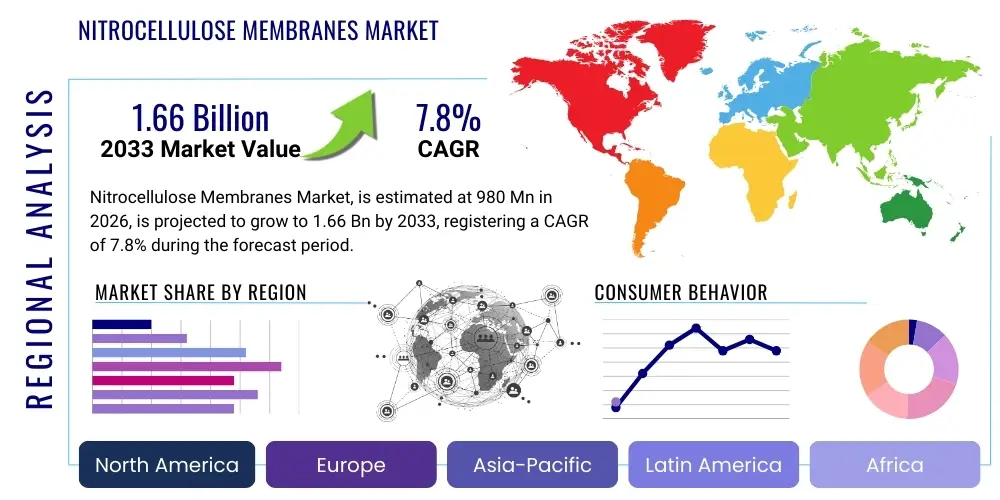

Nitrocellulose Membranes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443107 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Nitrocellulose Membranes Market Size

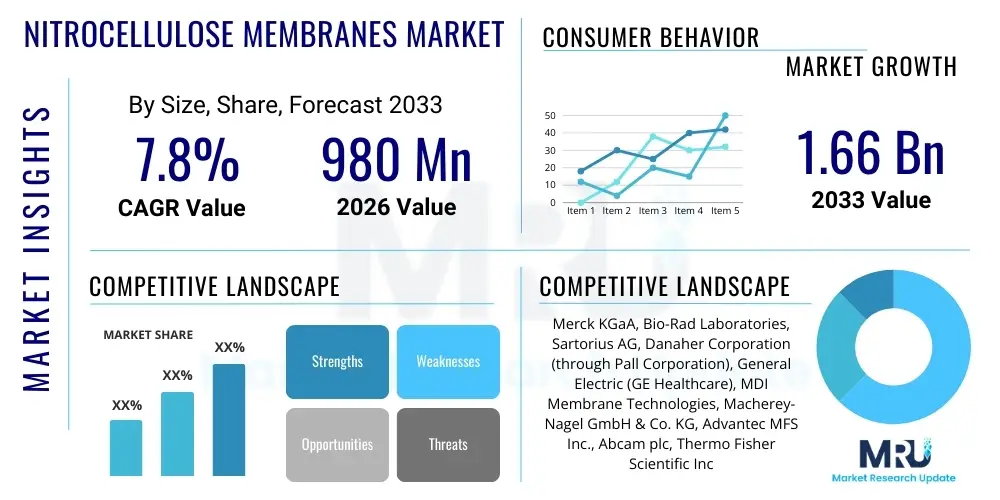

The Nitrocellulose Membranes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 980 Million in 2026 and is projected to reach USD 1.66 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating demand for advanced diagnostic tools, particularly in infectious disease testing and chronic disease management, where nitrocellulose membranes serve as essential components in lateral flow assays and various blotting techniques. The established reliability and superior protein binding capacity of these membranes continue to cement their crucial role across clinical, academic, and industrial research sectors.

Nitrocellulose Membranes Market introduction

The Nitrocellulose Membranes Market encompasses the production and distribution of specialized porous films made primarily from cellulose nitrate polymers, widely recognized for their excellent protein and nucleic acid binding characteristics. These membranes are foundational materials in biological research and in vitro diagnostics (IVD), serving critical functions in separation, immobilization, and detection processes. Their versatility is underscored by their application across major scientific techniques such as Western blotting, Southern blotting, and Northern blotting, facilitating the identification and quantification of specific biomolecules in complex mixtures. The intrinsic properties, including customizable pore sizes and surface chemistries, enable precise analytical performance crucial for high-stakes research and diagnostic outputs.

Major applications driving market demand include the rapid expansion of point-of-care (POC) diagnostics, especially utilizing Lateral Flow Assay (LFA) technology for infectious diseases (such as COVID-19, influenza, and HIV) and pregnancy testing. Beyond clinical diagnostics, nitrocellulose membranes are indispensable in proteomics research for studying protein expression, post-translational modifications, and protein-protein interactions, forming the backbone of academic and pharmaceutical drug discovery pipelines. The benefits of using these membranes stem from their high signal-to-noise ratio, superior immobilization efficiency, and relative ease of handling and integration into automated systems, making them a preferred material over alternatives like PVDF in many diagnostic contexts.

Key driving factors accelerating the market growth include substantial increases in global healthcare expenditure, coupled with rising investments in biotechnology and pharmaceutical R&D activities across developed and emerging economies. Furthermore, technological advancements leading to ultra-sensitive and high-capacity membranes, such as supported and laminated variants, are enhancing their performance in multiplexed assays and high-throughput screening. The need for faster, reliable, and cost-effective diagnostic solutions, particularly in decentralized testing environments, further fuels the adoption of nitrocellulose membranes, ensuring consistent market expansion throughout the forecast period.

Nitrocellulose Membranes Market Executive Summary

The Nitrocellulose Membranes Market is experiencing robust expansion, fundamentally driven by accelerating demand in the in vitro diagnostics sector and sustained investment in global proteomics research. Current business trends indicate a critical shift toward optimizing membrane surface chemistry and structural integrity to accommodate the rising complexity of diagnostic assays, particularly multiplexed LFA systems that require high precision and reduced background noise. Major manufacturers are focusing intensely on improving lot-to-lot consistency and developing specialized membranes tailored for automated manufacturing processes, aiming to capture the lucrative contracts from large IVD companies. Furthermore, supply chain resilience is a growing strategic priority, as the reliance on specialized raw materials necessitates robust sourcing and inventory management practices to mitigate geopolitical or logistical disruptions.

Regionally, North America maintains market dominance due to a highly established life science research infrastructure, significant federal funding for biomedical sciences, and the presence of major pharmaceutical and biotechnology hubs driving innovative application development. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by improving healthcare access, expanding diagnostic manufacturing capabilities in countries like China and India, and increasing government initiatives aimed at combating infectious diseases through mass screening programs. European markets demonstrate steady growth, primarily focused on compliance with stringent regulatory standards (e.g., IVDR compliance) which drives demand for premium, certified membrane products used in clinical trials and certified diagnostic kits.

Segment trends reveal that the diagnostic application segment, particularly Lateral Flow Assays (LFA), remains the primary revenue generator, reflecting the global preference for rapid, low-cost testing solutions. Within membrane types, supported nitrocellulose membranes, which offer enhanced mechanical stability and easier handling in high-throughput settings, are seeing accelerated adoption over unsupported types. Future growth is expected to be catalyzed by the convergence of membrane technology with advanced detection methods, such as fluorescent or nanoparticle-based labeling, pushing the boundaries of sensitivity in both clinical and basic research settings and solidifying the membrane's role as a core consumable in molecular biology and diagnostics.

AI Impact Analysis on Nitrocellulose Membranes Market

User questions regarding the impact of Artificial Intelligence (AI) on the Nitrocellulose Membranes Market primarily center on two critical areas: how AI can enhance the interpretation and analysis of data generated using these membranes (e.g., automating band detection in Western blots or quantifying signal intensity in LFAs), and whether AI-driven R&D will accelerate the discovery of superior alternative materials, potentially displacing nitrocellulose. Users are keenly interested in the integration capabilities—specifically, if AI-powered image processing software can be seamlessly linked with existing high-throughput blotting and assay readers to improve accuracy, reduce human error in visual assessment, and speed up the often manual and subjective steps of biological quantification. A core concern is the validation of these AI systems and ensuring that the output remains clinically or scientifically reliable.

The integration of AI is transforming the downstream analysis of data derived from nitrocellulose membrane assays, particularly in high-volume laboratory environments. AI algorithms, leveraging machine learning and computer vision, are becoming indispensable for automating the interpretation of complex banding patterns in Western blots, compensating for background noise, and performing quantitative comparisons across multiple samples with unprecedented precision. This capability significantly enhances the reproducibility and efficiency of proteomics studies, reducing the time researchers spend on manual quantification and allowing for deeper, more statistically robust biological inferences. For diagnostic manufacturers, AI aids in the quality control of LFA strip manufacturing by rapidly identifying structural defects or inconsistencies in the membrane strip that would impact test accuracy.

Beyond analysis, AI is beginning to influence the entire R&D lifecycle for biomaterial selection and assay optimization. Machine learning models can analyze vast databases of material properties and performance data (e.g., protein binding kinetics, fluid dynamics) to predict optimal pore sizes, surface treatments, or even entirely new substrate compositions for specific diagnostic applications. While this doesn't immediately replace nitrocellulose, it optimizes its usage and rapidly prototypes new generations of membranes with features tailored for specific biomarker detection or high-sensitivity applications. This predictive capacity streamlines material development, ensuring that the next generation of membrane consumables meets the increasingly stringent requirements of precision medicine and advanced molecular diagnostics.

- AI enhances automated image analysis of blots and lateral flow results, improving quantification accuracy and reducing subjective bias.

- Machine learning algorithms are used for quality control during membrane manufacturing, detecting structural irregularities at high speed.

- Predictive modeling powered by AI optimizes membrane pore size and surface chemistry for new high-sensitivity assays.

- AI-driven data interpretation accelerates the speed of drug discovery and academic research utilizing blotting techniques.

- Concerns focus on data validation, model transparency, and seamless integration with existing laboratory hardware and informatics systems.

DRO & Impact Forces Of Nitrocellulose Membranes Market

The market dynamics are governed by a robust interplay of drivers and restraints, framed within significant opportunities for innovation. Key drivers center on the global increase in the incidence of chronic and infectious diseases, necessitating widespread and rapid diagnostic testing capabilities, which inherently rely on nitrocellulose membrane-based assays. The expanding global infrastructure for life science research, particularly in emerging economies, further bolsters demand for high-quality blotting materials. Conversely, the market faces constraints related to the potential for membrane fouling, the inherent fragility of some unsupported membrane types which complicates high-throughput handling, and ongoing price pressure due to the commoditization of standard membrane grades. These competitive pressures often necessitate strategic investments in advanced manufacturing technologies to maintain profitability and market share.

Significant opportunities for market expansion arise from the continued transition towards point-of-care testing (POCT) and personalized medicine, both requiring highly sensitive and portable diagnostic platforms. The development of multiplexed assays utilizing nitrocellulose membranes—enabling simultaneous detection of multiple analytes on a single strip—presents a high-value niche. Furthermore, advancements in membrane modification techniques, such as plasma treatment and chemical functionalization, open avenues for creating "smart" membranes with enhanced specificity, binding capacity, and longevity, thus broadening their application into novel biosensors and environmental monitoring. These technological refinements allow membranes to participate in more complex analytical scenarios previously limited to highly sophisticated laboratory instruments.

The market is profoundly influenced by several key impact forces. The threat of substitution, mainly from alternative polymeric materials like PVDF (Polyvinylidene Fluoride) which offer better chemical resistance, remains a constant competitive factor, particularly in specific demanding applications. However, nitrocellulose generally maintains a cost advantage and superior protein retention capabilities for many standard assays. Supplier bargaining power is relatively high for specific high-purity raw materials required for medical-grade membranes, leading to supply chain sensitivity. Buyer bargaining power is also substantial, driven by large IVD manufacturers who purchase membranes in massive volumes and exert pressure on pricing and quality standards. Regulatory oversight, especially in diagnostics, acts as a pivotal external force, mandating strict compliance which favors established, certified membrane suppliers over smaller, non-validated competitors.

Segmentation Analysis

The Nitrocellulose Membranes Market is systematically segmented based on Type, Application, and End-User, reflecting the diverse requirements and technological variations across the life science and diagnostic industries. Understanding these segments is crucial for strategic planning, as different membrane characteristics (e.g., pore size, structural support) are optimized for distinct end-use applications. For instance, diagnostic segments prioritize rapid flow rates and high sensitivity required for quick readout assays, while research applications often focus on optimal protein immobilization and high resolution for blotting techniques. This varied requirement profile necessitates specialized production capabilities and targeted marketing efforts within each segment.

By Type, the market is divided into Supported and Unsupported Membranes. Supported membranes, typically cast onto an inert backing material like polyester, provide superior mechanical strength, making them ideal for high-throughput, automated manufacturing processes common in lateral flow diagnostics. Unsupported membranes, while potentially offering higher binding surface area, are more delicate and primarily utilized in traditional laboratory blotting procedures where manual handling is standard. The shift towards automation globally is significantly favoring the supported segment due to its enhanced robustness and ease of integration into continuous production lines, despite the marginally higher manufacturing complexity and cost associated with the backing material integration.

Application-wise, the market is dominated by In Vitro Diagnostics (IVD), followed by life science research including proteomics, genomics, and drug discovery. The IVD segment, encompassing lateral flow assays for rapid disease screening, accounts for the largest share due to the widespread adoption of point-of-care testing globally. End-user segmentation reflects the primary consumers of these specialized materials, including Diagnostic Laboratories, Research & Academic Institutions, and Pharmaceutical & Biotechnology Companies. Diagnostic labs represent the fastest growing end-user group, driven by the volume requirement for routine clinical testing and specialized molecular diagnostics.

- By Type:

- Supported Nitrocellulose Membranes

- Unsupported Nitrocellulose Membranes

- By Application:

- In Vitro Diagnostics (IVD)

- Proteomics

- Genomics

- Drug Discovery & Development

- Others (e.g., filtration, environmental testing)

- By End-User:

- Diagnostic Laboratories

- Research & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Hospitals and Clinics

- By Pore Size:

- 0.1 µm and Below

- 0.2 µm to 0.45 µm

- 0.45 µm and Above

Value Chain Analysis For Nitrocellulose Membranes Market

The value chain for nitrocellulose membranes begins with the highly specialized Upstream Analysis, focusing on the procurement of high-purity raw materials, primarily cellulose pulp and nitric acid, used in the nitration process to create nitrocellulose polymers. The quality and source of the cellulose significantly impact the final membrane characteristics, such as porosity, mechanical strength, and binding capacity. Key upstream challenges include maintaining material consistency, complying with strict purity requirements (especially for medical-grade membranes), and managing the hazardous nature of the nitration process. Manufacturers often rely on a limited number of specialized chemical suppliers, giving these upstream providers moderate bargaining power concerning pricing and quality standards, which affects the subsequent manufacturing costs.

The Midstream segment involves the core manufacturing process: dissolving the nitrocellulose polymer and casting it onto specialized equipment (often roll-to-roll casting for mass production) to form the porous sheet, followed by drying, lamination (for supported membranes), and precise slitting into specific widths (e.g., 20mm to 100mm wide rolls) required by IVD manufacturers. This stage requires significant capital investment in cleanroom facilities, advanced casting machinery, and stringent quality control protocols, particularly for pore size homogeneity and surface treatment uniformity. Companies that invest in proprietary casting technologies to improve batch-to-batch consistency gain a substantial competitive advantage, particularly when supplying high-volume diagnostic kit manufacturers who demand zero tolerance for functional variability.

The Downstream analysis involves the distribution channels and end-user consumption. Membranes are distributed both Directly and Indirectly. Direct distribution typically involves large-scale sales of OEM rolls or bulk sheets directly to major IVD manufacturers (like Abbott, Roche, Siemens) who integrate the membranes into their finalized diagnostic kits (e.g., COVID-19 rapid tests, cardiac marker panels). Indirect distribution relies heavily on established global scientific supply distributors (e.g., Thermo Fisher Scientific, Merck KGaA) who package, market, and sell smaller volumes of pre-cut sheets or specific formats to academic research institutions, smaller diagnostic labs, and hospitals. Marketing efforts in the indirect channel focus heavily on technical specifications, validated performance data, and providing robust technical support to researchers who may require tailored membrane formats for complex experimental setups.

Nitrocellulose Membranes Market Potential Customers

The primary consumers, or End-Users/Buyers, of nitrocellulose membranes span across highly regulated and diverse scientific ecosystems, fundamentally divided into clinical diagnostic manufacturers and core research entities. In Vitro Diagnostic (IVD) companies represent the largest volume purchasers, utilizing the membranes as the core reaction matrix in Lateral Flow Assays (LFAs). These customers require millions of square meters of membrane annually, demanding exceptional manufacturing consistency, verified lot stability, and strict adherence to relevant regulatory approvals (FDA, CE Mark). Their procurement is highly centralized and governed by long-term supply agreements, making them critical strategic partners for membrane manufacturers.

A second major customer segment includes Academic Research Institutions and University Laboratories. These buyers typically procure smaller, more diverse quantities of membranes tailored for specific experimental techniques, such as Western blotting in proteomics or nucleic acid detection. Their purchasing decisions are often influenced by grant funding cycles, brand reputation, and the availability of specialized membrane formats (e.g., high-retention membranes, specific pore sizes for small molecule transfer). While their volume is lower than IVD companies, their demand for diverse, cutting-edge products drives innovation in membrane functionalization and technical support services from distributors.

Furthermore, Pharmaceutical and Biotechnology companies constitute a crucial high-value customer group. They utilize nitrocellulose membranes extensively for Quality Control (QC) testing, especially during the production of biologics (e.g., protein drug purity checks) and in early-stage drug discovery screening. In these environments, reliability and extremely low background noise are paramount, as assays often involve expensive or rare samples. Procurement decisions in this sector are heavily weighted toward suppliers providing comprehensive validation documentation, ultra-high purity materials, and those who can ensure supply chain security, viewing the membrane as a critical component in maintaining regulatory compliance and product integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980 Million |

| Market Forecast in 2033 | USD 1.66 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Bio-Rad Laboratories, Sartorius AG, Danaher Corporation (through Pall Corporation), General Electric (GE Healthcare), MDI Membrane Technologies, Macherey-Nagel GmbH & Co. KG, Advantec MFS Inc., Abcam plc, Thermo Fisher Scientific Inc., G&G Manufacturing, EMD Millipore, Cytiva, VWR International, Advansta, Inc., Trelleborg AB, Faton Technology, Sentry Sciences, Whatman plc, Axygen Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nitrocellulose Membranes Market Key Technology Landscape

The technological landscape of the nitrocellulose membranes market is characterized by continuous refinement aimed at enhancing three critical performance parameters: protein binding efficiency, mechanical robustness, and flow rate control. A major focus is placed on optimizing the manufacturing process, specifically the controlled casting techniques, such as the roll-to-roll method, which allows for highly uniform pore structures and consistent porosity across large batches, essential for high-volume diagnostic production. Advanced solvent systems and polymer blends are utilized to manipulate the physical properties of the final membrane, enabling manufacturers to fine-tune protein immobilization without compromising fluid kinetics. This ongoing technological push directly addresses the industry need for membranes that can perform reliably in automated, high-throughput environments while maintaining superior biological assay sensitivity.

Surface modification technology represents another critical area of innovation. Manufacturers are employing techniques like plasma treatment, chemical derivatization, and proprietary coating agents to alter the surface charge and hydrophilicity of the nitrocellulose matrix. These modifications are specifically designed to reduce non-specific binding (background noise) while maximizing the specific binding of target molecules, thereby improving the signal-to-noise ratio in sensitive assays like ELISA and Western blotting. The development of 'high-capacity' membranes, which utilize advanced polymer architecture to increase the available internal surface area, allows for greater loading of protein samples, crucial for detecting low-abundance biomarkers in complex biological fluids. Furthermore, the integration of colored microparticles or fluorescent dyes within the membrane matrix during manufacturing is facilitating the creation of membranes optimized for quantitative or multiplexed lateral flow readouts.

The convergence of membrane technology with microfluidics and integrated diagnostic platforms is dictating future technological trends. This involves developing membranes that are perfectly suited for lamination onto plastic diagnostic cartridges and microfluidic chips, demanding precise dimensional stability and inertness toward various solvents used in these integrated systems. Specialized supported membranes are engineered with features that allow for controlled capillary flow over defined distances, critical for achieving accurate timing and reagent interaction in highly complex, multi-step assays contained within compact diagnostic devices. Ensuring that these next-generation membranes are compatible with robotic liquid handling and optical detection systems is paramount, propelling manufacturers to adopt highly digitized quality assurance and manufacturing control systems to guarantee seamless integration into advanced laboratory automation workflows.

Regional Highlights

The regional market landscape for nitrocellulose membranes exhibits distinct growth patterns influenced by differences in healthcare spending, R&D intensity, and regulatory frameworks across major geographical areas. North America, comprising the United States and Canada, currently holds the largest market share, a dominance attributed to the presence of global biotechnology leaders, high adoption rates of advanced diagnostic technologies (including molecular diagnostics and personalized medicine), and substantial governmental and private sector funding directed toward biomedical research, particularly in cancer and neurological disorders. The robust clinical trial pipeline and the high volume of academic research activities solidify the region’s established market position, driving demand for premium, high-specification membrane products.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is spurred by significant investments in healthcare infrastructure development, particularly in populous nations like China and India, coupled with increasing governmental focus on combating widespread infectious diseases, necessitating mass screening and rapid diagnostic test deployment. The growing local manufacturing base for IVD kits in APAC provides a ready market for bulk membrane purchases, often favoring cost-competitive and scalable production solutions. Furthermore, the relaxation of certain regulatory barriers, combined with rising disposable incomes, facilitates the quicker market entry and adoption of new diagnostic tools reliant on nitrocellulose technology.

Europe remains a mature yet expanding market, characterized by stringent regulatory oversight, notably the In Vitro Diagnostic Regulation (IVDR), which pushes manufacturers toward validated, high-quality, and traceable membrane products. Western European countries, including Germany, the UK, and France, maintain a strong focus on advanced academic research and pharmaceutical R&D, providing a stable demand base. The Latin America (LATAM) and Middle East & Africa (MEA) regions, while smaller, offer promising growth opportunities driven by expanding public health programs, increasing penetration of basic diagnostic services, and rising awareness of point-of-care testing benefits, especially in resource-limited settings for diseases like Dengue, Zika, and Malaria. These regions often prioritize low-cost, robust lateral flow device components.

- North America: Market leader; driven by high R&D intensity, established biotech industry, and high adoption of personalized diagnostics.

- Europe: Stable growth; sustained by rigorous IVDR compliance, strong academic research funding, and demand for high-quality clinical consumables.

- Asia Pacific (APAC): Fastest growing region; fueled by expanding IVD manufacturing bases, rising incidence of infectious diseases, and government-backed healthcare modernization.

- Latin America (LATAM): Emerging market; growth driven by improvements in public health infrastructure and adoption of cost-effective LFA technology.

- Middle East and Africa (MEA): Growth potential focused on rapid diagnostics for endemic diseases and infrastructure development in clinical laboratories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nitrocellulose Membranes Market.- Merck KGaA (including EMD Millipore portfolio)

- Bio-Rad Laboratories

- Sartorius AG

- Danaher Corporation (Pall Corporation)

- General Electric (GE Healthcare)

- Thermo Fisher Scientific Inc.

- Macherey-Nagel GmbH & Co. KG

- Advantec MFS Inc.

- Abcam plc

- Cytiva (formerly GE Healthcare Life Sciences)

- G&G Manufacturing

- Faton Technology

- Trelleborg AB

- Sentry Sciences

- Whatman plc

- Advansta, Inc.

- Axygen Inc.

- Biotium, Inc.

- 3M Company

- VWR International (part of Avantor)

Frequently Asked Questions

Analyze common user questions about the Nitrocellulose Membranes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for nitrocellulose membranes in the diagnostics sector?

The primary driver is the exponentially growing global demand for In Vitro Diagnostics (IVD), specifically the widespread adoption of Lateral Flow Assays (LFAs). Nitrocellulose membranes are the foundational matrix in these rapid, point-of-care tests for infectious diseases, pregnancy, and chronic condition monitoring, leveraging their optimal fluid dynamics and reliable biomolecule immobilization capabilities crucial for fast, accurate results outside centralized laboratories.

How do supported nitrocellulose membranes differ technically from unsupported membranes in terms of application?

Supported nitrocellulose membranes are cast onto an inert backing material (typically polyester), providing enhanced mechanical stability and robustness. This makes them highly suitable for high-volume, automated manufacturing of diagnostic strips and integration into robotic handling systems, particularly in large IVD production lines. Unsupported membranes, while sometimes offering higher effective surface binding area, are more fragile and are predominantly utilized in manual laboratory blotting techniques where flexibility in handling is required, such as traditional Western blotting research protocols.

Which geographical region exhibits the highest projected growth rate in the Nitrocellulose Membranes Market and why?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant government investments in upgrading healthcare infrastructure, the expansion of local biotechnology and pharmaceutical manufacturing, and the urgent need for large-scale, cost-effective diagnostics to manage high-incidence infectious and chronic diseases across densely populated countries like China and India.

What are the key technical challenges facing manufacturers of high-quality nitrocellulose membranes?

The central technical challenges include achieving absolute lot-to-lot consistency in critical parameters like pore size distribution, thickness uniformity, and protein binding capacity across vast production rolls. Ensuring minimal background noise (non-specific binding) is also difficult but essential for high-sensitivity assays. Furthermore, managing the complex supply chain for specialized, high-purity cellulose nitrate raw materials presents a persistent operational challenge impacting consistency and cost control.

How is technological innovation improving the performance of nitrocellulose membranes in advanced assays?

Technological innovation focuses on surface modification techniques, such as chemical functionalization or plasma treatments, to enhance specific target binding while simultaneously reducing non-specific protein adhesion. Furthermore, advancements in controlled casting are producing membranes optimized for multiplexing, allowing simultaneous detection of multiple biomarkers on a single strip, thereby increasing the informational density and efficiency of diagnostic and research assays, aligning with the needs of personalized medicine.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager