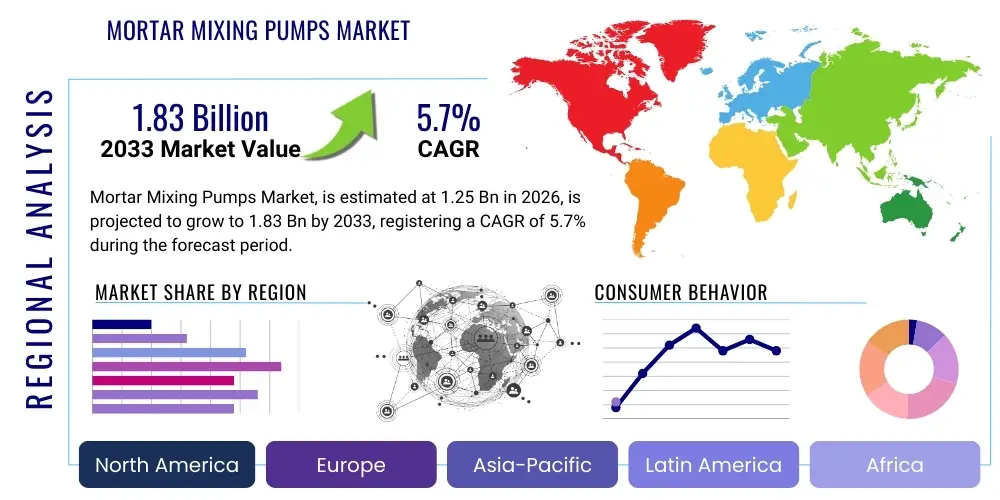

Mortar Mixing Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443373 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Mortar Mixing Pumps Market Size

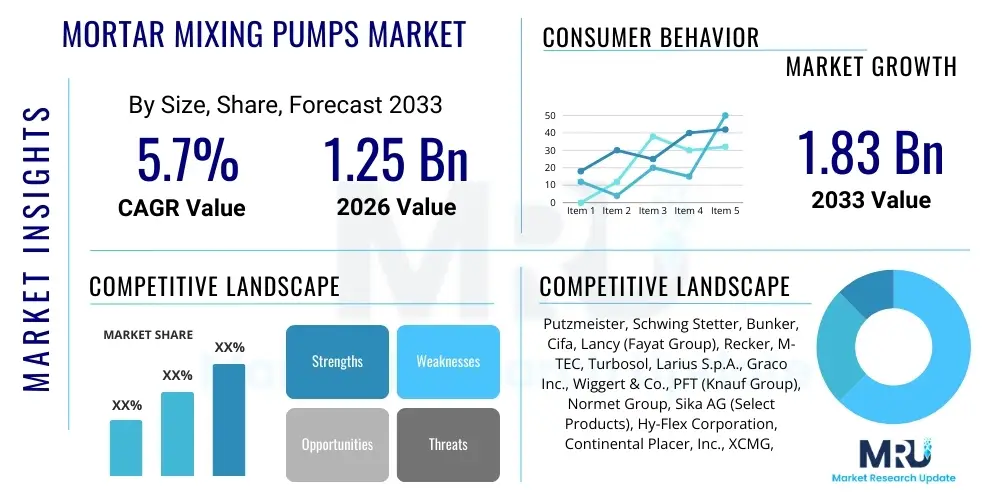

The Mortar Mixing Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.65% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.83 Billion by the end of the forecast period in 2033.

Mortar Mixing Pumps Market introduction

The Mortar Mixing Pumps Market encompasses specialized construction machinery designed for the efficient preparation, mixing, and continuous conveyance of various pre-mixed dry mortars, including plaster, screed, grout, and insulating materials. These machines significantly streamline construction processes by automating labor-intensive tasks, ensuring consistent material quality, and enabling high-volume output necessary for large-scale commercial and infrastructure projects. The foundational necessity for rapid, high-quality material application in both new construction and repair operations solidifies the market's continuous demand trajectory, particularly in regions undergoing rapid urbanization and extensive infrastructural development.

Mortar mixing pumps, often categorized by their power source (electric or diesel) and output capacity, serve a crucial function in bridging the gap between material delivery and application on the job site. Products range from compact, portable units suitable for residential renovations to high-performance, trailer-mounted systems used in major civil engineering projects. Key applications span across residential and commercial building construction, tunnel lining, bridge restoration, and specialized applications like fireproofing and self-leveling floor installations. The core benefit these pumps offer is substantial reduction in project timelines and labor costs, while simultaneously minimizing material waste and ensuring homogeneous mixture consistency, a critical factor for structural integrity and finishing quality.

Driving factors for this market growth are intrinsically linked to global macroeconomic indicators, including burgeoning public and private investments in infrastructure, the sustained push for affordable housing solutions requiring rapid build times, and stringent regulatory standards demanding higher quality finishes and precise material consistency. Furthermore, the global shortage of skilled manual labor in construction compels companies to adopt automated machinery like mortar mixing pumps to maintain productivity. The technological evolution toward modular and energy-efficient designs, coupled with enhanced digital integration for performance monitoring, continues to accelerate the adoption rate of these essential construction tools across diverse geographies.

Mortar Mixing Pumps Market Executive Summary

The Mortar Mixing Pumps Market is currently characterized by intense technological innovation focused on improving mobility, enhancing energy efficiency, and integrating telematics for predictive maintenance and performance optimization. Business trends indicate a strong movement toward electric-powered pumps, driven by increasingly strict emission regulations in developed economies and the rising cost volatility associated with diesel fuel. Manufacturers are also prioritizing modular designs that allow for easy transport and rapid setup, catering to the dynamic nature of modern construction sites. Consolidation among major original equipment manufacturers (OEMs) and strategic partnerships aimed at expanding service networks and offering comprehensive material-equipment packages are key competitive strategies defining the current market landscape.

Geographically, market expansion is led by the Asia Pacific (APAC) region, primarily due to massive ongoing infrastructure investments in countries like China, India, and Southeast Asian nations, coupled with rapid urbanization pushing vertical construction. North America and Europe, while mature, exhibit steady growth fueled by renovation, restoration projects, and the mandatory replacement cycles of aging construction equipment, alongside a strong focus on high-capacity and highly automated pumping systems. Regulatory frameworks promoting sustainable construction practices further influence regional trends, pushing demand for pumps compatible with specialized eco-friendly or lightweight mortars.

Segmentation trends highlight the dominance of electric-powered pumps, particularly in urban environments where noise and air pollution are primary concerns, although diesel pumps retain prominence in remote, large-scale infrastructure sites lacking reliable power access. By application, the commercial and infrastructure segments represent the largest market share, attributable to the high-volume requirements of multi-story buildings, highways, and utility projects. Moreover, there is a discernible shift toward pumps equipped with variable speed drives and integrated mixing systems, allowing contractors greater flexibility in handling different types of materials, thereby maximizing equipment utilization across various project types.

AI Impact Analysis on Mortar Mixing Pumps Market

Common user questions regarding AI's impact on the Mortar Mixing Pumps Market generally revolve around how AI can enhance operational efficiency, ensure optimal material consumption, and predict mechanical failures before they occur. Users frequently ask about the feasibility of integrating AI-driven sensors for real-time consistency control of the mixed mortar and whether AI can optimize pump settings based on ambient temperature, humidity, and specific material properties to eliminate manual adjustments. Key themes include achieving autonomous operation, minimizing unplanned downtime, and integrating pump data seamlessly into larger project management and BIM (Building Information Modeling) platforms. Users seek assurance that these AI solutions will be retrofit-capable and provide a clear, measurable return on investment (ROI) by reducing waste and maintenance costs.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to fundamentally transform the operational profile and maintenance regimen of mortar mixing pumps. AI-driven predictive maintenance (PdM) leverages telematics data—such as motor temperature, vibration levels, pressure fluctuations, and hour metering—to anticipate component wear, drastically reducing the incidence of catastrophic failures and optimizing maintenance schedules to factory downtime rather than on-site failure. This shift from reactive or preventive maintenance to predictive upkeep extends the serviceable life of the equipment and significantly increases overall job site reliability, addressing a critical concern for construction firms operating under tight deadlines.

Beyond maintenance, AI algorithms are crucial for material quality assurance and operational excellence. Embedded sensors can monitor the consistency (viscosity and water content) of the mixed mortar in real-time. ML models, trained on thousands of material formulations and environmental conditions, can autonomously adjust the mixing parameters (e.g., water dosage, mixing time) to ensure the output mortar consistently meets specified engineering standards, irrespective of minor variations in the dry mix input or ambient conditions. This level of precision is paramount in specialized applications like self-leveling compounds or high-strength grouts, ensuring compliance and superior performance.

- AI-driven Predictive Maintenance (PdM) based on real-time operational data.

- Autonomous adjustment of mixing ratios for consistent material quality and reduced waste.

- Integration of pump performance data into centralized BIM and project management software.

- Optimization of energy consumption by dynamically adjusting motor speeds to required flow rates.

- Automated diagnostics for faster troubleshooting and reduced reliance on specialized field technicians.

DRO & Impact Forces Of Mortar Mixing Pumps Market

The Mortar Mixing Pumps Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the global surge in infrastructure development projects, the necessity for automation due to chronic skilled labor shortages in construction, and the demand for enhanced quality and speed in building operations. Restraints predominantly center on the high initial capital expenditure required for sophisticated machinery, the requirement for specific training to operate and maintain these complex systems, and the cyclical nature of the construction industry, which can impact equipment purchasing decisions during economic downturns. Opportunities lie primarily in the emerging markets of Asia and Africa, the increasing acceptance of modular and prefabrication construction techniques that rely on consistent material supply, and the potential for technological innovation focusing on battery-powered and highly mobile units.

Impact forces within the market are exerted both by internal industry shifts and external macroeconomic factors. The escalating cost of raw materials (steel, components) and energy directly pressures manufacturers' profit margins and influences the final price of the pumps, affecting purchasing power, especially for smaller contractors. Furthermore, intense competition among global market leaders drives continuous product differentiation and innovation, forcing faster product cycles and increasing the investment needed for R&D. The transition towards stricter environmental regulations, particularly regarding noise and emissions, acts as a powerful external force compelling the rapid retirement of older, less-efficient diesel models in favor of advanced electric or hybrid systems.

The long-term growth trajectory is critically dependent on addressing the perceived high-cost barrier through financing solutions and demonstrating a clear, superior ROI derived from labor savings and faster project completion. The ability of OEMs to integrate seamlessly with digital construction ecosystems and offer reliable, worldwide service support will dictate competitive success. The inherent efficiency and material consistency provided by these pumps are becoming non-negotiable standards in high-specification building contracts, thus underpinning the structural demand growth despite short-term economic fluctuations. Regulatory mandates favoring precise construction methods and reducing material variability further solidify the positive impact forces driving market expansion.

Segmentation Analysis

The Mortar Mixing Pumps Market is comprehensively segmented based on material output capacity, power source, and end-use application, providing crucial insights into market dynamics and target customer groups. The output capacity segmentation categorizes pumps into low (below 20 L/min), medium (20-60 L/min), and high (above 60 L/min) throughput ranges, directly correlating to project scale, where large infrastructure and commercial projects dominate the high-capacity segment. The power source split between electric, diesel, and pneumatic drives reflects the operational environments, with electric models dominating urban sites due to environmental constraints and ease of maintenance, while diesel models prevail in remote or extremely large construction zones where power access is challenging.

Application-based segmentation is critical, delineating demand across residential, commercial, and infrastructure sectors. The commercial segment, encompassing multi-story offices, hospitals, and retail complexes, generates the highest revenue due to demanding deadlines and high-volume plastering and screeding requirements. The infrastructure segment includes critical applications such as road and bridge repair, tunneling, and dam construction, requiring specialized grouting pumps capable of handling high pressures and specialized material compositions. Understanding these segments allows manufacturers to tailor features such as mobility, power efficiency, and pressure capabilities to precise end-user needs, ensuring optimal product market fit and maximizing sales penetration across diverse construction verticals.

Further granularity is achieved through segmenting by product type, such as continuous mixers, forced mixers, and specialized injection pumps. The continuous mixers, which form the bulk of the market, are favored for standard plastering and screeding materials, offering uninterrupted material flow. Conversely, forced action mixers are necessary for materials that require intense, non-continuous mixing, often seen in specialized chemical grouts or structural repair compounds. These distinctions underscore the technological diversity within the market and the necessity for a differentiated product portfolio to address the full spectrum of modern construction requirements, ranging from simple residential builds to highly complex structural repairs.

- By Power Source:

- Electric Pumps

- Diesel Pumps

- Pneumatic Pumps

- By Output Capacity:

- Low Capacity (Up to 20 L/min)

- Medium Capacity (20 L/min to 60 L/min)

- High Capacity (Above 60 L/min)

- By End-Use Application:

- Residential Construction

- Commercial Construction (Offices, Retail, Healthcare)

- Infrastructure (Roads, Bridges, Tunnels, Utilities)

- By Product Type:

- Continuous Mixers and Pumps

- Forced Action Mixers (Batch Mixers)

- Grout and Injection Pumps

Value Chain Analysis For Mortar Mixing Pumps Market

The value chain for the Mortar Mixing Pumps Market begins with the upstream suppliers responsible for raw materials, core components, and specialized sub-assemblies. This upstream segment is dominated by suppliers of high-grade steel and alloys for pump bodies, manufacturers of specialized electric motors or diesel engines (the power core), and producers of high-precision hydraulic components and control systems. Maintaining stable and high-quality sourcing from this stage is critical, as the durability and performance reliability of the final pump depend heavily on the quality of these foundational components. Relationships with component suppliers are often long-term and strategic, focusing on cost efficiencies and adherence to stringent quality certifications.

The midstream involves the Original Equipment Manufacturers (OEMs) who design, assemble, and test the final pumping units. This stage includes significant investment in R&D for engineering new features such as telematics, efficiency improvements, and ergonomic design. Manufacturing capabilities are paramount, requiring advanced CNC machining, robotic welding, and rigorous quality control protocols. Direct and indirect distribution channels then move the finished product to the end-users. Direct sales are often utilized for large, custom, or high-value pumps, involving internal sales teams that provide technical consultation and after-sales support directly to major construction firms or rental companies. This provides OEMs with direct feedback and better control over pricing and service standards.

Indirect channels involve a robust global network of authorized dealers, regional distributors, and equipment rental companies. Rental fleets represent a substantial portion of the market, especially for smaller or project-specific contractors who prefer operational expenditure over capital investment. Distributors often handle inventory management, local marketing, and critical first-line service and parts supply, serving as the primary touchpoint for numerous end-users. The downstream segment includes the end-users (construction companies, specialized plastering contractors, infrastructure developers) and after-sales services, including maintenance, spare parts supply, and technical training. The profitability of the entire chain is heavily reliant on the efficiency of the spare parts and service network, as minimizing downtime is crucial for construction productivity.

Mortar Mixing Pumps Market Potential Customers

Potential customers for mortar mixing pumps span a diverse range of organizations within the construction and civil engineering sectors, all unified by the need for efficient, high-volume, and consistent material application. The largest segment of buyers comprises general contracting firms specializing in commercial and high-density residential developments, where rapid progress and standardized material quality are mandated by tight project schedules and demanding specifications. These customers typically require medium to high-capacity electric or diesel pumps, valued for their reliable throughput and ability to handle large volumes of plaster, screed, and masonry mortar over extended periods.

Another significant customer base includes specialized plastering and flooring contractors. These companies focus exclusively on the final stages of building fit-out, often seeking mobile, easily transportable, and highly precise continuous mixers. For these specialized firms, the key purchasing criteria include ease of cleaning, speed of setup, and the ability to seamlessly switch between different types of proprietary pre-mixed materials. Furthermore, the burgeoning popularity of self-leveling floor compounds and insulating mortars drives demand for pumps specifically engineered to handle these modern, high-viscosity materials.

Lastly, government agencies and large infrastructure developers constitute a crucial segment, particularly in the purchase of high-pressure grout and injection pumps used for tunnel sealing, bridge cable grouting, dam maintenance, and geological stabilization. These public works projects demand equipment with exceptional reliability, high durability in harsh environments, and the capacity to meet stringent governmental safety and quality standards. Equipment rental companies, acting as intermediaries, are also major buyers, stocking diverse fleets to cater to the fluctuating demand profiles of all three end-user types, thus smoothing capital expenditure cycles for smaller construction businesses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.83 Billion |

| Growth Rate | 5.65% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Putzmeister, Schwing Stetter, Bunker, Cifa, Lancy (Fayat Group), Recker, M-TEC, Turbosol, Larius S.p.A., Graco Inc., Wiggert & Co., PFT (Knauf Group), Normet Group, Sika AG (Select Products), Hy-Flex Corporation, Continental Placer, Inc., XCMG, Zoomlion, ELBA-Werk, Sermac |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mortar Mixing Pumps Market Key Technology Landscape

The technological landscape of the Mortar Mixing Pumps Market is rapidly evolving, driven primarily by the pursuit of higher efficiency, reduced environmental footprint, and enhanced operator safety. One dominant trend is the shift toward advanced variable frequency drives (VFDs) and sophisticated motor control systems, particularly in electric pumps. VFD technology allows the pump output to be precisely matched to the specific application demand, significantly reducing energy consumption compared to fixed-speed systems. This precision control also minimizes pulsation in the material flow, leading to smoother application and better finish quality, crucial for modern plastering techniques. Furthermore, integration of high-efficiency permanent magnet motors (PMMs) is gaining traction, offering better power density and lower heat generation, which extends component lifespan and reduces maintenance requirements.

Another pivotal technological advancement involves the pervasive integration of digital monitoring, telemetry, and smart sensor technology. Modern mortar pumps are often equipped with embedded GPS modules, CAN bus systems, and cloud connectivity, enabling real-time remote diagnostics and performance tracking. These systems monitor parameters such as pumping pressure, mixer shaft speed, vibration analysis, and engine health. This data is leveraged for two key benefits: facilitating AI-driven predictive maintenance programs, as previously discussed, and providing construction managers with verifiable performance metrics for compliance reporting and resource allocation. The availability of real-time operational data is transforming equipment management from a reactive cost center into a proactively optimized asset.

Material handling innovation also defines the current technology landscape. Manufacturers are developing mixing systems optimized for challenging, pre-bagged specialty mortars, such as self-leveling underlayments, polymer-modified plasters, and structural repair grouts. This includes implementing specialized agitation mechanisms and non-metallic mixing barrels to prevent material contamination or premature setting. Furthermore, the focus on modular component design, facilitating quicker disassembly and cleaning, addresses a major operational pain point for contractors, particularly when frequently switching between material types. Overall, the market is moving towards "smart pumps" that are not only faster and more reliable but also deeply interconnected with the overall digital construction site environment, maximizing uptime and material precision.

Regional Highlights

The global Mortar Mixing Pumps Market exhibits significant regional variation in growth patterns, adoption rates, and technological preferences, reflecting diverse economic development levels and construction practices worldwide.

- Asia Pacific (APAC): This region is the undisputed leader in market growth, driven by massive urbanization, government-led affordable housing initiatives, and extensive investment in new transportation and utility infrastructure (e.g., China’s Belt and Road Initiative, India’s Smart Cities Mission). The primary demand is for high-throughput, robust pumps capable of handling continuous, large-scale projects. While price sensitivity remains a factor, quality and durability are increasingly prioritized.

- North America: Characterized by high labor costs and stringent safety standards, North America focuses heavily on sophisticated, automated, and high-capacity equipment. Growth is predominantly driven by commercial construction, specialized repair, and the mandatory replacement cycle of aging equipment. There is a strong preference for telematics-integrated and fuel-efficient diesel and advanced electric pumps that offer clear productivity gains to offset high operational expenses.

- Europe: The European market is mature but highly progressive in environmental compliance. Demand is shifting rapidly toward electric and highly silent pumps due to strict urban noise and emission regulations (Stage V). Germany, France, and the UK lead the adoption of pumps designed for specialized, eco-friendly, and thermal insulation mortars, driven by energy efficiency mandates for buildings. Rental fleets play a crucial role in equipment dissemination across the continent.

- Latin America: This region presents a growing opportunity, marked by increasing construction activity and a transition away from traditional, manual mixing methods. Market growth is sporadic but significant in key economies like Brazil and Mexico. Price competitiveness and robust, low-maintenance designs are key purchasing criteria, often preferring proven, lower-technology models or reconditioned equipment due to capital constraints.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) states due to ambitious mega-projects (e.g., NEOM in Saudi Arabia) requiring large volumes of concrete and mortar. High temperatures necessitate specialized pumps capable of maintaining material consistency under extreme heat. Africa is an emerging market, focusing on basic, durable, and easily maintainable equipment to support rapid urbanization and infrastructure backlogs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mortar Mixing Pumps Market.- Putzmeister (Sany Group)

- Schwing Stetter (XCMG Group)

- Bunker Bau- und Industriemaschinen GmbH

- Cifa S.p.A. (Zoomlion Group)

- Lancy (Fayat Group)

- Recker GmbH

- M-TEC MATHIS TECHNIK GmbH

- Turbosol S.p.A.

- Larius S.p.A.

- Graco Inc.

- Wiggert & Co. GmbH

- PFT (Knauf Group)

- Normet Group Oy

- Sika AG (Select Pumping Equipment Division)

- Hy-Flex Corporation

- Continental Placer, Inc. (CPI)

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- ELBA-Werk Maschinen Gesellschaft mbH

- Sermac S.p.A.

Frequently Asked Questions

Analyze common user questions about the Mortar Mixing Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for electric mortar mixing pumps?

The increasing adoption of electric mortar mixing pumps is primarily driven by stricter global environmental regulations, particularly in urban areas, which mandate lower noise pollution and zero operational emissions. Furthermore, reduced maintenance complexity and lower long-term running costs compared to diesel variants enhance their appeal.

How does the integration of AI improve the performance and reliability of these pumps?

AI significantly improves reliability through Predictive Maintenance (PdM), analyzing real-time sensor data (vibration, temperature) to anticipate component failure before it occurs, drastically reducing unplanned downtime. AI also optimizes mixing consistency by automatically adjusting parameters based on material properties and environmental factors.

Which end-use application segment holds the largest market share globally?

The Commercial Construction segment, encompassing large-scale office buildings, retail centers, and hospitals, holds the largest market share. These projects require high-capacity pumps for rapid and consistent application of large volumes of plaster, screed, and fireproofing materials to meet aggressive construction timelines.

What are the key restraint factors challenging the growth of the Mortar Mixing Pumps Market?

The key restraints include the high initial capital investment required for purchasing advanced, high-capacity machinery and the subsequent need for skilled operators and maintenance technicians capable of handling the equipment's technological complexity, posing a barrier for smaller contractors.

What technological innovations are shaping the future of mortar pump design?

Future design is centered on modularity, battery-powered systems for enhanced mobility, and deep integration of telematics and VFD technology. This ensures optimal energy consumption, precise material handling for specialized modern mortars, and remote diagnostic capabilities for maximized operational uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager