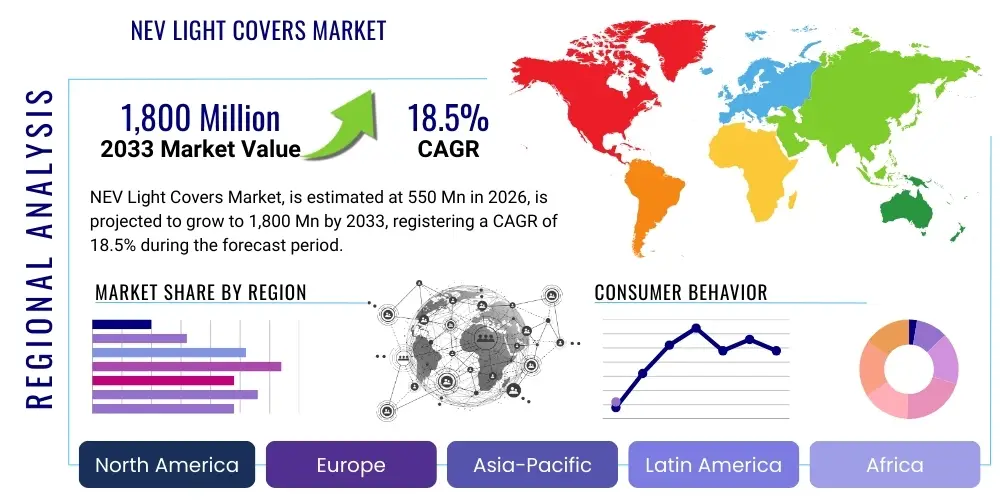

NEV Light Covers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441791 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

NEV Light Covers Market Size

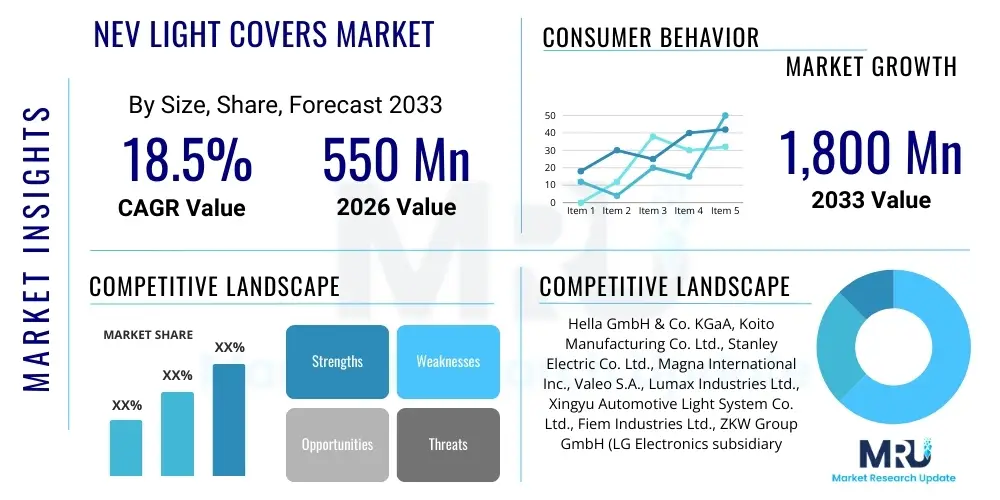

The NEV Light Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 550 million in 2026 and is projected to reach USD 1,800 million by the end of the forecast period in 2033.

NEV Light Covers Market introduction

The NEV Light Covers Market encompasses the production and supply of external protective shells and lenses specifically designed for lighting systems in New Energy Vehicles (NEVs), including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). These covers are critical components that protect sensitive light-emitting diodes (LEDs) and advanced lighting modules from environmental damage, UV degradation, and physical impact, while also playing a vital role in light diffusion and aerodynamic design integration crucial for enhancing vehicle efficiency.

The core product offerings within this market include specialized polycarbonate (PC) and polymethyl methacrylate (PMMA) moldings for headlights, taillights, fog lights, and interior ambient lighting systems. Major applications center on ensuring compliance with stringent safety regulations related to light output intensity and dispersion patterns, alongside contributing significantly to the overall aesthetic appeal and brand identity of modern NEVs. The low-profile, often seamlessly integrated design of NEV lighting necessitates high-precision manufacturing of these covers.

Driving factors propelling market growth include the global mandate toward vehicle electrification, significant advancements in adaptive and matrix LED technologies that require precise cover optics, and the continuous demand for lighter vehicle components to maximize battery range. Furthermore, the increasing focus on advanced material research to develop scratch-resistant and self-healing coatings for light covers is enhancing product lifespan and consumer acceptance, positioning the market for sustained expansion across all major automotive manufacturing regions.

NEV Light Covers Market Executive Summary

The NEV Light Covers Market is characterized by robust growth, driven primarily by favorable regulatory shifts promoting electric vehicle adoption and intense technological competition among Original Equipment Manufacturers (OEMs) to differentiate their NEV models through unique lighting signatures. Current business trends indicate a strong move towards lightweight, advanced polymer materials, particularly those offering superior thermal management and optical clarity required by high-intensity adaptive LED systems. Strategic partnerships between material suppliers and Tier 1 automotive lighting specialists are becoming crucial for developing cost-effective, high-performance lens solutions.

Regionally, Asia Pacific, led by China and South Korea, dominates the market due to massive domestic NEV production volumes and supportive government policies accelerating electrification mandates. Europe follows, demonstrating significant momentum driven by rigorous emissions standards and high consumer uptake of premium electric models, demanding sophisticated aesthetic and functional light covers. North America is poised for accelerated growth, supported by large-scale investments in BEV manufacturing capacity and expanding charging infrastructure, increasing the demand for localized supply chains for light cover components.

Segment trends highlight the dominance of Polycarbonate (PC) materials due to their excellent impact resistance and weight advantages over traditional glass. Furthermore, the Battery Electric Vehicle (BEV) segment holds the largest share, reflecting the global focus on pure electric mobility. Within product types, Headlight Covers remain the primary revenue generator, though demand for integrated Taillight Covers, often spanning the entire vehicle width, is rapidly increasing, reflecting emerging design preferences in the NEV landscape.

AI Impact Analysis on NEV Light Covers Market

User inquiries regarding the impact of AI on the NEV Light Covers Market often center on how automation affects the manufacturing process, how AI-driven design tools optimize lens performance, and the role of intelligent materials in future light cover production. Users are keenly interested in predictive maintenance models for molds, AI’s ability to simulate complex light refraction patterns for adaptive beam control, and the potential integration of sensor housing directly into the light cover structure. The overarching themes are efficiency maximization, design customization, and leveraging AI for quality control in high-volume production environments.

The influence of Artificial Intelligence primarily revolutionizes the design and production phases of NEV light covers. In design, AI algorithms can rapidly iterate through thousands of optical geometries, optimizing light distribution patterns to meet stringent regulatory standards while maximizing aerodynamic efficiency—a critical factor for NEVs. This speed greatly reduces the time-to-market for new vehicle models. Furthermore, AI-driven simulation tools analyze how various material compositions will perform under extreme thermal stress (generated by advanced LEDs) and environmental exposure, leading to the selection of more robust and durable polymers.

In manufacturing, AI and machine learning are deployed for predictive quality control and process optimization. High-resolution imaging systems coupled with AI detect minute defects, such as stress marks or inclusions in clear polymer moldings, far more accurately and consistently than human inspection. This reduces scrap rates, particularly crucial for high-cost, customized NEV components. Additionally, AI optimizes injection molding parameters (temperature, pressure, cycle time) in real-time to ensure maximum material efficiency and uniformity across all produced light covers, driving down operational costs and enhancing overall supply chain responsiveness.

- AI optimizes optical design simulation, minimizing aerodynamic drag crucial for NEV range.

- Machine learning enhances precision quality control during high-volume injection molding, reducing defects.

- Predictive maintenance algorithms use sensor data to forecast mold wear, ensuring consistent material thickness and optical clarity.

- Generative design tools assist engineers in creating unique, complex light cover geometries tailored to specific NEV brand aesthetics.

- AI aids in material stress analysis, predicting polymer degradation under extended UV and thermal exposure.

DRO & Impact Forces Of NEV Light Covers Market

The NEV Light Covers Market growth is strongly driven by global governmental electrification targets and consumer preference shifts toward advanced vehicle technologies, necessitating innovative lighting components. Restraints include the high initial investment required for advanced tooling necessary for complex, custom NEV light cover geometries and fluctuations in the raw material prices of specialized polymers like optical-grade polycarbonate. Significant opportunities exist in developing smart light cover materials capable of dynamic tinting or incorporating integrated sensor cleaning systems, aligning with the rise of autonomous driving features. These dynamics result in potent impact forces that shape investment strategies and product development cycles across the market.

The primary driving force remains the exponential growth of the global NEV fleet. As NEV production scales, so does the embedded demand for all specific components, including highly aesthetic and functional light covers. Furthermore, regulations mandating improved road safety and pedestrian awareness continually push OEMs to adopt sophisticated adaptive driving beam (ADB) technology, which, in turn, requires extremely precise and high-performance lens covers to function correctly. The necessity for lightweight components in NEVs to maximize battery efficiency further accelerates the adoption of advanced, lightweight polymers over heavier alternatives.

Conversely, the reliance on petroleum-derived polymers introduces material price volatility as a substantial restraint. Developing materials that offer superior scratch resistance and UV stability while maintaining optical clarity remains a technical hurdle, adding complexity and cost to manufacturing. Opportunities are centered on developing integrated solutions where the light cover serves multiple functions, perhaps incorporating radar or lidar sensor windows with self-cleaning capabilities, crucial for Level 3 and above autonomous vehicles. These opportunities incentivize deep R&D investment and collaborative efforts between the automotive and materials science sectors, dictating the long-term competitive landscape.

Segmentation Analysis

The NEV Light Covers Market is broadly segmented based on Material Type, Vehicle Type, and Cover Type. This structure allows for granular analysis of demand patterns, material preferences, and application-specific growth drivers. Polycarbonate (PC) dominates the material segment due to its superior impact resistance and thermal stability, essential for modern LED systems. The segmentation by vehicle type confirms the robust market growth stemming predominantly from the Battery Electric Vehicle (BEV) category, reflecting the industry's investment priorities. Analyzing cover type provides insights into revenue distribution, with Headlight Covers holding the highest value share due to their complex optical requirements and critical safety role, though taillight integration trends are rapidly altering this landscape.

The strategic importance of segmentation lies in identifying high-growth niches. For instance, within the material segment, while PC is prevalent, specialized coatings (e.g., anti-scratch, anti-fog) applied to the base polymer constitute a valuable micro-segment. Within the regional context, different vehicle types (e.g., PHEVs vs. BEVs) dominate various geographies based on infrastructure maturity and government incentives, directly influencing the component demand profile for light covers. A detailed analysis of these segments is vital for suppliers seeking to optimize production capacity and align R&D efforts with future automotive design trends, particularly those emphasizing seamless body integration and unique vehicle illumination signatures.

- By Material Type: Polycarbonate (PC), Polymethyl Methacrylate (PMMA), Glass, Others (e.g., Advanced Composites).

- By Vehicle Type: Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Fuel Cell Electric Vehicles (FCEV).

- By Cover Type: Headlight Covers, Taillight Covers, Fog Light Covers, Interior Lighting Covers.

Value Chain Analysis For NEV Light Covers Market

The value chain for the NEV Light Covers Market begins with upstream activities involving the extraction and processing of raw materials, predominantly crude oil derivatives used to produce specialty polymers like optical-grade PC and PMMA pellets. Key upstream suppliers include major chemical and petrochemical companies specializing in high-clarity resins and performance additives (e.g., UV stabilizers, flow enhancers). Quality control at this initial stage is paramount, as even minor imperfections in the polymer can compromise the optical integrity of the finished light cover, directly impacting safety and performance of the NEV lighting system.

Midstream activities involve sophisticated manufacturing processes, primarily high-precision injection molding and specialized coating application (hard coatings for scratch resistance, anti-fog coatings). Tier 2 suppliers focus on molding the covers, while Tier 1 automotive lighting specialists (e.g., Hella, Koito) often integrate the cover with the entire lighting module (including PCBs, LEDs, reflectors, and heat sinks). The shift towards complex, three-dimensional light cover designs requires significant investment in advanced mold tooling and robotics to achieve the necessary dimensional accuracy and aesthetic finish demanded by NEV OEMs.

Downstream distribution channels are characterized by a highly integrated supply network. Direct channels dominate, as Tier 1 suppliers ship assembled lighting modules directly to NEV OEM assembly plants globally, following strict Just-In-Time (JIT) schedules. Indirect distribution, primarily serving the aftermarket replacement segment, involves certified distributors and authorized service centers, though this segment is smaller for NEV components initially. The critical aspect of the downstream segment is the global logistical complexity required to support multi-regional manufacturing platforms utilized by major automotive groups, ensuring that specific, often customized, light covers arrive without damage or delay.

NEV Light Covers Market Potential Customers

The primary customers and end-users of NEV Light Covers are global New Energy Vehicle Original Equipment Manufacturers (OEMs), who procure these components as part of fully integrated lighting systems from Tier 1 suppliers. Companies like Tesla, Volkswagen Group (ID series), BYD, NIO, General Motors (Ultium platform), and Ford are the key buyers, driving the specifications and technological requirements for light covers. These OEMs demand components that align perfectly with their vehicle architectures, emphasizing material performance (weight reduction, durability), aesthetic integration (unique light signatures), and compliance with international safety standards (ECE, NHTSA).

Secondary, yet rapidly growing, customer segments include dedicated aftermarket providers and independent repair shops. As the NEV fleet ages, the demand for replacement light covers due to accident damage or environmental degradation increases. However, due to the complex integration and potential calibration requirements of modern NEV lighting modules (especially adaptive systems), the OEM-authorized service channel typically dominates replacement sales. Furthermore, specialized prototyping and design houses, often contracted by OEMs for future model development, act as early purchasers for custom, low-volume light cover solutions tailored for concept vehicles.

Ultimately, the procurement decision hinges on performance metrics such as optical efficiency, longevity (resistance to yellowing/crazing), thermal management capabilities, and compliance with strict weight budgets. The shift towards autonomous vehicles further elevates the need for multi-functional covers that can house or protect sensing hardware, transforming the light cover from a simple protective lens into a critical vehicle sensory interface component, making R&D departments of major OEMs the ultimate influence point for product innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,800 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, Koito Manufacturing Co. Ltd., Stanley Electric Co. Ltd., Magna International Inc., Valeo S.A., Lumax Industries Ltd., Xingyu Automotive Light System Co. Ltd., Fiem Industries Ltd., ZKW Group GmbH (LG Electronics subsidiary), Varroc Group, Osram Continental GmbH, BYD Auto Co. Ltd. (In-house production), Tesla Inc. Suppliers, SL Corporation, Zhejiang Shuanglin Auto Parts Co. Ltd., Federal-Mogul Motorparts (Tenneco), Automotive Lighting Reutlingen GmbH (Marelli), Mindko Lighting. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

NEV Light Covers Market Key Technology Landscape

The technological landscape of the NEV Light Covers market is rapidly evolving, driven by the demand for improved energy efficiency, sophisticated aesthetics, and enhanced functionality. A key foundational technology is high-precision injection molding, specifically optimized for optical-grade polymers. This process utilizes highly polished, multi-cavity molds with extremely tight tolerances to ensure zero distortion and maximum light transmission. Innovations in this area focus on reducing cycle times and managing the shrinkage rates of advanced polymers, which are crucial for maintaining the precise optical geometry required by modern adaptive LED systems.

Another pivotal technology involves the application of advanced protective coatings. These coatings, often applied through sophisticated flow coating or plasma deposition techniques, include hard coats to significantly enhance scratch and abrasion resistance, thereby preserving optical clarity over the vehicle’s lifespan. Furthermore, anti-fog and UV-blocking additives are critical to prevent material degradation (yellowing) and maintain functional integrity in diverse climatic conditions. The optimization of these coating technologies ensures that the light cover can withstand road debris and harsh cleaning agents without compromising its structural or visual properties.

Emerging technologies focus on material innovation and functional integration. This includes the development of self-healing polymers, which can automatically repair minor surface scratches upon exposure to heat or UV light, extending product longevity and maintaining aesthetic appeal. Crucially, the integration of radar-transparent material segments or specialized heating elements (to prevent ice and snow build-up over integrated sensor windows) is transforming the cover into a multifaceted component essential for NEVs equipped with advanced driver-assistance systems (ADAS) and autonomous driving features, demanding seamless integration between optical and sensing technology.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market for NEV Light Covers, primarily driven by massive production volumes in China, which leads global NEV manufacturing and adoption. Government mandates, coupled with significant investments in battery and vehicle manufacturing infrastructure in China and South Korea, ensure sustained demand. Japan also contributes significantly through major OEM activity and a strong focus on high-quality, long-life components. The region is characterized by aggressive pricing strategies and rapid product introduction cycles.

- Europe: Europe is a high-value market segment, distinguished by its focus on premium aesthetics, stringent environmental regulations, and early adoption of advanced lighting technologies like matrix LED systems. Countries such as Germany, the UK, and France are critical markets, with strong consumer preference for BEVs that feature sophisticated, customized light signatures. European demand emphasizes sustainable materials and highly complex geometric designs integrated seamlessly into vehicle bodywork.

- North America: The North American market is experiencing explosive growth, fueled by substantial investment from major US OEMs (e.g., Tesla, Ford, GM) in dedicated NEV platforms. The market is increasingly localized, focusing on establishing robust supply chains to meet large-scale domestic production targets. Demand here is characterized by the need for durable materials capable of handling extreme temperature variations and adherence to specific Federal Motor Vehicle Safety Standards (FMVSS).

- Latin America, Middle East, and Africa (LAMEA): This region is nascent but shows strong potential, particularly in key MEA countries investing in smart cities and sustainable transport solutions, and leading South American economies showing initial electrification momentum. Growth is currently slower compared to APAC and Europe, relying heavily on imported NEV models, but local manufacturing hubs are projected to emerge toward the latter half of the forecast period, driving future localized demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the NEV Light Covers Market.- Hella GmbH & Co. KGaA

- Koito Manufacturing Co. Ltd.

- Stanley Electric Co. Ltd.

- Magna International Inc.

- Valeo S.A.

- Lumax Industries Ltd.

- Xingyu Automotive Light System Co. Ltd.

- Fiem Industries Ltd.

- ZKW Group GmbH (LG Electronics subsidiary)

- Varroc Group

- Osram Continental GmbH

- BYD Auto Co. Ltd. (In-house production)

- Tesla Inc. Suppliers

- SL Corporation

- Zhejiang Shuanglin Auto Parts Co. Ltd.

- Federal-Mogul Motorparts (Tenneco)

- Automotive Lighting Reutlingen GmbH (Marelli)

- Mindko Lighting

Frequently Asked Questions

Analyze common user questions about the NEV Light Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are predominantly used for NEV light covers?

The NEV Light Covers Market primarily utilizes high-grade polymers, with Polycarbonate (PC) being the dominant material due to its superior impact resistance, lightweight properties, and excellent thermal stability required for modern LED lighting systems.

How does the shift to NEVs influence light cover design?

NEVs necessitate lightweight components to maximize battery range and utilize increasingly complex, full-width lighting designs integrated seamlessly into the vehicle's aerodynamic profile, driving demand for precise, custom-molded polymer covers.

Which region dominates the global NEV Light Covers Market?

Asia Pacific (APAC), particularly China, holds the largest market share due to its massive domestic production volume of Battery Electric Vehicles (BEVs) and strong governmental support for the electrification of the automotive sector.

What is the Compound Annual Growth Rate (CAGR) projected for this market?

The NEV Light Covers Market is projected to exhibit a high growth trajectory, estimated at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, reflecting the aggressive expansion of the global NEV fleet.

Are NEV light covers incorporating integrated sensor technology?

Yes, an emerging technological trend involves developing multi-functional NEV light covers that incorporate radar-transparent sections or self-cleaning mechanisms to protect and optimize the performance of integrated ADAS and autonomous driving sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager