Nanoparticle Measuring Instrument Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443340 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Nanoparticle Measuring Instrument Market Size

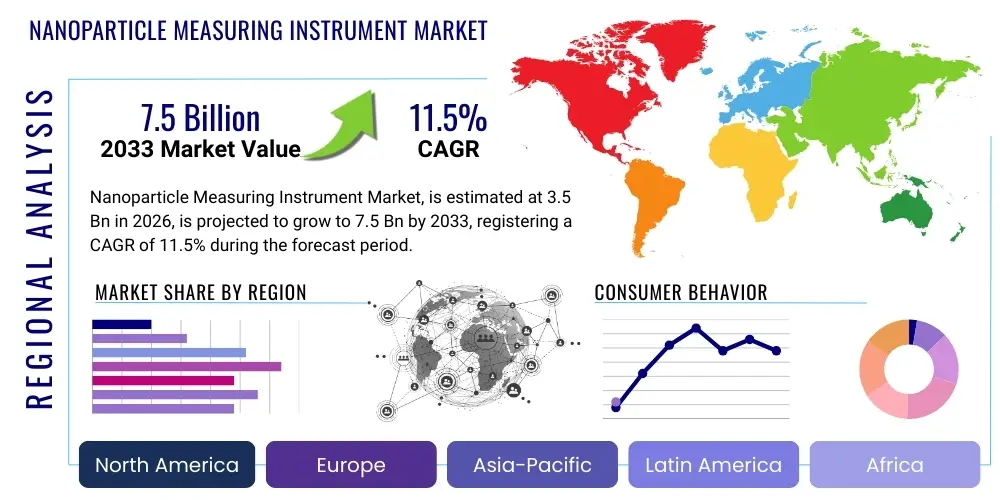

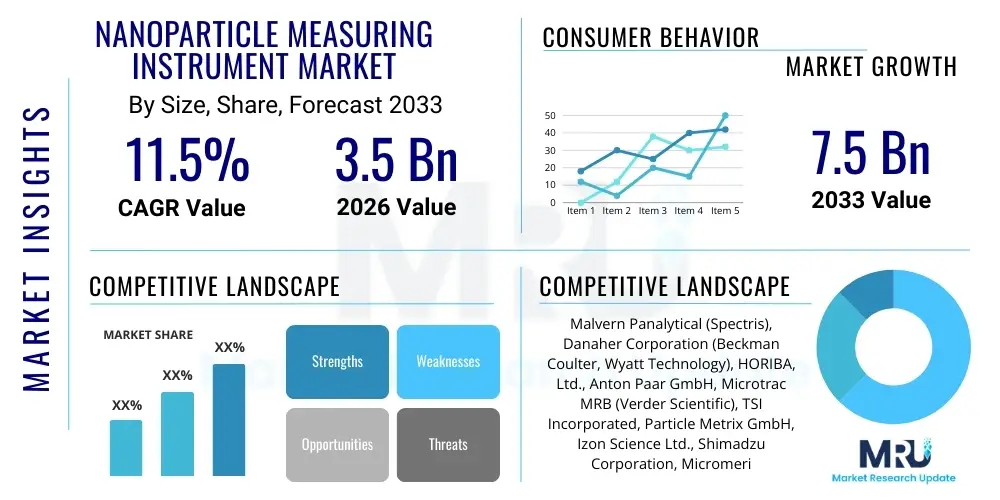

The Nanoparticle Measuring Instrument Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $3.5 Billion USD in 2026 and is projected to reach $7.5 Billion USD by the end of the forecast period in 2033. This substantial expansion is driven by the escalating demand for precise material characterization across high-growth sectors such as pharmaceuticals, advanced materials, and nanotechnology research. The necessity for stringent quality control and regulatory compliance in producing nano-enabled products further solidifies this upward trajectory.

The forecasted growth trajectory reflects a critical shift toward miniaturization and enhanced performance characteristics in industrial and academic applications. Instruments capable of accurately measuring size distribution, zeta potential, and concentration of nanoparticles are becoming indispensable tools in drug delivery systems, vaccine development, and the creation of next-generation electronic components. Furthermore, emerging economies are increasingly investing in sophisticated research infrastructure, leading to broader adoption of these high-precision instruments, thereby contributing significantly to the overall market size expansion over the next seven years.

Market valuation reflects the increasing average selling price (ASP) of advanced instruments, particularly those incorporating integrated functionalities like Nanoparticle Tracking Analysis (NTA) and Resonant Mass Measurement (RMM). The continuous innovation cycle, focusing on automation, improved sensitivity, and faster throughput, justifies the premium pricing and sustains revenue growth. Additionally, ongoing academic-industrial collaborations focused on developing novel nanomaterials fuel the installed base of measurement systems, ensuring sustained aftermarket revenues from consumables and service contracts throughout the forecast period.

Nanoparticle Measuring Instrument Market introduction

The Nanoparticle Measuring Instrument Market encompasses specialized analytical devices designed to characterize nanoscale materials, typically ranging from 1 to 1000 nanometers. These instruments utilize various physical principles, including light scattering, particle movement tracking, and electrical sensing, to provide crucial metrics such as particle size distribution, concentration, surface charge (zeta potential), and molecular weight. Key product categories include Dynamic Light Scattering (DLS) systems, Nanoparticle Tracking Analysis (NTA) instruments, Tunable Resistive Pulse Sensing (TRPS) technology, and specialized systems for Electron Microscopy image analysis integration. The primary objective of these tools is to ensure the stability, efficacy, and safety of nanoparticles utilized across diverse scientific and industrial applications, making them foundational to modern nanotechnology research and commercialization efforts.

Major applications of nanoparticle measuring instruments span drug discovery and formulation, where precise sizing ensures optimal drug loading and targeted delivery mechanisms, and materials science, focusing on characterizing catalysts, ceramics, and composite structures for performance optimization. In the biotechnology sector, these instruments are critical for analyzing viral vectors, liposomes, and extracellular vesicles (EVs), which are increasingly central to advanced diagnostics and therapeutics. The inherent benefits derived from these instruments include enhanced quality assurance, faster R&D cycles through reliable data, and compliance with increasingly rigorous regulatory guidelines (e.g., those governing nanomedicines and environmental safety protocols related to nanomaterial exposure).

Driving factors propelling market expansion include the exponential growth in global nanotechnology research funding, particularly in North America and APAC, coupled with the rising incidence of chronic diseases necessitating advanced nanomedicines. Furthermore, environmental monitoring requirements are increasingly focused on detecting and characterizing airborne and waterborne nanoparticles, necessitating high-sensitivity instrumentation. The continuous technological advancements, such as the integration of artificial intelligence for data processing and the development of multi-modal analysis systems offering simultaneous size and charge measurements, further stimulate demand by providing higher resolution and comprehensive characterization capabilities previously unavailable in standardized laboratory settings.

Nanoparticle Measuring Instrument Market Executive Summary

The Nanoparticle Measuring Instrument Market is characterized by vigorous competition and rapid technological integration, primarily driven by the need for ultra-high precision in advanced R&D. Current business trends indicate a strong move toward consolidated platform solutions that offer multiple analysis techniques (e.g., DLS and NTA combined) within a single unit, enhancing operational efficiency and lowering the total cost of ownership for end-users. Strategic partnerships between instrument manufacturers and major pharmaceutical companies are defining new product standards, emphasizing automation and 21 CFR Part 11 compliance for regulated environments. Furthermore, the market is witnessing increased mergers and acquisitions aimed at integrating specialized software solutions and proprietary algorithms, enabling advanced data interpretation crucial for complex nano-systems like quantum dots and novel bio-conjugates.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive government investment in nanotechnology parks, increasing foreign direct investment in contract research organizations (CROs), and the rapid expansion of domestic pharmaceutical and electronics manufacturing hubs, particularly in China, South Korea, and India. North America and Europe remain dominant in terms of current market share and expenditure on high-end, research-grade instruments, reflecting the established infrastructure and leading concentration of academic excellence and biotechnology firms. Regulatory harmonization efforts, especially concerning nanomaterial safety across the EU and US, are influencing regional adoption patterns, necessitating instruments that offer verifiable, traceable measurement results.

Segment trends demonstrate that the Dynamic Light Scattering (DLS) segment retains the largest market share due to its robustness, ease of use, and versatility across various sample types, making it the industry standard for initial size screening. However, Nanoparticle Tracking Analysis (NTA) is exhibiting the highest growth rate, propelled by its ability to provide high-resolution particle concentration data and visualization of individual particles, which is critical in characterizing complex biological samples like viruses and extracellular vesicles. The end-user segment is increasingly dominated by Pharmaceutical & Biotechnology companies, driven by the intense clinical pipeline involving lipid nanoparticles (LNPs) and mRNA delivery systems, demanding extremely accurate quality control throughout the manufacturing scale-up process.

AI Impact Analysis on Nanoparticle Measuring Instrument Market

Common user questions regarding AI's impact on Nanoparticle Measuring Instrument Market frequently center on concerns about data complexity, the reliability of automated interpretation, and the integration of machine learning (ML) algorithms into existing hardware platforms. Users inquire whether AI can accurately distinguish between complex polydisperse samples, automate instrument calibration and maintenance, and accelerate the development of novel nanomaterials by predicting stability or aggregation tendencies based on measured parameters. The overarching theme is the expectation that AI should transition nanoparticle characterization from a data collection process to an automated, predictive analytics environment, addressing bottlenecks associated with manual data filtering, anomaly detection, and correlation analysis across multiple instrument types (e.g., correlating DLS data with SEM imagery).

The integration of AI/ML models is fundamentally reshaping the operational landscape of nanoparticle measurement, moving beyond simple data processing toward predictive maintenance and enhanced analytical resolution. AI algorithms are now deployed to automatically optimize measurement parameters, such as laser intensity and acquisition time, ensuring optimal data quality regardless of sample concentration or viscosity, thus significantly reducing operator variability and required expertise. Furthermore, machine learning models are adept at classifying complex particle populations, enabling the swift identification of contaminants or aggregation states in real-time during manufacturing processes, a capability vital for maintaining batch consistency and ensuring product quality in sensitive sectors like injectable drug production.

This technological convergence allows researchers to extract deeper, more meaningful insights from high-volume datasets generated by instruments like NTA and high-throughput DLS systems. AI facilitates multivariate analysis, connecting particle characteristics (size, charge) with performance metrics (stability, cellular uptake), thereby accelerating the design cycle for new nanomaterials. The market anticipates that instruments offering proprietary, AI-driven software for enhanced data interpretation will achieve a significant competitive advantage, establishing new industry benchmarks for speed, accuracy, and ease of use in characterizing highly technical nanomaterial compositions, supporting the market's transition towards high-throughput automation.

- AI enables automated optimization of measurement protocols, minimizing operator error and maximizing data integrity.

- Machine Learning algorithms enhance anomaly detection, accurately identifying aggregated particles or contaminants in complex samples.

- Predictive analytics accelerate nanomaterial R&D by forecasting stability and performance based on initial characterization data.

- AI facilitates multi-modal data fusion, correlating measurements from diverse instrument platforms (e.g., DLS, NTA, microscopy) for holistic characterization.

- Automated image recognition and processing improve throughput and accuracy for systems utilizing techniques like Nanoparticle Tracking Analysis (NTA).

DRO & Impact Forces Of Nanoparticle Measuring Instrument Market

The Nanoparticle Measuring Instrument Market is fundamentally driven by escalating research and development activities in nanotechnology, materials science, and advanced drug delivery systems, coupled with stringent regulatory frameworks mandating precise characterization of nanoscale components for safety and efficacy. These primary drivers are counterbalanced by significant restraints, primarily the high capital expenditure associated with purchasing and maintaining advanced instrumentation, alongside the technical complexity requiring highly trained personnel for operation and data interpretation. Opportunities arise from the burgeoning demand for specialized measurements in emerging fields such as exosome analysis and quantum computing material development, offering pathways for market penetration via innovative, niche-focused products, creating a complex interplay of forces shaping market dynamics.

Key drivers include the global expansion of pharmaceutical outsourcing and manufacturing, particularly for complex generics and novel biological drugs that utilize nano-carriers like liposomes and solid lipid nanoparticles. This industry growth mandates robust quality control (QC) tools throughout the production lifecycle. Simultaneously, geopolitical impact forces related to trade regulations and intellectual property protection surrounding advanced analytical technology influence the distribution and adoption rates globally. Furthermore, the imperative for environmental health and safety (EHS) agencies to monitor engineered nanoparticles in air and water sources introduces a substantial demand force for portable and field-deployable measuring instruments, broadening the market scope beyond traditional laboratory settings.

Impact forces strongly influencing market trajectory include rapid technology obsolescence driven by continuous innovation in measurement physics (e.g., shifting from standard DLS to high-resolution NTA or RMM techniques), compelling end-users to upgrade systems frequently. Economic stability and the availability of research grants directly affect academic and public sector purchasing power, which represents a substantial segment of high-end instrument users. Overcoming restraints, such as developing user-friendly software interfaces and decreasing the cost of advanced sensors, is critical for sustained market penetration into smaller laboratories and routine industrial QC environments, ensuring that the market's strong underlying opportunities can be fully capitalized upon throughout the forecast period.

Segmentation Analysis

The Nanoparticle Measuring Instrument Market is meticulously segmented across technology type, application, and end-user, reflecting the diverse requirements of the scientific and industrial communities utilizing nanoscale materials. Technology segmentation is vital as different techniques offer varied strengths—DLS provides fast, ensemble measurements of size distribution, while NTA excels at single-particle analysis and concentration determination, and TRPS offers high-resolution, particle-by-particle sizing and concentration data. This variety allows end-users to select instruments precisely tailored to their specific research or quality control needs. The application segment is dominated by Life Sciences and Materials Science, underscoring the instrumental role of these devices in modern drug development and advanced material engineering, driving differentiated feature sets and software development specific to each field.

Furthermore, segmentation by end-user differentiates demand patterns, with Academic & Research Institutes primarily requiring versatile, high-specification instruments for discovery science, often prioritizing novel technology adoption and maximum measurement range. Conversely, Pharmaceutical & Biotechnology companies prioritize regulatory compliance, validation support, robustness, and automation for high-throughput quality control (QC) and stability testing. The detailed segmentation analysis provides strategic insights for manufacturers, enabling them to focus their product development efforts, pricing strategies, and marketing campaigns to effectively address the unique pain points and technical requirements of each distinct market vertical.

The geographic segmentation is equally critical, highlighting regional growth disparities driven by factors like infrastructure investment, regulatory environment, and concentration of nanotechnology enterprises. While established markets in North America and Europe demand replacement units and niche high-end systems, the APAC region drives volume sales, particularly for standardized DLS and basic microscopy preparation equipment used in growing manufacturing sectors. This structured approach to segmentation allows for accurate forecasting and resource allocation, identifying high-potential segments and regions that will contribute most significantly to overall market growth.

- By Technology:

- Dynamic Light Scattering (DLS)

- Nanoparticle Tracking Analysis (NTA)

- Tunable Resistive Pulse Sensing (TRPS)

- Laser Diffraction (LD)

- Microscopy & Imaging (AFM, SEM, TEM integration)

- Other (e.g., Resonant Mass Measurement (RMM), Electrical Sensing Zone (ESZ))

- By Application:

- Pharmaceutical & Biotechnology (Drug Delivery, Vaccine Development, Exosome Research)

- Materials Science (Catalysts, Polymers, Ceramics, Nanocomposites)

- Chemical & Petrochemical

- Environmental Science & Toxicology

- Food & Beverage Industry

- Academic Research

- By End-User:

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Government & Regulatory Agencies

- Manufacturing Industries (Chemicals, Electronics, Materials)

- Contract Research Organizations (CROs)

Value Chain Analysis For Nanoparticle Measuring Instrument Market

The value chain for the Nanoparticle Measuring Instrument Market begins with Upstream Analysis, focusing on the sourcing and supply of highly specialized components necessary for instrument fabrication. This includes high-precision optical components such as high-power solid-state lasers, sensitive photodetectors (e.g., Avalanche Photodiodes - APDs), temperature control systems, and complex fluidic management modules for sample handling. The competitiveness in this stage hinges on reliable sourcing of high-purity components and managing potential supply chain vulnerabilities, especially for rare earth elements or custom-designed optics. Instrument manufacturers strive to maintain strong relationships with specialized sensor and software developers to integrate cutting-edge technology into their platforms, ensuring superior performance and differentiation in the highly competitive analytical instrument space.

The Midstream phase involves the core manufacturing, assembly, software development, and quality assurance processes carried out by the key instrument vendors. This stage is characterized by significant investment in R&D to optimize measurement algorithms, develop intuitive user interfaces, and ensure instrument calibration standards meet global metrology requirements. The Distribution Channel is bifurcated into Direct and Indirect sales. Direct sales are typically favored for high-value, complex systems requiring extensive pre-sales consultation, post-sales application support, and validation services, particularly when serving large pharmaceutical accounts or national research facilities. Indirect channels, utilizing specialized distributors or value-added resellers (VARs), are employed to penetrate geographically dispersed markets and smaller academic laboratories, often relying on local expertise for rapid deployment and initial technical support.

Downstream analysis focuses on the end-users—Academic, Biotech, and Industrial entities—and the critical role of post-sale services. This includes comprehensive training, ongoing technical support, preventative maintenance contracts, and the supply of consumables (e.g., specialized cuvettes, sample preparation kits, calibration standards). Customer satisfaction and long-term retention are heavily influenced by the quality and responsiveness of these downstream services. Successful market players focus on creating an ecosystem of support, including application notes, software updates, and collaborative scientific webinars, ensuring the maximum utility and lifespan of their complex instruments in demanding laboratory environments, thereby reinforcing brand loyalty and future upgrade cycles.

Nanoparticle Measuring Instrument Market Potential Customers

The primary potential customers for Nanoparticle Measuring Instruments are entities heavily involved in advanced material synthesis, drug formulation, and fundamental nanoscale research, with Pharmaceutical & Biotechnology Companies representing the largest and fastest-growing segment. These firms require instruments for rigorous quality control throughout their entire workflow, from characterizing raw materials and active pharmaceutical ingredients (APIs) to validating the final product's stability and efficacy. Specifically, companies developing mRNA vaccines, targeted drug delivery systems using lipid nanoparticles (LNPs), and complex protein formulations rely on these instruments to ensure particle homogeneity, preventing aggregation which can compromise therapeutic effectiveness and patient safety. The demand here is driven by regulatory compliance and the need for instruments offering high throughput and validation capabilities.

Academic and Government Research Institutes constitute the second major customer base, focusing heavily on basic science and exploratory research, including the synthesis of novel quantum dots, advanced polymer research, and fundamental studies of cellular mechanisms involving extracellular vesicles (EVs). These customers typically seek versatile, multi-functional instruments capable of handling diverse sample types and supporting cutting-edge experimental designs, often prioritizing flexibility and the highest possible resolution and sensitivity over high-throughput automation. Their purchasing decisions are often tied to grant cycles and government funding initiatives focused on accelerating scientific discovery in key national priority areas such as sustainable energy and personalized medicine.

A rapidly expanding customer segment includes manufacturing industries outside of traditional pharmaceuticals, such as specialized Chemical Manufacturers producing high-performance coatings, pigments, and fine chemicals, as well as Environmental Monitoring Agencies and Contract Research Organizations (CROs). CROs, in particular, serve as essential intermediaries, offering specialized characterization services to smaller biotech firms, requiring a broad range of highly calibrated and validated instruments. These industrial users prioritize reliability, minimal downtime, standardized operating procedures (SOPs), and instruments that seamlessly integrate into established manufacturing quality assurance protocols, driving demand for robust, industrial-grade measurement systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion USD |

| Market Forecast in 2033 | $7.5 Billion USD |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Malvern Panalytical (Spectris), Danaher Corporation (Beckman Coulter, Wyatt Technology), HORIBA, Ltd., Anton Paar GmbH, Microtrac MRB (Verder Scientific), TSI Incorporated, Particle Metrix GmbH, Izon Science Ltd., Shimadzu Corporation, Micromeritics Instrument Corporation, Bettersize Instruments Ltd., Cordouan Technologies, Agilent Technologies, JEOL Ltd., CILAS, Retsch GmbH, Nanosight (Integrated with Malvern Panalytical technology, often listed as part of the parent company's offering), Brookhaven Instruments Corporation, Hitachi High-Tech Corporation, VWR International (Avantor). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanoparticle Measuring Instrument Market Key Technology Landscape

The technology landscape of the Nanoparticle Measuring Instrument Market is dynamic, dominated primarily by photon correlation spectroscopy techniques, specifically Dynamic Light Scattering (DLS), which measures particle movement due to Brownian motion and correlates this movement to particle size based on the Stokes-Einstein equation. DLS instruments are ubiquitous due to their reliability, speed, and capability to provide average size distributions in aqueous or solvent-based suspensions, making them foundational tools for basic characterization. However, DLS is inherently an ensemble technique, meaning it struggles to resolve complex polydisperse samples or accurately determine the concentration of trace components, necessitating the adoption of more advanced technologies in niche, high-value applications. The continuous evolution of DLS focuses on improving algorithms to better handle non-spherical particles and increasing measurement sensitivity, ensuring its relevance against newer methods.

A major advancement shaping the landscape is Nanoparticle Tracking Analysis (NTA), exemplified by instruments that visualize and track individual particles in solution, calculating size based on observed diffusion coefficients and providing simultaneous concentration measurements. NTA’s unique strength lies in its ability to resolve multimodal distributions and analyze low concentration samples, making it indispensable for biological applications such as extracellular vesicle (exosome) and viral vector characterization, where concentration is a critical metric. Another emerging and critical technology is Tunable Resistive Pulse Sensing (TRPS), which offers high-resolution, number-based sizing and concentration of particles through a pore, providing high confidence measurements that are less sensitive to refractive index variations, positioning it as a preferred method for highly critical biological and calibration applications.

Furthermore, the market relies on supplementary or complementary technologies. These include Electrophoretic Light Scattering (ELS) for measuring zeta potential (surface charge), crucial for predicting colloidal stability and shelf-life, and Resonant Mass Measurement (RMM) for extremely accurate mass and size measurements, particularly useful for protein aggregates. There is an increasing trend toward integrating software that combines data from multiple platforms, such as coupling DLS data with Atomic Force Microscopy (AFM) or Transmission Electron Microscopy (TEM) results for comprehensive morphological and size validation. This technological convergence ensures that end-users possess the necessary tools to meet increasingly complex characterization challenges across diverse application fields, driving demand for highly specialized and integrated modular systems.

Regional Highlights

- North America: This region maintains the largest market share, driven by substantial R&D expenditure by pharmaceutical giants, robust government funding for nanotechnology initiatives (especially in cancer research and advanced materials), and a high concentration of leading academic institutions and biotechnology startups. The demand here is focused on high-end, multi-modal instruments with full regulatory compliance support (e.g., 21 CFR Part 11) and advanced automation capabilities to support high-throughput screening and clinical manufacturing quality control. Adoption of Nanoparticle Tracking Analysis (NTA) and Resonant Mass Measurement (RMM) is particularly strong in the US due to intense activity in novel drug delivery systems and gene therapy development.

- Europe: Europe represents a mature market characterized by stringent quality standards enforced by the European Medicines Agency (EMA) and strong academic collaboration programs (e.g., Horizon Europe). Key growth segments include environmental monitoring of nano-pollution and materials science research related to the automotive and aerospace industries. Germany, the UK, and France are dominant contributors, focusing on integrating measurement instruments into standardized laboratory workflows and demanding high levels of certification and traceable metrology for all analytical equipment, driving replacement cycles for legacy DLS systems with newer, high-precision alternatives.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to rapidly industrializing economies, significant state investment in science parks and R&D infrastructure (especially in China and India), and the exponential expansion of domestic pharmaceutical and specialty chemical manufacturing. The market here is volume-driven, with initial demand for basic and mid-range Dynamic Light Scattering (DLS) systems in university and general QC labs. However, as local biotech sectors mature, there is an accelerating demand for advanced single-particle techniques (NTA, TRPS) to meet global export quality requirements and support domestic vaccine production initiatives, fueled by favorable government policies promoting technological self-sufficiency.

- Latin America (LATAM): The market in LATAM is gradually expanding, primarily concentrated in Brazil and Mexico, driven by increasing government focus on regional pharmaceutical production and public health research. Growth is constrained by fluctuating economic conditions and relatively lower R&D budgets compared to other regions. The market primarily relies on imports of standardized DLS instruments for university research and basic industrial quality control, with growth opportunities tied to enhanced regional cooperation and foreign direct investment in local manufacturing capabilities, particularly in the agrochemical and food safety sectors requiring nanoparticle characterization.

- Middle East and Africa (MEA): This region is an emerging market characterized by targeted growth in certain high-income nations like Saudi Arabia and the UAE, which are strategically investing heavily in developing advanced healthcare and materials science research hubs as part of economic diversification plans. The adoption of instruments is highly localized, often associated with major university-hospital collaborations and government-backed industrial projects (e.g., solar energy materials). High-end system purchases are often centralized, relying on expert suppliers to provide comprehensive installation, training, and long-term service contracts due to limited local technical expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanoparticle Measuring Instrument Market.- Malvern Panalytical (Spectris)

- Danaher Corporation (Beckman Coulter, Wyatt Technology)

- HORIBA, Ltd.

- Anton Paar GmbH

- Microtrac MRB (Verder Scientific)

- TSI Incorporated

- Particle Metrix GmbH

- Izon Science Ltd.

- Shimadzu Corporation

- Micromeritics Instrument Corporation

- Bettersize Instruments Ltd.

- Cordouan Technologies

- Agilent Technologies

- JEOL Ltd.

- CILAS

- Retsch GmbH

- Brookhaven Instruments Corporation

- Hitachi High-Tech Corporation

- VWR International (Avantor)

- IZON Science Limited

Frequently Asked Questions

Analyze common user questions about the Nanoparticle Measuring Instrument market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate technology for measuring nanoparticle concentration in complex biological samples?

Nanoparticle Tracking Analysis (NTA) and Tunable Resistive Pulse Sensing (TRPS) are typically considered the most accurate techniques for determining concentration in complex biological fluids, such as those containing extracellular vesicles or viral vectors. Unlike DLS, which measures an ensemble average, NTA and TRPS perform single-particle counting, providing absolute number concentration and resolving complex multimodal populations essential for dosage determination and regulatory submissions in the biotech sector.

How does zeta potential analysis relate to nanoparticle stability and shelf life?

Zeta potential, measured using Electrophoretic Light Scattering (ELS), quantifies the electrostatic charge on the surface of nanoparticles in suspension. A high absolute value of zeta potential (either strongly positive or strongly negative) indicates strong repulsive forces between particles, which predicts greater colloidal stability and prevents particle aggregation, thus extending the product’s shelf life. This metric is critical for formulation scientists developing long-term stable suspensions in pharmaceutical and materials science applications.

What are the key differences between Dynamic Light Scattering (DLS) and Nanoparticle Tracking Analysis (NTA)?

DLS is an ensemble technique that measures the average particle size distribution based on intensity, providing fast results for monodisperse samples but struggling with multimodal distributions and concentration. NTA, conversely, is a single-particle technique that visualizes and tracks individual particles, allowing for high-resolution sizing, precise concentration measurement, and visualization of polydispersity, making it superior for analyzing complex biological and polydisperse systems where concentration and visualization are mandatory.

Which end-user segment drives the highest demand for automated, high-throughput nanoparticle instruments?

The Pharmaceutical and Biotechnology Companies segment drives the highest demand for automated, high-throughput instruments. This requirement stems from the necessity to analyze thousands of samples daily during stability testing, quality control (QC) checks, and large-scale manufacturing processes, particularly in the production of liposome-based drugs, mRNA vaccines, and large-volume industrial nanoproducts, where rapid, compliant, and repeatable measurements are non-negotiable for batch release.

What role does Artificial Intelligence (AI) play in improving nanoparticle measurement reliability and efficiency?

AI significantly enhances reliability and efficiency by automating instrument parameter optimization, eliminating human bias in measurement setup, and facilitating advanced data interpretation. Machine learning algorithms are used for anomaly detection to filter out artifacts, classify heterogeneous particle populations more accurately than traditional statistical methods, and predict material stability, thereby accelerating the R&D cycle and ensuring consistent data quality in regulated environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager