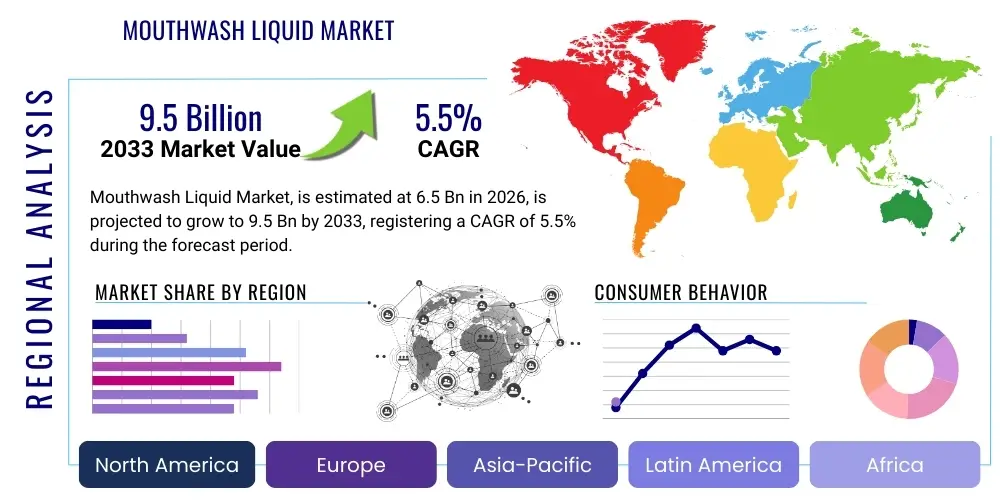

Mouthwash Liquid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441277 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Mouthwash Liquid Market Size

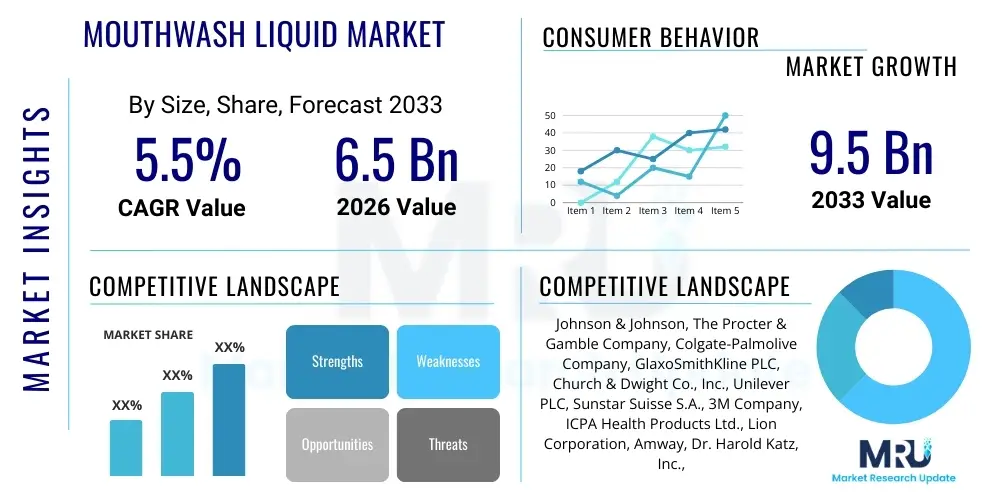

The Mouthwash Liquid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033.

Mouthwash Liquid Market introduction

The Mouthwash Liquid Market encompasses the global trade and consumption of liquid formulations designed for oral hygiene purposes, primarily focusing on breath freshness, plaque reduction, gum health, and cavity prevention. These products, often categorized as cosmetic or therapeutic, utilize active ingredients such as chlorhexidine, cetylpyridinium chloride, essential oils (e.g., eucalyptol, menthol), and fluoride to address specific oral health concerns. The market is characterized by intense competition among global pharmaceutical and consumer goods giants who continuously innovate to improve flavor profiles, efficacy, and natural ingredient integration, catering to a growing consumer base increasingly prioritizing comprehensive dental care beyond standard brushing. This proactive approach to oral hygiene, driven by rising awareness of systemic health links to periodontal disease, forms the foundational demand for mouthwash liquids globally.

Major applications of mouthwash liquid include daily prophylactic rinsing, targeted use for post-operative care, treatment of halitosis, and supplementary support in orthodontic treatments. The primary benefits derived from consistent mouthwash use include sustained fresh breath, reduced bacterial load in the oral cavity, diminished plaque accumulation on tooth surfaces, and strengthened enamel through fluoride application, thereby reducing the incidence of dental caries. Furthermore, therapeutic mouthwashes play a critical role in managing conditions such as gingivitis and periodontitis under professional guidance, cementing their necessity in comprehensive oral care regimes across various demographic segments. The convenience and instantaneous efficacy offered by liquid rinses contribute significantly to their high adoption rates.

Driving factors propelling market expansion include the increasing prevalence of dental diseases globally, particularly in developing economies experiencing dietary shifts and higher sugar intake. Heightened consumer expenditure on personal health and hygiene items, coupled with effective marketing campaigns emphasizing the aesthetics and confidence associated with fresh breath, further fuel sales growth. Regulatory endorsement and recommendation by dental associations worldwide concerning the use of fluoride-containing rinses for preventative care also provide substantial momentum. Moreover, product diversification into specialized categories, such as alcohol-free formulations, natural/organic variants, and specialized rinses for sensitive teeth, ensures the market remains dynamic and responsive to evolving consumer preferences and clinical needs.

Mouthwash Liquid Market Executive Summary

The Mouthwash Liquid Market is experiencing robust growth driven by escalating public health campaigns promoting oral hygiene and increased consumer disposable income allocated to preventative healthcare products. Key business trends indicate a strong pivot towards natural, alcohol-free formulations, addressing consumer sensitivity concerns and preferences for cleaner labels. Strategic mergers and acquisitions are common among leading players striving to expand their product portfolios and geographical reach, particularly targeting fast-growing e-commerce channels. Innovation remains focused on advanced delivery systems and clinically proven ingredients, such as specialized probiotics for oral flora balance, solidifying the market’s defensive growth characteristics against economic downturns due to its essential nature in personal care.

Regionally, Asia Pacific (APAC) stands out as the highest potential growth area, largely due to massive untapped consumer bases in countries like China and India, rapidly urbanizing populations, and improving access to modern retail infrastructure. North America and Europe, while mature, maintain significant market share, characterized by high adoption rates of therapeutic products and a strong focus on premium, specialized mouthwashes addressing specific conditions like dry mouth or sensitive gums. Regional manufacturers are increasingly adopting sustainable packaging solutions and localized flavor profiles to enhance market penetration and align with global environmental mandates, reflecting a broader trend towards corporate social responsibility.

Segment trends highlight the dominance of Therapeutic Mouthwash due to its prescriptive and high-efficacy positioning in combating periodontal diseases. However, the Cosmetic segment is gaining momentum, fueled by younger demographics prioritizing instantaneous fresh breath and aesthetic benefits. Distribution channel analysis shows significant migration towards the E-commerce segment, favored for its convenience, comparative pricing, and access to niche, international brands. Furthermore, specialized end-user segmentation, particularly products tailored for pediatric care or older adults with complex dental needs, presents substantial growth opportunities for focused product development and targeted marketing strategies, ensuring long-term segment diversification and market resilience.

AI Impact Analysis on Mouthwash Liquid Market

Common user questions regarding the influence of Artificial Intelligence on the Mouthwash Liquid Market primarily revolve around three key areas: personalized product recommendations (e.g., "Can AI analyze my oral microbiome and suggest the perfect mouthwash?"), optimized supply chain and inventory management (e.g., "How will AI reduce production costs and lead times for oral care giants?"), and advanced research and development (e.g., "Is AI used to screen new antimicrobial agents for mouthwash formulations?"). These concerns underscore user expectations for hyper-personalization, efficiency gains, and accelerated scientific discovery, moving the market beyond conventional mass-produced products toward data-driven, tailored solutions. Users anticipate AI will enhance product efficacy, lower prices through operational improvements, and offer a more precise consumer experience based on individual health data.

The implementation of AI algorithms is poised to revolutionize consumer interaction by enabling detailed analysis of individual oral health data, captured via smart toothbrushes or dental diagnostics, leading to highly customized mouthwash formulations recommended through direct-to-consumer platforms. In manufacturing, predictive maintenance using machine learning ensures maximum operational efficiency and minimizes downtime in high-speed bottling lines. Furthermore, AI-powered image analysis is being deployed in clinical trials to objectively measure plaque reduction and gingivitis status, significantly streamlining the validation process for new therapeutic mouthwash claims, thereby accelerating time-to-market for novel products.

- AI-Driven Personalization: Use of machine learning algorithms to analyze consumer oral health profiles (e.g., microbiome data, pH levels) for recommending bespoke mouthwash compositions and optimal usage routines.

- Supply Chain Optimization: Predictive analytics forecasting demand fluctuations for different flavors or types, optimizing raw material procurement (e.g., essential oils, active ingredients) and reducing wastage.

- Automated Quality Control: Deployment of computer vision systems on production lines to inspect bottling integrity, labeling accuracy, and fill volumes with superior speed and precision compared to manual checks.

- Accelerated R&D: Utilizing AI models for rapid screening and simulation of thousands of chemical compounds to identify novel, highly effective, and safe antimicrobial agents or flavor combinations.

- Intelligent Customer Service: Chatbots and virtual assistants providing instantaneous, data-driven responses to consumer queries regarding product ingredients, usage, and compatibility with specific dental conditions.

- Enhanced Market Forecasting: Machine learning models processing vast datasets (social media trends, search queries, sales data) to predict emerging flavor preferences or sudden shifts in demand for therapeutic versus cosmetic rinses.

DRO & Impact Forces Of Mouthwash Liquid Market

The market trajectory is primarily driven by expanding consumer awareness regarding the systemic health consequences of poor oral hygiene, including links to cardiovascular disease and diabetes, prompting greater adoption of preventative measures like mouthwash usage. Opportunities stem significantly from untapped markets in emerging economies and the development of specialized product lines targeting niche concerns such as sensitivity, dry mouth (xerostomia), or specific dietary requirements (e.g., vegan formulations). However, the market faces significant restraints from consumer concerns regarding the high alcohol content in traditional rinses, which can lead to discomfort and dryness, alongside regulatory scrutiny concerning the long-term safety profile of certain chemical additives, necessitating continuous reformulation and product transparency.

The primary Drivers include intensive promotional activities by global health organizations emphasizing the importance of daily rinsing as an adjunct to brushing, coupled with the rising availability of affordable, mass-market products through modern retail and e-commerce platforms. The increasing global burden of periodontal diseases and halitosis further acts as a fundamental demand driver. Manufacturers are capitalizing on these drivers by integrating clinically backed natural ingredients, such as herbal extracts and essential oils, to satisfy the growing consumer demand for products perceived as both safe and effective, ensuring continuous engagement across various consumer segments.

Restraints are notably focused on regulatory complexity across different regions regarding active ingredients, such as chlorhexidine limitations for over-the-counter use, and pervasive consumer confusion regarding the efficacy claims of cosmetic versus therapeutic products, which sometimes dampens adoption rates. Opportunities lie in penetrating the institutional sector, such as hospitals and long-term care facilities, where specialized antimicrobial mouthwashes are crucial for infection control. Impact forces are strong, primarily driven by changing consumer lifestyle preferences, rapid urbanization leading to increased emphasis on appearance and social confidence (fresh breath), and sustained R&D investments by major players to introduce novel, efficacy-proven formulations, ensuring dynamic competition and consistent product renewal.

Segmentation Analysis

The Mouthwash Liquid Market is intricately segmented based on product type, flavor, distribution channel, and end-user, allowing manufacturers to strategically tailor offerings to specific consumer needs and purchasing behaviors. Product Type segmentation differentiates between cosmetic rinses, focused primarily on temporary breath freshening, and therapeutic rinses, which contain active pharmaceutical ingredients targeting specific oral pathologies like gingivitis or plaque accumulation, reflecting the variance in consumer intent and clinical requirement. Flavor segmentation, crucial for consumer acceptance and repeat purchase, continues to be dominated by traditional mint profiles but is rapidly diversifying into fruit, spice, and unique herbal combinations to attract wider demographic appeal and counter flavor fatigue, especially among long-term users seeking variety.

Distribution channel analysis reveals a critical shift toward digital platforms. While pharmacies/drug stores remain crucial for therapeutic, high-efficacy products due to perceived professional trust, E-commerce is capturing substantial market share across all segments, offering competitive pricing, brand accessibility, and discreet purchasing options. Supermarkets and hypermarkets serve as high-volume channels for mainstream, cosmetic mouthwashes, leveraging convenience and bulk purchasing incentives. End-user segmentation, distinguishing between adults and pediatrics, highlights the need for specialized formulations, particularly non-alcohol, child-safe, and appealingly flavored options for the younger demographic, ensuring safety while instilling early oral care habits.

- By Type:

- Therapeutic Mouthwash

- Cosmetic Mouthwash

- Prescription-Only Rinses

- Medicated Rinses (e.g., Chlorhexidine-based)

- By Flavor:

- Mint (Peppermint, Spearmint)

- Cinnamon/Spice

- Fruit Flavors (Citrus, Berry)

- Unflavored/Neutral

- Herbal/Botanical

- By Distribution Channel:

- Pharmacies/Drug Stores

- Supermarkets/Hypermarkets

- E-commerce (Online Retail)

- Convenience Stores

- Dental Clinics (Direct Sales)

- By End-User:

- Adults (General Use)

- Pediatrics (Children's Formulations)

- Special Needs Users (e.g., Orthodontic, Dry Mouth Sufferers)

Value Chain Analysis For Mouthwash Liquid Market

The value chain for the Mouthwash Liquid Market begins with the upstream sourcing and manufacturing of critical raw materials, including bulk chemicals (water, alcohol, detergents), active pharmaceutical ingredients (fluoride, chlorhexidine), and sensory components (flavoring agents, coloring). Efficient procurement and quality control at this stage are paramount, as the integrity and stability of the final product hinge on the quality of these inputs. Strategic partnerships with specialized chemical suppliers and fragrance houses are common to ensure a consistent supply of high-grade, certified ingredients. Major players often integrate backward into flavoring component manufacturing to maintain competitive cost structures and protect proprietary flavor profiles, which are key differentiators in the cosmetic segment.

The midstream process involves formulation, blending, filling, and packaging, requiring sophisticated manufacturing facilities adhering to stringent Good Manufacturing Practices (GMP). Automation plays a critical role in high-speed bottling and labeling to meet massive global demand. Packaging innovation, particularly focusing on recycled plastics (PCR) and ergonomic designs, is a significant value addition point, addressing environmental concerns and improving consumer usability. The output of this stage—the finished mouthwash liquid—is then prepared for distribution, including aggregation and inventory management across various regional centers to ensure rapid fulfillment of orders from diverse sales channels.

The downstream segment is dominated by distribution channels, which act as the final link to the end consumer. This segment includes direct channels (e.g., dental professional sales) and indirect channels (retailers, e-commerce platforms). Direct sales often involve high-margin therapeutic rinses, while indirect channels handle high-volume cosmetic products. E-commerce platforms are increasingly critical, offering manufacturers direct access to consumer feedback and enabling personalized marketing. Effective logistics management, combined with targeted marketing strategies specific to each retail environment, maximizes product visibility and consumer pull, completing the value cycle from chemical sourcing to consumer purchase.

Mouthwash Liquid Market Potential Customers

The primary end-users and buyers of mouthwash liquid span a wide demographic range, categorized mainly into general consumers seeking enhanced daily oral hygiene and individuals with specific clinical oral health requirements. General consumers represent the largest volume segment, using cosmetic mouthwashes for breath freshness and basic plaque control. This group is highly susceptible to branding, advertising emphasizing social confidence, and convenience, purchasing primarily through supermarkets and online retail channels. Product choices here are driven by flavor preferences, price sensitivity, and perceived value, often favoring large, economy-sized bottles for household use, making them essential customers for bulk retail distribution strategies.

A second crucial segment comprises patients diagnosed with specific periodontal diseases such as gingivitis, periodontitis, or those undergoing advanced dental procedures (e.g., implants, orthodontics). These customers are the core market for therapeutic and medicated mouthwashes, often requiring prescription or professional recommendation. Purchases are frequently made via pharmacies or dental clinics, relying heavily on the authority and guidance of dental professionals (dentists, periodontists, hygienists). This segment prioritizes efficacy, clinically proven ingredients, and compliance with medical instructions, driving demand for premium, specialized, and higher-margin products.

Furthermore, specialized segments include children, who require alcohol-free, fluoride-containing, and child-friendly flavored rinses; institutional buyers (hospitals, nursing homes) who purchase antimicrobial rinses for infection control protocols; and consumers specifically targeting lifestyle-related issues like dry mouth (xerostomia), often associated with medication or aging. These diverse end-user profiles necessitate a highly differentiated product portfolio, ranging from high-fluoride, low-pH protection for institutional use to gentle, moisturizing rinses for geriatric care, reflecting the comprehensive nature of the potential customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, The Procter & Gamble Company, Colgate-Palmolive Company, GlaxoSmithKline PLC, Church & Dwight Co., Inc., Unilever PLC, Sunstar Suisse S.A., 3M Company, ICPA Health Products Ltd., Lion Corporation, Amway, Dr. Harold Katz, Inc., Philips Oral Healthcare, Tishcon Corp., Dabur India Ltd., Kao Corporation, Reckitt Benckiser Group PLC, Sanofi S.A., Henkel AG & Co. KGaA, Tom's of Maine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mouthwash Liquid Market Key Technology Landscape

The technological landscape within the Mouthwash Liquid Market is characterized by advancements in formulation science aimed at enhancing efficacy, stability, and consumer acceptability. A significant focus is placed on microencapsulation technologies, which are utilized to stabilize volatile ingredients, such as essential oils and flavors, ensuring their potency is maintained until use, while also enabling sustained release of active agents like fluoride or anti-plaque compounds over longer periods after rinsing. Furthermore, novel solvent systems are being developed to create effective alcohol-free formulations that maintain the desirable attributes of traditional rinses without the associated side effects of drying or burning, addressing a major consumer restraint.

In the therapeutic domain, technology involves the integration of advanced antimicrobial peptides and probiotic strains designed to selectively target pathogenic bacteria while preserving beneficial oral flora, representing a paradigm shift from broad-spectrum sterilization to targeted microbiome management. This requires sophisticated biological research and formulation techniques to ensure the survival and activity of these delicate biological components within a liquid medium. Manufacturing technologies are also evolving, employing advanced filtration and sterilization techniques to guarantee product purity and extend shelf life without relying excessively on chemical preservatives, aligning with the clean label trend increasingly sought by health-conscious consumers.

Another emerging technology is the development of smart packaging solutions that can monitor the degradation of active ingredients or provide interactive features. Though nascent, these technologies aim to link consumer use data with AI platforms to provide personalized feedback and compliance tracking. Crucially, the analytical technology used for testing and validation, including mass spectrometry and high-performance liquid chromatography (HPLC), continually improves, enabling manufacturers to precisely quantify and prove the concentration and bioavailability of active ingredients, thereby substantiating complex marketing and clinical claims in an increasingly regulated environment.

Regional Highlights

- North America: This region holds a dominant market share, characterized by high consumer awareness, significant disposable income, and strong adoption of specialized therapeutic mouthwashes. The US market drives innovation, particularly in premium, specialized segments like anti-plaque and anti-gingivitis formulations. Strict regulatory standards ensure high product quality, and the presence of major global players fosters intense marketing competition. E-commerce penetration is among the highest globally.

- Europe: The European market is mature, focusing heavily on natural, organic, and environmentally friendly formulations. Countries like Germany and the UK show high per capita expenditure on oral care. The market is highly influenced by EU regulations restricting certain chemical ingredients, pushing manufacturers towards natural extracts and essential oils. Alcohol-free products are highly favored across Western Europe due to health-conscious consumer bases.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rising middle-class populations, increasing urbanization, and greater penetration of Western oral hygiene habits. Markets in China and India present huge volume potential, though price sensitivity remains a factor. Increased awareness campaigns by local governments and dental associations significantly boost demand. Product offerings are often localized to cater to traditional preferences and pricing strategies.

- Latin America (LATAM): Growth in LATAM is moderate but steady, driven by improvements in organized retail and rising health awareness, particularly in Brazil and Mexico. The market is often price-competitive, with a strong presence of local manufacturers alongside international brands. Focus areas include basic preventative care and addressing common dental issues through affordable cosmetic rinses.

- Middle East and Africa (MEA): This region is characterized by fragmented demand, with high growth in the GCC countries (due to high disposable income and advanced retail infrastructure) contrasted by slower growth in certain African nations. The market is primarily import-driven, with a growing demand for high-end therapeutic and halal-certified mouthwashes, reflecting cultural and religious considerations in product consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mouthwash Liquid Market.- Johnson & Johnson (Listerine)

- The Procter & Gamble Company (Crest, Oral-B)

- Colgate-Palmolive Company (Colgate Plax)

- GlaxoSmithKline PLC (Sensodyne, Corsodyl)

- Church & Dwight Co., Inc. (Arm & Hammer)

- Unilever PLC

- Sunstar Suisse S.A. (GUM)

- 3M Company

- ICPA Health Products Ltd.

- Lion Corporation

- Amway

- Dr. Harold Katz, Inc. (TheraBreath)

- Philips Oral Healthcare

- Tishcon Corp.

- Dabur India Ltd.

- Kao Corporation

- Reckitt Benckiser Group PLC

- Sanofi S.A.

- Henkel AG & Co. KGaA

- Tom's of Maine (a subsidiary of Colgate-Palmolive)

Frequently Asked Questions

Analyze common user questions about the Mouthwash Liquid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Mouthwash Liquid Market?

The Mouthwash Liquid Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period from 2026 to 2033, driven by increasing consumer focus on preventative oral health measures and therapeutic product innovation.

What are the primary differences between cosmetic and therapeutic mouthwash products?

Cosmetic mouthwashes primarily offer temporary relief from bad breath and flavor masking, lacking active anti-plaque or anti-gingivitis components. Therapeutic mouthwashes contain clinically proven active ingredients like chlorhexidine or high-concentration fluoride, specifically formulated to treat or prevent oral diseases and require clinical backing.

Which geographical region dominates the consumption of mouthwash liquid?

North America currently holds the largest market share in the consumption of mouthwash liquid, characterized by high adoption rates of premium therapeutic products, strong consumer health awareness, and well-established retail and pharmaceutical distribution networks.

What role does E-commerce play in the distribution of mouthwash products?

E-commerce is the fastest-growing distribution channel, providing consumers with convenient access to a wider variety of domestic and international brands, competitive pricing, and subscription services, significantly increasing the market reach for both cosmetic and niche therapeutic formulations.

Are alcohol-free mouthwashes gaining preference among consumers?

Yes, there is a significant market trend and increasing consumer preference for alcohol-free mouthwashes due to concerns over oral dryness, potential irritation, and links to sensitive gums. Manufacturers are extensively innovating to ensure alcohol-free formulations maintain high efficacy in bacterial reduction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager