Molecular Sieve Adsorbents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441638 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Molecular Sieve Adsorbents Market Size

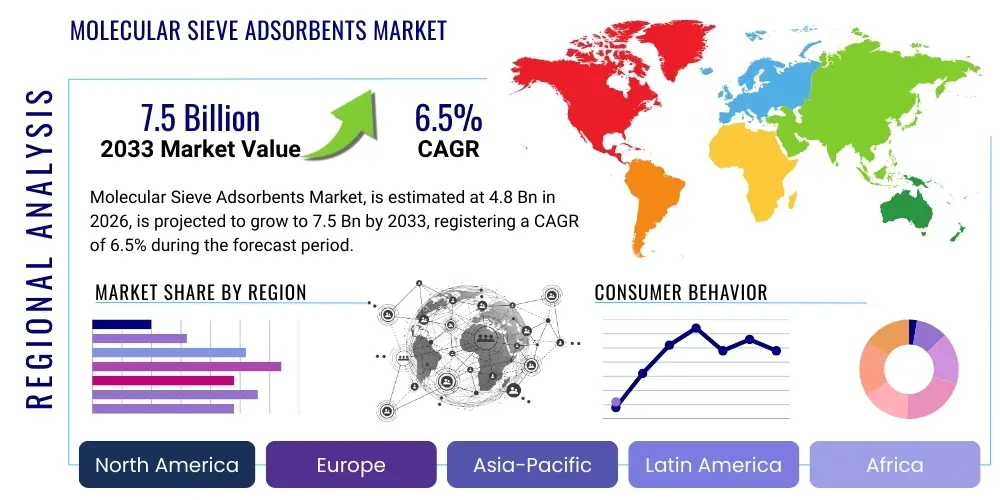

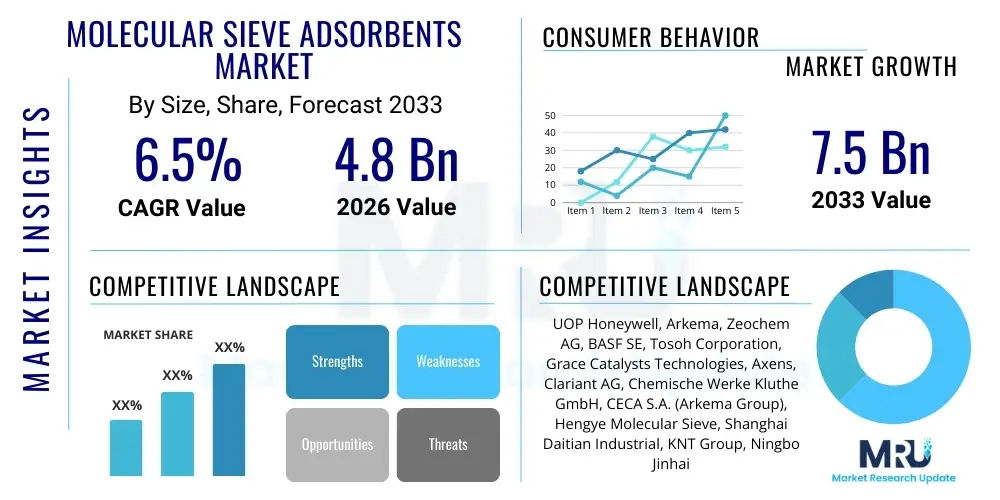

The Molecular Sieve Adsorbents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Molecular Sieve Adsorbents Market introduction

Molecular sieve adsorbents, primarily synthetic zeolites, represent highly specialized materials engineered with uniform pore sizes, allowing for selective adsorption based on molecular size and polarity. These crystalline aluminosilicates possess unique three-dimensional structures which make them indispensable across various industrial processes, particularly in separation and purification applications where high efficiency and selectivity are paramount. Their fundamental mechanism involves leveraging strong electrostatic forces within their precise pore geometry to trap specific molecules, such as water, carbon dioxide, or nitrogen, while allowing target substances to pass through unimpeded.

The product portfolio encompasses various standard types, notably 3A, 4A, 5A, and 13X, each designated by its effective pore aperture size, dictating its primary function; for instance, 3A sieves are commonly used for drying unsaturated hydrocarbons, preventing co-adsorption of larger molecules. Major applications span critical industrial sectors including the dehydration of natural gas, purification processes in petrochemical refining, deep drying of refrigerants, and large-scale air separation for oxygen and nitrogen generation. The reliability and efficiency of molecular sieves in achieving ultra-low dew points and high purity specifications drive their increasing adoption over traditional desiccants like silica gel or activated alumina.

The primary benefit of utilizing molecular sieve adsorbents is their exceptional thermal stability and regeneration capacity, allowing for numerous adsorption-desorption cycles without significant loss of performance. Driving factors propelling this market growth include the escalating global demand for ultra-pure industrial gases, mandated stringent moisture content limits in natural gas pipelines, and the necessity for enhanced recovery and purity in petrochemical streams. Furthermore, the rapid expansion of air separation units (ASUs) to support the steel, medical oxygen, and electronics industries contributes substantially to market momentum.

Molecular Sieve Adsorbents Market Executive Summary

The Molecular Sieve Adsorbents Market is currently experiencing robust expansion driven by sustained infrastructural investment in the energy sector and escalating demand for high-purity chemicals. Key business trends indicate a strong push towards developing higher-performance, customized zeolite formulations, such as high-silica and proprietary binderless molecular sieves, optimized for specialized applications like hydrogen purification and carbon capture, utilization, and storage (CCUS). Manufacturers are focusing on enhancing regeneration efficiency and reducing the energy footprint associated with pressure swing adsorption (PSA) and temperature swing adsorption (TSA) units, positioning adsorbent technology as a key enabler for green technologies and energy transition initiatives globally. Strategic collaborations between raw material suppliers and end-user industries are becoming increasingly common to ensure supply chain stability and rapid deployment of customized solutions.

Regionally, the Asia Pacific (APAC) continues to dominate the market, fueled by explosive growth in manufacturing, widespread industrialization, and significant investments in petrochemical refining and LNG infrastructure, particularly in countries like China and India. North America remains a crucial growth hub due to the extensive natural gas processing activities and stringent regulations requiring deep dehydration before pipeline injection. Europe, while mature, focuses on utilizing advanced molecular sieves in environmental applications, waste gas treatment, and supporting the continent's stringent emission standards. Segment-wise, the Oil & Gas application segment commands the largest market share, directly linked to the need for removing water and trace contaminants from methane streams, thereby protecting critical downstream equipment and meeting regulatory purity specifications. The 5A and 13X molecular sieve types are exhibiting high growth due to their applicability in complex separation processes like the removal of normal paraffins and the purification of air for cryogenic separation.

Overall, the market trajectory is characterized by technological maturity coupled with dynamic application diversification. The shift towards cleaner fuels and the necessity for superior gas separation techniques in sectors such as healthcare and electronics are major underlying catalysts. Challenges such as the volatility of raw material prices (alumina and silica) and the high initial capital investment required for implementing large-scale adsorption units temper the growth slightly, but the long-term fundamentals driven by industrial purity requirements remain exceptionally strong. Continuous research into metal-organic frameworks (MOFs) and novel zeolite structures promises to unlock even greater efficiency and selectivity in the next generation of molecular sieve technology.

AI Impact Analysis on Molecular Sieve Adsorbents Market

User inquiries regarding AI's influence in the molecular sieve market primarily center on optimizing operational efficiency, predicting material lifespan, and accelerating R&D of novel adsorbent structures. Common questions include: "How can AI reduce the energy consumption in TSA/PSA cycles?", "Can machine learning predict the optimal regeneration schedule for a specific molecular sieve?", and "How is generative AI accelerating the discovery of new high-performance zeolites?" These inquiries highlight user expectations for AI to solve key industry challenges: high operational costs, material degradation, and the slow pace of material innovation. The consensus theme is that AI will transform molecular sieve utilization from a reactive maintenance model to a proactive, highly optimized predictive system, ensuring maximum separation efficiency and minimizing downtime across critical industrial applications.

The integration of sophisticated AI models, including neural networks and genetic algorithms, is beginning to fundamentally shift how molecular sieve operations are managed and monitored. In manufacturing, AI-driven process control systems monitor real-time parameters such as temperature, pressure, flow rates, and outlet purity, allowing for dynamic adjustments to the adsorption cycles. This predictive optimization significantly reduces the consumption of regeneration energy and prolongs the effective life of the adsorbent bed by avoiding conditions that lead to premature fouling or kinetic deterioration. Furthermore, data collected across thousands of operational hours feeds into machine learning models to identify subtle degradation patterns that conventional monitoring systems often miss, enabling maintenance to be scheduled precisely when required, rather than based on fixed time intervals.

Beyond operational excellence, AI is playing a transformative role in materials science. Generative AI and high-throughput computational screening are dramatically shortening the timeline for discovering and tailoring novel porous materials, including specialized zeolites and MOFs, with targeted adsorption properties for highly complex separations, such as propane/propylene or specific isotopic separations. By simulating millions of possible structural configurations and predicting their adsorption isotherms and kinetic performance in silico, researchers can narrow down candidates rapidly, circumventing lengthy and expensive laboratory synthesis and testing phases. This computational edge is vital for meeting the evolving demands of sectors requiring absolute purity, such as semiconductor manufacturing and specialty chemical synthesis, cementing AI as a pivotal tool for future market competitiveness.

- AI-driven optimization of Pressure Swing Adsorption (PSA) and Temperature Swing Adsorption (TSA) cycles to minimize regeneration energy usage.

- Predictive maintenance analytics using sensor data to forecast molecular sieve bed degradation and schedule timely replacement or reactivation.

- Accelerated discovery of novel zeolite frameworks and high-silica materials using machine learning and computational chemistry models.

- Real-time quality control systems in adsorbent manufacturing, enhancing batch consistency and structural integrity of the final product.

- Enhanced process safety and fault detection through AI monitoring of critical operating parameters in large-scale adsorption units.

DRO & Impact Forces Of Molecular Sieve Adsorbents Market

The Molecular Sieve Adsorbents Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and technological investment cycles. Key drivers include the robust expansion of the global natural gas infrastructure, necessitating deep dehydration and acid gas removal to meet pipeline specifications and prevent corrosion, alongside the increasing complexity of petrochemical processes that require ultra-pure feedstock and separation capabilities. Concurrently, the increasing stringency of environmental regulations worldwide, particularly concerning industrial emissions and the recovery of volatile organic compounds (VOCs), mandates the use of highly efficient separation technologies like molecular sieves. The impact of these forces is significant, compelling manufacturers to continuously innovate and scale production capacity, particularly in high-growth regions like Asia Pacific and the Middle East.

However, the market faces significant restraints, primarily centered around operational costs and raw material volatility. The regeneration phase of molecular sieves in TSA and PSA processes is notably energy-intensive, presenting a substantial operating expenditure, especially with fluctuating energy prices; this drives users to seek alternatives or demand higher-efficiency adsorbents. Furthermore, the supply chain for key raw materials such as high-purity alumina, silica sources, and critical binders can be subject to geopolitical and logistical disruptions, leading to cost variability for end products. The high initial capital expenditure required for installing large-scale, high-pressure adsorption units, particularly in small-to-midsize operations, also acts as a dampener on market entry and rapid expansion, leading potential customers to prolong the use of less efficient, conventional methods.

The market opportunities are largely centered on addressing global environmental challenges and embracing emerging energy technologies. The most prominent opportunity lies in the nascent but rapidly expanding Carbon Capture, Utilization, and Storage (CCUS) sector, where specialized molecular sieves (like 13X and certain high-silica zeolites) are critical for efficient post-combustion CO2 separation. Additionally, the growing hydrogen economy—specifically the purification of hydrogen produced via steam methane reforming or electrolysis—presents a high-value niche requiring specialized adsorbents for trace contaminant removal. The impact forces acting on this market demonstrate a clear push toward sustainability and efficiency; while energy consumption remains a constraint, the unparalleled selectivity and long-term economic benefits derived from purity attainment ensure that molecular sieves remain indispensable across core industrial applications, favoring manufacturers who invest heavily in energy-efficient regeneration systems and specialized product lines.

Segmentation Analysis

The Molecular Sieve Adsorbents Market is highly diversified, primarily segmented based on the critical parameters of Type, Application, and Manufacturing Process. This segmentation allows for precise market sizing and strategic focus, reflecting the varied industrial demands across different sectors. The Type segment, defined by the specific crystalline structure and pore size (e.g., 3A, 4A, 5A, 13X), dictates the primary separation capability and thus influences end-user selection based on the critical separation task, such as deep water removal versus CO2 or sulfur compound scrubbing. Market dynamics within this structure are heavily influenced by the industrial requirements for selectivity, capacity, and mechanical strength, leading to continuous product modification and optimization efforts by major market participants to capture specialized application niches.

The Application segmentation reveals the foundational industries driving consumption, with Oil & Gas processing and Petrochemicals consistently representing the largest end-user base due to the high volume requirement for stream purification and dehydration necessary to protect pipelines, catalysts, and downstream equipment. However, the Air Separation segment is projected to exhibit the highest growth rate, propelled by escalating global demand for industrial oxygen and nitrogen in healthcare, metallurgy, and electronics manufacturing, utilizing molecular sieves for pre-purification processes in cryogenic units. Understanding these segment dynamics is crucial for capacity planning, as manufacturing facilities must be able to pivot production lines to meet the varying demands for different sieve types, often requiring specific binding agents and forming techniques for optimal performance in dynamic industrial settings.

Furthermore, segmentation by manufacturing process, encompassing binder-based and binderless sieves, provides insight into technological maturity and performance characteristics. Binderless molecular sieves, while often more expensive to produce, offer superior adsorption capacity and kinetic performance due to the elimination of non-adsorbing materials, making them preferred for high-performance PSA/TSA applications where efficiency gains translate directly into massive operational cost savings. Conversely, conventional binder-based sieves continue to dominate cost-sensitive, large-scale bulk applications where mechanical strength and stability under extreme temperature fluctuations are paramount. The overarching segmentation analysis highlights a competitive environment where performance superiority in niche applications drives premium pricing, while economies of scale dictate competitiveness in commodity-grade segments.

- Type: 3A, 4A, 5A, 13X, ZSM-5, Others (e.g., high-silica zeolites)

- Application: Oil & Gas (Natural Gas Dehydration, LNG Production), Petrochemicals (Refrigerant Drying, Olefin Purification), Air Separation Units (ASU), Healthcare & Medical (Oxygen Concentrators), Refrigeration Systems, Others (Insulating Glass, Packaging)

- Form: Beads, Pellets, Powder

- Process: Temperature Swing Adsorption (TSA), Pressure Swing Adsorption (PSA), Vacuum Pressure Swing Adsorption (VPSA)

Value Chain Analysis For Molecular Sieve Adsorbents Market

The value chain for the Molecular Sieve Adsorbents Market commences with the upstream extraction and processing of primary raw materials, predominantly high-purity sources of alumina (aluminum hydroxide) and silica (silicon dioxide), alongside various caustic chemicals used in the crystallization process, such as sodium hydroxide. This upstream segment is highly capital-intensive and relies on specialized chemical processing to ensure the requisite purity and structural uniformity necessary for synthesizing high-quality zeolite crystals. Efficient procurement and management of these commodity inputs are critical, as their price volatility directly impacts the manufacturing cost and, consequently, the final market price of the adsorbent materials. Innovation at this stage focuses on developing sustainable synthesis routes that minimize waste and energy consumption.

The core manufacturing stage involves the hydrothermal synthesis of the molecular sieve crystals, followed by forming processes (extrusion or pelletizing) often incorporating specialized inorganic binders to enhance mechanical robustness and crush strength, which is essential for packed bed applications. Quality control, involving rigorous testing for pore size distribution, bulk density, surface area, and adsorption capacity, constitutes a major element of value addition here. Distribution channels are typically multi-layered; direct sales models are favored for large industrial customers (e.g., major petrochemical firms or integrated EPC contractors building large ASUs), providing specialized technical support and customized loading procedures. Conversely, indirect distribution through specialized chemical distributors and local agents facilitates penetration into smaller industrial markets and after-sales service requirements for replacement beds or smaller-volume applications like insulating glass production or medical oxygen concentrators.

The downstream analysis focuses on the end-user deployment and the integration of the molecular sieves into complex industrial systems, primarily large-scale adsorption units (PSA/TSA). Engineering, Procurement, and Construction (EPC) firms play a crucial role in specifying the correct sieve type and managing the loading process into the adsorption towers. Performance monitoring and post-purchase technical services, including regeneration optimization and lifecycle management, add substantial downstream value. The longevity and reliability of the molecular sieve bed—which can last several years—are paramount, tying the performance directly to the operational efficiency and profitability of the end-user’s facility, making reliable material supply and expert system integration key differentiators in the market.

Molecular Sieve Adsorbents Market Potential Customers

The primary end-users and potential buyers in the Molecular Sieve Adsorbents Market are large industrial operators requiring highly selective separation and purification processes across high-volume chemical and energy streams. The Oil & Gas industry constitutes the foundational customer base, encompassing major pipeline operators, natural gas processing plants, liquefied natural gas (LNG) facilities, and refineries that utilize molecular sieves extensively for removing water, mercury, CO2, and sulfur compounds from their feedstock to prevent corrosion, poisoning of catalysts, and ensuring specification compliance. These entities require massive quantities of standard sieve types (3A and 4A for drying, 5A and 13X for specific separations) and are motivated by achieving optimal operational uptime and maximizing product purity.

Another crucial customer segment includes Industrial Gas Manufacturers (e.g., Air Products, Linde, Air Liquide) who design, build, and operate Cryogenic Air Separation Units (ASUs). Molecular sieves are indispensable in the pre-purification unit (PPU) of ASUs, ensuring that trace contaminants like water and CO2 are removed before the air enters the cold box, thus preventing freezing and subsequent catastrophic failure. These customers demand high-quality, high-capacity 13X sieves with exceptional thermal stability and kinetic performance. Furthermore, manufacturers of specialty chemicals and petrochemicals, particularly those involved in ethylene, propylene, and general synthesis gas production, are significant buyers, utilizing molecular sieves for complex chemical separations and deep solvent drying, aiming for catalytic protection and enhanced yield of high-value products.

Emerging and specialized customer segments include manufacturers of small-scale systems like portable Medical Oxygen Concentrators, where 13X-APG or specialized lithium-based zeolites are used to enrich air oxygen, and the rapidly growing Insulating Glass Industry, which requires sieves to maintain ultra-dry conditions within sealed glass units to prevent fogging. Lastly, environmental control and remediation industries focused on Carbon Capture and Volatile Organic Compound (VOC) abatement represent future high-growth customer clusters, demanding specialized, tailored sieve formulations with enhanced capacity and stability under harsh conditions, indicating a diversification of the customer portfolio beyond traditional energy sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UOP Honeywell, Arkema, Zeochem AG, BASF SE, Tosoh Corporation, Grace Catalysts Technologies, Axens, Clariant AG, Chemische Werke Kluthe GmbH, CECA S.A. (Arkema Group), Hengye Molecular Sieve, Shanghai Daitian Industrial, KNT Group, Ningbo Jinhai Chemical, CWK Chemische Werke Kluthe GmbH, Sorbead India, Tianjin Fubon Chemical, G&G Chemical, Zibo Xiangrun Environment Engineering Co. Ltd., Ruitian Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Molecular Sieve Adsorbents Market Key Technology Landscape

The technology landscape in the Molecular Sieve Adsorbents Market is characterized by continuous refinement aimed at improving adsorption capacity, enhancing kinetic performance, and reducing regeneration energy demands, primarily through advancements in zeolite synthesis and forming techniques. A pivotal technological trend is the development of specialized high-silica zeolites, such as ZSM-5, which offer superior selectivity and stability in acidic or high-temperature environments, making them ideal for petrochemical applications like the separation of xylene isomers and catalytic cracking processes. Furthermore, manufacturers are increasingly focusing on producing binderless molecular sieves, which eliminate the inert binder material, thereby maximizing the usable surface area and leading to significant increases in working capacity per unit volume, a critical factor for optimizing the efficiency of PSA units used in high-purity gas production.

Another area of intense technological focus involves refining the techniques used for implementing and regenerating the adsorbents within industrial separation units. Vacuum Swing Adsorption (VSA) and its variants, such as Rapid PSA (RPSA) and Vacuum Pressure Swing Adsorption (VPSA), represent key technological developments designed to minimize cycle times and significantly reduce the energy consumption associated with regenerating the adsorbent bed compared to traditional Temperature Swing Adsorption (TSA). These advanced cycle designs demand adsorbents with highly optimized kinetic properties, leading to the development of tailored sieve formulations that ensure rapid mass transfer without compromising mechanical durability, which is essential under the rapid pressure fluctuations inherent in RPSA systems.

The future technology trajectory is heavily invested in customizing sieve compositions for extremely challenging separations, notably including specialized metal-exchanged zeolites (e.g., lithium and copper exchanged) engineered for superior nitrogen/oxygen separation (in portable concentrators) or highly effective CO2 capture, addressing the nascent CCUS market requirements. Furthermore, smart manufacturing technologies, augmented by AI and digitalization, are being integrated into the synthesis process to ensure batch-to-batch consistency and optimize crystal growth kinetics. The deployment of advanced computational modeling to predict adsorption thermodynamics and kinetics in silico is rapidly becoming standard practice, drastically accelerating the commercialization timeline for new, high-performance molecular sieve materials tailored for the increasingly complex needs of modern industrial purification.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global molecular sieve market, driven by accelerated industrial expansion, massive investments in petrochemical complexes, and rapid urbanization. Countries like China, India, and South Korea are major consumers, supported by substantial buildouts of Liquefied Natural Gas (LNG) processing terminals and new Air Separation Units (ASUs) to fuel the burgeoning electronics and steel manufacturing sectors. The region’s focus on energy self-sufficiency and tightening environmental standards further necessitates the deployment of advanced adsorption technologies.

- North America: This region holds a significant market share, largely attributed to the extensive natural gas processing industry, particularly in the United States and Canada. Stringent regulations governing moisture and contaminant levels in pipeline gas mandate the use of high-performance molecular sieves for dehydration and acid gas removal. Growth is further bolstered by the mature refining industry and pioneering efforts in hydrogen production and carbon capture pilot projects, driving demand for specialized 5A and 13X adsorbents.

- Europe: Characterized by technological maturity and a strong emphasis on environmental protection, the European market shows steady demand for molecular sieves, primarily utilized in high-purity medical oxygen production, insulating glass manufacturing, and environmental applications like solvent recovery and industrial emission control. The region leads in adopting advanced, energy-efficient adsorption processes, supported by strict EU directives promoting cleaner industrial practices and sustainable chemical manufacturing.

- Middle East & Africa (MEA): MEA is projected to exhibit robust growth, fundamentally tied to large-scale infrastructure projects in the oil and gas sector. Significant investments in new refineries, petrochemical plants, and large-scale gas processing facilities necessitate vast quantities of molecular sieves for purification and drying of hydrocarbon streams. Saudi Arabia, UAE, and Qatar are key contributors, driven by ambitious diversification strategies and expansion of their chemical downstream capabilities.

- Latin America: The market in Latin America is primarily driven by industrial recovery and sustained investment in resource extraction, particularly in Brazil and Mexico. Demand stems from smaller-scale natural gas processing, refining operations, and local industrial gas production. Market expansion is steady, contingent upon continued infrastructural development and stable commodity prices influencing capital expenditure in the energy sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Molecular Sieve Adsorbents Market.- UOP Honeywell (A part of Honeywell International Inc.)

- BASF SE

- Arkema S.A.

- Zeochem AG (A part of CPH Chemie + Papier Holding AG)

- Tosoh Corporation

- Grace Catalysts Technologies

- Axens (Part of IFP Energies Nouvelles)

- Clariant AG

- Chemische Werke Kluthe GmbH (CWK)

- CECA S.A. (Arkema Group)

- Hengye Molecular Sieve

- Shanghai Daitian Industrial Co., Ltd.

- KNT Group

- Ningbo Jinhai Chemical Co., Ltd.

- Sorbead India

- Tianjin Fubon Chemical Co., Ltd.

- G&G Chemical Co., Ltd.

- Zibo Xiangrun Environment Engineering Co. Ltd.

- Ruitian Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Molecular Sieve Adsorbents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are molecular sieves and what differentiates them from other desiccants?

Molecular sieves are crystalline aluminosilicates (synthetic zeolites) possessing highly uniform, fixed pore structures that allow for precise, selective separation of molecules based strictly on size and polarity. Unlike bulk desiccants (like silica gel), sieves offer superior dynamic water adsorption capacity, chemical selectivity, and high thermal stability, enabling efficient, repeatable regeneration cycles for industrial use.

Which application segment drives the highest demand in the market?

The Oil and Gas segment currently constitutes the largest demand segment. Molecular sieves, particularly 3A, 4A, and 5A types, are essential for deep dehydration and purification of natural gas and LNG streams, ensuring strict pipeline specifications are met and preventing equipment corrosion and freezing across the vast global energy infrastructure.

How does the type of molecular sieve (e.g., 3A, 5A, 13X) relate to its function?

The designation (e.g., 3A, 5A, 13X) refers to the effective pore opening size in angstroms. 3A (3 Å) excludes hydrocarbons and is used for deep drying; 5A (5 Å) allows straight-chain hydrocarbons and is used for n-paraffin separation and bulk CO2 removal; and 13X (10 Å) is utilized for general gas purification and air separation pre-purification due to its large capacity for capturing CO2 and moisture.

What is the primary factor restraining market growth?

The most significant restraint is the high energy consumption associated with the regeneration process, particularly in Temperature Swing Adsorption (TSA) cycles, which contributes substantially to operating costs. Manufacturers are addressing this by developing novel, high-kinetics sieves and promoting energy-efficient Pressure Swing Adsorption (PSA) and Vacuum Swing Adsorption (VSA) technologies.

Which technological innovation is expected to transform the molecular sieve market?

The increasing focus on customized, high-performance materials, such as specialized metal-organic frameworks (MOFs) and high-silica zeolites, coupled with the integration of AI for computational material design and operational optimization of adsorption cycles, is set to be the key technological transformer, enabling more efficient Carbon Capture (CCUS) and complex chemical separations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager