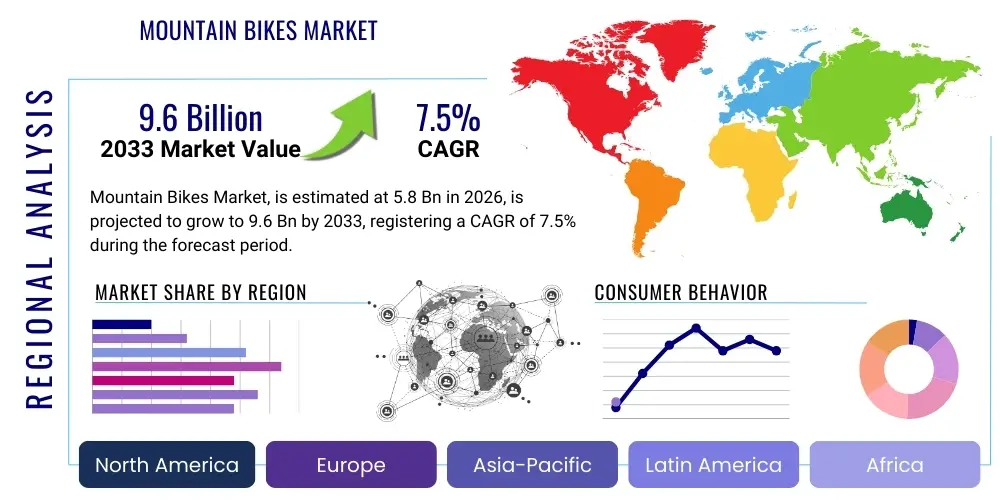

Mountain Bikes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443024 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Mountain Bikes Market Size

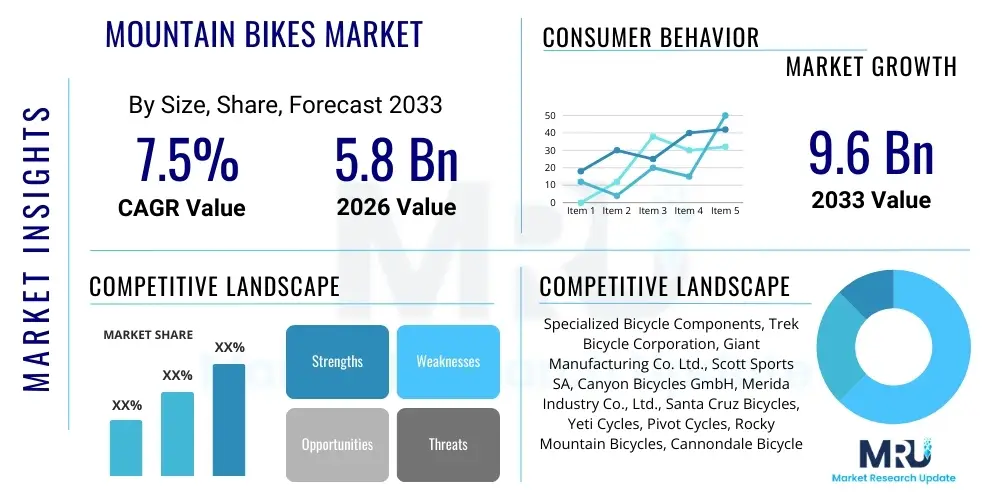

The Mountain Bikes Market is experiencing robust expansion driven by increasing participation in adventure sports, rising health consciousness, and significant technological advancements in bike components and design. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. This consistent growth trajectory is supported by the rapid adoption of electric mountain bikes (E-MTBs) which appeal to a broader consumer demographic seeking accessibility to challenging terrains.

The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.6 Billion by the end of the forecast period in 2033. This substantial increase reflects not only higher unit sales but also an escalating Average Selling Price (ASP) resulting from the consumer preference for high-performance bikes incorporating premium materials like carbon fiber and advanced electronic suspension systems. Developed regions, particularly North America and Europe, continue to dominate the market in terms of value due to established cycling cultures and high disposable incomes, while emerging economies in the Asia Pacific are witnessing explosive growth in volume driven by infrastructure development and government initiatives promoting cycling as a form of recreation and sustainable transportation.

Mountain Bikes Market introduction

The Mountain Bikes Market encompasses the manufacturing, distribution, and sale of bicycles specifically designed for off-road cycling. These bikes are characterized by durable frames, large knobby tires for superior traction, powerful braking systems, and sophisticated suspension mechanisms engineered to handle rugged trails, dirt roads, and challenging natural terrain. The product range is extensive, including categories such as cross-country (XC), trail, enduro, downhill, and electric mountain bikes (E-MTBs), each tailored for specific riding styles and performance requirements. Major applications span recreational cycling, competitive racing, professional training, and adventure tourism, appealing to a diverse consumer base ranging from novice enthusiasts to seasoned athletes. The core benefits delivered by modern mountain bikes include enhanced durability, superior handling, increased safety on technical terrain, and significant physiological benefits for the rider.

Key driving factors fueling the market expansion include the global surge in outdoor recreational activities, accelerated interest in health and fitness post-pandemic, and continuous innovation in material science and component technology. The integration of lighter, stronger frame materials such as advanced aluminum alloys and carbon composites has significantly improved performance, reducing overall bike weight while increasing structural rigidity and responsiveness. Furthermore, the proliferation of specialized bike parks and trail systems developed by municipal and private entities worldwide provides readily accessible venues, thereby lowering the barrier to entry for new riders and stimulating demand for segment-specific equipment.

Technological advancement, particularly in full-suspension systems and drivetrain efficiency, plays a crucial role in market dynamics. Modern mountain bikes feature highly complex geometries and adjustable suspension kinematics, allowing riders to fine-tune performance based on trail conditions and personal preference. The introduction and rapid commercialization of 1x (single chainring) drivetrains have simplified gear shifting, improved chain retention, and reduced bike weight, setting a new industry standard. These innovations, combined with effective marketing focused on the lifestyle and adventure aspects of mountain biking, ensure sustained consumer interest and drive the premiumization trend observed across all major segments.

Mountain Bikes Market Executive Summary

The Mountain Bikes Market is characterized by intense competition, rapid technological iteration, and distinct regional consumption patterns. Current business trends indicate a strong shift towards electrification, with E-MTBs becoming the most influential growth segment, challenging traditional market segmentation and attracting affluent, older riders looking to mitigate physical limitations. Manufacturers are heavily investing in vertical integration, particularly in high-end component manufacturing (suspension, batteries, motors for E-MTBs), to maintain competitive advantages and control supply chain vulnerabilities. Sustainability is also emerging as a pivotal trend; consumers increasingly favor brands that demonstrate eco-friendly manufacturing processes and utilize recyclable materials, pressuring companies to optimize their production footprints and sourcing strategies.

Segment trends demonstrate robust demand across the Trail and Enduro categories, reflecting the average consumer’s preference for versatile bikes capable of handling diverse terrain rather than highly specialized cross-country or downhill models. While the premium segment (bikes priced over $4,000) shows resilience due to performance-driven purchasing behavior, the mid-range segment is expanding rapidly in emerging markets, fueled by improving affordability and the establishment of local assembly operations. Segmentation by material reveals a steady increase in the adoption of carbon fiber in mid-to-high-end models, offering superior stiffness-to-weight ratios, essential for competitive performance and high-level recreational use. Component manufacturers are focusing on electronic integration, including wireless shifting and electronically controlled suspension, transforming the user experience and justifying premium pricing.

Regionally, North America and Europe continue to hold the largest market share in terms of revenue, driven by established trail networks, high disposable income, and strong brand loyalty. However, the Asia Pacific region, led by China and Southeast Asian countries, is forecast to exhibit the highest CAGR during the projection period. This growth is underpinned by rapid urbanization, increased government spending on cycling infrastructure, and a booming middle-class population increasingly prioritizing fitness and outdoor leisure. Latin America and the Middle East and Africa (MEA) present significant long-term opportunities, although growth currently faces headwinds related to import duties and underdeveloped specialized retail infrastructure. Strategic expansion into these developing regions often requires localized marketing, supply chain optimization, and the introduction of value-oriented models tailored to local economic conditions and trail environments.

AI Impact Analysis on Mountain Bikes Market

Analysis of common user questions regarding AI’s impact on the Mountain Bikes Market reveals key themes centered around personalization, performance optimization, and manufacturing efficiency. Users frequently inquire about how AI can refine bike component selection based on individual riding style, terrain preferences, and biometric data. There is strong user expectation regarding AI-driven suspension tuning, predicting optimal damping settings in real-time. Concerns often revolve around data privacy when utilizing interconnected biking systems and the potential cost implications of integrating complex AI hardware and software into already expensive equipment. Furthermore, professional riders and enthusiasts are keenly interested in how machine learning algorithms can analyze performance data to offer prescriptive training insights and prevent injury, transforming post-ride analysis into actionable feedback loops. The key summary is that users expect AI to transition mountain biking from a manually tuned activity to a data-driven, highly optimized, and personalized athletic endeavor.

In manufacturing, AI is expected to revolutionize supply chain management and quality control. Machine learning models can predict material stress tolerances more accurately than traditional finite element analysis, optimizing carbon layup schedules or aluminum forging processes for increased durability and reduced waste. This predictive capability directly addresses user expectations for higher reliability in high-stress components like frames and cranks. Furthermore, AI-driven demand forecasting allows manufacturers to precisely align production schedules with volatile consumer trends, particularly important given the seasonal nature of outdoor sports equipment, minimizing inventory risks and reducing lead times, thereby improving overall customer satisfaction and supply chain resilience.

For the end-user experience, AI applications extend into enhanced safety and navigation. Smart helmets or integrated bike computers powered by AI can monitor rider fatigue, detect crashes, and automatically contact emergency services, addressing critical safety concerns voiced by the adventure cycling community. Moreover, machine learning-enhanced GPS systems can recommend dynamic routes based on current weather, rider skill level, and real-time trail conditions, significantly enhancing the planning and execution of complex rides. This shift towards intelligent, connected biking systems ensures that the sport remains at the forefront of technological adoption, appealing to tech-savvy consumers while simultaneously improving accessibility and safety for all skill levels.

- Real-time electronic suspension optimization via machine learning algorithms adapting to terrain.

- AI-driven personalized frame geometry and component recommendation based on rider biomechanics and performance data.

- Predictive maintenance alerts for high-wear components (e.g., brakes, drivetrain) using sensor data analysis.

- Optimized supply chain and manufacturing efficiency, particularly for advanced carbon fiber layups, reducing material waste.

- Enhanced safety features through fatigue detection and automatic crash notification integrated into bike systems.

DRO & Impact Forces Of Mountain Bikes Market

The Mountain Bikes Market is profoundly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary Driver is the increasing global emphasis on health, fitness, and outdoor recreation, particularly amplified by a post-COVID societal shift towards individual outdoor activities. This is coupled with relentless technological innovation, especially the commercialization of Electric Mountain Bikes (E-MTBs), which has dramatically expanded the addressable market by attracting riders previously constrained by physical fitness or topographical challenges. These driving forces push the market toward higher volumes and greater revenue generation, particularly in premium and electrified segments.

However, significant Restraints temper this growth. The most critical constraint is the high initial cost associated with mid-to-high-end mountain bikes, especially those incorporating full suspension, carbon frames, and electronic components, making them luxury items inaccessible to budget-conscious consumers. Furthermore, market expansion is hindered by the lack of adequate trail infrastructure and specialized retail support in many developing regions. Environmental regulations concerning lithium-ion battery disposal and recycling, primarily relevant to the booming E-MTB segment, also pose operational and compliance challenges for manufacturers, potentially adding to production costs and complexity.

Opportunities for market growth primarily reside in geographical expansion into underserved markets, focused infrastructure investment (development of bike parks and urban trail systems), and leveraging technological convergence. The integration of connectivity features (IoT) and specialized cycling apps offers new avenues for value-added services and data monetization, appealing to the modern, data-driven consumer. The growing niche market for specialized adaptive mountain bikes (aMTBs) also presents an untapped opportunity, driven by increasing awareness and demand for inclusive outdoor sports equipment. The overall impact force is strongly positive, with technological drivers and consumer health awareness significantly outweighing cost restraints, propelling sustained, albeit premium-focused, growth.

Segmentation Analysis

The Mountain Bikes Market is meticulously segmented based on product type, frame material, application, distribution channel, and geography, allowing manufacturers to target specific rider demographics and performance needs. Product type segmentation, encompassing Cross-Country (XC), Trail, Enduro, Downhill (DH), and E-Mountain Bikes, is fundamental to market strategy, with Trail and E-MTB categories currently experiencing the fastest revenue growth due to their versatility and broader consumer appeal. Segmentation by frame material—dominated by Aluminum Alloys, Carbon Fiber, and Steel—reflects price points and performance expectations, where Carbon Fiber commands the premium segment due to its lightweight and strength characteristics, essential for competitive racing and high-performance recreational riding.

Application segmentation distinguishes between recreational use, competitive sports, and utility use, highlighting the vast scope of the market. Recreational users form the largest base, demanding durable, comfortable, and moderately priced bikes, while competitive cyclists drive demand for the most advanced, expensive, and specialized equipment. Distribution channels are diversifying, with a notable shift towards online sales and direct-to-consumer (D2C) models, which allows smaller, niche brands to compete globally, bypassing traditional Independent Bicycle Dealers (IBDs). Understanding these segments is crucial for strategic resource allocation, product development, and tailoring marketing communications to achieve optimal market penetration and yield.

- By Product Type:

- Cross-Country (XC)

- Trail Bikes

- Enduro Bikes

- Downhill/Freeride Bikes

- Electric Mountain Bikes (E-MTBs)

- Fat Bikes

- By Material:

- Aluminum Alloys

- Carbon Fiber

- Steel

- Titanium

- By Application:

- Recreational

- Competitive/Sports

- Utility/Commuting (Limited)

- By Distribution Channel:

- Independent Bicycle Dealers (IBDs)

- Specialty Sports Stores

- Online Retail/Direct-to-Consumer (D2C)

- Mass Merchandisers

Value Chain Analysis For Mountain Bikes Market

The Value Chain for the Mountain Bikes Market begins with the upstream activities centered on raw material sourcing and primary component manufacturing. Upstream suppliers are crucial, providing specialized materials such as aerospace-grade aluminum, carbon fiber prepregs, and advanced steel alloys. Key players in this stage include specialized metallurgy companies and chemical firms. A distinct feature of this upstream segment is the concentration of specialized component manufacturers—such as Shimano, SRAM, and Fox Factory—who hold proprietary technology for drivetrains, brakes, and suspension systems. These specialized suppliers often dictate technological standards and innovation pace across the entire market, holding significant bargaining power over bicycle assemblers.

The core of the value chain involves assembly and manufacturing, where bicycle brands design the frames and integrate components sourced upstream. This stage is dominated by large manufacturers, primarily based in Asia (Taiwan and China), who leverage economies of scale and expertise in complex composite and alloy fabrication. Distribution channels constitute the midstream to downstream phase, involving both direct and indirect routes. Indirect distribution relies heavily on Independent Bicycle Dealers (IBDs) who offer crucial pre-sales advice, sizing, and post-sales technical support, justifying their role despite the rise of direct sales. The direct-to-consumer (D2C) channel, facilitated by robust e-commerce platforms, is growing rapidly, offering consumers competitive pricing and reducing logistical costs for manufacturers, though it requires substantial investment in customer service infrastructure.

Downstream activities focus on the final consumer interaction, including retail, maintenance, and after-market services. Potential customers, including recreational riders, athletes, and specialized touring groups, drive the demand for comprehensive service packages and high-quality replacement parts. Aftermarket sales, including performance upgrades (e.g., custom wheels, electronic shifters) and accessories (helmets, apparel), form a significant revenue stream. The successful integration of direct and indirect channels is paramount; while D2C excels at sales efficiency, the complexity of modern mountain bikes mandates strong local IBD partnerships for assembly, warranty service, and technical repair, ensuring a high level of customer satisfaction and brand loyalty.

Mountain Bikes Market Potential Customers

Potential customers for the Mountain Bikes Market are broadly segmented into several distinct buyer profiles, ranging from casual recreational riders to specialized competitive athletes and adventure tourists. The largest demographic segment comprises general fitness and leisure enthusiasts, often middle-aged individuals with disposable income who purchase entry-to-mid-level trail or cross-country bikes for local trail usage and weekend excursions. These buyers prioritize comfort, durability, and reliable components over cutting-edge lightweight performance. The surging popularity of E-MTBs has notably expanded this profile to include older riders or those recovering from injuries, viewing the electric assist as a means to maintain their outdoor lifestyle without excessive physical strain.

A second crucial customer segment is the highly specialized and affluent competitive cyclist (Enduro, Downhill, XC racers). These buyers demand premium, highly specialized equipment, typically featuring carbon frames, electronic suspension, and the latest componentry, and are generally less price-sensitive, focusing instead on marginal performance gains and brand heritage. They are the primary consumers driving technological innovation and adopting new, high-cost materials. Furthermore, adventure tourists and cycling holiday operators represent a growing B2B potential customer base, requiring fleets of robust, often rental-grade mountain bikes that emphasize maintenance ease and extreme durability for extended, challenging trips in remote locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Scott Sports SA, Canyon Bicycles GmbH, Merida Industry Co., Ltd., Santa Cruz Bicycles, Yeti Cycles, Pivot Cycles, Rocky Mountain Bicycles, Cannondale Bicycle Corporation, Kona Bicycles, Shimano Inc., SRAM LLC, Fox Factory Holding Corp., Yamaha Motor Co., Ltd., Bosch (eBike Systems), Accell Group N.V., Derby Cycle AG, GT Bicycles. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mountain Bikes Market Key Technology Landscape

The technology landscape of the Mountain Bikes Market is rapidly evolving, driven primarily by advancements in materials science, suspension dynamics, and electric power integration. Carbon fiber layup technology remains a critical area, allowing manufacturers to engineer specific stiffness and compliance zones within the frame, optimizing power transfer while simultaneously enhancing rider comfort and reducing overall weight. Furthermore, hydroforming and advanced welding techniques for aluminum frames are constantly improving, providing high-performance alternatives at lower price points. The development of advanced composite resins and manufacturing techniques ensures that frames are not only lighter but also significantly more durable and impact-resistant, essential for the demanding nature of downhill and enduro riding.

Suspension technology represents another core pillar of innovation. Modern bikes utilize sophisticated air and coil spring systems coupled with highly sensitive damper circuits, often featuring electronic control integration. Systems like Fox Live Valve or SRAM's Flight Attendant use real-time sensors to analyze terrain inputs (e.g., incline, impact velocity) and adjust compression and rebound damping milliseconds faster than a human rider could react. This electronic integration significantly enhances performance, optimizing traction, efficiency, and comfort across highly variable terrains. Concurrently, drivetrain technology continues its refinement, with the widespread adoption of 12-speed and even 13-speed single chainring systems, offering massive gear ranges while simplifying mechanical complexity and improving chain retention reliability, crucial for aggressive riding.

The most transformative technological shift is the mass adoption and continuous improvement of Electric Mountain Bike (E-MTB) systems. Key technologies include lightweight, high-capacity lithium-ion battery packs strategically integrated into the frame for optimal weight distribution, and powerful, efficient mid-drive motors (e.g., Bosch, Shimano, Yamaha) that provide seamless pedal assistance. Manufacturers are focusing on reducing motor size and weight while increasing battery range and system integration with cycling computers and mobile applications. This electric propulsion technology not only boosts market revenue but also fundamentally changes bike geometry requirements, demanding stronger frames and specialized componentry to handle the increased weight, torque, and speeds achievable with electric assistance, thereby influencing innovation across the entire component supply chain.

Regional Highlights

The global Mountain Bikes Market exhibits distinct regional dynamics driven by local trail infrastructure, economic development, and cultural preferences for outdoor sports. North America, encompassing the United States and Canada, remains a central hub for innovation and high-value consumption. This region benefits from a well-established and extensive network of publicly accessible trails, a strong competitive racing scene, and high disposable income. Consumers in North America show a strong preference for high-performance Trail and Enduro bikes, often favoring premium brands and sophisticated componentry, leading to a higher Average Selling Price (ASP). The market here is highly receptive to technological introductions, particularly E-MTBs and advanced electronic suspension systems.

Europe represents the second-largest market, characterized by diverse cycling cultures ranging from competitive Alpine racing to recreational forest cruising. Countries such as Germany, Switzerland, and Austria are major markets due to their robust bike tourism industries and significant investment in bike park development. Europe has been particularly aggressive in the adoption of E-MTBs, often driven by favorable regulatory environments and subsidies promoting electric vehicle use. The market segments are highly specialized, with strong demand for lightweight XC bikes in Northern Europe and rugged Enduro/Downhill models in the mountainous Southern and Central regions. Regulatory standards regarding motor power and speed limits for E-MTBs vary by country, influencing specific product development within the European Union.

The Asia Pacific (APAC) region is projected to register the fastest growth, largely driven by surging urbanization, rising middle-class disposable incomes, and increasing government initiatives promoting cycling as a sustainable and healthy leisure activity, especially in China, Australia, and Japan. While the current market share is weighted towards entry-level and mid-range bikes, the demand for high-end models is rapidly accelerating, mirroring the trend seen in North America and Europe a decade ago. Significant manufacturing capabilities are concentrated in Taiwan and mainland China, which serve as global production hubs. Infrastructure development, while ongoing, is critical; the establishment of formalized trail networks in developing economies is expected to unlock tremendous potential for recreational and tourism-based mountain biking over the forecast period, transitioning the region from primarily a manufacturing base to a major consumption center.

- North America: Dominates high-value purchases; high adoption rates of E-MTBs and cutting-edge technology; strong presence of established brands and robust trail networks.

- Europe: Leading market for E-MTB volume sales; diverse market needs dictated by geography (Alps vs. flat terrain); stringent regulatory focus on battery safety and system efficiency.

- Asia Pacific (APAC): Highest projected CAGR; rapid growth in recreational cycling; dual role as both the primary global manufacturing base and a quickly maturing consumer market.

- Latin America (LATAM): Emerging market with high potential; growth often constrained by economic volatility and reliance on imported high-end components; increasing focus on local trail building and community engagement.

- Middle East & Africa (MEA): Niche market focused on high-end tourism and specific urban recreational areas; gradual market development contingent on climate suitability and infrastructure investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mountain Bikes Market, encompassing both full bicycle manufacturers and key component suppliers whose technological dominance significantly impacts the overall industry.- Specialized Bicycle Components

- Trek Bicycle Corporation

- Giant Manufacturing Co. Ltd.

- Scott Sports SA

- Canyon Bicycles GmbH

- Merida Industry Co., Ltd.

- Santa Cruz Bicycles

- Yeti Cycles

- Pivot Cycles

- Rocky Mountain Bicycles

- Cannondale Bicycle Corporation (A Dorel Industries brand)

- Kona Bicycles

- Shimano Inc. (Key Component Supplier)

- SRAM LLC (Key Component Supplier)

- Fox Factory Holding Corp. (Key Suspension Supplier)

- Bosch (eBike Systems)

- Yamaha Motor Co., Ltd. (eBike Systems)

- Accell Group N.V.

- Derby Cycle AG

- GT Bicycles (A Dorel Industries brand)

Frequently Asked Questions

Analyze common user questions about the Mountain Bikes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant factor driving the growth of the Mountain Bikes Market?

The most significant driver is the rapid proliferation and increasing acceptance of Electric Mountain Bikes (E-MTBs). E-MTBs lower the physical barrier to entry for diverse demographics, extending riding range and accessibility on challenging trails, thereby expanding the overall addressable market and boosting high-value sales globally.

How is carbon fiber technology influencing modern mountain bike design?

Carbon fiber allows manufacturers to create frames with optimized stiffness-to-weight ratios, crucial for performance cycling. Advanced layup techniques enable precise engineering of flex zones for comfort and critical stiffness zones for power transfer, making high-end carbon bikes lighter, faster, and more durable under competitive stress than their alloy counterparts.

Which geographical region holds the highest growth potential for mountain bike sales?

The Asia Pacific (APAC) region, particularly driven by emerging markets like China and Southeast Asia, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is fueled by improving infrastructure, rising middle-class disposable incomes, and increasing health and fitness consciousness among urban populations.

What is the primary restraint affecting the mass adoption of high-performance mountain bikes?

The principal restraint is the high initial cost. High-performance models incorporating full suspension, specialized materials (carbon fiber), and electronic components often retail at several thousand dollars, positioning them as discretionary luxury purchases rather than affordable recreational equipment for the general consumer base.

How are D2C (Direct-to-Consumer) models impacting the traditional mountain bike retail landscape?

D2C models are disrupting traditional retail by offering competitive pricing and greater transparency, bypassing the Independent Bicycle Dealer (IBD) markup. While effective for sales, D2C companies must invest heavily in specialized logistics and customer support to handle the complex assembly and maintenance requirements of modern mountain bikes, which often still require IBD service partnerships.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager