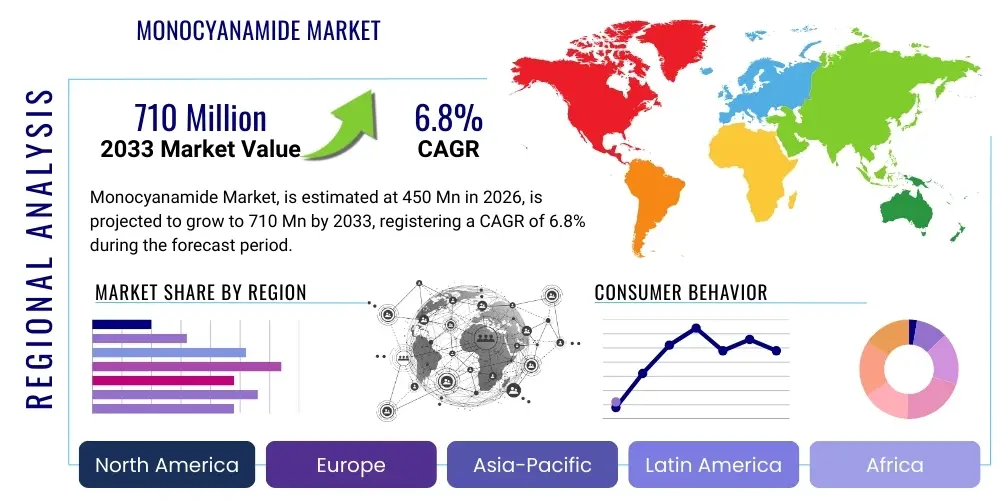

Monocyanamide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442318 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Monocyanamide Market Size

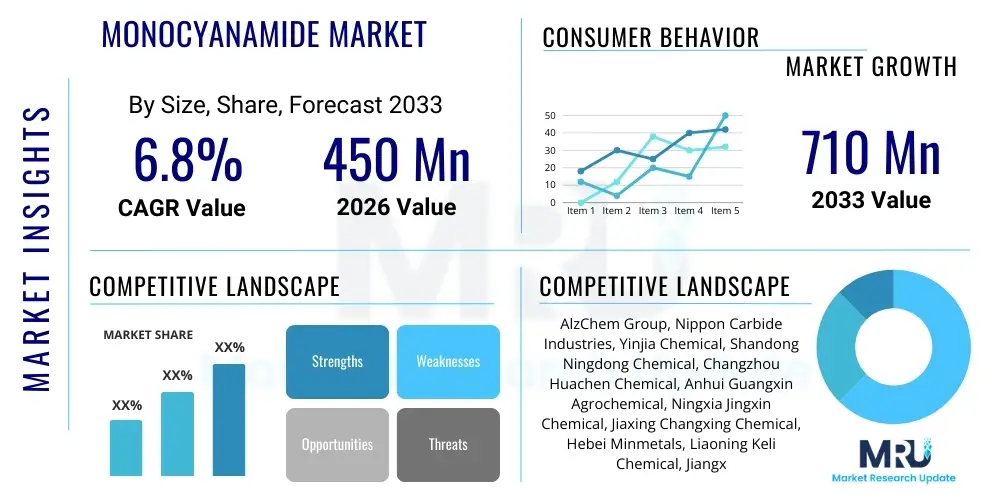

The Monocyanamide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the escalating global requirement for efficient agrochemicals and specialized pharmaceutical intermediates, coupled with technological advancements in production efficiency and purity standards that make monocyanamide a critical building block for various high-value chemical syntheses. The market trajectory is heavily influenced by agricultural practices demanding sustainable and higher-yield solutions, placing monocyanamide derivatives, such as dicyandiamide and guanidine salts, at the core of advanced chemical formulations.

Monocyanamide Market introduction

Monocyanamide (N-Cyanomethylamine), a fundamental organic compound, serves as a highly reactive chemical intermediate with the molecular formula CH2N2. It is typically a colorless solid or liquid solution, characterized by its high reactivity due to the presence of both amino and cyano functional groups. Historically, it has been synthesized primarily through the hydrolysis of calcium cyanamide (lime nitrogen), although modern, high-purity production often involves more sophisticated catalytic processes to meet stringent requirements, especially in pharmaceutical and specialized agrochemical applications. The compound is toxic and volatile, necessitating careful handling and advanced production safety protocols, which influences manufacturing concentration within regions possessing mature chemical infrastructure.

The principal applications of monocyanamide are concentrated in the agrochemical sector, where it is utilized extensively as a precursor for triazine herbicides (e.g., simazine, atrazine), fungicides, and insecticidal derivatives. Furthermore, its unique chemical structure makes it invaluable in the pharmaceutical industry for synthesizing active pharmaceutical ingredients (APIs), especially those containing guanidine moieties, used in treatments for diabetes and certain cardiovascular conditions. The increasing global focus on food security and yield enhancement, coupled with the rising demand for complex generic and proprietary drugs, continually fuels the demand for high-grade monocyanamide. Its role in producing slow-release nitrogen fertilizers and rubber processing accelerators further diversifies its market portfolio.

Key market driving factors include the escalating global population pressuring agricultural output, which in turn accelerates demand for advanced crop protection chemicals. Regulatory approvals of new monocyanamide-derived pesticides, particularly in Asia Pacific and North America, provide significant impetus. Technological advances leading to higher purity grades (>=98%) are opening doors to more sensitive pharmaceutical and electronic applications, demanding enhanced quality control throughout the supply chain. However, regulatory scrutiny regarding residual toxicity and environmental fate necessitates ongoing innovation in product formulation and waste management.

Monocyanamide Market Executive Summary

The Monocyanamide Market demonstrates robust growth, underpinned by significant penetration into high-value chemical synthesis pathways across key regions. Business trends indicate a strong move toward vertical integration among leading manufacturers, aiming to secure raw material supply (calcium carbide or limestone) and control purity standards from production to end-use application. There is a noticeable shift in manufacturing capacity from Western economies to the Asia Pacific region, specifically China and India, driven by lower operational costs and less stringent environmental enforcement, though global trade complexity is increasing due to tariff changes and supply chain diversification strategies adopted by multinational buyers seeking redundancy and quality assurance. Mergers and acquisitions are frequent, focused on consolidating market share and acquiring proprietary production technologies for high-purity variants.

Regionally, Asia Pacific maintains dominance, driven by massive agricultural consumption, particularly in rice and staple crop production requiring specialized herbicides, alongside burgeoning pharmaceutical manufacturing capabilities. North America and Europe, while being mature markets with slower growth rates for conventional agrochemicals, exhibit high demand for premium, regulated monocyanamide used in novel specialty chemicals and API development, often adhering to strict REACH and EPA guidelines. The regulatory landscape remains a critical determinant of regional market dynamics; for instance, European Union regulations concerning certain triazine derivatives mandate continuous innovation in less harmful alternatives, potentially restraining certain traditional application segments while simultaneously creating opportunities for novel uses.

Segment trends reflect a clear bifurcation in demand: high-purity (>=98%) monocyanamide experiences premium pricing and faster growth, primarily serving the lucrative pharmaceutical and specialty chemical segments where trace impurities can compromise final product quality. Conversely, lower-purity grades primarily cater to bulk agrochemical and industrial applications. The liquid form of monocyanamide (aqueous solutions) is preferred due to ease of transport, handling, and formulation stability, especially for large-scale agricultural use, dominating the market volume. Furthermore, the increasing adoption of precision agriculture techniques is necessitating the development of targeted, high-efficacy monocyanamide-derived inputs, driving innovation in formulation science.

AI Impact Analysis on Monocyanamide Market

User queries regarding AI's impact on the Monocyanamide market frequently center on three core themes: optimization of complex chemical synthesis routes, predictive modeling of raw material volatility, and leveraging AI for accelerated discovery of novel cyanamide derivatives for high-value applications. Users seek confirmation on whether AI-driven process control can mitigate the inherent dangers and high energy consumption associated with traditional calcium cyanamide hydrolysis, and how machine learning algorithms might enhance the purity and yield required for stringent pharmaceutical standards. Key concerns revolve around the initial capital expenditure needed for integrating AI into legacy chemical manufacturing plants and the availability of sufficiently trained personnel to manage these advanced systems. Furthermore, there is significant interest in how AI can optimize supply chain logistics, especially given the hazardous nature of the product, ensuring just-in-time delivery while minimizing storage risks.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally shifting the operational and research paradigms within the monocyanamide industry. In manufacturing, AI algorithms are being deployed to monitor real-time reaction kinetics, optimizing temperature, pressure, and catalyst ratios to maximize yield and minimize energy consumption in the highly exothermic production process. This predictive maintenance capability also significantly reduces downtime and enhances worker safety by proactively identifying potential equipment failures or deviations from safe operating parameters. Furthermore, generative AI models are beginning to play a crucial role in materials informatics, rapidly screening millions of potential molecular structures derived from monocyanamide, thereby accelerating the discovery timeline for new, highly effective, and environmentally benign agrochemicals and APIs, offering a critical competitive edge.

In the commercial sphere, AI applications extend to sophisticated demand forecasting models that incorporate complex variables such as regional climate patterns, commodity crop prices, and regulatory changes, allowing producers to optimize inventory levels and better manage volatile input costs. This strategic planning capability, coupled with AI-powered quality control systems that can instantly detect and categorize impurities using spectroscopic data, ensures a consistently high-quality output required by pharmaceutical clients. Although the initial adoption rate remains moderate due to the specialized nature of chemical production, the long-term trend indicates that AI integration will become a non-negotiable standard for efficiency, safety, and innovation in the Monocyanamide market.

- Enhanced process optimization: AI minimizes energy consumption and optimizes reaction parameters (temperature, pressure) in hydrolysis and catalytic processes, increasing yield purity.

- Accelerated R&D: Machine learning facilitates the rapid screening and design of novel agrochemical and pharmaceutical derivatives based on the monocyanamide backbone.

- Predictive Maintenance: AI algorithms analyze equipment data to predict and prevent failures, ensuring safer and continuous production cycles, crucial for hazardous chemical manufacturing.

- Supply Chain Resilience: Advanced AI forecasting models manage inventory and logistics for hazardous materials, adapting quickly to geopolitical shifts and raw material price fluctuations.

- Improved Quality Control: Automated, AI-driven spectroscopy verifies product purity (especially >=98% grade) instantly, crucial for meeting stringent pharmaceutical specifications.

DRO & Impact Forces Of Monocyanamide Market

The dynamics of the Monocyanamide Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market’s impact forces. A primary driver is the indispensable nature of monocyanamide as a synthetic intermediate for foundational agrochemicals, particularly potent herbicides and fungicides required for intensive modern agriculture aimed at maximizing crop output per hectare globally. Concurrently, the burgeoning pharmaceutical industry, particularly in emerging economies, increasingly relies on monocyanamide for the synthesis of key APIs like Metformin, creating a stable, high-value demand stream independent of agricultural cycles. These intrinsic application strengths provide fundamental stability to the market even amidst economic volatility, solidifying its position as a critical chemical commodity.

However, significant restraints temper this growth trajectory. The most pronounced restraint is the inherent toxicity and stringent regulatory environment surrounding the production, handling, storage, and transport of monocyanamide. Regulators in regions such as the EU (via REACH) impose rigorous safety standards, driving up operational costs and necessitating substantial capital investment in closed-loop systems and advanced waste treatment facilities. Furthermore, the volatility and fluctuating costs of raw materials, such as coal and natural gas used in the upstream production of calcium carbide (a precursor to calcium cyanamide), introduce significant cost uncertainties that challenge smaller manufacturers and compress profit margins across the value chain. Public perception concerning the environmental impact of synthetic agrochemicals also influences end-user market adoption, particularly in organic farming sectors.

Opportunities for market expansion are centered on innovation and geographical diversification. The development of advanced, low-toxicity, and biodegradable derivatives presents a major opportunity to align the product with sustainability trends and circumvent existing regulatory restrictions, opening access to high-growth specialty markets. Geographically, significant untapped potential exists in developing regions of Africa and parts of Latin America, where rapid modernization of agricultural practices necessitates high-efficacy chemical inputs. Moreover, R&D focused on non-traditional synthesis routes, such as greener electrochemical methods that bypass the energy-intensive calcium carbide process, holds the promise of dramatically reducing production costs and environmental footprints, thus generating substantial long-term competitive advantage for the innovators.

Segmentation Analysis

The Monocyanamide Market is meticulously segmented based on Purity, Application, and Physical Form, reflecting the diverse end-use requirements across various industries. This segmentation is crucial for strategic market planning, as pricing and growth rates vary significantly depending on the required grade and ultimate application. The market exhibits clear differentiation between bulk chemical commodity uses and highly specialized, low-volume applications. Understanding these nuances allows manufacturers to optimize production capabilities, tailor marketing efforts, and align capital expenditures toward the segments promising the highest returns and stable growth, such as the pharmaceutical grade market where demand is inelastic to commodity price cycles but extremely sensitive to quality control standards.

The purity segmentation (e.g., >=98% and <98%) is perhaps the most defining characteristic, directly correlating with suitability for high-stakes applications. High-purity Monocyanamide is the standard prerequisite for synthesizing complex APIs, specialty polymer additives, and electronic chemicals, necessitating sophisticated post-production purification steps and commanding premium prices due to the zero-tolerance policy for trace contaminants. Conversely, the lower purity segment is cost-competitive and focuses primarily on bulk agrochemical precursors and certain industrial processes where residual impurities have minimal impact on performance but offer significant cost savings, driving volume sales in large agrarian economies. The physical form segment—solid vs. liquid solutions (aqueous)—addresses logistical and handling constraints, with liquid solutions dominating for bulk use due to ease of handling and dosing in formulation.

- By Purity:

- <98% Purity (Industrial Grade)

- >=98% Purity (Pharmaceutical and Specialty Grade)

- By Application:

- Agrochemicals (Herbicides, Fungicides, Insecticides, Fertilizer Stabilizers)

- Pharmaceutical Intermediates (API Synthesis, e.g., Metformin)

- Dyes and Pigments

- Rubber Chemicals and Accelerators

- Specialty Chemicals

- By Physical Form:

- Liquid (Aqueous Solution)

- Solid (Crystalline Powder/Granules)

Value Chain Analysis For Monocyanamide Market

The Monocyanamide market value chain begins with highly energy-intensive upstream processes, involving the extraction and processing of raw materials, primarily limestone and coal, which are converted into calcium carbide, the precursor to calcium cyanamide. This foundational stage is characterized by significant capital investment requirements and high energy costs, leading to concentration among large, integrated chemical conglomerates that possess captive raw material sources and large-scale, high-temperature furnace operations necessary for carbide production. The quality and cost efficiency at this initial stage profoundly impact the final cost structure of monocyanamide. Environmental compliance for managing byproducts and emissions from carbide production represents a major cost component in mature markets, driving production toward regions with more permissive energy costs or regulatory frameworks.

The core manufacturing process involves the hydration and subsequent conversion of calcium cyanamide into monocyanamide, requiring careful control due to the hazardous and exothermic nature of the reaction. Midstream operations focus heavily on purification, where manufacturers distinguish themselves by achieving the ultra-high purity (>98%) required for pharmaceutical applications through crystallization, distillation, or chromatographic methods. Distribution channels are highly specialized, often involving cold chain logistics and strict adherence to regulations governing hazardous material transport (e.g., IMO, DOT regulations). Direct distribution is common for high-volume agrochemical clients or large pharmaceutical companies requiring tailor-made solutions and stringent batch-to-batch consistency and traceability.

Downstream analysis highlights the utilization of monocyanamide as a crucial building block. Agrochemical formulators represent the largest volume consumers, blending monocyanamide derivatives into finished pesticides and controlled-release fertilizers distributed through agricultural cooperatives, retailers, and direct-to-farm channels. Pharmaceutical companies, conversely, represent the highest value segment, integrating the intermediate into complex multi-step synthesis pathways for APIs, often necessitating just-in-time delivery to avoid lengthy storage risks. The indirect channels involve specialized chemical distributors who manage smaller volumes, provide localized blending and repackaging services, and handle regulatory documentation for diverse smaller end-users across specialty chemical, dye, and rubber industries, thus ensuring comprehensive market coverage.

Monocyanamide Market Potential Customers

The primary end-users of monocyanamide are large-scale chemical formulators operating in the highly competitive agrochemical sector, where the compound serves as a vital, cost-effective precursor for synthesizing essential crop protection chemicals, including broad-spectrum herbicides (like those derived from triazines) and systemic fungicides. These customers prioritize bulk volume, competitive pricing, and reliable supply continuity to support their seasonal production cycles and global distribution networks. Given the critical role of these chemicals in ensuring global food supply, these customers often enter into long-term supply contracts with monocyanamide producers, emphasizing quality consistency to meet various country-specific residue limits and formulation stability requirements.

A second crucial customer demographic comprises pharmaceutical and life sciences companies, ranging from large multinational pharmaceutical corporations to specialized Contract Manufacturing Organizations (CMOs). These buyers represent the premium segment, demanding the highest purity grades (typically >98%) for synthesizing active pharmaceutical ingredients (APIs), most notably Metformin, a cornerstone drug for type 2 diabetes management. For this customer group, factors such as batch traceability, regulatory documentation (DMF filings), adherence to Good Manufacturing Practice (GMP) standards, and minimizing trace metal contamination are far more important than price sensitivity, making product quality assurance and compliance paramount purchasing criteria.

Other significant buyers include manufacturers in the specialty chemicals sector, particularly those involved in producing rubber processing accelerators, specialized polyurethane catalysts, and certain classes of reactive dyes and pigments. These customers often require customized solutions, such as specific concentrations or solvent formulations, and smaller, more flexible batch sizes compared to the bulk agrochemical buyers. Furthermore, agricultural technology companies focused on sustainable farming solutions represent an emerging customer base, utilizing monocyanamide derivatives in innovative slow-release fertilizer technologies and nitrification inhibitors designed to enhance nutrient efficiency and minimize nitrogen runoff, aligning with broader environmental sustainability initiatives and presenting a growth vector for niche applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AlzChem Group, Nippon Carbide Industries, Yinjia Chemical, Shandong Ningdong Chemical, Changzhou Huachen Chemical, Anhui Guangxin Agrochemical, Ningxia Jingxin Chemical, Jiaxing Changxing Chemical, Hebei Minmetals, Liaoning Keli Chemical, Jiangxi Xingtai Technology, Jiangsu Huada Chemical, Shanghai ZJ Bio-Tech, Wuxi Yangxing Chemical, Jiangsu Suke Chemical, Shandong Futeng, Nanjing Runjing Chemical, Denka, SK Chemical, Lonza Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Monocyanamide Market Key Technology Landscape

The technological landscape of the Monocyanamide market is predominantly defined by the continuous refinement of the calcium cyanamide route, though significant investment is directed towards alternative, cleaner synthesis methods. The traditional technology involves the reaction of calcium carbide with nitrogen gas at high temperatures to form calcium cyanamide, which is then hydrolyzed in controlled conditions to yield monocyanamide. Key technological innovations in this established pathway focus on optimizing the energy efficiency of the calcium carbide furnace stage and enhancing catalyst systems during the hydrolysis to maximize yield and minimize hazardous byproducts such as ammonia and melamine. Manufacturers achieving high-purity standards often employ multi-stage crystallization and ion exchange purification technologies to meet the zero-tolerance impurity requirements of the pharmaceutical industry, representing a high-barrier-to-entry technological niche.

A crucial area of emerging technological development is the shift toward non-calcium cyanamide based synthesis. Researchers are exploring greener, often electrochemical or catalytic routes that utilize less energy-intensive precursors, potentially bypassing the need for high-temperature carbide production entirely. For instance, processes involving the direct cyanation of amines or advanced methods utilizing liquid ammonia and carbon dioxide are under investigation. These novel technologies promise a reduced environmental footprint, lower dependency on volatile coal and limestone prices, and potentially safer operational profiles. The successful commercialization of these greener alternatives would fundamentally restructure the upstream component of the value chain, granting early adopters a substantial cost and regulatory compliance advantage, especially in highly regulated markets like Europe.

Furthermore, technology is playing a critical role in application development. The use of monocyanamide derivatives in smart agriculture requires advanced microencapsulation and polymer matrix technologies to formulate slow-release fertilizers and nitrification inhibitors effectively. These formulations ensure that the active component is delivered gradually over time, enhancing nutrient utilization efficiency and reducing environmental leaching. In the pharmaceutical space, technological breakthroughs involve continuous flow chemistry reactors replacing traditional batch processing. Flow chemistry offers superior control over highly reactive intermediates like monocyanamide, allowing for safer, faster, and more scalable synthesis of complex APIs, thus reducing production time and minimizing risk exposure in handling hazardous materials, thereby defining the cutting edge of modern monocyanamide utilization.

Regional Highlights

Regional dynamics are critical to understanding the Monocyanamide market due to the highly localized nature of agricultural production, distinct regional regulatory frameworks, and variations in industrial chemical manufacturing capabilities. Asia Pacific (APAC) dominates the global market, accounting for the largest share in both production volume and consumption value. This supremacy is fueled by China and India, which are global hubs for bulk agrochemical production and possess vast manufacturing infrastructure for calcium carbide, the primary raw material. Furthermore, the immense agricultural sector in these countries, coupled with the rapid growth of the generic pharmaceutical industry, ensures sustained high demand for both industrial and high-purity grades of monocyanamide.

North America and Europe represent mature, high-value markets characterized by stringent quality demands and a focus on specialty applications rather than bulk volume. In North America, demand is robust, driven by large-scale commercial farming requiring advanced crop protection chemicals and significant investment in pharmaceutical R&D. European demand, while slightly constrained by stricter environmental regulations (such as the phase-out of certain triazine herbicides), maintains a high requirement for premium-grade monocyanamide used in complex chemical synthesis pathways. Regulatory compliance, specifically adherence to REACH standards, dictates market access and operational standards for all players in this region, favoring companies with advanced environmental abatement technologies.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as emerging markets experiencing accelerated growth. LATAM, particularly Brazil and Argentina, shows strong uptake driven by the expansion of large-scale cash crop production (soybeans, corn), necessitating increased imports and localized formulation of monocyanamide-derived agrochemicals. The MEA region’s growth is nascent but promising, stimulated by investments in modernizing agricultural practices and developing domestic specialty chemical industries, though market penetration is currently hampered by geopolitical instability and underdeveloped logistical infrastructure. These regions offer significant long-term growth potential as agricultural intensification efforts gain momentum, creating lucrative opportunities for global manufacturers seeking market diversification and expansion.

- Asia Pacific (APAC): Dominates production and consumption; driven by mass agrochemical and generic pharmaceutical manufacturing, particularly in China and India.

- North America: High-value market focused on specialty chemicals, pharmaceutical intermediates, and advanced crop protection technologies; strong emphasis on EPA compliance.

- Europe: Mature market with stringent environmental regulations (REACH); high demand for premium, regulated monocyanamide for API synthesis and specialized industrial applications.

- Latin America (LATAM): Rapidly growing market fueled by expanding large-scale commercial agriculture (Brazil, Argentina) and increasing need for high-efficacy inputs.

- Middle East & Africa (MEA): Emerging market potential linked to agricultural modernization efforts, though hampered by logistical and regional instability issues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Monocyanamide Market.- AlzChem Group

- Nippon Carbide Industries

- Yinjia Chemical

- Shandong Ningdong Chemical

- Changzhou Huachen Chemical

- Anhui Guangxin Agrochemical

- Ningxia Jingxin Chemical

- Jiaxing Changxing Chemical

- Hebei Minmetals

- Liaoning Keli Chemical

- Jiangxi Xingtai Technology

- Jiangsu Huada Chemical

- Shanghai ZJ Bio-Tech

- Wuxi Yangxing Chemical

- Jiangsu Suke Chemical

- Shandong Futeng

- Nanjing Runjing Chemical

- Denka

- SK Chemical

- Lonza Group

Frequently Asked Questions

Analyze common user questions about the Monocyanamide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Monocyanamide primarily used for, and why is its purity important?

Monocyanamide is primarily used as a versatile chemical intermediate in two major sectors: the agrochemical industry (for synthesizing herbicides, fungicides, and fertilizer stabilizers) and the pharmaceutical industry (for key APIs like Metformin). Purity, especially the >=98% grade, is critical for pharmaceutical applications as trace impurities can severely compromise drug efficacy, stability, and regulatory compliance.

What are the main drivers and restraints impacting the growth of the Monocyanamide market?

The main drivers include increasing global demand for high-efficacy crop protection chemicals due to rising population and the steady expansion of the generic and proprietary pharmaceutical manufacturing base. Key restraints involve the inherent toxicity and hazardous nature of the compound, leading to stringent environmental regulations (like REACH), and the market's vulnerability to volatile raw material costs, particularly calcium carbide precursors.

Which geographical region holds the largest market share for Monocyanamide production and consumption?

The Asia Pacific (APAC) region currently dominates the Monocyanamide market in terms of both production capacity and consumption volume. This dominance is attributed to the large-scale, cost-effective chemical manufacturing infrastructure, particularly in China and India, coupled with the massive internal demand stemming from their expansive agricultural sectors and growing pharmaceutical industries.

How is technological innovation influencing the synthesis of Monocyanamide?

Technological innovation is focused on two areas: optimizing the traditional calcium cyanamide route for greater energy efficiency and purity, and critically, exploring greener, non-calcium carbide-based synthesis methods, such as electrochemical processes. These emerging technologies aim to reduce operational costs, minimize environmental impact, and improve worker safety during production.

In what form is Monocyanamide most commonly supplied for industrial applications, and why?

Monocyanamide is most commonly supplied in the form of an aqueous liquid solution for industrial and bulk agrochemical applications. The liquid form is preferred over the solid crystalline powder due to its enhanced stability, ease of handling, safer transport logistics, and streamlined integration into subsequent formulation processes, especially for large-volume crop protection products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager