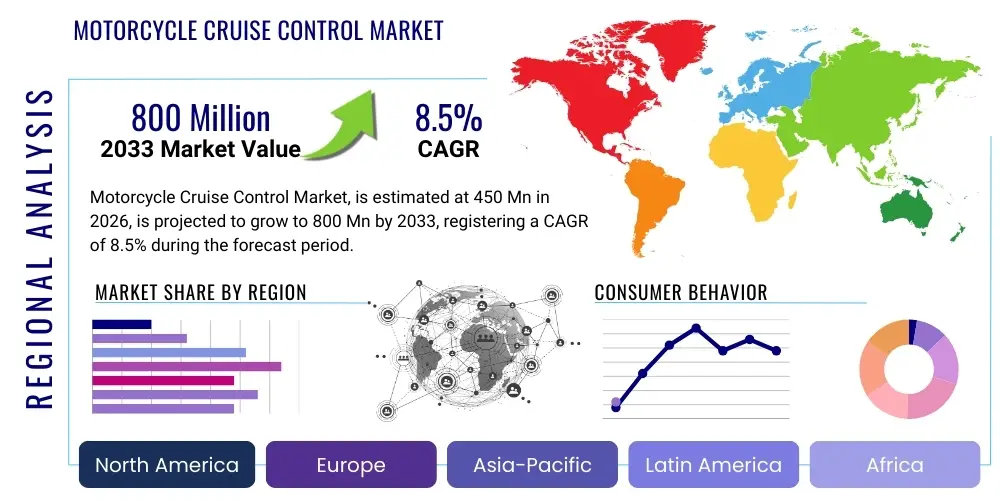

Motorcycle Cruise Control Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442499 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Motorcycle Cruise Control Market Size

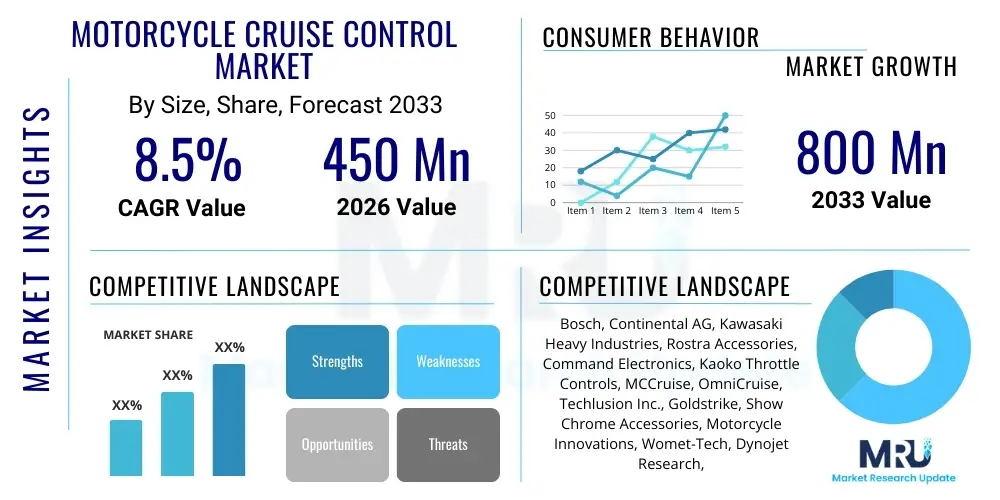

The Motorcycle Cruise Control Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $800 Million by the end of the forecast period in 2033.

Motorcycle Cruise Control Market introduction

The Motorcycle Cruise Control Market encompasses the specialized systems designed to automatically maintain a set speed for motorcycles without continuous throttle input from the rider. These systems, ranging from traditional mechanical throttle locks to sophisticated electronic fly-by-wire solutions, are increasingly viewed as essential safety and convenience features, particularly for touring, long-distance riding, and commuting on highways. The integration of electronic control units (ECUs) and advanced sensors has enabled features such as precise speed maintenance, quicker response times, and seamless disengagement mechanisms, significantly enhancing the overall riding experience by reducing rider fatigue and improving control consistency. The market growth is inherently tied to the rising global production of premium and touring motorcycles, where these systems are increasingly offered as standard equipment or high-demand aftermarket upgrades.

Product descriptions within this market vary based on technological complexity. Mechanical systems, typically simpler and less costly, involve physically locking the throttle grip position, while electronic cruise control utilizes the motorcycle's engine management system to modulate fuel injection or throttle body position to maintain the designated speed. Major applications center on enhancing rider comfort during extended journeys, thereby mitigating the physical strain associated with maintaining a fixed speed manually, especially at higher velocity ranges. The primary benefits include reduced risk of speeding tickets due to unintended acceleration, substantial decrease in forearm and wrist fatigue, and improved overall fuel efficiency through stabilized engine operation. Furthermore, electronic systems often integrate with other rider aids, such as traction control and quick shifters, creating a more comprehensive safety and performance package.

Driving factors propelling this market expansion include stringent government regulations in several regions mandating or encouraging advanced rider assistance systems (ARAS) adoption, coupled with continuous innovation in motorcycle electronics. Consumer demand for luxury features and enhanced safety in high-displacement motorcycles further fuels sales. Moreover, the increasing average age of motorcycle riders in developed economies necessitates features that enhance comfort and reduce physical exertion over long durations. The market also benefits significantly from the strong aftermarket segment, which provides retrofit options for a vast installed base of motorcycles lacking factory-installed cruise control, thereby broadening the accessible consumer base beyond new motorcycle sales.

Motorcycle Cruise Control Market Executive Summary

The Motorcycle Cruise Control Market is characterized by robust technological development and favorable consumer acceptance across key demographics, predominantly driven by the touring and cruiser segments. Business trends indicate a strong move towards integrated electronic solutions (fly-by-wire) over traditional mechanical systems, as electronic implementation offers superior safety, accuracy, and integration potential with features like Adaptive Cruise Control (ACC), which is beginning to penetrate the high-end motorcycle segment. Key industry participants are focusing heavily on strategic partnerships with original equipment manufacturers (OEMs) to ensure their proprietary technologies are utilized in new model development cycles, securing long-term supply contracts, and capitalizing on the rising trend of factory-fitted ARAS. Furthermore, the aftermarket segment remains highly competitive, with firms innovating on ease of installation and universal compatibility to capture retrofit demand globally.

Regionally, the market dynamics are heavily influenced by disposable income and motorcycle culture. North America and Europe currently represent the most lucrative markets due to high demand for large-displacement touring motorcycles and a mature regulatory environment promoting safety features. The Asia Pacific (APAC) region, however, is projected to exhibit the fastest growth rate, fueled by increasing urbanization, rising middle-class income, and the subsequent expansion of premium motorcycle sales in countries such as China, India, and Southeast Asia. Regulatory harmonization and improved infrastructure development supporting long-distance touring in APAC are key accelerators. Emerging markets in Latin America and the Middle East and Africa (MEA) are witnessing nascent growth, primarily focusing on mid-range motorcycle segment adoption and localized manufacturing partnerships.

Segmentation trends reveal that the Electronic Cruise Control (ECC) segment dominates the market in terms of revenue and future growth potential, largely displacing mechanical systems due to its superior functionality and safety features. By application, the OEM segment holds the majority share, reflecting the industry shift toward offering these systems as standard amenities on high-value models. Nonetheless, the aftermarket segment is critical for maintaining market vitality, offering customized and cost-effective solutions for legacy models and budget-conscious consumers. The high-displacement motorcycle category (above 600cc) remains the primary consumer demographic, given that cruise control provides maximum utility on long-haul touring machines, although technological miniaturization is enabling adoption in smaller, commuter-focused motorcycles as well.

AI Impact Analysis on Motorcycle Cruise Control Market

User queries regarding AI's impact on motorcycle cruise control often center on the transition from conventional ECC to advanced, autonomous systems. Common questions explore the timeline for Adaptive Cruise Control (ACC) deployment, concerns about sensor reliability in varying weather conditions (rain, fog), the ethical implications of autonomous emergency braking on two wheels, and how AI algorithms will handle nuanced road dynamics specific to motorcycles (e.g., lean angle, counter-steering). Users are generally eager for enhanced safety features but cautious about the potential loss of rider control. The consensus expectation is that AI will primarily improve system responsiveness, predictive capability, and integration with other onboard safety systems, transitioning the technology from a simple speed-holding device to an integral component of a proactive, collision-avoidance platform.

The core influence of Artificial Intelligence in the motorcycle cruise control domain is centered on the rapid advancement of Adaptive Cruise Control (ACC) and Predictive Cruise Control (PCC) technologies. AI algorithms process real-time data collected from radar, LiDAR, and camera systems to not only maintain a set speed but also adjust following distance dynamically based on traffic flow and ambient conditions. This integration demands sophisticated machine learning models capable of distinguishing between various vehicle types, pedestrian movements, and environmental obstacles, a task far more complex on a dynamically leaning two-wheeler than on a four-wheeled vehicle. AI ensures the system maintains safety margins, manages speed transitions smoothly, and provides timely warnings or interventions, dramatically elevating the safety profile of motorcycle touring.

Furthermore, AI is pivotal in optimizing energy consumption and system diagnostics. Predictive algorithms can analyze topography and traffic patterns (when integrated with navigation systems) to optimize throttle input, reducing unnecessary acceleration and braking, thereby improving fuel efficiency. For manufacturers, AI-driven diagnostics facilitate remote monitoring and predictive maintenance alerts for the cruise control system components, enhancing reliability and reducing downtime. The next generation of cruise control will utilize AI to learn individual rider preferences, customizing the aggression of acceleration/deceleration profiles to match the user's riding style, fundamentally changing the human-machine interface towards a more personalized and intuitive experience, although extensive testing is required to validate these complex safety-critical functionalities.

- AI enables Adaptive Cruise Control (ACC) by processing radar/camera inputs for dynamic speed and distance adjustment.

- Machine learning algorithms enhance predictive capabilities, anticipating traffic changes and road hazards specific to motorcycles.

- Integration with navigation systems uses AI to optimize cruising speed based on route topography and real-time traffic data (Predictive Cruise Control).

- AI facilitates personalized riding modes, adapting cruise control responsiveness to match individual rider preferences and input history.

- Enhanced sensor fusion and diagnostics rely on AI for reliable operation across adverse weather conditions and rapid component failure identification.

DRO & Impact Forces Of Motorcycle Cruise Control Market

The Motorcycle Cruise Control Market is fundamentally shaped by a confluence of driving forces focused on safety and comfort, regulatory pressures, and ongoing technological refinement, counterbalanced by inherent restraints such as high integration costs and rider apprehension regarding autonomous control. Opportunities arise primarily from the burgeoning demand for premium, long-haul motorcycles and the potential for regulatory mandates for advanced rider assistance systems (ARAS). The key impact forces dictating market evolution involve the rapid maturation of radar technology, the imperative to reduce rider fatigue on extended trips, and competitive pressure among OEMs to differentiate their products through superior electronic packages, pushing the industry toward standardization of electronic cruise control and subsequent adoption of adaptive systems.

Drivers: Significant market drivers include the documented reduction in rider fatigue achieved through prolonged use of cruise control, which is crucial for maintaining focus and alertness on long journeys. The global increase in long-distance motorcycle tourism, particularly in developed regions, necessitates comfort-enhancing features. Moreover, regulatory bodies are increasingly supportive of technologies that contribute to overall road safety, potentially leading to future incentives or requirements for systems like cruise control and speed limiters. Technological advancements, particularly in fly-by-wire throttle control systems, have made electronic cruise control installation simpler, more reliable, and capable of seamless integration with ABS and traction control systems, thereby improving safety performance and justifying the increased cost of these advanced motorcycles.

Restraints: The primary restraint remains the high initial cost associated with sophisticated electronic cruise control systems, particularly for the mid-range and low-displacement motorcycle segments common in emerging markets. Furthermore, the complexity of integrating electronic cruise control into motorcycles that still utilize cable-actuated throttles presents a technical challenge and cost barrier in the aftermarket. Rider resistance and skepticism towards automated riding aids, especially concerning potential malfunctions or overriding driver input, persist among traditional riders. Additionally, the operational limitations of radar-based ACC in adverse weather (heavy rain, dense fog) or complex urban environments still need comprehensive technological solutions before widespread adoption in all motorcycle classes.

Opportunities: Major opportunities reside in the development and proliferation of Adaptive Cruise Control (ACC) systems tailored specifically for motorcycle dynamics, including lean angle consideration and optimized braking profiles. The rapidly expanding aftermarket segment offers significant growth potential by developing universally compatible, competitively priced electronic kits for older motorcycles. Furthermore, geographical expansion into high-growth regions like Southeast Asia, coupled with the introduction of customized, lower-cost versions of electronic cruise control for smaller capacity (250cc-500cc) premium commuter and adventure motorcycles, presents a clear path for market penetration and volume growth throughout the forecast period.

Segmentation Analysis

The Motorcycle Cruise Control Market segmentation provides a clear insight into the varying adoption patterns across technology, motorcycle type, and sales channel. The market is primarily segmented by Technology into Electronic Cruise Control (ECC) and Mechanical Cruise Control, reflecting the ongoing technological transition towards digitally managed systems. Segmentation by Motorcycle Type highlights the critical difference in application scope, with Touring, Cruiser, and Adventure motorcycles being the primary adopters, contrasting with lower adoption rates in Sport and Commuter motorcycles. Finally, the Sales Channel classification (OEM vs. Aftermarket) distinguishes between factory-fitted components and consumer-installed systems, providing a perspective on market maturity and consumer accessibility across different price points and installation complexities.

The dominance of the Electronic Cruise Control segment is due to its superior performance characteristics, including instantaneous speed adjustments, better integration with the engine control unit (ECU), and the ability to disengage immediately upon braking or clutch pull, offering enhanced safety compared to mechanical systems. While mechanical systems remain relevant in the budget and legacy aftermarket segments, they are increasingly marginalized in new production due to their inherent functional limitations. The Motorcycle Type segmentation underscores the correlation between system complexity and motorcycle usage; long-distance travel machines benefit most significantly from fatigue reduction, naturally driving demand in the Touring and Adventure segments, which often feature advanced electronic infrastructure capable of supporting sophisticated cruise control implementation.

Analyzing the Sales Channel reveals that the Original Equipment Manufacturer (OEM) segment is growing faster, driven by motorcycle manufacturers standardizing these features on higher-displacement models to meet consumer expectations for comfort and safety. This trend establishes cruise control as a benchmark feature in the premium category. Conversely, the Aftermarket segment, while mature, remains vital for extending the lifespan and functionality of older motorcycles and providing customized solutions. Aftermarket growth is sustained by riders seeking cost-effective upgrades and the widespread availability of bolt-on or plug-and-play kits, especially for popular models, ensuring market penetration across the broader motorcycle owner demographic.

- By Technology

- Electronic Cruise Control (ECC)

- Mechanical Cruise Control

- By Motorcycle Type

- Touring Motorcycles

- Cruiser Motorcycles

- Adventure Motorcycles

- Sport Motorcycles

- Standard/Commuter Motorcycles

- By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Motorcycle Cruise Control Market

The value chain for the Motorcycle Cruise Control Market begins with upstream activities focused on the sourcing of critical electronic and mechanical components, including microcontrollers (MCUs), sensors (especially radar/LiDAR for ACC), actuators, and specialized wiring harnesses. Key suppliers in this phase are semiconductor manufacturers and electronic component specialists who provide high-grade, reliable parts that meet stringent automotive safety standards (ASIL classification). The midstream phase is dominated by cruise control system developers and Tier 1 suppliers, who focus on system design, software development (including proprietary control algorithms), system integration, and rigorous testing. This stage involves significant R&D investment to ensure seamless compatibility with diverse engine management systems (ECUs) and throttle-by-wire architectures prevalent across different motorcycle OEMs.

Downstream activities involve the crucial integration and distribution phases. For the OEM sales channel, the systems are integrated directly onto the motorcycle assembly line. This requires close collaboration between the Tier 1 suppliers and the motorcycle manufacturers (OEMs) to tailor the software and hardware specifically for each model variant. In the aftermarket channel, distribution is handled by authorized distributors, online retailers, and specialized motorcycle parts shops. Direct distribution is often utilized by specialized aftermarket manufacturers who maintain their own e-commerce platforms and global installer networks, offering installation support and direct technical feedback to end-users, thus bypassing traditional retail layers for custom solutions.

The distribution channel bifurcates into direct and indirect routes. Direct channels involve the OEM sales route, where the system is sold directly to the motorcycle manufacturer and fitted at the factory, representing the largest volume and value segment. Indirect channels are more prevalent in the aftermarket, utilizing distributors, large-scale third-party e-commerce platforms (like Amazon or specialized motorcycle parts websites), and physical brick-and-mortar retailers. The complexity of electronic systems often necessitates professional installation, meaning certified dealer networks and specialized motorcycle mechanics play a crucial role in the aftermarket distribution and service lifecycle, acting as essential intermediaries to ensure correct fitment and calibration for optimal performance and safety, thereby validating the integrity of the overall value proposition.

Motorcycle Cruise Control Market Potential Customers

The primary end-users and buyers of Motorcycle Cruise Control systems are segmented based on their riding profile and the type of machine they operate, predominantly gravitating towards those requiring reduced physical strain during long-haul travel. The core customer base comprises owners of high-displacement touring motorcycles (e.g., Harley-Davidson Ultra Classic, BMW K 1600 GT, Honda Gold Wing) and adventure touring bikes (e.g., KTM 1290 Super Adventure, Ducati Multistrada V4). These riders prioritize comfort, safety, and the integration of sophisticated electronics, making them ideal targets for factory-installed Electronic Cruise Control and the emerging Adaptive Cruise Control (ACC) features. Their purchasing decisions are often guided by premium features, brand reputation, and seamless technological integration provided by the OEM.

A secondary, yet rapidly expanding, segment of potential customers includes owners of middle-weight adventure and cruiser motorcycles (typically 500cc to 900cc) who use their bikes for extended weekend trips and longer commutes. While this group may not always purchase the highest-spec touring models, they actively seek aftermarket solutions to enhance the comfort of their rides. For this segment, the buying criteria are focused on ease of installation, reliability, and cost-effectiveness. Aftermarket manufacturers specifically target these consumers by offering universally compatible or model-specific electronic kits that require moderate technical expertise for installation, thus broadening the accessibility of cruise control technology beyond the ultra-premium segment.

Furthermore, fleet operators and commercial entities utilizing motorcycles for long-distance logistics or enforcement duties represent a niche but growing customer base. For these organizational buyers, the benefit of cruise control extends beyond individual rider comfort to standardized operational procedures, potential reduction in fuel costs through optimized speed, and improved compliance with mandated speed limits during high-volume route runs. The procurement process for this segment is heavily influenced by total cost of ownership (TCO), long-term durability, and the supplier's ability to provide bulk maintenance and support services, positioning reliability and fleet management features as key differentiators in their purchasing matrix, irrespective of whether they opt for OEM or specialized fleet aftermarket installation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Kawasaki Heavy Industries, Rostra Accessories, Command Electronics, Kaoko Throttle Controls, MCCruise, OmniCruise, Techlusion Inc., Goldstrike, Show Chrome Accessories, Motorcycle Innovations, Womet-Tech, Dynojet Research, Motogadget |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Motorcycle Cruise Control Market Key Technology Landscape

The technological landscape of the Motorcycle Cruise Control Market is rapidly evolving, shifting predominantly from simple mechanical throttle locks to sophisticated electronic systems managed by complex algorithms. The current standard bearer is Electronic Cruise Control (ECC), which necessitates a ride-by-wire (RBW) throttle system, allowing the Electronic Control Unit (ECU) to precisely regulate the throttle position electronically, ensuring smooth and accurate speed maintenance. This technology relies heavily on robust sensors to monitor wheel speed, gear position, and clutch status, guaranteeing that the system disengages safely and instantaneously when necessary. Key advancements in ECC focus on miniaturization of control components, enhanced weatherproofing, and improved software integration to minimize latency and optimize fuel mapping while cruising, making the system feel seamless to the rider.

The most significant emerging technology shaping the market is Adaptive Cruise Control (ACC), which utilizes advanced sensor technologies, primarily radar (both front and rear), to provide longitudinal control, dynamically adjusting speed to maintain a predetermined safe following distance from vehicles ahead. ACC systems on motorcycles face unique challenges compared to cars, particularly concerning lean angle and stability. Suppliers like Bosch and Continental have developed specialized motorcycle-specific radar units that are compact, lightweight, and capable of functioning reliably even when the bike is leaning into a turn. The development focus is currently on sophisticated software algorithms that safely manage deceleration and acceleration in variable traffic, ensuring rider comfort and safety, and minimizing intrusive interventions.

Beyond ACC, the technology landscape includes the development of Predictive Cruise Control (PCC), which integrates GPS mapping and connectivity to anticipate changes in road conditions, such as steep gradients or upcoming sharp turns, and pre-adjust the cruising speed proactively. Furthermore, connectivity and Over-the-Air (OTA) update capabilities are becoming standard, enabling manufacturers to refine algorithms, introduce new features, and patch security vulnerabilities in the cruise control software post-sale. Material science also plays a subtle role, with advancements in durable, lightweight casing and robust electrical connectors enhancing the reliability of both OEM and aftermarket cruise control components against vibration and environmental extremes inherent to motorcycle operation, collectively pushing the boundaries of what these rider aids can achieve.

Regional Highlights

- North America: North America represents a mature and high-value market segment for motorcycle cruise control, dominated by a strong culture of long-distance touring, particularly within the US and Canada. The region exhibits high adoption rates of both OEM and premium aftermarket electronic cruise control systems, driven by the popularity of large V-twin cruisers and high-end adventure bikes. The regulatory environment generally supports safety-enhancing technologies, and consumers possess the disposable income necessary to purchase motorcycles where cruise control is often standard. This region is also a key early adopter of advanced features like Adaptive Cruise Control (ACC) due to consumer appetite for cutting-edge technology and extensive interstate highway systems conducive to long-haul cruising.

- Europe: Europe stands as a highly competitive and technologically advanced market. Strict safety regulations (e.g., Euro 5/6 standards) indirectly encourage the adoption of sophisticated electronic systems, including advanced cruise control, often mandating ride-by-wire throttle systems that simplify ECC implementation. Western European countries, particularly Germany, the UK, and France, exhibit robust demand stemming from frequent interstate travel and a strong market for premium sports-touring and adventure motorcycles. Manufacturers are intensely focused on integrating cruise control seamlessly into comprehensive ARAS packages to meet sophisticated consumer demands and regulatory conformity, thereby securing Europe as a leader in technological standardization.

- Asia Pacific (APAC): The APAC region is poised for the fastest growth, largely fueled by burgeoning motorcycle markets in China, India, and ASEAN countries. While historically focused on smaller displacement commuter bikes, rising disposable incomes are driving a sharp increase in the sale of mid-to-high displacement premium motorcycles (500cc+). This demographic shift is directly translating into increased demand for comfort and convenience features like cruise control. The market here is unique due to the strong presence of local manufacturers and highly competitive pricing, necessitating cost-effective electronic solutions that can be adapted for diverse road conditions and varying quality of infrastructure. Aftermarket growth is also substantial as riders upgrade their relatively newer mid-size bikes.

- Latin America (LATAM): The LATAM market, characterized by economic variability, presents moderate but steady growth potential. The market is primarily driven by the expansion of the adventure and touring segments, particularly in countries like Brazil and Mexico. Adoption is currently focused on mid-range electronic cruise control systems in the OEM segment, often subsidized through local manufacturing initiatives or regional trade agreements. Aftermarket penetration is crucial here, catering to a large population of older motorcycles requiring affordable and rugged mechanical or basic electronic retrofit solutions capable of withstanding diverse climatic and road environments typical of the region.

- Middle East and Africa (MEA): The MEA region is a small yet emerging market, with demand concentrated in affluent Gulf Cooperation Council (GCC) nations. High ambient temperatures necessitate robust and reliable electronic systems. The consumer base is highly focused on luxury and premium motorcycle brands, thus favoring sophisticated OEM-fitted electronic and adaptive cruise control systems. Growth is projected to be steady, primarily linked to infrastructure investment and the increased popularity of recreational touring, though market size remains constrained by socio-economic factors in the broader African continent, where focus remains heavily on basic commuter transportation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Motorcycle Cruise Control Market.- Bosch (Robert Bosch GmbH)

- Continental AG

- Kawasaki Heavy Industries (OEM integration specialists)

- Rostra Accessories

- Command Electronics

- Kaoko Throttle Controls

- MCCruise

- OmniCruise

- Techlusion Inc.

- Goldstrike

- Show Chrome Accessories

- Motorcycle Innovations

- Womet-Tech

- Dynojet Research

- Motogadget

- Beetle Speed

- Throttlemeister

- Audiovox Corporation (Specialty Electronics Division)

- BMW Motorrad (Internal Development)

- Honda Motor Co., Ltd. (Internal Development)

Frequently Asked Questions

Analyze common user questions about the Motorcycle Cruise Control market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Mechanical and Electronic Motorcycle Cruise Control?

Mechanical cruise control utilizes a physical locking mechanism (throttle lock) to hold the throttle grip position, offering basic speed maintenance but requiring manual disengagement. Electronic Cruise Control (ECC) uses the motorcycle’s ECU (Engine Control Unit) and ride-by-wire system to precisely manage engine output and maintain speed digitally, offering smoother operation and automatic disengagement upon braking or clutch use, significantly enhancing safety and reliability.

Is Adaptive Cruise Control (ACC) available for motorcycles, and how does it function?

Yes, Adaptive Cruise Control (ACC) is currently available on high-end motorcycle models from major OEMs. ACC uses front-mounted radar sensors to monitor the distance to vehicles ahead. It automatically adjusts the motorcycle's speed and maintains a safe, predetermined following distance without continuous rider input, enhancing safety during highway traffic conditions.

Are aftermarket motorcycle cruise control systems safe to install on older bikes?

Aftermarket electronic cruise control systems designed for older motorcycles (without factory ride-by-wire) are generally safe if installed correctly by a certified technician and compatible with the bike's existing electrical system. Mechanical throttle locks are less complex but offer fewer safety features and should only be used temporarily, requiring vigilance from the rider, as they do not automatically disengage.

Which motorcycle segment drives the highest demand for cruise control systems?

The Touring and Adventure motorcycle segments (typically 600cc and above) drive the highest demand. Riders in these segments routinely undertake long-distance journeys, making features that minimize rider fatigue and maximize comfort, such as sophisticated electronic cruise control, essential standard equipment.

How will AI and connected technologies influence the future of motorcycle cruise control?

AI will lead to the proliferation of Predictive Cruise Control (PCC), integrating GPS and real-time traffic data to optimize cruising speed based on road conditions proactively. Connected technologies will enable Over-the-Air (OTA) software updates, improving system accuracy, introducing new features, and enhancing diagnostics for cruise control components, moving towards highly personalized and intelligent rider assistance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager