Mycophenolate Mofetil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441301 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Mycophenolate Mofetil Market Size

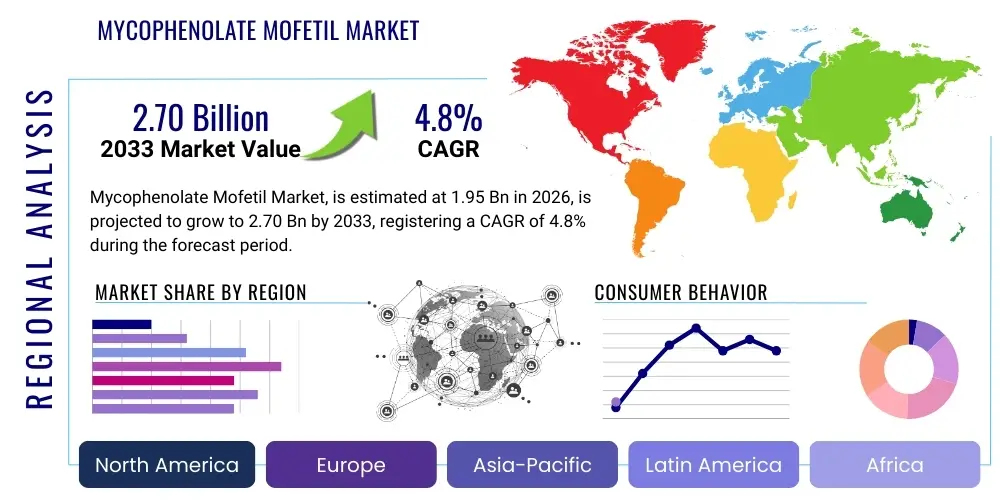

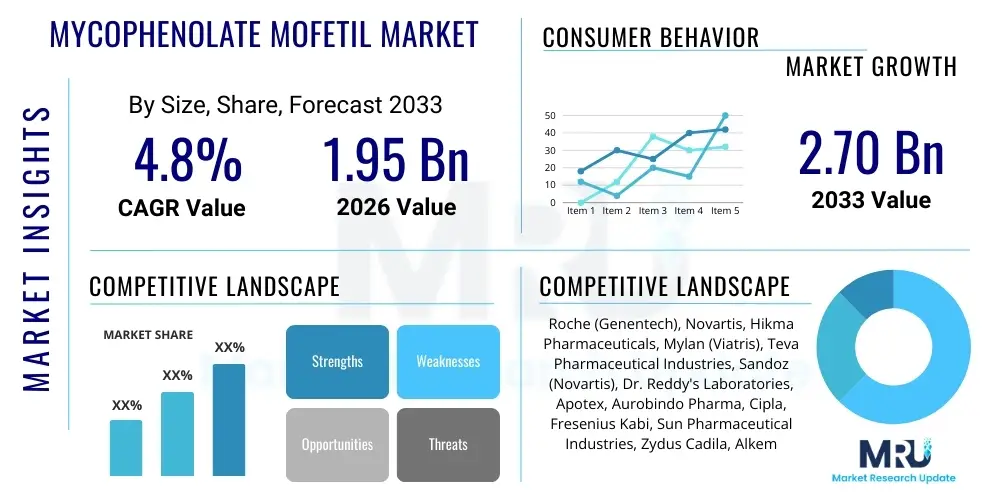

The Mycophenolate Mofetil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 2.70 Billion by the end of the forecast period in 2033.

Mycophenolate Mofetil Market introduction

The Mycophenolate Mofetil (MMF) market encompasses the production, distribution, and utilization of this crucial immunosuppressive agent. MMF is the prodrug of mycophenolic acid (MPA), which acts as a potent, selective, non-competitive, and reversible inhibitor of inosine monophosphate dehydrogenase (IMPDH). By inhibiting IMPDH, MMF starves lymphocytes of guanosine nucleotides necessary for proliferation, thereby effectively suppressing the immune response essential in preventing organ rejection following allogeneic transplantation (kidney, heart, liver). Its established efficacy and broad application spectrum make it a cornerstone therapy in transplant medicine globally. Furthermore, its off-label use in various autoimmune disorders, such as systemic lupus erythematosus (SLE), rheumatoid arthritis, and certain dermatological conditions, further expands its market reach and therapeutic significance. The increasing sophistication of transplant procedures and the rising incidence of chronic diseases requiring immune modulation are foundational elements driving sustained market demand for MMF products.

Product differentiation within the MMF market primarily revolves around dosage forms (capsules, tablets, oral suspension, and intravenous formulations) and the availability of generic versus branded versions. Branded products, such as Roche’s CellCept, initially dominated, but the transition towards generic alternatives has significantly shifted market dynamics, impacting pricing and accessibility, particularly in developing economies. Major applications focus intensely on solid organ transplant immunosuppression protocols, often used in combination with calcineurin inhibitors (like cyclosporine or tacrolimus) and corticosteroids. The therapeutic benefits of MMF include its relative safety profile compared to older immunosuppressants, its adaptability in combination therapies, and its proven ability to enhance long-term graft survival, which directly translates into improved quality of life for transplant recipients. The increasing global burden of end-stage organ failure necessitating transplantation is a key structural driver supporting the market’s positive trajectory.

The market environment is characterized by stringent regulatory oversight regarding manufacturing and quality control, especially concerning bioequivalence for generic versions. Driving factors for market expansion include demographic shifts leading to a higher pool of patients requiring transplantation, advancements in surgical techniques making transplant procedures safer and more frequent, and growing public health awareness regarding organ donation. Moreover, research into novel formulations, such as enteric-coated mycophenolate sodium (Myfortic), aimed at reducing gastrointestinal side effects, contributes to product innovation and patient compliance, sustaining market vitality. However, cost pressures exerted by healthcare payers and intense generic competition necessitate continuous strategic adjustments by market players to maintain profitability and market share.

Mycophenolate Mofetil Market Executive Summary

The Mycophenolate Mofetil (MMF) market demonstrates steady growth, primarily fueled by the increasing number of solid organ transplant procedures worldwide and the established role of MMF in maintenance immunosuppression protocols. Business trends are dominated by aggressive generic penetration following major patent expirations, leading to significant price erosion but vastly increasing accessibility, especially in high-volume, cost-sensitive markets like India and China. Strategic alliances, mergers, and acquisitions focusing on bolstering generic production capacity and supply chain efficiency are prevalent among large pharmaceutical and biotechnology companies. Furthermore, companies are increasingly investing in post-marketing surveillance and real-world evidence generation to optimize MMF dosing and management protocols in diverse patient populations, thereby enhancing its clinical utility and market acceptance against competing immunosuppressants. The development of alternative delivery systems and efforts to minimize adverse effects, particularly gastrointestinal distress, represent critical areas of ongoing R&D investment aimed at capturing premium market segments.

Regionally, North America and Europe currently hold the largest market shares due to well-established healthcare infrastructure, high rates of transplant surgeries, and sophisticated reimbursement policies that support long-term drug use. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is attributed to rapidly improving healthcare access, increased governmental funding for specialized medical procedures, and the emergence of specialized transplant centers in countries such as China, Japan, and South Korea. Regulatory harmonization efforts and faster approvals for essential medications like MMF are further contributing to market acceleration in emerging economies. The Middle East and Africa (MEA) and Latin America also represent emerging opportunities, driven by rising health tourism for transplant procedures and the necessary expansion of local pharmaceutical supply chains to meet growing patient needs.

Segmentation trends reveal that the solid organ transplantation application segment remains the primary revenue driver, particularly kidney and liver transplants, which constitute the majority of transplant procedures globally. Within product segmentation, oral formulations (tablets and capsules) dominate due to convenience for chronic, maintenance therapy, although intravenous formulations remain essential for perioperative and initial post-transplant care when oral intake is compromised. Furthermore, the generic drug segment continues to cannibalize the branded segment, commanding an increasingly larger volume share, putting consistent downward pressure on overall average selling prices (ASPs). However, specialized clinical settings continue to prioritize specific branded formulations for complex patients, driven by perceived consistency in manufacturing and bioequivalence surety. Future segmentation growth is likely to be influenced by the penetration into niche autoimmune indications where MMF proves superior or safer than standard treatment options, diversifying the market beyond its core transplant focus.

AI Impact Analysis on Mycophenolate Mofetil Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mycophenolate Mofetil market frequently center on how AI can optimize dosing to minimize toxicity, predict patient adherence, enhance drug discovery for related immunosuppressants, and improve supply chain logistics for essential generic drugs. Key concerns revolve around the integration of real-time monitoring data (pharmacogenomics and therapeutic drug monitoring, TDM) with AI algorithms to create personalized dosing regimens for transplant recipients, moving beyond standardized protocols that often lead to under- or over-immunosuppression. Expectations highlight AI’s potential to dramatically reduce adverse events, such as nephrotoxicity and opportunistic infections, thereby increasing the efficacy and safety of MMF treatment. Users are also keen on understanding AI’s role in analyzing large datasets from clinical trials and electronic health records (EHRs) to identify non-transplant applications for MMF and improve diagnostic accuracy for autoimmune diseases where MMF is utilized, thereby broadening the total addressable market and improving therapeutic outcomes.

- AI-driven Therapeutic Drug Monitoring (TDM) optimization for personalized MMF dosing, minimizing toxicity and maximizing efficacy.

- Predictive analytics leveraging patient genetic markers and environmental factors to forecast potential acute rejection episodes, prompting proactive MMF adjustment.

- Enhancement of supply chain management and inventory control for MMF generics, predicting demand spikes and preventing shortages.

- Accelerated identification of novel drug targets for immunosuppression through AI analysis of molecular pathways targeted by MMF.

- Improved clinical trial design and patient stratification for MMF usage in complex autoimmune conditions using machine learning models.

- AI-enabled analysis of pharmacovigilance data to rapidly detect and characterize rare or severe adverse drug reactions associated with MMF use.

DRO & Impact Forces Of Mycophenolate Mofetil Market

The market for Mycophenolate Mofetil (MMF) is characterized by a complex interplay of drivers, restraints, and opportunities that shape its growth trajectory. The primary drivers include the consistent rise in the global incidence of end-stage organ failure, notably kidney failure due to diabetes and hypertension, leading to an increased demand for organ transplantation procedures. MMF’s status as an essential, first-line immunosuppressant in standard transplant protocols ensures continuous demand proportional to the growth in transplant volumes. Furthermore, the expanding utilization of MMF in treating various autoimmune disorders, often driven by failure or contraindication of primary treatments, provides a crucial secondary growth avenue. Increased healthcare spending, particularly in emerging economies where access to specialized care is improving, acts as a significant force multiplier, ensuring broader patient reach and compliance with long-term therapy, which is critical for immunosuppressive agents like MMF.

However, significant restraints temper the market’s potential. The most substantial challenge is the widespread availability and aggressive pricing of generic MMF, which severely limits revenue growth for branded products and compresses overall average selling prices across the market, impacting profitability margins for all manufacturers. Additionally, MMF is associated with notable side effects, including gastrointestinal issues (nausea, diarrhea) and hematological toxicities (leukopenia), necessitating careful monitoring and sometimes leading to treatment discontinuation or switching to less effective alternatives. These side effects present a clinical limitation that competitive products without these profiles seek to exploit. Regulatory hurdles concerning drug approvals and stringent bioequivalence requirements for generics also introduce time and cost barriers for new market entrants, although these same standards ensure product safety and reliability.

Opportunities for market players are primarily focused on product innovation and geographic expansion. The development of advanced formulations, such as delayed-release or modified-release systems, designed to mitigate gastrointestinal side effects, promises to improve patient compliance and capture a premium market share. Furthermore, expanding the approved or recognized off-label indications for MMF, potentially through new clinical trials targeting specific refractory autoimmune diseases, offers diversification away from the saturated transplant market. Geographically, establishing robust supply chains and securing market penetration in underserved regions, particularly within the Asia Pacific and Latin America, represents significant, untapped revenue streams. Impact forces, therefore, include the critical balance between maximizing patient access through low-cost generics and justifying premium pricing through superior patient-centric formulations and enhanced clinical data supporting broader applications.

Segmentation Analysis

The Mycophenolate Mofetil market is primarily segmented based on product type, application, and dosage form. This segmentation provides a granular view of market dynamics, reflecting differential pricing, patient preferences, and the specific needs of various clinical settings. Product type segmentation distinguishes between branded MMF, which commands higher prices due to established reputation and initial market presence, and generic MMF, which dominates the market volume due to lower cost and widespread availability post-patent expiry. Application-based segmentation reveals the market’s reliance on solid organ transplantation, while dosage forms segment the market into oral (the mainstay of maintenance therapy) and intravenous (essential for acute care). Understanding these segments is vital for manufacturers to tailor their production, distribution strategies, and pricing policies effectively to target specific patient cohorts and healthcare provider needs.

- By Product Type:

- Branded

- Generic

- By Dosage Form:

- Tablets and Capsules

- Oral Suspension

- Intravenous Injection

- By Application:

- Solid Organ Transplantation

- Kidney Transplantation

- Heart Transplantation

- Liver Transplantation

- Other Organ Transplantation

- Autoimmune Diseases

- Systemic Lupus Erythematosus (SLE)

- Rheumatoid Arthritis

- Psoriasis

- Others

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Mycophenolate Mofetil Market

The Value Chain for the Mycophenolate Mofetil market begins with upstream activities involving the sourcing and synthesis of the raw chemical intermediates required to produce mycophenolate acid and its ester, MMF. This stage demands strict quality control, adherence to Good Manufacturing Practices (GMP), and reliable sourcing, often from specialized chemical suppliers in Asia. The subsequent stage involves bulk drug substance manufacturing and formulation development, where pharmaceutical companies transform the raw materials into finished dosage forms (tablets, capsules, injections). This stage is capital-intensive and requires high levels of regulatory compliance. The distribution channel, which represents the midstream, involves complex logistics encompassing warehousing, cold chain management for specific formulations, and efficient delivery to hospital systems, specialized clinics, and retail pharmacies. Direct channels are often utilized for large institutional purchases (major transplant centers), ensuring streamlined bulk supply. Indirect channels rely on wholesalers, distributors, and pharmacy benefit managers (PBMs) to reach the vast network of community pharmacies and individual patients. Downstream activities involve prescribing practices by transplant physicians and rheumatologists, patient adherence programs, and therapeutic monitoring, ultimately leading to product consumption and patient outcomes. The efficiency of the distribution network, particularly the balance between high-volume generic distribution and specialized branded product distribution, significantly impacts overall market performance and patient accessibility.

Mycophenolate Mofetil Market Potential Customers

Potential customers for Mycophenolate Mofetil primarily consist of patient populations requiring long-term immunosuppression to prevent allograft rejection or manage chronic autoimmune conditions. The primary end-users are transplant recipients across various solid organ categories, particularly those undergoing kidney, heart, and liver transplants, who require continuous, high-adherence maintenance therapy for the life of the transplanted organ. Specialized medical centers, large hospital systems with established transplant units, and government healthcare procurement agencies (e.g., Veterans Affairs, NHS) are the major institutional buyers due to the critical nature and high volume of use within these facilities. Secondary end-users include patients diagnosed with severe autoimmune diseases, such as systemic lupus erythematosus nephritis or refractory rheumatoid arthritis, who are managed by rheumatologists and specialized internal medicine practitioners. Furthermore, payers, including insurance companies and governmental health programs, are critical stakeholders, as their coverage and formulary decisions directly influence patient access and the choice between branded and generic MMF products, making them influential decision-makers in the procurement cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 2.70 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche (Genentech), Novartis, Hikma Pharmaceuticals, Mylan (Viatris), Teva Pharmaceutical Industries, Sandoz (Novartis), Dr. Reddy's Laboratories, Apotex, Aurobindo Pharma, Cipla, Fresenius Kabi, Sun Pharmaceutical Industries, Zydus Cadila, Alkem Laboratories, Strides Pharma Science, Glenmark Pharmaceuticals, Amneal Pharmaceuticals, Accord Healthcare, Intas Pharmaceuticals, Hetero Drugs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mycophenolate Mofetil Market Key Technology Landscape

The technology landscape surrounding the Mycophenolate Mofetil market is primarily defined by advancements in pharmaceutical formulation technology, bioanalytical techniques for therapeutic drug monitoring (TDM), and the digital integration of patient management systems. Significant innovation focuses on improving the pharmacokinetic profile of MMF. For instance, the development of enteric-coated mycophenolate sodium (Myfortic, derived from MMF) represents a successful technological effort to bypass the stomach and reduce the gastrointestinal side effects associated with immediate-release MMF, thereby improving patient adherence to maintenance therapy. Technologies like fluid-bed granulation and advanced coating systems are critical in manufacturing these modified-release forms, ensuring consistent dissolution profiles and bioequivalence, a major concern for regulatory bodies when assessing generic versions. These formulation enhancements aim to deliver more predictable drug exposure and better patient tolerability, justifying their presence in the premium segment of the market.

Another pivotal technological area involves sophisticated TDM methods. Mycophenolic acid (MPA), the active metabolite of MMF, exhibits significant pharmacokinetic variability among patients, making standardized dosing often insufficient. High-Performance Liquid Chromatography (HPLC) coupled with mass spectrometry (MS) is the gold standard technology used in clinical laboratories to measure MPA trough levels and, increasingly, area under the curve (AUC) measurements. The integration of artificial intelligence and pharmacokinetic modeling software leverages these high-precision TDM data points to personalize dosing recommendations, moving from traditional weight-based prescriptions to individualized, patient-specific regimens. This technological shift is crucial for maximizing therapeutic efficacy while minimizing adverse effects like bone marrow suppression or infection risk, significantly enhancing the safety profile of MMF use in complex clinical settings.

Furthermore, the manufacturing technology for generic MMF requires highly optimized chemical synthesis pathways to ensure purity, scalability, and cost efficiency. Companies utilize advanced synthesis optimization techniques, including catalytic processes and chiral separation technology (although MMF is not chiral, the intermediate steps often involve complex chemistry), to reduce overall production costs, enabling competitive generic pricing. Digital technology, specifically patient-facing mobile applications and remote monitoring devices, increasingly plays a role in tracking patient adherence, reporting side effects, and scheduling follow-up lab tests required for TDM. The convergence of precise analytical TDM technology, AI-driven personalization algorithms, and advanced drug delivery systems dictates the competitive edge within the contemporary MMF market, ensuring that therapeutic outcomes are maximized through technological sophistication.

Regional Highlights

Regional dynamics play a crucial role in shaping the Mycophenolate Mofetil market, driven by varying healthcare policies, transplant infrastructure development, and generic penetration rates. North America, encompassing the United States and Canada, represents a mature market characterized by high per capita healthcare expenditure, a significant volume of complex transplant surgeries, and advanced TDM protocols. The U.S. market, in particular, dictates global pricing trends and is heavily influenced by Medicare/Medicaid and private insurance reimbursement decisions. While generic penetration is exceptionally high, premium formulations and specific branded products still maintain a market presence, especially in major academic transplant centers where physician preference and established protocols influence drug choice. Strict regulatory pathways ensure high quality but can slow the introduction of novel MMF formulations.

Europe mirrors North America in terms of high transplant volumes and sophisticated medical care, though the market structure is more fragmented due to individual national healthcare systems (e.g., NHS in the UK, centralized systems in Germany and France). Pricing is often subjected to rigorous negotiation by national health authorities, leading to lower average prices compared to the U.S. Generic uptake is substantial across the EU5 countries, though physician confidence in bioequivalence remains a critical determinant of prescription habits. Eastern Europe is experiencing growth driven by infrastructure improvement and increasing access to transplantation services, offering moderate growth opportunities for cost-effective generic manufacturers.

The Asia Pacific (APAC) region is the fastest-growing market globally. This surge is fueled by massive demographic populations, improving economic conditions, and government initiatives to expand specialized healthcare access, particularly in China and India, which are rapidly developing their transplant capabilities. Although regulatory harmonization is challenging, local manufacturers hold a dominant position, supplying cost-effective generic MMF, making the region crucial for high-volume sales. Latin America and the Middle East and Africa (MEA) are emerging regions where growth is currently sporadic but promising. The implementation of standardized organ donation programs and the expansion of medical tourism for complex procedures are laying the groundwork for sustained MMF demand in these developing markets, albeit tempered by economic volatility and reliance on imported pharmaceuticals.

- North America: Dominant market share, driven by high transplant rates, established regulatory framework, and sophisticated reimbursement policies.

- Europe: Large volume market with strong generic presence, characterized by national pricing controls and high quality standards in major Western European countries.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid expansion of healthcare infrastructure, massive patient pool in China and India, and strong growth in local generic manufacturing.

- Latin America: Emerging market showing steady growth due to improving healthcare investment and increasing access to specialized transplant centers.

- Middle East & Africa (MEA): Growth potential tied to regional government investment in healthcare infrastructure and rising medical tourism for complex procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mycophenolate Mofetil Market.- Roche (Genentech)

- Novartis (including Sandoz)

- Mylan (Viatris)

- Teva Pharmaceutical Industries

- Hikma Pharmaceuticals

- Dr. Reddy's Laboratories

- Apotex

- Aurobindo Pharma

- Cipla

- Fresenius Kabi

- Sun Pharmaceutical Industries

- Zydus Cadila

- Alkem Laboratories

- Strides Pharma Science

- Glenmark Pharmaceuticals

- Amneal Pharmaceuticals

- Accord Healthcare

- Intas Pharmaceuticals

- Hetero Drugs

- Lupin Limited

Frequently Asked Questions

Analyze common user questions about the Mycophenolate Mofetil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Mycophenolate Mofetil market?

The primary driver is the increasing volume of solid organ transplant procedures globally, particularly kidney and liver transplants, where Mycophenolate Mofetil (MMF) is mandated as a foundational drug in maintenance immunosuppression protocols to prevent allograft rejection. The secondary driver is its expanding application in severe autoimmune diseases like Systemic Lupus Erythematosus (SLE).

How has generic competition affected the overall revenue landscape of the MMF market?

Generic competition has severely eroded the market share and pricing power of branded MMF products following patent expirations. While this has depressed the overall average selling price and revenue margins, it has significantly boosted market volume and access, especially in cost-sensitive emerging markets, ensuring wider availability of the critical immunosuppressant.

Which dosage form of Mycophenolate Mofetil dominates the market and why?

Oral dosage forms, specifically tablets and capsules, dominate the market. They are preferred because MMF is a maintenance drug requiring long-term, chronic use, making oral administration essential for patient convenience, compliance, and suitability for outpatient management following hospital discharge from transplant procedures.

What technological advancements are shaping the future of MMF administration and efficacy?

Key technological advancements include the development of enteric-coated formulations, such as mycophenolate sodium, designed to reduce severe gastrointestinal side effects and improve patient adherence. Furthermore, the integration of AI-driven tools with High-Performance Liquid Chromatography (HPLC) for precise Therapeutic Drug Monitoring (TDM) is enabling personalized dosing to optimize efficacy and minimize toxicity.

Which geographic region is expected to exhibit the fastest growth for Mycophenolate Mofetil?

The Asia Pacific (APAC) region, particularly driven by large economies like China and India, is projected to record the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly advancing healthcare infrastructure, government initiatives supporting specialized transplant surgeries, and increased local generic manufacturing capabilities ensuring high volume market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager