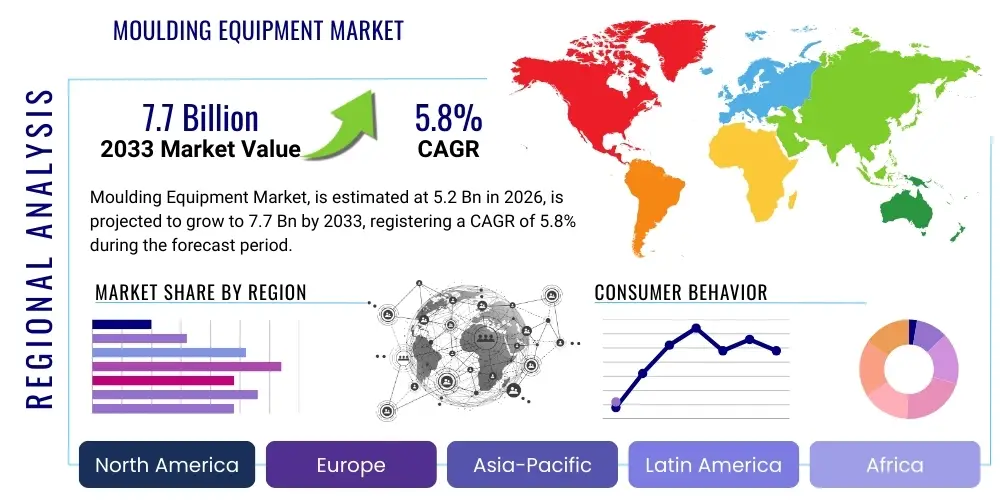

Moulding Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443530 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Moulding Equipment Market Size

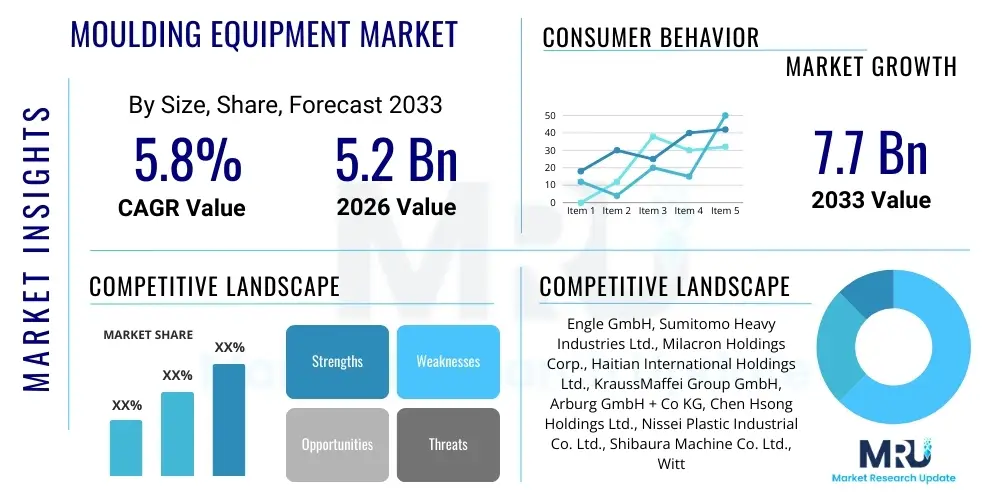

The Moulding Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Moulding Equipment Market introduction

The Moulding Equipment Market encompasses sophisticated machinery designed for manufacturing parts by shaping liquid or pliable raw materials, such as plastics, metals, ceramics, and composites, through the use of a rigid frame called a mold or matrix. This equipment category is pivotal to modern industrial production, providing high-volume, repeatable manufacturing capabilities crucial for sectors demanding precision and scalability. Key equipment types include injection moulding machines, blow moulding machines, compression moulding machines, and rotational moulding systems, each optimized for specific material properties and end-product geometries. The continuous technological evolution in this domain focuses on achieving higher energy efficiency, faster cycle times, and enhanced automation capabilities to meet stringent quality requirements globally.

The principal applications for moulded products span across the automotive industry, where lightweight components are vital for fuel efficiency; the packaging sector, driven by consumer goods demand; and the medical device industry, necessitating ultra-precise, sterile components. The inherent benefit of moulding equipment lies in its ability to produce complex shapes with minimal material waste and high consistency, significantly reducing per-unit manufacturing costs in large-scale operations. Furthermore, the shift towards sustainable manufacturing practices has spurred innovation in moulding machinery capable of processing recycled and bio-based polymers, aligning industrial outputs with global environmental goals.

Market growth is predominantly driven by the rapid expansion of end-user industries, particularly the burgeoning consumer electronics and electric vehicle (EV) markets, which require highly specialized plastic and composite components. Economic development in emerging nations, leading to increased domestic manufacturing capacity, further stimulates demand for state-of-the-art moulding machinery. The ongoing implementation of Industry 4.0 principles, including integration of IoT and predictive analytics into moulding processes, enhances operational efficiencies and output quality, thereby encouraging capital investment in next-generation equipment.

- Product Description: Machinery used to shape materials (plastics, metals) into desired forms using molds, including injection, blow, compression, and extrusion types.

- Major Applications: Automotive component manufacturing, consumer packaging, medical devices, construction materials, and aerospace components.

- Benefits: High precision and repeatability, fast cycle times, mass production capacity, excellent material utilization, and geometric complexity handling.

- Driving Factors: Growth in the automotive and medical sectors, rising demand for lightweight plastic components, and increasing adoption of industrial automation and smart factory technologies.

Moulding Equipment Market Executive Summary

The Moulding Equipment Market is characterized by intense technological competition focused on automation, energy efficiency, and material handling versatility. Current business trends indicate a strong move toward all-electric and hybrid moulding machines, replacing traditional hydraulic systems due to their superior precision and significant reduction in energy consumption and operational noise. Manufacturers are increasingly integrating robotic arms and sophisticated material handling systems directly into the moulding cell, facilitating lights-out manufacturing and minimizing human error. Furthermore, strategic mergers and acquisitions among key market players aim to consolidate technological expertise, particularly in advanced simulation and design software that optimizes mold performance and reduces tooling time.

Geographically, the Asia Pacific region, particularly China and India, maintains market dominance, driven by robust manufacturing sectors, high rates of urbanization, and substantial foreign direct investment in automotive and electronics production hubs. North America and Europe, while slower in terms of production volume growth compared to APAC, lead in the adoption of high-precision, specialized moulding equipment for demanding applications such as aerospace and advanced healthcare. Regional growth is contingent upon localized economic policies, tariffs on manufacturing components, and regional commitments to industrial digitalization initiatives that favor investment in new machinery.

Segmentation analysis highlights the injection moulding segment as the largest revenue generator, benefiting from its unparalleled versatility in producing components ranging from intricate electronic casings to large automotive panels. Within end-user segments, the automotive industry represents a primary consumer, driven by the shift towards electric vehicles requiring numerous specialized plastic and composite components for battery housings and interior structures. There is also notable growth in the medical segment, spurred by the aging global population and continuous innovation in disposable diagnostic and therapeutic devices, demanding exceptionally clean and precise moulding capabilities.

AI Impact Analysis on Moulding Equipment Market

Common user inquiries regarding AI's influence on the Moulding Equipment Market frequently revolve around optimizing cycle times, achieving zero-defect production, predicting machine failure, and reducing energy expenditure. Users are keen to understand how AI-driven process control systems can eliminate material waste associated with trial-and-error setups, particularly when dealing with complex or new polymer formulations. Concerns often center on the necessary integration cost, the expertise required to manage sophisticated AI algorithms, and data security issues related to proprietary production parameters. The expectation is that AI will move moulding equipment from reactive maintenance schedules to fully predictive, prescriptive manufacturing environments.

AI is fundamentally transforming the operational paradigm of moulding equipment by enabling real-time, closed-loop process optimization. Machine learning algorithms analyze vast datasets streaming from IoT sensors within the mold cavity, screw rotation mechanisms, and temperature controllers. This data is used to instantaneously adjust parameters such as injection speed, holding pressure, and cooling time, compensating for external variables like ambient temperature or minor material batch inconsistencies. The result is unprecedented consistency in component quality, reduction in scrap rates, and maximized output efficiency, surpassing the capabilities of traditional human-supervised control systems.

Furthermore, AI significantly enhances predictive maintenance schedules. By analyzing vibration data, power consumption anomalies, and component wear indicators, AI models can forecast the exact timing of component failure (e.g., heater band burnout or hydraulic pump degradation). This predictive capability minimizes unexpected downtime, allowing for scheduled maintenance during non-production hours, thereby increasing overall equipment effectiveness (OEE). The application of AI in visual inspection systems also automates quality control, utilizing deep learning to identify subtle defects invisible to the human eye, ensuring only flawless components proceed down the manufacturing line.

- Predictive Maintenance: AI analyzes sensor data (vibration, temperature, power draw) to forecast component failure, drastically reducing unscheduled downtime and optimizing maintenance schedules.

- Process Optimization: Machine learning algorithms dynamically adjust injection speed, pressure, and temperature parameters in real-time, optimizing cycle times and minimizing energy consumption based on current material conditions.

- Automated Quality Control: Deep learning vision systems inspect molded parts instantly, identifying micro-defects with higher accuracy and speed than human operators or traditional machine vision, leading to near-zero defect rates.

- Tooling Lifecycle Management: AI models predict mold wear and tear, advising on optimal cleaning, repair, or replacement timing to maintain high-quality outputs over the lifespan of the tool.

- Energy Efficiency: Algorithms correlate production variables with energy usage, identifying opportunities to reduce power consumption without compromising production quality or speed.

DRO & Impact Forces Of Moulding Equipment Market

The Moulding Equipment Market is significantly influenced by a complex interplay of internal and external factors encapsulated by Drivers, Restraints, and Opportunities, collectively forming the critical impact forces shaping the industry trajectory. Primary drivers include the global expansion of high-volume manufacturing sectors, particularly packaging and automotive lightweighting initiatives that necessitate precision-molded components. The inherent demand for high throughput and consistent quality pushes manufacturers to invest in advanced, faster moulding systems. However, these drivers are counterbalanced by significant restraints, primarily the high initial capital expenditure associated with purchasing and installing sophisticated, automated moulding equipment, and the substantial operational cost related to energy consumption and specialized maintenance.

Opportunities for market expansion are strongly rooted in technological advancements, notably the integration of Industry 4.0 technologies such as IoT connectivity, advanced robotics, and specialized software for process simulation and optimization. This digitalization offers manufacturers the chance to enhance efficiency, reduce material waste, and improve operational transparency, leading to faster return on investment. Furthermore, the burgeoning demand for specialized medical and aerospace components, requiring ultra-clean room manufacturing and highly controlled processes, presents premium market segments for high-end equipment manufacturers specializing in complex materials like specialized polymers and advanced composites.

The immediate impact forces driving market decisions include stringent environmental regulations across Europe and North America focusing on resource efficiency and waste reduction, compelling equipment providers to offer energy-efficient and material-recycling solutions. Additionally, global supply chain volatility impacts the procurement of raw materials and electronic components necessary for equipment manufacturing, influencing pricing and lead times. The cyclical nature of the automotive and construction industries also exerts a strong force, directly affecting capital spending plans for large-scale moulding machinery purchases, requiring market players to maintain diversified application portfolios to mitigate sector-specific downturn risks.

- Drivers (D): Increased demand for high-volume, lightweight components in automotive and aerospace; rapid growth in the packaging sector; advancements in automation and IoT integration; expansion of the healthcare and medical device manufacturing.

- Restraints (R): High initial investment costs for advanced moulding machinery; complex maintenance requirements and need for specialized technical skillsets; volatility in raw material (polymer/metal) prices; high energy consumption in traditional hydraulic systems.

- Opportunities (O): Development of all-electric and hybrid machines for improved energy efficiency; customization capabilities for processing novel materials (e.g., bioplastics, specialized composites); expansion into emerging markets (APAC); adoption of AI for predictive quality control.

- Impact Forces: Environmental regulations mandating energy efficiency; technological substitution risks from additive manufacturing (3D printing); global economic instability affecting capital expenditure; intense competitive pricing pressure.

Segmentation Analysis

The Moulding Equipment Market segmentation offers a granular view of diverse technological capabilities and application domains, primarily categorized by equipment type, end-user industry, and operational characteristics such as machine capacity or automation level. This structure allows market participants to tailor their offerings to specific industrial needs, ranging from high-tonnage machines required for large automotive parts to micro-moulding equipment necessary for intricate medical components. Understanding these segments is crucial for strategic planning, as each category responds differently to macro-economic trends and technological innovations, with segments like injection moulding generally dominating due to their versatility and scale.

By equipment type, the market is broadly segmented into Injection Moulding, Blow Moulding, Compression Moulding, Extrusion Moulding, and Rotational Moulding. Injection moulding machines, further divided into hydraulic, electric, and hybrid types, constitute the largest segment, driven by their ability to handle complex geometries and high material variability. Blow moulding is dominant in the packaging sector (bottles, containers), while compression moulding is gaining traction in the automotive and aerospace composite fields due to its suitability for thermoset materials and structural parts. These technological distinctions define market specialization and competitive advantage.

The segmentation by end-user industry illustrates the broad applicability of moulding technology. Key sectors include Automotive (responsible for interior, exterior, and under-hood components), Packaging (high-volume production of bottles, caps, and films), Healthcare (disposable syringes, diagnostic kits, and implants), and Consumer Goods (housing, appliances, and electronics). The rapid digitalization and electrification trends are particularly influencing the Automotive and Consumer Electronics segments, driving demand for high-performance, precision-moulded plastic parts that meet stringent safety and lightweighting standards.

- By Equipment Type: Injection Moulding Machines (Hydraulic, Electric, Hybrid), Blow Moulding Machines (Extrusion, Injection, Stretch), Compression Moulding Machines, Extrusion Moulding Lines, Rotational Moulding Equipment, Thermoforming Equipment.

- By Operating Technology: Fully Automatic, Semi-Automatic, Manual.

- By End-User Industry: Automotive, Packaging, Healthcare & Medical, Consumer Goods & Electronics, Construction, Aerospace & Defense, Industrial Machinery.

- By Clamping Force/Tonnage: Low Tonnage (<200 Tons), Medium Tonnage (200-500 Tons), High Tonnage (>500 Tons).

Value Chain Analysis For Moulding Equipment Market

The value chain for the Moulding Equipment Market begins with upstream activities involving the sourcing and processing of core raw materials and components necessary for machine construction. This includes high-grade steel and specialized alloys for mold bases and platens, precision electrical and electronic components (e.g., servo motors, controllers, PLCs), and hydraulic systems (for non-electric machines). Key upstream suppliers include metal processing firms, specialized component manufacturers, and software developers providing advanced simulation and control systems. The efficiency and cost-effectiveness of this stage are critical, as component quality directly dictates the lifespan, precision, and performance of the final moulding machine, necessitating strong supplier relationships and rigorous quality inspection protocols.

The core manufacturing stage involves the design, assembly, testing, and customization of the moulding equipment. Leading manufacturers invest heavily in R&D to improve machine features such as energy efficiency, automation capabilities, and compatibility with new materials. After manufacturing, the downstream segment focuses on distribution, installation, and post-sales support. Distribution channels vary, including direct sales teams for large, complex installations (especially for high-tonnage machines) and indirect networks utilizing regional distributors and agents who often provide localized support and financing solutions to smaller or geographically isolated customers. The sales process is highly technical, often requiring consultation and customization based on the client's specific production requirements.

The final phase of the value chain is focused on maximizing customer lifetime value through specialized services. This includes comprehensive maintenance contracts, supply of spare parts, retrofitting services for older machines, and ongoing training for client operational staff on new software and automation features. Direct distribution channels are often preferred for premium equipment to maintain control over installation quality and ensure immediate technical support, which is a major differentiator in this capital-intensive market. Indirect channels, however, prove highly effective for penetrating local markets and providing necessary after-sales service in regions where direct presence is economically unfeasible, requiring robust technical transfer agreements between the OEM and the distributor.

Moulding Equipment Market Potential Customers

Potential customers for moulding equipment are predominantly high-volume manufacturers across various industrial sectors that rely on consistent, standardized production of components. The largest buyer group comprises automotive Tier 1 and Tier 2 suppliers who utilize large-scale injection and compression moulding equipment for parts ranging from interior dashboards and lighting fixtures to critical structural components and battery enclosures in electric vehicles. The shift towards lightweight materials like specialized plastics and composites in the automotive industry ensures continuous, cyclical demand for updated, high-tonnage machinery capable of processing these advanced compounds with precision and speed.

Another significant customer segment is the packaging industry, which necessitates high-speed, multi-cavity blow moulding and injection moulding machines for the continuous production of bottles, containers, caps, and closures for beverages, food products, and personal care items. These customers prioritize machine speed, reliability, and low cycle times to maintain competitive production costs. Furthermore, the stringent hygiene and material traceability requirements in the medical and pharmaceutical sectors create a specialized demand for electric, clean-room compliant injection moulding equipment used for manufacturing disposable surgical instruments, drug delivery devices, and diagnostic kits, where precision and zero contamination are non-negotiable requirements.

Beyond these major industrial buyers, potential customers also include custom moulding service providers (job shops) who serve various industries needing small to medium-batch specialized parts. These providers require highly versatile, quick-change tooling systems and flexible machinery that can rapidly switch between different materials and mold configurations. Finally, manufacturers in the construction sector utilize moulding equipment for piping and structural fittings, while the consumer electronics industry relies on micro-moulding technology for highly intricate and thin-walled casings and connectors, demonstrating the pervasive and diversified demand base for this capital machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Engle GmbH, Sumitomo Heavy Industries Ltd., Milacron Holdings Corp., Haitian International Holdings Ltd., KraussMaffei Group GmbH, Arburg GmbH + Co KG, Chen Hsong Holdings Ltd., Nissei Plastic Industrial Co. Ltd., Shibaura Machine Co. Ltd., Wittmann Battenfeld GmbH, Husky Injection Moulding Systems Ltd., Fanuc Corporation, Toyo Machinery & Metal Co. Ltd., Windsor Machines Ltd., The Japan Steel Works Ltd. (JSW), Shini Plastics Technologies Inc., Cosmos Machinery Ltd., Premier Tech Ltd., Bole Machinery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Moulding Equipment Market Key Technology Landscape

The Moulding Equipment Market is undergoing a rapid technological transformation, fundamentally driven by the mandates of Industry 4.0 and the increasing complexity of materials being processed. A defining trend is the migration from traditional hydraulic machines to all-electric and hybrid systems. All-electric machines offer superior energy efficiency, consuming significantly less power than hydraulic counterparts, and provide exceptional precision, repeatability, and quieter operation, making them essential for medical and consumer electronics moulding. Hybrid machines offer a balance, leveraging electric drives for non-pressurized axes while maintaining hydraulic power for clamping or high-force injection, providing an optimal cost-to-performance ratio for mid-range applications.

Furthermore, connectivity and data utilization are paramount. Modern moulding equipment integrates extensive sensor technology and Internet of Things (IoT) platforms, allowing for real-time monitoring of critical process variables such as melt temperature, cavity pressure, and cooling fluid flow. This data is essential for enabling advanced control systems, including closed-loop feedback mechanisms that adjust machine operation instantaneously to compensate for process variations. This connectivity facilitates communication not only within the moulding cell (with robotics and conveyors) but also with centralized Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) systems, enabling comprehensive operational transparency and efficiency tracking across the entire facility.

Specialized tooling and auxiliary equipment also represent a crucial technological segment. Advanced mold design utilizes conformal cooling channels, often fabricated using additive manufacturing (3D printing), which allows for cooling paths that closely follow the contour of the part, significantly reducing cooling time—a major component of the overall cycle time. Additionally, auxiliary equipment like high-performance material dryers, automated material handling systems, and advanced robotics for part removal and secondary operations are essential components of a modern, fully automated moulding cell. Innovation in these peripheral technologies directly contributes to the overall efficiency and competitive positioning of the primary moulding machine.

Regional Highlights

Asia Pacific (APAC) dominates the global Moulding Equipment Market, driven primarily by the colossal manufacturing bases in China, India, Japan, and South Korea. China, in particular, is the largest consumer and producer of moulding machinery, fueled by aggressive growth in consumer electronics, automotive manufacturing (including a high concentration of EV production), and a rapidly expanding domestic packaging sector. Favorable government policies promoting manufacturing investment, lower labor costs, and a substantial domestic supplier ecosystem for parts and raw materials continue to anchor the region’s leadership position, although competition is intensifying with the adoption of high-precision equipment imported from Europe and Japan.

North America and Europe represent mature markets characterized by high demand for specialized, high-precision, and energy-efficient moulding equipment. In these regions, growth is less driven by capacity expansion and more by technological upgrade cycles and regulatory compliance. European manufacturers, particularly in Germany and Italy, are global leaders in producing advanced all-electric injection moulding machines and complex automation solutions. The focus is heavily on applications requiring extremely tight tolerances, such as those found in medical devices, aerospace components, and highly engineered automotive parts, necessitating superior machine performance and comprehensive digital integration capabilities (Industry 4.0).

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting moderate growth, largely dependent on infrastructure development and localized industrialization efforts. In LATAM, Brazil and Mexico are primary consumers, driven by domestic automotive assembly and packaging demand. MEA growth is concentrated in specific industrial hubs, often tied to oil and gas infrastructure (requiring specialized piping and components) and consumer goods production. These regions typically favor reliable, medium-cost equipment, often imported from APAC or older generation machinery from North America, but increasing investment in medical and high-tech sectors is gradually driving demand for newer, more advanced machinery.

- Asia Pacific (APAC): Dominant market share due to large-scale manufacturing (China, India); high concentration of electronics and automotive production; strong demand for both standard and high-speed machinery.

- North America: Focus on technological sophistication; high adoption rate of all-electric machines; strong demand from the medical device, aerospace, and high-performance automotive sectors; emphasis on automation and reducing labor dependency.

- Europe: Leading innovation hub for energy-efficient and precision moulding equipment; driven by stringent environmental regulations (EU mandates) and high standards in automotive and specialized engineering; strong presence of key equipment manufacturers (Germany, Austria, Italy).

- Latin America (LATAM): Growth tied to domestic manufacturing in Brazil and Mexico; increasing foreign investment in automotive and consumer goods; demand focused on general-purpose injection and blow moulding equipment.

- Middle East & Africa (MEA): Emerging markets with growth tied to construction, infrastructure projects, and localized packaging needs; adoption of technology is segmented, with high-end specialized equipment used in oil & gas and medical sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Moulding Equipment Market.- Engle GmbH

- Sumitomo Heavy Industries Ltd.

- Milacron Holdings Corp. (now part of Hillenbrand)

- Haitian International Holdings Ltd.

- KraussMaffei Group GmbH

- Arburg GmbH + Co KG

- Chen Hsong Holdings Ltd.

- Nissei Plastic Industrial Co. Ltd.

- Shibaura Machine Co. Ltd. (formerly Toshiba Machine)

- Wittmann Battenfeld GmbH

- Husky Injection Moulding Systems Ltd.

- Fanuc Corporation

- Toyo Machinery & Metal Co. Ltd.

- Windsor Machines Ltd.

- The Japan Steel Works Ltd. (JSW)

- Shini Plastics Technologies Inc.

- Cosmos Machinery Ltd.

- Premier Tech Ltd.

- Bole Machinery

- Sodick Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Moulding Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of all-electric moulding machines?

The primary driver is the superior energy efficiency and operational precision offered by all-electric machines compared to traditional hydraulic systems. They provide faster cycle times, highly accurate repeatability, and are essential for meeting stringent quality standards in high-value sectors like medical and consumer electronics, while also reducing operational energy costs significantly.

How is Industry 4.0 influencing the competitive landscape of moulding equipment?

Industry 4.0 integration, specifically through IoT sensors, AI-driven process optimization, and predictive maintenance capabilities, is enhancing machine efficiency and reliability. This trend favors manufacturers who can offer comprehensive connectivity solutions and digital services, shifting competition from hardware specifications alone to overall system performance and data-driven intelligence.

Which end-user segment holds the largest market share for moulding equipment?

The Automotive industry currently holds the largest market share, driven by the persistent global trend toward vehicle lightweighting and the increasing demand for complex plastic components required for electric vehicle battery systems, interiors, and exteriors. This necessitates high-tonnage injection and compression moulding solutions.

What challenges do manufacturers face regarding material variability in the moulding process?

Processing recycled polymers or new specialized composites presents challenges related to inconsistent material flow behavior and thermal properties. Modern moulding equipment addresses this through advanced control algorithms and AI systems that monitor melt viscosity and adjust injection parameters dynamically to ensure consistent part quality despite raw material variations.

What is the growth outlook for the Moulding Equipment Market in the Asia Pacific region?

The APAC region is projected to experience robust growth, sustaining its market leadership throughout the forecast period. This growth is underpinned by substantial domestic demand, continuous industrialization, and strong governmental support for local manufacturing, particularly in high-growth segments like consumer electronics and electric vehicle components production in nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager