Neutron Source Generator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442203 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Neutron Source Generator Market Size

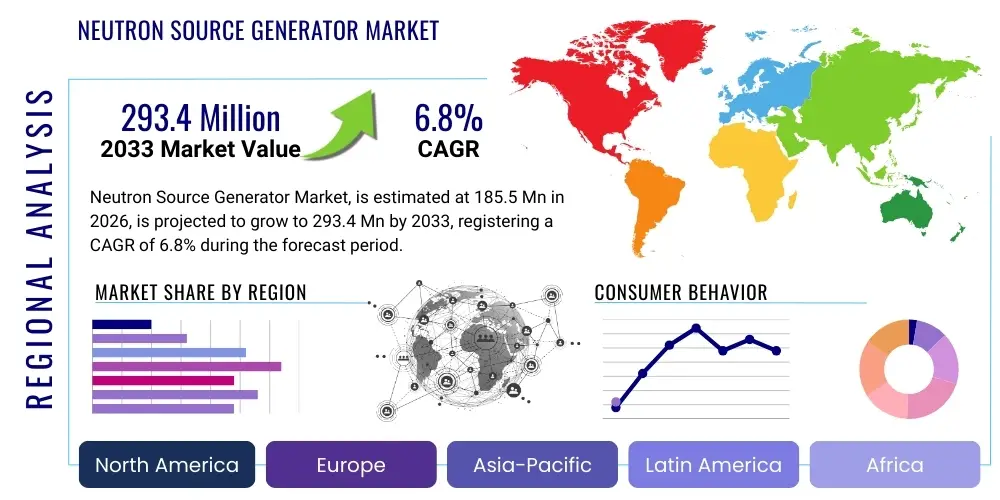

The Neutron Source Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $293.4 Million by the end of the forecast period in 2033.

Neutron Source Generator Market introduction

The Neutron Source Generator Market encompasses specialized equipment designed to produce controlled streams of neutrons for various scientific, industrial, and defense applications without relying on nuclear fission reactors. These generators typically utilize particle accelerators, specifically relying on Deuterium-Tritium (D-T) or Deuterium-Deuterium (D-D) fusion reactions within sealed tubes or more complex accelerator platforms, to generate high-flux neutrons, offering significant advantages in terms of portability, safety, and operational flexibility compared to traditional reactor sources or radioisotope sources. The primary function is to provide a reliable, on-demand supply of neutrons for crucial processes such as non-destructive testing (NDT), advanced materials research, medical isotope production, geological exploration, and sophisticated security screening, serving as indispensable tools in fields requiring atomic-level analysis or penetration capabilities far exceeding conventional imaging modalities like X-rays. Key product categories include ruggedized sealed-tube neutron generators (STNGs) optimized for field use, and sophisticated accelerator-based neutron sources (A-BNS) tailored to specific energy requirements and flux levels demanded by specialized end-users, ensuring applicability across a wide spectrum of technical demands.

Major applications driving the robust adoption of neutron source generators include the critical field of oil and gas well logging, where these tools are essential for characterizing subterranean formations, determining reservoir porosity, and monitoring fluid saturation changes crucial for enhanced oil recovery operations. Additionally, the generators play a vital role in homeland security and defense, facilitating the rapid detection of explosives, illicit narcotics, and fissile materials through advanced neutron activation analysis techniques at ports, borders, and critical infrastructure points. Furthermore, advanced research facilities worldwide utilize these systems for spectroscopy and diffraction studies to probe the fundamental atomic and molecular structure of new materials, driving innovation in condensed matter physics and nuclear engineering. The inherent benefits of these modern, accelerator-based systems—such as their compact size, enhanced safety features allowing them to be instantly switched off, minimal maintenance requirements in the sealed-tube format, and the capability to operate safely in non-reactor environments—position them as essential technological enablers across diverse, high-tech, and safety-critical industries, leading to substantial market growth.

Driving factors stimulating market expansion include rising global investments in nuclear security and counter-terrorism measures necessitating advanced detection technologies capable of high specificity and rapid throughput. Concurrently, there is increasing commercial demand for high-performance, non-destructive inspection and quality control techniques in sectors like aerospace, automotive, and infrastructure monitoring, often favoring neutron-based methods for their unique penetrating power and elemental specificity. Technological maturity, specifically the continuous development of compact, higher-yield neutron tubes and the reduction in the size, weight, and power (SWaP) footprint of accelerator platforms, further underpins market growth by expanding deployment possibilities. Critically, regulatory shifts favoring safer, non-radioactive alternatives for industrial gauging and analysis strongly contribute to the widespread transition away from traditional radioisotope sources, such as Californium-252, solidifying the role of electronically controlled neutron generators as the future standard for reliable, controlled neutron flux generation across all major application domains.

Neutron Source Generator Market Executive Summary

The Neutron Source Generator Market is characterized by a strong and sustained growth trajectory, primarily fueled by ongoing technological breakthroughs that enhance portability, increase neutron yield, and improve system durability, which are crucial for demanding applications like downhole oil logging and mobile security screening. Current business trends indicate a significant market shift towards the development and commercialization of compact accelerator-based neutron sources (A-BNS) specifically optimized for clinical settings, driven by the expanding opportunities in Boron Neutron Capture Therapy (BNCT). Key competitive strategies involve strategic mergers, acquisitions, and collaborative research agreements between generator manufacturers and specialized end-user industries—such as oilfield services giants and emerging BNCT solution providers—to ensure product specifications are tightly aligned with precise operational needs, focusing R&D efforts on maximizing operational uptime, reducing the high initial capital investment costs, and facilitating easier regulatory approval across diverse international markets globally.

From a regional perspective, North America and Europe currently maintain substantial market share, largely due to their mature research infrastructure, significant historical and ongoing governmental spending in defense and nuclear research, and the established presence of core technology innovators specializing in advanced accelerator physics and high-voltage systems. However, the future growth engine for the market is unequivocally the Asia Pacific (APAC) region, which is forecast to register the highest Compound Annual Growth Rate (CAGR) over the projection period. This rapid expansion is underpinned by massive governmental and private investments in crucial infrastructure projects, surging demand for reliable non-destructive testing capabilities across newly industrializing economies (China, India, South Korea), and the increasing scope of oil and gas exploration in previously untapped areas. This regional disparity demands that international market players adopt flexible supply chain strategies and develop systems that balance high technical performance with regional cost sensitivities to capitalize effectively on the burgeoning APAC demand.

Segmentation analysis clearly highlights the accelerator-based technology segment, particularly the Deuterium-Tritium (D-T) reaction type, as the leading and fastest-growing category, attributable to its unparalleled ability to produce high neutron yields essential for deep penetration in industrial and security applications. In terms of end-users, the Oil and Gas sector remains the bedrock of demand, valuing the technology's effectiveness in characterizing complex subterranean formations under extreme conditions. Nevertheless, the medical and healthcare segment is poised for transformative growth, driven by the increasing clinical acceptance and deployment of BNCT facilities globally. This projected high growth rate in healthcare reflects a significant paradigm shift toward developing specialized, patient-friendly, and highly precise neutron delivery systems designed for cancer treatment, signifying a crucial evolution in the commercial application profile of neutron source generator technology and diversifying the market’s reliance away from purely industrial uses.

AI Impact Analysis on Neutron Source Generator Market

Common user inquiries regarding the intersection of Artificial Intelligence (AI) and the Neutron Source Generator Market frequently center on utilizing machine learning to enhance system reliability and optimize the performance of complex beam dynamics, specifically addressing the high operational costs and maintenance complexities inherent in accelerator technology. Users are keenly interested in how AI can facilitate predictive maintenance of critical, high-wear components like ion sources and targets, ensuring maximum operational uptime, especially for mission-critical applications like downhole logging or long-duration security screening. A major theme is the application of deep learning algorithms for real-time interpretation and classification of neutron spectroscopic data, asking how AI can automate the process of transforming raw neutron counts into accurate, actionable insights about material composition or geological structure, thereby reducing the dependency on highly specialized human experts. Overall, the expectation is that AI will automate operational optimization, significantly enhance the diagnostic speed and certainty, and fundamentally transition the generators into integrated, intelligent, data-driven analytical platforms, drastically improving the cost-effectiveness and utility of the technology in commercial and scientific contexts.

The immediate and most palpable impact of AI resides in the optimization of the complex operational parameters required to generate a stable, high-flux neutron beam efficiently. Machine learning models, trained on extensive historical operational data, are increasingly deployed to monitor real-time sensor readings related to vacuum integrity, plasma characteristics, high-voltage supply stability, and target cooling cycles. These models can autonomously predict potential component failures hours or days in advance, allowing for scheduled, preventive maintenance rather than reactive repairs, consequently boosting the mean time between failures (MTBF) and significantly lowering operational expenditure. This autonomous optimization capability is particularly vital for compact sealed-tube systems deployed in remote or harsh environments, such as deep boreholes or unstaffed border inspection points, where continuous manual calibration and human intervention are either impractical or prohibitively expensive, ensuring sustained performance delivery.

Furthermore, AI is revolutionary in enhancing the value derived from neutron-based measurements across critical applications. In security screening, neural networks are being trained on vast datasets of elemental signatures to rapidly and accurately identify trace amounts of explosives, narcotics, or fissile materials within complex, heterogeneous cargo, substantially shortening inspection times and increasing detection specificity, thereby improving border security efficiency. Similarly, in the Oil and Gas sector, advanced algorithms integrate multiple logging parameters (such as neutron porosity, gamma ray, and density measurements) to construct sophisticated, high-resolution subsurface reservoir models. These AI-enhanced interpretations surpass traditional deterministic methods by handling non-linear relationships and uncertainties in the data with greater precision, leading to more accurate estimates of hydrocarbon reserves and superior decision-making in drilling and extraction strategies. This pivotal integration of AI transforms the neutron source generator from a basic measurement device into an indispensable, intelligent diagnostic platform, greatly increasing its market utility and driving demand in high-value, data-intensive industries globally.

- AI-driven Predictive Maintenance: Minimizing operational downtime and extending the lifespan of complex accelerator components (ion source, targets) through real-time telemetry analysis and failure forecasting.

- Automated Data Interpretation: Utilizing machine learning and deep learning for rapid and accurate analysis of complex neutron spectral data in NDT, well logging, and security, enhancing accuracy and reducing reliance on manual expert interpretation.

- Optimized Flux Control: Employing AI control systems to autonomously adjust accelerator parameters (beam current, target temperature, voltage) to maintain stable and high-yield neutron flux for consistent application performance.

- Enhanced Security Screening: Accelerating the detection and specific identification of contraband, explosives, and fissile materials using pattern recognition in Prompt Gamma Neutron Activation Analysis (PGNAA).

- Improved Reservoir Modeling: Integrating AI and machine learning into oil and gas logging processes for superior lithology and fluid identification, leading to more reliable exploration decisions and optimized resource extraction strategies.

DRO & Impact Forces Of Neutron Source Generator Market

The Neutron Source Generator Market is fundamentally propelled by powerful drivers, predominantly the increasing global need for advanced, non-invasive inspection and accurate diagnostic techniques across key industrial and geological sectors, coupled with the critical rising global focus on stringent nuclear security, counter-proliferation measures, and anti-smuggling efforts at international borders. Significant market restraints include the high initial capital expenditure required for sophisticated accelerator-based systems, the complexity and expense associated with adhering to varied international regulatory hurdles surrounding the use and transportation of neutron-generating components (especially those containing Tritium), and the necessity for employing a limited pool of highly specialized technical expertise for sustained operation and intricate maintenance routines. Major opportunities are concentrated in the rapid, global expansion of specialized medical applications, specifically Boron Neutron Capture Therapy (BNCT) for cancer treatment, the development of ultra-compact sources for niche areas like aerospace and planetary exploration, and the inevitable systemic replacement of older, radiochemical sources with modern, intrinsically safer, and electronically controlled accelerator alternatives across various industrial quality control applications. The overall impact forces are strongly positive, indicating that accelerating technological advancements are effectively mitigating key financial and operational restraints while concurrently opening up new, high-value application niches, ensuring robust, sustained market momentum and increased penetration across diverse end-user sectors.

Drivers: Significant market drivers include the persistent, high global energy demand necessitating highly detailed oil and gas exploration and production monitoring, where neutron generators provide indispensable, real-time logging data for precise reservoir evaluation in challenging deep-water and unconventional drilling environments. Furthermore, the establishment of increasingly stringent safety, quality control, and testing standards across globally competitive industries such as aerospace, nuclear power infrastructure, construction, and advanced automotive manufacturing mandates rigorous Non-Destructive Testing (NDT) of materials, frequently favoring neutron-based techniques for their ability to offer superior penetration depth and highly accurate isotopic specificity compared to less effective traditional methods like X-ray or gamma radiography. Finally, strategic governmental and defense initiatives, often focused on nuclear proliferation detection, comprehensive border security enhancements, and counter-terrorism measures globally, create a continuous, high-priority, non-cyclical demand stream for sophisticated, deployable neutron activation systems capable of detecting trace amounts of illicit materials with unparalleled speed and precision, ensuring critical infrastructure protection and national security.

Restraints: Despite the compelling drivers, the market expansion is significantly constrained by the financial intensity and technical specialization inherent in the technology. The development, manufacturing, and deployment of high-flux accelerator sources demand substantial, continuous R&D investment and highly specialized components, leading to premium pricing that often deters adoption by smaller industrial laboratories, mid-sized research institutions, or developing economies with limited capital budgets. Operational challenges are substantial, specifically the legal and logistical need for meticulous radiation shielding, adherence to stringent international radiation safety protocols (driven by bodies like the IAEA), and complex licensing requirements, all of which introduce significant administrative and operational complexity, thereby raising the operational expenditures (OPEX). Additionally, the technologically limited lifespan of critical consumable components, notably the Deuterium-Tritium targets within sealed tubes, requires frequent and costly replacement cycles, contributing directly to higher maintenance costs and potential operational interruptions, collectively posing a tangible barrier to market entry and widespread adoption for cost-sensitive potential users.

Opportunities: Major market opportunities are primarily concentrated in the medical technology field, where the accelerating clinical acceptance and therapeutic promise of Boron Neutron Capture Therapy (BNCT) is driving intensive, focused development of accelerator-based neutron sources specifically optimized for safe, high-precision deployment within hospital clinical settings, offering a potentially transformative and highly localized cancer therapy option. Another crucial opportunity involves the accelerating global trend towards decommissioning and replacing aging research reactors and existing Californium-252 radioisotope sources, which are increasingly being mandated for substitution by modern, intrinsically safer, electronically controlled, and high-performance sealed-tube generators. These modern alternatives offer superior flux control, eliminate the complexity of long-term radioactive waste upon shutdown, and ensure simplified long-term safety compliance, creating a massive replacement market. Furthermore, the ongoing technological trend toward extreme miniaturization and enhanced yield capacity opens lucrative new markets in portable applications, including drone-mounted environmental monitoring systems, handheld geological analysis devices for mining, and rapidly deployable security platforms, fundamentally expanding the technology's application scope from fixed laboratories to dynamic, distributed field environments globally.

Segmentation Analysis

The Neutron Source Generator Market is rigorously analyzed across crucial dimensions including technology type, specific application area, and end-user industry, enabling a finely detailed and comprehensive understanding of complex market dynamics, adoption readiness, and evolving technological preference patterns. The segmentation by technology distinguishes fundamentally between the mechanism used for neutron generation: Accelerator-Based Neutron Sources (A-BNS), which rely on Deuterium-Tritium (D-T) or Deuterium-Deuterium (D-D) reactions utilizing particle accelerators (cyclotrons or linacs), and the more mature Sealed Tube Neutron Generators (STNGs), which are compact, self-contained fusion tubes. A third, though diminishing, segment covers traditional Radioisotope-Based Sources (e.g., Cf-252, Am-Be). This technological segregation reflects the industry's decisive and continuing migration toward electronically switched, intrinsically safer, and higher-yield accelerator-based options due to superior flux control, safety benefits, and performance advantages in demanding environments. Application segmentation further dissects the market based on functional use, separating large, foundational markets like Oil and Gas Well Logging from rapidly evolving, specialized niches such as Medical Applications (BNCT) and critical Homeland Security tasks (explosive and fissile material detection), highlighting the diverse, critical utility of these advanced devices across the economy.

Detailed analysis by end-user industry is absolutely critical for strategic positioning, revealing that highly regulated, technically specialized, and capital-intensive sectors—namely Oil & Gas Exploration, Defense & National Security, and Academic Research & National Laboratories—constitute the primary, high-volume consumer base. The widely varying technical requirements inherent across these disparate industries necessitate highly customized hardware and software solutions; for example, oil well logging tools demand exceptional mechanical robustness and resilience to high-pressure/high-temperature (HPHT) environments, utilizing robust sealed tubes, whereas advanced medical applications for BNCT require finely tuned, clinically safe, and highly reliable systems optimized for precise neutron beam delivery in sensitive biological settings. This multifaceted and granular segmentation approach allows all market stakeholders to accurately identify the most attractive, high-growth niches, precisely understand the specific regulatory compliance landscape impacting adoption within each segment (e.g., nuclear safety, medical device certification), and rigorously tailor their research and development investments and commercialization efforts to efficiently and effectively meet the specialized, mission-critical requirements across the entire global value chain.

The strategic importance of this detailed segmentation structure lies in its ability to transparently reveal current market penetration levels and accurately pinpoint areas that are technologically ripe for significant disruption and accelerated growth. While traditional, mature industrial uses in non-destructive testing and resource exploration remain foundational components providing stable, recurring revenue, the emerging and specialized segments, most notably the medical/healthcare sector (driven by BNCT) and small-scale, highly portable security devices, are overwhelmingly projected to exhibit the most accelerated growth trajectory throughout the forecast period. Achieving this anticipated growth, however, is significantly contingent upon generator manufacturers successfully addressing the complex technical challenges associated with continuously reducing system size, weight, and power consumption (SWaP) while simultaneously maintaining or increasing high neutron yield and flux stability. Success in these technological advancements will ensure the technology's viability in increasingly mobile, resource-constrained, and sensitive operational settings, further cementing the fundamental shift towards compact, advanced, and intelligent neutron delivery systems globally.

- By Type:

- Sealed Tube Neutron Generators (STNGs)

- Accelerator-Based Neutron Sources (D-T, D-D, Spallation Sources)

- Radioisotope-Based Sources (Cf-252, Am-Be)

- By Application:

- Non-Destructive Testing (NDT) and Material Analysis

- Oil and Gas Well Logging (Pulsed Neutron Logging, Reservoir Monitoring)

- Homeland Security and Defense (Explosive, Narcotics, and Fissile Material Detection)

- Medical Applications (Boron Neutron Capture Therapy - BNCT, Radioisotope Production)

- Academic Research and Scientific Studies (Neutron Diffraction, Spectroscopy)

- By End User:

- Oil & Gas Industry (Exploration and Production Companies, Service Providers)

- Aerospace and Defense (Military, Weapon Systems, Cargo Screening)

- Healthcare and Medical Facilities (Hospitals, Cancer Treatment Centers)

- Research Institutions and Universities (National Laboratories, Academic Research Groups)

- Industrial Manufacturing (Automotive, Construction, Quality Control)

Value Chain Analysis For Neutron Source Generator Market

The value chain for the Neutron Source Generator Market initiates with highly specialized upstream activities centered on the meticulous procurement, manufacturing, and refinement of essential, high-technology components, critical for the production of controlled neutron beams. This includes sourcing ultra-high-precision high-voltage power supplies, sophisticated plasma sources, highly reliable ultra-high-vacuum components, advanced cooling systems, and the specialized target materials (e.g., Deuterium and Tritium gases or solid targets). The core suppliers in this upstream segment are typically highly specialized, niche vendors known for their expertise in stringent quality control, advanced vacuum integrity, and deep accelerator physics knowledge, whose component quality directly and significantly dictates the final generator's operational performance, stability, and crucial lifespan. The subsequent manufacturing phase involves complex, precision assembly processes conducted under exceptionally stringent quality control and secure environment standards, where generators are often custom-built or meticulously configured to meet the highly specific flux, energy, and physical form-factor requirements dictated by the end-user application, relying heavily on proprietary intellectual property related to complex beam dynamics and robust thermal management systems.

The midstream and downstream segments are focused on system integration, calibration, secure distribution, and integrated field services. Due to the inherent technical complexity, high cost, and sensitive nature of neutron source technology, the primary distribution channel relies heavily on direct sales models or involves exclusive, deep technical partnerships with specialized system integrators, particularly dominant in the regulated defense, security, and large-scale oil and gas sectors, where the generator is always embedded within a larger, mission-critical diagnostic or logging tool. Indirect channels, which involve specialized distributors or value-added resellers (VARs), are occasionally employed for the standardized, lower-flux sealed tube generators supplied to general academic institutions or general industrial NDT laboratories, but direct engagement remains predominant. Post-sales support, encompassing mandatory maintenance contracts, complex regulatory compliance support, and the provision of replacement targets, constitutes a crucial, recurring, and high-margin revenue stream in the downstream market, emphasizing the profound reliance on deep, continuous technical support and fostering strong, long-term customer relationships for ensuring sustained, successful market presence and competitive advantage.

The technical complexity and the associated regulatory stringency of the Neutron Source Generator technology necessitate that the overall distribution channel remains highly specialized and carefully managed. Direct sales models are primarily employed to ensure that manufacturers maintain absolute control over intricate installation procedures, complex initial calibration, and critical regulatory compliance, particularly when deploying systems in sensitive defense, national security, or highly regulated nuclear research applications. However, as the core technology matures and a greater degree of standardization is achieved, especially for developing clinical-grade medical BNCT systems and standardized portable security devices, there is an observable, strategic trend toward cautiously leveraging indirect channels. This involves engaging highly trained regional service partners and specialized value-added resellers to significantly improve geographical reach, enhance local responsiveness, and service a broader, non-nuclear specialized customer base. This strategic dual-channel approach is meticulously balanced to ensure maximum global market penetration while simultaneously maintaining the requisite, non-negotiable level of technical support, regulatory oversight, and quality control necessary for such high-technology instruments, thereby optimizing both commercial reach and critical operational integrity across the rapidly expanding global deployment footprint.

Neutron Source Generator Market Potential Customers

Potential customers for Neutron Source Generators span an impressively wide array of specialized, highly technological sectors that share the common requirement for precise, on-demand, non-destructive atomic analysis, superior material penetration capabilities, or controlled nuclear interactions. The largest current consumer segment remains the global Oil & Gas industry, encompassing major multinational energy corporations and specialized oilfield services firms, such as the industry leaders, who extensively utilize pulsed neutron generators for complex reservoir characterization, enhanced oil recovery monitoring, and accurately determining subterranean rock porosity and fluid saturation downhole. These critical end-users prioritize exceptional durability, guaranteed reliability under extreme pressure and high-temperature (HPHT) conditions, and highly accurate real-time data acquisition, consequently necessitating extremely rugged, robust, sealed-tube designs that can withstand harsh subterranean environments while concurrently delivering highly accurate elemental data crucial for maximizing hydrocarbon extraction efficiency, managing resource output, and ensuring critical operational safety in complex geological formations.

A second, immensely influential group comprises governmental organizations and state-run enterprises globally, including Defense Ministries, Homeland Security agencies, and customs and border protection authorities responsible for international trade security. These entities actively utilize high-yield accelerator-based neutron activation systems for high-throughput cargo scanning, sensitive explosive and narcotic detection (via precise elemental analysis), and verifying the presence of fissile materials in critical nuclear non-proliferation programs. These governmental customers consistently demand rapid throughput, highly reliable deployability, and exceptional sensitivity in detecting trace substances, often resulting in the adoption of large, fixed, or mobile accelerator-based systems that are seamlessly integrated into extensive, permanent security screening portals or, increasingly, in advanced handheld/portable devices for immediate field analysis. The continuous allocation of strategic defense expenditure in developed nations ensures a constant, high-priority demand stream for the most sophisticated and cutting-edge neutron source technologies available, frequently propelling the leading edge of technological development in terms of miniaturization, yield enhancement, and deployment capability.

Finally, the academic and rapidly expanding medical communities represent vital, high-potential future customer bases. Research institutions, global universities, and major national laboratories extensively employ a broad variety of neutron sources for foundational physics experiments, specialized materials science research (e.g., neutron scattering and diffraction studies), and the crucial production of specialized, short-lived radioisotopes for research and diagnostic applications, valuing high beam stability and precise flux flexibility. The emerging healthcare segment, specifically specialized hospitals and dedicated cancer treatment centers implementing or planning Boron Neutron Capture Therapy (BNCT), represents the most significant, high-growth demographic. These clinical customers require dedicated, high-output, and exceptionally stable neutron sources that can be safely and easily housed within a standard clinical environment, marking a fundamental strategic shift away from specialized industrial requirements towards systems meticulously optimized for high patient safety standards, precise dose delivery, and simplified clinical operation, dramatically broadening the potential market reach beyond traditional nuclear domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $293.4 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Phoenix LLC, Adelphi Technology Inc., SODERN (ArianeGroup), Starfire Industries LLC, VNIIA (VNIITFA), AMETEK ORTEC, Thermo Fisher Scientific Inc., L-3 Communications, PING Technology and Development Inc., NUKEM Technologies GmbH, IBA (Ion Beam Applications), Neutron Therapeutics, General Atomics, Advanced Public Safety Inc., Schlumberger Limited, Halliburton Company, Baker Hughes, Lawrence Livermore National Laboratory (Select Technologies), NSD-Fusion GmbH, Photoneutron Systems, Q-Peak Inc., Pulse Sciences, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neutron Source Generator Market Key Technology Landscape

The technology landscape of the Neutron Source Generator Market is currently dominated by sophisticated, electronically controlled accelerator platforms and highly engineered sealed-tube systems. Sealed-tube neutron generators (STNGs) represent the core commercial technology, utilizing compact D-T or D-D fusion reactions confined within a permanent vacuum tube. These systems are critically valued for their exceptional ruggedness, small physical footprint, and proven reliability, establishing them as the industry standard choice for deployment in harsh operational environments, most notably downhole well logging for the energy sector and mobile security inspection devices at borders. Continuous and extensive technological refinement is primarily focused on achieving a significant increase in the achievable neutron yield and substantially extending the operating lifespan (flux output capacity) of the sealed tubes through advancements in innovative ion source design and the formulation of more robust, longer-lasting target materials. Success in these refinements directly minimizes the frequency and cost of crucial replacement cycles, substantially enhancing overall field utility and maximizing the system's economic efficiency.

In contrast, the larger, more complex accelerator-based neutron sources (A-BNS), which incorporate linear accelerators, cyclotrons, or specialized RFQ systems, are utilized specifically when a significantly higher neutron flux or a precise energy tailoring of the beam is mandated. These sophisticated systems are predominantly deployed in highly specialized applications such as Boron Neutron Capture Therapy (BNCT) within clinical settings and in advanced, fundamental nuclear research laboratories. The paramount technological trend in this complex segment is miniaturization without any compromise on critical performance; developing ultra-compact, powerful systems that can be safely and effectively housed within standard hospital environments or smaller academic research facilities, thereby reducing the industry's reliance on increasingly scarce and costly large, centralized nuclear reactor facilities. Key technological innovations driving this trend include the development of high-intensity, high-current ion sources, utilization of advanced superconducting RF cavities to reduce system size and power draw, and highly robust beam transport systems designed to deliver exceptionally stable and precise beam current to the target, ensuring highly reproducible neutron production profiles essential for critical clinical and sensitive research protocols globally.

Furthermore, several emerging and disruptive technologies are beginning to exert influence on the market, notably the development of advanced plasma focus devices and intense pulsed neutron sources, although commercial deployment remains largely restricted to extremely high-end academic and defense research due to their inherent complexity and operational demands. Significantly, the pervasive integration of advanced sensor arrays, powerful digital signal processing capabilities, and embedded AI/machine learning algorithms is fundamentally transforming neutron generators into integrated, intelligent analytical tools, markedly enhancing their overall diagnostic capabilities. The core technological focus across the entire industry remains unwaveringly centered on substantially enhancing intrinsic safety features, drastically increasing the mean time between failures (MTBF), and continuously improving the neutron production efficiency (measured as neutrons per second per watt of electrical input power) to simultaneously drive down the operational footprint and make the technology significantly more accessible and economically viable for a much broader array of crucial commercial, clinical, and industrial uses, ensuring long-term technological dominance against all competing analytical methods.

Regional Highlights

- North America: North America maintains its definitive leadership position in the Neutron Source Generator Market, a dominance primarily attributable to exceptionally substantial defense and homeland security expenditures, rigorous environmental and operational regulations necessitating the adoption of highly advanced oil and gas well logging techniques, and the critical presence of numerous specialized technology providers, world-leading national laboratories, and extensive research universities across the United States and Canada. The region significantly benefits from a robust and mature R&D infrastructure coupled with extensive private sector investment in cutting-edge nuclear and accelerator technologies, particularly in the rapid development of next-generation accelerator systems optimized for advanced materials testing and emerging medical applications like BNCT. The region’s strong, though complex, regulatory framework, while posing certain adoption restraints, simultaneously enforces globally high standards for product performance, intrinsic safety, and environmental compliance, consequently favoring established, technologically sophisticated manufacturers capable of delivering compliant and highly reliable neutron source technology solutions across highly demanding industrial and crucial governmental sectors.

- Europe: Europe represents a mature, sophisticated, and technologically advanced market segment, clearly distinguished by significant governmental funding channeled into expansive, cross-border collaborative research programs focused intensely on foundational nuclear physics, ambitious fusion energy research initiatives, and critical infrastructure maintenance (Non-Destructive Testing). Key influential countries, including Germany, France, and the UK, are aggressively driving demand, specifically for compact, high-yield neutron sources used extensively in automated cargo inspection systems and detailed materials analysis for the critical aerospace and high-end automotive manufacturing industries. Furthermore, the region stands as a pioneer in the global adoption and early clinical trials of BNCT, stimulating dedicated regional demand for specialized, highly regulated, hospital-based neutron delivery systems. The European regulatory environment, which places a heavy and continuous emphasis on intrinsic safety and minimizing environmental impact, further accelerates the strategic shift away from environmentally complex and hazardous radioisotope-based sources toward sophisticated, electronically controlled accelerator generators, ensuring the region remains a vital hub for both fundamental innovation and high-value commercial adoption of advanced neutron source technology.

- Asia Pacific (APAC): The Asia Pacific (APAC) region is decisively projected to be the fastest-growing market globally, propelled by explosive rates of industrialization, massive governmental and private investments in large-scale infrastructure projects (e.g., roads, complex bridges, power plants), and rapidly increasing energy exploration activities, particularly dominant in major economies like China, India, and Southeast Asia. The regional demand is heavily concentrated in the Oil & Gas sector, demanding durable well logging tools, and in government-led national security initiatives requiring advanced detection capabilities at high-volume ports and expansive borders. While the initial adoption rate was historically slower due to significant initial cost constraints and reliance on legacy systems, rapidly increasing domestic manufacturing capabilities, coupled with substantial government incentives promoting localized nuclear and research infrastructure development, are vigorously accelerating market penetration. This region offers immense strategic potential for manufacturers capable of focusing on delivering high-volume, cost-effective, yet reliable sealed-tube generators tailored specifically for widespread industrial Non-Destructive Testing (NDT) and essential well logging applications, presenting the most critical and expansive growth vector for the global market over the forecast period.

- Latin America and MEA: Latin America is an emerging market, primarily seeing growth driven by ongoing investments in oil and gas exploration (e.g., Brazil, Mexico) and local mining activities requiring portable analytical tools for elemental analysis and quality control. The Middle East and Africa (MEA) region experiences growth fueled by extensive, continuous oil and gas activities in the Gulf Cooperation Council (GCC) countries and significant investments in sophisticated national security infrastructure, creating consistent demand for advanced well logging tools and high-performance security detection systems at key checkpoints and critical energy facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neutron Source Generator Market.- Phoenix LLC

- Adelphi Technology Inc.

- SODERN (ArianeGroup)

- Starfire Industries LLC

- VNIIA (VNIITFA)

- AMETEK ORTEC

- Thermo Fisher Scientific Inc.

- L-3 Communications

- PING Technology and Development Inc.

- NUKEM Technologies GmbH

- IBA (Ion Beam Applications)

- Neutron Therapeutics

- General Atomics

- Advanced Public Safety Inc.

- Schlumberger Limited

- Halliburton Company

- Baker Hughes

- Lawrence Livermore National Laboratory (Select Technologies)

- NSD-Fusion GmbH

- Photoneutron Systems

- Q-Peak Inc.

- Pulse Sciences, Inc.

Frequently Asked Questions

Analyze common user questions about the Neutron Source Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of accelerator-based neutron generators over radioisotope sources?

Accelerator-based neutron generators offer superior safety because they can be instantly switched off, completely eliminating the continuous and ongoing radiation hazard associated with traditional radioisotope sources like Californium-252. They also provide significantly greater control over neutron yield and precise energy tuning, allowing for customized applications, achieving higher flux density when needed, and crucially generating zero complex, long-term radioactive waste requiring specialized disposal, thereby reducing operational and severe environmental risks across all commercial and research applications.

How is the Neutron Source Generator Market influenced by the Oil and Gas industry?

The Oil and Gas industry represents the single largest end-user segment, acting as a foundational driver by demanding robust, high-flux sealed-tube neutron generators used extensively in Pulsed Neutron Logging (PNL). These downhole devices are essential for detailed reservoir evaluation, accurate identification of fluid saturation (oil, gas, water), determining rock porosity, and monitoring complex enhanced oil recovery techniques, ensuring that the technology's continuous evolution is heavily dictated by the industry's critical requirements for extreme durability, downhole accuracy, and resilience under immense pressure and temperature.

What is Boron Neutron Capture Therapy (BNCT) and its predicted role in market growth?

BNCT is an emerging, highly precise, two-step cancer treatment that utilizes external neutron beams (increasingly generated by compact accelerators) to selectively activate Boron-10 atoms pre-delivered specifically to malignant tumor cells, causing highly localized, targeted cell destruction. The rapid increase in clinical acceptance and deployment of BNCT facilities globally requires dedicated, high-output, and exceptionally stable neutron sources, positioning the medical sector as the fastest-growing application area and a major future driver for high-flux, compact, hospital-compatible generator development and commercialization.

What are the main regulatory challenges currently impacting the global deployment of neutron sources?

The deployment and operation of neutron sources are constrained by strict, multi-layered international and national regulations concerning radiation safety, the secure transport of specialized radioactive or tritium-containing components, and adherence to severe security protocols (e.g., IAEA safeguards and export controls). Compliance with this highly complex and evolving regulatory framework necessitates substantial operational overhead, requires specialized site licensing, and demands continuous monitoring and expert personnel, serving as a critical market restraint but simultaneously promoting the necessary development of safer, intrinsically compliant, and non-radioisotope accelerator alternatives.

How does advanced neutron source technology contribute to homeland security and defense initiatives?

In defense and homeland security, high-yield neutron generators are critically employed for advanced, non-intrusive inspection of high-volume cargo, checked luggage, and military vehicles through techniques like Prompt Gamma Neutron Activation Analysis (PGNAA). This technology reliably and quickly identifies specific elemental signatures indicative of explosives (high nitrogen content), illegal narcotics, and hidden fissile materials, providing superior detection capabilities and specificity compared to conventional X-ray systems, making neutron sources indispensable tools for sophisticated anti-terrorism and nuclear counter-proliferation efforts worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager