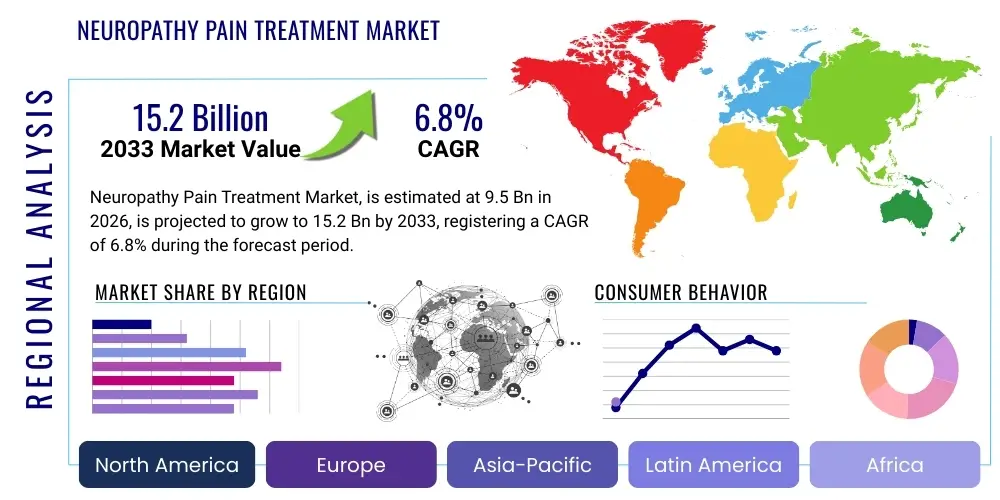

Neuropathy Pain Treatment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442205 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Neuropathy Pain Treatment Market Size

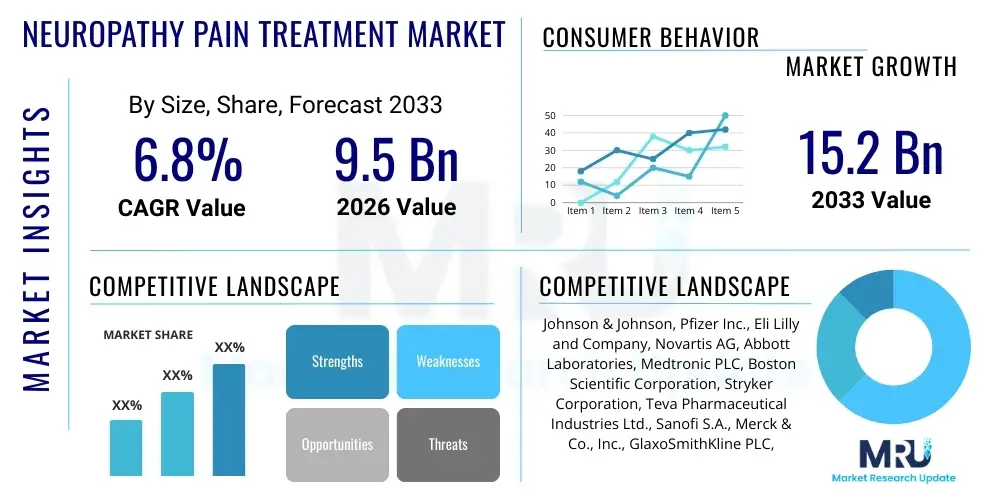

The Neuropathy Pain Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $9.5 Billion in 2026 and is projected to reach $15.2 Billion by the end of the forecast period in 2033.

Neuropathy Pain Treatment Market introduction

The Neuropathy Pain Treatment Market encompasses a diverse range of pharmacological and non-pharmacological interventions aimed at managing pain associated with nerve damage, or neuropathy. This chronic condition, often a complication of underlying diseases like diabetes, chemotherapy, infections, or trauma, leads to significant impairment in quality of life. Key product categories include anticonvulsants, antidepressants (specifically SNRIs and TCAs), opioid and non-opioid analgesics, and topical treatments. These products are designed to modulate nerve signaling pathways, reduce inflammation, or alleviate the mechanical symptoms of neuropathic pain, ranging from burning and tingling sensations to sharp, stabbing pain.

Major applications for these treatments span several clinical areas, with diabetic neuropathy representing the largest segment due to the global increase in diabetes prevalence. Other critical applications include postherpetic neuralgia (PHN), chemotherapy-induced peripheral neuropathy (CIPN), trigeminal neuralgia, and HIV-associated neuropathy. The primary benefit of these treatments is symptomatic relief, allowing patients to regain functional capacity, improve sleep quality, and reduce the psychological burden associated with chronic pain. Innovations are heavily focused on developing targeted therapies with improved efficacy and fewer systemic side effects, moving beyond broad-spectrum pain relievers.

Driving factors for market expansion are multifaceted. The rapidly aging global population is a major contributor, as the incidence of chronic diseases linked to neuropathy increases significantly with age. Furthermore, heightened diagnostic capabilities and increased patient awareness about specialized pain management options are expanding the diagnosed and treated patient pool. Significant R&D investments by pharmaceutical companies into novel drug delivery systems, such as localized patches and sustained-release formulations, coupled with the rising adoption of neuromodulation devices, are also propelling market growth, positioning specialized neuropathy treatments as a high-growth sector within chronic pain management.

Neuropathy Pain Treatment Market Executive Summary

The Neuropathy Pain Treatment Market is experiencing robust growth driven by high unmet medical needs and continuous innovation in treatment modalities. Business trends indicate a strategic shift towards combination therapies and non-pharmacological interventions, particularly in developed economies where concerns over opioid dependency are driving demand for alternatives like targeted neuromodulation devices and advanced topical agents. Pharmaceutical companies are focusing on securing fast-track designations for drugs targeting difficult-to-treat neuropathies, such as those resistant to conventional gabapentinoids. Furthermore, increased collaborative research between academic institutions and biotechnology firms is accelerating the development of disease-modifying agents that address the underlying mechanisms of nerve damage, rather than just masking symptoms.

Regional trends highlight North America’s dominance, primarily due to well-established healthcare infrastructure, high awareness levels, and significant expenditure on chronic disease management, including a high prevalence of diabetic neuropathy. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by expanding healthcare access, a vast patient population base (particularly in China and India), and increasing disposable income allowing for greater uptake of premium or innovative treatments. European markets are characterized by stringent regulatory pathways but offer a stable demand base, often prioritizing cost-effectiveness, leading to strong generic drug uptake alongside specialized device adoption.

Segment trends underscore the continued reliance on the pharmaceutical segment, with anticonvulsants and antidepressants maintaining their leading positions. However, the device segment, particularly spinal cord stimulation (SCS) and peripheral nerve stimulation (PNS) systems, is projected to witness accelerated growth due to technological advancements providing minimally invasive options and improved long-term efficacy profiles. In terms of application, diabetic neuropathy remains the dominant segment, though chemotherapy-induced peripheral neuropathy (CIPN) is gaining traction as cancer survival rates improve and managing treatment side effects becomes a primary focus for oncology care providers. This dynamic segmentation reflects a maturing market seeking integrated and personalized pain relief strategies.

AI Impact Analysis on Neuropathy Pain Treatment Market

User queries regarding the impact of Artificial Intelligence (AI) on neuropathy pain treatment primarily revolve around three key themes: enhanced diagnostics, personalized medicine approaches, and accelerated drug discovery. Users frequently ask if AI can more accurately identify patients at risk of severe neuropathy progression, whether machine learning algorithms can predict individual patient responses to specific drug classes (e.g., gabapentinoids vs. SNRIs), and how AI-driven analysis of genomic and clinical data is speeding up the identification of novel therapeutic targets. The primary concern often centers on the clinical validation and regulatory approval timeline for AI-guided treatments, alongside data privacy issues related to the aggregation of vast patient datasets required for training these models.

AI's influence is transformative, moving beyond simple data processing to fundamentally altering clinical workflows and R&D pipelines. In diagnostics, AI algorithms, trained on vast datasets of nerve conduction studies, quantitative sensory testing (QST) results, and patient reported outcomes (PROs), are demonstrating superior accuracy in early detection and differential diagnosis of various neuropathy types, reducing the time lag often associated with current diagnostic practices. Furthermore, AI facilitates the integration of multimodal patient data—including wearables data, genetic profiles, and imaging results—to create comprehensive digital phenotypes, enabling clinicians to select the most effective treatment protocol tailored to the patient’s specific biological and pain profile, minimizing trial-and-error prescribing.

The utilization of AI in drug discovery is significantly shortening the preclinical development phase for novel neuropathic agents. Machine learning models are being employed for target identification, predicting compound efficacy and toxicity, and optimizing chemical synthesis routes. This efficiency gain is crucial in a therapeutic area where traditional drug development has faced high failure rates. Consequently, AI is not only improving patient care by enhancing personalization and diagnostic precision but also acting as a powerful catalyst for innovation, promising a new generation of highly specific and effective treatments that address underlying mechanisms of neuropathy rather than just symptom management.

- AI accelerates the identification of novel drug targets by analyzing complex genomic and proteomic data sets associated with nerve pathology.

- Machine learning algorithms enhance diagnostic accuracy and speed by interpreting Nerve Conduction Studies (NCS) and quantitative sensory testing (QST) results.

- Predictive analytics enables personalized medicine by forecasting patient response to specific classes of pharmaceuticals (e.g., anticonvulsants, topical agents).

- Natural Language Processing (NLP) extracts structured insights from electronic health records (EHRs) to identify epidemiological trends and treatment gaps in real-time.

- AI optimizes clinical trial design and patient recruitment for new neuropathy treatments, improving efficiency and reducing development costs.

- Development of AI-powered digital therapeutics and virtual reality (VR) programs for adjunctive pain management and patient self-monitoring.

DRO & Impact Forces Of Neuropathy Pain Treatment Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces. A major driver is the escalating global prevalence of chronic metabolic disorders, especially Type 2 Diabetes Mellitus, which is the leading cause of peripheral neuropathy. The continuous rise in the global geriatric population, highly susceptible to age-related neuropathies, further solidifies the demand base. Additionally, sustained technological advancements in neuromodulation devices, which offer durable, drug-free pain relief alternatives, are appealing to both physicians and patients concerned about long-term pharmacotherapy side effects, pushing the market forward.

Conversely, significant restraints hinder optimal market performance. High treatment costs, particularly for advanced device therapies like Spinal Cord Stimulators (SCS), and limited reimbursement coverage in developing regions restrict patient access. Furthermore, the limited efficacy of currently approved pharmacological agents (many patients achieve only partial pain relief) and the substantial side effect profiles associated with long-term use (e.g., dizziness, sedation, potential for abuse in the case of opioids) pose major clinical challenges. The complexity in accurately diagnosing the underlying etiology of neuropathy also complicates treatment standardization, leading to fragmented clinical pathways.

Opportunities for growth are concentrated in untapped therapeutic areas and emerging geographies. The high unmet need for treatments targeting chemotherapy-induced peripheral neuropathy (CIPN) and painful small fiber neuropathy presents substantial commercial opportunities for novel drug developers. Moreover, the integration of digital health solutions, remote monitoring systems, and wearable technology offers pathways for improved patient adherence and real-time dosage adjustments. The increasing acceptance of combination therapies, integrating pharmaceuticals, interventional procedures, and physical therapy, represents a strong opportunity to provide comprehensive, multi-modal pain management solutions, ultimately improving therapeutic outcomes and market penetration.

Segmentation Analysis

The Neuropathy Pain Treatment Market is intricately segmented based on Type of Neuropathy, Drug Class, Treatment Type, and Distribution Channel, providing a detailed view of key therapeutic avenues and commercial flows. The dominant segmentation revolves around the etiology of the neuropathy, as this dictates the treatment protocol. Diabetic neuropathy commands the largest share, but there is increasing attention on niche segments like entrapment neuropathies and alcohol-induced neuropathies. Segmentation by drug class highlights the market’s reliance on established pharmacological standards, though the growth rate of advanced devices signals a shift towards interventional pain management. This granular segmentation allows stakeholders to target investment towards high-growth, high-need areas such as novel non-opioid therapeutics.

The segmentation by Treatment Type distinguishes between pharmacological, surgical/interventional (including neuromodulation), and non-pharmacological treatments. While drugs remain the cornerstone, the increasing adoption of minimally invasive procedures, such as radiofrequency ablation and pulsed electromagnetic field therapy, is diversifying the treatment landscape. Further segmentation by distribution channel reflects the primary points of access for patients, ranging from hospital pharmacies, which handle complex infusion therapies and initial prescriptions, to retail pharmacies for maintenance medication, and specialized pain clinics which often manage device implantations and interventional procedures. Understanding these segments is crucial for effective market entry and strategic positioning.

- By Type of Neuropathy:

- Diabetic Neuropathy

- Postherpetic Neuralgia (PHN)

- Chemotherapy-Induced Peripheral Neuropathy (CIPN)

- Trigeminal Neuralgia

- Alcoholic Neuropathy

- Other Neuropathies (e.g., Traumatic, Idiopathic)

- By Drug Class:

- Anticonvulsants (e.g., Gabapentin, Pregabalin)

- Antidepressants (e.g., SNRIs, TCAs)

- Opioids and Opioid-Like Agents

- Topical Agents (e.g., Capsaicin, Lidocaine Patches)

- NSAIDS and Analgesics

- By Treatment Type:

- Pharmacological Treatment

- Device Treatment (e.g., Spinal Cord Stimulators, Peripheral Nerve Stimulators)

- Surgical and Interventional Procedures

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Neuropathy Pain Treatment Market

The Value Chain for the Neuropathy Pain Treatment Market commences with upstream activities focusing on Research and Development (R&D) and raw material procurement. The R&D phase involves intense preclinical studies, clinical trials for novel drug compounds (including Small Molecule Drugs and Biologics), and the engineering design of complex neuromodulation devices. Key upstream participants include specialized Contract Research Organizations (CROs), academic institutions generating basic science knowledge, and chemical synthesis suppliers providing Active Pharmaceutical Ingredients (APIs). The complexity of developing treatments for nerve damage requires significant upfront investment and specialized expertise in neurobiology and pain physiology, often resulting in high barriers to entry.

Midstream activities involve the manufacturing, quality control, and formulation of approved treatments. Drug manufacturing is typically managed by large pharmaceutical companies (Big Pharma) or specialized generic manufacturers, ensuring compliance with Good Manufacturing Practices (GMP). For device manufacturers, this stage includes the precise assembly of implantable stimulators, leads, and battery components. Downstream activities focus on marketing, sales, and distribution. Distribution channels are varied: direct sales forces are crucial for promoting high-value devices requiring physician training (e.g., pain specialists, neurosurgeons), while pharmaceutical distribution relies on wholesalers and specialty distributors to reach hospital pharmacies, retail outlets, and pain clinics. Effective sales strategies often involve continuous Medical Science Liaison (MSL) support to educate prescribers on optimal usage and patient selection.

The involvement of Direct and Indirect channels heavily influences market penetration. Direct channels dominate the high-cost, high-service segment of implantable devices, where manufacturers maintain tight control over inventory and installation logistics. Indirect channels, primarily wholesalers and large pharmacy chains, manage the flow of established pharmaceutical products, leveraging economies of scale for efficient inventory management. Success within this value chain is increasingly dependent on securing favorable reimbursement policies, especially for innovative therapies, as well as establishing robust supply chain resilience to ensure consistent availability of specialized treatments across global markets.

Neuropathy Pain Treatment Market Potential Customers

The primary end-users and buyers of neuropathy pain treatments are patients suffering from various forms of chronic neuropathic pain, seeking relief from debilitating symptoms that severely restrict daily activities and quality of life. These individuals are typically diagnosed and managed by a broad spectrum of healthcare providers, including endocrinologists (for diabetic patients), oncologists (for CIPN patients), neurologists, and specialized pain management physicians. The buying decision is heavily influenced by the prescribing physician, who selects treatments based on efficacy data, patient comorbidity profiles, and potential side effect risk versus benefit.

Institutional buyers represent a crucial customer segment, particularly hospitals, specialized pain clinics, and ambulatory surgical centers (ASCs). Hospitals and ASCs are major purchasers of high-value interventional devices, such as Spinal Cord Stimulators (SCS) and radiofrequency ablation equipment, necessitated by their role in performing invasive procedures. These institutions prioritize treatments offering long-term outcomes, cost-effectiveness (in terms of reducing readmission rates), and ease of integration into existing surgical workflows. Group Purchasing Organizations (GPOs) and large integrated delivery networks (IDNs) act as influential centralized buyers, negotiating favorable contracts for pharmaceuticals and devices across multiple facilities.

Payers, including government health systems (e.g., Medicare, NHS) and private insurance companies, are arguably the most influential indirect customers. Their policies determine accessibility and affordability for patients. Payers are increasingly scrutinizing the cost-effectiveness of newer, high-priced therapies, driving demand for treatments backed by strong clinical evidence demonstrating superior long-term outcomes and reduced healthcare resource utilization. Therefore, manufacturers must strategically align their product development and pricing structures to meet the evidence-based requirements set forth by these powerful payer organizations, ensuring broad market access for their neuropathy pain treatments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $9.5 Billion |

| Market Forecast in 2033 | $15.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., Eli Lilly and Company, Novartis AG, Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Stryker Corporation, Teva Pharmaceutical Industries Ltd., Sanofi S.A., Merck & Co., Inc., GlaxoSmithKline PLC, Grünenthal GmbH, Daiichi Sankyo Company, Limited, H. Lundbeck A/S, Astellas Pharma Inc., Bausch Health Companies Inc., Sun Pharmaceutical Industries Ltd., Allergan (AbbVie), Nevro Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neuropathy Pain Treatment Market Key Technology Landscape

The technology landscape for neuropathy pain treatment is rapidly evolving, moving towards advanced neuromodulation and highly localized drug delivery systems. Key technological innovations center around optimizing Spinal Cord Stimulation (SCS) and Peripheral Nerve Stimulation (PNS) devices. Modern SCS systems now feature high-frequency and burst stimulation modalities (such as Nevro's HF10 or Boston Scientific's WaveWriter) that aim to provide superior pain relief without the paresthesia sensation associated with traditional low-frequency stimulation. These devices often integrate rechargeable batteries with extended lifespans and sophisticated programming algorithms, allowing for personalized therapy adjustment based on real-time feedback and patient activity levels, significantly improving long-term therapeutic outcomes and patient satisfaction compared to older generations of devices.

Beyond devices, advancements in pharmaceutical technologies are focusing on enhanced specificity and reduced systemic exposure. Transdermal patch technology, exemplified by high-concentration lidocaine patches and capsaicin patches, delivers therapeutic agents directly to the site of peripheral nerve damage, minimizing the common gastrointestinal or central nervous system side effects associated with oral systemic medications like gabapentinoids and tricyclic antidepressants. Furthermore, the development of targeted antibody therapies and gene therapies, though still nascent, represents the frontier of technological exploration, aiming to interfere with specific inflammatory pathways or repair damaged nerve structures rather than just managing downstream pain signals. These biological approaches leverage sophisticated understanding of nerve pathology.

A burgeoning technological segment involves digital health and remote monitoring. Telehealth platforms integrated with wearable devices allow clinicians to track patient pain levels, activity, and adherence remotely. This data fuels iterative treatment refinement and provides valuable real-world evidence. The combination of optimized hardware (advanced SCS systems) with smart, connected software platforms ensures continuous therapeutic engagement and data collection. These technologies are foundational to the paradigm shift towards predictive and preventive neuropathy care, making the treatment process more efficient, data-driven, and patient-centric, particularly beneficial in managing complex, chronic conditions requiring continuous adjustment of treatment parameters.

Regional Highlights

- North America: Dominates the global market share owing to high prevalence rates of diabetes, robust insurance coverage, and aggressive adoption of high-value interventional treatments like SCS and PNS. The region benefits from significant R&D spending, leading to faster access to novel drugs and devices. The stringent focus on reducing opioid prescribing drives demand for non-narcotic pharmacological options and device-based therapies.

- Europe: Represents a mature market characterized by universal healthcare systems and a strong focus on clinical guideline adherence. Western European countries (Germany, UK, France) are key contributors, favoring cost-effective established drugs (generics) but also demonstrating increasing acceptance of innovative implantable devices, often supported by country-specific health technology assessments (HTAs).

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the massive, growing diabetic population, particularly in India and China, and improving healthcare infrastructure. Market growth is heavily influenced by increasing patient awareness, rising disposable incomes, and the expansion of key player operations into these rapidly developing economies.

- Latin America (LATAM): Growth is steady but constrained by economic instability and variable reimbursement policies. The market primarily relies on established, affordable pharmacological treatments. However, urbanization and private sector investment are gradually opening doors for specialized pain clinics and advanced device penetration in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Currently the smallest market segment, characterized by high growth potential in GCC countries (due to high chronic disease prevalence and specialized medical infrastructure investment) and limited access in many parts of Africa. Focus remains on basic pain management pharmacotherapy, with limited uptake of advanced neuromodulation devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neuropathy Pain Treatment Market.- Johnson & Johnson

- Pfizer Inc.

- Eli Lilly and Company

- Novartis AG

- Abbott Laboratories

- Medtronic PLC

- Boston Scientific Corporation

- Stryker Corporation

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- Merck & Co., Inc.

- GlaxoSmithKline PLC

- Grünenthal GmbH

- Daiichi Sankyo Company, Limited

- H. Lundbeck A/S

- Astellas Pharma Inc.

- Bausch Health Companies Inc.

- Sun Pharmaceutical Industries Ltd.

- Allergan (AbbVie)

- Nevro Corp.

Frequently Asked Questions

Analyze common user questions about the Neuropathy Pain Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Neuropathy Pain Treatment Market?

The central driver is the escalating global prevalence of chronic diseases, particularly Type 2 Diabetes Mellitus, which accounts for the vast majority of neuropathic pain cases worldwide. The concurrent increase in the elderly population, highly susceptible to age-related nerve damage, further fuels demand for specialized treatment solutions.

Which treatment segment holds the largest share in the market, and why?

The pharmacological treatment segment, specifically Anticonvulsants (like Gabapentin and Pregabalin) and Antidepressants (SNRIs), holds the largest market share. This dominance is due to their established clinical efficacy, broad prescribing guidelines, and high accessibility as a first-line treatment option globally, despite limitations in full efficacy for many patients.

How is technology influencing future neuropathy pain management?

Technology is rapidly shifting the landscape through advanced neuromodulation devices, such as high-frequency Spinal Cord Stimulators (SCS), which offer non-pharmacological, long-term pain relief. Additionally, AI and machine learning are being utilized to enhance personalized dosing strategies and accelerate the discovery of targeted, disease-modifying agents.

What are the main challenges restraining market expansion for neuropathy treatments?

Major restraints include the substantial cost associated with innovative interventional devices, limited patient access due to variable reimbursement policies, and the therapeutic challenge of existing drugs which often provide only partial relief and carry significant side effects (e.g., sedation, dizziness, or risk of dependency).

Which geographical region is projected to experience the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to the rapidly increasing diagnosis rates of diabetes, significant government investment in healthcare infrastructure, and the growing urbanization and economic development that improves patient access to specialized medical care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager