MTP Fiber Optic Connector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441943 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

MTP Fiber Optic Connector Market Size

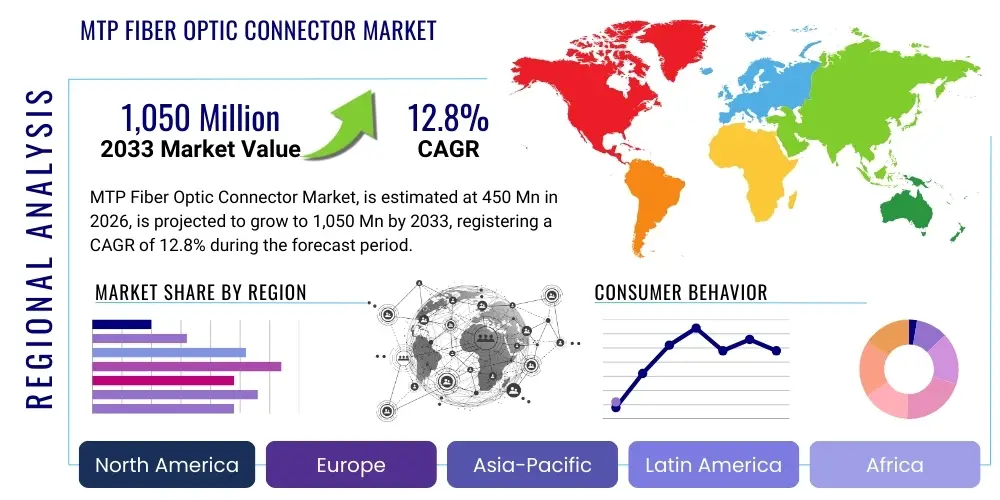

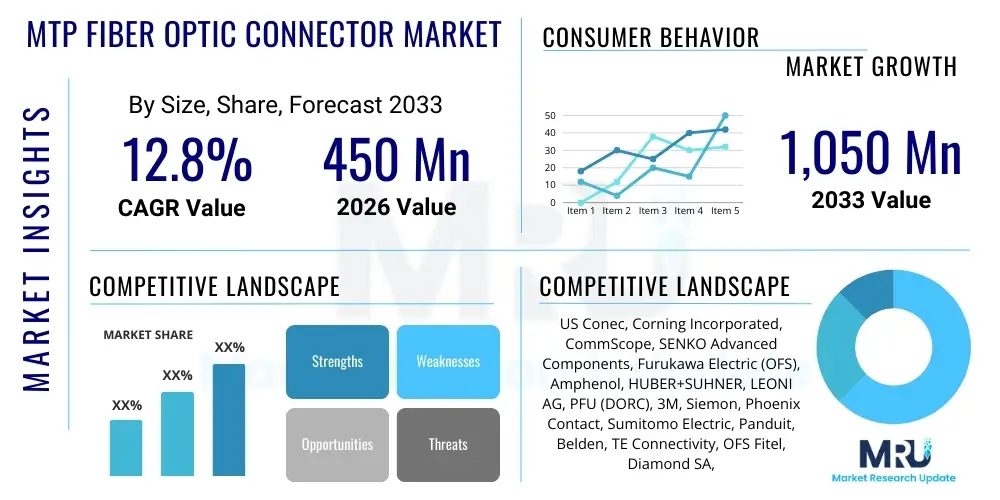

The MTP Fiber Optic Connector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,050 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for higher data transmission speeds, particularly within hyperscale data centers, telecommunications infrastructure upgrades (5G rollouts), and enterprise networking environments requiring robust, high-density optical interconnect solutions. The inherent capabilities of MTP connectors, such as facilitating multi-fiber connectivity (typically 12, 24, 48, or 72 fibers) in a single compact housing, make them indispensable for efficient space management and rapid deployment in modern high-bandwidth ecosystems.

Market expansion is also heavily influenced by continuous technological advancements in fiber optic technology, including the transition to 400G and 800G Ethernet standards, which necessitate complex parallel optics architectures. MTP (Multi-fiber Termination Push-on) technology, often confused with its US-centric trademarked variant MPO (Multi-fiber Push On), stands as the industry standard for these high-speed applications due to its superior mechanical alignment, standardized mating interfaces, and proven reliability in mission-critical installations. Furthermore, the rising adoption of cloud computing, edge computing, and Internet of Things (IoT) devices generates massive data volumes, consequently increasing the necessity for reliable, high-density interconnects in centralized data processing facilities. The forecast period anticipates strong growth propelled by infrastructure investments across North America and Asia Pacific, specifically targeting next-generation networking protocols and fiber-to-the-home (FTTH) expansion strategies that utilize high-capacity backbone connectivity.

MTP Fiber Optic Connector Market introduction

The MTP Fiber Optic Connector Market encompasses the design, manufacture, and distribution of specialized multi-fiber connectors used primarily in high-density optical networking applications, offering significant advantages over traditional single-fiber connectors by consolidating multiple fibers—typically 12, 24, or 48—into a single compact ferrule, thus optimizing space utilization and streamlining installation processes. The primary applications span across large-scale data centers, telecommunication central offices, enterprise networking backbones, and increasingly, specialized industrial and medical imaging systems that require high throughput and reliable connectivity. Key benefits driving their adoption include superior density, faster deployment times due to pre-terminated trunk cables, enhanced modularity, and simplified cable management in densely populated racks. The fundamental driving factors supporting market growth are the pervasive global demand for ultra-low latency and high-speed data transmission required by emerging technologies like 5G wireless networks, artificial intelligence processing, large language models (LLMs), and virtualization technologies that heavily rely on robust fiber infrastructure within and between computing clusters.

MTP Fiber Optic Connector Market Executive Summary

The MTP Fiber Optic Connector Market exhibits robust growth, fueled predominantly by strategic business trends centered around infrastructure convergence and standardization toward parallel optics. Regionally, the Asia Pacific market, particularly China and India, is emerging as a dominant growth engine due to aggressive government initiatives supporting digital transformation and massive investment in new hyperscale data center construction, challenging the traditional market leadership of North America. Segmentally, the demand for 24-fiber MTP connectors is accelerating sharply, driven by the immediate requirement for 400G and future 800G connectivity in high-performance computing (HPC) and AI clusters, shifting the focus from the legacy 12-fiber standard. Suppliers are increasingly concentrating on developing custom high-performance variations, such as low-loss MTP Elite connectors, to meet stringent hyperscale requirements, while the overall market structure favors established players capable of guaranteeing high manufacturing precision and interoperability across diverse vendor equipment environments.

AI Impact Analysis on MTP Fiber Optic Connector Market

Common user questions regarding AI's influence on the MTP connector market frequently revolve around how AI training and inference requirements translate into physical network infrastructure needs, specifically questioning whether current MTP density standards (12/24/48 fibers) are sufficient for future AI workloads, and if AI will accelerate the transition beyond 800G Ethernet, demanding even higher fiber counts and potentially entirely new connector form factors. Users are also concerned about the supply chain implications, asking if the sudden, massive demand for AI computing clusters will strain the availability of high-precision MTP components and whether AI optimization can be applied to manufacturing processes to ensure quality and scalability. The consensus among analysts is that AI adoption, particularly in generative models and large machine learning systems, acts as an exponential demand multiplier for MTP connectors, fundamentally because AI clusters require unprecedented levels of bandwidth and connectivity density within and between GPUs (Graphical Processing Units) and associated memory units, far exceeding the requirements of traditional cloud computing or content delivery networks. This surge necessitates ultra-low latency, high-density optical interconnects, directly mandating the increased deployment of advanced MTP cabling systems.

- AI drives exponential demand for parallel optics architectures in data centers.

- Increased utilization of 400G and 800G high-speed interconnects mandated by AI cluster density.

- Requirement for ultra-low loss (MTP Elite) variants to maintain signal integrity over short AI cluster distances.

- AI workload sensitivity to latency necessitates premium, highly reliable connector solutions.

- Potential for AI-driven automation in connector manufacturing and quality control processes.

- Accelerated obsolescence cycles for lower-density network infrastructure components.

DRO & Impact Forces Of MTP Fiber Optic Connector Market

The MTP Fiber Optic Connector Market is shaped by powerful Drivers, Restraints, and Opportunities (DRO), collectively forming the market's Impact Forces. Key drivers include the relentless global proliferation of data centers, specifically the hyperscale facilities built by tech giants to support cloud services and AI, which inherently require high-density, modular cabling solutions. Another critical driver is the ongoing standardization and deployment of higher-speed Ethernet protocols (40G, 100G, 200G, 400G, 800G), all of which leverage parallel optics and MTP interfaces for efficient signal aggregation. Restraints primarily involve the high initial cost of MTP connector systems and associated specialized termination equipment compared to standard simplex connectors, alongside the technical challenge of ensuring precise fiber alignment and low insertion loss across multi-fiber ferrules, which requires highly sophisticated manufacturing techniques and stringent quality control. Opportunities abound in the expansion into emerging markets, the strategic use of MTP connectors in fiber-to-the-antenna (FTTA) for 5G backhaul, and the continuous innovation toward smaller, higher-density connectors (e.g., 96-fiber solutions) and robust outdoor/industrial-grade MTP products. The net Impact Force of these factors is overwhelmingly positive, projecting strong, sustained growth, particularly within the specialized high-performance computing and hyperscale data center segments where bandwidth density outweighs cost considerations.

Segmentation Analysis

The MTP Fiber Optic Connector Market is systematically segmented based on key functional and application characteristics, providing granular insights into demand patterns across various industry verticals and technical specifications. These segmentations are critical for manufacturers to align production capabilities with evolving standards and for end-users to select appropriate solutions for their specific network architectures, ranging from backbone cabling within large corporate campuses to critical inter-rack connectivity in hyperscale environments. The primary methods of segmentation involve differentiating by fiber type (single-mode versus multimode), fiber count (12, 24, 48, etc.), application type (data center, telecom, enterprise), and end-use configuration (trunk cables, harnesses, cassettes). This structured approach helps address the diverse requirements arising from latency sensitivity, distance limitations, and required bandwidth capabilities across the global networking landscape.

- By Fiber Count:

- 12 Fiber

- 24 Fiber

- 48 Fiber

- 72 Fiber and Above

- By Cable Type:

- Trunk Cables

- Harnesses/Fan-out Cables

- Patch Cords

- By Fiber Type:

- Single Mode (SM)

- Multimode (MM)

- By Application:

- Data Centers (Hyperscale, Colocation, Enterprise)

- Telecommunications

- Enterprise Networks

- Industrial/Military

Value Chain Analysis For MTP Fiber Optic Connector Market

The value chain for the MTP Fiber Optic Connector Market begins with upstream suppliers providing critical raw materials, primarily high-precision plastic and metal components for the connector housing, specialized ferrules (often ceramic or high-performance polymer), and raw optical fiber sourced from specialized manufacturers like Corning and Prysmian. The complexity here lies in sourcing materials capable of maintaining micron-level tolerances essential for reliable multi-fiber alignment. Midstream activities involve the specialized manufacturing and assembly processes, including highly precise polishing, termination, and rigorous quality testing of the MTP connectors onto bulk cable assemblies, a stage where technological differentiation and intellectual property play a crucial role. This phase is characterized by significant capital investment in automation and cleanroom environments to minimize defects and ensure low-loss performance, leading to a highly consolidated manufacturing sector dominated by a few key precision engineering firms. Downstream distribution channels are bifurcated into direct sales to hyperscale cloud providers who purchase vast quantities based on specific engineering designs, and indirect sales through specialized distributors and system integrators who provide tailored solutions, pre-terminated cable cassettes, and installation services to smaller enterprise and telecom clients, ensuring market reach across varied project scales. Direct sales channels are prioritized for high-volume, standardized products, whereas indirect channels offer customization and comprehensive integration services.

MTP Fiber Optic Connector Market Potential Customers

The primary customers for MTP Fiber Optic Connectors are organizations characterized by high-bandwidth data processing, large-scale network infrastructures, and a requirement for rapid scalability and space efficiency. Hyperscale data center operators, including major cloud service providers (CSPs) such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), represent the single largest customer segment due to their continuous need to upgrade internal network fabrics (spine-and-leaf architecture) to support 400G and 800G connections, driving the demand for 24-fiber and higher-count MTP trunk cables and cassettes. Telecommunication carriers and network service providers constitute another vital segment, utilizing MTP connectors in central offices, metro networks, and emerging 5G infrastructure deployments where high fiber density reduces cabinet size and simplifies complex fiber management required for massive MIMO and centralized RAN architectures. Furthermore, large financial institutions, universities conducting high-performance computing research, and major enterprise corporations running complex server virtualization and storage area networks (SANs) are consistent buyers, leveraging MTP systems to future-proof their internal data center environments and consolidate server connectivity, recognizing that MTP provides the most efficient migration path to next-generation speeds while minimizing physical space consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,050 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | US Conec, Corning Incorporated, CommScope, SENKO Advanced Components, Furukawa Electric (OFS), Amphenol, HUBER+SUHNER, LEONI AG, PFU (DORC), 3M, Siemon, Phoenix Contact, Sumitomo Electric, Panduit, Belden, TE Connectivity, OFS Fitel, Diamond SA, Fujikura Ltd., AFL Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MTP Fiber Optic Connector Market Key Technology Landscape

The MTP Fiber Optic Connector Market's technological landscape is defined by precision engineering centered on minimizing insertion loss and maximizing fiber density, utilizing innovations that enhance the longevity and reliability of multi-fiber connections in strenuous data center environments. Core technology revolves around the advanced design of the MTP ferrule, which, unlike the standard MPO, incorporates features such as a removable housing, alignment pins with strict tolerances, and specialized spring mechanisms for secure and repeatable mating, ensuring consistent mechanical contact across all fibers simultaneously. A significant technological advancement is the widespread adoption of MTP Elite (or Low Loss) connectors, which employ highly advanced polishing techniques, often incorporating interferometer-based inspection systems, to achieve insertion loss values typically below 0.35dB, a critical requirement for long-distance 100G+ transmissions and complex fiber channel links that rely on tight power budgets. The transition to higher fiber counts (48, 72, and 96-fiber solutions) utilizes miniaturization techniques and robust strain relief mechanisms to package more optical capacity within the same physical footprint. Furthermore, polarity management systems, crucial for seamless plug-and-play functionality in complex parallel optics links (Type A, B, and C configurations), rely on key-up/key-down and pinned/unpinned configurations standardized by the MTP technology, providing crucial differentiation and ensuring data integrity when migrating between different transceiver types (e.g., QSFP to QSFP-DD). The ongoing development of robust connectors suitable for harsh environments (industrial, military) using ruggedized boots and enhanced sealing technologies also represents a vital segment of the technological frontier.

Regional Highlights

North America remains a cornerstone of the MTP Fiber Optic Connector Market, driven primarily by the colossal presence of hyperscale cloud providers and the early, aggressive adoption of cutting-edge networking technologies, including 400G and 800G Ethernet standards. The region’s technological maturity dictates global trends, with major data center hubs in Virginia, Texas, and California constantly demanding high-density, low-loss MTP solutions for their rapidly expanding infrastructure supporting artificial intelligence, machine learning, and vast computational workloads. Investments in next-generation network architecture here are characterized by a focus on high-reliability, premium-grade MTP components, often favoring U.S.-based manufacturers and certified MTP solutions to maintain peak operational efficiency and minimize downtime in mission-critical environments. The presence of significant research institutions and early technology adopters ensures sustained demand, especially for the latest 24-fiber and higher-count configurations essential for complex parallel optics deployment. The robust telecommunications sector, engaged in continuous infrastructure modernization, further cements North America's leadership position in terms of market value and technological innovation influence, even as other regions rapidly increase their capacity.

The Asia Pacific (APAC) region is projected to register the fastest growth rate in the MTP Fiber Optic Connector Market during the forecast period, transitioning from being a manufacturing hub to a dominant consumer market. This exponential growth is fueled by massive government-led digital initiatives, escalating internet penetration rates, and significant foreign direct investment pouring into data center construction in emerging economies like India and Southeast Asia (Singapore, Indonesia). China, in particular, drives substantial volume due to its vast network infrastructure buildout, large domestic cloud providers, and ambitious 5G deployment plans that necessitate millions of high-density fiber connection points. The APAC market shows a high degree of price sensitivity compared to North America and Europe, often leading to strong demand for cost-optimized MPO/MTP variants, though the increasing presence of hyperscale US operators is raising the standard for premium, low-loss connectors across the region. Localization of manufacturing and distribution channels is a key strategic imperative for global players aiming to capitalize on this dynamic, rapidly expanding regional requirement for scalable, modular fiber solutions.

Europe represents a mature yet continually growing market, characterized by stringent regulatory requirements, a focus on energy efficiency, and a distributed data center landscape driven by data localization laws (such as GDPR). Key markets, including Germany, the UK, France, and the Netherlands, are consistently upgrading their metro networks and supporting the increasing demand for colocation and edge computing facilities. The European demand for MTP connectors is largely concentrated in large enterprise upgrades and carrier-neutral facilities that require flexible, high-density interconnections to service multiple tenants. Furthermore, major European telecom operators are heavily investing in Fiber-to-the-Home (FTTH) and 5G backhaul, using MTP technology to efficiently manage fiber aggregation points in central office and street cabinet installations. While the volume may be lower than APAC, the demand for sophisticated, customized MTP solutions tailored to meet specific industrial and telecom standards remains high, contributing significantly to the market’s overall revenue stability and favoring suppliers that offer comprehensive system integration and high-quality passive network components.

- North America: Market leader, driven by hyperscale cloud infrastructure and early adoption of 400G/800G standards. Focus on premium, low-loss MTP Elite connectors.

- Asia Pacific (APAC): Fastest growing region, fueled by massive data center construction in China and India, and pervasive 5G network rollout. Characterized by high volume demand.

- Europe: Stable growth, driven by enterprise modernization, data localization requirements necessitating regional data centers, and robust FTTH/5G infrastructure investment.

- Latin America (LATAM): Emerging market with rising adoption, focused primarily on telecommunication upgrades and initial expansion of regional cloud facilities, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Significant growth potential linked to smart city projects, oil and gas sector network modernization, and the buildout of new connectivity hubs like those in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MTP Fiber Optic Connector Market.- US Conec

- Corning Incorporated

- CommScope

- SENKO Advanced Components

- Furukawa Electric (OFS)

- Amphenol

- HUBER+SUHNER

- LEONI AG

- PFU (DORC)

- 3M

- Siemon

- Phoenix Contact

- Sumitomo Electric

- Panduit

- Belden

- TE Connectivity

- OFS Fitel

- Diamond SA

- Fujikura Ltd.

- AFL Global

Frequently Asked Questions

Analyze common user questions about the MTP Fiber Optic Connector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between MTP and MPO connectors, and why is MTP often preferred in hyperscale environments?

MPO (Multi-fiber Push On) is a generic standard for multi-fiber connectors, whereas MTP (Multi-fiber Termination Push-on) is a registered trademark of US Conec that denotes a high-performance version of the MPO connector. MTP connectors are preferred in hyperscale environments due to superior mechanical features, including removable housing, elliptically shaped guide pin tips, and robust spring clamps, ensuring improved fiber alignment, reduced insertion loss repeatability, and better overall long-term reliability essential for high-density, mission-critical applications.

How are MTP connectors supporting the transition to 400G and 800G Ethernet speeds in data centers?

MTP connectors are fundamental to 400G and 800G deployments because these protocols rely on parallel optics transmission schemes. For instance, 400G SR8 requires 16 fibers (8 transmit, 8 receive), directly utilizing a 16-fiber or 24-fiber MTP interface. The high density and standardized alignment mechanisms of MTP technology enable efficient bundling of these multiple fiber paths within a single connector, facilitating the necessary high throughput and low latency required for next-generation network fabrics, particularly in AI and HPC clusters.

What are the key drivers impacting the market growth of MTP connectors over the next five years?

The central drivers of market growth are the relentless global buildout of hyperscale and edge data centers driven by cloud computing adoption, the widespread implementation of 5G network infrastructure requiring dense backhaul connectivity, and the exponential demand for high-bandwidth interconnects spurred by artificial intelligence and machine learning workloads, which mandate high-fiber-count MTP solutions for inter-rack and intra-cluster communication within server halls.

In which regional market is the demand for MTP Fiber Optic Connectors expected to grow the fastest, and why?

The Asia Pacific (APAC) region is forecast to experience the fastest growth due to aggressive government investments in digital infrastructure, including extensive 5G rollouts and massive data center construction initiatives in key markets like China, India, and Southeast Asia. This region is undergoing rapid digitalization, creating an unprecedented volume-based requirement for high-density, scalable connectivity solutions like MTP trunk cabling and harnesses.

What role does polarity play in MTP system installation, and what types are commonly used?

Polarity management is crucial to ensure that the transmit signal from one transceiver correctly reaches the receive port of the connected transceiver across a multi-fiber array. The industry utilizes three main polarity methods (Type A, Type B, and Type C) to manage fiber mapping. MTP connectors achieve this through specific key-up/key-down orientation configurations and the use of pinned or unpinned ferrules, ensuring installers can maintain correct end-to-end signal integrity when deploying complex pre-terminated multi-fiber cable assemblies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager