Multiphase Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440894 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Multiphase Pumps Market Size

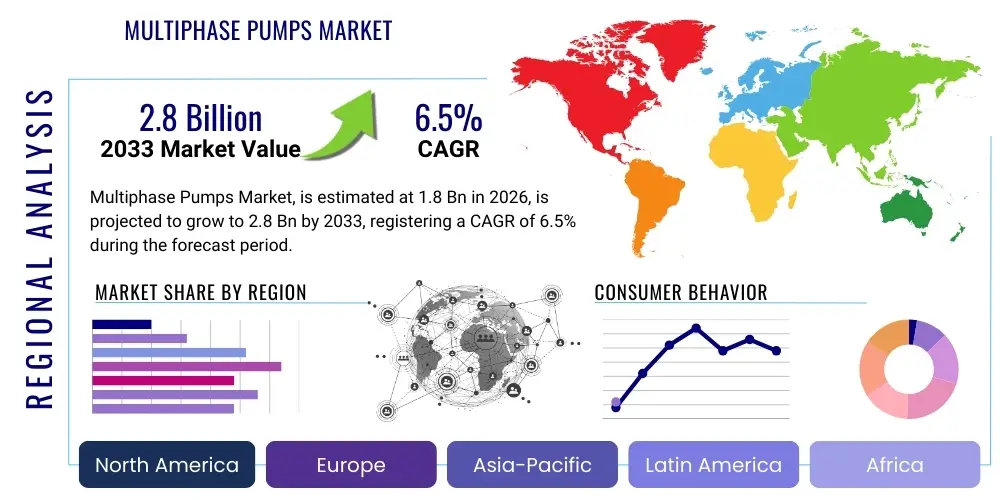

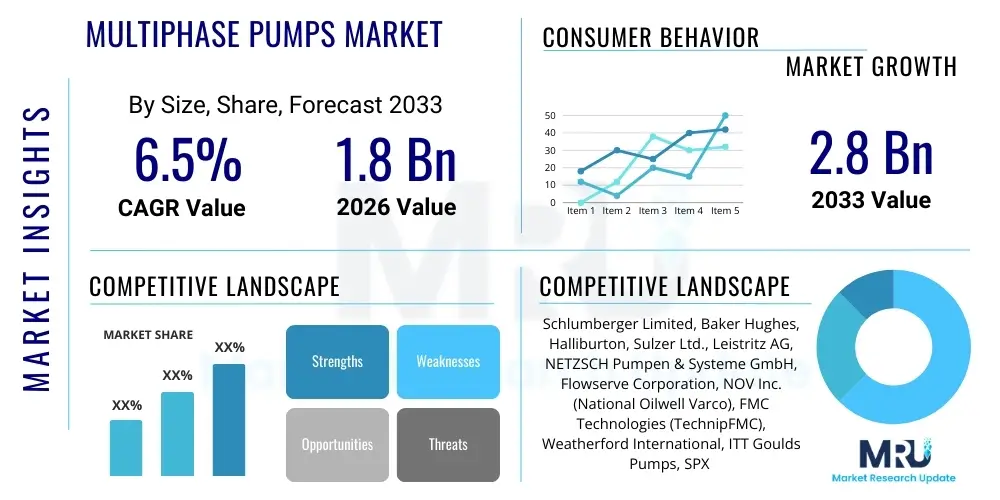

The Multiphase Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Multiphase Pumps Market introduction

The Multiphase Pumps Market encompasses specialized rotating equipment designed to transport unseparated well fluids—a combination of crude oil, natural gas, and water—from the reservoir to processing facilities or flow lines. This technology eliminates the need for bulky and expensive traditional separation equipment near the wellhead, especially in challenging environments like deepwater offshore installations or remote onshore locations. The core function is to maintain flow assurance and boost pressure across varying gas volume fractions (GVF), significantly optimizing production economics.

Multiphase pumping systems are categorized primarily by design—including twin-screw pumps, helico-axial pumps (often integrated into subsea boosting stations), and specialized Electric Submersible Pumps (ESPs) adapted for high-gas content service. Major applications span enhanced oil recovery (EOR), extending the life of mature oil fields, and facilitating long-distance subsea tie-backs where conventional lifting methods are uneconomical or technically prohibitive. The primary benefit derived from this technology is the substantial reduction in operational expenditure (OPEX) and capital expenditure (CAPEX) through simplified infrastructure and reduced topside weight.

Driving factors for market growth include the persistent need for increased crude oil and natural gas production globally, particularly from non-conventional and deep-sea reserves. Furthermore, the inherent environmental advantages of multiphase pumping, such as reduced fugitive emissions and a smaller footprint compared to traditional separation manifolds, align well with the industry's increasing focus on sustainability and regulatory compliance. Technological advancements focusing on improving pump reliability, especially when handling high GVF and abrasive solids, are continually expanding the operational envelope of these critical systems.

Multiphase Pumps Market Executive Summary

The Multiphase Pumps Market demonstrates robust growth, driven primarily by the transition toward deepwater and ultra-deepwater exploration and production (E&P) activities where subsea processing is becoming the norm. Business trends indicate a strong focus on integration and digitalization; manufacturers are increasingly embedding predictive maintenance capabilities and real-time monitoring sensors into pumping units to enhance reliability and uptime. Key players are forming strategic alliances with major Engineering, Procurement, and Construction (EPC) firms and oilfield service providers to secure large-scale, long-term subsea infrastructure contracts, signaling a shift toward integrated solutions rather than standalone equipment supply. Furthermore, there is a clear commercial focus on developing modular, compact pump designs suitable for deployment in marginal fields, allowing operators to monetize smaller reserves that were previously deemed non-commercial.

Regionally, the market is highly dynamic. While North America, particularly the Gulf of Mexico, remains a crucial area due to deepwater developments, the Asia Pacific (APAC) region is emerging as a significant growth driver, fueled by offshore developments in countries like Malaysia, Indonesia, and Australia. The Middle East and Africa (MEA) region is also experiencing heightened activity, particularly for utilizing multiphase pumps to enhance recovery in mature onshore fields and facilitate challenging offshore projects along the West African coast. Regulatory environments supporting lower carbon footprints are favoring the adoption of these technologies, especially in Europe (North Sea), where the focus is on maximizing recovery efficiently from existing infrastructure.

Segment trends reveal a preference for helico-axial pumps in demanding subsea applications due to their high-pressure boost capability and robustness in handling high gas fractions. Conversely, twin-screw pumps maintain dominance in surface and shallow water boosting applications where lower flow rates and varying viscosities are common. The service segment, encompassing installation, maintenance, and refurbishment, is experiencing faster growth than the equipment segment itself, underscoring the criticality of uptime and specialized technical support for these complex, high-value assets. Overall, the market trajectory is characterized by continued innovation aimed at expanding the GVF tolerance and pressure differential capabilities of the pumping systems.

AI Impact Analysis on Multiphase Pumps Market

Common user questions regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Multiphase Pumps Market revolve primarily around predictive maintenance, optimization of pump performance under fluctuating field conditions, and the automation of diagnostics. Users frequently inquire about how AI can predict failures in high-cost subsea pumps before they occur, thus avoiding catastrophic production stoppages. Another key theme is the application of ML models to dynamically adjust pump speed and parameters in real-time based on fluctuating Gas Volume Fraction (GVF) and fluid viscosity, ensuring maximum energy efficiency and minimal wear. Users also show strong interest in integrating AI-driven flow assurance software with pump control systems to model complex flow regimes and troubleshoot potential blockages or slugging issues proactively, maximizing the operational lifespan and reliability of these critical field assets.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, pressure) and historical failure patterns to forecast equipment failure months in advance, significantly reducing unscheduled downtime and optimizing maintenance schedules.

- Real-time Performance Optimization: ML algorithms dynamically adjust pump operating points (e.g., speed, torque) based on instantaneous changes in fluid composition and flow rate, ensuring the pump operates near its optimal efficiency curve.

- Anomaly Detection and Diagnostics: AI systems continuously monitor operational parameters to instantly identify subtle deviations indicative of internal erosion, cavitation, or bearing wear, enabling rapid intervention.

- Enhanced Flow Assurance Modeling: ML integration helps in building more accurate and faster flow models, predicting slug flow severity and enabling the pump control system to mitigate negative impacts proactively.

- Automated Commissioning and Calibration: AI assists in the rapid and precise calibration of newly installed pumps, adapting baseline performance parameters specific to the unique characteristics of the well and reservoir.

- Optimized Spare Parts Management: Predictive insights into component degradation allow for 'just-in-time' procurement and stocking of specialized, long lead-time parts, minimizing inventory costs while ensuring readiness.

- Remote Monitoring and Control: Deployment of autonomous systems that utilize AI to manage routine operational adjustments without continuous human oversight, critical for remote subsea installations.

DRO & Impact Forces Of Multiphase Pumps Market

The Multiphase Pumps Market is influenced by a powerful interplay of market drivers (D), technological restraints (R), and strategic opportunities (O), creating significant impact forces. The primary driver is the accelerating shift toward deepwater and ultra-deepwater oil and gas exploitation, necessitating subsea boosting solutions that simplify infrastructure and reduce the footprint. This is complemented by the push for enhanced oil recovery (EOR) in mature fields, where multiphase pumps offer a reliable method to boost declining reservoir pressures and extend field life. However, market growth is restrained by the extremely high capital investment required for subsea equipment, coupled with technical challenges related to reliability and maintaining efficiency when exposed to highly corrosive or abrasive fluids and extreme gas volume fluctuations.

Key opportunities lie in integrating these systems with renewable energy sources for power, particularly for remote onshore applications or smaller offshore platforms, aligning with global decarbonization goals. Furthermore, the development of smaller, standardized, and modular multiphase pump units designed specifically for marginal field exploitation presents a significant commercial avenue, lowering the entry barrier for smaller operators. The inherent high complexity and specialized nature of installation and servicing create high impact forces that favor established market players with proven subsea track records and deep engineering expertise, effectively consolidating competition around quality and reliability rather than simple cost.

The market impact forces are categorized by supply chain resilience, regulatory pressures, and commodity price volatility. While stable oil prices stimulate large-scale subsea investments, price downturns can severely delay or cancel major projects, directly affecting pump demand. Regulatory mandates emphasizing reduced environmental discharge and improved operational safety continue to favor the adoption of contained subsea processing solutions, including multiphase pumps. Overall, the market’s progression hinges on continuous technological improvement in materials science and sealing technology to overcome the reliability hurdles inherent in handling complex, unseparated fluid streams under high-pressure, deepwater conditions.

Segmentation Analysis

The Multiphase Pumps Market is segmented based on critical technical and application parameters that define system design and deployment strategy. Key segments include the pump type, which dictates the operational envelope (e.g., pressure capability and GVF tolerance), the application environment (onshore versus offshore), and the specific components and services that constitute the total solution. Understanding these segmentations is vital for both manufacturers and operators to select the optimal technology tailored to the specific reservoir characteristics and operational constraints of a given oil and gas field. The segmentation reflects the diverse engineering challenges encountered across the global energy landscape, from high-pressure deepwater tie-backs to low-volume, high-viscosity onshore boosting requirements.

- By Pump Type:

- Twin-Screw Pumps

- Helico-Axial (Centrifugal/Axial) Pumps

- Progressive Cavity Pumps (PCP)

- Electric Submersible Pumps (ESP) adapted for multiphase service

- By Application:

- Onshore Applications (Remote well boosting, long-distance pipelines)

- Offshore Applications (Subsea Boosting Systems, FPSO integration)

- Shallow Water

- Deepwater and Ultra-deepwater

- By Component:

- Pumping Unit (Bare Pump)

- Motor and Drives (Variable Speed Drives)

- Seals and Bearings

- Monitoring and Control Systems (Instrumentation)

- By Service:

- Installation and Commissioning

- Maintenance, Repair, and Overhaul (MRO)

- Consulting and Field Support

Value Chain Analysis For Multiphase Pumps Market

The value chain for the Multiphase Pumps Market is complex and capital-intensive, starting with specialized raw material procurement and advanced manufacturing, leading up to highly specialized installation and long-term service contracts. The upstream analysis focuses on the sourcing of high-grade materials, such as specialized corrosion-resistant alloys (e.g., duplex and super-duplex stainless steel) required for the pump housing and internal components due to the harsh operating conditions involving sour gas (H2S) and high salinity. This stage is dominated by specialized metallurgical suppliers and precision component manufacturers. Manufacturing involves intricate machining and rigorous quality control, given that these pumps operate under extreme pressure differentials and must withstand decades of continuous use in submerged environments. The high barriers to entry here necessitate significant R&D investment and proprietary design knowledge held by a few global technology leaders.

The distribution channel primarily follows a hybrid model. Direct sales and tendering are predominant for large-scale, custom subsea contracts, where the pump manufacturers directly interface with International Oil Companies (IOCs) and National Oil Companies (NOCs) during the front-end engineering design (FEED) phase. This direct approach ensures that the pump specifications are perfectly integrated into the overall subsea production system architecture. Indirect distribution involves working through major Engineering, Procurement, and Construction (EPC) companies, who often include the multiphase pumping unit as part of a much larger turnkey subsea system delivery package, particularly common in large field developments requiring integrated processing solutions.

Downstream analysis highlights the critical role of the service segment. Due to the high criticality and location (often thousands of meters subsea), maintenance and repair services are specialized and high-margin activities. Original Equipment Manufacturers (OEMs) typically maintain long-term service agreements (LTSAs), providing highly trained field engineers, remotely operated vehicle (ROV) support, and highly specialized maintenance facilities for refurbishment. This downstream support ensures maximum operational availability and becomes a crucial differentiation factor for customers, given that the cost of pump failure in a deepwater scenario far outweighs the initial equipment purchase price.

Multiphase Pumps Market Potential Customers

The primary end-users and buyers of multiphase pumping systems are entities engaged in upstream oil and gas exploration and production (E&P) activities, particularly those operating in challenging or mature fields. International Oil Companies (IOCs) such as ExxonMobil, Shell, TotalEnergies, and BP represent the largest customer base, driven by their extensive portfolio of deepwater and complex subsea projects, especially in the Gulf of Mexico, offshore Brazil, and West Africa. These companies demand proven, reliable technology that can sustain high production volumes over decades, justifying the high initial capital outlay. National Oil Companies (NOCs), including Saudi Aramco, Petrobras, Equinor, and ADNOC, are also critical buyers, increasingly adopting these technologies for aggressive recovery schemes in both their complex offshore and vast onshore fields to meet national energy production targets.

Independent oil and gas producers, especially those focused on marginal fields or specialized enhanced oil recovery (EOR) projects, constitute a growing segment of the customer base. These smaller operators often seek modular or standardized multiphase pump solutions that minimize CAPEX and allow for rapid deployment and redeployment. Furthermore, specialized subsea engineering and construction firms, acting as EPC contractors, serve as immediate buyers by integrating the pumps into larger subsea production systems commissioned by the IOCs or NOCs. Their purchasing decisions are heavily influenced by ease of integration, installation requirements, and the manufacturer's track record in complex subsea environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Baker Hughes, Halliburton, Sulzer Ltd., Leistritz AG, NETZSCH Pumpen & Systeme GmbH, Flowserve Corporation, NOV Inc. (National Oilwell Varco), FMC Technologies (TechnipFMC), Weatherford International, ITT Goulds Pumps, SPX FLOW, Inc., Milton Roy Company, Dover Corporation, Ebara Corporation, Weir Group, Nikkiso Co., Ltd., Axflow Holding AB, Gardner Denver (Ingersoll Rand), PCM Pumps. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multiphase Pumps Market Key Technology Landscape

The technological landscape of the Multiphase Pumps Market is defined by continuous innovation focused on improving efficiency, reliability, and the operational envelope, particularly the ability to handle extremely high Gas Volume Fractions (GVF) and abrasive solids. The most significant technological advancement lies in the refinement of the Helico-Axial design, which uses multiple stages of mixed-flow impellers and diffusers to manage the varying density and compressibility of the multiphase flow. Modern helico-axial pumps integrate advanced computational fluid dynamics (CFD) modeling during design to optimize hydraulics, minimize internal recirculation, and mitigate cavitation effects, enabling robust operation at GVFs exceeding 90% and high-pressure boosts crucial for deepwater risers and long subsea tie-backs. Furthermore, the development of high-speed, permanent magnet motors (PMMs) and high-power density Variable Speed Drives (VSDs) is vital, allowing for precise control and higher rotational speeds in compact subsea footprints, directly impacting efficiency and reliability.

Another crucial area of innovation is materials science and sealing technology. The harsh downhole and subsea environments necessitate the use of specialized, corrosion-resistant materials such as high-nickel alloys and ceramics for pump internals to combat erosion and chemical degradation caused by sand, H2S, and CO2. Sealing technology, often involving pressurized mechanical seals or barrier fluid systems, is continuously being improved to prevent process fluid ingress into the motor and bearing chambers, which is a common failure point in high-pressure subsea applications. The trend is moving toward seal-less or magnetic coupling designs for ultimate reliability, reducing maintenance complexity, although these remain highly complex and expensive solutions for ultra-deepwater use cases.

The landscape is also significantly shaped by the integration of sophisticated monitoring and control systems. Fiber optic sensing, acoustic monitoring, and downhole pressure and temperature gauges provide real-time data on pump health, fluid composition, and flow characteristics. This data feeds into advanced control algorithms and predictive maintenance platforms, often leveraging AI, which allows operators to adjust pump parameters remotely, predict component wear, and manage flow assurance proactively. This digitalization effort transforms the multiphase pump from a standalone piece of machinery into an integral, intelligent component of the overall subsea production optimization system, significantly extending the mean time between failure (MTBF) and ensuring consistent production uptime.

Regional Highlights

The global Multiphase Pumps Market exhibits significant regional variations in growth and technology adoption, primarily dictated by the concentration of current and planned deepwater E&P projects and the maturity of existing fields requiring enhanced recovery solutions.

- North America: Dominated by deepwater activities in the US Gulf of Mexico (GOM), North America is a critical early adopter region, driving demand for high-reliability subsea boosting systems. The region’s strict safety and environmental regulations also spur the adoption of advanced, leak-proof pumping technologies. Furthermore, the extensive unconventional oil fields onshore require tailored multiphase pumping solutions for efficient extraction and transport.

- Europe: The North Sea (Norway, UK) remains a mature but active market, focusing heavily on maximizing recovery from aging assets through advanced EOR techniques and subsea tie-backs. Europe leads in the adoption of standardized subsea solutions and modular systems, driven by sustainability targets and the need for cost-effective decommissioning planning.

- Asia Pacific (APAC): This region is experiencing the fastest growth, primarily fueled by new offshore field developments in Australia (e.g., Gorgon, Prelude), Malaysia, and Indonesia. APAC market demand is characterized by diverse requirements, ranging from shallow water marginal fields needing flexible, smaller units to large-scale deepwater projects demanding high-capacity helico-axial pumps. Investment in gas-focused projects also drives demand for pumps tolerant of high Gas Volume Fractions.

- Latin America (LATAM): Brazil is the undisputed powerhouse in LATAM, driven by massive pre-salt ultra-deepwater oil discoveries. Petrobras’s heavy investments in subsea processing and boosting technology, essential for lifting high-viscosity oil from extreme depths, make this region a crucial market for major technology providers specializing in heavy-duty, high-pressure equipment.

- Middle East and Africa (MEA): The Middle East focuses heavily on leveraging multiphase pumps for increasing production from vast, mature onshore fields through boosting applications, often replacing conventional gas lift systems. Africa, particularly West Africa (Angola, Nigeria), drives significant offshore demand for deepwater boosting solutions, where pump reliability under challenging tropical conditions is paramount.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multiphase Pumps Market.- Schlumberger Limited

- Baker Hughes

- Halliburton

- Sulzer Ltd.

- Leistritz AG

- NETZSCH Pumpen & Systeme GmbH

- Flowserve Corporation

- NOV Inc. (National Oilwell Varco)

- FMC Technologies (TechnipFMC)

- Weatherford International

- ITT Goulds Pumps

- SPX FLOW, Inc.

- Milton Roy Company

- Dover Corporation

- Ebara Corporation

- Weir Group

- Nikkiso Co., Ltd.

- Axflow Holding AB

- Gardner Denver (Ingersoll Rand)

- PCM Pumps

Frequently Asked Questions

Analyze common user questions about the Multiphase Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and benefit of a multiphase pump in oil and gas operations?

The primary function of a multiphase pump is to transport unprocessed well fluid (oil, gas, and water mixture) simultaneously without requiring initial separation near the wellhead. The key benefit is substantial reduction in infrastructure costs (CAPEX) and increased production efficiency, especially in subsea and remote applications.

Which pump types are most commonly utilized for deepwater subsea multiphase boosting?

Helico-axial (centrifugal/axial) pumps are the most commonly utilized pump type for deepwater subsea boosting due to their high-pressure differential capability, high reliability, and superior performance when handling high Gas Volume Fractions (GVF), often exceeding 90%.

How do high oil price volatility and low oil prices affect the multiphase pump market?

High oil price volatility generally creates uncertainty and can delay investment decisions. Low oil prices can severely restrain large-scale subsea project sanctioning, which are the main drivers for high-end multiphase pump demand. However, low prices also increase the need for cost-efficient solutions, favoring multiphase pumps over traditional separation methods.

What are the main technical challenges associated with the long-term operation of multiphase pumps?

The main technical challenges include ensuring component reliability against internal erosion caused by solids (sand), combating corrosion from sour fluids (H2S), maintaining seal integrity under high pressure, and managing significant operational efficiency drops due to extreme fluctuations in the Gas Volume Fraction (GVF).

How does the integration of AI improve the performance and lifespan of multiphase pumping systems?

AI significantly improves performance and lifespan by enabling predictive maintenance, utilizing sensor data to forecast potential failures, and optimizing the pump's operating parameters (like speed) in real-time to match instantaneous fluid composition changes, thus minimizing wear and maximizing energy efficiency.

The detailed technical specifications and market dynamics of multiphase pumps reflect their increasing role as indispensable technology in global energy production infrastructure. Continued research and development in materials science, computational modeling, and digital integration are crucial for sustaining the market's growth trajectory and expanding the operational limits of these complex machines. The shift towards subsea processing, driven by new discoveries in deep and ultra-deep waters, ensures that helico-axial and highly engineered twin-screw pumping solutions will remain at the forefront of hydrocarbon recovery technology for the foreseeable future, making the market highly attractive for specialized engineering firms and large oilfield service providers focused on integrated subsea solutions. The long-term service contracts associated with these assets provide stable, high-margin revenue streams that further underpin the market's value proposition.

Furthermore, the drive for operational excellence and reduced environmental impact positions multiphase pumping systems favorably against conventional separation methods. By eliminating the need for extensive topside infrastructure and reducing the potential for emissions associated with flaring or venting, these systems support the global energy industry's commitment to cleaner production methods. Regulatory bodies, particularly in environmentally sensitive regions like the European North Sea and the Arctic, increasingly favor technologies that minimize seabed disturbance and platform footprints, reinforcing the strategic importance of compact, reliable subsea multiphase pumping technology. This technological superiority and regulatory alignment solidify the market's resilience even amid fluctuating commodity prices.

The complexity involved in designing and manufacturing these pumps—which must handle highly abrasive, corrosive, and rapidly changing fluid compositions at depths exceeding 3,000 meters—maintains high barriers to entry. This exclusivity guarantees that the market remains concentrated among a few key technology innovators. These players focus their R&D efforts on achieving higher levels of component modularity and standardization to reduce customization costs and installation time, thereby making the technology more accessible for smaller, marginal field developments. The competitive landscape is not simply about unit pricing but is heavily weighted toward proven field reliability, specialized engineering capacity, and the extent of the manufacturer's global service network to support these mission-critical assets over their operational lifecycle, often spanning 20 to 30 years.

In addition to traditional oil and gas applications, emerging opportunities exist in the carbon capture, utilization, and storage (CCUS) sector. While not direct multiphase pumping in the classic sense, the technology and expertise used in handling high-pressure, multi-component fluid streams (such as dense phase CO2) are transferable. Companies proficient in high-pressure, robust pump engineering are strategically positioning themselves to cater to the growing need for specialized compression and pumping equipment required for the transportation and injection of captured CO2, broadening the potential market scope beyond traditional hydrocarbon extraction. This diversification provides a long-term growth hedge against potential future declines in global crude oil demand due to the energy transition, ensuring sustained technological relevance and commercial expansion for market leaders.

The segmentation by service, specifically Maintenance, Repair, and Overhaul (MRO), is particularly crucial in the deepwater segment. Since retrieval of a subsea pump for repairs is an extremely expensive and time-consuming operation, often requiring specialized vessels and ROV support, system longevity and minimal intervention requirements are paramount. Manufacturers are focusing on designing components with modular interfaces that allow for quicker, less intrusive replacement procedures, sometimes utilizing automated or semi-automated subsea tools. The MRO segment is therefore driven by the need for extended operational intervals, advanced condition monitoring, and the strategic stockpiling of critical, high-cost spare components to ensure rapid response capabilities globally, further underscoring the value of integrated, end-to-end service solutions provided by the OEM.

Technological advancement is also focusing on energy efficiency, particularly the optimization of Variable Speed Drive (VSD) systems. VSDs are essential for matching pump output to the dynamic flow characteristics of the reservoir, but improving their power conversion efficiency directly translates to lower OPEX and reduced heat dissipation, which is critical for submerged equipment. Innovations in VSD cooling systems and improved motor insulation materials are allowing pumps to operate reliably at higher temperatures and depths. This focus on maximizing the energy input-to-hydraulic output ratio addresses operator concerns regarding the high power consumption inherent in subsea boosting, making multiphase pump adoption more economically viable for power-constrained platforms and subsea grids.

Furthermore, the competitive dynamic in the market is characterized by intense intellectual property development. Manufacturers hold numerous patents covering unique impeller geometries, sealing arrangements, and erosion-resistant coatings. Licensing agreements and cross-industry collaborations are common, aimed at integrating best-in-class control electronics and diagnostic software into the pump systems. For example, collaboration with specialized sensor manufacturers is leading to the integration of miniature sensors directly into key stress points within the pump casing, providing unprecedented granular data on internal operating conditions, noise signatures, and incipient material fatigue. This highly competitive technological race ensures that the performance envelope of multiphase pumps continues to expand rapidly year over year, addressing increasingly challenging reservoir conditions and production demands across the globe.

The regulatory environment, especially concerning safety protocols for high-pressure systems and environmental compliance related to potential subsea fluid leaks, acts as a continuous quality filter on the market. Only manufacturers who adhere to stringent international standards (such as API and ISO specifications) and demonstrate robust quality assurance protocols throughout the design and manufacturing lifecycle can successfully bid on major integrated subsea contracts. This regulatory scrutiny promotes high product quality and reliable long-term performance, reinforcing the dominant position of established players with extensive compliance history and tested equipment designs. New entrants face significant hurdles in establishing the required track record and achieving necessary certifications for deepwater deployment.

Finally, the market is subject to global geopolitical stability, as major oil and gas investment decisions are often tied to favorable regulatory and security conditions in key producing regions. Political instability in regions like certain parts of Africa or Latin America can lead to project deferrals, directly impacting the demand for long lead-time equipment like subsea multiphase pumps. Therefore, market players must maintain diverse regional sales portfolios and flexible manufacturing capacities to mitigate localized geopolitical risks. The reliance on globally sourced high-grade components also necessitates careful supply chain management to avoid disruption from trade disputes or localized manufacturing shutdowns, adding another layer of complexity to the market dynamics.

The twin-screw pump segment, though slightly less dominant in ultra-deepwater than helico-axial systems, remains vital for onshore and shallow-water boosting applications. Its strength lies in handling extremely viscous fluids and solids efficiently at lower flow rates and varying conditions, making it ideal for aging onshore fields requiring pressure support or for the highly variable production profiles characteristic of unconventional shale plays. Innovations in twin-screw technology focus on improving the material composition of the screws and internal lining to reduce wear and minimize maintenance cycles, enhancing its economic viability for long-term production boosting in remote environments. The ability of twin-screw pumps to handle high differential pressures across a wide range of flow rates provides operational flexibility that is highly valued in fields with fluctuating reservoir characteristics and declining gas-oil ratios over time, securing its niche market position.

The potential for utilizing multiphase pumps in geothermal energy extraction is a nascent but high-potential opportunity. Geothermal resources often involve pumping highly corrosive and abrasive brines containing dissolved gases and solids under high pressure and temperature. The specialized material requirements, high-reliability demands, and multiphase fluid handling expertise developed for the oil and gas market position leading multiphase pump manufacturers well to enter this adjacent clean energy sector. As global investments in geothermal power generation increase, particularly in volcanic and seismically active regions, the demand for robust, chemically resistant pumping solutions adapted from existing multiphase oil and gas technology is expected to grow, offering a strategic pathway for market diversification and revenue growth outside the traditional hydrocarbon domain.

In summary, the Multiphase Pumps Market is a highly technical, capital-intensive sector characterized by high reliability requirements, driven by global deepwater E&P and EOR initiatives. Technological superiority, demonstrated field reliability, and comprehensive service capabilities are the core competitive differentiators. The future of the market is deeply intertwined with advancements in AI-driven diagnostics, sophisticated materials engineering, and the strategic integration of these critical assets into digitized, optimized subsea production systems, ensuring their enduring importance in the energy recovery lifecycle.

The robust market growth is therefore sustained not just by the volume of oil and gas exploration, but critically by the complexity and depth of the fields being developed, which inherently necessitate the technological sophistication offered by multiphase pumping solutions. This complexity ensures that the market remains premium-priced, rewarding the continuous innovation cycle pursued by the key industry leaders. Furthermore, the trend towards modularity and standardization, although challenging given the custom nature of reservoirs, promises to unlock new market segments by making the technology more economically scalable for medium-sized independent operators and marginal field projects globally.

Specific attention is being paid to reducing the acoustic signature and vibration of subsea pumps. Low noise operation is critical for two primary reasons: minimizing interference with sensitive seismic monitoring equipment used for reservoir surveillance, and reducing environmental impact on marine life. Manufacturers are investing in specialized anti-vibration mountings and advanced fluid dampening technologies to meet increasingly strict noise emission standards, adding another layer of technological sophistication to the design and production process. This focus on environmental compatibility further strengthens the market positioning of multiphase pumps as a responsible technology choice for deepwater resource development.

Finally, the long-term operational costs are a significant factor influencing procurement decisions. While the initial investment (CAPEX) is high, the elimination of topside separation facilities, the reduction in flow lines, and the efficiency gains achieved through continuous, optimized production often lead to a lower total cost of ownership (TCO) over the 20-30 year lifespan of a subsea asset. Market reports and sales literature heavily emphasize the TCO calculation, using proven field data to demonstrate the long-term economic superiority of multiphase pumping systems compared to conventional boosting and separation methodologies, thereby successfully justifying the necessary high initial capital expenditure to major IOCs and NOCs.

The market's future health is closely linked to success in standardizing subsea component interfaces. Currently, many subsea systems are custom-built, leading to long lead times and vendor lock-in. Industry initiatives focusing on standardizing components, including pump modules and power interfaces, aim to increase competition, accelerate deployment times, and reduce lifetime maintenance costs. Success in this standardization effort could significantly widen the adoption rate of multiphase pumps across smaller and more cost-sensitive projects, potentially unlocking billions of dollars in currently uneconomical marginal reserves and providing sustained market expansion opportunities for manufacturers who proactively embrace open standards and modular design principles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Multiphase Pumps Market Statistics 2025 Analysis By Application (Onshore, Offshore), By Type (Twin screw multiphase pumps, Helico-axial multiphase pumps), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Multiphase Pumps Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Twin screw multiphase pumps, Helico-axial multiphase pumps, Others), By Application (Onshore, Offshore), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager