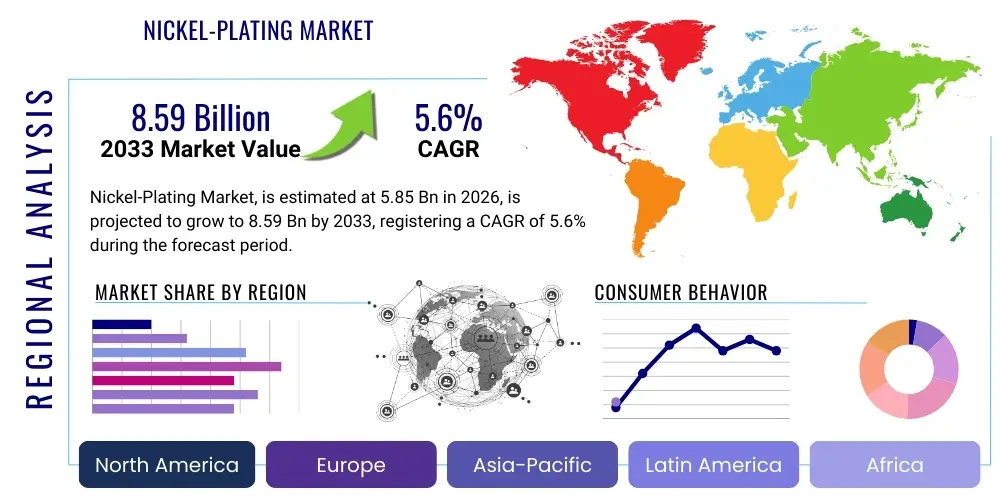

Nickel-Plating Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443238 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Nickel-Plating Market Size

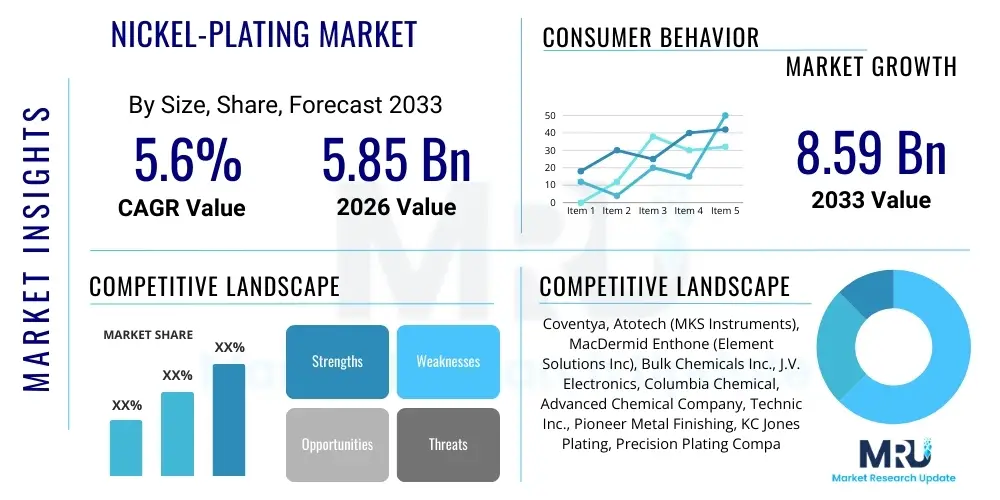

The Nickel-Plating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.60% between 2026 and 2033. The market is estimated at USD 5.85 Billion in 2026 and is projected to reach USD 8.59 Billion by the end of the forecast period in 2033.

Nickel-Plating Market introduction

The Nickel-Plating Market encompasses the deposition of a layer of nickel onto a substrate, typically for enhanced corrosion resistance, wear protection, aesthetic appeal, or specific magnetic and electrical properties. Nickel plating is a mature yet technologically evolving surface finishing technique, primarily utilized across demanding industrial sectors. The market is characterized by diverse processes, including electrolytic nickel plating, electroless nickel plating (EN), and specialized techniques such as electroforming, each catering to distinct performance requirements and substrate materials.

Nickel-plated products are foundational components in numerous high-value applications. Major application areas include the automotive industry, where nickel coatings are crucial for engine components, fasteners, and decorative trim; the electronics sector, where they provide conductivity and solderability for connectors and PCBs; and the aerospace and defense sectors, demanding high-performance coatings for critical parts exposed to extreme conditions. The inherent benefits of nickel plating—superior hardness, ductility, and magnetic shielding capabilities—sustain its dominant position over alternative metallic coatings in many engineering specifications.

Driving factors for market expansion include the burgeoning demand for electric vehicles (EVs), which rely heavily on specialized corrosion-resistant coatings for battery contacts and internal components. Furthermore, the relentless miniaturization trend in the electronics industry necessitates precision plating processes like electroless nickel. Stringent regulatory environments in key regions are also prompting manufacturers to invest in cleaner, more efficient plating technologies, thereby spurring innovation and market growth.

Nickel-Plating Market Executive Summary

The global Nickel-Plating Market demonstrates robust growth driven by high-specification requirements across core manufacturing industries, particularly automotive and electronics. Business trends indicate a strong shift towards advanced electroless nickel (EN) plating, which offers uniform thickness deposition regardless of component geometry, proving indispensable for complex parts used in defense and high-precision machinery. Sustainability and environmental compliance are major operational focuses, leading to increased adoption of trivalent chromium processes and reduced reliance on hazardous chemicals, influencing vendor selection and technological investment strategies across the supply chain.

Regionally, Asia Pacific (APAC) stands as the undeniable leader in terms of market share and growth momentum, primarily fueled by the massive concentration of electronics manufacturing, automotive production, and rapid industrialization in countries like China, South Korea, and India. North America and Europe maintain a mature market status characterized by high demand for quality and precision plating services, particularly from the aerospace and medical device sectors. These regions are also spearheading research into novel alloy plating combinations designed for extreme service environments.

Segment trends highlight the dominance of the Electroless Nickel Plating segment due to its superior functional attributes over traditional electrolytic methods, capturing higher revenue potential in critical end-use applications. Moreover, within the end-use industries, the automotive sector remains the largest consumer, but the electronics segment is projected to exhibit the highest CAGR, propelled by the proliferation of 5G infrastructure, consumer devices, and sophisticated microcomponents requiring highly reliable surface finishes.

AI Impact Analysis on Nickel-Plating Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the nickel-plating market predominantly center on how AI can enhance process consistency, reduce waste, and improve quality control in highly complex plating operations. Key themes revolve around the automation of bath composition monitoring, predictive failure analysis of equipment, and optimizing energy consumption during electrodeposition. Users are keenly interested in moving beyond traditional statistical process control (SPC) towards predictive models capable of adjusting parameters in real-time, thereby minimizing rework and scrap rates associated with chemical imbalances or temperature fluctuations in plating tanks. The central expectation is that AI integration will transform nickel plating from an experience-driven craft into a data-driven science, ensuring high repeatability required by demanding sectors like aerospace and microelectronics.

- AI-driven real-time monitoring of plating bath chemistry, predicting and correcting drift in concentration or pH levels.

- Optimization of energy usage during high-current density plating cycles through pattern recognition and load balancing.

- Enhanced quality control systems utilizing computer vision and machine learning for automated defect detection on plated components.

- Implementation of predictive maintenance schedules for pumps, filters, and rectifiers based on operational data analysis, minimizing unplanned downtime.

- Simulation and modeling tools powered by AI to predict the resulting coating thickness and uniformity across complex geometries before physical application.

- Automated decision-making systems integrating operational data with incoming material batch quality to maintain consistent plating outcomes.

DRO & Impact Forces Of Nickel-Plating Market

The Nickel-Plating Market is fundamentally shaped by a delicate balance of inherent performance advantages and escalating environmental scrutiny. Key drivers center on the indispensability of nickel coatings for specialized corrosion and wear protection in high-stress applications, particularly in the swiftly expanding electric vehicle (EV) battery architecture and advanced defense systems. Nickel plating offers a cost-effective method to achieve superior functional durability compared to alternative materials in many heavy industrial settings. However, growth is substantially restrained by increasingly stringent regulations concerning wastewater treatment, heavy metal discharge, and occupational health hazards associated with certain plating chemicals, driving up compliance costs and complexity for small and medium-sized enterprises (SMEs).

Opportunities for market players lie primarily in the development and commercialization of environmentally friendly plating solutions, such as substitutes for traditional hexavalent chromium or improved, high-speed electroless nickel formulations suitable for continuous processing lines. Furthermore, technological innovation focused on advanced composite nickel plating, incorporating nano-particles or PTFE (Teflon), opens lucrative avenues in specialized markets requiring friction reduction or unique thermal properties. The convergence of Industry 4.0 principles, including sensor integration and process automation, acts as an amplifying impact force, making high-precision plating accessible and repeatable across global manufacturing hubs.

Segmentation Analysis

The Nickel-Plating Market is comprehensively segmented based on the fundamental plating process utilized, the primary substrate material, and the diverse industrial sectors that constitute the end-users. This multi-dimensional segmentation allows for precise market sizing and strategic targeting. The Type segment is critical, differentiating between electrolytic methods, which are high-speed and cost-effective for large volumes, and electroless methods, which guarantee superior uniform coverage essential for complex or non-conductive parts. Substrate differentiation helps manufacturers tailor specific bath compositions and pre-treatment procedures, while the End-Use segmentation reflects the overall economic health and technological advancement of global industrial production.

- By Type:

- Electrolytic Nickel Plating (Watt’s Bath, Sulfamate Bath)

- Electroless Nickel Plating (High Phosphorus, Medium Phosphorus, Low Phosphorus)

- Electroforming

- Composite Nickel Plating (Ni-PTFE, Ni-P-Diamond)

- By Substrate:

- Metallic Substrates (Steel, Aluminum, Copper, Brass)

- Non-Metallic Substrates (Plastics, Ceramics, Composites)

- By End-Use Industry:

- Automotive (EV components, engine parts, decorative)

- Aerospace and Defense (Turbine blades, fasteners, structural components)

- Electronics and Semiconductors (Connectors, PCBs, heat sinks)

- Machinery and Equipment (Hydraulic cylinders, molds, pumps)

- Chemical and Petrochemical Processing

- Consumer Goods and Others (Jewelry, plumbing fixtures)

Value Chain Analysis For Nickel-Plating Market

The value chain for the Nickel-Plating Market commences with upstream activities focused on the extraction and refinement of raw materials, primarily nickel metal sourced from mining operations, followed by the manufacturing of specialized plating chemicals, including nickel salts, acids, and proprietary additives. Key upstream suppliers include major global chemical and metal refining companies. Quality control and purity of these raw inputs are paramount as they directly influence the performance and consistency of the final plated product. Procurement stability and price volatility of nickel metal remain critical external factors influencing operational costs for plating service providers.

Midstream activities involve the core plating process, executed either by captive plating shops integrated within large manufacturing organizations (e.g., automotive OEMs) or, more commonly, by independent, specialized plating service providers (job shops). These job shops manage complex technical processes including pre-treatment (cleaning, etching), the plating cycle itself, and post-treatment (baking, finishing). The distribution channel for plating services is predominantly direct, where industrial clients contract directly with the job shop for specific component finishing requirements. Chemical suppliers, however, utilize both direct sales teams for large industrial customers and third-party specialty chemical distributors for smaller job shops globally.

Downstream activities encompass the integration of the finished nickel-plated component into final assembly lines across various end-use sectors, such as electronics assembly, vehicle manufacturing, or machinery installation. The success of the downstream application relies heavily on the quality, adherence, and functional specifications of the nickel coating. Feedback loops between end-users and plating service providers are vital, ensuring specifications related to corrosion resistance testing, hardness measurements, and dimensional tolerances are consistently met, driving technological advancement in coating techniques.

Nickel-Plating Market Potential Customers

Potential customers for the Nickel-Plating Market are extensive, spanning virtually all sectors requiring highly durable, corrosion-resistant, or electrically conductive surface finishes. The primary end-users are large-scale manufacturers and original equipment manufacturers (OEMs) in highly regulated and technical industries. These customers prioritize reliability, compliance with international standards (such as REACH or RoHS), and the ability of plating shops to handle high volumes and complex geometries while maintaining tight tolerances. Reliability and certification (e.g., ISO, AS9100 for aerospace) are crucial procurement criteria for these buyers.

The largest buyer segment is consistently the automotive industry, which requires nickel plating for both functional longevity (e.g., brake systems, fuel injectors, battery casings) and decorative purposes (e.g., exterior trim, interior handles). The rapidly expanding electric vehicle segment, in particular, drives demand for advanced electroless nickel-phosphorus coatings necessary for thermal management and protection of sensitive electronics within battery packs. Another significant customer base includes specialized machine builders and heavy equipment manufacturers, who utilize nickel plating to prolong the life of expensive components like hydraulic pistons, valves, and precision tools operating in abrasive or corrosive environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.85 Billion |

| Market Forecast in 2033 | USD 8.59 Billion |

| Growth Rate | 5.60% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coventya, Atotech (MKS Instruments), MacDermid Enthone (Element Solutions Inc), Bulk Chemicals Inc., J.V. Electronics, Columbia Chemical, Advanced Chemical Company, Technic Inc., Pioneer Metal Finishing, KC Jones Plating, Precision Plating Company, Allied Finishing Inc., Sharretts Plating Company, Lincoln Industries, Plating Technology, Industrial Plating Company, Metal Finishing Technologies, Palmer Nickel, Surface Technology Inc., Reliant Aluminum Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel-Plating Market Key Technology Landscape

The technology landscape of the Nickel-Plating Market is defined by continuous process refinement aimed at improving efficiency, coating performance, and environmental sustainability. A primary technological focus remains on Electroless Nickel (EN) plating, specifically the development of high-speed EN baths that offer enhanced deposition rates without sacrificing the uniformity and corrosion resistance properties. Recent innovations include lead-free and cadmium-free EN systems, aligning with global hazardous substance restrictions, and advanced post-treatment processes such as heat treatment for optimizing coating hardness and wear characteristics.

Furthermore, the market is witnessing significant advancements in composite plating technologies. These involve co-depositing inert particles, such as silicon carbide, diamond dust, or PTFE (Teflon), within the nickel matrix. This development significantly enhances specific functional properties, such such as lubricity (Ni-PTFE coatings crucial for moving parts) or extreme hardness (Ni-Diamond coatings for tooling and molds). The precise control required for these composite layers often leverages sophisticated computer-controlled rectifiers and bath filtration systems, moving plating shops toward more digitized manufacturing environments.

A crucial technological trend gaining traction involves pulse plating techniques, especially in electrolytic systems. Pulse plating allows for better control over grain structure and deposit density, resulting in coatings with superior mechanical properties and reduced internal stress. Integration of sophisticated analytical tools, including spectrophotometers and chromatography, into the plating line for automated chemical analysis is standard practice, ensuring bath chemistry remains within extremely narrow parameters, which is vital for achieving repeatable, high-quality finishes in complex industrial applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the global nickel plating market, driven by the massive concentration of electronics manufacturing (e.g., smartphones, semiconductors), high growth in the automotive sector (including substantial EV production hubs in China and South Korea), and expanding industrial machinery fabrication in India and Southeast Asia. APAC is both the largest producer and consumer of nickel-plated products, benefiting from lower operating costs and robust government support for manufacturing.

- North America: Characterized by high-precision demand, particularly from the aerospace & defense and medical device manufacturing industries. The focus is less on volume and more on stringent quality compliance (e.g., NADCAP certification) and the utilization of high-performance composite nickel alloys for critical components requiring extreme durability and reliability.

- Europe: A mature market defined by strict environmental mandates (e.g., REACH compliance). European firms lead in the adoption of sustainable and specialized plating chemistries, focusing heavily on aesthetic plating for luxury automotive and consumer goods, alongside critical functional plating for machinery and renewable energy infrastructure.

- Latin America (LATAM): Exhibits steady growth tied to its automotive assembly hubs (Mexico, Brazil) and general industrial investment. The market often adopts established, cost-effective electrolytic plating processes, although demand for high-performance EN plating is rising with increased foreign investment in advanced manufacturing.

- Middle East and Africa (MEA): Emerging market primarily driven by infrastructure development, oil and gas sector demands (requiring highly corrosion-resistant components), and localized automotive assembly operations. The growth potential is linked to diversification away from oil and expansion of localized industrial bases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel-Plating Market.- Coventya

- Atotech (MKS Instruments)

- MacDermid Enthone (Element Solutions Inc)

- Bulk Chemicals Inc.

- J.V. Electronics

- Columbia Chemical

- Advanced Chemical Company

- Technic Inc.

- Pioneer Metal Finishing

- KC Jones Plating

- Precision Plating Company

- Allied Finishing Inc.

- Sharretts Plating Company

- Lincoln Industries

- Plating Technology

- Industrial Plating Company

- Metal Finishing Technologies

- Palmer Nickel

- Surface Technology Inc.

- Reliant Aluminum Products

Frequently Asked Questions

Analyze common user questions about the Nickel-Plating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between electrolytic and electroless nickel plating?

Electrolytic nickel plating requires an external electrical current and offers faster deposition rates, making it cost-effective for high volumes. Electroless nickel (EN) plating relies on autocatalytic chemical reduction, providing superior, uniform coating thickness regardless of the part's geometry, essential for complex components like PCBs or deep recesses.

Which end-use industry drives the highest demand for nickel plating?

The Automotive industry consistently drives the largest volume demand for nickel plating, utilized extensively for corrosion protection in fasteners, engine components, decorative finishes, and increasingly, specialized coatings for electric vehicle (EV) battery contacts and internal structural elements.

How do environmental regulations impact the future growth of the nickel plating market?

Strict environmental regulations, particularly regarding heavy metal discharge and wastewater treatment, act as a restraint by increasing operational costs. However, they simultaneously drive market opportunity by compelling manufacturers to invest in cleaner, lead-free, and more sustainable plating chemistries, fostering technological innovation.

What role does composite nickel plating play in specialized applications?

Composite nickel plating, such as Nickel-PTFE or Nickel-Diamond, enhances functional performance by embedding inert particles within the nickel matrix. This results in coatings with tailored properties, such as reduced friction (lubricity) or significantly increased hardness and wear resistance, crucial for aerospace and tooling applications.

What is the forecast growth rate (CAGR) for the Nickel-Plating Market?

The Nickel-Plating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.60% during the forecast period of 2026 to 2033, driven largely by sustained demand from the global electronics and electric vehicle manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager