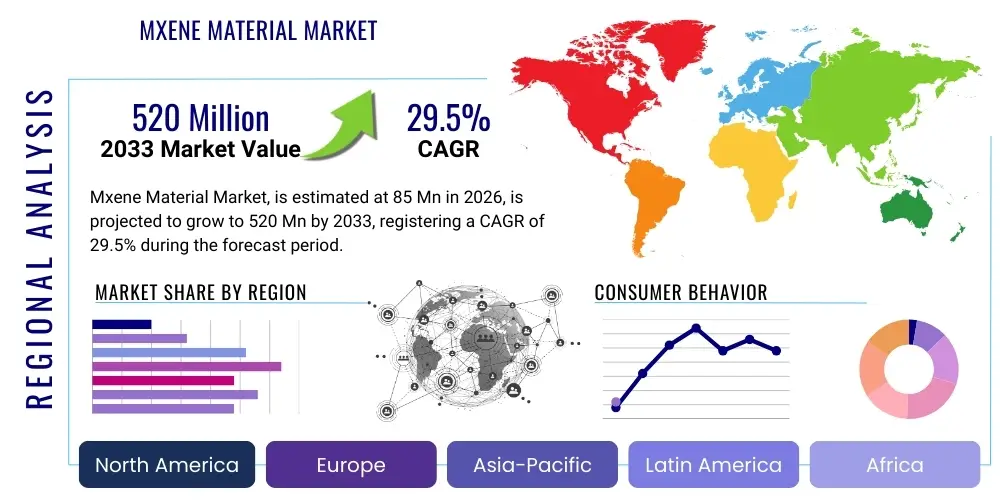

Mxene Material Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442327 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Mxene Material Market Size

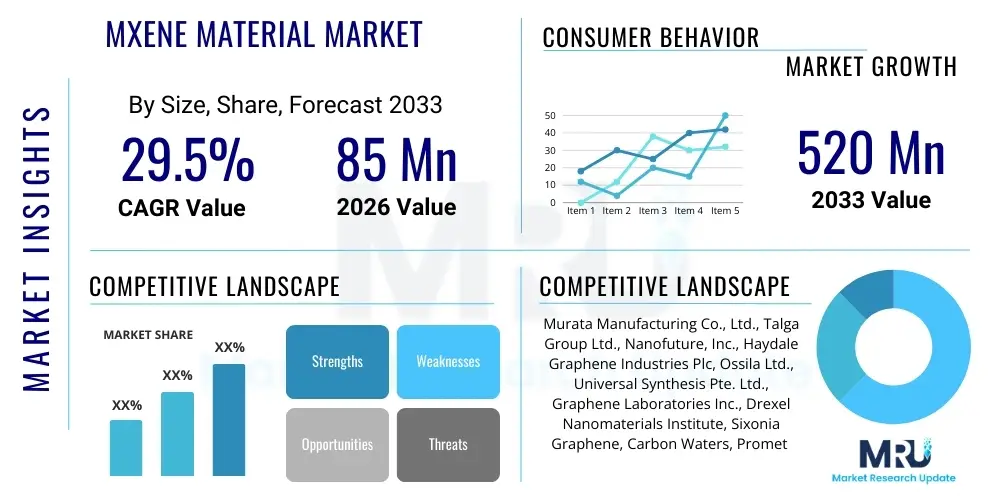

The Mxene Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 29.5% between 2026 and 2033. The market is estimated at USD 85 Million in 2026 and is projected to reach USD 520 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the rapid commercialization efforts and increasing research interest in two-dimensional transition metal carbides, nitrides, and carbonitrides, collectively known as Mxenes. These materials are highly valued for their exceptional electrical conductivity, large surface area, and tunable surface chemistry, positioning them as critical components in next-generation energy storage devices and advanced electronic applications. The shift towards electrification in the automotive sector and the miniaturization of consumer electronics further amplify the demand for high-performance functional materials like Mxenes, driving the market expansion significantly over the forecast period.

Mxene Material Market Introduction

The Mxene Material Market encompasses the production, distribution, and application of a novel class of two-dimensional (2D) materials characterized by their unique layered structure derived from MAX phases. Mxenes, first discovered in 2011, possess the chemical formula Mn+1XnTx, where M is an early transition metal, X is carbon and/or nitrogen, and Tx represents surface terminating groups (e.g., O, OH, F). Their extraordinary properties, including metallic conductivity comparable to graphene, hydrophilicity, and flexible mechanical strength, make them revolutionary candidates across diverse technological fields. Major applications currently dominating the market include high-performance supercapacitors and batteries, where Mxenes enhance charge storage capacity and cycling stability. Furthermore, their use in electromagnetic interference (EMI) shielding, flexible electronics, and highly sensitive sensors is rapidly gaining traction due to their unique electronic characteristics and ease of solution-processing.

The core benefits driving the market adoption of Mxene materials involve their superior energy storage kinetics and robust structural integrity. In the energy sector, Mxenes offer significantly faster charging and discharging rates compared to traditional electrode materials, addressing critical needs for electric vehicles and portable devices. Beyond energy, their exceptional EMI shielding capabilities are crucial for modern electronics requiring reliable protection against electromagnetic pollution. Driving factors for market growth include increasing government and private sector investment in nanotechnology research, growing demand for flexible and wearable electronic devices, and the urgent need for highly efficient and sustainable water purification technologies leveraging Mxene membranes.

Mxene Material Market Executive Summary

The Mxene Material Market is experiencing robust acceleration driven primarily by technological breakthroughs in synthesis methods, enabling mass production with controlled morphology and high purity. Key business trends indicate strong collaboration between academic institutions and industrial giants, particularly in the Asia Pacific region, aiming to scale up production capacity and reduce manufacturing costs. The integration of Mxenes into existing manufacturing frameworks for batteries and composites represents a significant trend, moving the material from laboratory novelty to commercial viability. Furthermore, venture capital interest in startups focusing on specialized Mxene applications, such as biomedical coatings and catalytic converters, is escalating, diversifying the application portfolio beyond core energy storage solutions.

Regionally, the market is highly dynamic, with Asia Pacific, led by China and South Korea, dominating both production and consumption due to aggressive investments in electronics manufacturing and electric vehicle infrastructure. North America and Europe are pivotal centers for advanced research and application development, particularly focusing on military, aerospace, and high-end biomedical devices, capitalizing on the high-performance nature of Mxenes. Segment trends highlight Energy Storage as the dominant application, specifically the use of Ti3C2Tx Mxene in supercapacitors due to its established synthesis protocols and outstanding performance metrics. However, the Electronics segment, particularly EMI shielding and 5G antenna applications, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the increasing complexity and interconnectivity of modern electronic systems.

AI Impact Analysis on Mxene Material Market

Users frequently inquire about how Artificial Intelligence (AI) can accelerate the discovery, optimization, and commercial scale-up of Mxene materials. Common concerns revolve around predicting the optimal synthesis parameters, understanding the correlation between surface termination groups and material performance, and developing effective modeling tools to simulate real-world application behavior. The consensus is that AI, particularly machine learning (ML) algorithms, will dramatically reduce the time and cost associated with experimental trials. Users anticipate that AI-driven materials informatics will lead to the rapid identification of novel Mxene compositions (beyond Ti3C2Tx) with tailored properties for specific functions, such as enhanced catalytic activity or superior mechanical resilience. The expectation is a paradigm shift from traditional trial-and-error chemistry to predictive materials design, enhancing market competitiveness and driving innovation efficiency.

AI's primary influence centers on predictive modeling. By training ML models on vast datasets derived from computational chemistry (DFT calculations) and experimental results, researchers can quickly screen thousands of potential MAX phase precursors and etching conditions, identifying optimal pathways to synthesize high-quality Mxenes with desired terminations (e.g., maximizing -O termination for specific electrochemical applications). This capability addresses the current challenge of controlling surface functionalization, which is critical for performance tuning. Furthermore, AI is being integrated into process control for large-scale production, using real-time data analysis from reactors to maintain consistency in material quality, crucial for industrial adoption and meeting stringent commercial standards.

- AI accelerates the prediction of novel Mxene compositions and structures.

- Machine Learning optimizes synthesis parameters (etching time, temperature) for purity and yield.

- Data analytics enhance quality control and process monitoring during large-scale manufacturing.

- AI modeling predicts performance metrics (e.g., capacitance, shielding effectiveness) before physical synthesis.

- Materials informatics facilitates high-throughput screening of Mxene derivatives for specialized applications (e.g., catalysis).

DRO & Impact Forces Of Mxene Material Market

The Mxene Material Market growth is fundamentally driven by the accelerating demand for high-performance energy storage solutions, primarily in the electric vehicle (EV) and grid storage sectors, where the superior rate capability of Mxenes offers a distinct advantage over conventional materials. Furthermore, the rapid expansion of wireless communication technologies, including 5G and future 6G networks, necessitates advanced electromagnetic interference (EMI) shielding materials, a niche where solution-processable Mxene thin films excel due to their high electrical conductivity and low percolation thresholds. These driving forces are further bolstered by significant government funding worldwide channeled into nanotechnology and advanced materials research, facilitating technological readiness and commercial scaling.

However, the market faces significant restraints, chiefly related to the scalability and high cost of current synthesis methods. The standard preparation route via hydrofluoric acid (HF) etching poses safety and environmental challenges, limiting industrial throughput. Although milder etching methods (e.g., using ammonium bifluoride) are emerging, they still require refinement to achieve commercial viability and consistently high material quality. Furthermore, the long-term stability and oxidation resistance of Mxenes in air and humid environments remain areas of intensive research, posing limitations on their immediate adoption in durable goods and outdoor applications. Addressing these stability challenges is crucial for unlocking the material's full commercial potential.

Opportunities abound in developing next-generation applications, particularly in biomedicine (drug delivery, bio-sensing), flexible wearable devices, and advanced filtration membranes for industrial water treatment and desalination. The unique combination of metallic conductivity and hydrophilicity positions Mxenes perfectly for creating highly efficient, low-cost water purification systems. Impact forces in this market are high, stemming primarily from rapid technological obsolescence risk (due to the emergence of competing 2D materials like functionalized graphene or hBN) and the critical reliance on intellectual property rights surrounding synthesis patents. Successful navigation of these technological and competitive forces will determine the long-term market leaders and the rate of mass adoption.

Segmentation Analysis

The Mxene material market is meticulously segmented based on Type, Application, and End-Use, reflecting the material's versatility and diverse commercial potential. Segmentation by Type is crucial as different chemical compositions exhibit varied properties; for instance, Ti3C2Tx is primarily used in energy storage due to its excellent conductivity, while V2CTx might be favored for certain catalytic or sensing applications. Application-based segmentation reveals the primary revenue streams, with Energy Storage currently leading, followed closely by the rapidly growing Electronics sector. Understanding these segments is vital for stakeholders to allocate R&D resources efficiently and tailor production processes to meet specific material specifications required by various industries.

The End-Use segmentation categorizes the final consuming industries, providing insight into demand drivers; Automotive demand, driven by EV battery technology, exhibits unique requirements regarding thermal stability and cycling life, distinct from the requirements of the Consumer Electronics sector, which prioritizes flexibility and miniaturization. The successful commercialization of Mxenes depends heavily on optimizing material properties for each specific end-use environment. This detailed segmentation aids market participants in targeted marketing, competitive positioning, and strategic planning, ensuring that product development aligns with the most lucrative and technically demanding industry needs. The shift in market share between segments, particularly the anticipated surge in the Electronics and Aerospace segments, defines the future competitive landscape.

- By Type:

- Titanium Carbide-based Mxenes (Ti3C2Tx)

- Vanadium Carbide-based Mxenes (V2CTx)

- Niobium Carbide-based Mxenes (Nb2CTx)

- Other Mxene Compositions (Mo, Ta, Cr-based)

- By Application:

- Energy Storage (Supercapacitors, Lithium-ion Batteries, Sodium-ion Batteries)

- Electronics (EMI Shielding, Conductive Inks, Sensors, Flexible Displays)

- Composites and Coatings (Structural Reinforcement, Anti-corrosion)

- Water Purification and Environmental Remediation (Membranes, Adsorption)

- Biomedical (Drug Delivery, Bio-sensors, Imaging)

- By End-Use Industry:

- Automotive

- Consumer Electronics

- Aerospace and Defense

- Healthcare and Biomedical

- Energy and Utilities

- Chemical and Industrial

Value Chain Analysis For Mxene Material Market

The value chain for the Mxene material market begins with the upstream procurement of precursor materials, primarily high-purity transition metal powders (M) and carbon/nitrogen sources (X) used to synthesize the MAX phases. This initial stage is capital-intensive and requires specialized chemical processing capabilities to produce high-quality MAX powders with controlled stoichiometry. The primary challenge at this stage is maintaining cost-effectiveness while ensuring the purity necessary for subsequent etching processes. Key suppliers in the upstream segment are typically specialized chemical manufacturers and material science companies focused on high-performance ceramics and metal alloys.

The core manufacturing process, midstream, involves the etching of the MAX phase to exfoliate the 2D Mxene sheets. This critical step, often performed using hazardous chemicals like hydrofluoric acid, dictates the final quality, layer thickness, and surface termination (Tx) of the Mxene product. Manufacturers focus intensely on process optimization—moving towards less hazardous etching agents and developing techniques for large-volume, high-concentration Mxene dispersion. Distribution channels involve specialized chemical distributors, direct sales to large industrial customers (e.g., major battery manufacturers), and supply chains feeding academic and commercial R&D laboratories. Due to the nascent nature of the market, a significant portion of sales remains direct, facilitating technical support and customized product specification.

Downstream activities involve integrating Mxenes into final product applications. For direct channels, this means selling to Tier 1 manufacturers in automotive or electronics who incorporate Mxenes into electrodes, shielding films, or composite structures. Indirect sales occur through intermediaries who might process Mxenes further into functional materials, such as conductive inks or printable pastes, which are then sold to a wider range of end-users. The final stage focuses on application development and commercialization, where collaboration between Mxene producers and end-users is crucial to validate performance claims and establish standardized integration protocols across diverse sectors like energy storage, aerospace, and water purification.

Mxene Material Market Potential Customers

Potential customers for Mxene materials are predominantly found within high-technology sectors requiring advanced materials with exceptional electrical, thermal, and mechanical properties. The largest segment of end-users includes manufacturers of energy storage devices, specifically those developing next-generation supercapacitors and high-power lithium-ion or sodium-ion batteries, where Mxenes offer superior power density and cycling stability. These customers are typically large, multinational corporations in the automotive and consumer electronics industries focused on improving device performance and reducing charging times. This segment represents the highest volume potential for mass-produced Mxenes, driving the need for cost-effective and scalable synthesis methods.

Another major customer base resides in the electronics and telecommunications industries. Companies manufacturing flexible displays, wearable sensors, and complex printed circuit boards (PCBs) are keen on Mxene adoption due to its superior electromagnetic interference (EMI) shielding capabilities and high conductivity for use in flexible inks. The need to protect sensitive components from increasing levels of electromagnetic radiation in high-speed data environments (like 5G infrastructure) positions Mxenes as a strategic material for these firms. Furthermore, aerospace and defense contractors constitute a specialized, high-value customer group, utilizing Mxenes for advanced lightweight composites, highly sensitive radar systems, and conductive anti-corrosion coatings for severe environments, demanding the utmost reliability and performance specifications.

The long-term customer outlook includes entities involved in water and environmental management, such as municipal water authorities and industrial filtration companies, seeking advanced membrane technologies for efficient water purification and desalination. Additionally, research institutions and pharmaceutical companies represent a growing market for custom Mxene derivatives tailored for drug delivery systems, biosensors, and advanced biomedical imaging agents, capitalizing on the material's biocompatibility and surface functionalization capabilities. These diverse applications ensure a broad and resilient customer base for the evolving Mxene material market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85 Million |

| Market Forecast in 2033 | USD 520 Million |

| Growth Rate | 29.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co., Ltd., Talga Group Ltd., Nanofuture, Inc., Haydale Graphene Industries Plc, Ossila Ltd., Universal Synthesis Pte. Ltd., Graphene Laboratories Inc., Drexel Nanomaterials Institute, Sixonia Graphene, Carbon Waters, Promet Materials, XG Sciences, 2D Materials Pte Ltd., ACS Material LLC, Cheezheng Technology, TMX Nanomaterials, A-Z Materials, Strem Chemicals, Alfa Aesar, Sigma-Aldrich. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mxene Material Market Key Technology Landscape

The core technology landscape in the Mxene market is centered on advanced synthesis and functionalization methods designed to overcome the limitations of the traditional hydrofluoric acid (HF) etching process. The conventional method involves selectively etching the 'A' element layer (typically aluminum) from the MAX phase precursor, which is technologically mature but carries significant safety and environmental costs. Current technological advancements focus heavily on developing HF-free or minimally aggressive etching techniques, such as those employing mild fluoride salts (like LiF in acid solutions or NH4HF2) or molten salt methods. These innovative approaches aim to produce larger quantities of highly uniform, single-to-few-layer Mxene sheets while improving process safety and reducing manufacturing complexity, thereby lowering the barrier to industrial scaling and broadening commercial accessibility.

Another crucial technological frontier is post-synthesis surface engineering and functionalization. Since the surface termination groups (Tx) critically determine the Mxene's performance—for example, oxygen termination enhances capacitance while fluorine termination might improve chemical stability—researchers are developing precise methods to control the surface chemistry. Technologies involving thermal annealing, plasma treatment, and chemical grafting are being explored to tailor Mxene properties for specific applications, such as improving dispersibility in different solvents for ink formulation or enhancing selectivity for sensing applications. Furthermore, the development of scalable deposition techniques, including spray coating, spin coating, and large-area printing, is essential for integrating Mxenes into flexible electronics and large-format electrodes, moving the technology beyond laboratory samples.

In the application space, technological advancements are focused on creating novel hybrid structures. Integrating Mxenes with other functional materials, such as graphene, carbon nanotubes, or polymers, leverages the strengths of both components. For instance, Mxene-graphene hybrids are showing promise in supercapacitors by combining Mxene's volumetric capacitance with graphene's high surface area. Similarly, embedding Mxenes into polymer matrices enhances the structural integrity and shielding effectiveness of composites. The use of advanced characterization techniques—such as high-resolution transmission electron microscopy (HRTEM) and sophisticated electrochemical testing—is integral to validating the quality and performance of these new material systems, ensuring they meet the stringent requirements of high-tech end-users.

Regional Highlights

The global Mxene material market exhibits distinct regional dynamics driven by varying levels of R&D investment, manufacturing capacity, and regulatory environments. Asia Pacific (APAC) holds the dominant market share and is expected to maintain the highest growth rate during the forecast period. This dominance is primarily attributable to significant governmental support for nanotechnology, the presence of major consumer electronics and electric vehicle (EV) battery manufacturing hubs in countries like China, South Korea, and Japan, and aggressive commercialization strategies adopted by local material science firms. China, in particular, is a major producer and consumer, utilizing Mxenes in advanced electrode materials and next-generation electronic components.

North America, particularly the United States, represents a leading market for high-value, specialized Mxene applications. The region's market growth is propelled by robust private sector investment in flexible electronics, defense technologies (aerospace and military sensors), and biomedical research. American research institutions and startup companies are at the forefront of developing advanced synthesis methods and intellectual property related to novel Mxene compositions. The high demand for advanced materials in sectors subject to stringent performance requirements, coupled with a strong venture capital ecosystem, fuels premium pricing and innovation-focused market expansion in this region.

Europe is a critical center for academic research and application development, focusing heavily on sustainability and next-generation automotive technologies. Countries like Germany and the United Kingdom are driving demand through R&D in solid-state batteries, advanced catalytic converters, and high-efficiency water treatment systems utilizing Mxene membranes. Regulatory pressures favoring environmentally friendly manufacturing processes also encourage the adoption of innovative, high-performance materials. The Middle East and Africa (MEA) and Latin America currently represent smaller but growing markets, primarily focused on incorporating Mxenes into industrial coatings, energy storage projects, and specialized filtration systems aimed at addressing local infrastructure and environmental challenges.

- Asia Pacific (APAC): Dominates market share due to concentrated manufacturing capacity in electronics and EVs; high volume consumption, especially in China and South Korea, drives scalable production efforts and cost reduction.

- North America: Focuses on high-value applications, including aerospace, defense, and advanced biomedical devices; strong presence of foundational research institutions and venture-backed startups driving innovation in synthesis.

- Europe: Key player in sustainable materials R&D, focusing on automotive electrification (EV batteries) and industrial water filtration; driven by regulatory framework supporting clean technologies.

- Latin America (LATAM): Emerging market primarily interested in infrastructure applications, such as energy storage for grid stability and corrosion-resistant coatings for resource extraction industries.

- Middle East & Africa (MEA): Growing interest in utilizing Mxenes for desalination membranes to address water scarcity and for specialized sensors in the oil and gas sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mxene Material Market, encompassing specialized material developers, chemical producers, and key research institutions transitioning to commercial production.- Murata Manufacturing Co., Ltd.

- Talga Group Ltd.

- Nanofuture, Inc.

- Haydale Graphene Industries Plc

- Ossila Ltd.

- Universal Synthesis Pte. Ltd.

- Graphene Laboratories Inc.

- Drexel Nanomaterials Institute

- Sixonia Graphene

- Carbon Waters

- Promet Materials

- XG Sciences

- 2D Materials Pte Ltd.

- ACS Material LLC

- Cheezheng Technology

- TMX Nanomaterials

- A-Z Materials

- Strem Chemicals

- Alfa Aesar

- Sigma-Aldrich

Frequently Asked Questions

Analyze common user questions about the Mxene Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Mxenes over traditional energy storage materials?

Mxenes offer ultra-high electrical conductivity, superior volumetric capacitance, and excellent charge transfer kinetics, enabling significantly faster charging/discharging rates and higher power densities crucial for next-generation supercapacitors and high-rate battery electrodes.

What is the main challenge hindering the widespread commercial adoption of Mxene materials?

The primary challenge is the scalability and cost-efficiency of synthesis. Current production methods, often relying on hazardous HF acid etching, are expensive and pose environmental risks, necessitating the development of safer, high-throughput, and cost-effective synthesis techniques.

Which specific type of Mxene dominates the current market and why?

Titanium Carbide-based Mxenes (Ti3C2Tx) dominate the market. This is due to its robust synthesis protocol (derived from Ti3AlC2 MAX phase), high metallic conductivity, and established performance track record in energy storage and EMI shielding applications.

How are Mxenes utilized in flexible and wearable electronics?

Mxenes are utilized in flexible electronics as highly conductive inks for printed circuits, high-performance electrode materials for flexible batteries/supercapacitors, and effective thin-film layers for electromagnetic interference (EMI) shielding due to their excellent flexibility and electrical properties.

Which geographical region is expected to lead the growth in Mxene material consumption?

The Asia Pacific (APAC) region is projected to lead in both consumption and growth, driven by massive investments in electric vehicle manufacturing, consumer electronics production, and strong governmental backing for advanced material science research in countries like China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager