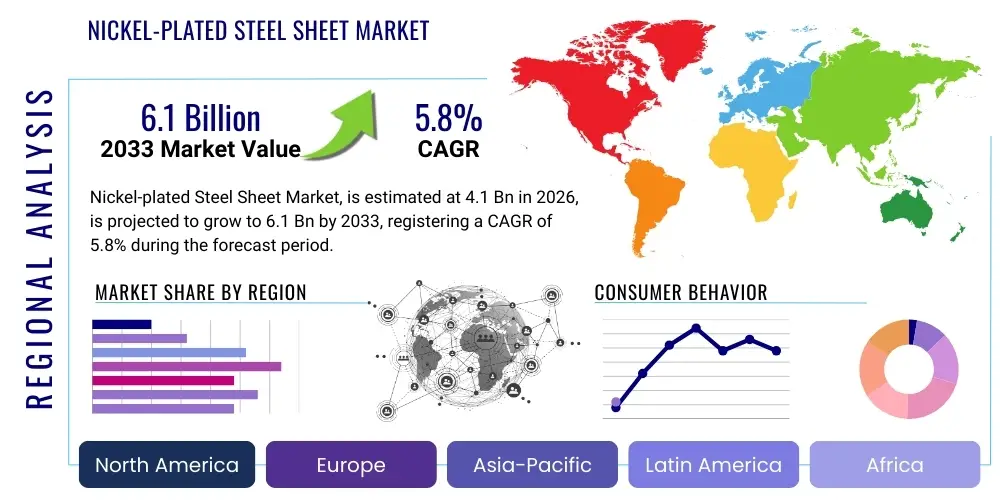

Nickel-plated Steel Sheet Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441328 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Nickel-plated Steel Sheet Market Size

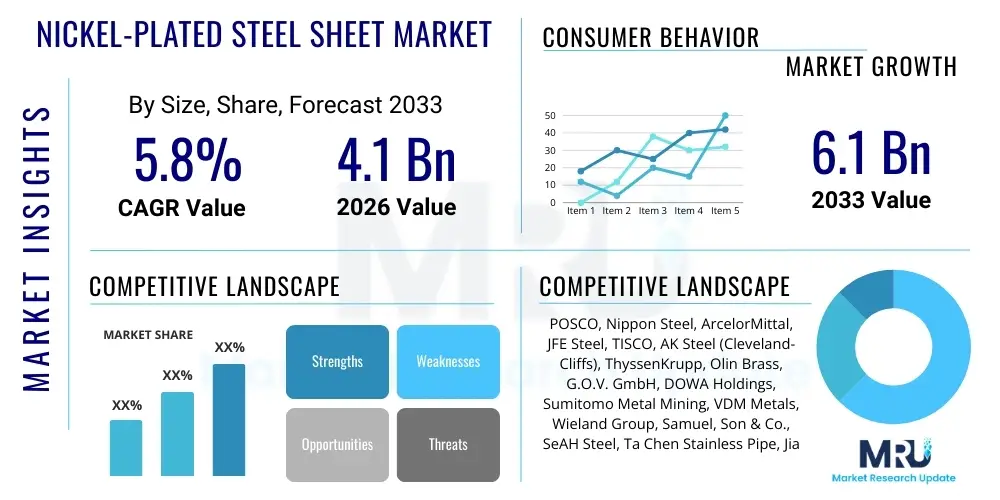

The Nickel-plated Steel Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating global demand for high-performance rechargeable batteries, particularly within the electric vehicle (EV) and consumer electronics sectors. Nickel-plated steel sheets are critical components in battery casings and connectors, providing superior corrosion resistance, excellent conductivity, and mechanical integrity essential for long-term reliability and safety.

Nickel-plated Steel Sheet Market introduction

The Nickel-plated Steel Sheet Market encompasses the production, distribution, and consumption of thin steel substrate materials coated with a layer of pure or alloyed nickel. This composite material leverages the mechanical strength and cost-effectiveness of steel with the advanced surface properties of nickel, including exceptional corrosion and oxidation resistance, good electrical conductivity, and high solderability. Nickel plating enhances the lifespan of the steel base, making it suitable for demanding applications where durability and precise electrical performance are paramount. The plating process often utilizes advanced techniques such as electroplating or vacuum deposition to ensure uniform thickness and optimal adhesion, tailoring the product specifically to stringent industry specifications, especially those required by the battery and electronic manufacturing sectors.

Product description highlights the versatility of these sheets, which typically range in thickness and composition depending on the end-use application. Low-carbon steel is commonly used as the substrate due to its ductility and cost profile, while the nickel layer provides the functional surface properties. Major applications span a wide array of industries. In the electronics sector, these sheets are indispensable for electromagnetic shielding, chassis components, and specialized connectors where stable electrical grounding is mandatory. Furthermore, their application in consumer goods, such as household appliances and hardware, relies on their resistance to wear and tear and their aesthetically pleasing, durable finish, ensuring product longevity and consumer satisfaction across diverse product categories.

The primary benefit driving the market growth is the unique combination of structural integrity and functional surface characteristics offered by nickel-plated steel. The corrosion resistance is vital for battery casings, preventing premature failure due to internal chemical reactions or external environmental exposure, thus guaranteeing the safety and performance of electric vehicles and portable devices. Key driving factors fueling this market expansion include the exponential growth of the global electric vehicle industry, substantial investments in 5G and IoT infrastructure requiring advanced electronic components, and increasing regulatory emphasis on sustainable and durable material use across industrial and consumer sectors. These macro trends solidify the position of nickel-plated steel as a material of choice for future technological advancements requiring high reliability.

Nickel-plated Steel Sheet Market Executive Summary

The Nickel-plated Steel Sheet Market is characterized by robust business trends centered around technological refinement, capacity expansion focused on high-specification materials, and strategic supply chain consolidation to meet burgeoning demand from the energy storage sector. Companies are heavily investing in specialized plating technologies, particularly continuous coil plating and high-speed electroplating, to enhance production efficiency, reduce waste, and improve the uniformity and adhesion quality of the nickel layer, which is critical for lithium-ion battery production tolerances. Furthermore, there is a distinct trend toward developing nickel-plated steel alloys optimized for higher thermal resistance and enhanced deep-drawing capabilities, catering to complex battery housing geometries required by next-generation EV platforms, thereby positioning manufacturers who achieve these technical milestones for significant competitive advantage and market share gains.

Regional trends indicate that the Asia Pacific (APAC) region, driven predominantly by China, South Korea, and Japan, maintains its dominant market position, largely due to its concentrated manufacturing base for electric vehicles, batteries, and advanced electronics. APAC leads not only in consumption but also in production capacity, acting as the global hub for raw material processing and finished sheet manufacturing. However, North America and Europe are exhibiting accelerating growth, fueled by substantial governmental incentives supporting localized battery gigafactory construction and supply chain resilience initiatives aimed at reducing dependence on Asian imports. The establishment of large-scale domestic production facilities in these Western regions is creating significant opportunities for local suppliers of specialized steel and plating services, necessitating rapid technology transfer and localized infrastructure development to meet the exacting quality standards demanded by tier-one automotive and battery manufacturers.

Segmentation trends highlight the overwhelming influence of the Battery Shells segment, which is expected to register the fastest growth rate and account for the largest market share throughout the forecast period. The transition from internal combustion engines (ICE) to electric mobility underpins this growth, demanding enormous volumes of highly reliable, dimensionally consistent nickel-plated steel for prismatic and cylindrical cell casings. Material thickness segmentation also shows increasing preference for thinner gauge sheets (0.1mm to 0.5mm) as manufacturers strive to minimize weight and maximize energy density in portable electronics and lightweight EV applications. Simultaneously, the market is observing segmentation growth in specialized high-frequency electronic shielding applications, demanding materials with specific magnetic permeability and plating uniformity to manage electromagnetic interference (EMI) effectively in complex modern devices.

AI Impact Analysis on Nickel-plated Steel Sheet Market

Common user questions regarding AI's influence typically revolve around how artificial intelligence can optimize the complex plating process, reduce material defects, and forecast highly volatile raw material pricing, specifically for nickel and steel. Users seek clarity on AI's role in predictive maintenance for massive rolling mills and plating lines, ensuring minimal downtime and maximizing throughput efficiency. Furthermore, there is significant interest in utilizing machine learning algorithms for supply chain management, optimizing inventory levels of high-purity nickel input and mitigating risks associated with geopolitical supply disruptions. The key themes summarized from user inquiries point towards AI as a transformative tool for achieving higher quality consistency, greater operational efficiency, and enhanced resilience against external market volatility in the production of nickel-plated steel sheets, moving the industry towards highly automated, data-driven manufacturing paradigms.

- AI optimizes electroplating parameters (current density, temperature, duration) in real-time, ensuring superior plating uniformity and adhesion, reducing costly defect rates.

- Machine learning models analyze sensor data from rolling and plating lines to predict equipment failure (predictive maintenance), significantly minimizing unscheduled downtime.

- AI-driven demand forecasting improves inventory management for nickel and steel inputs, stabilizing production schedules amidst fluctuating battery manufacturing requirements.

- Computer vision systems utilize AI for high-speed surface inspection, identifying micro-cracks or plating imperfections invisible to human operators, enhancing quality control standards.

- Algorithmic modeling assists in optimizing energy consumption during high-intensity electroplating processes, contributing to lower operational costs and a reduced carbon footprint for manufacturers.

DRO & Impact Forces Of Nickel-plated Steel Sheet Market

The market for Nickel-plated Steel Sheets is shaped by a critical balance of influential factors, collectively categorized as Drivers, Restraints, and Opportunities (DRO), which dictate its growth trajectory and competitive landscape. The primary driver is the accelerating electrification of the automotive sector, creating an insatiable demand for standardized, corrosion-resistant materials for lithium-ion battery casings. This demand forces continuous innovation in plating quality and manufacturing scale. However, significant restraints include the extreme volatility and high costs associated with primary nickel, a key input material, which subjects manufacturers to considerable price fluctuations and necessitates sophisticated hedging strategies. Simultaneously, the opportunities lie in developing advanced plating methodologies that improve bonding strength and longevity, and expanding applications into non-traditional sectors such as renewable energy infrastructure and advanced medical devices, demanding materials with extremely high purity and reliability standards.

Drivers compelling market expansion include technological advancements in battery design, particularly the shift towards higher-energy-density cells that require enhanced sealing and corrosion protection features, making nickel-plated steel an ideal protective barrier. The stringent performance requirements set by global automotive Original Equipment Manufacturers (OEMs) regarding material consistency and mechanical properties further accelerate the adoption of high-quality plated steel products. Moreover, regulatory mandates in key markets promoting e-mobility and energy storage solutions indirectly stimulate demand for the foundational components like these specialized sheets, reinforcing their status as a critical supply chain element necessary for achieving global decarbonization goals and sustainable energy transitions across utility and transportation sectors.

Restraints hindering exponential growth encompass not only raw material price instability but also the complexities inherent in the manufacturing process, where maintaining uniform plating thickness across large coils requires immense capital investment and highly skilled technical expertise. Furthermore, emerging competition from alternative materials, such as specialized aluminum alloys or advanced composites being explored for lightweighting battery casings, poses a long-term threat to market share, particularly in high-performance or ultra-lightweight vehicle segments. The operational hurdles related to disposing of or recycling the plating chemicals used in electroplating processes also contribute to heightened regulatory scrutiny and operational costs, mandating continuous investment in sustainable manufacturing practices and waste minimization technologies to maintain economic viability and environmental compliance.

The impact forces influencing the market are multifaceted, combining macro-economic trends with micro-level material science breakthroughs. High bargaining power of large battery manufacturers (buyers) dictates prices and quality standards, forcing suppliers into tight margin environments and demanding relentless quality consistency. Simultaneously, the power of nickel suppliers (sellers) remains moderate to high due to oligopolistic market structures for high-purity, battery-grade nickel, creating upstream supply vulnerability. Competitive rivalry within the plated steel sheet manufacturing segment is intense, characterized by large integrated steel producers and specialized plating houses competing fiercely on scale, technical capability, and reliable delivery logistics. These forces necessitate continuous process optimization and strategic partnerships throughout the value chain to sustain growth and mitigate risks effectively.

Segmentation Analysis

The Nickel-plated Steel Sheet Market is segmented based on critical characteristics including thickness, plating method, and end-use application, providing a granular view of demand patterns and technological requirements across various industrial domains. Segmentation by application is crucial, as the performance requirements for an electric vehicle battery casing are vastly different from those needed for simple consumer electronics shielding, influencing the required material composition, plating thickness, and quality control protocols. The analysis reveals distinct pockets of high growth, particularly within the energy storage and electric mobility sectors, which are driving the need for thinner, higher-quality sheets capable of resisting harsh chemical and thermal environments, while also demanding materials that meet extremely tight geometric tolerances for automated assembly processes.

The segmentation by plating method, encompassing electroplating, vacuum plating, and hot dip plating, reflects the trade-offs between cost, volume, and surface integrity. Electroplating dominates the market due to its scalability and ability to achieve precise thickness control necessary for electronic and battery applications, despite the environmental challenges associated with chemical waste management. Conversely, alternative methods like vacuum plating, though higher in cost, are gaining traction for niche, ultra-high-purity applications where absolutely zero defects and superior adhesion are non-negotiable prerequisites. Understanding these segmented technological preferences allows manufacturers to tailor their production lines and investment strategies effectively to capture specific market shares.

Furthermore, geographic segmentation provides critical insights into regional demand dynamics, with Asia Pacific leading in overall volume due to concentrated manufacturing activities, and North America and Europe accelerating their self-sufficiency efforts. The competitive landscape is increasingly segmented between high-volume commodity producers serving general construction and consumer goods, and highly specialized manufacturers catering exclusively to the stringent quality and certification requirements of the automotive battery and medical device industries. Future market strategies must therefore be highly targeted, focusing on continuous innovation in the highest growth segments to ensure long-term profitability and alignment with global industrial shifts toward electrification and advanced electronics integration.

- By Thickness:

- Thin Sheet (0.1mm - 0.5mm)

- Medium Sheet (0.5mm - 1.5mm)

- Thick Sheet (> 1.5mm)

- By Application:

- Battery Shells (Lithium-ion)

- Electronics (Shielding and Components)

- Automotive Components (Non-battery specific)

- Construction Materials

- Consumer Goods and Hardware

- By Plating Method:

- Electroplating

- Vacuum Plating (PVD/CVD)

- Hot Dip Plating

Value Chain Analysis For Nickel-plated Steel Sheet Market

The value chain for the Nickel-plated Steel Sheet Market commences with the highly complex upstream analysis, involving the extraction and refinement of raw materials, specifically high-purity nickel and various grades of steel coil. Nickel sourcing is critical, dominated by major global mining and smelting operations, often subject to geopolitical risks and price volatility. Steel production, typically involving integrated steel mills or mini-mills, provides the foundational substrate, demanding specific chemical compositions and mechanical properties (e.g., ductility for deep drawing). The primary challenge upstream lies in securing a stable, cost-effective supply of battery-grade nickel sulfate or high-purity nickel metal suitable for plating processes, as quality discrepancies at this stage directly impact the final sheet performance and manufacturing yield rates downstream.

The midstream phase focuses on the specialized manufacturing process: the plating operation itself. This involves integrated steel companies or dedicated service providers who transform raw steel coils into nickel-plated sheets using sophisticated continuous processing lines, predominantly employing electroplating technology. This stage requires significant capital investment in specialized equipment, strict adherence to quality control for plating thickness, adhesion, and surface finish, and management of hazardous chemical waste. Distribution channels, both direct and indirect, then handle the movement of the finished product. Direct distribution involves large-volume sales to tier-one battery manufacturers or major automotive component suppliers, requiring robust logistics and just-in-time delivery capabilities. Indirect channels utilize specialized metal distributors and service centers who cut, slit, and tailor the sheets to meet the smaller, diverse requirements of electronics and general manufacturing end-users, adding essential processing value before the final sale.

Downstream analysis centers on the utilization of the sheets by the end-users, principally the battery manufacturing sector, where the plated steel is formed into cylindrical or prismatic cell casings under extremely precise manufacturing tolerances. Other significant downstream users include electronics companies utilizing the material for shielding or connectors, and general industry users for various corrosive environments. The efficiency and reliability of the value chain are increasingly assessed based on sustainability metrics, with pressure growing on all participants—from nickel miners to platers—to demonstrate responsible sourcing, energy efficiency, and effective material recycling programs. The tight integration required between sheet suppliers and battery producers, especially in terms of quality auditing and specification adherence, underscores the criticality of strategic, long-term partnerships throughout the entire value chain.

Nickel-plated Steel Sheet Market Potential Customers

The primary cohort of potential customers for the Nickel-plated Steel Sheet Market comprises manufacturers operating within the energy storage and electric mobility ecosystem. Specifically, this includes major global producers of lithium-ion batteries, who require vast quantities of high-precision, corrosion-resistant plated steel for the structural integrity and electrical functionality of their cell casings, terminal connections, and safety vents. These buyers are typically tier-one global conglomerates such as CATL, LG Energy Solution, Samsung SDI, and Northvolt, whose purchasing power and stringent quality demands significantly influence pricing and technological development within the plating industry. They necessitate materials that can withstand aggressive chemical environments over long lifecycles while also supporting high-speed stamping and deep-drawing processes without fracturing or plating degradation.

A second major category includes the electronics and communication equipment manufacturers. These companies utilize nickel-plated steel for electromagnetic interference (EMI) shielding in complex devices like servers, 5G base stations, and high-end consumer electronics, where reliable signal integrity and grounding are essential. Unlike the battery sector which demands deep-drawing quality, the electronics sector often focuses on thinner gauges and specific magnetic properties of the plating layer to maximize shielding efficiency. Key buyers here range from major telecommunications infrastructure providers to consumer device OEMs, who value the material's cost-effectiveness compared to other shielding materials like pure nickel or specialized alloys, provided the corrosion resistance meets their long-term operational needs.

Finally, a diversified customer base exists within the general manufacturing, automotive component, and construction industries. This includes suppliers of specialized fasteners, household appliances, plumbing fixtures, and general automotive parts (excluding battery components). These end-users prioritize the material’s resistance to general wear, aesthetically pleasing finish, and resistance to environmental corrosion, often utilizing medium to thick gauge sheets. While their individual consumption volumes may be lower than those of the battery giants, this segment provides market stability and diversifies the risk portfolio for nickel-plated steel manufacturers, supporting broad market demand across various economic cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | POSCO, Nippon Steel, ArcelorMittal, JFE Steel, TISCO, AK Steel (Cleveland-Cliffs), ThyssenKrupp, Olin Brass, G.O.V. GmbH, DOWA Holdings, Sumitomo Metal Mining, VDM Metals, Wieland Group, Samuel, Son & Co., SeAH Steel, Ta Chen Stainless Pipe, Jiangsu Changbao Steel Tube, Zhejiang Huahai Stainless Steel, Hengshui Ruitong, Wuxi Huacheng. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel-plated Steel Sheet Market Key Technology Landscape

The technological landscape of the Nickel-plated Steel Sheet Market is primarily defined by advancements in continuous coil processing and high-speed electroplating techniques, aimed at achieving superior plating quality, consistency, and reduced environmental impact. The dominant technology remains automated continuous electroplating, which involves running large coils of steel through various cleaning, activation, and plating baths. Recent innovations focus heavily on pulse plating technology, which uses pulsed direct current instead of continuous current to deposit nickel. This technique allows for better control over the grain structure of the nickel deposit, resulting in a finer, more ductile, and less porous coating, which is crucial for applications requiring extreme deep drawing or highly corrosive resistance, such as those found in critical battery components, thereby significantly enhancing product lifespan and reducing failure rates in demanding operational environments.

Beyond traditional electroplating, emerging and niche technologies are playing an increasing role, particularly in high-specification sectors. Vacuum plating techniques, specifically Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), are utilized where exceptionally high purity and ultra-thin, dense coatings are mandatory, typically for advanced microelectronics or specialized sensor components. Although these methods are generally slower and more capital-intensive than electroplating, they offer unparalleled control over material deposition at the atomic level, ensuring functional superiority for highly sensitive applications. Furthermore, hybrid plating processes that combine an initial nickel flash layer with subsequent protective layers or alloy depositions are gaining traction, allowing manufacturers to optimize the sheet for specific dual-functionality requirements, such as enhanced solderability combined with magnetic shielding capabilities, expanding the utility and market reach of the final product.

A critical area of technological focus also includes surface preparation and post-treatment processes. Innovations in degreasing, pickling, and activation steps are essential prerequisites for optimal nickel adhesion, preventing blistering and flaking during subsequent stamping or forming operations. In terms of sustainability, advancements in closed-loop chemical recycling systems and minimizing effluent discharge from electroplating baths represent a significant technological priority. Companies investing in these environmental technologies not only comply with increasingly stringent global regulations but also achieve operational cost savings through reduced chemical consumption and waste treatment overhead, leading to a more competitive and environmentally responsible manufacturing profile in a highly scrutinized global supply chain environment.

Regional Highlights

The global Nickel-plated Steel Sheet Market exhibits distinct regional consumption and production characteristics, deeply influenced by the localized maturity of the electric vehicle and electronics manufacturing sectors.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share in both production capacity and consumption. This dominance is intrinsically linked to the concentration of major battery gigafactories (primarily in China, South Korea, and Japan) and the world's largest consumer electronics manufacturing hub. The demand here is overwhelming for high-quality, high-volume sheets tailored for lithium-ion battery casings (cylindrical and prismatic cells). The region benefits from established upstream supply chains for steel and nickel processing, providing a cost and logistics advantage that is difficult for other regions to match in the short term.

- North America: Emerging as the fastest-growing market, driven by significant government policy support (like the Inflation Reduction Act in the US) aimed at localizing EV and battery production. Substantial investments in domestic battery manufacturing capacity are fueling an urgent demand for reliable, domestic suppliers of nickel-plated steel. The region’s growth is characterized by a focus on integrating advanced, highly automated plating technologies to meet stringent quality requirements and achieve rapid scalability necessary for tier-one automotive contracts.

- Europe: Represents a mature yet rapidly expanding market, motivated by the aggressive European Union mandates for phasing out fossil fuel vehicles and promoting energy independence. Germany, France, and Nordic countries are central to the demand, driven by automotive OEMs and new large-scale battery producers establishing operations. European manufacturers focus heavily on sustainable sourcing, low-carbon steel substrates, and highly efficient, environmentally compliant plating processes to align with regional Green Deal objectives and maintain competitive edge in a highly regulated market environment.

- Latin America & Middle East/Africa (LAMEA): These regions currently hold a smaller market share, primarily driven by localized infrastructure projects, general consumer goods manufacturing, and small-scale automotive component assembly. However, future growth potential lies in the gradual development of localized renewable energy storage projects and increasing adoption of light electric vehicles, necessitating specialized material supply, although currently much of the high-specification product is imported from established Asian or European supply bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel-plated Steel Sheet Market.- POSCO

- Nippon Steel

- ArcelorMittal

- JFE Steel

- TISCO (Taiyuan Iron and Steel)

- AK Steel (Cleveland-Cliffs)

- ThyssenKrupp

- Olin Brass

- G.O.V. GmbH

- DOWA Holdings

- Sumitomo Metal Mining

- VDM Metals

- Wieland Group

- Samuel, Son & Co.

- SeAH Steel

- Ta Chen Stainless Pipe

- Jiangsu Changbao Steel Tube

- Zhejiang Huahai Stainless Steel

- Hengshui Ruitong

- Wuxi Huacheng

Frequently Asked Questions

Analyze common user questions about the Nickel-plated Steel Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Nickel-plated Steel Sheet?

The exponential growth of the global electric vehicle (EV) market and subsequent massive demand for lithium-ion battery cells, which require nickel-plated steel for highly corrosion-resistant and durable casings, is the primary market driver.

How does raw material volatility affect the profitability of the Nickel-plated Steel Sheet Market?

High volatility in the price of raw nickel, a critical component, significantly affects manufacturing costs and profitability. Producers must implement sophisticated hedging and long-term procurement strategies to stabilize input costs and manage pricing risk effectively against fluctuating global metal commodity markets.

Which plating method is most commonly used for high-volume battery applications?

Continuous high-speed electroplating is the most common method for high-volume applications like battery casings due to its scalability, efficiency, and ability to achieve the required precision in nickel thickness and uniformity across large steel coils.

In which geographical region is the largest consumption market concentrated?

Asia Pacific (APAC), particularly driven by manufacturing hubs in China, South Korea, and Japan, holds the largest market share in consumption, primarily due to the established concentration of battery and consumer electronics production facilities in the region.

What are the key technical advantages of using nickel-plated steel over alternative materials for battery shells?

Nickel-plated steel offers an optimal combination of mechanical strength (from steel) and superior corrosion resistance, excellent electrical conductivity, and high solderability (from nickel plating), which are essential for long-term safety and performance in demanding battery environments, often at a competitive cost compared to full stainless steel or specialized aluminum.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager