Molecular Farming Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443115 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Molecular Farming Market Size

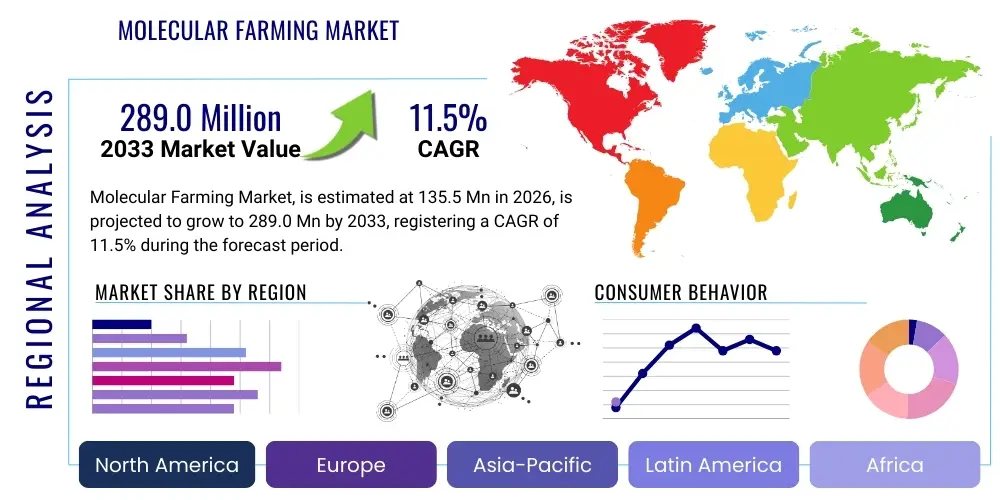

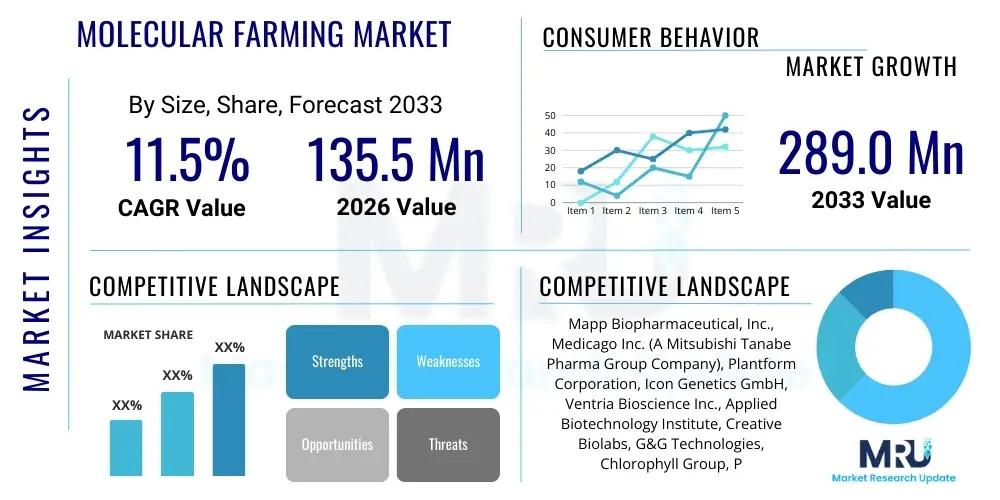

The Molecular Farming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 135.5 Million in 2026 and is projected to reach USD 289.0 Million by the end of the forecast period in 2033.

Molecular Farming Market introduction

Molecular farming, often termed pharming, represents a transformative biotechnology approach focused on using genetically engineered plants and crops to produce valuable proteins, pharmaceuticals, industrial enzymes, vaccines, and diagnostic reagents. This innovative methodology leverages the natural biosynthetic machinery of plants—such as tobacco, corn, rice, and algae—as cost-effective and scalable bioreactors. The products generated, known as plant-made pharmaceuticals (PMPs) or plant-made industrial products (PMIPs), offer significant advantages over traditional microbial or mammalian cell culture systems, primarily in terms of scalability, safety, and reduced production costs. The resulting bioproducts are characterized by high purity and efficacy, paving the way for novel therapeutic and industrial solutions.

The major applications of molecular farming span several critical sectors, including human and animal health, industrial biotechnology, and agriculture. In the healthcare domain, applications include the production of monoclonal antibodies, vaccines against infectious diseases (such as COVID-19 and influenza), growth factors, and complex therapeutic proteins that are often difficult to synthesize using conventional methods. For industrial use, molecular farming is increasingly employed to manufacture high-value enzymes, bio-plastics, and specialty chemicals. The inherent biosafety benefit, specifically the absence of contamination risks from human pathogens that can occur in mammalian systems, strongly drives its adoption in regulated pharmaceutical environments, establishing molecular farming as a highly beneficial, safe, and efficient production platform.

Driving factors for the robust growth of the Molecular Farming Market include escalating global demand for cost-effective biopharmaceuticals, rapid technological advancements in genetic engineering techniques (like CRISPR/Cas9), and increasing regulatory acceptance of plant-derived medicinal products. Furthermore, the capacity of plant systems to rapidly scale up production in response to global health crises, such as pandemics, highlights their strategic importance. The environmental sustainability of plant-based production compared to energy-intensive bioreactors also contributes to its market appeal, positioning molecular farming as a key component of future biomanufacturing strategies worldwide.

Molecular Farming Market Executive Summary

The Molecular Farming Market is experiencing dynamic growth fueled by accelerating investment in plant-based expression systems and significant advancements in optimizing protein yield and quality across various host organisms, including transient expression systems in tobacco relatives and stable integration into food crops. Current business trends indicate a strong shift towards developing complex biologics, particularly multi-subunit vaccines and highly glycosylated antibodies, where plant systems offer distinct advantages in assembly and post-translational modification capabilities. Key players are increasingly forming strategic alliances with large pharmaceutical companies to transition PMPs from clinical trials to commercial production, streamlining regulatory processes and expanding market penetration in high-value therapeutic segments. Furthermore, private equity funding is concentrating on specialized startups focusing on non-food crops and controlled environment agriculture (CEA) to mitigate environmental risks and ensure biosecurity, thereby reinforcing the supply chain integrity of plant-made products.

Regional trends reveal North America maintaining market dominance, driven by extensive research infrastructure, high rates of adoption of advanced biotechnology, and substantial government funding supporting pharmaceutical innovation through molecular farming platforms. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), primarily due to rapidly expanding biotechnology sectors in China and India, increasing healthcare expenditure, and governmental policies promoting self-sufficiency in vaccine and therapeutic protein production. Europe demonstrates consistent growth, particularly within industrial enzyme applications and sustainable bioproduction initiatives, leveraging strong academic-industry partnerships focused on improving plant host efficiency and biosafety containment measures. The strategic focus across all geographies is shifting towards diversifying host species beyond traditional tobacco and corn, incorporating algae, duckweed, and moss to cater to niche markets and overcome regulatory hurdles associated with food crops.

Segmentation trends highlight the Product segment, specifically therapeutic proteins and antibodies, as the largest contributor to market revenue, driven by the expanding pipeline of plant-made biologics entering clinical development for oncology, autoimmune disorders, and infectious diseases. Within the technology segment, transient expression systems are gaining traction due to their speed and flexibility for rapid prototyping and emergency vaccine production, although stable transformation remains crucial for large-scale, cost-effective commercial manufacturing. Application-wise, the pharmaceutical sector retains primary market share, but the industrial enzyme and cosmetic ingredient segments are showing promising exponential growth, leveraging the ability of molecular farming to produce large quantities of specialized, sustainable, and highly pure biological components essential for various industrial processes.

AI Impact Analysis on Molecular Farming Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and Molecular Farming frequently center on how machine learning algorithms can accelerate the identification of optimal plant hosts, improve gene editing efficiency, and predict protein expression yields. Users express keen interest in AI's role in streamlining the design and optimization of synthetic genes and promoters tailored for maximum expression within specific plant bioreactors. Furthermore, concerns often revolve around data privacy when sharing proprietary genomic and yield data, and the necessary integration of complex, large-scale 'omics datasets—genomics, proteomics, and metabolomics—generated during the bioproduction process. Expectations are high that AI will significantly reduce the time and cost associated with preclinical research and process scaling, thereby accelerating the commercialization timeline for Plant-Made Pharmaceuticals (PMPs) and Plant-Made Industrial Products (PMIPs).

AI is fundamentally transforming molecular farming by enabling sophisticated predictive modeling and high-throughput screening that was previously impossible using traditional experimental methods. Machine learning (ML) models are employed to analyze vast biological datasets to identify optimal gene expression cassettes, predict protein folding stability in planta, and suggest effective strategies for subcellular targeting to maximize therapeutic protein yield and purity. This predictive capability substantially shortens the time required for strain engineering and process optimization, mitigating common challenges such as gene silencing, low expression rates, and inconsistent glycosylation patterns, which are significant obstacles in large-scale plant-based bioproduction. The adoption of AI-driven robotics in Controlled Environment Agriculture (CEA) systems further optimizes growth conditions, ensuring uniform plant health and consistent product quality.

The implementation of deep learning architectures allows researchers to design novel therapeutic proteins or vaccines in silico, ensuring that the final construct is optimized for production within the chosen plant host, minimizing resource waste in wet lab experiments. Moreover, AI aids in real-time monitoring of bioreactor performance (whether greenhouse or hydroponic systems), analyzing spectral data, and adjusting environmental parameters (light, nutrients, CO2 levels) instantaneously to maintain peak expression efficiency and reduce batch variability. This integration of AI not only boosts R&D productivity but also enhances regulatory compliance through improved data traceability and predictable manufacturing consistency, which are critical for gaining market authorization for plant-derived biologics.

- AI-driven optimization of gene expression cassettes and synthetic promoters for enhanced yield.

- Machine learning models predicting optimal plant host selection and sub-cellular targeting mechanisms.

- High-throughput phenotyping and quality control using computer vision and image analysis.

- Predictive modeling of protein folding, stability, and post-translational modifications (glycosylation).

- Automation and robotic integration in Controlled Environment Agriculture (CEA) for precise growing conditions.

- Analysis of 'omics data (genomics, proteomics) to accelerate trait development and process scale-up.

DRO & Impact Forces Of Molecular Farming Market

The Molecular Farming Market expansion is robustly driven by the increasing need for low-cost, high-volume production of therapeutics, particularly vaccines and monoclonal antibodies, offering a significant economic advantage over traditional fermentation methods. Key restraints, however, include complex regulatory pathways surrounding the use of genetically modified organisms (GMOs) in agriculture and the potential risk of gene flow and cross-pollination affecting food crops, necessitating stringent biological containment measures. Opportunities abound in the development of specialized industrial enzymes and the rapid response capability provided by molecular farming for emerging global health crises. These factors collectively exert a substantial influence on market dynamics, where technological innovation acts as the primary impact force, pushing boundaries in yield optimization and product quality, counterbalanced by regulatory stringency demanding rigorous biosecurity protocols.

Drivers: A primary driver is the economic efficiency inherent in plant-based production, which significantly lowers infrastructure and operational costs compared to mammalian cell culture systems, making high-value biopharmaceuticals more accessible. Furthermore, the capacity of plant systems to correctly fold and assemble complex, multi-subunit proteins, such as specific viral antigens or antibodies, overcomes limitations encountered in simpler microbial systems. Increasing investments in synthetic biology and transient expression technology provide unparalleled speed and flexibility, which are critical for the rapid production of therapeutics and diagnostics during public health emergencies, strongly accelerating market adoption across the pharmaceutical landscape.

Restraints: Significant regulatory resistance, particularly in certain developed economies, concerning the release of Genetically Modified (GM) plants remains a substantial impediment to large-scale deployment. Public perception and consumer acceptance issues related to "pharming" in open fields pose containment challenges and potential backlash against food supply contamination. Technical challenges related to low expression levels in some stable transformation systems, coupled with difficulties in achieving consistent and predictable glycosylation patterns across different plant species, require persistent research efforts and often slow down the transition from lab bench to commercial volume manufacturing.

Opportunities: The market benefits from substantial opportunities in producing novel high-value industrial materials, including biodegradable polymers, advanced biomaterials, and specialty chemicals that demand large volumes and high purity. The utilization of non-food host systems (e.g., moss, algae, duckweed) effectively addresses regulatory and public perception concerns related to food safety and contamination, opening up new avenues for clinical and industrial development. The burgeoning demand for next-generation vaccines, including oral vaccines and mucosal delivery systems, which plant systems are uniquely positioned to produce efficiently and stably, presents a vast untapped commercial opportunity globally.

Impact Forces: The most powerful impact force is technological maturity, specifically the widespread adoption of gene editing tools (CRISPR) which dramatically enhances the precision and speed of engineering plant genomes for higher yield and improved product consistency. Secondarily, the force of regulatory harmonization is gradually easing market access; as agencies like the FDA and EMA establish clearer guidelines for plant-derived biopharmaceuticals, it reduces uncertainty for investors and manufacturers. Lastly, the force of supply chain resilience, highlighted by recent global events, promotes molecular farming as a decentralized, rapid-deployment manufacturing strategy, reducing dependence on centralized traditional bioreactor facilities.

Segmentation Analysis

The Molecular Farming Market is segmented primarily based on the type of product derived, the specific expression system or host organism utilized, the underlying technology enabling genetic modification, and the final application area. This detailed segmentation allows for a nuanced understanding of market drivers and growth pockets within the highly specialized biotechnology sector. Therapeutic proteins and industrial enzymes represent the core revenue generators, while transient expression technology is rapidly gaining traction due to its speed and utility in emergency response scenarios. Geographic segmentation remains crucial, highlighting regional differences in regulatory environments and agricultural capacity, which dictate adoption rates.

The dominance of the pharmaceutical segment is rooted in the high demand for monoclonal antibodies, recombinant vaccines, and growth factors, where the scalability and cost-efficiency of plant systems offer a compelling alternative to mammalian cell culture. The technological segmentation emphasizes the dichotomy between stable transformation, preferred for commercial, high-volume, long-term production, and transient expression, optimized for rapid turnaround and product development. Analyzing these segments provides strategic insights for stakeholders regarding investment prioritization, focusing on areas with both high growth potential and lower regulatory barriers, particularly non-food host systems and veterinary applications.

Furthermore, segmentation by host organism (e.g., tobacco, maize, algae) is vital as each organism offers distinct advantages regarding expression levels, glycosylation capabilities, and suitability for specific products or geographic deployment. For instance, algae are preferred for high-value compounds due to their contained environment, while traditional food crops like maize offer immense scalability but require stringent containment protocols. Understanding these intrinsic segment dynamics is essential for market penetration and risk mitigation planning, guiding companies toward the most efficient production platforms for their target product profile.

- By Product:

- Therapeutic Proteins (e.g., Antibodies, Recombinant Proteins, Growth Factors)

- Vaccines (e.g., Human Vaccines, Veterinary Vaccines)

- Industrial Enzymes (e.g., Cellulases, Lipases, Amylases)

- Diagnostic Proteins and Reagents

- Specialty Chemicals and Bioplastics

- By Host Organism:

- Tobacco (Nicotiana benthamiana and others)

- Maize/Corn

- Rice

- Algae

- Potatoes and Tomatoes

- Moss and Duckweed

- By Technology:

- Stable Transformation

- Transient Expression

- By Application:

- Pharmaceuticals (Oncology, Infectious Diseases, Autoimmune Disorders)

- Industrial Applications (Biofuels, Specialty Chemicals)

- Cosmetics and Personal Care

- Nutraceuticals and Functional Foods

- Veterinary Medicine

Value Chain Analysis For Molecular Farming Market

The value chain for the Molecular Farming Market initiates with rigorous upstream research and development, involving gene identification, sequence optimization, and the selection and engineering of the optimal plant host. This phase requires significant intellectual property protection and specialized biotechnology expertise in synthetic biology and plant genomics. Key upstream activities include the sourcing of high-purity expression vectors, advanced seed stock, and proprietary genetic constructs essential for stable or transient transformation processes. Efficiency at this stage—particularly the optimization of transformation techniques—directly dictates the subsequent cost of goods sold and the speed of product pipeline development, making technological capability the primary value determinant in the initial stages.

The core production phase, or midstream segment, involves cultivation, expression, and biomass harvesting, often utilizing highly controlled environments such as greenhouses, vertical farms, or designated, contained outdoor fields. This stage relies heavily on agricultural expertise integrated with Good Manufacturing Practices (GMP) to ensure product consistency and biosecurity. Following harvesting, the value chain moves into downstream processing, which includes critical purification and formulation steps. Since plant-made proteins often constitute a small fraction of the total biomass, efficient and scalable purification methods (chromatography, filtration) are essential to achieve the high purity required for pharmaceutical-grade products, significantly adding value and complexity before final product release.

Distribution channels for molecular farming products are bifurcated: direct channels are typically used for high-value pharmaceuticals, where manufacturers engage directly with large pharmaceutical entities or government health organizations. This allows for strict quality control and specialized cold-chain logistics. Indirect channels are more common for industrial enzymes and cosmetic ingredients, utilizing established bio-distributors and specialty chemical suppliers to reach diverse global manufacturing clients. The choice between direct and indirect distribution is highly dependent on the regulatory requirements of the end application, the shelf-life stability of the product, and the scale of the required volumes, ensuring the product maintains efficacy and compliance until it reaches the final end-user or processing facility.

Molecular Farming Market Potential Customers

The primary customers and end-users of molecular farming products are large multinational pharmaceutical companies seeking cost-effective and scalable alternatives for manufacturing complex biologics, including monoclonal antibodies for chronic diseases and advanced subunit vaccines. These buyers are motivated by the promise of reduced capital expenditure, rapid scale-up capacity, and minimized risk of mammalian pathogen contamination compared to traditional cell culture methods. They often enter into exclusive licensing agreements or strategic partnerships with molecular farming technology providers to integrate PMP platforms into their existing R&D and manufacturing infrastructure, ensuring a resilient and diversified supply chain for novel therapeutics.

A second substantial customer segment encompasses contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) specializing in bioprocessing. These organizations purchase expression systems and purified intermediate products to offer specialized plant-based production services to smaller biotech firms or institutions that lack the internal infrastructure for molecular farming. This group values the speed and flexibility of transient expression systems, enabling rapid production of clinical trial material and catering to niche markets or urgent demands for diagnostic reagents and research tools, thereby acting as vital intermediaries in the commercialization pathway.

Beyond the healthcare sector, potential customers include manufacturers in industrial biotechnology, nutraceuticals, and the cosmetics industry. Industrial users are key buyers of high-volume enzymes (e.g., industrial cellulases or proteases used in detergents and textile processing) where molecular farming offers unmatched scalability and environmental sustainability. Nutraceutical and cosmetic companies seek plant-derived growth factors, peptides, and functional ingredients, prioritizing purity and natural sourcing, making molecular farming an ideal production platform that aligns with consumer demand for sustainable and bio-derived compounds, diversifying the market's revenue base away from purely pharmaceutical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 135.5 Million |

| Market Forecast in 2033 | USD 289.0 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mapp Biopharmaceutical, Inc., Medicago Inc. (A Mitsubishi Tanabe Pharma Group Company), Plantform Corporation, Icon Genetics GmbH, Ventria Bioscience Inc., Applied Biotechnology Institute, Creative Biolabs, G&G Technologies, Chlorophyll Group, Protalix Biotherapeutics, Fraunhofer USA, Greenovation Biotech GmbH, Synageva BioPharma Corp., Crop redesign, Leaf Expression Systems, Eleva GmbH, Kentucky BioProcessing (KBP), Bio-Express, SemBioSys Genetics Inc., ArborGen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molecular Farming Market Key Technology Landscape

The technological backbone of the Molecular Farming Market rests on sophisticated genetic engineering techniques, primarily encompassing methods for transferring target genes into plant cells to create stable or transient expression systems. Stable transformation involves integrating the gene of interest directly into the plant's genome, allowing the trait to be passed down to subsequent generations. This typically utilizes technologies like Agrobacterium-mediated transfer or biolistics (gene gun) and is the preferred method for high-volume, continuous commercial production where regulatory approval hinges on genomic stability and predictability. Recent advancements focus on targeted gene insertion using CRISPR/Cas9 technology, significantly reducing off-target effects and speeding up the development cycle by increasing transformation efficiency and controlling expression levels with unprecedented precision.

Conversely, transient expression systems, predominantly utilizing plants like Nicotiana benthamiana, leverage viral vectors or modified Agrobacterium infiltration to temporarily express the protein in the plant tissue without permanently altering the genome. This technology is crucial for rapid response scenarios, vaccine prototyping, and the production of small batches of high-value diagnostic proteins, owing to its ability to generate massive amounts of biomass rapidly (often within days or weeks) and achieve exceptionally high protein yields compared to stable lines. Continuous technological refinement in transient systems focuses on optimizing the infiltration process and designing highly efficient viral vectors that maximize the duration and stability of the temporary expression, making it a pivotal technology for emergency therapeutic manufacturing.

Furthermore, post-harvest processing and downstream purification technologies represent an equally vital component of the technology landscape. Novel approaches in large-scale bioprocessing are necessary to efficiently separate and purify the target proteins from complex plant matrices while maintaining biological activity. This includes specialized extraction techniques to lyse plant cells without degrading the product, followed by advanced chromatography and ultrafiltration methods tailored to handle plant-derived impurities. The development of platform technologies that standardize purification across multiple products, often utilizing affinity tags engineered into the recombinant protein, is critical for reducing manufacturing costs and accelerating the regulatory approval process for Plant-Made Pharmaceuticals (PMPs).

Regional Highlights

- North America: North America, led by the United States and Canada, commands the largest market share, driven by a robust biotechnology industry, high levels of public and private investment in R&D, and the presence of major pharmaceutical companies actively exploring molecular farming platforms. The region benefits from established regulatory pathways for GMO commercialization (though stringent), and advanced infrastructure for controlled environment agriculture (CEA). The US dominates vaccine and monoclonal antibody research using plant systems, capitalizing on significant government initiatives aimed at pandemic preparedness and rapid manufacturing capacity expansion.

- Europe: The European market demonstrates steady growth, concentrating heavily on industrial applications, particularly the development of high-value enzymes, bio-based materials, and cosmetic ingredients using contained plant systems like moss (e.g., for specialized protein production). While regulatory environments regarding GMO food crops are generally more restrictive than in North America, Europe maintains strong research capabilities in transient expression systems and benefits from strong academic-industrial collaborations, particularly in Germany and the UK, focusing on environmental sustainability in biomanufacturing.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by supportive governmental policies in countries like China, India, and Japan, which prioritize self-sufficiency in healthcare and vaccine production. Increasing R&D expenditure, the growing prevalence of infectious diseases, and the availability of large agricultural land resources contribute to its high growth rate. The market here focuses heavily on cost-effective stable transformation systems, particularly in rice and tobacco, for localized production of vaccines and biosimilars catering to huge populations.

- Latin America (LATAM): Growth in LATAM is emerging, primarily driven by countries such as Brazil and Argentina, which possess significant agricultural infrastructure. Molecular farming applications in this region often target veterinary vaccines and local agricultural biopesticides. Challenges include securing consistent regulatory frameworks and attracting sufficient foreign direct investment, but the potential for large-scale, low-cost biomass production remains a key advantage.

- Middle East and Africa (MEA): The MEA region is at an nascent stage, with activity centered on addressing endemic health issues and leveraging molecular farming for diagnostics. Limited advanced research infrastructure and high investment costs restrain rapid adoption; however, increased focus on localized high-value crop production in contained systems, especially in resource-scarce environments, presents future opportunities for niche market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molecular Farming Market.- Mapp Biopharmaceutical, Inc.

- Medicago Inc. (A Mitsubishi Tanabe Pharma Group Company)

- Plantform Corporation

- Icon Genetics GmbH

- Ventria Bioscience Inc.

- Applied Biotechnology Institute

- Creative Biolabs

- G&G Technologies

- Chlorophyll Group

- Protalix Biotherapeutics

- Fraunhofer USA

- Greenovation Biotech GmbH

- Synageva BioPharma Corp.

- Crop redesign

- Leaf Expression Systems

- Eleva GmbH

- Kentucky BioProcessing (KBP)

- Bio-Express

- SemBioSys Genetics Inc.

- ArborGen

Frequently Asked Questions

Analyze common user questions about the Molecular Farming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Molecular Farming and how does it differ from traditional biomanufacturing?

Molecular Farming is the use of genetically engineered plants as bioreactors to produce high-value biological products like pharmaceuticals and industrial proteins. It differs from traditional microbial or mammalian cell culture by offering higher scalability, lower production costs, and reduced risk of contamination from human pathogens.

What are the primary challenges facing the commercial adoption of Plant-Made Pharmaceuticals (PMPs)?

Primary challenges include stringent and often complex regulatory pathways for genetically modified organisms (GMOs), public acceptance issues, the potential risk of gene flow to food crops, and technical difficulties related to achieving consistent protein expression yields and glycosylation patterns in plants.

Which types of products are most successfully produced using molecular farming technology?

The most successful products include therapeutic proteins such as monoclonal antibodies, subunit vaccines (especially those requiring rapid development), and high-volume industrial enzymes, due to the cost-efficiency and scalability of plant-based expression systems.

How do stable transformation and transient expression technologies compare in molecular farming?

Stable transformation involves permanent integration of the gene into the plant genome, ideal for long-term, large-scale commercial production. Transient expression involves temporary gene expression without genomic alteration, prioritized for speed, prototyping, and rapid response manufacturing needs.

Which host organisms are predominantly used in molecular farming today?

Common host organisms include Nicotiana benthamiana (tobacco) for transient expression, maize/corn and rice for large-scale stable transformation, and contained systems like algae, moss, and duckweed for specialized, high-value protein production with minimal contamination risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager