Multibeam Sonar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443053 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Multibeam Sonar Market Size

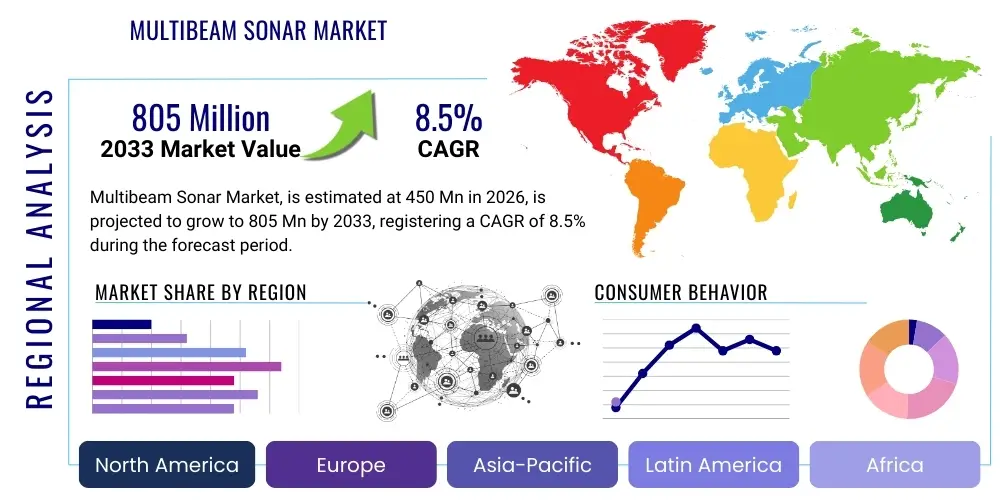

The Multibeam Sonar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 805 million by the end of the forecast period in 2033.

Multibeam Sonar Market introduction

Multibeam sonar systems represent a critical advancement in marine technology, providing high-resolution, three-dimensional mapping capabilities essential for modern hydrographic surveying and underwater reconnaissance. These advanced acoustic instruments transmit a broad fan of sound pulses perpendicular to the path of the vessel or platform, capturing thousands of discrete depth measurements (soundings) in a single sweep. The complex signals are processed using sophisticated digital beamforming techniques to generate highly accurate bathymetric models and acoustic backscatter imagery of the seabed. This technology offers a significant leap in efficiency and data quality compared to legacy single-beam echo sounders, enabling comprehensive coverage of large areas quickly and reliably, which is paramount for safety and precision in maritime operations globally.

The core product encompasses several integrated components, including the transducer array, the topside processing unit (sonar processor), and motion sensors (Inertial Navigation Systems - INS) which compensate for the dynamic movements of the deployment platform. Key applications driving market demand are broad and multifaceted, spanning foundational nautical charting conducted by governmental hydrographic offices, detailed site surveys for major offshore oil, gas, and renewable energy installations, and critical military operations such such as mine countermeasures (MCM) and covert underwater surveillance. The intrinsic benefits of multibeam sonar—including superior spatial resolution, high area coverage rates, and the ability to simultaneously collect both bathymetry and seabed classification data (backscatter)—make it indispensable for any entity operating within the marine environment requiring reliable, verifiable geospatial information.

The market expansion is robustly driven by several macro factors. Firstly, international regulations, notably those stipulated by the International Hydrographic Organization (IHO), continuously mandate the updating and improvement of nautical charts to ensure maritime safety, particularly in busy shipping lanes and rapidly changing coastal zones. Secondly, the unprecedented global investment in offshore renewable energy, necessitating meticulous pre-installation surveys for cable routes and foundation stability, creates sustained high-volume demand. Furthermore, the increasing deployment of multibeam systems on autonomous platforms (AUVs and USVs) addresses the industry need for reduced operational costs and enhanced flexibility, pushing technological limits in size, weight, and power (SWaP) consumption.

Multibeam Sonar Market Executive Summary

The global Multibeam Sonar Market is entering a dynamic growth phase, characterized by strategic technological integration and geographic market shifts. Key business trends are centered on the convergence of acoustic sensing with artificial intelligence (AI) and machine learning (ML), aimed at automating the labor-intensive data processing pipeline, thus reducing operational latency and enhancing data product reliability. Furthermore, there is a strong emphasis on developing highly portable, high-frequency shallow-water systems to meet the rising demands from port security, coastal management, and near-shore infrastructure maintenance. Competitive strategies increasingly involve vertical integration, where hardware manufacturers partner with specialized software analytics firms to offer end-to-end data acquisition and interpretation solutions, creating higher barriers to entry for new market participants.

Regionally, the market exhibits a clear bifurcation in growth trajectory and technological maturity. North America and Europe maintain technological leadership, focusing on sophisticated defense procurement and driving innovation in high-end deep-water systems and autonomous deployment platforms. Europe, in particular, showcases powerful commercial growth fueled by stringent environmental directives and massive governmental subsidies supporting offshore wind development, leading to consistent demand for specialized intermediate-depth survey tools. In contrast, the Asia Pacific (APAC) region is projected to register the fastest compound annual growth rate, underpinned by massive infrastructural investments in coastal economic zones, including expansion of vital commercial ports, coupled with significant modernization programs within national navies aimed at enhancing maritime domain awareness.

Analysis of market segments highlights the dominance of the Hydrography and Charting application due to perpetual regulatory requirements, yet the fastest proportional expansion is clearly identifiable within the Offshore Construction Support sector, reflecting the global energy transition away from fossil fuels towards renewables. Segmentation by Platform reveals AUV/USV-mounted systems as the most significant technological pivot point, promising unprecedented cost-efficiency and operational reach, thereby disrupting traditional vessel-based survey models. Manufacturers are therefore heavily prioritizing R&D in smaller, lighter transducer arrays and power-efficient processing units to capitalize on this rapidly growing autonomous segment, positioning themselves for long-term growth by aligning with the industry's shift towards unmanned maritime operations across all water depths.

AI Impact Analysis on Multibeam Sonar Market

Common user inquiries regarding the influence of Artificial Intelligence on the Multibeam Sonar Market overwhelmingly focus on the transition from manual, time-consuming data analysis to automated, intelligent interpretation. Users frequently ask about the practical deployment of machine learning for efficiently cleaning vast, complex acoustic datasets by automatically identifying and removing noise and artifacts, a process traditionally requiring intense human labor. Furthermore, there is immense interest in AI's capacity to perform real-time object classification—distinguishing between natural geological features, marine debris, unexploded ordnance (UXO), and submerged infrastructure—which enhances the efficiency of search and recovery missions and military reconnaissance. The ability of AI to optimize the sonar system’s operational parameters dynamically, such as adjusting pulse length, frequency, and beam width based on instantaneous environmental conditions (e.g., thermal layering, turbidity), is also a key area of expectation, promising superior data quality without expert manual tuning.

The integration of AI algorithms, particularly deep learning models, is redefining the post-processing phase of multibeam surveys, moving the industry toward rapid, actionable intelligence. AI facilitates the automatic segmentation and classification of the seabed based on acoustic backscatter characteristics, providing highly detailed habitat maps essential for environmental assessments without the need for extensive ground-truthing. This dramatic reduction in post-processing time, which can often account for up to 70% of a total survey project duration, directly translates into lower project costs and faster delivery timelines for critical infrastructure and defense projects. Moreover, AI allows for advanced predictive modeling, enabling survey managers to anticipate equipment failures, optimize vessel routes based on predicted acoustic interference, and allocate resources more effectively.

Looking forward, the transformative impact of AI extends to enhancing the autonomy and decision-making capabilities of AUVs and USVs deployed with multibeam systems. AI-powered mission controllers will enable platforms to interpret the data they are collecting in real-time, allowing for adaptive path planning—for example, automatically orbiting a newly discovered anomaly or increasing the survey density over areas identified as having high complexity. This adaptive surveying dramatically improves the certainty of data acquisition and minimizes the risk of requiring expensive follow-up missions. This convergence of high-fidelity sensing hardware with sophisticated machine intelligence represents the future benchmark for efficiency and accuracy in all sectors of underwater mapping and surveillance.

- Automation of Data Cleaning and Artifact Removal using advanced neural networks, substantially reducing post-processing burdens.

- Real-Time Anomaly and Object Detection, enabling immediate classification and geo-referencing of critical submerged targets (UXO, debris, pipelines).

- Automated Seabed Classification based on backscatter data, generating detailed geological and biological habitat maps.

- Dynamic Optimization of Sonar Parameters (e.g., gain, frequency, pulse length) in response to changing environmental conditions for superior data collection.

- Enhanced Sensor Fusion, integrating multibeam bathymetry with acoustic imagery and LiDAR data for holistic underwater visualization.

- Adaptive Mission Planning and Navigation for Autonomous Platforms, allowing real-time modification of survey patterns based on collected data.

- Predictive Maintenance Analytics for Transducer Arrays, forecasting required servicing based on operational usage patterns.

DRO & Impact Forces Of Multibeam Sonar Market

The principal drivers sustaining the robust growth of the multibeam sonar market are rooted in geopolitical and economic imperatives, particularly the global shift toward maritime security and clean energy. The accelerating development of offshore renewable energy infrastructure, including major wind farm construction projects in Europe, North America, and Asia, necessitates extensive, high-precision bathymetric surveys for site assessment, foundation design, and subsequent monitoring, creating powerful, long-term demand. Concurrently, increasing tensions over maritime boundaries and resource exploitation drive major defense spending on naval modernization programs, specifically the procurement of advanced multibeam systems crucial for mine countermeasure operations (MCM), submarine detection, and strategic intelligence gathering in littoral and deep-sea environments.

Despite these powerful drivers, the market faces significant constraining factors that limit wider adoption, particularly in developing economies and smaller organizations. The exceptionally high initial investment required for purchasing and integrating state-of-the-art deep-water multibeam systems, which include sophisticated hardware, motion sensors, and proprietary processing software, often presents a prohibitive financial barrier. Moreover, the operation and maintenance of these highly technical systems demand a specialized workforce possessing advanced hydrographic and acoustic engineering expertise, contributing to high operational costs and dependency on a limited pool of highly-trained professionals. Furthermore, environmental regulations concerning acoustic emissions in sensitive marine areas occasionally restrict operational freedom, particularly the frequency and duration of surveys in regions designated for marine mammal protection.

Substantial market opportunities are emerging primarily through technological innovation and geographical diversification. The opportunity to simplify user interfaces and integrate AI/ML for automated data processing offers a pathway to mitigate the constraint related to operational complexity and the reliance on specialist staff, thereby broadening the potential user base to general commercial surveyors and civil engineers. Geographically, untapped potential exists in mapping and monitoring vast inland waterways, river systems, and reservoir infrastructure, driven by increasing concerns over flood mitigation and infrastructure longevity, areas historically underserved by high-resolution 3D acoustic mapping. The ongoing development of lightweight, modular, and low-cost systems tailored specifically for small vessel and USV integration also provides a critical opportunity to democratize access to high-resolution survey technology across smaller commercial sectors.

- Drivers: Accelerated Offshore Renewable Energy Development (Wind, Wave); Increased Global Naval and Maritime Surveillance Budgets; Mandatory International Standards for Nautical Charting and Survey Quality (IHO); Technological Advancements in AUV/USV Integration.

- Restraints: Exorbitant Capital Expenditure for High-End Systems; Shortage of Qualified Hydrographic Data Processing Specialists; Regulatory Restrictions on Acoustic Sounding in Environmentally Sensitive Regions; Complexity and Time Required for Post-Processing Large Datasets.

- Opportunities: Expansion into the Unserved Inland Waterway and Port Infrastructure Monitoring Markets; Integration of AI for Automated Data Classification and Real-Time Interpretation; Commercialization of High-Frequency, Portable Systems; Demand for Multi-Aspect Systems (Bathymetry + Backscatter + Sub-Bottom Profiling).

- Impact Forces: The necessity for technological convergence with cloud computing and big data analytics to handle massive datasets, regulatory standardization pushing for higher data quality thresholds, and sustained government investment in strategic seabed mapping initiatives.

Segmentation Analysis

The market for multibeam sonar is structurally segmented to reflect the variance in technological complexity, operational environments, and specific end-user requirements, providing a detailed framework for market analysis and strategic planning. Segmentation by Type, dividing the offerings into Deep Water Multibeam Sonar (DWMB) and Shallow Water Multibeam Sonar (SWMB), highlights the fundamental trade-off between coverage and resolution. SWMB systems, typically operating at higher frequencies (e.g., 400 kHz), provide exceptionally fine-grained resolution over smaller coverage swaths, making them ideal for harbor inspection, pipeline integrity surveys, and environmental studies in coastal regions. DWMB systems, conversely, utilize lower frequencies (e.g., 12 kHz to 50 kHz) to achieve maximum acoustic penetration and coverage in deep ocean environments, sacrificing some resolution for the ability to map vast, remote areas for strategic or scientific purposes.

The Application segment is particularly vital, reflecting the diverse end-user demands across critical global sectors. Hydrography and Charting remain the most robust application category, acting as the bedrock demand for multibeam technology, sustained by continuous governmental commitments to navigational safety. However, the Offshore Construction Support segment is demonstrating dynamic, high-velocity growth, directly correlating with global expenditure on complex subsea infrastructure, necessitating high-accuracy, repeatable surveys throughout the project lifecycle—from site selection to decommissioning. Meanwhile, the Military and Defense segment demands the most specialized and high-specification equipment, with a primary focus on reliable, covert systems for Mine Countermeasures (MCM), submarine track mapping, and high-fidelity target detection in challenging littoral environments, often requiring ruggedized, custom-built solutions.

Segmentation by Platform showcases the structural shift toward unmanned and autonomous marine operations, a transformation driven by efficiency and safety objectives. While traditional Hull-mounted systems continue to dominate the high-power, large-vessel segment (naval and large research ships), offering stability and reliability, the most significant transformative growth is concentrated in the AUV/USV-mounted systems segment. These autonomous platforms require specialized multibeam heads optimized for extreme Size, Weight, and Power (SWaP) constraints, offering the distinct advantage of conducting surveys in high-risk or inaccessible areas without human presence. The increasing affordability and maturity of AUV and USV platforms are accelerating the procurement of these miniaturized, yet powerful, multibeam payloads, indicating a fundamental market shift toward distributed, fleet-based surveying methodologies and positioning the platform segment as a key area for technological differentiation among leading manufacturers.

- By Type:

- Deep Water Multibeam Sonar (DWMB): Optimized for depth penetration and long range, typically lower frequency.

- Shallow Water Multibeam Sonar (SWMB): Optimized for high resolution and detail in coastal and harbor environments, typically higher frequency.

- By Application:

- Hydrography and Nautical Charting: Fundamental mapping required by regulatory bodies (IHO).

- Offshore Construction Support: Site assessment, cable laying, and infrastructure monitoring for Oil & Gas and Offshore Renewables.

- Underwater Surveying and Mapping: General geological and resource mapping.

- Search and Recovery (SAR): Locating sunken vessels, aircraft, and debris.

- Scientific Research and Oceanography: Deep-sea ecosystem and seafloor dynamics study.

- Military and Defense: Mine Countermeasures (MCM), route surveys, and high-stakes surveillance.

- By Platform:

- Hull-mounted Systems: Permanent installation on large survey vessels and naval ships.

- Towed Systems: Used for stability and noise reduction in deep or challenging environments.

- Autonomous Underwater Vehicle (AUV)/Unmanned Surface Vehicle (USV)-mounted Systems: Rapidly growing segment driving miniaturization and low-power consumption.

- By Frequency:

- Low Frequency (<50 kHz): For extreme deep-water coverage.

- Medium Frequency (50 kHz - 200 kHz): Balanced performance for intermediate depths.

- High Frequency (>200 kHz): For shallow water, ultra-high resolution imaging.

Value Chain Analysis For Multibeam Sonar Market

The Multibeam Sonar market value chain is initiated at the upstream level with the highly specialized manufacturing of core acoustic and electronic components. This stage includes the production of high-performance piezoelectric ceramics, the assembly of complex transducer arrays containing hundreds of individually controlled elements, and the fabrication of specialized high-speed digital signal processors (DSPs). Given the stringent performance requirements—especially the need for high signal-to-noise ratios and precise beam control—this segment is characterized by high R&D intensity and intellectual property concentration, dominated by a limited number of specialized electronic and materials suppliers who adhere to rigorous military or industrial standards. Procurement of integrated motion sensors (INS/GPS) and dedicated hydrographic software libraries also forms a crucial part of the upstream input.

The midstream phase is occupied by the Original Equipment Manufacturers (OEMs), who undertake the system integration, proprietary software development, and final assembly of the multibeam sonar units. Key OEMs like Kongsberg, Teledyne, and Thales leverage their internal component capabilities and sophisticated engineering teams to develop proprietary beamforming algorithms and calibration routines that define the system’s performance characteristics. Distribution channels are highly segmented. For high-value, deep-water, and military systems, a direct sales model is predominantly employed, necessitating close interaction between the OEM and the end-user for custom integration, installation, and long-term technical support. Conversely, standard commercial shallow-water systems often utilize indirect channels, relying on global networks of certified marine electronics distributors and system integrators who provide local installation and maintenance services.

The downstream segment encompasses the service providers and end-users responsible for data acquisition and subsequent processing. Service providers include dedicated marine survey companies, offshore engineering firms, and hydrographic bureaus. The final, crucial step in the value chain is post-processing, where raw acoustic data is cleaned, corrected for sound velocity variations, and visualized using specialized software to generate the final deliverables—nautical charts, geological maps, or inspection reports. Significant value is added at this stage through the application of advanced analytics and increasingly, AI-driven classification techniques. Market success often hinges not just on the quality of the sonar hardware, but on the efficiency and interpretive power of the proprietary processing software provided or utilized by the end-user, emphasizing the growing importance of the software element throughout the entire value chain.

Multibeam Sonar Market Potential Customers

Governmental organizations represent the largest and most consistently stable segment of potential customers for multibeam sonar technology. This group is segmented into two main sub-groups: national hydrographic offices (H.O.s) and national defense agencies (Navies and Coast Guards). Hydrographic offices are mandated by international law (IHO) to ensure navigational safety within their jurisdiction, requiring continuous investment in high-end, hull-mounted multibeam systems for strategic mapping of coastal zones, EEZs, and international shipping lanes. Naval forces are critical buyers, relying on multibeam technology for tactical advantage, including reconnaissance, mapping complex harbor entrances, identifying mine hazards, and facilitating anti-submarine warfare (ASW) operations. These government buyers prioritize extreme reliability, robust military specification (Mil-Spec) construction, and comprehensive through-life support.

The commercial sector constitutes the second major customer base, characterized by rapid growth driven by energy and infrastructure needs. Marine survey contractors form the core commercial consumers, acquiring various multibeam systems (shallow, deep, and AUV-mounted) to fulfill contracts for energy clients—both traditional oil and gas (pipeline inspection, site clearance) and offshore renewables (pre-installation surveys, foundation monitoring). The massive scale of offshore wind farm projects, in particular, has led to a surge in demand for intermediate-depth, high-resolution systems capable of accurately mapping extensive areas rapidly. Furthermore, major port authorities and dredging companies are increasingly adopting multibeam systems for maintaining channel depths, monitoring siltation rates, and inspecting complex quay wall structures, where precise, repeatable measurements are paramount for safety and operational efficiency.

Finally, the academic and scientific communities serve as specialized, high-impact customers, driving demand for innovative and experimental sonar capabilities. Research institutions and universities utilize multibeam technology for deep-sea oceanography, climate change studies, habitat mapping, and fundamental geological research, often requiring systems capable of providing unique scientific insights beyond standard bathymetry, such as advanced backscatter classification or full water column visualization. This segment often acts as an early adopter of new technologies, such as advanced data processing techniques and deep-rated autonomous platforms, seeking cutting-edge capabilities even if procurement budgets are often smaller than those commanded by large government or commercial entities. Their requirements often prioritize data quality and system flexibility for deployment across diverse research vessels and platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kongsberg Gruppen, Teledyne Technologies, R2Sonic, EdgeTech, Thales Group, ATLAS ELEKTRONIK, Sonardyne International, Nortek AS, Raytheon Technologies, Furuno Electric, WASSP, Klein Marine Systems, Chesapeake Technology, Inc., SyQwest, Tritech International, Hydroacoustics Inc., BAE Systems, SAAB AB, Innomar Technologie GmbH, Exail (iXblue) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multibeam Sonar Market Key Technology Landscape

The technological core of the multibeam sonar market is defined by continuous innovation in transducer array design and signal processing. Modern systems utilize advanced two-dimensional, electronically steered transducer arrays (often planar or cylindrical) to achieve highly precise beam control, enabling the system to instantaneously form and listen to hundreds of narrow acoustic beams. The most significant technological shift has been the move toward fully digitized systems, where the acoustic signal is sampled and digitized as early as possible within the transducer housing. This digitization minimizes analog noise and allows for more complex, software-defined beamforming algorithms (such as focusing the beams along the axis of transmission), resulting in dramatically improved resolution and greater suppression of side-lobe interference, even in noisy urban or coastal environments.

Miniaturization and integration remain paramount in the contemporary technological landscape, driven heavily by the rapid proliferation of Autonomous Underwater Vehicles (AUVs) and Unmanned Surface Vehicles (USVs). Manufacturers are engaged in intense competition to reduce the Size, Weight, and Power (SWaP) footprint of multibeam heads without compromising acoustic performance. This involves integrating the sonar processing unit (SPU) directly into the transducer housing and utilizing highly efficient, low-power processing chipsets. Successful SWaP reduction is crucial as it directly determines the endurance, range, and payload capacity of autonomous platforms, which are increasingly favored for cost-effective, long-duration deep-sea and coastal monitoring missions, representing a significant technological vector for future growth.

Beyond hardware refinement, software and data fusion technologies are fundamentally altering how multibeam data is collected and utilized. The integration of high-accuracy Inertial Navigation Systems (INS) is now standard, critical for real-time compensation of vessel motion (heave, roll, pitch) to ensure accurate geo-referencing of every sounding, which is essential for meeting rigorous IHO standards. Furthermore, the development of water column imaging (WCI) capability—allowing the user to visualize objects and processes suspended between the surface and the seabed—has become a key differentiator. WCI is leveraged in applications ranging from fisheries assessment and gas plume detection to military mine hunting, providing far more than just bathymetry and transitioning the multibeam system into a comprehensive volume surveillance tool. Ongoing efforts focus on standardizing data formats and optimizing cloud-based processing workflows to manage the terabytes of data generated by modern high-resolution surveys efficiently.

Regional Highlights

North America maintains its position as a powerhouse in the multibeam sonar market, characterized by significant governmental investment and sophisticated technological capabilities. Demand in the United States and Canada is largely anchored by robust defense modernization programs, with continuous procurement of military-specification multibeam systems for subsurface surveillance, mine warfare, and strategic mapping of international waters. The region also hosts major manufacturers and research hubs that lead in integrating AI/ML with acoustic sensor data, particularly for developing advanced autonomous survey solutions capable of operating in challenging Arctic conditions. Commercial demand remains stable, supported by residual exploration activities in the Gulf of Mexico and ongoing regulatory requirements for updating navigational charts along the extensive coastlines and Great Lakes system.

Europe demonstrates a focused and high-growth trajectory, predominantly fueled by ambitious environmental mandates and unparalleled investment in offshore renewable energy. European nations, especially those bordering the North Sea, are aggressively funding the establishment of vast offshore wind farms, requiring specialized shallow-to-intermediate water multibeam surveys for foundation design, cable routing, and environmental impact assessments. This commercial driver is supplemented by strong governmental demand for hydrographic systems necessary for managing the heavy commercial traffic through the Suez Canal route and the vital North Atlantic shipping lanes. Europe is home to several global industry leaders, fostering intense competitive innovation focused on precision, modularity, and integration with dynamic positioning systems (DPS).

The Asia Pacific (APAC) region is forecasted to exhibit the steepest growth curve over the forecast period, driven by rapid urbanization, massive coastal infrastructure development, and escalating geopolitical competition. Countries like China, India, South Korea, and Japan are heavily investing in expanding port capacities and constructing new maritime trade corridors, directly necessitating high-volume hydrographic surveying services. Furthermore, geopolitical instability, particularly surrounding territorial disputes, is spurring significant increases in naval expenditure across the region, focusing on acquiring advanced multibeam systems for maritime domain awareness (MDA) and reinforcing submarine fleet capabilities. This convergence of commercial infrastructure expansion and strategic military modernization positions APAC as the primary engine of global market consumption in the coming decade, creating lucrative opportunities for both domestic and international sonar manufacturers.

- North America: Stable military demand, technological leadership in AUV integration, and robust regulatory hydrography programs.

- Europe: High-growth commercial sector led by massive offshore wind and renewable energy investment; strong presence of leading sonar manufacturers.

- Asia Pacific (APAC): Fastest growing region due to accelerated port construction, coastal infrastructure projects, and strategic naval modernization.

- Latin America (LATAM): Emerging market driven by offshore energy exploration activities (especially Brazil and Mexico) and necessity for modernizing national hydrographic fleets.

- Middle East & Africa (MEA): Focused investment on critical maritime choke points security, and initial-phase development of regional offshore energy assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multibeam Sonar Market.- Kongsberg Gruppen

- Teledyne Technologies Inc.

- R2Sonic LLC

- EdgeTech

- Thales Group

- ATLAS ELEKTRONIK GmbH (thyssenkrupp Marine Systems)

- Sonardyne International Ltd.

- Nortek AS

- Raytheon Technologies Corporation

- Furuno Electric Co., Ltd.

- WASSP Ltd.

- Klein Marine Systems (L3Harris Technologies)

- Chesapeake Technology, Inc.

- SyQwest Inc.

- Tritech International Ltd.

- Hydroacoustics Inc.

- BAE Systems Plc

- SAAB AB

- Innomar Technologie GmbH

- Exail (iXblue)

Frequently Asked Questions

Analyze common user questions about the Multibeam Sonar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental benefit of using multibeam sonar over traditional single-beam echo sounders?

Multibeam sonar collects data from a wide swath of the seafloor simultaneously by utilizing multiple acoustic beams, providing comprehensive 100% area coverage and high-resolution 3D bathymetric data much faster than the narrow, single-point measurements of traditional single-beam systems.

In which specific maritime application is the demand for multibeam systems currently the most critical?

The demand is most critical in offshore construction support, primarily driven by the exponential global growth of offshore renewable energy projects, where meticulous site surveys and real-time monitoring of subsea cable and turbine foundation placements are regulatory necessities.

How do technological constraints like SWaP impact the adoption of multibeam sonar?

Constraints on Size, Weight, and Power (SWaP) consumption are major drivers in manufacturing, as meeting these limitations is essential for integrating high-performance multibeam systems onto smaller, endurance-focused Autonomous Underwater Vehicles (AUVs) and Unmanned Surface Vehicles (USVs).

Which factors contribute to the high cost barrier associated with multibeam sonar technology?

The high cost is attributable to the complexity of the core components, specifically the highly accurate transducer arrays, the advanced digital signal processing hardware required for beamforming, and the expensive proprietary software necessary for calibration and high-fidelity data processing.

What role does Artificial Intelligence play in future multibeam data processing?

AI is pivotal for future processing by automating data cleaning, performing real-time object classification, and dynamically optimizing system settings, significantly reducing the post-processing workload and enabling autonomous platforms to make intelligent, adaptive decisions during survey missions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager