Neurological Disorder Diagnostics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441813 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Neurological Disorder Diagnostics Market Size

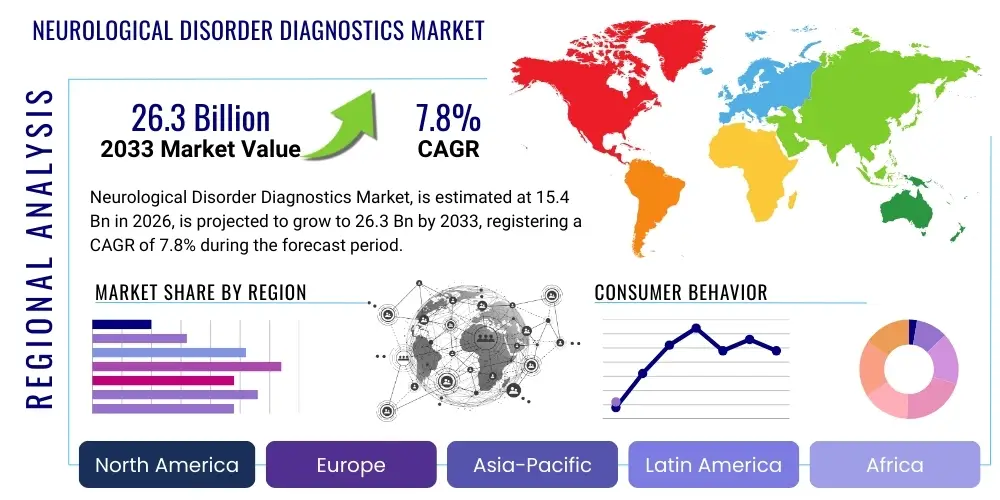

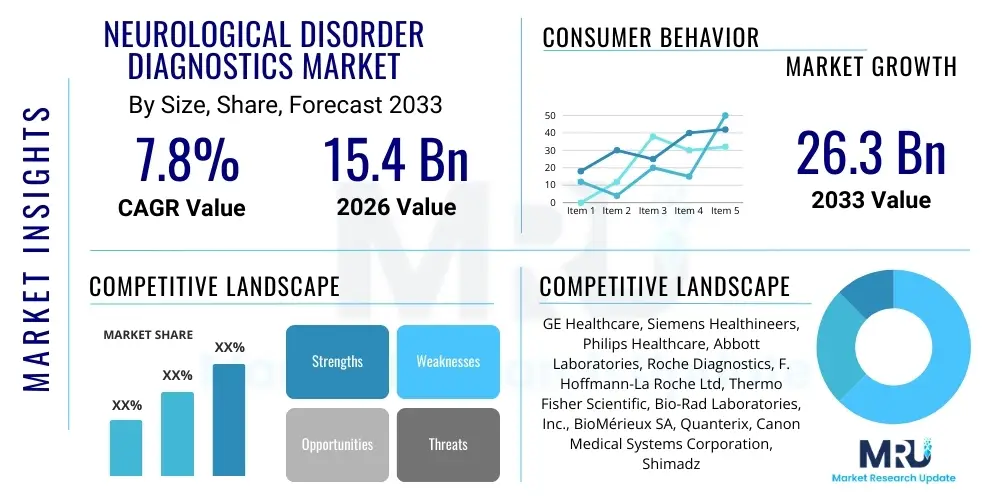

The Neurological Disorder Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.4 Billion in 2026 and is projected to reach USD 26.3 Billion by the end of the forecast period in 2033.

Neurological Disorder Diagnostics Market introduction

The Neurological Disorder Diagnostics Market encompasses a diverse array of technologies and procedures aimed at accurately identifying diseases affecting the central and peripheral nervous systems, including the brain, spinal cord, and nerves. This market is fundamentally driven by the escalating global incidence of neurological conditions such as Alzheimer’s disease, Parkinson’s disease, epilepsy, stroke, and multiple sclerosis. Diagnostic tools range from sophisticated neuroimaging modalities like Magnetic Resonance Imaging (MRI) and Positron Emission Tomography (PET) to advanced laboratory techniques focusing on biomarkers and genetic analysis, ensuring timely intervention and improved patient outcomes. The continuous evolution of diagnostic precision, particularly non-invasive methods, is central to market expansion.

Product categories within this domain are broad, covering diagnostic imaging systems, clinical laboratory tests, and cutting-edge screening devices. Major applications span oncology (brain tumors), neurodegenerative diseases, neuroinfections, and trauma assessment. The primary benefits derived from these diagnostics include early detection, precise disease staging, monitoring therapeutic efficacy, and enabling personalized medicine approaches. The ability to differentiate between various subtypes of neurological conditions through advanced molecular profiling is significantly enhancing the effectiveness of treatment protocols and clinical trials worldwide.

Driving factors propelling market growth include the rapidly aging global population, which is inherently susceptible to age-related neurodegenerative diseases, coupled with substantial investments in neuroscientific research and development. Furthermore, heightened public and professional awareness regarding the symptoms and consequences of untreated neurological disorders is contributing to increased screening and diagnostic demand. Technological innovations, specifically the integration of artificial intelligence for image analysis and the miniaturization of diagnostic devices, are creating lucrative pathways for future market penetration and expansion into previously underserved geographical areas.

Neurological Disorder Diagnostics Market Executive Summary

The Neurological Disorder Diagnostics Market is undergoing a rapid transformation, shifting towards minimally invasive and highly accurate diagnostic modalities driven by substantial advancements in genomics and artificial intelligence. Current business trends indicate a strong focus on strategic mergers, acquisitions, and collaborations between technology providers and clinical institutions to consolidate expertise and expand geographical footprints. Key market participants are heavily investing in developing multimodal platforms that combine imaging, biomarker analysis, and genetic screening to provide comprehensive diagnostic profiles, addressing the complexity and heterogeneity of neurological diseases. This technological push is crucial for maintaining competitive advantage and meeting the demand for earlier and more definitive diagnosis across various neurodegenerative and psychiatric disorders.

Regionally, North America maintains the dominant market share, attributed to advanced healthcare infrastructure, high healthcare expenditure, and the presence of leading technological innovators. However, the Asia Pacific region is poised for the fastest growth, primarily driven by improving healthcare access, increasing awareness programs, and substantial government initiatives aimed at modernizing clinical facilities in countries like China, India, and Japan. Europe also holds a significant market position, underpinned by robust academic research and early adoption of innovative technologies, particularly in areas like personalized medicine and advanced neuroimaging techniques. Regulatory harmonization, while challenging, is facilitating the quicker introduction of new diagnostic tools across major economic blocs.

Segment trends reveal that the neuroimaging segment, particularly high-field MRI, continues to hold the largest market share due to its established efficacy in structural and functional assessment of the brain. Conversely, the biomarker diagnostics segment, encompassing blood-based and CSF assays, is anticipated to register the highest Compound Annual Growth Rate (CAGR). This accelerating growth is fueled by the demand for non-invasive, cost-effective screening tools for common conditions like Alzheimer’s and concussion. Furthermore, the application segment focused on Alzheimer's disease and dementia is expanding rapidly due to the demographic imperative of aging societies and the intensive research underway to develop disease-modifying therapies, which require precise diagnostic confirmation.

AI Impact Analysis on Neurological Disorder Diagnostics Market

User queries regarding the impact of Artificial Intelligence (AI) in neurological diagnostics primarily center on its ability to enhance diagnostic accuracy, reduce the time required for image interpretation, and facilitate the early detection of subtle disease indicators that might be missed by the human eye. Common questions include the reliability of AI algorithms in diverse patient populations, the potential for AI-driven risk stratification, and the security and ethical considerations related to handling large volumes of sensitive neurological data. Users are highly interested in how Machine Learning (ML) is optimizing neuroimaging workflows, particularly in automating segmentation, detecting microbleeds, and predicting disease progression in conditions like multiple sclerosis and Parkinson's disease. The general expectation is that AI will transition diagnostics from reactive symptom management to proactive, predictive screening.

The incorporation of AI and deep learning models is fundamentally reshaping the landscape of neurological diagnostics by offering powerful tools for quantitative analysis. These models are particularly effective in analyzing complex data sets generated by MRI, EEG, and genomic sequencing, uncovering hidden patterns correlated with specific neurological pathologies. AI assists neurologists by standardizing the interpretation process, minimizing inter-observer variability, and flagging critical anomalies for urgent review. This increased efficiency translates directly into faster patient throughput and optimized clinical decision-making, which is particularly beneficial in high-volume settings or in the assessment of acute neurological emergencies such as stroke.

Furthermore, AI is instrumental in accelerating biomarker discovery and validation. By processing vast transcriptomic and proteomic data, AI algorithms can identify novel blood or CSF biomarkers that predict the onset or severity of neurodegenerative diseases years before clinical symptoms manifest. This predictive capability is vital for future personalized interventions. However, the market must address significant concerns related to regulatory approval for these sophisticated AI-driven devices, ensuring data privacy compliance, and developing robust validation studies across diverse ethnic and pathological groups to ensure algorithmic fairness and generalizability in clinical practice.

- AI enhances neuroimaging interpretation speed and accuracy (e.g., automated lesion detection).

- Machine Learning (ML) facilitates biomarker identification and validation for neurodegenerative diseases.

- AI algorithms enable precise prediction of disease progression and patient prognosis.

- Deep Learning optimizes EEG and MEG data analysis for epilepsy and sleep disorder diagnostics.

- Automation of diagnostic workflow reduces human error and clinician workload.

DRO & Impact Forces Of Neurological Disorder Diagnostics Market

The Neurological Disorder Diagnostics Market is governed by a robust interplay of driving forces centered on demographic shifts and technological maturation, balanced against significant cost and regulatory restraints, while substantial untapped opportunities remain in areas like decentralized testing and emerging market penetration. The primary impact forces—market rivalry, threat of new entrants, bargaining power of buyers and suppliers, and threat of substitutes—collectively define the competitive intensity and profitability potential. High technological complexity elevates the barrier for new entrants, yet the bargaining power of sophisticated healthcare systems (buyers) remains significant due to the high capital investment required for diagnostic equipment. Overall, the market momentum is strongly positive, driven by unmet clinical needs in neurodegenerative disease management.

Drivers: The most prominent driver is the escalating prevalence and incidence of chronic neurological diseases globally, including Alzheimer’s disease, Parkinson’s disease, and epilepsy, which necessitates continuous screening and early diagnosis for effective management. This trend is amplified by the increasing life expectancy worldwide, resulting in a larger geriatric population segment inherently vulnerable to these conditions. Moreover, substantial governmental and private funding dedicated to neuroscience research, particularly focused on identifying definitive biomarkers, is rapidly propelling innovation in diagnostic technologies. Advancements in non-invasive imaging and liquid biopsy techniques offer less burdensome and more accessible diagnostic solutions, further stimulating market demand. This confluence of demographic demand and scientific progress creates a perpetual need for advanced, high-resolution diagnostic tools.

Restraints: Significant restraints include the extremely high cost associated with advanced diagnostic systems such as ultra-high-field MRI and specialized PET scanners, which limits adoption, particularly in lower-income settings. Furthermore, reimbursement policies for novel and expensive diagnostic procedures often lag behind technological development, creating financial barriers for healthcare providers and patients. A critical constraint is the shortage of highly skilled professionals, including specialized neuroradiologists and neurophysiologists, necessary to operate complex equipment and accurately interpret sophisticated diagnostic results, particularly in rapidly evolving molecular and genetic testing domains. Stringent and prolonged regulatory approval processes for new diagnostic devices also impede rapid market entry and widespread commercialization.

Opportunities: Major opportunities reside in the development and commercialization of portable, point-of-care diagnostic devices suitable for remote and primary care settings, significantly broadening access to neurological screening. The accelerating integration of AI and Machine Learning into diagnostic workflows presents a vast opportunity for developing predictive diagnostic models and personalized risk assessment tools. Furthermore, focusing on the identification and validation of accessible blood-based biomarkers (liquid biopsy) for neurodegenerative conditions represents a substantial growth area, offering a less invasive alternative to traditional Cerebrospinal Fluid (CSF) analysis. Penetration into emerging economies with improving healthcare infrastructure, especially across Asia Pacific and Latin America, provides significant untapped market potential as these regions prioritize neurological healthcare investment.

Impact Forces (Porter's Five Forces Analysis):

- Threat of New Entrants: Medium to Low. Entry barriers are high due to the necessity for substantial R&D investment, long regulatory pathways, capital-intensive manufacturing, and the requirement for established distribution networks and clinical validation.

- Bargaining Power of Suppliers: Low to Medium. For major imaging components and specialized reagents, suppliers may hold some leverage, especially for proprietary technologies. However, the large volume of standardized components keeps general supplier power contained.

- Bargaining Power of Buyers: Medium to High. Major buyers (large hospital systems, government procurement agencies) exercise significant leverage due to their purchasing volume and demand for evidence-based cost-effectiveness.

- Threat of Substitutes: Medium. Traditional non-instrumented clinical evaluation and symptom-based diagnosis remain substitutes in some settings. However, the superiority of advanced diagnostics in precision limits substitution, particularly for definitive diagnosis.

- Intensity of Competitive Rivalry: High. The market is concentrated among a few global technology leaders (Siemens Healthineers, GE Healthcare, Philips), leading to intense competition based on technological innovation, pricing, service quality, and expansion of installed base.

Segmentation Analysis

The Neurological Disorder Diagnostics Market is comprehensively segmented based on technology, product type, application, and end-user, providing a granular view of market dynamics and growth potential across various dimensions. Technology segmentation highlights the dominance of neuroimaging, which includes modalities like MRI, CT, and advanced PET scanners, serving as the foundational pillars of structural and functional diagnosis. However, molecular diagnostics and biomarker analysis are rapidly gaining traction, driven by advances in precision medicine and the need for non-invasive testing methods. The product type classification differentiates between instruments (capital equipment) and reagents/consumables, with the latter showing faster recurring revenue growth due to their essential role in daily testing procedures.

Application segmentation reveals that neurodegenerative diseases, particularly Alzheimer's disease and Parkinson's disease, constitute the fastest-growing segment, reflecting the urgent need for early and accurate diagnostic tools in this area due to demographic pressures. Other significant applications include infectious diseases, epilepsy, and stroke. End-user categorization emphasizes the crucial role of hospitals and neurology clinics, which are the primary purchasers and utilizers of high-end diagnostic equipment. However, diagnostic laboratories and research institutions are also crucial segments, particularly in the adoption of high-throughput genetic and biomarker testing platforms necessary for large-scale studies and personalized diagnostics.

Understanding these segmentations is vital for stakeholders, allowing companies to tailor their product development and market penetration strategies to specific high-growth areas. The ongoing shift toward specialized, high-resolution technologies across all segments underscores the market's focus on diagnostic certainty. Furthermore, the emerging prominence of telehealth and remote monitoring solutions is blurring the lines between traditional end-users, creating new opportunities for diagnostic companies to offer decentralized or community-based screening services, enhancing overall market accessibility and patient convenience, particularly for chronic condition monitoring.

- By Technology:

- Neuroimaging Techniques (MRI, CT, PET, SPECT, Ultrasound)

- In Vitro Diagnostics (IVD)

- Biomarker Diagnostics (CSF, Blood)

- Genetic Diagnostics (NGS, PCR)

- Neuro-Electrophysiology (EEG, EMG, Evoked Potentials)

- By Product Type:

- Instruments (Scanners, Analyzers, Electrophysiology Devices)

- Reagents and Consumables (Assay Kits, Biomarker Panels)

- By Application:

- Alzheimer’s Disease and Dementia

- Parkinson’s Disease

- Epilepsy

- Stroke

- Multiple Sclerosis

- Traumatic Brain Injury (TBI)

- Sleep Disorders

- By End-User:

- Hospitals and Neurological Clinics

- Diagnostic Laboratories and Imaging Centers

- Academic and Research Institutes

Value Chain Analysis For Neurological Disorder Diagnostics Market

The value chain for neurological disorder diagnostics is complex, involving specialized technological development, rigorous clinical validation, streamlined manufacturing, and highly regulated distribution channels that connect specialized suppliers to end-users. The upstream segment is dominated by raw material suppliers and technology component manufacturers, including providers of high-field magnets, advanced sensors, proprietary chemical reagents, and sophisticated software developers focused on imaging processing and AI algorithms. These suppliers often possess proprietary intellectual property, affording them moderate bargaining power. Strategic collaborations at this stage, particularly between sensor developers and system integrators, are critical for continuous product innovation and differentiation in the highly competitive instruments market.

The core processes involve the design, assembly, and testing of diagnostic platforms, followed by stringent regulatory approval processes (e.g., FDA clearance, CE marking) which constitute a major bottleneck and cost element in the midstream. Manufacturing often requires specialized cleanroom facilities and highly skilled engineering expertise, especially for complex systems like MRI or NGS sequencers. This stage is dominated by large, established medical device manufacturers. Effective management of quality control and compliance is non-negotiable, directly impacting the clinical credibility and market success of the diagnostic products. The ability to rapidly scale production of consumables and reagents, crucial for consistent revenue generation, is also a key competitive advantage.

The downstream segment focuses on distribution and utilization. Products reach end-users—primarily hospitals, specialized clinics, and central laboratories—through a mixture of direct sales forces for high-capital equipment (facilitating installation, training, and maintenance) and indirect channels (third-party distributors) for reagents, consumables, and lower-cost devices, especially in geographically dispersed regions. Direct sales ensure better control over service quality and customer relationships, which is crucial for maximizing the utilization of complex imaging equipment. Direct distribution also allows for immediate feedback loops essential for post-market surveillance and continuous software upgrades, while indirect channels leverage local expertise and existing logistics networks to maximize market reach and efficiency.

Neurological Disorder Diagnostics Market Potential Customers

The primary customer base for neurological disorder diagnostics solutions consists of specialized healthcare facilities and professional institutions requiring high-fidelity tools for patient management, clinical trials, and foundational research. Hospitals, particularly large academic medical centers and specialized neurology departments, represent the largest end-user segment due to their high patient volume, need for a broad range of diagnostic modalities (from acute stroke management to chronic disease monitoring), and robust capital budgets for acquiring high-end imaging and electrophysiology systems. These institutions prioritize integration capabilities, throughput efficiency, and advanced clinical applications that facilitate differential diagnosis and treatment planning for complex disorders.

Diagnostic laboratories and independent imaging centers form the second major customer cohort. These facilities are heavy users of IVD products, including biomarker assay kits and genetic testing panels, leveraging economies of scale for high-throughput screening and specialized molecular analysis. Their purchasing decisions are primarily driven by test menu breadth, turnaround time, cost-effectiveness, and the need for standardized, high-volume automation. The growing trend of outsourcing molecular diagnostics by hospitals is significantly boosting the demand profile of these independent centers, requiring them to invest continuously in automated sample processing and bioinformatics capabilities.

Finally, the pharmaceutical and biotechnology industries, along with academic and government research institutes, are crucial potential customers. These entities use neurological diagnostic tools, especially advanced neuroimaging and specialized biomarker platforms, predominantly for drug discovery, clinical trials enrollment (patient stratification), and monitoring therapeutic efficacy. They require state-of-the-art, high-resolution, and often experimental diagnostic technologies that can provide quantitative data for regulatory submissions and fundamental research insights. Their procurement is highly specific, often targeting early-stage technologies or specialized software licenses for complex data analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 26.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Siemens Healthineers, Philips Healthcare, Abbott Laboratories, Roche Diagnostics, F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., BioMérieux SA, Quanterix, Canon Medical Systems Corporation, Shimadzu Corporation, Hitachi, Ltd., Natus Medical Incorporated, Nihon Kohden Corporation, Hologic, Inc., Luminex Corporation, Fujifilm Holdings Corporation, Varian Medical Systems (A Siemens Healthineers Company), Elekta AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neurological Disorder Diagnostics Market Key Technology Landscape

The technological landscape of neurological disorder diagnostics is highly dynamic, characterized by continuous innovation aimed at increasing resolution, reducing invasiveness, and improving the functional assessment capabilities of the nervous system. Neuroimaging remains a cornerstone, with developments in Magnetic Resonance Imaging (MRI) focusing on ultra-high field systems (7T and above) that offer unprecedented spatial resolution for visualizing subtle structural changes, such as microinfarcts or early amyloid plaques. Functional MRI (fMRI) and Diffusion Tensor Imaging (DTI) are increasingly utilized to map brain connectivity and assess functional impairments related to cognitive decline, moving diagnostics beyond purely structural assessment. Concurrently, PET scanning is advancing through novel radiotracers, allowing for precise visualization of specific pathologies like amyloid and tau deposits, which is crucial for accurate diagnosis and monitoring of Alzheimer's disease progression, establishing it as a critical tool in clinical trials and specialized diagnosis.

In parallel to imaging advancements, the field of In Vitro Diagnostics (IVD) is undergoing a revolution driven by genomics and biomarker discovery. Next-Generation Sequencing (NGS) platforms are becoming standard for identifying genetic predispositions and confirming diagnoses for hereditary neurological conditions, such as certain forms of epilepsy and motor neuron diseases. The biomarker segment, specifically liquid biopsy, is highly active, focusing on validating reliable, minimally invasive markers in Cerebrospinal Fluid (CSF) and, increasingly, in peripheral blood. Advances in highly sensitive immunoassay platforms, such as Single Molecule Array (Simoa) technology, are enabling the detection of ultra-low concentrations of neuronal injury markers like neurofilament light chain (NfL) and phospho-tau in blood, promising decentralized and recurrent monitoring capabilities crucial for both drug development and widespread screening initiatives, particularly for conditions like traumatic brain injury (TBI) and multiple sclerosis.

Furthermore, neuro-electrophysiology technologies, including advanced Electroencephalography (EEG) and Magnetoencephalography (MEG), are being integrated with AI for automated signal processing and pattern recognition, significantly improving the diagnosis of functional disorders like epilepsy and sleep disturbances. Portable and wearable EEG devices are democratizing access to functional brain monitoring, allowing for long-term data acquisition outside of traditional clinical settings. The synergistic combination of these technologies—high-resolution imaging fused with molecular insights and functional monitoring—is creating robust multimodal diagnostic protocols that enhance diagnostic confidence, enable earlier intervention, and support the shift toward precision neuro-oncology and personalized treatment for chronic neurodegenerative conditions. Continued investment in sensor technology, miniaturization, and advanced data analytics will remain key drivers of technological breakthroughs in this specialized market.

- Advanced Neuroimaging: High-field MRI (3T, 7T), fMRI, DTI, and molecular PET imaging using specific radiotracers (e.g., Amyloid and Tau PET).

- Molecular Diagnostics (IVD): Next-Generation Sequencing (NGS) for genetic profiling and multi-omics integration.

- Biomarker Detection: Ultra-sensitive immunoassay technologies (Simoa) for detecting blood-based biomarkers (e.g., NfL, p-Tau, Aβ).

- Neuro-Electrophysiology: Portable, high-density EEG and MEG systems integrated with specialized signal processing algorithms and cloud-based platforms.

- Digital and AI Integration: Machine learning algorithms for automated image segmentation, lesion quantification, and predictive modeling based on multimodal patient data.

Regional Highlights

- North America: This region dominates the global market, largely due to high healthcare expenditure, established presence of major market players, rapid adoption of advanced diagnostics (especially AI-driven neuroimaging and specialized genetic testing), and robust reimbursement policies. The high prevalence of neurological disorders and a strong focus on clinical research, particularly in the United States, drives continuous demand for cutting-edge diagnostic tools. Significant investment in early-stage biomarker discovery and the proactive approach toward managing chronic diseases further cements its leading position.

- Europe: Europe represents a mature market characterized by advanced healthcare systems (Germany, UK, France), substantial government funding for neurodegenerative disease research, and high awareness levels. The region is a key adopter of multimodal diagnostics and personalized medicine approaches. Regulatory initiatives from the European Medicines Agency (EMA) facilitate the introduction of validated diagnostic tools, although cost containment pressures in public healthcare systems often influence procurement decisions, favoring cost-effective or high-efficiency solutions.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate, fueled by improving healthcare infrastructure, massive untapped patient populations, increasing medical tourism, and rising disposable incomes in countries like China, India, and South Korea. Governments in this region are prioritizing the modernization of diagnostic facilities and expanding health coverage, creating immense opportunities for mid-to-high-end diagnostic equipment manufacturers. Demand is particularly strong for accessible screening tools for stroke and TBI.

- Latin America (LATAM): This region is characterized by fragmented healthcare systems but demonstrates steady growth, driven by urbanization and rising incidence of neurological conditions. Market adoption is focused on essential diagnostic technologies (CT, lower-field MRI, standard laboratory tests) due to budget constraints, but increasing foreign investment and local manufacturing partnerships are expected to boost the uptake of more advanced solutions in major economic hubs like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is highly variable. The GCC countries (Saudi Arabia, UAE) invest heavily in state-of-the-art hospitals, driving demand for premium diagnostic equipment and specialized services. Conversely, the African continent faces significant infrastructure and accessibility challenges, relying heavily on basic imaging and clinical assessments, presenting an opportunity for affordable, decentralized diagnostic solutions and tele-neurology platforms to bridge the geographical gap in care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neurological Disorder Diagnostics Market.- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc.

- BioMérieux SA

- Quanterix

- Canon Medical Systems Corporation

- Shimadzu Corporation

- Hitachi, Ltd.

- Natus Medical Incorporated

- Nihon Kohden Corporation

- Hologic, Inc.

- Luminex Corporation

- Fujifilm Holdings Corporation

- Varian Medical Systems (A Siemens Healthineers Company)

- Elekta AB

- PerkinElmer Inc.

Frequently Asked Questions

Analyze common user questions about the Neurological Disorder Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the neurological disorder diagnostics market?

The primary driver is the accelerating global prevalence of neurodegenerative diseases, such as Alzheimer's and Parkinson's, fueled significantly by the rapid increase in the geriatric population worldwide, demanding earlier and more accurate diagnostic confirmation.

How is biomarker testing revolutionizing neurological diagnostics?

Biomarker testing, particularly using highly sensitive liquid biopsy techniques, is enabling minimally invasive and cost-effective detection of disease-specific proteins (e.g., NfL, p-Tau) in blood or CSF, facilitating early screening and personalized monitoring of disease progression.

Which geographical region holds the largest market share for neurological disorder diagnostics?

North America currently holds the largest market share, attributable to high healthcare spending, superior adoption rates of advanced technologies like high-field MRI and AI, and the strong presence of key industry leaders and robust research infrastructure.

What role does Artificial Intelligence play in modern neurological diagnostics?

AI optimizes neurological diagnostics by automating image analysis, enhancing the speed and precision of lesion detection in scans, assisting in complex EEG interpretation, and processing multi-omics data for improved predictive modeling and biomarker validation.

What are the main restraints impacting the growth of this market?

The chief restraints are the high capital cost of advanced diagnostic instrumentation (e.g., PET/MRI systems), the complexity of regulatory approval processes, and a persistent global shortage of specialized neuroradiologists and neurophysiologists required for complex testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager