelry markets, which are increasingly receptive to high-value, cost-effective alternatives like Moissanite.

- Latin America: The market in Latin America is emerging, driven by urbanization and rising disposable incomes. While traditional preferences for gold and natural stones persist, Moissanite is gaining traction, particularly in urban centers, offering luxury aesthetics at accessible price points, positioning it well for future growth.

- Middle East and Africa (MEA): Growth in MEA is currently constrained by deeply entrenched cultural preferences for natural diamonds and gold, yet interest is surfacing in specific markets like the UAE, driven by expat communities and luxury tourism. The region represents a long-term opportunity dependent on educational outreach and overcoming cultural barriers regarding synthetic stones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Moissanite Market.- Charles & Colvard

- Moissanite International

- C3 International

- Pure Grown Diamonds

- Swarovski (Specific product lines)

- Brilliant Earth

- Takara

- MiaDonna

- GRA

- Novo Gems

- Stuller

- Helzberg Diamonds

- Fire & Ice Moissanite

- A.Jaffe

- Rosado's Box

- Gemesis

- CaratLane

- Tiffany & Co. (Lab Grown Segment)

- Diamond Nexus

- Forever Moissanite

Frequently Asked Questions

Analyze common user questions about the Moissanite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Moissanite over natural diamonds?

Moissanite offers superior brilliance and fire (dispersion) due to its higher refractive index, exceptional durability (9.25 on the Mohs scale, second only to diamond), and is significantly more cost-effective. Crucially, Moissanite is guaranteed to be conflict-free and ethically manufactured in a laboratory setting, appealing to environmentally and socially conscious consumers.

Is Moissanite considered a real gemstone or merely a simulant?

Moissanite is a genuine, naturally occurring mineral (Silicon Carbide or SiC), but virtually all commercially available Moissanite gemstones are created in a controlled laboratory environment. It is a diamond simulant, meaning it looks visually similar, but possesses a different chemical composition and superior optical properties compared to diamond, making it a distinct and recognized gemstone in its own right.

How is the quality of Moissanite graded, and what is the difference between specific premium lines?

Moissanite quality is generally assessed using proprietary systems that parallel the diamond industry’s 4Cs (Cut, Clarity, Color, Carat), although color grading typically focuses on the DEF (Near-Colorless) and GHI (Faintly Colored) ranges. Premium lines, such as Charles & Colvard’s Forever One, denote the highest level of clarity and D-E-F color grading, maximizing the stone’s intrinsic optical performance and commanding a higher market price.

What is the current market trend regarding Moissanite distribution?

The dominant distribution trend is a significant shift towards online channels, including dedicated brand websites and major e-commerce platforms. This shift minimizes overheads, allows for greater inventory transparency, and appeals directly to the digital-native consumer base. Traditional retail jewelry stores are also integrating Moissanite into their offerings, often focusing on specialty bridal retailers.

Which geographical region shows the highest growth potential for Moissanite adoption?

The Asia Pacific (APAC) region, specifically emerging markets like China and India, presents the highest growth potential. This growth is driven by increasing consumer purchasing power, cultural acceptance of modern jewelry alternatives, and an active search for high-value, affordable luxury products for major life events such as engagements and weddings.

The extensive analysis of the Moissanite Market reveals a strong upward trajectory, reinforced by shifting consumer values and continuous technological refinement in synthesis and cutting processes. The market’s resilience is rooted in its ability to offer an ethical, visually striking, and economically viable alternative to traditional luxury gemstones. Future growth will be contingent upon successful market education, overcoming residual legacy perceptions, and effectively leveraging digital commerce to reach global consumer bases. The integration of advanced AI technologies promises further optimization across the entire value chain, solidifying Moissanite’s position as a leading innovator in the luxury materials sector.

Continued investment in research and development is vital, focusing on scalability and achieving consistent DEF color grading across increasingly larger carat sizes. The competitive landscape demands robust intellectual property protection and sophisticated marketing strategies that emphasize the stone’s scientific superiority and ethical provenance. Stakeholders must monitor the parallel advancements in the lab-grown diamond sector, ensuring that Moissanite maintains a differentiated identity based on its unique optical properties and exceptional value proposition. The formal expansion into industrial applications, while currently minor, also provides a long-term buffer against potential fluctuations in the consumer jewelry market. This comprehensive market overview provides a strategic foundation for businesses aiming to capitalize on the sustained global demand for high-quality, ethically sourced gemstones.

Further examination of niche markets, such as men's jewelry and specialized industrial cutting tools utilizing Moissanite's extreme hardness, indicates potential avenues for diversification beyond the core bridal segment. These adjacent markets require tailored product specifications and distinct distribution strategies, representing opportunities for high-margin specialization. The long-term viability of the Moissanite market is intrinsically linked to its capacity for innovation, ensuring its product offerings remain superior in brilliance and clarity, while simultaneously managing consumer perception against intense competition. This detailed report underscores the necessity of continuous adaptation in pricing, product delivery, and ethical supply chain management to sustain the projected high-growth CAGR through 2033.

The evolution of consumer financing options and the increasing acceptance of installment payment plans for high-value purchases also contribute to market accessibility. By offering flexible payment structures, retailers can mitigate the perceived initial high cost of larger carat sizes, making premium Moissanite accessible to a broader demographic. This financial adaptability, coupled with the inherent value proposition of the gemstone, creates a powerful mechanism for driving volume sales globally. Furthermore, the rising awareness of ecological footprint concerns associated with resource extraction is cementing Moissanite’s appeal as an environmentally responsible choice, further differentiating it in the luxury goods sector. The market intelligence gathered suggests a highly favorable environment for strategic entry and expansion, particularly for digitally focused vertical retailers.

Understanding regional regulatory nuances, especially concerning import duties, material labeling requirements, and consumer protection laws across North America, Europe, and APAC, is crucial for seamless international trade. Companies must invest in localized marketing strategies that resonate with specific cultural values; for instance, emphasizing durability and longevity in Asian markets while highlighting ethical sourcing and modern aesthetics in Western contexts. The robust growth observed in the online-only distribution channel necessitates continuous investment in cybersecurity and reliable logistics to maintain customer trust and operational integrity, especially when handling high-value shipments internationally. The final market outlook remains optimistic, provided stakeholders maintain rigorous quality control standards and continue to lead the narrative on ethical luxury consumption.

The development of patented cutting techniques that maximize the 'fire' (dispersion) of Moissanite is a key competitive differentiator among top manufacturers. While all Moissanite exhibits high brilliance, subtle variations in faceting geometry can enhance specific visual effects, creating premium tiers within the market. These technological advantages translate directly into higher consumer appeal and justify premium pricing points. Protecting these intellectual property assets is paramount for sustaining market leadership and preventing commoditization. The focus on certified grading and transparent sourcing documentation is expected to become the industry standard, moving the market further away from relying solely on cost advantage toward a value proposition based on verifiable quality and ethical origin.

Future market resilience also depends on the successful integration of Moissanite into broader fashion and accessory categories beyond the traditional bridal sector. Collaboration with high-fashion designers and influential stylists can help reposition Moissanite as a versatile, everyday luxury material. This diversification reduces reliance on seasonal spikes and major purchasing events, providing a more stable and year-round demand curve. The comprehensive adoption of omni-channel retailing, seamlessly merging the online personalized experience with the tangible reassurance of physical store presence (even through temporary pop-up locations), will be vital for capturing the full spectrum of consumer engagement in the forecast period.

The current market dynamics indicate a strong opportunity for small and medium enterprises (SMEs) specializing in custom jewelry design to integrate Moissanite into their bespoke offerings. The material's accessibility and consistent quality allow smaller businesses to compete effectively on design and personalization, areas where larger traditional jewelers often lag. Furthermore, the sustainability narrative resonates strongly with local and independent businesses that emphasize craftsmanship and responsible sourcing. This democratization of high-quality gemstone access is fundamentally reshaping the competitive landscape, shifting power away from historical monopolies toward innovation and consumer-centric models, which strongly favors the Moissanite market’s continued expansion.

In summary, the Moissanite Market is characterized by high innovation, strong ethical credentials, and favorable economic positioning. The convergence of consumer preference for value-driven luxury and the technological superiority of synthetic SiC ensures a dynamic growth environment. Strategic foresight demands focused investment in technology, robust supply chain management, and adaptive digital marketing strategies to fully leverage the projected 9.5% CAGR, positioning Moissanite as a formidable competitor to traditional luxury alternatives well into the next decade.

The ability of manufacturers to consistently improve the color grading, specifically pushing the boundaries toward flawless D-color stones in larger sizes, is a critical technical driver. The visual perception of perfect colorlessness in stones above 3 carats significantly enhances their competitive edge against mined diamonds of comparable quality, where the price differential becomes exponentially greater. This technological achievement is not just a matter of science but a powerful marketing tool that reinforces the superiority of lab-created materials. Retail strategies must capitalize on these advancements by offering clear, verifiable certifications that attest to the stone’s quality, thereby building consumer trust and minimizing the perceived risk associated with purchasing a non-traditional gemstone. The market's success is increasingly tied to its commitment to transparency and measurable quality metrics.

Further analysis of the competitive ecosystem reveals that horizontal mergers and acquisitions among cutting houses and distribution networks are becoming common, aimed at consolidating market power and achieving economies of scale in the expensive cutting and polishing stages. Vertical integration, exemplified by large brands controlling synthesis through retail, ensures proprietary quality control and brand storytelling from rough crystal to finished piece. This integration minimizes supply chain vulnerabilities and protects the premium branding associated with the highest grades of Moissanite. Companies that successfully navigate these integration strategies will be best positioned to capture market share across diversified geographical regions and product segments, maintaining margin health in a rapidly evolving luxury market.

The importance of intellectual property management extends beyond synthesis technology to encompass specialized cutting patents and unique proprietary coatings or treatments, although the latter is less common in high-end Moissanite. Ensuring the legal protection of key innovations is crucial for preventing market dilution from lower-quality imitators, especially in regions with weaker IP enforcement. For consumers, the assurance of purchasing officially licensed or patented Moissanite directly translates into guaranteed optical performance and durability, reinforcing the brand promise. This technical and legal diligence forms a foundational layer for sustaining long-term market valuation and premium pricing strategies against aggressive competition from cheaper simulants.

The future market landscape will likely be influenced by the regulatory harmonization of gemstone labeling standards worldwide. Clear and mandatory disclosure regarding the laboratory origin of Moissanite, distinguishing it accurately from lab-grown diamonds and mined diamonds, is essential for continued consumer clarity. Industry self-regulation, adopted by key market players to proactively establish ethical marketing guidelines, can preempt potentially burdensome government regulations. This collaborative approach ensures that the market maintains its reputation for transparency and ethical practice, which are central tenets of its successful appeal to the modern consumer base, driving the sustained growth trajectory projected for the end of the forecast period in 2033.

The emphasis on customizable jewelry options within the Moissanite market addresses the strong consumer demand for personalization. Digital tools allowing customers to design bespoke rings, select specific settings, and choose unique fancy cuts are powerful conversion drivers online. This capability, coupled with the affordability of Moissanite, enables consumers to realize unique designs that would be prohibitively expensive with natural diamonds. This combination of personalization and value is a critical strategic lever. The continuous advancement in 3D printing technology further facilitates rapid prototyping and personalized manufacturing, drastically reducing the time and cost associated with custom jewelry creation, thereby enhancing the overall customer value proposition across all key segments of the Moissanite market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Moissanite Jewellery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Moissanite Market Size Report By Type (Round Brilliant, Cushion, Square Brilliant, Heart, Other), By Application (Rings, Earrings, Pendants, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager