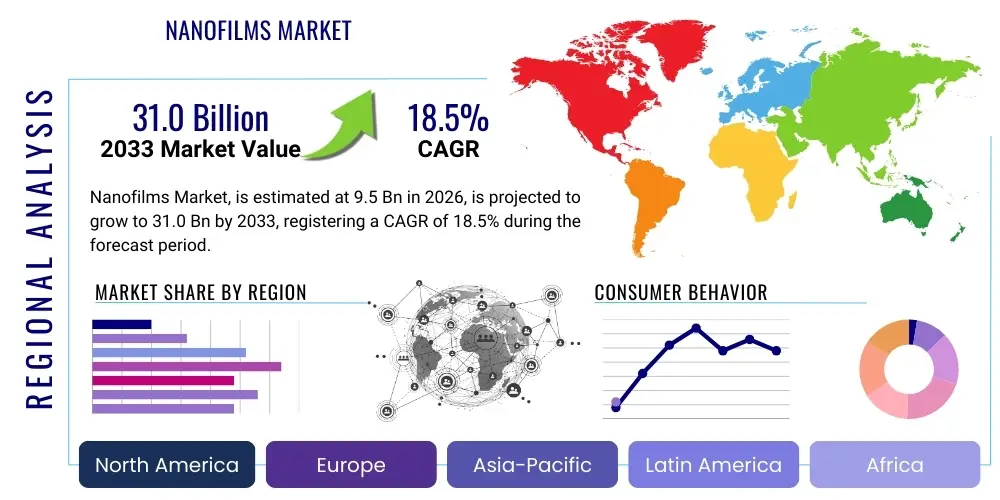

Nanofilms Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442830 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Nanofilms Market Size

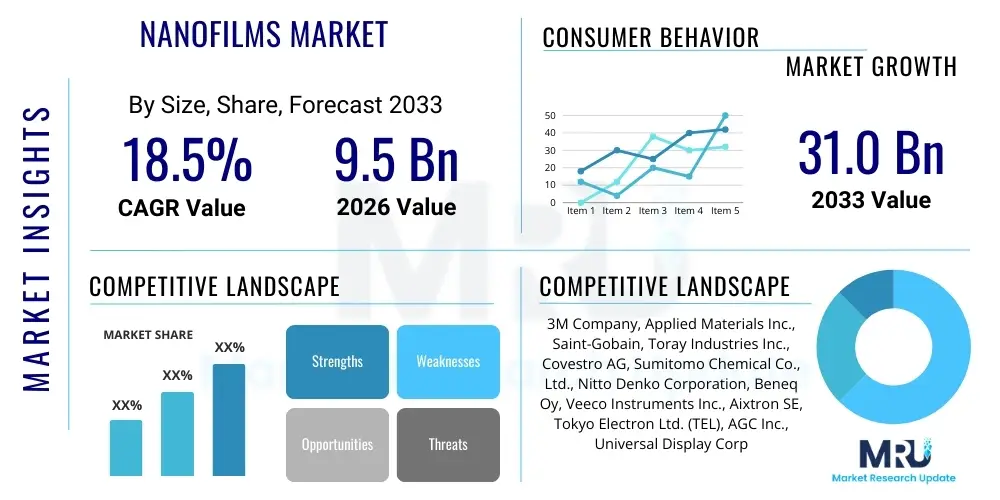

The Nanofilms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 31.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for miniaturized electronic components, sophisticated medical devices, and high-performance energy storage solutions globally. Nanofilms, defined by their thickness typically below 100 nanometers, offer superior functional properties such as enhanced barrier performance, electrical conductivity, optical transparency, and mechanical strength, making them indispensable in advanced manufacturing across multiple sectors.

Market expansion is further bolstered by sustained investment in semiconductor fabrication technologies, particularly in Asia Pacific, which leverages nanofilms for producing advanced logic and memory chips. The versatility of these films allows for precise control over material properties at the atomic level, enabling the development of next-generation flexible displays, smart packaging, and highly efficient solar cells. Technological advancements in deposition techniques, such as Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD), are continuously lowering production costs and improving film quality, thereby accelerating market adoption.

Furthermore, emerging applications in the biomedical field, including drug delivery systems, biosensors, and biocompatible coatings, are contributing significantly to the revenue trajectory. Governments and private entities are increasingly funding research into novel nanomaterials and their scalable manufacturing processes, acknowledging their critical role in future technological infrastructure. These investments ensure a pipeline of innovative nanofilm products entering the commercial sector, guaranteeing robust, sustained growth throughout the forecast period.

Nanofilms Market introduction

The Nanofilms Market encompasses the production, utilization, and commercialization of ultra-thin layers of material, typically ranging from a few nanometers to tens of nanometers in thickness. These films are engineered to exhibit unique physical, chemical, and electrical properties distinct from their bulk counterparts, owing to quantum confinement effects and high surface-to-volume ratios. Key product descriptions include films made from metals (e.g., silver, gold), metal oxides (e.g., TiO2, ZnO), polymers, and carbon-based nanomaterials (e.g., graphene, carbon nanotubes), each tailored for specific functional requirements.

Major applications of nanofilms span various high-tech industries. In electronics, they are crucial for creating dielectric layers, transparent electrodes, and protective coatings in integrated circuits (ICs), transistors, and memory devices. Within the energy sector, nanofilms enhance the efficiency and longevity of solar photovoltaics, fuel cells, and advanced battery electrodes. Biomedical applications leverage their high surface area for drug encapsulation, tissue engineering scaffolds, and sensitive diagnostic sensors. The primary benefits driving adoption include significantly reduced material usage, enhanced device performance (faster switching speeds, better energy conversion), improved durability, and the ability to integrate functionality into flexible and miniaturized form factors.

The market is primarily driven by escalating global demand for smaller, more powerful electronic devices (smartphones, wearables), the accelerating transition towards renewable energy sources requiring high-efficiency thin-film solar technology, and groundbreaking innovations in flexible electronics and smart packaging. Continuous advancements in precision manufacturing techniques, coupled with substantial research and development spending, underpin the commercial viability and expansion of the Nanofilms Market across all major geographical regions.

Nanofilms Market Executive Summary

The Nanofilms Market is characterized by intense technological competition and rapid application diversification, exhibiting strong business trends centered around material innovation and scaling up deposition techniques. Key business trends include strategic collaborations between academic institutions and industrial leaders to standardize manufacturing protocols, and a pronounced shift towards environmentally friendly and cost-effective roll-to-roll processing for large-scale production. Investment in specialized equipment, particularly ALD and advanced sputtering systems, is soaring, reflecting the need for atomic-level precision. Furthermore, M&A activities are focusing on consolidating expertise in niche materials, such as 2D nanomaterials like molybdenum disulfide (MoS2) and specialized polymer nanofilms, to capture high-value market segments.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, driven by its unparalleled manufacturing capacity for consumer electronics and semiconductor foundry operations, notably in South Korea, Taiwan, and China. North America and Europe, while possessing smaller manufacturing bases, lead in innovation and high-value applications, particularly in aerospace, advanced medical devices, and high-efficiency photovoltaic research. Latin America and MEA are emerging markets, primarily adopting nanofilm technologies through imported finished goods or early-stage integration in localized smart infrastructure projects. Regulatory landscapes across these regions are evolving to address the safety and lifecycle management of nanomaterials, impacting adoption rates and market entry barriers.

Segmentation trends reveal that the material segment dominated by Metal Oxides remains critical due to their use as barrier layers and dielectrics, while advanced materials like Graphene and Carbon Nanotubes are the fastest-growing segments, owing to their revolutionary electrical and mechanical properties for flexible and transparent electronics. By end-user, the Electronics and Semiconductor segment retains the largest market share, though the Energy and Healthcare segments are exhibiting superior growth trajectories. The increasing complexity of integrated circuits demands thinner, more uniform films, ensuring sustained premium pricing for advanced deposition techniques like Atomic Layer Deposition (ALD), positioning it as a rapidly expanding technology segment.

AI Impact Analysis on Nanofilms Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Nanofilms Market primarily revolve around optimizing synthesis and deposition processes, accelerating materials discovery, and enhancing quality control. Users seek confirmation on whether AI can significantly reduce the time and cost associated with experimental validation of new film structures, and how Machine Learning (ML) algorithms are being implemented to predict the functional characteristics of films based on precursor ratios and process parameters. Key themes include the implementation of Digital Twins for virtual prototyping of deposition chambers, the use of computer vision in real-time defect detection during manufacturing, and the potential of Generative AI (GenAI) to propose novel nanocomposite material formulations with target properties like specific dielectric constants or tensile strengths.

AI’s integration is fundamentally transforming the R&D and manufacturing lifecycle of nanofilms. Deep learning models are capable of processing vast datasets from high-throughput experimentation (HTE), identifying non-linear correlations between input variables (temperature, pressure, precursor flow) and output film properties (crystallinity, thickness uniformity, defect density) that are invisible to traditional statistical methods. This predictive capability dramatically minimizes the number of costly, time-consuming physical experiments required to optimize a new material or process, leading to accelerated commercialization. Furthermore, AI-driven automation in quality assurance ensures atomic-level precision and consistency, critical for high-reliability applications like advanced microelectronics and medical implants, thereby addressing major bottlenecks in current nanofilm production scaling.

The utilization of AI extends into supply chain management and predictive maintenance for specialized nanofilm manufacturing equipment (e.g., PVD/CVD reactors). ML algorithms monitor equipment sensor data in real-time to forecast potential failures, optimizing maintenance schedules and maximizing uptime, which is crucial in capital-intensive semiconductor fabrication environments. Consequently, AI integration not only enhances the technical performance of nanofilms but also significantly improves the economic efficiency and scalability of their production, solidifying its role as a key competitive differentiator in the market.

- AI accelerates new nanomaterial discovery and formulation through predictive modeling.

- Machine Learning optimizes deposition processes (e.g., ALD, CVD) for enhanced film uniformity and quality.

- Real-time AI-powered visual inspection reduces defect rates in large-scale nanofilm manufacturing.

- Generative algorithms aid in the virtual design of nanofilm stacks for targeted optical or electrical performance.

- AI enables predictive maintenance of high-precision deposition equipment, minimizing operational downtime.

- Data analytics derived from AI improves yield optimization and reduces material waste during fabrication.

DRO & Impact Forces Of Nanofilms Market

The dynamics of the Nanofilms Market are influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core Impact Forces shaping its trajectory. The primary driver is the pervasive trend of device miniaturization and the relentless pursuit of high-performance materials in consumer electronics and advanced computing, mandating the use of ultra-thin, highly functional films. Restraints mainly center on the high capital expenditure required for advanced deposition equipment, such as ALD systems, and the inherent technical challenges associated with scaling up high-precision, large-area fabrication while maintaining atomic-level uniformity. Opportunities abound in emerging sectors, particularly flexible and printed electronics, smart textiles, and the development of next-generation solid-state batteries, which rely heavily on novel nanofilm architectures. These DRO elements create significant market momentum, compelling stakeholders to prioritize technological advancements and strategic resource allocation.

Impact forces acting on the market are categorized into four critical areas: technological evolution, regulatory pressures, supply chain complexity, and competitive intensity. Technological evolution is perhaps the strongest force, driven by continuous innovation in precursors and processing temperatures, enabling the deposition of complex multi-layer structures with sub-nanometer control. Regulatory pressures related to the environmental safety and toxicity of certain nanomaterials, particularly during disposal, introduce compliance costs and restrict the use of some promising chemistries. Furthermore, the specialized and global nature of the precursor chemical supply chain makes it vulnerable to geopolitical instability and logistics disruptions, necessitating robust sourcing strategies among key manufacturers.

Competitive intensity is high, characterized by a mix of specialized equipment providers, large chemical conglomerates, and focused nanomaterials startups. Successful market penetration is determined by patents protecting novel deposition methods and unique material compositions. The cumulative effect of these impact forces requires market participants to invest heavily in both R&D and sustainable manufacturing practices. The constant demand for faster, lighter, and more efficient devices ensures that the technological driver remains dominant, consistently pushing the boundary of what nanofilms can achieve and sustaining the market’s aggressive growth outlook despite existing cost and scaling challenges.

Segmentation Analysis

The Nanofilms Market segmentation provides a granular view of market structure based on Material Type, Deposition Technique, and End-User Application, reflecting the diverse utility and specialized manufacturing requirements inherent in the industry. Material segmentation reveals a reliance on established inorganic materials while highlighting the explosive potential of newer 2D materials. Deposition techniques differentiate between physical and chemical methods, reflecting differences in capital investment and film quality. End-user analysis clearly illustrates the market concentration in high-tech industries, primarily those requiring precision, barrier function, or electrical conductivity. This complex segmentation underscores the bespoke nature of the nanofilm product landscape, where optimal material choice is critically dependent on the required functional outcome and target application environment.

- By Material Type:

- Metal Oxides (e.g., Aluminum Oxide, Titanium Dioxide, Zinc Oxide)

- Polymers

- Metals (e.g., Gold, Silver, Copper)

- Carbon-Based Nanomaterials (e.g., Graphene, Carbon Nanotubes)

- Inorganic Salts

- By Deposition Technique:

- Chemical Vapor Deposition (CVD)

- Physical Vapor Deposition (PVD)

- Sputtering

- Evaporation

- Atomic Layer Deposition (ALD)

- Roll-to-Roll (R2R) Processing

- Solution Processing (e.g., Spin Coating, Inkjet Printing)

- By End-User Application:

- Electronics and Semiconductors

- Energy (Solar Cells, Batteries, Fuel Cells)

- Healthcare and Biomedical Devices

- Optics and Displays

- Automotive and Aerospace

- Packaging and Barrier Coatings

Value Chain Analysis For Nanofilms Market

The Nanofilms Market value chain is structured and highly specialized, beginning with the complex production of ultra-high purity precursor chemicals (upstream), moving through highly capital-intensive manufacturing processes, and concluding with sophisticated integration into final end-user products (downstream). Upstream analysis focuses on chemical suppliers providing high-purity organometallic compounds, gases, and specialized polymers required for CVD, ALD, and solution processing. Quality control at this stage is paramount, as impurity levels directly impact the performance and uniformity of the resulting nanofilm. Key players in this segment are specialized chemical producers who adhere to stringent semiconductor-grade purity standards, often forming long-term supply agreements with film manufacturers.

The core manufacturing stage involves nanofilm deposition—utilizing specialized equipment like PVD/CVD/ALD systems. This segment is characterized by high operational complexity and significant barriers to entry due to the necessity for controlled vacuum environments and highly skilled technical personnel. Distribution channels are typically segmented into direct sales for high-volume, customized applications (e.g., semiconductor foundries) and indirect distribution via specialized industrial distributors for smaller volume or general-purpose nanofilms, particularly those used in optics or commodity packaging. Direct channels ensure close collaboration for highly customized film stacks, while indirect channels provide wider geographical reach and logistical efficiency for standardized products.

Downstream integration involves the incorporation of the nanofilms onto substrates by Original Equipment Manufacturers (OEMs) in electronics, energy, or medical fields. These downstream users are the primary drivers of technology specifications, dictating requirements for adhesion, flexibility, and conductivity. The value added at this final stage is substantial, converting a raw component (the film) into a functional part of a high-value device (e.g., a touchscreen, an IC, or a prosthetic coating). The efficiency of the entire chain relies on seamless coordination and adherence to strict quality protocols from precursor synthesis through final device assembly, ensuring traceability and reliability.

Nanofilms Market Potential Customers

Potential customers and end-users of nanofilm products are concentrated across high-technology and precision manufacturing industries that require thin, highly functional materials to achieve performance enhancements impossible with traditional bulk materials. The largest customer segment comprises semiconductor manufacturers (foundries and integrated device manufacturers - IDMs) who utilize nanofilms as high-k dielectrics, diffusion barriers, and passivation layers within advanced microprocessors and memory chips (DRAM, NAND). These customers demand exceptional uniformity, low defect density, and precise thickness control, often requiring Atomic Layer Deposition (ALD) derived films for sub-10nm fabrication nodes.

The second major cohort includes developers and manufacturers in the energy sector, particularly those involved in renewable energy and advanced storage. This encompasses solar panel manufacturers requiring transparent conductive oxides (TCOs) and anti-reflection coatings to maximize photovoltaic efficiency, as well as battery manufacturers utilizing nanofilms as separators or electrode coatings to enhance energy density, cyclability, and safety in lithium-ion and solid-state batteries. Furthermore, display and optics manufacturers are key buyers, needing nanofilms for anti-glare, scratch resistance, and the creation of flexible OLED displays, where films must be robust yet pliable.

Finally, the medical and aerospace industries represent high-value, high-reliability customer bases. Biomedical device companies procure nanofilms for biocompatible coatings on implants, highly sensitive biosensor surfaces, and sophisticated drug delivery patches, where material purity and adhesion are non-negotiable. Aerospace and defense entities utilize specialized nanofilms for radar-absorbing materials, thermal barrier coatings, and protective layers in harsh operating environments, prioritizing durability, weight reduction, and extreme thermal stability. These diverse customer needs ensure sustained demand across the spectrum of nanofilm properties and production capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 31.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Applied Materials Inc., Saint-Gobain, Toray Industries Inc., Covestro AG, Sumitomo Chemical Co., Ltd., Nitto Denko Corporation, Beneq Oy, Veeco Instruments Inc., Aixtron SE, Tokyo Electron Ltd. (TEL), AGC Inc., Universal Display Corporation (UDC), Evonik Industries AG, Merck KGaA, Angstrom Engineering Inc., CVD Equipment Corporation, Planar Systems Inc., Ascent Solar Technologies, DuPont Teijin Films. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanofilms Market Key Technology Landscape

The Nanofilms Market technology landscape is defined by sophisticated deposition methodologies that enable atomic-level control over film thickness and composition. Key technologies dominating the sector include Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), and Atomic Layer Deposition (ALD). CVD involves chemical reactions of precursor gases on the substrate surface, yielding high-quality, conformal films and is widely used for producing silicon oxide, nitride, and various metal films. PVD, which includes techniques like sputtering and evaporation, is a vacuum deposition method commonly used for metallic and alloy films, favored for its relatively high deposition rates and scalability in certain applications, such as large-area coatings for architectural glass or flexible electronics.

The most advanced and rapidly growing segment is ALD, recognized for its ability to deposit films with unparalleled uniformity and conformality, even on highly complex, three-dimensional structures. ALD utilizes sequential, self-limiting chemical reactions, providing atomic-scale thickness control crucial for sub-10nm semiconductor fabrication and high-performance battery electrode coatings. Beyond traditional vacuum-based methods, solution processing techniques, such as spin coating, dip coating, and inkjet printing, are gaining traction, particularly for manufacturing organic and polymeric nanofilms for flexible electronics and disposable sensors. These methods offer lower equipment costs and potential for high-volume, continuous processing like Roll-to-Roll (R2R) manufacturing, significantly reducing the cost barrier for certain applications.

Characterization technologies are also paramount in this landscape, including techniques like Atomic Force Microscopy (AFM), Scanning Electron Microscopy (SEM), and Ellipsometry, which are essential for quality control, thickness measurement, and defect analysis. Furthermore, the integration of computational materials science and AI-driven process control is rapidly becoming a core technological competence. Manufacturers are adopting advanced simulation tools to predict film stress, adhesion properties, and device integration effects before physical deposition, streamlining the R&D cycle and accelerating the industrialization of novel nanofilm products.

Regional Highlights

The global Nanofilms Market exhibits distinct regional dynamics driven by varying levels of industrialization, technological expertise, and end-user demand concentration.

- Asia Pacific (APAC): APAC commands the largest share of the Nanofilms Market, propelled by its immense manufacturing infrastructure for consumer electronics, semiconductors, and displays. Countries like China, South Korea, Taiwan, and Japan are global hubs for IC fabrication and flat-panel display production, creating enormous domestic demand for high-performance dielectric, conductive, and barrier nanofilms. Government initiatives supporting renewable energy, particularly solar PV expansion in China and India, further solidify the region's dominance.

- North America (NA): North America is a major market characterized by high innovation, particularly in aerospace, defense, medical devices, and advanced R&D in energy storage (solid-state batteries). While lacking the large-scale semiconductor fabrication volumes of APAC, the region focuses on high-value, specialized nanofilm applications. The presence of leading research institutions and key equipment manufacturers drives significant technological breakthroughs, focusing heavily on ALD and advanced materials like Graphene.

- Europe: Europe represents a mature market with robust demand from the automotive, medical technology, and industrial coating sectors. Regulatory focus on environmental standards drives the adoption of advanced, eco-friendly nanofilms for surface protection and energy efficiency (e.g., smart window coatings). Germany, France, and the UK are key contributors, specializing in precision manufacturing and the integration of nanofilms into high-end optics and complex machinery.

- Latin America (LA) and Middle East & Africa (MEA): These regions are emerging markets, primarily consuming nanofilms through imported finished goods, though localized growth is accelerating in infrastructure development and oil & gas applications. In MEA, investments in solar power (requiring anti-soiling and anti-reflective coatings) and smart city projects are beginning to create localized demand for basic and intermediate nanofilm products. LA's market penetration is steadily increasing, driven by expanding electronics assembly and localized manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanofilms Market.- 3M Company

- Applied Materials Inc.

- Saint-Gobain

- Toray Industries Inc.

- Covestro AG

- Sumitomo Chemical Co., Ltd.

- Nitto Denko Corporation

- Beneq Oy

- Veeco Instruments Inc.

- Aixtron SE

- Tokyo Electron Ltd. (TEL)

- AGC Inc.

- Universal Display Corporation (UDC)

- Evonik Industries AG

- Merck KGaA

- Angstrom Engineering Inc.

- CVD Equipment Corporation

- Planar Systems Inc.

- Ascent Solar Technologies

- DuPont Teijin Films

- BASF SE

- Novacentrix

- Nanofilm Technologies International Limited

- Arkema S.A.

- Materion Corporation

Frequently Asked Questions

Analyze common user questions about the Nanofilms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Atomic Layer Deposition (ALD) for nanofilms?

ALD is highly advantageous due to its ability to deposit ultra-thin films with precise, atomic-level thickness control, exceptional conformality over complex 3D structures, and superior film density. This precision is crucial for next-generation semiconductor components and high-performance energy storage devices where film uniformity is critical.

How are nanofilms contributing to advancements in the energy sector?

Nanofilms enhance the energy sector by improving the efficiency and longevity of photovoltaic devices through specialized anti-reflective and conductive oxide coatings. In battery technology, they serve as high-performance separators or electrode protective layers, boosting energy density, charge-discharge cycle stability, and overall safety.

Which application segment holds the largest market share in the Nanofilms Market?

The Electronics and Semiconductor segment currently holds the largest market share. This is driven by the continuous demand for miniaturization, requiring nanofilms for crucial functions such as high-k dielectrics, transparent electrodes, and barrier layers in advanced integrated circuits (ICs), memory chips, and high-resolution displays.

What technological challenges are restraining the widespread adoption of nanofilms?

Key restraints include the significant capital cost required for high-precision deposition equipment (ALD/CVD), the complexity of ensuring large-area uniformity and low defect density during scale-up, and the high cost of ultra-high purity precursor chemicals necessary for high-quality film synthesis.

How is Graphene impacting the development of advanced nanofilms?

Graphene, a carbon-based nanomaterial, is revolutionary for nanofilms due to its exceptional electrical conductivity, mechanical strength, and flexibility. It is enabling the development of next-generation transparent and flexible electronics, highly efficient touch screens, and sophisticated sensors, representing one of the fastest-growing material segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager