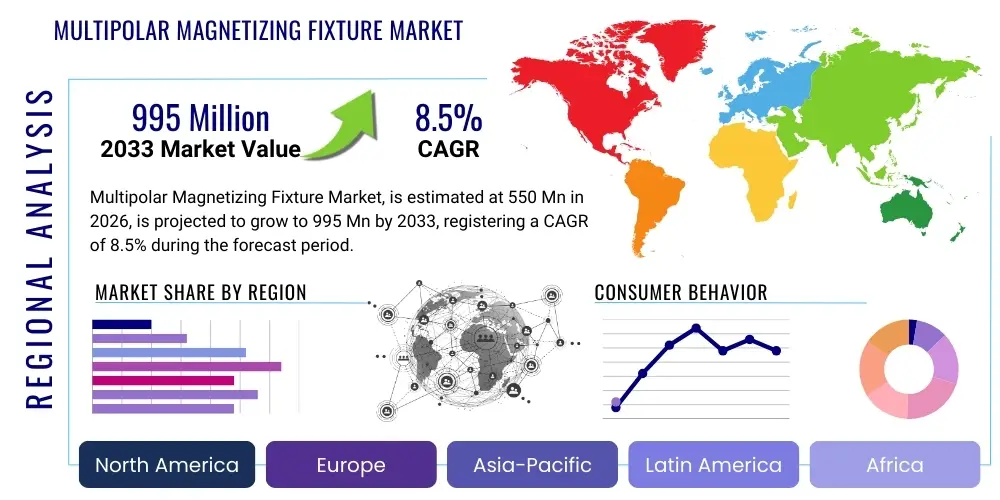

Multipolar Magnetizing Fixture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443256 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Multipolar Magnetizing Fixture Market Size

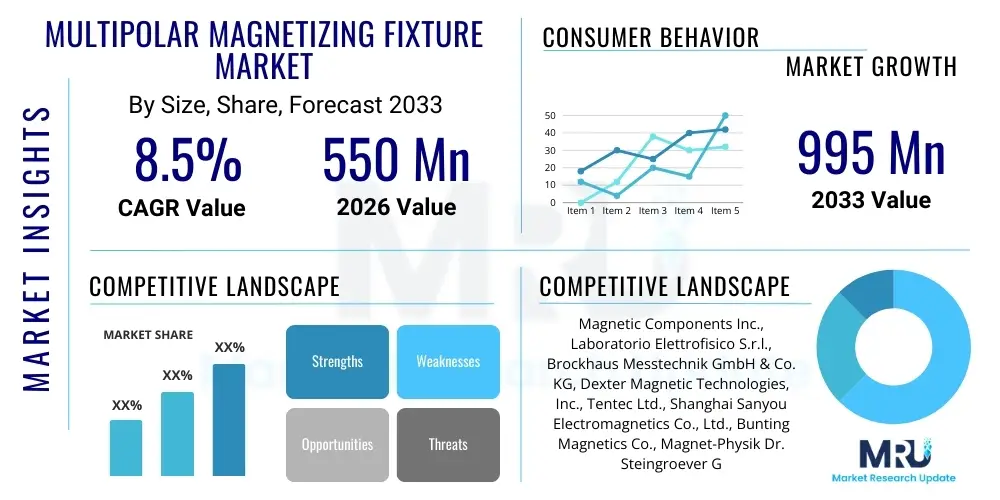

The Multipolar Magnetizing Fixture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $995 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating global transition towards electric vehicles (EVs), requiring highly precise and efficient permanent magnet motors, and the increasing demand for miniaturized, high-performance sensors and actuators across industrial automation and consumer electronics sectors. The shift toward higher pole counts and complex magnet geometries in synchronous motors necessitates highly specialized fixture designs capable of ensuring uniformity and maximum magnetic flux density during the magnetization process, driving significant investment in advanced fixture technology globally.

Multipolar Magnetizing Fixture Market introduction

Multipolar magnetizing fixtures are critical, highly specialized tools designed for the precise magnetization of permanent magnet components used in motors, sensors, and magnetic couplings. These fixtures utilize intense, pulsed magnetic fields to impart complex, predetermined magnetic patterns—often featuring numerous alternating North and South poles—onto sintered or bonded magnet assemblies. The primary function of these systems is to ensure the uniformity and precise angular alignment of the magnetic poles, which directly impacts the efficiency, torque density, and operational lifespan of the final electromechanical device. Precision in magnetization is paramount, particularly in high-performance applications such as traction motors for EVs and sophisticated aerospace components, where marginal deviations in flux density can lead to significant performance losses.

Major applications for multipolar magnetizing fixtures span the advanced manufacturing landscape, prominently including the production of Brushless DC (BLDC) motors, Permanent Magnet Synchronous Motors (PMSMs), and specialized servo motors. The automotive sector, especially EV manufacturing, represents the largest consumer, utilizing these fixtures to magnetize rotor assemblies for powertrains and auxiliary systems like pumps and cooling fans. Beyond automotive, applications are extensive in industrial robotics, where high-torque density and compact motors are essential, as well as in the medical device industry for high-precision surgical tools and imaging systems. The increasing complexity of modern electromechanical designs mandates corresponding sophistication in the magnetization equipment, driving market innovation towards fixtures that integrate advanced cooling mechanisms and dynamic current control capabilities.

The market expansion is significantly driven by inherent benefits offered by these advanced fixtures, notably enhanced product consistency, superior magnetic field strength utilization, and reduced manufacturing cycle times compared to sequential or less sophisticated magnetization methods. Furthermore, the global emphasis on energy efficiency pushes manufacturers to adopt magnetization techniques that maximize motor performance by precisely tailoring the magnetic flux path. This technological convergence, coupled with governmental incentives supporting electrification and green technology adoption worldwide, solidifies the market's strong foundational drivers. The necessity of maintaining strict quality control standards for magnetic parameters, critical for certifications in key industries, ensures sustained demand for high-caliber, reliable magnetizing solutions.

Multipolar Magnetizing Fixture Market Executive Summary

The Multipolar Magnetizing Fixture Market is experiencing robust expansion, fundamentally driven by pervasive business trends favoring electrification and industrial automation across major global economies. The paramount business trend observed is the exponential growth in Electric Vehicle (EV) production, which relies heavily on advanced permanent magnet motors and, consequently, highly specialized magnetization equipment. This has prompted fixture manufacturers to focus on scalability, high throughput capabilities, and the development of fixtures compatible with next-generation magnetic materials, such as heavy-rare-earth-free magnets. The competitive landscape is characterized by intensive R&D efforts aimed at reducing fixture cycle times and integrating sophisticated monitoring systems for real-time quality assurance, ensuring that the magnetization process can keep pace with high-volume, high-precision manufacturing demands prevalent in automotive and robotics industries.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily due to the concentration of global EV and consumer electronics manufacturing bases in China, Japan, and South Korea. China, in particular, exhibits high growth owing to strong governmental support for the domestic EV supply chain and substantial investment in smart factory infrastructure. North America and Europe, while possessing mature industrial sectors, are witnessing significant growth catalyzed by stringent efficiency regulations and localized supply chain initiatives for critical components like specialized motors for aerospace and renewable energy applications. These regions are prioritizing highly automated, flexible fixtures that can handle diverse product mixes, catering to specialized, high-value manufacturing segments rather than sheer volume alone.

Segmentation trends highlight a critical shift toward electromagnets over permanent magnets in fixture construction, offering greater control over flux magnitude and pulse shaping, although this introduces complexity in cooling and power requirements. Application-wise, the automotive segment maintains the largest market share, but rapid growth is forecasted in the industrial machinery segment, specifically robotics and high-speed spindles, demanding extremely accurate and thermally stable magnetizing processes. Additionally, the increasing complexity of magnetization patterns, such as Halbach arrays and skewed pole geometries, drives demand for highly customized, design-specific fixtures, boosting the high-value, low-volume segment of the market. Manufacturers are increasingly integrating simulation software and finite element analysis (FEA) tools into the fixture design cycle to meet these complex technical specifications efficiently.

AI Impact Analysis on Multipolar Magnetizing Fixture Market

User inquiries regarding AI's impact on the Multipolar Magnetizing Fixture Market predominantly center on optimization, predictive maintenance, and quality control. Users frequently ask how AI can refine the magnetization pulse profile for optimal field strength uniformity, reduce fixture design lead times, and predict potential failures in high-current electrical components, such as capacitors and switches, utilized in the pulsing unit. The core thematic concern is leveraging machine learning to transition from empirically determined magnetization settings to scientifically optimized, real-time adaptive processes. Users expect AI to minimize human intervention and maximize yield, especially when dealing with batch variations in magnetic material characteristics or temperature fluctuations during high-volume production cycles.

The implementation of Artificial Intelligence, particularly machine learning algorithms, is poised to revolutionize the operational efficiency and design precision of multipolar magnetizing fixtures. AI enables the dynamic optimization of the magnetization waveform and current profiles, accounting for non-linear material responses and thermal effects that are typically hard to model using traditional deterministic methods. By analyzing vast datasets derived from sensor readings (e.g., temperature, voltage, flux density) during successive magnetization cycles, AI systems can iteratively adjust parameters to achieve superior pole homogeneity and maximum flux density, translating directly into higher motor efficiency and extended product reliability. This data-driven approach moves the industry closer to truly autonomous, zero-defect magnetization processes.

Furthermore, AI significantly enhances the design phase by utilizing generative design and topology optimization algorithms to create lighter, more thermally efficient fixture geometries. Simulation-based AI can rapidly evaluate thousands of design iterations, considering factors like mechanical stress, thermal dissipation requirements for the copper coils, and electromagnetic field uniformity within the fixture cavity. In the realm of operational maintenance, predictive analytics powered by AI monitors the health of high-voltage components, forecasting the end-of-life or imminent failure of critical system elements, such as IGBTs and power supplies. This predictive capability drastically reduces unexpected downtime, a critical factor in capital-intensive, high-throughput manufacturing environments, thus improving overall equipment effectiveness (OEE) across the installed base of magnetizing systems.

- AI optimizes magnetization pulse sequences for superior pole uniformity and maximized residual induction (Br).

- Machine learning algorithms enable predictive maintenance of high-current power supply components, reducing unscheduled downtime.

- Generative AI accelerates fixture design, optimizing electromagnetic field distribution and thermal management structures.

- Automated quality control systems use AI vision and sensor fusion to verify pole alignment and field intensity post-magnetization.

- AI minimizes scrap rates by adapting parameters in real-time to material variations and environmental conditions.

DRO & Impact Forces Of Multipolar Magnetizing Fixture Market

The Multipolar Magnetizing Fixture Market is shaped by powerful Drivers and significant Restraints, balanced by emerging Opportunities that collectively define its growth trajectory and competitive dynamics. The fundamental driver is the global energy transition, specifically the aggressive adoption of electric vehicle powertrains and highly efficient industrial motors, which demand precise magnetization of complex magnet arrays. These drivers necessitate fixtures capable of handling higher throughput and more complex flux patterns (e.g., skewed or segmented magnets). However, the market faces restraints primarily related to the high capital expenditure required for advanced pulsing equipment and fixtures, coupled with the technical complexity involved in integrating these systems into existing production lines. Successfully navigating these forces requires manufacturers to focus on modularity and developing fixtures compatible with standardized automation protocols.

A key opportunity lies in the synergistic integration of additive manufacturing (3D printing) for fixture component production, allowing for rapid prototyping of complex internal cooling channels and customized coil supports. This reduces the lead time for highly specialized fixtures and enhances thermal stability, addressing a major limitation in high-frequency pulsing operations. Another opportunity arises from the need for in-situ or integrated metrology—combining magnetization with immediate, automated magnetic field mapping. This closed-loop quality system ensures instantaneous feedback and correction, which is particularly appealing for high-stakes applications in aerospace and medical technology. These opportunities allow vendors to move up the value chain by offering complete process solutions rather than just hardware components.

The market is also impacted by external forces, notably the intensifying global competition in the rare earth magnet supply chain. Fluctuations in the cost and availability of materials like Neodymium and Dysprosium influence magnet design strategies, which, in turn, dictates the complexity and requirements of the magnetizing fixtures. Furthermore, global intellectual property (IP) protection surrounding advanced magnetization techniques, particularly those involving multi-stage pulsing or dynamic flux control, acts as an entry barrier. The regulatory environment demanding higher motor efficiency (e.g., IE4/IE5 standards) applies continuous pressure on manufacturers to invest in the most advanced, precision-focused magnetization technology available, solidifying these systems as mandatory investments rather than optional upgrades.

Segmentation Analysis

The Multipolar Magnetizing Fixture Market is analyzed based on several critical parameters, allowing for a detailed understanding of market dynamics and specialized user requirements. The primary segmentation criteria involve the type of magnetization technology utilized, the physical structure of the fixture, the type of end-use application, and the geographical region. Analyzing these segments reveals varying growth rates and adoption patterns. For instance, while high-voltage pulse fixtures dominate due to their ability to achieve high flux densities quickly, continuous-field fixtures see niche adoption in specific sensor manufacturing where lower magnetic fields are acceptable but high volume consistency is paramount. The segmentation provides critical insight for manufacturers planning product diversification and targeting specific industrial verticals that exhibit high-precision demands.

Segmentation by application clearly delineates the market dominance of the automotive sector, driven by the massive scale of EV motor production, yet acknowledges the rapidly expanding potential within industrial automation and robotics. These segments require robust, highly durable fixtures designed for continuous operation and often necessitate fixtures optimized for atypical magnet geometries, such as those found in linear motors or magnetic bearings. Furthermore, the segmentation by magnet type—sintered magnets versus bonded magnets—is important because sintered magnets require significantly higher peak fields and more rugged fixture construction compared to lower-energy bonded magnets. This differentiation guides material selection for the fixture body, including the choice between laminated steel or high-strength tool steel cores.

From a product perspective, the market is broadly divided into fixtures based on power supply ratings (low, medium, and high voltage/energy), which correlates directly with the size and coercive force requirement of the magnets being processed. Customized fixtures, designed explicitly for unique product lines, represent a significant revenue stream due to their high specificity and margin, contrasting with standard, off-the-shelf fixtures designed for general-purpose motor assemblies. Understanding this segmentation helps vendors calibrate their service models, focusing either on high-volume standard sales or high-value engineering consultation and custom design projects. The continuous technological push towards smaller, more powerful magnets means the High Voltage/High Energy fixture segment is projected to maintain the fastest growth rate throughout the forecast period.

- Technology Type:

- Pulse Magnetization Fixtures

- DC Field Magnetization Fixtures

- AC Magnetization Fixtures (Niche applications)

- Fixture Type:

- Rotor Magnetizing Fixtures (Internal and External Pole Configurations)

- Stator Magnetizing Fixtures

- Sensor Magnetizing Fixtures

- Custom/Application-Specific Fixtures

- Magnet Type:

- Sintered Rare Earth Magnets (NdFeB, SmCo)

- Bonded Magnets (Ferrite, Rare Earth)

- End-Use Application:

- Automotive (EV Traction Motors, EPS, Auxiliary Systems)

- Industrial Automation & Robotics (Servo Motors, Actuators)

- Consumer Electronics (Spindles, Haptic Feedback Devices)

- Aerospace & Defense

- Medical Devices

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East & Africa (MEA)

Value Chain Analysis For Multipolar Magnetizing Fixture Market

The value chain for the Multipolar Magnetizing Fixture Market is complex, starting with highly specialized upstream suppliers and concluding with sophisticated integration at the end-user manufacturing facilities. Upstream activities involve the sourcing of critical materials, including high-purity copper wiring, specialized high-permeability, low-hysteresis core materials (often laminated silicon steel or custom alloys), and advanced insulating materials designed to withstand extreme thermal and electrical stress. Furthermore, the production of high-voltage capacitor banks, IGBT switching units, and proprietary power electronics used in the pulsing equipment forms a crucial, technologically demanding segment of the upstream supply chain. Reliability and sourcing continuity for these high-power components are essential, as they dictate the performance and longevity of the entire magnetization system.

The core manufacturing stage involves the precision engineering and assembly of the fixture itself. This requires expert knowledge in electromagnetic modeling (FEA simulation), precision machining, and thermal management system integration (e.g., water cooling channels). Due to the customization and high-precision nature of the final product, this stage is characterized by high barriers to entry and strong reliance on specialized engineering skills. Distribution channels are typically direct or rely on highly specialized system integrators, especially for major automotive or aerospace clients. Indirect distribution, involving general industrial equipment distributors, is minimal, as the sale of magnetizing fixtures almost always necessitates pre-sale engineering consultancy and comprehensive post-sale service and calibration support due to their inherent complexity and criticality to the end-user’s production process.

Downstream activities center on the integration, commissioning, and continuous calibration of the fixture systems within the end-user’s factory environment. This stage is critical for ensuring that the delivered fixture performs to specification, often involving magnetic field mapping validation using sophisticated probes and sensors. End-users require intensive training and ongoing maintenance services, particularly given the high stresses placed on the fixture components during repeated, high-energy pulsing. The value chain concludes with the final consumer—motor manufacturers, Tier 1 suppliers, and device makers—who leverage the highly precise magnetization to ensure their final products meet stringent performance metrics for efficiency and reliability, cementing the fixture as a value-added, enabling technology in modern manufacturing.

Multipolar Magnetizing Fixture Market Potential Customers

The primary potential customers in the Multipolar Magnetizing Fixture Market are industrial entities engaged in the large-scale or high-precision manufacturing of products that incorporate permanent magnet assemblies. The most significant customer base resides within the automotive sector, specifically Tier 1 and Tier 2 suppliers that specialize in electric motor components, Electric Power Steering (EPS) systems, and specialized actuators for braking and thermal management. These buyers require fixtures that can handle extremely high throughput while maintaining nanoscopic control over magnetization consistency, driving demand for automated, integrated systems capable of continuous operation in a 24/7 manufacturing environment. Their purchase decisions are heavily weighted on throughput metrics, uptime guarantees, and the capability of the fixture to handle iterative changes in motor design.

Another major customer category includes manufacturers of high-performance industrial equipment, notably those producing advanced robotics, CNC machinery, and high-speed pumps. These end-users prioritize fixtures that can achieve exceptionally tight tolerances in magnetic pole uniformity, directly impacting the smooth operation, precision, and longevity of their servo motors and actuators. Within this industrial segment, flexibility is also a key purchasing criterion, as many companies run multiple product lines requiring rapid changeover capabilities between different fixture configurations. Their focus is often on leveraging advanced magnetization technology to differentiate their final motor products based on superior efficiency (e.g., IE5 compliant motors) and torque density.

Finally, the medical device and aerospace industries represent high-value niche segments. Customers in these fields, which include producers of MRI components, miniature surgical motors, and specialized aerospace control systems, are characterized by extremely low volume, high customization requirements, and unparalleled regulatory stringency. For these buyers, the fixture manufacturer's expertise in validation, documentation, and the ability to produce highly stable, repeatable magnetization patterns is far more critical than raw throughput. They seek customized fixtures integrated with advanced monitoring and traceability features to ensure compliance with relevant industry standards and certifications, reflecting a strong preference for vendors offering full-service engineering partnerships rather than just equipment supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $995 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magnetic Components Inc., Laboratorio Elettrofisico S.r.l., Brockhaus Messtechnik GmbH & Co. KG, Dexter Magnetic Technologies, Inc., Tentec Ltd., Shanghai Sanyou Electromagnetics Co., Ltd., Bunting Magnetics Co., Magnet-Physik Dr. Steingroever GmbH, Arnold Magnetic Technologies, Metis Instruments & Equipments, Electron Energy Corporation, Gauss & Co. Magnetizing Systems, K&J Magnetics, Magnetic Instrumentation, Inc., AMAGS, MAGSYS Magnet Systeme GmbH, AIM Magnetics Co., Ltd., Advanced Magnetics, Inc., VACUUMSCHMELZE GmbH & Co. KG, Kanetec Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multipolar Magnetizing Fixture Market Key Technology Landscape

The technological landscape of the Multipolar Magnetizing Fixture Market is rapidly evolving, driven by the necessity for greater precision and efficiency in magnet processing. A major innovation involves the adoption of High Energy Pulse Forming technology, where sophisticated power supplies utilize IGBT modules and advanced capacitor banks to deliver extremely precise, high-current pulses (often exceeding 10,000 Amperes) with tailored wave shapes. This allows manufacturers to control the magnetization depth and uniformity across complex, thick magnet structures, which is critical for achieving maximum magnetic performance in high-power density motors. Furthermore, the integration of real-time monitoring sensors, such as Hall effect probes and temperature sensors, allows for instantaneous feedback loops, ensuring that the magnetization process remains within tight thermal and magnetic tolerances, preventing demagnetization effects during the pulse.

Another crucial technological development is the pervasive use of Finite Element Analysis (FEA) and Computational Magnetics Software integrated directly into the fixture design process. Modern fixture development is entirely simulation-driven, enabling engineers to accurately predict the magnetic field distribution within the fixture cavity and the resulting magnetization pattern on the rotor or magnet assembly before physical prototyping. This drastically reduces development time and minimizes costly iterations. Beyond simulation, fixture manufacturers are increasingly utilizing advanced material science, employing high-strength tool steels and composite materials for the fixture core and casing to better manage the massive mechanical forces (up to several tons) generated during the high-current pulse, ensuring fixture longevity and dimensional stability over millions of cycles.

Automation and modularity define the operational technology trends. The integration of fixtures into fully automated production lines necessitates quick-change mechanisms, automatic component handling (robotics integration), and standardized communication protocols (e.g., OPC UA) for seamless control and data exchange with central manufacturing execution systems (MES). Modular fixture design is gaining traction, allowing a single pulsing unit to support various motor sizes and geometries simply by swapping out the fixture head. This flexibility is vital in environments where product life cycles are shortening and manufacturers must pivot quickly between different component specifications. This focus on system integration transforms the fixture from a standalone tool into a critical, data-generating node within the smart factory ecosystem, enhancing overall manufacturing throughput and traceability.

Regional Highlights

- Asia Pacific (APAC): APAC represents the undeniable epicenter of the global Multipolar Magnetizing Fixture Market, dominating both in terms of consumption volume and production capacity. This leadership position is directly attributable to the region's overwhelming presence in global automotive manufacturing, specifically the mass production of electric vehicles (EVs) in China, which accounts for the largest share of global permanent magnet motor demand. Furthermore, the extensive consumer electronics and industrial automation supply chains in Japan, South Korea, and Taiwan drive continuous demand for high-precision, miniaturized magnetic components, requiring highly specialized fixtures. The competitive market dynamics in APAC focus heavily on price-to-performance ratio, high throughput capabilities, and rapid technological adoption, often spearheaded by strong governmental support for domestic manufacturing and technology localization efforts.

- North America: The North American market is characterized by robust demand stemming from the reshoring and expansion of EV manufacturing capabilities, notably in the U.S. and Canada, coupled with significant investment in the aerospace and defense sectors. These industries prioritize fixtures that offer unparalleled precision, quality assurance documentation, and rugged reliability. The market emphasizes customized solutions and relies heavily on advanced automation integration. Growth is further supported by the substantial presence of major R&D centers focusing on next-generation motor designs and high-efficiency permanent magnetic materials, driving demand for experimental and highly flexible magnetization systems for prototyping and low-volume, high-value production runs.

- Europe: Europe maintains a strong, technology-driven market, focusing heavily on sustainability, efficiency standards (such as EU Green Deal directives), and high-quality industrial machinery. Germany, Italy, and France are key consumers, driven by their established automotive, high-precision engineering, and robotics industries. European customers often seek fixtures that offer integrated traceability, superior energy efficiency, and adherence to stringent environmental regulations. The market growth is stable and geared towards the premium segment, favoring vendors who offer comprehensive systems that include advanced diagnostic tools, closed-loop control, and long-term service contracts, reflecting a preference for durability and technical sophistication over low-cost alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multipolar Magnetizing Fixture Market.- Laboratorio Elettrofisico S.r.l.

- Magnetic Components Inc.

- Brockhaus Messtechnik GmbH & Co. KG

- Dexter Magnetic Technologies, Inc.

- Tentec Ltd.

- Shanghai Sanyou Electromagnetics Co., Ltd.

- Bunting Magnetics Co.

- Magnet-Physik Dr. Steingroever GmbH

- Arnold Magnetic Technologies

- Metis Instruments & Equipments

- Electron Energy Corporation

- Gauss & Co. Magnetizing Systems

- K&J Magnetics

- Magnetic Instrumentation, Inc.

- AMAGS

- MAGSYS Magnet Systeme GmbH

- AIM Magnetics Co., Ltd.

- Advanced Magnetics, Inc.

- VACUUMSCHMELZE GmbH & Co. KG

- Kanetec Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Multipolar Magnetizing Fixture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a multipolar magnetizing fixture in modern manufacturing?

The primary function is to precisely magnetize permanent magnet assemblies, typically rotors or stators, with complex, alternating North and South pole patterns. This precision is crucial for maximizing the efficiency, torque, and speed control of high-performance electric motors, particularly those used in electric vehicles and robotics.

Which application segment drives the highest demand for these magnetizing systems?

The Automotive segment, specifically the large-scale production of Permanent Magnet Synchronous Motors (PMSMs) and Brushless DC (BLDC) motors for Electric Vehicles (EVs), drives the highest volume and value demand for sophisticated multipolar magnetizing fixtures globally.

What technological factors are restraining market growth despite high demand?

Key restraints include the extremely high initial capital investment required for advanced high-energy pulsing equipment, the technical complexity involved in designing fixtures for highly complex magnet geometries (e.g., Halbach arrays), and the necessity for specialized engineering expertise for system integration and calibration.

How does the integration of AI impact the design and operation of magnetizing fixtures?

AI significantly optimizes fixture operation by dynamically adjusting the magnetization pulse profile in real-time to compensate for material variations, ensuring superior pole uniformity. In design, AI uses generative modeling to create more thermally efficient and mechanically robust fixture structures, reducing development lead times.

What is the key differentiator between standard and custom multipolar magnetizing fixtures?

Custom fixtures are designed specifically for unique magnet geometries and magnetization patterns (e.g., skewed poles or specialized sensors) not covered by standard, off-the-shelf configurations. They typically offer higher precision and performance but require extensive engineering consultancy and higher initial cost compared to standardized units used for commodity motors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager