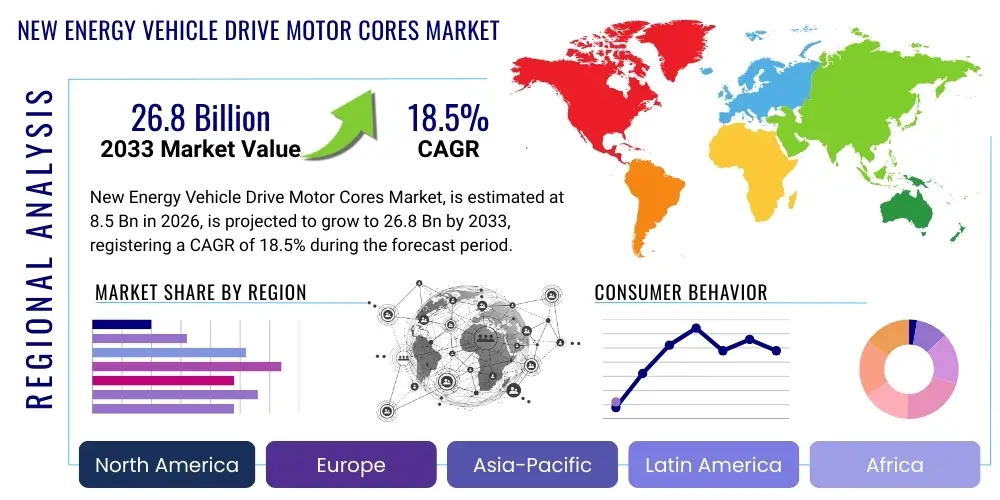

New Energy Vehicle Drive Motor Cores Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441519 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

New Energy Vehicle Drive Motor Cores Market Size

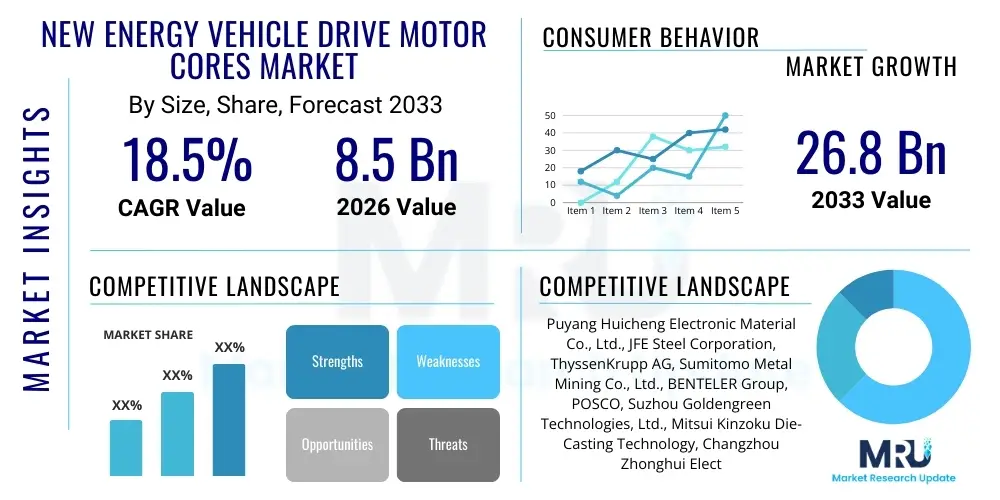

The New Energy Vehicle Drive Motor Cores Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 26.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global governmental policies promoting zero-emission vehicles, coupled with the rapid technological advancements in electric powertrain efficiency and energy density. The core, being the critical component determining motor performance and efficiency, is increasingly scrutinized for material science improvements, particularly the use of high-grade non-oriented electrical steel (NOES) and sophisticated stacking technologies.

Market valuation reflects the increasing volume production of Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs) across major manufacturing hubs, predominantly in Asia Pacific and Europe. Furthermore, the shift from conventional Internal Combustion Engine (ICE) vehicles necessitates significant investment in the supply chain for specialized EV components. Drive motor core manufacturers are expanding capacity and integrating automation to meet the demanding quality and throughput requirements of major automotive OEMs, establishing long-term partnerships that secure market share and foster iterative product innovation, such as thinner laminations and advanced coating techniques to reduce core loss.

New Energy Vehicle Drive Motor Cores Market introduction

The New Energy Vehicle Drive Motor Cores Market encompasses the design, manufacture, and distribution of laminated steel stacks essential for the electric motors powering modern NEVs. These cores, typically constructed from high-performance electrical steel, form the stator and rotor components, which are crucial for generating the electromagnetic fields necessary for propulsion. The performance metrics of the motor, including torque density, power output, and overall energy efficiency, are directly dependent on the material composition, lamination thickness, and geometric precision of these cores. The industry is characterized by rigorous standards, demanding components that can withstand high rotational speeds, significant temperature variations, and minimize magnetic losses (hysteresis and eddy current losses).

Major applications for these cores span across the spectrum of NEVs, including passenger cars, commercial buses, electric trucks, and emerging last-mile delivery vehicles. The continuous push toward longer driving ranges and faster charging times in BEVs directly translates into demand for lighter, more efficient motor cores, pushing manufacturers toward innovative stamping and interlocking technologies. Benefits derived from advanced motor cores include enhanced vehicle performance, increased battery range due to improved motor efficiency, reduced noise and vibration harshness (NVH), and prolonged motor lifespan. These benefits solidify the motor core’s position as a high-value critical component within the electric vehicle architecture.

The market is primarily driven by supportive regulatory frameworks, such as emissions reduction mandates and zero-emission vehicle (ZEV) credits implemented globally, particularly in China, the EU, and the US. Simultaneously, the decreasing cost of battery technology makes NEVs increasingly competitive with ICE vehicles, boosting consumer adoption. Key driving factors also include technological shifts, such such as the migration towards higher voltage architectures (e.g., 800V systems) that require specialized core designs to manage increased magnetic flux density and mitigate thermal challenges. The integration of axial flux motors, which utilize different core geometries compared to traditional radial flux motors, also presents a significant growth vector for specialized core suppliers.

New Energy Vehicle Drive Motor Cores Market Executive Summary

The New Energy Vehicle Drive Motor Cores Market is experiencing robust business trends characterized by intense vertical integration and strategic material sourcing to ensure supply chain resilience amid volatile raw material pricing, particularly for electrical steel. Major automotive OEMs are increasingly collaborating with specialized stamping and core assembly providers to secure capacity and access proprietary manufacturing techniques that ensure ultra-precise tolerances. Furthermore, there is a distinct trend towards automation and digitization within core manufacturing facilities, utilizing advanced robotics and AI-driven quality inspection systems to handle the complex requirements of very thin lamination stacks (often below 0.35mm, trending towards 0.20mm and below), which are crucial for maximizing motor efficiency at high operating frequencies. Cost optimization through standardization of core designs for multiple vehicle platforms remains a central objective for high-volume manufacturers.

Regionally, the Asia Pacific, led by China, dominates the production and consumption landscape, benefiting from comprehensive government subsidies and the world's largest NEV production base. Europe demonstrates exceptionally high growth rates, driven by stringent CO2 targets and significant investment in domestic gigafactories and associated component manufacturing ecosystems, particularly in Germany and Scandinavia. North America is rapidly accelerating, stimulated by incentives like the Inflation Reduction Act (IRA), which necessitates domestic sourcing and manufacturing, leading to substantial localization efforts for motor core production. These regional dynamics are defining trade flows and influencing where major capacity expansions are occurring, often favoring proximity to major battery and vehicle assembly plants.

In terms of segment trends, the market for stator cores holds the largest revenue share due to their complex structure and larger size relative to rotor cores, though the growth in permanent magnet synchronous motors (PMSM) continues to drive demand for highly specialized rotor core designs compatible with magnet insertion and retention mechanisms. By lamination type, interlocking and welding techniques are gaining prominence over traditional riveting, as they offer superior structural rigidity and magnetic circuit integrity, crucial for high-performance applications. The BEV segment remains the fastest-growing application area, requiring the most advanced core technology to meet demanding performance and efficiency benchmarks, thereby commanding premium pricing for ultra-thin, laser-cut laminations.

AI Impact Analysis on New Energy Vehicle Drive Motor Cores Market

Common user questions regarding AI’s impact on the NEV Drive Motor Cores market revolve around how machine learning can optimize the design process, improve manufacturing yields, and facilitate predictive maintenance of stamping equipment. Users are keen to understand if AI can accelerate the iteration cycle for novel core geometries, especially those aimed at reducing core loss and optimizing cooling channels. Concerns often center on the computational cost and data infrastructure required to implement sophisticated AI models in high-precision, high-volume manufacturing environments. The consensus expectation is that AI will primarily serve as a powerful tool for material simulation, automated quality control (defect detection in laminations), and supply chain forecasting, ensuring optimal scheduling and minimizing scrap rates, which is critical given the high cost of electrical steel.

The integration of artificial intelligence and advanced analytics fundamentally transforms the lifecycle of drive motor cores, beginning with the computational design phase. AI algorithms are utilized to execute millions of virtual simulations, exploring variations in lamination shape, stacking factor, and material properties (e.g., permeability and coercivity) far beyond the capacity of traditional finite element analysis (FEA). This optimization capability allows manufacturers to quickly identify designs that maximize efficiency and torque density while adhering to strict thermal management constraints. Furthermore, AI-driven process control within stamping operations monitors parameters such as press force, die temperature, and material feed rate in real-time, enabling proactive adjustments that maintain micron-level tolerances and drastically reduce the occurrence of burrs or warping, thereby enhancing the overall magnetic performance of the finished core stack.

Beyond design and immediate manufacturing, AI deployment is pivotal for enhancing operational efficiency across the production floor. Predictive maintenance models analyze sensor data from high-speed stamping machines—monitoring vibration signatures and power consumption—to accurately forecast tooling wear and potential failures. This shifts maintenance from reactive or time-based schedules to condition-based servicing, maximizing machine uptime and extending the life of expensive dies, which can cost hundreds of thousands of dollars. In the supply chain, machine learning models analyze global electrical steel prices, production capacities of steel mills, and logistics bottlenecks, providing sophisticated risk assessment and inventory optimization strategies, securing the necessary raw materials required for sustained production volumes.

- AI-Optimized Core Design: Machine learning models accelerate material selection and geometric optimization to minimize core loss (hysteresis and eddy current) and maximize power density.

- Automated Quality Control (AQC): Vision systems coupled with deep learning algorithms detect minute surface defects, burrs, and stacking irregularities in individual laminations at high production speeds.

- Predictive Maintenance (PdM): AI analyzes stamping press operational data (vibration, temperature, current draw) to forecast potential equipment failure, maximizing uptime and die lifespan.

- Manufacturing Process Optimization: Real-time adjustment of stamping parameters (e.g., pressure, speed) based on sensor feedback to ensure ultra-precise geometric tolerances and stack integrity.

- Supply Chain Resilience: AI models predict raw material price fluctuations (electrical steel) and manage inventory levels effectively to mitigate supply chain risk.

DRO & Impact Forces Of New Energy Vehicle Drive Motor Cores Market

The market is predominantly influenced by powerful drivers, primarily the aggressive global regulatory push towards electrification and mandates for vehicle efficiency improvement, which necessitates superior motor core technology. However, significant restraints include the volatility and constrained global supply of high-grade Non-Oriented Electrical Steel (NOES), essential for minimizing magnetic losses, alongside the substantial capital expenditure required for high-speed, precision stamping equipment and complex tooling. Opportunities abound in the development of novel materials, such as amorphous metals or specialized high-silicon steels, and in the growing demand for cores designed for unique motor architectures, including axial flux and in-wheel motors. The primary impact forces are the intense competition on material costs and the rapid technological obsolescence driven by continuous efficiency targets, requiring constant R&D investment to maintain competitive advantage.

Drivers: Global regulatory deadlines, such as the EU's Fit for 55 package and China's NEV credit system, compel automakers to rapidly scale EV production, directly increasing demand for motor cores. Furthermore, consumer demand for extended range and higher performance mandates the continuous refinement of electric powertrains, prioritizing efficiency gains achievable only through ultra-thin laminations (0.20mm and below) and precision stacking techniques. The expanding application base beyond passenger cars into heavy-duty commercial vehicles and specialized industrial EVs provides a substantial volume driver. The shift to 800V architectures also drives demand for cores capable of managing higher frequencies and thermal loads effectively.

Restraints: The most critical constraint is the dependence on specialized, expensive electrical steel, which faces supply chain concentration issues and significant lead times. Manufacturing complexity is another major hurdle; producing high-precision laminations with minimal burr formation requires highly specialized, multi-stage stamping dies that are costly to procure and maintain. Moreover, the stringent quality requirements mean that scrap rates, particularly during initial ramp-up phases, can be prohibitively high. Intellectual property protection for advanced core stacking and bonding techniques also acts as a barrier to entry for new market participants, focusing market power among established core specialists.

Opportunities: The ongoing quest for efficiency opens significant market opportunities in material innovation, including the adoption of soft magnetic composites (SMCs) for complex 3D flux paths or novel iron alloys that offer improved performance at high temperatures. The push towards standardization and modularity in EV platforms presents an opportunity for core manufacturers to supply globally standardized core stacks, simplifying logistics and reducing custom engineering costs. The burgeoning aftermarket for EV repairs and performance upgrades also represents a long-term revenue stream for replacement cores. Finally, establishing localized production capabilities in emerging NEV markets (e.g., Southeast Asia, Latin America) allows manufacturers to capitalize on evolving regional supply chain mandates.

Segmentation Analysis

The New Energy Vehicle Drive Motor Cores Market is comprehensively segmented based on motor type, core component, material type, lamination thickness, and vehicle type, each revealing distinct growth trajectories and technological requirements. Segmentation by motor type, particularly the Permanent Magnet Synchronous Motor (PMSM) versus the Induction Motor (IM) and Synchronous Reluctance Motor (SRM), dictates the precise geometric and material specifications of the core required. The market is increasingly dominated by PMSM cores due to their superior efficiency and power density, especially for high-performance BEVs. Material segmentation highlights the shift towards lower-loss grades of electrical steel, essential for meeting rigorous energy consumption standards.

Core component segmentation differentiates between stator cores and rotor cores, with the stator core segment typically leading in volume and value due to its complexity and size, encompassing the windings that generate the magnetic field. However, advancements in rotor core technology, especially related to mechanical integrity at extreme rotational speeds and thermal management, are critical for high-end applications. Furthermore, the segmentation by lamination thickness is a key performance indicator; thinner laminations (e.g., 0.20mm and 0.25mm) are gaining market share rapidly over thicker counterparts (0.30mm and 0.35mm), driven by the necessity to reduce eddy current losses at the high switching frequencies used by modern inverters.

The application segmentation, primarily driven by Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and specialized Commercial Electric Vehicles (CEVs), dictates the required production scale and performance demands. BEVs represent the largest and most demanding segment, prioritizing light weight and maximum efficiency, thereby demanding premium, custom-engineered cores. PHEVs require cores optimized for mixed-use (high frequency for electric mode, low NVH for seamless transition), while CEVs, such as electric trucks and buses, prioritize durability and sustained torque output, often utilizing slightly thicker, more robust core stacks optimized for continuous heavy-duty operation rather than peak acceleration performance.

- By Motor Type:

- Permanent Magnet Synchronous Motors (PMSM)

- Induction Motors (IM)

- Synchronous Reluctance Motors (SRM)

- Axial Flux Motors

- By Core Component:

- Stator Cores

- Rotor Cores

- By Lamination Thickness:

- 0.30 mm – 0.35 mm

- 0.20 mm – 0.25 mm

- Below 0.20 mm (Ultra-Thin Laminations)

- By Material Type:

- High-Grade Non-Oriented Electrical Steel (NOES)

- Soft Magnetic Composites (SMC)

- Amorphous Metals

- By Stacking Technology:

- Welding

- Interlocking (Keying)

- Riveting

- Bonding (Adhesive)

- By Vehicle Type:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- Commercial Electric Vehicles (CEVs)

Value Chain Analysis For New Energy Vehicle Drive Motor Cores Market

The value chain for NEV Drive Motor Cores is highly specialized and begins upstream with the production of raw materials, primarily high-grade Non-Oriented Electrical Steel (NOES), a process dominated by specialized steel mills that require massive capital investment and complex metallurgical knowledge. This is followed by critical midstream activities: precision stamping, cutting (often laser or high-speed progressive die stamping), and advanced stacking/bonding processes, which determine the final geometric precision and magnetic performance of the core. Downstream activities involve the integration of these cores into the motor assembly (including winding and housing) performed by Tier 1 motor suppliers or directly by automotive OEMs, followed by distribution through specialized automotive supply channels, utilizing both direct contracts and indirect logistics networks.

Upstream analysis reveals that the supply of high-performance electrical steel is a bottleneck, as only a limited number of global steel producers possess the capability to consistently manufacture the high-silicon, low-loss grades required for demanding EV applications. Key characteristics at this stage include minimizing material imperfections and ensuring homogeneous magnetic properties across large production batches. Steel manufacturers must continually invest in advanced rolling and annealing technologies to meet the demand for thinner gauges and higher saturation densities. Dependence on these few suppliers necessitates long-term strategic agreements and risk mitigation strategies for motor core manufacturers.

Downstream analysis focuses on the intense collaboration between motor core producers and Tier 1 motor assembly companies (or OEMs performing in-house motor production). The distribution channel is predominantly direct, characterized by highly customized, just-in-time (JIT) delivery contracts specifying strict quality control benchmarks. Indirect channels, such as general industrial distributors, play a minor role, typically serving small-volume niche EV manufacturers or the specialized aftermarket. The efficiency and reliability of the distribution network are crucial, as motor cores are large, sensitive components, and any supply disruption can halt the NEV assembly line. The trend toward modular motor platforms facilitates easier integration and standardization within the downstream segment.

The increasing complexity of core assembly, including intricate keying mechanisms or advanced adhesive bonding for structural integrity, is shifting more value capture towards the midstream core specialists. These specialists must master both the high-speed stamping process and the precision assembly phase. Direct sales dominate the market, as OEMs require specific design input and quality assurance that only direct contracts can provide. Indirect distribution primarily handles replacement components or niche applications, but the vast majority of volume flows directly from the core manufacturer to the motor assembler under rigorous contractual agreements.

New Energy Vehicle Drive Motor Cores Market Potential Customers

The primary potential customers and end-users of New Energy Vehicle Drive Motor Cores are the large-scale automotive original equipment manufacturers (OEMs) and their designated Tier 1 suppliers who specialize in powertrain components. These customers require high-volume, globally scalable production capabilities combined with ultra-high quality and precision engineering. The core purchasing decision is driven by efficiency requirements (miles per kilowatt-hour), motor performance specifications (torque and speed), and long-term cost of ownership, making technological leadership in minimizing core loss a key purchasing criterion.

A significant portion of demand originates from global automotive giants transitioning their entire portfolios to electrification. These companies either perform motor assembly in-house (vertical integration, e.g., Tesla, certain traditional OEMs) or rely heavily on established Tier 1 motor and inverter system suppliers (e.g., Bosch, Continental, Magna). The decision to buy or manufacture cores in-house depends heavily on geographic localization requirements and control over proprietary intellectual property related to stacking and winding technologies. Customers are increasingly demanding "stack assemblies" rather than individual laminations, shifting the complexity burden further onto the core manufacturer.

Secondary but rapidly growing customer segments include specialized manufacturers of commercial electric vehicles (e.g., electric bus and truck manufacturers), aerospace and marine EV powertrain developers, and niche performance EV startups. These segments often require specialized, lower-volume runs with unique specifications tailored to extreme operating conditions (high torque, high duty cycle, or unique cooling requirements). Furthermore, the burgeoning electric power tools and industrial robotics markets, which utilize high-efficiency electric motors, also represent an adjacent potential customer base that demands precision-engineered magnetic components, leveraging the technological advancements developed for the automotive sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 26.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Puyang Huicheng Electronic Material Co., Ltd., JFE Steel Corporation, ThyssenKrupp AG, Sumitomo Metal Mining Co., Ltd., BENTELER Group, POSCO, Suzhou Goldengreen Technologies, Ltd., Mitsui Kinzoku Die-Casting Technology, Changzhou Zhonghui Electric, Tempel Steel Company, Schuler Group, Wuxi Huigong Automation Technology, Foshan City Xinghui Precision Stamping, Shandong Wina Green Power, Sango Co., Ltd., Zhejiang Kaida Technology, Nidec Corporation, Aisan Industry Co., Ltd., Precision Stamping Corporation, VAMA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Energy Vehicle Drive Motor Cores Market Key Technology Landscape

The technological landscape of the NEV Drive Motor Cores market is characterized by a relentless pursuit of lower magnetic losses, increased saturation flux density, and superior mechanical robustness under high-speed operation. The fundamental shift involves moving away from conventional stamping methods towards high-precision, high-speed progressive die stamping and laser cutting technologies. Laser cutting, while slower, provides superior accuracy and minimizes mechanical stress (burr formation) on the thin electrical steel sheets, which is critical for maintaining magnetic integrity. Progressive stamping, conversely, is used for high-volume production, necessitating extremely durable tooling materials and sophisticated lubrication systems to handle materials as thin as 0.20mm.

A crucial technological development lies in stacking and bonding techniques. Traditional riveting is increasingly being replaced by advanced methods like welding (e.g., TIG, laser welding) and adhesive bonding (also known as lamination bonding or interlocking). Laser welding offers high structural rigidity but can affect magnetic properties near the weld point, necessitating careful process control. Adhesive bonding, using electrically insulating and heat-resistant resins, provides robust mechanical integrity while preserving the magnetic performance across the entire lamination surface, crucial for minimizing vibration and noise (NVH) in the finished motor. The choice of stacking technology is heavily dependent on the motor type and the required operating environment, especially temperature exposure.

Material technology remains central to innovation. While high-grade Non-Oriented Electrical Steel (NOES) dominates, the development of new alloys with higher silicon content and specialized surface coatings (for insulation) is ongoing to reduce hysteresis and eddy current losses, especially as operating frequencies increase beyond 10 kHz in 800V systems. Furthermore, Soft Magnetic Composites (SMCs) are emerging as a disruptive technology, particularly for motors requiring complex 3D flux paths (like axial flux motors). SMCs allow for isotropic magnetic properties and highly intricate core shapes not achievable through traditional stamping, although their current flux density and core loss performance still lag slightly behind the best NOES grades for radial flux motors.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for both NEV production and motor core manufacturing, primarily driven by China, which boasts the largest domestic NEV market and extensive supply chain infrastructure. Government support, large domestic steel production capabilities (e.g., POSCO, JFE), and significant investment in localized EV manufacturing hubs make this region dominant. South Korea and Japan are leaders in high-performance electrical steel and precision tooling technology, exporting premium components globally. The region focuses on massive scale production and rapid technological adoption, often leading the market in the deployment of ultra-thin laminations and advanced stacking techniques for mass-market vehicles.

- Europe: Europe represents the fastest-growing market in terms of component value growth, driven by stringent emission targets (EU Green Deal) and localized production mandates. Countries like Germany, France, and the UK are heavily investing in battery and EV component gigafactories, fostering a localized supply chain (near-shoring). European demand emphasizes high efficiency, thermal robustness, and sustainable sourcing, often utilizing premium electrical steel grades and advanced laser-welding techniques for luxury and high-performance EV platforms. Regulatory pressure for domestic manufacturing capacity makes local expansion essential for core suppliers.

- North America (NA): The North American market, galvanized by the US Inflation Reduction Act (IRA) and similar regional policies, is undergoing rapid localization. The focus is shifting from importing finished cores and motors to establishing domestic stamping and assembly facilities, particularly in the US South and Midwest, close to planned EV assembly plants. Demand is characterized by a preference for robust cores suited for larger vehicle architectures (trucks, SUVs) and a high emphasis on securing a secure, domestic supply of necessary raw materials and components to comply with tax credit requirements. Mexico is also emerging as a key manufacturing hub due to logistics and competitive labor costs.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are in nascent stages of NEV adoption and motor core localization. Growth is slower but steady, primarily focused on establishing basic EV infrastructure and initial assembly operations, often utilizing imported cores or motors. Opportunities exist in countries initiating public transport electrification (e.g., electric buses in major LATAM cities) and for localized assembly catering to regional standards, focusing on durability and cost-effectiveness rather than cutting-edge efficiency improvements seen in APAC or Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Energy Vehicle Drive Motor Cores Market.- Puyang Huicheng Electronic Material Co., Ltd.

- JFE Steel Corporation

- ThyssenKrupp AG

- Sumitomo Metal Mining Co., Ltd.

- BENTELER Group

- POSCO

- Suzhou Goldengreen Technologies, Ltd.

- Mitsui Kinzoku Die-Casting Technology

- Changzhou Zhonghui Electric

- Tempel Steel Company

- Schuler Group (Equipment Supplier)

- Wuxi Huigong Automation Technology

- Foshan City Xinghui Precision Stamping

- Shandong Wina Green Power

- Sango Co., Ltd.

- Zhejiang Kaida Technology

- Nidec Corporation (Integrated Motor Manufacturer)

- Aisan Industry Co., Ltd.

- Precision Stamping Corporation

- VAMA (Valin ArcelorMittal Automotive)

- Arnold Magnetic Technologies

- ETEC E-Motor Cores

- Stamper & Die Inc.

- Laser Sintering Solutions GmbH

- Hitachi Metals, Ltd. (now part of Resonac)

Frequently Asked Questions

Analyze common user questions about the New Energy Vehicle Drive Motor Cores market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in NEV drive motor cores, and why is it crucial for performance?

The primary material is high-grade Non-Oriented Electrical Steel (NOES), specifically iron alloys enriched with silicon (typically 3% to 6%). This material is crucial because its isotropic magnetic properties and thin gauge minimize energy loss—both hysteresis loss and eddy current loss—during high-frequency operation. The reduction of core loss directly translates to improved motor efficiency, extended battery range, and reduced thermal stress on the motor components, which are essential metrics for modern NEVs.

How is the move toward 800V vehicle architectures impacting the design of motor cores?

The transition to 800V architectures necessitates much higher motor operating frequencies, significantly increasing the potential for eddy current losses within the core laminations. Consequently, manufacturers are forced to adopt ultra-thin laminations, often 0.20mm or thinner, and implement advanced electrically insulating coatings. This change demands highly specialized, high-precision stamping and bonding techniques to maintain the mechanical integrity of the stack while maximizing magnetic performance at higher switching speeds. Thermal management within the core is also becoming a critical design challenge.

What are Soft Magnetic Composites (SMCs), and how are they used in this market?

Soft Magnetic Composites (SMCs) are iron powder particles coated with an insulating layer, pressed and bonded into a solid core shape. Unlike traditional stamped steel laminations, SMCs allow for complex, three-dimensional magnetic flux paths, making them ideal for novel motor designs like axial flux motors. While currently exhibiting slightly higher core losses than premium NOES, SMCs offer design flexibility, excellent isotropy, and reduced manufacturing waste, positioning them as a specialized material solution for niche, high-density, or non-radial flux motor applications.

Which stacking technologies are replacing traditional riveting in high-performance motor cores?

High-performance cores are increasingly utilizing advanced bonding techniques such as laser welding and adhesive bonding (lamination bonding) to replace conventional riveting. Laser welding provides superior mechanical rigidity and high-volume throughput but requires careful control to avoid damaging magnetic properties. Adhesive bonding ensures high stack stiffness, reduces NVH (Noise, Vibration, and Harshness), and maintains the magnetic integrity across the entire surface by using an insulating resin, crucial for minimizing losses in high-frequency EV motors.

How do global electrification policies, such as the EU's mandates, influence regional motor core manufacturing investment?

Global electrification policies, such as the EU’s CO2 reduction targets and the US IRA, directly drive investment toward local manufacturing. These policies incentivize or mandate localized sourcing, forcing automotive OEMs and their suppliers (including motor core producers) to establish new or expand existing facilities within the respective economic zones (e.g., Europe and North America). This localization minimizes trade friction, secures the supply chain against geopolitical risks, and ensures compliance with regional content requirements necessary for consumer tax credits or regulatory targets, leading to massive capital deployment in new precision stamping capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager