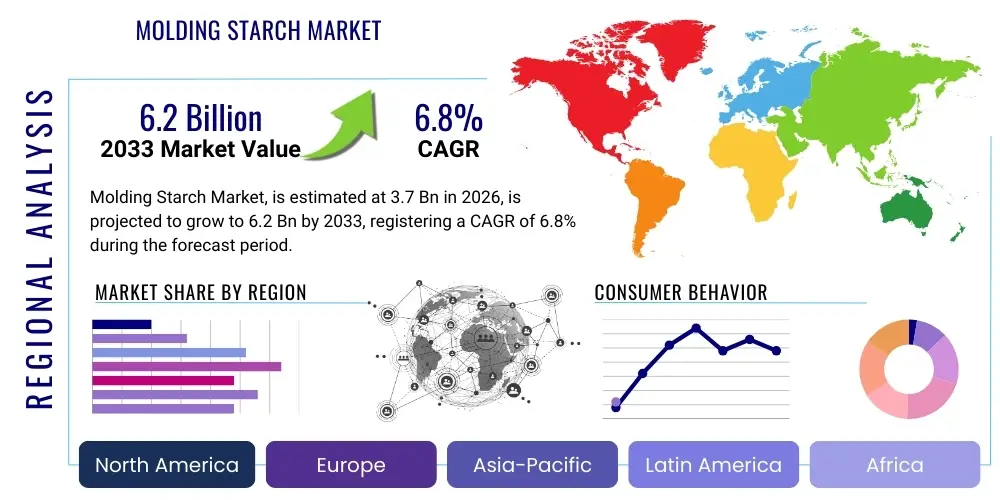

Molding Starch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440783 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Molding Starch Market Size

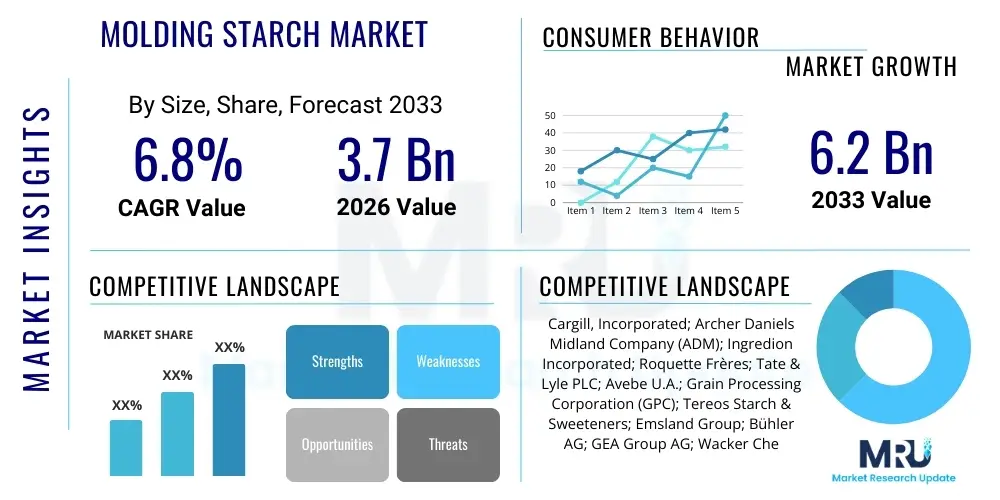

The Molding Starch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.7 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the escalating global demand for confectionery products, particularly gummies, jellies, and various chewy candies, alongside significant advancements in pharmaceutical applications and the increasing adoption of automated molding technologies across diverse industries. The market's growth trajectory reflects a broader trend of innovation in starch modification, aiming to enhance functional properties such as gel strength, texture, and release characteristics, while also addressing evolving consumer preferences for natural and clean-label ingredients. The inherent reusability and cost-effectiveness of molding starch further cement its critical role in high-volume production environments, driving sustained investment and technological development.

Molding Starch Market introduction

The molding starch market encompasses the production, distribution, and application of various starches specifically formulated for the creation of molds in confectionery, pharmaceutical, and other industrial sectors. At its core, molding starch, often derived from corn, potato, or tapioca, acts as a versatile and indispensable medium for shaping soft candies, lozenges, and other delicate products through the impression molding process. This involves pressing a master mold into a bed of conditioned starch, creating precise cavities that are then filled with liquid product formulations. The starch provides structural support, facilitates easy release, and absorbs excess moisture, contributing significantly to the final product's texture, stability, and shelf life. The primary applications for molding starch are profoundly concentrated within the confectionery industry, where it is instrumental in manufacturing gummies, jellies, fondant creams, and various chewy confections, offering unparalleled precision and consistency in high-speed production lines. Beyond sweets, its utility extends to the pharmaceutical sector for molding medicated lozenges, suppositories, and tablet preforms, ensuring accurate dosage and product integrity. The benefits of using molding starch are multifaceted, including its excellent moisture absorption properties, superior mold definition, cost-effectiveness, and the ability for repeated reuse after conditioning, which significantly reduces operational expenses and environmental impact. Key driving factors propelling this market forward include the continuous growth in global confectionery consumption, especially premium and functional confectionery, the rising demand for natural and plant-based ingredients in food and pharmaceuticals, and the ongoing technological advancements in automated molding and starch regeneration systems that enhance efficiency and product quality. Furthermore, the increasing disposable incomes in emerging economies and the expanding product portfolios of food and pharmaceutical manufacturers contribute substantially to the market's positive outlook.

Molding Starch Market Executive Summary

The Molding Starch Market is experiencing dynamic shifts, characterized by robust business trends, distinct regional growth patterns, and evolving segment dynamics, all contributing to its projected substantial expansion. From a business trends perspective, the industry is witnessing a significant drive towards automation and digitalization in confectionery and pharmaceutical production, enhancing precision, throughput, and reducing labor costs. This is complemented by a growing focus on sustainability, leading to the development of more efficient starch conditioning and regeneration systems that minimize waste and energy consumption. Furthermore, there is an increasing demand for specialty and modified starches engineered to impart specific functional properties, such as enhanced thermal stability, improved gelling characteristics, or tailored moisture absorption rates, catering to diverse product requirements and processing conditions. Clean label initiatives are also influencing product innovation, with manufacturers seeking natural and minimally processed starch solutions. Regionally, the Asia Pacific market is emerging as a powerhouse, driven by burgeoning populations, rising disposable incomes, and the rapid expansion of the food and beverage industry, particularly in countries like China and India, where confectionery consumption is soaring. North America and Europe, while mature markets, continue to innovate, focusing on premium, functional, and health-conscious confectionery, as well as high-value pharmaceutical applications. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, fueled by urbanization and increasing consumer spending. In terms of segment trends, the confectionery application segment remains the dominant force, propelled by the enduring popularity of gummies and jellies globally. Within this, there is a distinct trend towards innovative product formats, healthier ingredient profiles, and customized flavor experiences. The pharmaceutical segment is witnessing steady growth due to the increasing incidence of chronic diseases and the demand for palatable drug delivery systems, such as medicated lozenges. Moreover, modified starches are gaining traction over native starches due to their superior functional attributes and adaptability to complex industrial processes. Overall, the market's executive summary points to a trajectory of sustained growth, innovation, and strategic adaptation to meet evolving consumer and industry demands across the globe.

AI Impact Analysis on Molding Starch Market

User questions regarding AI's impact on the molding starch market often revolve around efficiency gains, quality control, predictive maintenance of equipment, and the potential for new product development. Key themes include how AI can optimize starch conditioning processes to reduce waste, ensure consistent mold quality, and predict equipment failures before they occur. Users are keen to understand if AI can contribute to more sustainable manufacturing practices, analyze complex data patterns from production lines, and even assist in developing novel starch formulations for enhanced functionality. The underlying expectation is that AI will drive a new era of precision manufacturing, significantly improving operational efficiencies, reducing material costs, and enabling faster innovation cycles within the confectionery and pharmaceutical molding sectors. This analytical capability translates into more responsive production systems capable of adapting to real-time changes in raw material properties or environmental conditions, ultimately leading to higher yield and superior product quality.

- Optimized Starch Conditioning: AI algorithms can analyze real-time data from starch beds, including temperature, humidity, and moisture content, to precisely control conditioning parameters. This ensures optimal starch consistency for molding, reducing material waste, improving mold definition, and extending the lifespan of the molding starch.

- Predictive Maintenance for Molding Equipment: AI-powered sensors and analytics can monitor the performance of starch molding lines, detecting anomalies in machinery operation. This enables predictive maintenance, preventing costly breakdowns, minimizing downtime, and ensuring uninterrupted production schedules, leading to significant operational savings.

- Enhanced Quality Control and Consistency: Machine vision systems integrated with AI can inspect mold cavities and finished products for defects with unparalleled speed and accuracy. This ensures uniform product shape, size, and weight, identifying imperfections early in the process and maintaining high quality standards consistently across large production batches.

- Supply Chain Optimization and Raw Material Management: AI can forecast demand for molding starch and its raw materials (e.g., corn, potato), optimizing procurement strategies, minimizing inventory holding costs, and mitigating risks associated with supply chain disruptions or price volatility. This leads to more efficient resource allocation and cost reduction.

- Accelerated Product Development and Formulation: AI can analyze vast datasets of starch properties, processing conditions, and desired product characteristics to accelerate the development of new or modified starch formulations. This allows manufacturers to quickly identify optimal starch blends for specific confectionery textures or pharmaceutical applications, reducing R&D cycles.

- Energy Efficiency and Sustainability: AI systems can optimize energy consumption in starch drying, cooling, and regeneration processes by identifying the most energy-efficient operating parameters. This not only reduces operational costs but also contributes to more sustainable manufacturing practices by minimizing the environmental footprint of production facilities.

- Process Automation and Robotics Integration: AI facilitates the seamless integration of robotics into molding processes, from automated starch handling to precision filling and demolding. This increases throughput, reduces manual labor requirements, minimizes human error, and creates a safer working environment in high-volume production plants.

DRO & Impact Forces Of Molding Starch Market

The Molding Starch Market is profoundly shaped by a complex interplay of drivers, restraints, opportunities, and pervasive impact forces that dictate its growth trajectory and competitive landscape. Key drivers propelling market expansion include the consistently rising global demand for confectionery products, particularly the ubiquitous popularity of gummies, jellies, and chewy candies, which heavily rely on molding starch for their formation. The increasing consumption of convenience foods and snacks, often utilizing starch-based ingredients, further stimulates demand. Innovations in starch-based product development, aimed at enhancing functional properties and addressing evolving consumer preferences, such as for natural and clean-label ingredients, act as significant accelerators. Additionally, the growing applications in the pharmaceutical and nutraceutical sectors for precise drug delivery and dietary supplements contribute substantially. Geographically, the rapid economic development and expanding middle classes in emerging markets like Asia Pacific and Latin America are opening up vast new avenues for market penetration and growth. However, several restraints temper this growth. The inherent volatility in raw material prices, primarily corn, potato, and tapioca, can significantly impact production costs and profit margins for starch manufacturers. The availability and increasing adoption of alternative gelling agents and hydrocolloids in confectionery and other applications pose a competitive threat. Stringent food safety regulations and quality standards across various regions necessitate considerable investment in compliance and quality assurance. Furthermore, the high initial capital investment required for advanced molding machinery and starch conditioning systems can be a barrier for smaller players, while environmental concerns regarding starch waste and energy consumption in processing facilities are prompting a shift towards more sustainable, yet often costlier, practices. Despite these challenges, ample opportunities exist, particularly in the development of specialty and modified starches that offer superior performance characteristics tailored for niche applications, such as gluten-free or allergen-free products. The expansion into new application areas, including cosmetics, construction materials, and foundry, represents untapped potential. The adoption of sustainable production practices and circular economy principles, such as advanced starch regeneration technologies, can not only mitigate environmental concerns but also create a competitive advantage. The relentless march of automation and digitalization in confectionery and pharmaceutical production promises enhanced efficiency and precision, while increasing disposable incomes globally continue to fuel demand for value-added food and healthcare products. The overall market is also significantly influenced by external impact forces, including rapid technological advancements in starch modification techniques and molding equipment, shifting consumer preferences towards healthier and natural food options, global economic stability that affects consumer spending and industrial investment, and the ever-evolving regulatory framework for food additives and ingredients. The competitive landscape, characterized by both large multinational corporations and specialized regional players, along with potential supply chain disruptions from geopolitical events or climate change, consistently reshape market dynamics and demand strategic foresight from industry participants.

Segmentation Analysis

The Molding Starch Market is comprehensively segmented across various dimensions, providing a granular understanding of its intricate structure and diverse demand drivers. This segmentation allows for precise market analysis, enabling stakeholders to identify key growth areas, competitive landscapes, and emerging opportunities within specific niches. The market is primarily broken down by Type of starch, Application across different industries, the Form of starch, its core Function, the End-Use Industry, and the Distribution Channel through which it reaches consumers. Each segment plays a crucial role in defining the overall market dynamics, with variations in demand, technological requirements, and regulatory considerations influencing their individual growth trajectories. Understanding these distinct segments is paramount for strategic planning, product development, and effective market positioning, allowing businesses to tailor their offerings to specific customer needs and capitalize on high-potential sectors. For instance, the demand for corn starch in confectionery applications differs significantly from the demand for tapioca starch in pharmaceutical uses, each driven by unique functional requirements and market preferences. This detailed breakdown ensures that market participants can navigate the complexities of the industry with informed precision, leveraging insights to foster innovation and sustainable growth across the value chain.

- Type: This segment categorizes molding starch based on its botanical origin, which significantly impacts its functional properties and cost-effectiveness.

- Corn Starch: The most widely used type due to its abundance, cost-effectiveness, and versatile gelling and binding properties, making it a staple in the confectionery industry.

- Potato Starch: Valued for its high viscosity, clear paste formation, and excellent film-forming capabilities, often preferred for premium confectionery and certain pharmaceutical applications.

- Tapioca Starch: Gaining popularity for its neutral taste, excellent textural properties, and ability to form clear, stable gels, suitable for clean-label products and specialized confectionery.

- Wheat Starch: Offers good binding and gelling characteristics, though its use can be limited by allergen concerns (gluten).

- Other Starches (e.g., Rice, Pea): Niche applications, often used for specific textural properties, allergen-free formulations, or clean-label demands in premium products.

- Application: This segment defines the primary industries or products where molding starch is utilized, reflecting the diverse end-uses.

- Confectionery: The dominant application, encompassing a wide range of sweets that rely on starch molding for shape and structure.

- Gummies: The largest sub-segment, driven by global demand for chewy fruit-flavored candies.

- Jellies: Traditional and innovative jelly products utilizing starch molds.

- Chews: Various chewy candies requiring precise molding.

- Fondants: Creamy fillings and soft centers molded in starch.

- Marshmallows: Soft, aerated confections requiring starch beds for setting.

- Licorice: Extruded and molded licorice products.

- Pharmaceuticals: Critical for producing various medical products with accurate dosing and form.

- Lozenges: Medicated candies molded for targeted drug delivery.

- Tablets: Pre-forming tablet shapes before compression or specialized molded tablets.

- Suppositories: Medicated inserts requiring precise molding.

- Other Industrial Applications: Emerging and niche uses beyond food and pharma.

- Cosmetics: For molding bath bombs, solid toiletries, or certain cosmetic bases.

- Building Materials: As a binder or additive in specific construction elements.

- Foundry: As a binder in sand molds for metal casting (traditional use, now more specialized).

- Confectionery: The dominant application, encompassing a wide range of sweets that rely on starch molding for shape and structure.

- Form: Categorization based on the processing of the starch.

- Native Starch: Unmodified starch, offering natural properties, cost-effectiveness, but with limitations in specific functionalities or processing conditions.

- Modified Starch: Chemically, physically, or enzymatically altered starch to enhance properties like stability, viscosity, gelling, or process tolerance, catering to specific industrial needs.

- Function: This segment describes the primary role the molding starch plays in the final product or process.

- Gelling Agent: Crucial for forming stable gels in products like gummies and jellies.

- Thickener: Contributing to the desired viscosity of liquid formulations before molding.

- Stabilizer: Preventing separation or degradation of ingredients.

- Binder: Holding ingredients together in solid forms.

- Texturizer: Imparting specific mouthfeel and chewiness to products.

- End-Use Industry: A broader classification of the sectors consuming molding starch.

- Food & Beverage: Encompassing all confectionery, bakery, and other food-related applications.

- Pharmaceutical: Including drug manufacturers and nutraceutical companies.

- Cosmetics & Personal Care: Manufacturers of beauty and hygiene products.

- Industrial: Other non-food, non-pharma uses such as specialty chemicals or materials.

- Distribution Channel: How molding starch products reach the end-users.

- Direct Sales: Manufacturers selling directly to large industrial clients.

- Indirect Sales (Distributors, Online Retailers): Via intermediaries, often for smaller clients or broader market reach.

Value Chain Analysis For Molding Starch Market

The value chain for the Molding Starch Market is an intricate network spanning from raw material procurement to final product consumption, involving numerous interconnected stages that add value at each step. The upstream segment of this value chain is dominated by the agricultural sector, where primary raw materials such as corn, potatoes, tapioca, and wheat are cultivated. These agricultural products are then supplied to large-scale starch manufacturers who process them through milling, washing, steeping, grinding, and drying to extract native starches. Further processing, including chemical, physical, or enzymatic modification, creates a diverse range of modified starches with tailored functional properties specific to molding applications. This initial processing stage is critical as the quality and characteristics of the raw starch directly influence the performance of the molding starch. Moving downstream, these refined molding starches are then supplied to a wide array of end-use industries. The confectionery sector stands as the largest consumer, utilizing molding starch for the production of gummies, jellies, fondants, and various chewy candies. Pharmaceutical companies represent another significant end-user, employing molding starch for manufacturing medicated lozenges, suppositories, and specific tablet preforms, where precision and hygiene are paramount. Other industrial applications, though smaller, include cosmetics for molding solid products and certain traditional foundry applications. The distribution channels for molding starch are multifaceted. Direct sales channels are typically employed for large-volume transactions with major confectionery giants or pharmaceutical corporations, fostering strong, long-term relationships and often involving customized product solutions. Indirect sales channels, which include a network of distributors, wholesalers, and specialized ingredient suppliers, cater to a broader range of medium and small-sized manufacturers, offering wider market access and logistical support. The advent of e-commerce and digital platforms is also creating new avenues for indirect distribution, particularly for specialty starches and smaller batch orders. The efficiency and optimization of this entire value chain are crucial for maintaining product quality, ensuring consistent supply, and managing costs effectively in a competitive market. Furthermore, sustainability practices, such as responsible sourcing of raw materials, energy-efficient processing, and the development of reusable starch systems, are increasingly becoming integral components of the value chain, driven by consumer demand and regulatory pressures. Collaboration between upstream suppliers, starch manufacturers, and downstream end-users is essential to drive innovation, address emerging market needs, and secure a resilient supply chain.

Molding Starch Market Potential Customers

The potential customers for the Molding Starch Market primarily consist of various industrial manufacturers across the food and beverage, pharmaceutical, and other specialized industrial sectors, all seeking reliable, high-performance molding media for their production processes. The largest and most prominent segment of end-users are confectionery manufacturers, encompassing companies that produce a vast array of candies such as gummies, jellies, chewy sweets, fondant creams, and licorice. These manufacturers rely heavily on molding starch for its ability to create precise and consistent shapes, facilitate easy product release, and contribute to desirable textural attributes while absorbing excess moisture. Within this segment, there's a broad spectrum from multinational confectionery giants operating high-speed automated lines to specialized artisanal producers focusing on niche markets, all requiring different grades and volumes of molding starch. Another significant customer base resides within the pharmaceutical industry, specifically companies involved in the production of medicated lozenges, throat pastilles, certain types of tablets, and suppositories. For these applications, molding starch offers a hygienic and effective medium for shaping drug formulations, ensuring accurate dosage and product integrity, often under stringent regulatory requirements. The demand here is driven by the need for palatable and effective drug delivery systems, particularly for over-the-counter medications and dietary supplements. Beyond these core industries, potential customers also include manufacturers in the cosmetics and personal care sector, where molding starch can be used for shaping solid products like bath bombs, exfoliating scrubs, or certain pressed cosmetic powders, leveraging its binding and moisture-absorbing properties. Moreover, traditional industrial users, such as specialized foundries that still employ starch as a binder in sand molds for metal casting, represent a smaller but consistent customer segment. The common thread among all these potential customers is the need for a versatile, cost-effective, and functional material that can provide structural support during the setting or cooling phase of their products, ensure clean demolding, and often contribute to the final product's sensory or functional characteristics. As such, starch suppliers aim to serve these diverse needs by offering a range of native and modified starches, each tailored to specific processing requirements and desired end-product attributes, while also providing technical support and solutions for optimizing molding processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.7 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Incorporated; Archer Daniels Midland Company (ADM); Ingredion Incorporated; Roquette Frères; Tate & Lyle PLC; Avebe U.A.; Grain Processing Corporation (GPC); Tereos Starch & Sweeteners; Emsland Group; Bühler AG; GEA Group AG; Wacker Chemie AG; C-Chem Co., Ltd.; Universal Starch-Chem Allied Ltd.; China National Starch Holdings Limited; Novamont S.p.A.; Agrana Beteiligungs-AG; Bangkok Starch Industrial Co., Ltd.; Visco Starch; Amylum (part of Tate & Lyle). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molding Starch Market Key Technology Landscape

The molding starch market is continuously evolving, driven by significant advancements in technology aimed at enhancing efficiency, product quality, and sustainability across the entire molding process. Central to this technological landscape are sophisticated starch conditioning systems, which precisely control the moisture content and temperature of the starch powder before and after its use in molding. These systems often incorporate advanced sensors and automation to ensure optimal starch properties, crucial for consistent mold definition and efficient product release. Modern starch molding lines have transitioned from manual or semi-automated processes to highly integrated, fully automated systems that can handle large volumes with exceptional speed and precision. These lines include automated depositor systems for filling the starch molds, rapid cooling tunnels to set the products, and efficient demolding mechanisms that minimize product damage. Furthermore, innovative starch drying and cooling technologies are pivotal for regenerating used molding starch, allowing for its repeated reuse. This involves advanced dehumidifiers, precise temperature control, and air circulation systems that restore the starch to its ideal condition, significantly reducing material waste and operational costs while extending the lifespan of the starch. Beyond the physical processing equipment, the technological landscape also encompasses advanced analytical tools used for quality control of both the raw starch and the finished products. These tools, including spectroscopy, rheometry, and particle size analyzers, ensure that the starch meets stringent specifications for viscosity, gel strength, and purity, which are critical for consistent molding performance. The development of specialty and modified starches themselves represents a significant technological leap. These starches are engineered through chemical, physical, or enzymatic modification to exhibit enhanced functional properties such as improved thermal stability, superior gelling characteristics at lower concentrations, increased resistance to retrogradation, or specific textural contributions, allowing for broader application in complex formulations and varied processing conditions. Lastly, the integration of Industry 4.0 principles, including the Internet of Things (IoT) for real-time data collection, artificial intelligence (AI) for predictive maintenance and process optimization, and robotic automation for handling and packaging, is transforming the molding starch market. These digital technologies promise to further revolutionize efficiency, reduce human error, and enable a higher degree of customization and responsiveness in production, making the entire molding starch value chain smarter and more sustainable. These advancements collectively underscore a market moving towards higher levels of precision, automation, and environmental responsibility, setting new benchmarks for quality and operational excellence.

Regional Highlights

- North America: This region represents a mature yet highly innovative market, characterized by significant consumption of confectionery products, a strong pharmaceutical sector, and early adoption of advanced manufacturing technologies. The demand is driven by high consumer spending on premium and functional candies, the growth of the nutraceutical industry, and a focus on clean-label and natural ingredients. Manufacturers here prioritize efficiency, automation, and sustainable practices, leading to steady demand for high-quality, modified molding starches. Key countries include the United States and Canada, with robust R&D activities fostering product innovation.

- Europe: Similar to North America, Europe is a well-established market with a strong tradition of confectionery manufacturing and a sophisticated pharmaceutical industry. The region is marked by stringent food safety regulations, a strong emphasis on sustainability, and a growing consumer preference for organic, natural, and allergen-free products. This drives demand for specialty and modified starches that meet high quality standards and specific dietary requirements. Countries like Germany, the UK, France, and Italy are significant contributors, with ongoing investments in automation and environmentally friendly processing solutions.

- Asia Pacific (APAC): APAC is the fastest-growing market for molding starch, propelled by rapid urbanization, increasing disposable incomes, and a burgeoning population that drives massive demand for confectionery and processed foods. Countries such as China, India, Japan, and Southeast Asian nations are witnessing significant expansion in their food and beverage industries. The growth here is also fueled by the pharmaceutical sector's expansion, particularly in generic drug manufacturing. While cost-effectiveness remains a key factor, there is a rising demand for quality and innovative starch solutions as consumer preferences evolve.

- Latin America: This region is an emerging market for molding starch, demonstrating promising growth driven by economic development, increasing consumption of packaged foods, and a growing middle class. Countries like Brazil, Mexico, and Argentina are key markets, with local confectionery manufacturers expanding their production capacities. The demand is largely focused on cost-effective and readily available starch types, though there is a gradual shift towards higher-quality modified starches as the market matures and consumer preferences diversify. Investment in local manufacturing capabilities is increasing.

- Middle East and Africa (MEA): The MEA region presents significant growth potential, albeit from a smaller base. Market expansion is driven by population growth, urbanization, and increasing foreign investment in the food and beverage industry. The demand for confectionery and processed foods is rising, particularly in countries with growing young populations and expanding retail sectors. While local production is developing, there is also reliance on imports. Opportunities exist for suppliers to provide basic and functional molding starches, with a long-term potential for specialty products as industrial infrastructure and consumer awareness evolve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molding Starch Market.- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Avebe U.A.

- Grain Processing Corporation (GPC)

- Tereos Starch & Sweeteners

- Emsland Group

- Bühler AG

- GEA Group AG

- Wacker Chemie AG

- C-Chem Co., Ltd.

- Universal Starch-Chem Allied Ltd.

- China National Starch Holdings Limited

- Novamont S.p.A.

- Agrana Beteiligungs-AG

- Bangkok Starch Industrial Co., Ltd.

- Visco Starch

- Amylum (part of Tate & Lyle)

Frequently Asked Questions

What is molding starch and its primary function in the industry?

Molding starch is a specially processed carbohydrate, typically derived from corn, potato, or tapioca, used as a medium to create precise impressions or molds for shaping confectionery items like gummies and jellies, or pharmaceutical products such as lozenges. Its primary function is to provide structural support during product setting, facilitate easy release of the finished product from the mold, and absorb excess moisture, contributing to final product texture and stability. It is essential for high-volume, consistent production.

What are the key benefits of using molding starch over alternative methods?

Key benefits include its exceptional ability to create detailed and consistent mold impressions, superior moisture absorption, cost-effectiveness due to its reusability after proper conditioning, and excellent release properties that minimize sticking. Molding starch also supports high-speed automated production lines, offering efficiency and versatility in shaping various product formulations, making it a preferred choice for intricate designs and large batch manufacturing.

How is the molding starch market segmented, and which segments are showing the most growth?

The molding starch market is segmented by Type (e.g., Corn, Potato, Tapioca), Application (Confectionery, Pharmaceuticals, Industrial), Form (Native, Modified), Function (Gelling Agent, Thickener), and End-Use Industry. The confectionery application segment, particularly for gummies and jellies, exhibits the most significant growth globally. Geographically, the Asia Pacific region is experiencing rapid expansion driven by increasing consumption and industrialization.

What role do technological advancements play in the molding starch market?

Technological advancements are crucial, driving innovation in automated starch molding lines, advanced starch conditioning and regeneration systems, and precision depositing equipment. These technologies enhance production efficiency, ensure consistent product quality, reduce material waste, and extend the lifespan of the starch. Furthermore, the development of specialty and modified starches with tailored functional properties addresses evolving industry needs for specific textures, stability, and process tolerance.

What are the main drivers and restraints impacting the molding starch market's growth?

The primary drivers include the rising global demand for confectionery, particularly chewy candies, growth in the pharmaceutical sector for lozenge production, and increasing adoption of automation. Key restraints encompass the volatility of raw material prices (corn, potato), competition from alternative gelling agents, stringent food safety regulations, and the significant initial investment required for advanced molding equipment. Addressing these factors is crucial for sustained market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager