Nickel Hydroxide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442674 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Nickel Hydroxide Market Size

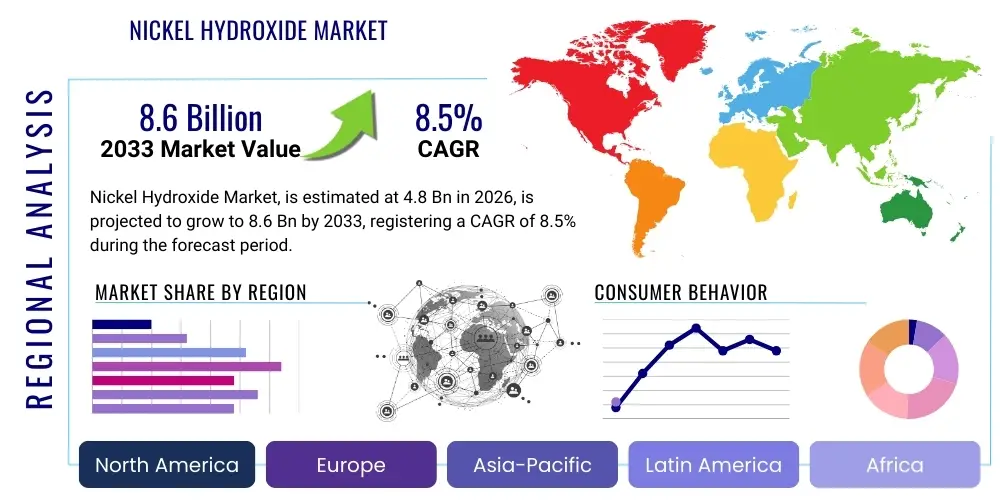

The Nickel Hydroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Nickel Hydroxide Market introduction

Nickel hydroxide (Ni(OH)2) is a critical precursor material fundamentally required in the manufacturing of high-performance cathode active materials (CAMs) for rechargeable batteries, particularly Nickel-Metal Hydride (NiMH) and advanced Lithium-ion batteries (Li-ion). Its stability, high specific capacity, and low self-discharge properties make it indispensable for energy storage applications demanding high energy density and long cycle life. The primary function of nickel hydroxide in Li-ion battery manufacturing is its conversion into precursors like Nickel Manganese Cobalt (NMC) and Nickel Cobalt Aluminum (NCA) oxides, which form the structural backbone of modern electric vehicle (EV) batteries and grid storage solutions. The escalating global push towards electrification across transportation and utility sectors is the dominant macro trend fueling the demand trajectory for high-purity nickel hydroxide, necessitating massive scale-up in specialized chemical production capacity worldwide.

The core product description centers around two main technical grades: spherical nickel hydroxide (SNEP) and high-power density pressed nickel hydroxide (HPP), each tailored for specific battery chemistries and performance requirements. SNEP is predominantly used in the preparation of cathode precursors due to its highly uniform particle size distribution and superior tap density, crucial for achieving optimal packing density in the final cathode structure. Major applications span far beyond automotive; they include portable electronics, industrial backup power systems, specialized aerospace batteries, and increasingly, stationary energy storage systems (ESS) designed to stabilize renewable energy integration into the grid. The intrinsic benefits of using nickel hydroxide include improved capacity retention at high temperatures, enhanced safety profiles compared to cobalt-heavy alternatives, and overall better performance characteristics essential for mission-critical applications.

Driving factors for this market expansion are multifaceted, encompassing stringent regulatory mandates globally promoting zero-emission vehicles, significant technological advancements leading to increased nickel content in cathode formulations (e.g., NMC 811 and beyond), and rapidly declining production costs for rechargeable battery packs. Furthermore, geopolitical strategies focused on energy independence and the increasing deployment of micro-grid solutions in developing economies contribute substantially to sustained nickel hydroxide consumption. The market is also benefiting from ongoing R&D efforts aimed at optimizing synthesis processes to produce ultra-high-purity material, thereby maximizing battery performance and longevity while addressing sustainability concerns related to raw material sourcing.

Nickel Hydroxide Market Executive Summary

The Nickel Hydroxide Market currently operates within a highly dynamic landscape characterized by intensive capital investments across the battery supply chain, volatile raw material pricing, and pronounced regional imbalances in production capability versus consumption demand. Key business trends indicate a significant consolidation among precursor and cathode manufacturers, driven by the necessity to secure long-term, high-volume supply agreements with nickel miners and refiners to mitigate price risk and ensure material traceability. Vertical integration is becoming a defining strategy, with large chemical companies and automotive OEMs increasingly investing in upstream nickel processing facilities or forming strategic joint ventures to lock in material flows, shifting the competitive focus from sheer volume to purity and sustainable sourcing certifications. Furthermore, the development of advanced recycling technologies focused on recovering nickel from end-of-life batteries is rapidly moving from pilot stage to commercial deployment, gradually introducing a critical secondary supply stream into the market dynamics.

Regional trends clearly highlight the Asia Pacific (APAC) region, specifically China, South Korea, and Japan, as the undisputed global hub for nickel hydroxide consumption and subsequent cathode production, largely due to established battery manufacturing infrastructure and dominant market share in EV production. However, North America and Europe are exhibiting accelerated growth rates, bolstered by massive governmental subsidies and mandates (such as the US Inflation Reduction Act and European Green Deal policies) designed to localize the battery supply chain and reduce reliance on APAC manufacturing. This localization effort is driving substantial Foreign Direct Investment (FDI) into new processing plants across Western geographies, creating regional market expansion opportunities but simultaneously introducing challenges related to environmental compliance and faster permitting processes. The emergence of Indonesia as a global nickel mining and refining powerhouse is reshaping the raw material landscape, increasing supply but also raising environmental concerns regarding refining methods.

Segmentation trends reveal that the Li-ion battery segment, particularly the high-nickel NMC category, remains the primary and fastest-growing end-use application, consistently demanding higher purity and more specialized forms of nickel hydroxide. While the traditional Nickel-Metal Hydride (NiMH) battery segment maintains stable demand in specific consumer electronics and hybrid vehicle applications, its growth rate is significantly outpaced by the EV sector. Within the Li-ion segment, the sub-segmentation based on manufacturing process—specifically chemical precipitation methods optimized for ultra-fine, homogeneous particles—is witnessing the highest innovation. Market growth is structurally linked to the global adoption rate of electric mobility, making the stability of long-term automotive production forecasts the single most influential factor determining future demand volumes and subsequent price movements in the nickel hydroxide precursor market.

AI Impact Analysis on Nickel Hydroxide Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Nickel Hydroxide market reveals key themes centered on supply chain optimization, advanced material discovery, and process efficiency. Users frequently inquire about how AI can stabilize the highly volatile price of nickel, predict sourcing bottlenecks, and accelerate the discovery of novel nickel-based cathode materials that require less cobalt or higher energy density. Concerns often revolve around the security implications of automated, AI-driven manufacturing plants and the initial capital investment required for implementing sophisticated predictive analytics across the supply chain. Expectations are high that AI, particularly machine learning (ML) algorithms, will fundamentally transform the synthesis process of nickel hydroxide, allowing manufacturers to achieve previously unattainable levels of purity and particle uniformity, which directly correlates to enhanced battery performance and longer lifespan.

The immediate and tangible influence of AI is most visible in optimizing the complex chemical synthesis process of nickel hydroxide. Traditional batch processes rely heavily on empirical testing and manual parameter adjustments, which are time-consuming and often result in variability. AI-driven process control systems utilize real-time sensor data—measuring pH, temperature, and concentration gradients—to dynamically adjust reaction conditions. This optimization minimizes impurities, maximizes yield, and ensures extremely tight tolerances on particle size distribution (PSD), which is crucial for high-performance cathode materials like NMC 811. By using ML models trained on historical production data, manufacturers can predict equipment failures, schedule maintenance proactively, and significantly reduce operational downtime, thereby improving the overall throughput and cost efficiency of nickel hydroxide production facilities.

Furthermore, AI is rapidly reshaping upstream sourcing and downstream logistics. Predictive models utilize vast datasets encompassing geological survey results, global commodity exchange rates, geopolitical stability indices, and transportation network status to provide highly accurate forecasts of nickel raw material availability and pricing volatility. This intelligence empowers nickel hydroxide producers to execute more strategic hedging and purchasing decisions, stabilizing their cost base and mitigating risks associated with supply disruptions. In the realm of material science, AI algorithms are employed to screen thousands of potential nickel-based compound formulations in silico, dramatically reducing the time and cost associated with laboratory R&D for developing next-generation precursors with superior electrochemical properties. This predictive R&D capability is essential for sustaining the pace of innovation required by the accelerating EV market.

- AI-driven optimization of chemical precipitation parameters (pH, temperature) for enhanced purity and particle size uniformity.

- Machine Learning (ML) algorithms deployed for predictive maintenance of reactors and processing equipment, minimizing unplanned downtime.

- Predictive supply chain analytics utilized to forecast nickel raw material price volatility and identify geopolitical sourcing risks.

- Accelerated discovery of novel high-nickel, low-cobalt cathode precursor chemistries through high-throughput virtual screening (in silico R&D).

- Automation of quality control and inspection processes using computer vision, ensuring consistent product specification adherence.

- Improved energy efficiency in refining and synthesis plants through AI-managed utility consumption and process flow optimization.

DRO & Impact Forces Of Nickel Hydroxide Market

The dynamics of the Nickel Hydroxide Market are governed by powerful driving forces centered around global decarbonization efforts, while simultaneously constrained by significant risks related to raw material extraction and environmental governance. The primary driver is the exponentially increasing global demand for electric vehicle batteries, necessitating ever-greater quantities of high-purity nickel content in cathode chemistry to achieve longer driving ranges and faster charging times. This demand surge is amplified by utility-scale energy storage deployments, where nickel-based batteries are preferred for their robust cycling stability and performance reliability, particularly in regulating intermittent renewable energy sources. These drivers create an impactful market environment where technological advancement in battery chemistry—specifically the industry migration towards NMC 811 and next-generation ultra-high nickel content batteries—directly translates into higher mandated specifications for nickel hydroxide precursor quality, driving innovation in processing technologies.

Restraints are dominated by the profound volatility and complexity of the global nickel supply chain. The extraction and refining of nickel are energy-intensive and geographically concentrated processes, making the market highly sensitive to geopolitical shifts, trade restrictions, and fluctuating commodity prices. Environmental, Social, and Governance (ESG) concerns pose a significant restraint, particularly surrounding the production of high-grade nickel intermediates (like Mixed Hydroxide Precipitate or MHP) derived from laterite ores, often involving energy-intensive and potentially pollutant-generating High-Pressure Acid Leaching (HPAL) techniques. This environmental scrutiny imposes higher regulatory burdens and increases operational costs, particularly for producers aiming to comply with Western sustainability standards and achieve traceability requirements demanded by major automotive OEMs, potentially slowing down capacity expansion in certain regions.

Opportunities within the market largely revolve around sustainable circular economy initiatives and strategic vertical integration. The critical need for raw material security fosters significant opportunities in battery recycling technology, specifically hydro- and pyrometallurgical routes designed to recover high-purity nickel hydroxide and its precursors from spent batteries. This establishes a localized, less geopolitically sensitive supply loop. Furthermore, ongoing research into developing advanced, lower-cost synthesis routes for nickel hydroxide, potentially utilizing greener energy sources and minimizing waste products, represents a pivotal opportunity for companies aiming for long-term competitive advantage. The accelerating trend of precursor manufacturers partnering directly with mining companies or battery cell producers to create closed-loop, integrated supply chains offers enhanced efficiency, reduced transportation costs, and greater control over product specifications, thereby stabilizing the overall market framework and mitigating external impact forces.

Segmentation Analysis

The Nickel Hydroxide Market is intricately segmented based on its technical specifications, manufacturing method, and diversified end-use applications, reflecting the varied requirements of the energy storage and specialty chemical sectors. The primary segmentation centers on the Purity Grade and the form factor (Type), as battery performance is extremely sensitive to chemical contaminants and particle morphology. High-purity nickel hydroxide, typically 99.9% or higher, is mandatory for advanced lithium-ion battery precursors, while lower grades may suffice for industrial catalysts or specialized plating applications. Understanding these segmentation nuances is crucial for strategic market positioning, as the high-purity segment commands significantly premium pricing and faces more stringent technical barriers to entry.

The segmentation by Application dominates the market structure, with rechargeable batteries—specifically NMC and NCA cathodes for EVs and ESS—consuming the vast majority of globally produced nickel hydroxide. This segment's exponential growth trajectory dictates overall market investment patterns, driving demand for nickel hydroxide capable of supporting high volumetric energy density and long cycle life required by the automotive sector. Secondary segments, including electroplating, chemical catalysis, and fuel cell research, maintain stable but relatively minor contributions to overall volume. The geographical segmentation further highlights the concentration of demand in Asia Pacific, driven by its established leadership in battery gigafactory deployment, contrasting with the rapidly expanding but currently smaller markets in North America and Europe which are focused on establishing localized supply resilience.

Manufacturing Method segmentation is also critical, differentiating between the traditional chemical precipitation process (primarily focused on optimizing pH and temperature control in aqueous solutions) and newer, often proprietary routes designed to achieve superior particle density and uniform spherical shape required for next-generation cathode precursors. The precision required for generating uniform spherical nickel hydroxide particles—which are critical for maximizing electrode density and minimizing internal resistance—drives intense competition in technological process development. Suppliers must continuously invest in process engineering to meet the evolving quality standards set by major battery manufacturers, ensuring their product maintains excellent specific surface area and particle size distribution consistency.

- By Type:

- Spherical Nickel Hydroxide Powder (SNEP)

- High Power Density Pressed Nickel Hydroxide (HPP)

- Non-Spherical Nickel Hydroxide

- By Purity Grade:

- Battery Grade (High Purity)

- Chemical Grade

- Industrial Grade

- By Application:

- Lithium-ion Batteries (NMC, NCA Precursors)

- Nickel-Metal Hydride (NiMH) Batteries

- Electroplating and Surface Treatment

- Catalysts (e.g., hydrogenation, polymerization)

- Specialty Chemicals and Pigments

- By End-Use Industry:

- Automotive (Electric Vehicles and Hybrid Vehicles)

- Consumer Electronics (Portable Devices)

- Energy Storage Systems (Grid and Utility Scale)

- Industrial Power (Backup and Stationary Power)

- Aerospace and Defense

Value Chain Analysis For Nickel Hydroxide Market

The value chain for the Nickel Hydroxide Market is complex, beginning with the upstream extraction of nickel ore and extending through sophisticated chemical processing and ultimately to the end-use battery manufacturer. The upstream segment involves the mining of primary nickel resources, predominantly sulfides (which are easier to refine to battery grade) and laterites (which require more complex High-Pressure Acid Leaching, HPAL, or pyrometallurgical routes to produce intermediates like Mixed Hydroxide Precipitate, MHP, or Nickel Matte). Securing stable and environmentally compliant sourcing of these raw materials is the foundational challenge in the value chain. The subsequent refining step converts these raw materials into high-purity nickel sulfate, which serves as the direct feedstock for nickel hydroxide synthesis. Bottlenecks at this refining stage, particularly due to the limited number of facilities capable of producing ultra-high purity nickel sulfate, significantly influence precursor supply stability and pricing.

The midstream stage is the core focus of the nickel hydroxide market, where specialty chemical manufacturers utilize precise chemical precipitation techniques—often proprietary—to convert nickel sulfate into spherical nickel hydroxide powder. This transformation step requires significant technological expertise, substantial capital investment in reaction vessels, and meticulous quality control to ensure uniform particle morphology and purity, essential prerequisites for cathode material synthesis. Distribution channels are highly specialized and often involve direct, long-term contracts between precursor manufacturers (the nickel hydroxide producers) and cathode active material (CAM) producers (e.g., Umicore, BASF, LG Chem subsidiaries). Given the high value and critical nature of the material, transactions are typically managed directly, minimizing the reliance on general chemical distributors.

The downstream segment involves the cathode active material production, where nickel hydroxide is combined with sources of lithium, cobalt, and manganese through calcination to form the final CAM powders (NMC, NCA). These CAMs are then sold to battery cell manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI) who integrate them into finished battery cells for application in EVs, ESS, and consumer electronics. The direct distribution channel dominates, characterized by tightly integrated relationships, confidentiality agreements, and specifications tailored to the needs of tier-one battery producers. Indirect distribution, involving general chemical traders, is marginal and typically reserved for lower-grade industrial or chemical applications, underscoring the strategic importance of direct supplier-buyer relationships in the high-purity battery segment.

Nickel Hydroxide Market Potential Customers

The primary consumers and buyers of nickel hydroxide are globally recognized chemical companies specializing in cathode active material (CAM) production, which forms the vital link between raw material refining and battery cell manufacturing. These potential customers require consistently high volumes of ultra-high-purity spherical nickel hydroxide powder to maintain the integrity and performance of their lithium-ion battery precursors, such as NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum). Major buyers include global giants like Umicore, BASF, POSCO Future M, L&F, and various subsidiaries of large South Korean and Chinese chemical conglomerates who supply the world’s leading battery gigafactories. Their procurement decisions are driven primarily by material purity, consistency of particle size distribution, and the supplier's capacity to guarantee long-term, stable, and traceable supply streams, particularly in light of increasing scrutiny on ethical sourcing practices.

A secondary, yet substantial, segment of potential customers includes traditional battery manufacturers that still utilize Nickel-Metal Hydride (NiMH) technology, mainly for specialized industrial applications, backup power systems, and select hybrid electric vehicles (HEVs) that do not yet utilize full Li-ion powertrains. These customers, while requiring high purity, may tolerate slightly different morphological specifications compared to the strict requirements of advanced EV lithium-ion batteries. Furthermore, specialty chemical companies utilizing nickel hydroxide as a highly effective catalyst in various industrial chemical processes, such as hydrogenation, polymerization, and certain organic syntheses, form another customer base. Their purchasing criteria often prioritize specific crystallographic structures or surface area characteristics suitable for catalytic activity, rather than the spherical shape crucial for dense electrode packing.

Finally, emerging potential customers include organizations focused on battery recycling, as they transition to large-scale hydro- and pyrometallurgical processes to recover nickel from end-of-life batteries. While currently acting as both a customer (purchasing spent batteries) and a producer (supplying recovered nickel sulfate), these recycling entities will eventually become crucial indirect customers for primary nickel hydroxide producers, as they integrate recovered material back into the supply chain or sell their recycled nickel sulfate to traditional hydroxide manufacturers. Given the global impetus towards sustainable sourcing, automotive original equipment manufacturers (OEMs) are increasingly acting as powerful influencers—if not direct purchasers—by imposing strict quality, sustainability, and transparency requirements on their entire battery supply chain, thereby dictating the specifications and choice of preferred nickel hydroxide suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Metal Mining Co., Ltd., Tanaka Chemical Corporation, Jinchuan Group Co., Ltd., Jiyuan Nickel Industry, Huayou Cobalt Co., Ltd., Jilin Jien Nickel Industry Co., Ltd., Eramet Group, Vale S.A., Nicomet Industries Limited, Hunan Shanshan Advanced Materials Co., Ltd., SNAM S.p.A., Jiangsu Changqing Technology Co., Ltd., Zhejiang Huayou Cobalt Co., Ltd., Norilsk Nickel, BHP Group, Glencore plc, GEM Co., Ltd., Tinci Materials, Qingdao Huafei Nickel Cobalt, Shiga Battery Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel Hydroxide Market Key Technology Landscape

The technological landscape of the Nickel Hydroxide market is primarily defined by highly specialized chemical engineering processes aimed at achieving superior morphological control, critical for optimal battery performance. The core technology centers around continuous chemical co-precipitation (or chemical precipitation) from nickel sulfate solutions. The key innovation within this established technique involves ultra-precise control of reaction parameters, including reactor geometry, stirring speed, flow rates, temperature profiles, and reagent addition timing. Advanced manufacturers utilize sophisticated crystallization kinetics modeling and computational fluid dynamics (CFD) simulations to ensure highly uniform nucleation and growth of spherical particles. This rigorous control is necessary to produce Spherical Nickel Hydroxide Powder (SNEP) with monodisperse particle size distribution (PSD) and high tap density, which maximizes the volumetric energy density of the resulting cathode material.

A second crucial technological advancement lies in the integration of nickel hydroxide synthesis with the upstream refining process and the subsequent downstream cathode precursor manufacturing. Many leading companies are adopting integrated production lines where high-purity nickel sulfate derived from refined nickel matte or MHP is immediately fed into the hydroxide precipitation reactors. This integration minimizes contamination risks associated with external transport and storage, significantly improving the overall chemical purity and reducing production costs. Furthermore, the development of proprietary doping technologies, where minor elements like aluminum or manganese are incorporated during the precipitation phase, allows producers to tailor the nickel hydroxide structure to enhance the thermal stability and cyclability of the final cathode material, addressing critical safety and longevity concerns in high-performance EVs.

Furthermore, sustainable production technologies are rapidly gaining prominence. This includes the deployment of advanced filtration and recycling systems within the manufacturing plant to treat and reuse process water and minimize the generation of effluent waste. Another emerging technological front involves optimizing recovery processes from recycled batteries. Hydro- and pyrometallurgical recycling routes are being refined to efficiently yield high-purity nickel sulfate suitable for direct use in the precipitation process, minimizing the energy and environmental footprint compared to virgin mining. The implementation of real-time spectroscopic analysis and AI-driven quality assurance systems throughout the production line represents the pinnacle of technological sophistication, ensuring every batch meets the exacting standards required by Tier 1 battery cell manufacturers who demand zero defects in their precursor materials.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Nickel Hydroxide Market, driven by the presence of major global battery manufacturers (e.g., in China, South Korea, and Japan) and the highest concentration of EV production and gigafactories globally. China is both the largest producer and consumer, utilizing advanced co-precipitation techniques. The region also benefits from resource-rich countries like Indonesia, which is rapidly scaling up nickel refining capacity to supply precursors, although often utilizing processes that face increasing environmental scrutiny.

- North America: Exhibits the highest projected CAGR, fueled by massive government incentives (e.g., Inflation Reduction Act) aimed at localizing the battery supply chain and reducing reliance on foreign imports. Significant investments are flowing into new precursor manufacturing facilities in the US and Canada, creating a robust, rapidly maturing market focused on high-specification, domestically sourced materials to meet strict content requirements for automotive tax credits.

- Europe: Characterized by strong regulatory push for sustainability (EU Green Deal) and the rapid establishment of large-scale battery production capacity (Battery Valley initiatives). European demand is focused on securing traceable, ethically sourced nickel hydroxide, prioritizing suppliers who can demonstrate low carbon footprints and transparent supply chains, driving investment into advanced recycling and cleaner processing technologies within the continent.

- Latin America: Important primarily as a source of raw materials, particularly through nickel mining operations in countries like Brazil. The region's market for finished nickel hydroxide remains smaller, relying heavily on imports, but its strategic importance is rising due to its critical role in the upstream supply of nickel sulfate feedstocks to global precursor manufacturers.

- Middle East and Africa (MEA): Currently a smaller market in terms of consumption but gaining strategic significance due to potential nickel reserves and investments in processing infrastructure, particularly aimed at supplying emerging local energy storage projects and supporting global supply chain diversification efforts away from established regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel Hydroxide Market.- Sumitomo Metal Mining Co., Ltd.

- Tanaka Chemical Corporation

- Jinchuan Group Co., Ltd.

- Jiyuan Nickel Industry

- Huayou Cobalt Co., Ltd.

- Jilin Jien Nickel Industry Co., Ltd.

- Eramet Group

- Vale S.A.

- Nicomet Industries Limited

- Hunan Shanshan Advanced Materials Co., Ltd.

- SNAM S.p.A.

- Jiangsu Changqing Technology Co., Ltd.

- Zhejiang Huayou Cobalt Co., Ltd.

- Norilsk Nickel

- BHP Group

- Glencore plc

- GEM Co., Ltd.

- Tinci Materials

- Qingdao Huafei Nickel Cobalt

- Shiga Battery Materials

Frequently Asked Questions

Analyze common user questions about the Nickel Hydroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand increase for Nickel Hydroxide?

The primary driver is the explosive growth in the global production of Lithium-ion batteries, specifically the shift toward high-nickel cathode chemistries (NMC 811 and NCA) required for electric vehicles (EVs) and utility-scale energy storage systems (ESS). These applications demand extremely high energy density and long cycle life, which is facilitated by nickel-rich precursors.

How does the purity of Nickel Hydroxide impact battery performance?

High purity (typically >99.9%) is non-negotiable for battery-grade nickel hydroxide. Even trace impurities can severely degrade electrochemical performance, leading to accelerated capacity fade, increased internal resistance, and reduced thermal stability. Strict control over contaminants is essential for manufacturing durable and safe cathode active materials.

What are the main risks associated with the Nickel Hydroxide supply chain?

The main risks include extreme volatility in the price of raw nickel commodities, geopolitical instability in key mining regions, and significant logistical challenges in transporting high-volume precursor materials. Additionally, increased environmental, social, and governance (ESG) scrutiny regarding the sustainability and ethical sourcing of nickel poses a major operational and reputational risk to the entire supply chain.

Which regions dominate the production and consumption of Battery Grade Nickel Hydroxide?

Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates both the consumption and sophisticated manufacturing of battery-grade nickel hydroxide due to established leadership in cathode and battery cell production. However, North America and Europe are rapidly increasing localized production capacity due to strategic policies promoting supply chain self-sufficiency.

What is the role of Spherical Nickel Hydroxide Powder (SNEP) in advanced battery manufacturing?

SNEP is critical because its uniform spherical morphology and high tap density allow for optimal packing within the electrode structure. This maximizes the volumetric energy density of the resulting cathode and minimizes internal impedance, which translates directly into longer EV driving ranges and higher charging efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager