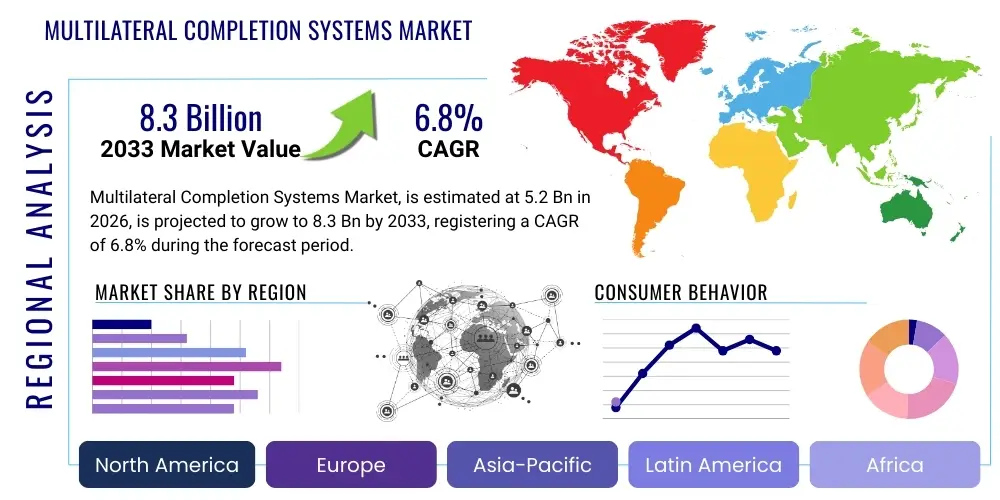

Multilateral Completion Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443182 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Multilateral Completion Systems Market Size

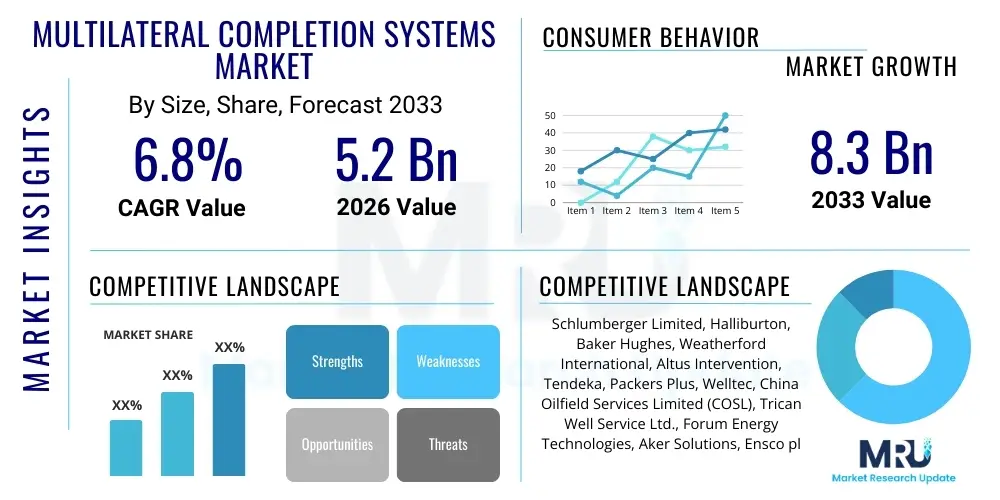

The Multilateral Completion Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033.

Multilateral Completion Systems Market introduction

Multilateral Completion Systems (MLCs) represent a sophisticated technological advancement within the oil and gas industry, specifically designed to enhance reservoir contact and optimize hydrocarbon recovery by drilling multiple lateral wellbores branching off a single main vertical or deviated wellbore. These systems are crucial in maximizing the drainage area from a single well platform, particularly in complex geological structures, mature fields, and deep-water environments where drilling costs are prohibitively high. MLC technology allows operators to access remote pockets of reserves that would otherwise be economically unviable, thus providing a significant return on investment through increased production rates and reduced drilling footprint.

The core product encompasses specialized junction systems, sealing technologies, downhole tools, and proprietary installation procedures necessary to connect the lateral wellbores seamlessly and reliably to the main wellbore. These systems must ensure hydraulic isolation between the boreholes while maintaining structural integrity under extreme downhole pressures and temperatures. Major applications span both onshore and offshore exploration and production activities, focusing primarily on mature fields requiring enhanced oil recovery (EOR) techniques and unconventional reservoirs, such as shale and tight sands, where lateral reach is paramount. The successful deployment of MLCs leads directly to reduced infrastructure requirements and optimized field development planning.

Driving factors propelling the adoption of MLCs include the global imperative to maximize resource utilization from existing assets, the sustained volatility in crude oil prices necessitating cost-effective drilling techniques, and significant advancements in horizontal drilling and reservoir modeling technologies. The primary benefit of MLCs is the substantial increase in the reservoir drainage area, which translates into higher cumulative production and accelerated payout times for energy projects. Furthermore, MLCs contribute to lower environmental impact by reducing the number of well pads needed to cover a specified area, aligning with increasingly stringent environmental, social, and governance (ESG) standards within the energy sector.

Multilateral Completion Systems Market Executive Summary

The Multilateral Completion Systems market is currently experiencing robust growth, underpinned by significant technological integration and expanding global offshore deep-water activities. Business trends highlight a strong shift toward higher complexity MLC installations, specifically Level 4 and Level 5 systems, which offer pressure integrity and selective control over lateral production. Key industry players are focusing on developing advanced retrieval and intervention tools for MLC junctions to ensure long-term operational efficiency and maintenance. Strategic collaborations between drilling contractors and completion specialists are also defining the competitive landscape, aiming to offer integrated drilling-to-production solutions that reduce non-productive time (NPT).

Regionally, the market dynamics are heavily influenced by capital expenditure cycles in major oil and gas basins. North America remains a dominant market, driven by the intense application of directional drilling techniques in unconventional onshore plays, although the complexity of systems deployed is generally lower than in offshore regions. Conversely, regions like the Middle East and the Asia Pacific, particularly those with deep-water assets (e.g., Brazil, West Africa, and Southeast Asia), are witnessing accelerated adoption of highly sophisticated MLC technologies (Level 5) aimed at optimizing complex deep reservoirs and maximizing recovery from increasingly challenging fields. Government policies supporting domestic production and infrastructure investment further catalyze regional growth.

Segment trends underscore the increasing dominance of Level 4 and Level 5 junction systems due to the rising demand for controlled access and selective production monitoring capabilities in highly heterogeneous reservoirs. While onshore applications, particularly in shale, contribute significantly to market volume, the higher average revenue per well is generated by complex offshore projects where the economic advantages of multilateral technology are most pronounced. The segmentation by application confirms that offshore environments, despite fewer overall wells, command a higher value share due to the requirement for advanced sealing, pressure integrity, and downhole intelligence integrated within the multilateral system architecture. Continuous innovation in robust, reliable isolation sleeves and intelligent completion components is driving growth across all system types.

AI Impact Analysis on Multilateral Completion Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Multilateral Completion Systems commonly center on how machine learning (ML) can optimize complex drilling paths, predict junction failure risks, and enhance real-time production optimization across multiple laterals. Users are particularly interested in the application of predictive maintenance algorithms to reduce intervention costs associated with MLC failures and the use of reinforcement learning to fine-tune production chokes and lift gas injection for optimal flow from each lateral segment. The key themes revolve around achieving 'intelligent multilateral wells,' where data streams from downhole sensors (pressure, temperature, flow) are processed instantly by AI to make automated decisions, thereby moving beyond manual reservoir management toward fully autonomous well completion optimization.

The integration of AI fundamentally transforms the operational lifecycle of MLCs, beginning with the planning phase. ML algorithms, trained on vast datasets of geological surveys, drilling parameters, and historical completion effectiveness, can determine the optimal number, length, and trajectory of laterals for maximizing Net Present Value (NPV) while minimizing drilling risk. This predictive modeling capability significantly reduces uncertainties inherent in complex reservoir geometry. Furthermore, during the construction phase, AI-powered systems monitor torque, drag, and downhole vibrations in real-time, providing immediate adjustments to steer the drill bit precisely, ensuring accurate placement of the MLC junction and subsequent laterals, which is critical for system reliability.

Post-installation, AI is instrumental in managing production optimization from the multilateral structure. By analyzing fluid dynamics and identifying cross-flow potential or premature water/gas breakthrough in specific laterals, AI systems can intelligently control intelligent completion valves integrated within the MLC assembly. This allows for precise, automated adjustments to the flow from individual laterals without human intervention, maintaining the optimal reservoir sweep and extending the productive life of the well. This shift from reactive maintenance to proactive, predictive control represents the most substantial economic benefit derived from AI integration in the Multilateral Completion Systems market, driving demand for smart, sensor-laden completion technologies.

- Enhanced Reservoir Modeling: AI optimizes lateral placement based on high-resolution geological data.

- Predictive Maintenance: Machine learning forecasts junction and tool failures, minimizing non-productive time (NPT).

- Real-Time Drilling Optimization: AI guides directional drilling for accurate multilateral junction installation.

- Autonomous Production Control: Algorithms automatically adjust flow control devices (ICDs/ICVs) in laterals for maximum sweep efficiency.

- Data Fusion and Interpretation: AI processes complex sensor data from multiple laterals simultaneously to diagnose flow issues.

DRO & Impact Forces Of Multilateral Completion Systems Market

The Multilateral Completion Systems market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, all interacting as impactful forces on market trajectory. The primary driver is the necessity for enhanced recovery rates from aging oil fields globally, combined with the increasing difficulty and expense of accessing new deep-water and ultra-deep-water reserves, where MLCs offer a cost-effective alternative to drilling multiple single wells. The continuous technological maturation, particularly in robust Level 5 junctions that guarantee pressure integrity and selective lateral control, further fuels adoption. However, the market faces significant restraints, chiefly the high initial capital investment required for MLC implementation, the technical complexity demanding specialized personnel and equipment, and inherent installation risks that could lead to non-productive time (NPT) if not managed meticulously.

Opportunities for market expansion are substantial, driven largely by the proliferation of unconventional resources globally, such as shale and coalbed methane, where the increased drainage area provided by laterals is paramount to economic viability. Furthermore, the integration of advanced downhole monitoring and control systems—often termed "intelligent completions"—into the multilateral architecture represents a high-value opportunity, enabling operators to remotely monitor and manage flow from individual laterals. The focus on reducing the environmental footprint of drilling operations also acts as a latent opportunity, as MLCs inherently decrease the surface footprint compared to equivalent production achieved via multiple single wells.

The impact forces within this market are predominantly technological and economic. Economic forces, such as the volatility of global oil prices, directly influence upstream capital expenditure; high prices encourage investment in complex MLC projects, while sustained low prices drive operators toward minimizing drilling expenditure, potentially favoring simpler completion methods or existing assets. Technologically, the rapid development of specialized drilling tools, such as rotary steerable systems (RSS) and specialized whipstock technology for reliable window cutting, significantly lowers the technical barriers to entry for multilateral installations. Furthermore, geopolitical stability in key producing regions and regulatory environments regarding offshore exploration spending exert crucial external impact forces that determine the geographical spread and intensity of MLC deployments.

Segmentation Analysis

The Multilateral Completion Systems market is segmented based on critical operational and technological criteria, predominantly System Type, Application, and Well Type. Segmentation by System Type is crucial as it dictates the complexity, functionality, and cost of the completion system, ranging from Level 1 (simplest, uncemented open-hole sidetracks) to Level 5 (most complex, offering pressure integrity and selective re-entry capabilities for each lateral). The rising complexity of reservoir management demands increasingly sophisticated junctions, skewing the revenue generation toward Level 4 and Level 5 systems. The application segmentation, covering onshore and offshore environments, reflects the distinct operational challenges and capital expenditure levels, with offshore applications generally demanding higher specifications and commanding premium pricing due to the need for robust, long-lasting reliability in challenging subsea conditions.

Further segmentation by Well Type (Oil Well vs. Gas Well) illustrates variations in system design tailored to fluid characteristics and flow assurance requirements. Oil wells, particularly those requiring Enhanced Oil Recovery (EOR) techniques or operating in heavy oil formations, often utilize MLCs to maximize viscous fluid contact. Gas wells, especially in tight gas formations, leverage the extended reach of multilaterals to achieve economic flow rates from low-permeability rock. Understanding these segments is vital for vendors to tailor their product offerings, focusing on technologies that address specific reservoir characteristics and operational constraints, thereby optimizing the total cost of ownership for the operator.

- By System Type

- Level 1 (Uncased)

- Level 2 (Cased, Uncemented)

- Level 3 (Cased, Cemented, Limited Isolation)

- Level 4 (Cased, Cemented, Pressure Integrity)

- Level 5 (Advanced Sealing, Selective Re-entry and Control)

- By Application

- Onshore

- Offshore

- Shallow Water

- Deep Water

- Ultra-Deep Water

- By Well Type

- Oil Well

- Gas Well

- Injector Well (Water/Gas)

- By Component

- Junctions and Connectors

- Downhole Tools (Whipstocks, Cementing Systems)

- Flow Control Devices (ICDs/ICVs)

Value Chain Analysis For Multilateral Completion Systems Market

The value chain for the Multilateral Completion Systems market is complex, integrating specialized material procurement, high-precision manufacturing, expert design and engineering, specialized drilling services, and ultimate well operations and maintenance. The upstream activities involve the sourcing and manufacturing of specialized alloys, elastomers, and high-strength composite materials necessary for constructing the robust downhole tools and junction components that must withstand extreme temperatures, pressures, and corrosive environments. Research and Development (R&D) forms a significant early component, focusing on improving junction reliability (e.g., Level 5 seals) and integrating intelligent completion technology, driven by the intellectual property held by major service companies.

Midstream activities center around the fabrication of the completion hardware, assembly, and quality assurance processes. This phase is characterized by stringent testing protocols to ensure system integrity before deployment. Specialized service providers, often the major integrated oilfield service companies, then take ownership of the design engineering and system integration tailored to specific well geometry and reservoir characteristics. This critical phase involves precise operational planning, including trajectory mapping and selection of appropriate whipstock and drilling systems required to create the lateral windows. The successful execution heavily relies on the synergy between the hardware provider and the drilling services contractor.

Downstream activities include the installation of the MLC system, which is typically executed by the service company personnel on the rig, demanding high levels of technical expertise and specialized running tools. The distribution channel is primarily direct, involving the service provider selling and deploying the system directly to the End-User (E&P companies). Indirect distribution plays a minimal role but might include specialized partnerships or leasing arrangements for high-cost, reusable downhole tools. Post-installation, the value chain extends to long-term monitoring, intervention, and maintenance services, which are often bundled as part of a long-term service contract, generating recurring revenue and ensuring the longevity and optimal performance of the multilateral well architecture.

Multilateral Completion Systems Market Potential Customers

The primary potential customers and end-users of Multilateral Completion Systems are large-scale Exploration and Production (E&P) companies, both international oil companies (IOCs) and national oil companies (NOCs), that possess substantial reserves in complex or mature fields. IOCs such as ExxonMobil, Chevron, Shell, and BP are continuous adopters, especially in their deep-water assets off the coast of Africa, the Gulf of Mexico, and Brazil, where MLCs provide essential economic leverage by maximizing production from expensive drilling campaigns. These entities prioritize Level 4 and Level 5 systems due to their long-term reliability and reservoir management capabilities.

National Oil Companies (NOCs), including Saudi Aramco, ADNOC, Petrobras, and Rosneft, constitute another significant customer base. NOCs frequently utilize MLC technology to enhance recovery rates from vast, complex domestic reservoirs, often driving massive field development projects where efficiency and resource maximization are strategic national priorities. For instance, in mature onshore fields operated by NOCs, MLCs offer a way to increase output without expanding the surface footprint. Furthermore, independent E&P operators, particularly those focused on tight oil and gas formations (e.g., U.S. shale basins), are significant consumers of lower-to-mid complexity MLCs (Levels 2 and 3) to optimize drainage in unconventional resources where capital efficiency is critical.

In essence, the buying decision is driven by the economic viability of the well, the geological complexity of the reservoir, and the imperative to manage reservoir pressure and fluid contacts effectively over the lifespan of the well. Customers seek vendors who can demonstrate reliability, minimize installation risks, and offer integrated solutions that incorporate intelligent completion technology for maximum operational flexibility. The procurement cycle is often long and technical, involving extensive pre-qualification and adherence to stringent industry standards regarding material science and structural integrity, reflecting the high stakes associated with downhole completion failure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Halliburton, Baker Hughes, Weatherford International, Altus Intervention, Tendeka, Packers Plus, Welltec, China Oilfield Services Limited (COSL), Trican Well Service Ltd., Forum Energy Technologies, Aker Solutions, Ensco plc (Valaris), Superior Energy Services, Nine Energy Service, Petrofac Limited, Archer Limited, Expro Group, Global Drilling Fluids and Chemicals Ltd., Key Energy Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multilateral Completion Systems Market Key Technology Landscape

The technological landscape of the Multilateral Completion Systems market is defined by continuous innovation aimed at improving junction integrity, enhancing selective access, and reducing intervention frequency. The most crucial advancements revolve around Level 5 junction technology, which utilizes metal-to-metal seals and advanced cementing techniques to guarantee full pressure integrity and hydraulic isolation between the main bore and the lateral bore, mimicking the performance of a conventionally drilled and cased junction. Specialized drilling tools, particularly high-performance steerable drilling systems (RSS) coupled with sophisticated logging-while-drilling (LWD) tools, are essential for precisely navigating and placing the wellbore window where the lateral is initiated, ensuring geometric alignment for successful MLC installation.

A second major technological trend is the integration of Intelligent Completion (IC) systems directly within the multilateral architecture. This involves embedding permanent downhole gauges (PDGs) and hydraulically or electrically actuated flow control valves (ICVs/ICDs) at the entry point of each lateral. These intelligent components allow operators to monitor reservoir performance—including pressure, temperature, and flow rate—at the individual lateral level and selectively choke or shut off specific laterals if they experience unwanted fluid production (like water or gas breakthrough). This real-time management capability is critical for optimizing the reservoir sweep efficiency and maximizing the ultimate recovery factor (URF) from complex reservoirs.

Furthermore, innovations in specialized deployment and retrieval technology are vital for reducing operational risk and cost. This includes advanced whipstock systems that ensure repeatable and reliable window cutting, as well as specialized fishing and intervention tools designed specifically for multilateral environments, which are geometrically complex and prone to debris accumulation. The move toward modular, standardized MLC components is also gaining traction, enabling faster installation times and greater compatibility across different well specifications and service providers, thereby standardizing the deployment process and improving overall market efficiency and reliability.

Regional Highlights

The global Multilateral Completion Systems market exhibits significant regional variation in terms of adoption rate, complexity of systems utilized, and market maturity, primarily correlating with regional capital expenditure in deep-water and unconventional drilling. North America, particularly the US, commands a significant market share, driven primarily by high-volume onshore drilling activities in shale plays such as the Permian Basin and Marcellus Shale. While the US market utilizes MLC technology extensively, the emphasis is often on simpler, cost-effective systems (Level 2 and 3) to facilitate rapid deployment and high initial production rates across numerous wells. The proximity of technology manufacturers and a mature service infrastructure support sustained market dominance in this region.

Europe, while featuring mature North Sea operations, focuses heavily on complex offshore deep-water completions (Level 4 and 5) to maximize recovery from aging fields in the UK and Norway sectors. The stringent regulatory environment in Europe demands exceptional reliability and safety in downhole tools, pushing the technological envelope towards advanced sealing mechanisms and long-life integrity solutions. The region is characterized by high adoption rates of intelligent completion systems integrated with multilateral infrastructure for sophisticated reservoir management.

The Middle East and Africa (MEA) region is forecast to demonstrate the highest growth potential during the forecast period. Middle Eastern NOCs are increasingly deploying MLCs in both giant conventional fields and newer sour gas developments to sustain production targets. Africa, particularly West Africa (Angola, Nigeria) and East Africa, features substantial deep-water exploration where multilateral drilling provides a viable economic pathway for accessing scattered reserves, significantly reducing the subsea infrastructure required. Latin America, driven almost exclusively by Brazil's pre-salt deep-water exploration efforts, represents a major consumer of Level 5 MLCs, requiring the utmost pressure and temperature resilience necessary for those challenging deep-sea environments.

- North America: Dominant market share driven by extensive onshore unconventional (shale) drilling, focusing on Level 2 and 3 systems for rapid field development.

- Middle East & Africa (MEA): Highest projected CAGR, fueled by NOC investment in optimizing giant conventional fields and complex deep-water discoveries (e.g., Brazil, Angola) favoring robust Level 4 and 5 completions.

- Asia Pacific (APAC): Strong growth in offshore territories like Malaysia, Indonesia, and Australia, focusing on mitigating high well count costs through multilateral deployment in remote fields.

- Europe: Mature market concentrating on technologically advanced Level 5 installations and intelligent completions to extend the economic life of complex North Sea assets.

- Latin America: Growth concentrated in deep-water projects (Brazil pre-salt) requiring specialized, high-integrity MLC solutions to handle extreme pressure and depth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multilateral Completion Systems Market.- Schlumberger Limited

- Halliburton

- Baker Hughes

- Weatherford International

- Altus Intervention

- Tendeka

- Packers Plus Energy Services Inc.

- Welltec A/S

- Forum Energy Technologies

- Aker Solutions

- Superior Energy Services

- Nine Energy Service

- Expro Group

- Global Drilling Fluids and Chemicals Ltd.

- Trican Well Service Ltd.

- Petrofac Limited

- Archer Limited

- Vallourec

- Oil States International, Inc.

- Ensco plc (Valaris)

Frequently Asked Questions

Analyze common user questions about the Multilateral Completion Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of utilizing Multilateral Completion Systems (MLCs) in oil and gas production?

The primary economic benefit of MLCs is maximized reservoir contact and increased drainage area from a single wellbore, substantially reducing the total number of wells required for field development. This directly leads to lower drilling costs per barrel, optimized capital expenditure, and faster return on investment (ROI), particularly in offshore and complex onshore reservoirs where single-well costs are exceptionally high.

How are Multilateral Completion Systems classified, and which system level provides the highest integrity?

MLCs are typically classified into five levels (Level 1 to Level 5) based on the complexity and integrity of the junction seal. Level 5 systems offer the highest integrity, featuring cemented casing, full pressure integrity, and the ability for selective re-entry and production control into each lateral, crucial for complex deep-water or high-pressure, high-temperature (HPHT) environments.

What role does Intelligent Completion (IC) technology play in the Multilateral Completion Systems market?

IC technology integrates permanent downhole sensors and remotely controlled flow valves directly into the multilateral junction and lateral segments. This allows operators to monitor fluid flow, pressure, and temperature in real-time for each individual lateral, enabling proactive adjustments to optimize production, manage reservoir sweep, and prevent premature water or gas breakthrough.

Which geographical regions are expected to drive the highest growth for complex Level 5 Multilateral Completion Systems?

The highest demand for complex Level 5 systems is concentrated in deep-water environments due to stringent reliability requirements. Key growth regions include Latin America (specifically Brazil’s pre-salt basins), the West African deep-water zones, and mature North Sea assets requiring sophisticated reservoir management solutions for aging wells.

What technical challenges restrain the broader adoption of Multilateral Completion Systems?

Key technical restraints include the inherent complexity of accurately installing the junction components, the risk of non-productive time (NPT) due to junction failure or sealing issues, and the need for specialized drilling systems and highly trained personnel to successfully execute the multilateral well design and deployment process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager