Non-Alcoholic Beer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442355 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Non-Alcoholic Beer Market Size

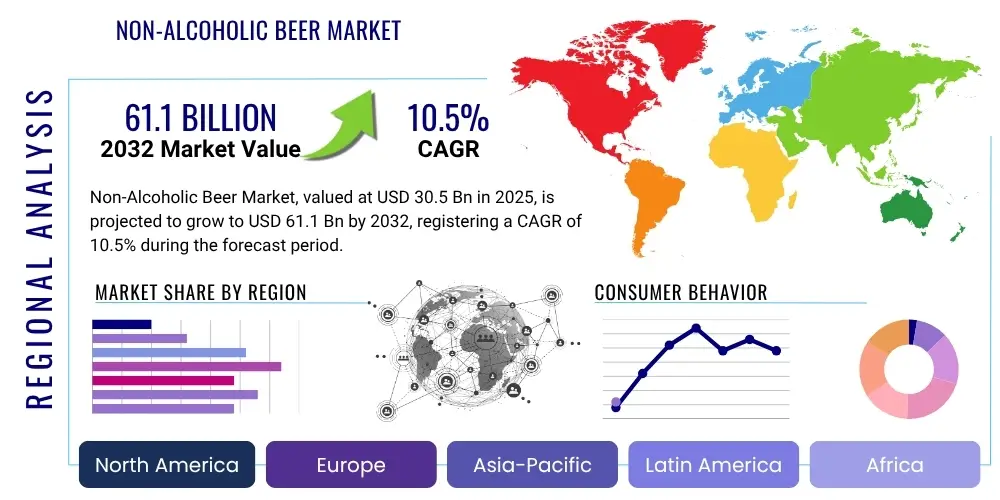

The Non-Alcoholic Beer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 45.9 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by evolving consumer health consciousness, particularly among younger demographics who are actively seeking alternatives to high-alcohol beverages. The growth is further supported by innovations in brewing technology that have dramatically improved the taste profile of non-alcoholic options, eliminating the perception of compromise in flavor often associated with older products. Regulatory support in various regions promoting responsible drinking also contributes substantially to market momentum.

Non-Alcoholic Beer Market introduction

The Non-Alcoholic Beer Market encompasses malt beverages that contain 0.0% to 0.5% alcohol by volume (ABV), offering consumers the sensory experience of traditional beer without the intoxicating effects of high alcohol content. These products are manufactured using specialized brewing techniques such as vacuum distillation, arrested fermentation, or reverse osmosis, designed to minimize or completely remove ethanol while preserving key flavor compounds. Major applications span social consumption, integration into health and wellness routines, and consumption by individuals restricted from alcohol due to health, religious, or legal reasons. The primary benefit lies in providing a socially acceptable, flavorful alternative that aligns with growing global trends toward moderation and improved physical well-being.

Key driving factors accelerating the adoption of non-alcoholic beer include the 'Sober Curious' movement, aggressive marketing campaigns by major brewing conglomerates investing heavily in premium non-alcoholic lines, and widening distribution channels including mainstream grocery stores, specialty liquor outlets, and online platforms. The product category is witnessing profound diversification, moving beyond traditional lagers to include craft varieties such as non-alcoholic IPAs, stouts, and sours. This innovation pipeline addresses sophisticated consumer palates and expands the market’s appeal across diverse consumer segments globally. Furthermore, sports sponsorships and endorsements by health influencers are bolstering the image of non-alcoholic beer as a functional and refreshing beverage suitable for active lifestyles.

The transition from a niche category to a mainstream staple is evident in the rapid expansion of supermarket shelf space dedicated to these products and the increasing presence of non-alcoholic taps in bars and restaurants. This transition is not merely substitution but represents a fundamental shift in drinking culture where flavor and experience are prioritized over alcohol content. The convergence of favorable public health initiatives, technological advancements in de-alcoholization, and robust global marketing strategies positions the non-alcoholic beer market for sustained, high-value growth throughout the forecast period. Consumers are demanding healthier indulgences, and the current generation of non-alcoholic beers successfully meets this demand through improved quality and variety.

Non-Alcoholic Beer Market Executive Summary

The Non-Alcoholic Beer Market is undergoing a rapid transformation, characterized by significant business model innovation and aggressive product launches. Business trends highlight strategic acquisitions and partnerships, with major global brewers actively purchasing successful craft non-alcoholic brands to immediately gain market share and access niche consumer bases. Investment is heavily focused on optimizing supply chains to handle the delicate nature of non-alcoholic brewing and distribution, ensuring product integrity and shelf stability. Manufacturers are also leveraging sustainable packaging initiatives and transparent sourcing to appeal to environmentally conscious millennials and Generation Z consumers, further solidifying brand loyalty and premium positioning.

Regionally, Europe maintains its dominance, driven by strong traditional acceptance in markets like Germany and Spain, coupled with stringent new regulations in Scandinavia promoting low-ABV consumption. North America is the fastest-growing region, fueled by the booming health and wellness movement and significant demand for non-alcoholic craft beverages, especially in urban centers. The Asia Pacific (APAC) market, though currently smaller, presents immense long-term opportunity, particularly in sophisticated markets such as Japan and Australia, where consumers are increasingly adopting Western lifestyle moderation trends, leading to increasing per capita consumption rates and diversification of product offerings.

Segment trends reveal that the 0.0% ABV segment is outpacing the 0.5% segment, reflecting a consumer desire for absolute abstinence or maximum compliance with health goals. By product type, Non-Alcoholic Lagers retain the largest volume share, but Non-Alcoholic IPAs and specialty beers are capturing the highest growth rates, indicating a premiumization trend within the segment. Distribution trends show that the Off-Trade channel (supermarkets, hypermarkets) remains dominant, yet the On-Trade channel (bars, restaurants) is crucial for brand visibility and consumer trial, prompting brewers to implement specific strategies to increase availability in hospitality venues. Flavor innovation, extending beyond traditional hops and malt to include fruit-infused and botanical varieties, is also a key growth segment.

AI Impact Analysis on Non-Alcoholic Beer Market

User inquiries regarding AI's influence on the Non-Alcoholic Beer Market commonly revolve around three central themes: optimizing the de-alcoholization process for better flavor retention, predicting consumer flavor preferences to guide product development, and enhancing supply chain efficiency and cold chain management. Consumers and industry stakeholders are keen to understand how AI can solve the long-standing challenge of 'off-flavors' sometimes resulting from thermal processes, expecting machine learning algorithms to fine-tune temperature and pressure parameters in real-time. Additionally, there is significant interest in using predictive AI to map the fragmentation of consumer tastes—moving beyond simple trend forecasting to hyper-personalized flavor recommendations and targeted marketing campaigns that resonate deeply with specific sober-curious cohorts. The application of AI in minimizing waste during brewing and ensuring optimal inventory distribution in highly volatile seasonal markets is also a major area of concern and expectation.

- AI-driven optimization of de-alcoholization techniques (e.g., vacuum distillation), minimizing thermal stress and maximizing aroma and flavor compound retention, resulting in cleaner finished products.

- Predictive analytics utilizing vast consumer purchase data and social media sentiment to forecast emerging non-alcoholic flavor trends, accelerating the speed-to-market for innovative products like non-alcoholic sours or infused specialty beers.

- Enhanced quality control systems using AI-powered sensors and computer vision to monitor fermentation kinetics and packaging integrity, ensuring consistent 0.0% ABV compliance and reduced product defects.

- Optimized cold chain logistics and inventory management through machine learning models that predict regional demand fluctuations and minimize spoilage of highly perishable non-alcoholic beverages across complex distribution networks.

- Personalized marketing and recommendation engines that utilize user data to suggest specific non-alcoholic beer styles and brands, increasing customer engagement and conversion rates within digital retail platforms.

DRO & Impact Forces Of Non-Alcoholic Beer Market

The Non-Alcoholic Beer Market is strongly influenced by demographic shifts and technological advancements (Drivers), while facing challenges related to product parity and distribution costs (Restraints). The primary Driver is the escalating consumer focus on health and wellness, characterized by the global trend toward mindful drinking and reduced alcohol intake among younger populations. This behavioral change is powerfully supported by sophisticated de-alcoholization technologies that deliver premium taste profiles, overcoming historical consumer resistance. Opportunities abound in geographical expansion, particularly leveraging underpenetrated markets in APAC and Latin America, and through strategic diversification into functional beverages that offer added health benefits, such as electrolytes or vitamins, blending the market with the broader health drinks category.

However, significant Restraints exist, notably the perceived high production cost associated with advanced de-alcoholization equipment, which can restrict smaller brewers' entry. Furthermore, while taste has improved, maintaining a long shelf life and ensuring flavor stability without high levels of preservatives presents a technical challenge. Impact Forces manifest through the intensity of competition, as major global beverage corporations leverage immense marketing budgets and distribution power to dominate shelf space, putting pressure on smaller, innovative craft producers. Substitute threats are high, coming from sophisticated soft drinks, premium functional waters, and other low-to-no alcohol categories like non-alcoholic spirits and wines, forcing continuous innovation in product differentiation to maintain market share.

The market also benefits from a crucial underlying factor: increasing regulatory scrutiny and public health campaigns globally encouraging reduced alcohol consumption. This favorable regulatory environment creates a positive societal acceptance for non-alcoholic alternatives. The convergence of favorable consumer psychology, robust R&D investment, and supporting macroeconomic factors ensures that the positive Impact Forces (Drivers and Opportunities) significantly outweigh the constraints, propelling the market forward aggressively throughout the forecast period. Strategic responses to these forces include vertical integration to control production costs and focused digital marketing to build strong consumer communities around the lifestyle aspects of non-alcoholic consumption.

Segmentation Analysis

The Non-Alcoholic Beer Market is broadly segmented based on crucial parameters including Product Type, Distribution Channel, and Alcohol Content, reflecting the diverse consumer base and complex market structure. Segmentation by Product Type (Lager, Stout, Wheat Beer, etc.) helps manufacturers tailor their offerings to regional preferences and specific consumption occasions, with lagers historically holding the volume leadership due to broad appeal and traditional acceptance, while specialty craft types drive innovation and premium pricing. Segmentation by Distribution Channel (On-Trade vs. Off-Trade) is vital for market strategy, as Off-Trade provides volume sales and On-Trade offers crucial product sampling and brand building opportunities, demanding unique pricing and promotional strategies for each channel.

Analysis of Alcohol Content segmentation reveals a critical trend favoring the 0.0% ABV category. This segment is experiencing faster growth as consumers increasingly seek legally and medically safe options that guarantee zero intoxicating effects, supporting religious observance, medical adherence, and driving compatibility. The increasing prevalence of 0.0% offerings underscores the industry's technical prowess in achieving high quality without residual alcohol. Furthermore, segmentation by flavor, moving beyond traditional malt to incorporate fruit, hop infusions, and botanicals, caters directly to the younger generation's demand for experimental and novel beverage experiences, thereby capturing consumers previously dominated by specialized soda or craft cocktail markets.

Understanding these segments allows market participants to refine their product portfolios and resource allocation effectively. For instance, companies focusing on the 0.5% ABV segment often target consumers transitioning away from moderate drinking, whereas those dominating the 0.0% space prioritize health-conscious consumers and drivers. Geographic segmentation further overlays these trends, showing, for example, a preference for wheat beers in Central Europe and a rapid uptake of non-alcoholic IPAs in North America. This granular segmentation approach is instrumental for successful market penetration and achieving sustainable competitive advantage in this rapidly evolving beverage category.

- By Product Type: Lagers, Ales (IPAs, Pale Ales), Stouts & Porters, Specialty Beers (Wheat Beer, Sours).

- By Alcohol Content: 0.0% ABV, Up to 0.5% ABV.

- By Distribution Channel: On-Trade (Bars, Restaurants, Hotels), Off-Trade (Supermarkets, Hypermarkets, Convenience Stores, Online Retail).

- By Technology: Arrested Fermentation, Vacuum Distillation, Reverse Osmosis, Specialized Yeast Fermentation.

Value Chain Analysis For Non-Alcoholic Beer Market

The value chain for the Non-Alcoholic Beer Market begins with Upstream Analysis, which involves the sourcing of high-quality raw materials, primarily barley malt, hops, yeast, and water. Efficiency and sustainability in sourcing these agricultural inputs are crucial, impacting both cost structure and brand image. Brewers must establish robust relationships with maltsters and hop growers to ensure consistency, particularly since flavor profiles are heavily reliant on the quality of these initial inputs, even before the de-alcoholization process begins. Investment in specialized yeast strains capable of producing complex flavors with minimal ethanol production is also a critical upstream component distinguishing modern non-alcoholic beer producers.

The core process involves brewing followed by de-alcoholization, which uses specialized technologies like reverse osmosis or vacuum distillation—a significant point of capital expenditure and technological specialization. These midstream activities dictate the final product quality and flavor stability, differentiating key players based on their ability to minimize off-flavors. Downstream analysis focuses on packaging (canning or bottling), quality control, and distribution. Given the often shorter shelf life or sensitivity to temperature changes compared to full-strength beer, efficient cold chain logistics are paramount. Packaging design also plays a major role, aligning the non-alcoholic product visually with premium or craft alcoholic counterparts to reduce stigma and encourage cross-category substitution.

Distribution channels for non-alcoholic beer are bifurcated into Direct and Indirect sales. Direct channels include brand-owned online stores or flagship brewery sales, offering higher margins and direct consumer data acquisition. Indirect channels, which dominate volume, rely heavily on Off-Trade retailers (supermarkets, convenience stores) and On-Trade establishments (restaurants, hotels). The selection of channel strategy is critical; aggressive placement in non-traditional outlets like coffee shops or fitness centers (indirect) expands market reach beyond traditional beer drinkers, positioning the product as a true lifestyle beverage. Success hinges on optimizing inventory turnover across diverse retailer environments, utilizing data-driven insights to manage stock levels and promotional activity across both physical and digital storefronts.

Non-Alcoholic Beer Market Potential Customers

The primary consumers, or End-Users/Buyers, of non-alcoholic beer are highly segmented, moving far beyond the traditional designation of individuals restricted from consuming alcohol. A core group includes the 'Mindful Drinkers' or 'Sober Curious' demographic, primarily Millennials and Gen Z, who actively seek to limit alcohol intake for holistic health, fitness, or mental wellness reasons without sacrificing social participation or premium taste experiences. This demographic is characterized by high disposable income and a willingness to pay a premium for high-quality, flavorful alternatives, often driven by social media trends and health influencer endorsements.

A second major customer group comprises athletes and fitness enthusiasts who utilize non-alcoholic beer as a post-workout recovery beverage. Certain non-alcoholic beers contain carbohydrates and electrolytes, offering benefits similar to sports drinks, while avoiding the dehydrating effects of alcohol. This utility-driven consumption links the product to specific functional benefits, expanding its application beyond typical beverage occasions. Additionally, designated drivers and pregnant women represent stable, traditional consumption segments that rely on these products for safe, flavorful social inclusion, though their volume contribution is typically lower than the actively 'Sober Curious' segment.

A third rapidly growing consumer base is found in regions or communities where religious or cultural norms strongly restrict alcohol consumption. As the quality of non-alcoholic beer improves, it becomes a preferred option over traditional soft drinks in these markets. Furthermore, the market is increasingly targeting older demographics who may be reducing alcohol intake due to medical recommendations or age-related lifestyle adjustments. Successful market players customize their marketing messages—from promoting 'no compromise' flavor for the younger, social set, to emphasizing functional benefits and compatibility for the older, health-focused segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 45.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Krombacher Brauerei, Bitburger Braugruppe, Asahi Breweries, Suntory Holdings, Athletic Brewing Co., Big Drop Brewing Co., Clausthaler (Binding Brauerei), Bavaria N.V., Weihenstephaner, Erdinger Weissbräu, Nirvana Brewery, BrewDog. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Alcoholic Beer Market Key Technology Landscape

The technological landscape of the Non-Alcoholic Beer Market is dominated by advanced de-alcoholization techniques designed to strip alcohol while preserving the complex volatile aroma and flavor compounds derived from malt and hops. Historically, the heat-dependent methods often resulted in a 'worty' or compromised flavor. Modern innovation centers around minimizing thermal exposure. Key technologies include Vacuum Distillation, where beer is heated at lower temperatures (around 35-40°C) under reduced pressure, causing alcohol to evaporate quickly without damaging flavor molecules. Another critical method is Reverse Osmosis, which uses highly selective membranes to separate ethanol and water from larger flavor compounds, though this method can be capital-intensive and slow, often favored for smaller, high-quality craft batches. These sophisticated processes are essential competitive differentiators, directly correlating product quality with technological investment.

Arrested Fermentation represents a less equipment-intensive but highly skilled approach. This technique involves using specialized yeast strains or controlling the temperature and time of fermentation to prevent the yeast from producing significant levels of alcohol (keeping ABV below 0.5%). While simpler in initial setup, mastering arrested fermentation requires deep microbiological knowledge to ensure consistent flavor profiles batch-to-batch. A complementary technology involves the use of specialized, non-Saccharomyces yeasts that naturally produce fewer esters and fusel alcohols, contributing to a cleaner, non-alcoholic base beer. Continuous technological refinement focuses on hybridizing these methods, such as combining arrested fermentation with mild vacuum stripping, to achieve both cost efficiency and superior flavor results across high-volume production.

The ongoing technology race in this sector is driven by the demand for 'zero-compromise' taste. Beyond the de-alcoholization process itself, technology is also integrated into upstream quality control. Advanced sensor technology and automated systems monitor every stage, from mash conversion to final packaging, ensuring chemical consistency and compliance with 0.0% standards. Furthermore, shelf-life extension technologies, including high-tech pasteurization alternatives and advanced packaging materials that minimize oxygen ingress, are crucial for supporting global distribution and maintaining premium quality in diverse climate conditions. Future technological advancements are expected to focus on enzymatic processes and non-thermal separation techniques to further enhance flavor stability and mouthfeel.

Regional Highlights

Regional dynamics are crucial for understanding the global non-alcoholic beer landscape, reflecting differing cultural attitudes toward alcohol and varying paces of health-consciousness adoption.

- Europe: The historical powerhouse of the non-alcoholic beer market, holding the largest market share globally. Dominated by countries like Germany, Spain, and the UK, Europe has long integrated low- and no-alcohol options into daily life. Growth here is driven by well-established supply chains, consumer demand for functional and isotonic non-alcoholic beers, and proactive government policies promoting public health. The German market, in particular, benefits from a strong brewing heritage and sophisticated technology in de-alcoholization.

- North America (NA): Projected to exhibit the fastest growth rate. This acceleration is fueled primarily by the 'Sober Curious' movement, strong penetration of the craft beverage segment, and significant venture capital investment in dedicated non-alcoholic breweries. US consumers are increasingly seeking sophisticated, flavor-forward alternatives like non-alcoholic IPAs and stouts, with online retail playing a disproportionately large role in driving discovery and sales velocity.

- Asia Pacific (APAC): An emerging high-potential market. Growth is currently concentrated in developed economies such as Australia and Japan, where Western health trends are prevalent. The market in populous countries like China and India remains relatively untapped but presents immense long-term opportunities due to rapid urbanization and the growing middle-class seeking healthier, premium beverage choices. Local brewers are increasingly launching culturally tailored non-alcoholic variations.

- Latin America (LATAM): Showing steady, though nascent, growth, primarily centered in larger economies like Brazil and Mexico. Market penetration is often led by global players introducing established European or North American brands. The market potential is vast, contingent upon rising disposable incomes and successful educational campaigns to introduce the concept of high-quality non-alcoholic beer to traditional consumers.

- Middle East and Africa (MEA): A significant market segment driven by religious and cultural prohibitions against alcohol consumption. Countries within the Middle East have a high per capita consumption rate for non-alcoholic malt beverages. Growth in this region is stable and focused on maximizing distribution and ensuring Halal compliance across product formulations and manufacturing processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Alcoholic Beer Market.- Anheuser-Busch InBev

- Heineken N.V.

- Carlsberg Group

- Krombacher Brauerei

- Bitburger Braugruppe

- Asahi Breweries

- Suntory Holdings

- Athletic Brewing Co.

- Big Drop Brewing Co.

- Clausthaler (Binding Brauerei)

- Bavaria N.V.

- Weihenstephaner

- Erdinger Weissbräu

- Nirvana Brewery

- BrewDog

- Peroni Brewery (owned by Asahi Group)

- Goose Island Beer Company (owned by AB InBev)

- Kirin Holdings Company

- Kopparberg Breweries

- Molson Coors Beverage Company

Frequently Asked Questions

Analyze common user questions about the Non-Alcoholic Beer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Non-Alcoholic Beer Market?

The Non-Alcoholic Beer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven by global health and wellness trends and technological improvements in flavor retention.

Which geographical region dominates the non-alcoholic beer industry?

Europe currently holds the largest market share in the non-alcoholic beer industry, owing to long-standing consumer acceptance, robust brewing infrastructure, and strong demand in countries such as Germany and Spain.

What is the key difference between 0.0% ABV and 0.5% ABV non-alcoholic beer?

The primary difference is the maximum allowed alcohol content. 0.0% ABV guarantees virtually no alcohol and is preferred by strictly abstinent consumers, while 0.5% ABV is the regulatory threshold in many regions for labeling a beverage as "non-alcoholic," though both are considered non-intoxicating.

What technological advancements are driving improved flavor in non-alcoholic beer?

Improved flavor profiles are primarily driven by advanced de-alcoholization techniques, including Vacuum Distillation and Reverse Osmosis, which minimize heat exposure during alcohol removal, thereby better preserving the volatile flavor compounds of hops and malt.

What are the main distribution channels for non-alcoholic beer globally?

The dominant distribution channel is the Off-Trade segment, encompassing supermarkets, hypermarkets, and online retail. However, the On-Trade channel (bars and restaurants) is increasingly important for brand visibility and facilitating consumer trial and acceptance.

Who are the primary potential customers for non-alcoholic beer?

Potential customers include the 'Sober Curious' generation (Millennials and Gen Z seeking mindful drinking habits), athletes requiring functional recovery beverages, and individuals adhering to health, religious, or regulatory restrictions on alcohol consumption.

How is AI impacting the Non-Alcoholic Beer production process?

AI is primarily used to optimize de-alcoholization parameters for enhanced flavor consistency, predictive analytics for forecasting niche flavor trends, and improving cold chain logistics to manage the perishability of the final product.

Are non-alcoholic beers typically considered functional beverages?

Yes, increasingly. Modern non-alcoholic beers are often marketed as functional beverages, particularly those fortified with electrolytes, vitamins, or specific compounds (like polyphenols) that appeal to fitness enthusiasts and the broader health-conscious consumer base.

What is the role of craft brewers in the Non-Alcoholic Beer Market?

Craft brewers play a vital role as innovators, introducing diverse and complex non-alcoholic styles like specialty IPAs and sours. They drive the premiumization trend and challenge established market leaders on flavor quality and product differentiation.

What are the major market restraints limiting growth?

Key market restraints include the high initial capital expenditure required for advanced de-alcoholization equipment, the persistent challenge of maintaining optimal flavor stability over long shelf periods, and intense competition from highly capitalized global brewing giants.

How do brewers ensure the quality and safety of 0.0% ABV products?

Brewers utilize sophisticated quality control systems, often including rapid chromatography and advanced testing protocols, to rigorously monitor alcohol content throughout production. Compliance is further secured through strict adherence to manufacturing guidelines specific to the chosen de-alcoholization technology.

What is the significance of the arrested fermentation method?

Arrested fermentation is significant because it allows brewers to produce low-alcohol beer using conventional equipment by stopping the fermentation process early or employing specialized yeasts, offering a more cost-effective entry point for smaller breweries compared to capital-intensive thermal methods.

Which segment of non-alcoholic beer is growing the fastest?

The 0.0% ABV segment is exhibiting the fastest growth, largely due to consumer demand for absolute certainty regarding alcohol absence, aligning perfectly with strict health, driving, and regulatory requirements across global markets.

What impact does non-alcoholic beer have on the on-trade sector?

Non-alcoholic beer boosts profitability and inclusivity in the on-trade sector (bars, restaurants) by providing a premium, socially acceptable option for non-drinking patrons, thus extending dwell time and diversifying revenue streams beyond traditional alcoholic beverages.

How are environmental sustainability concerns affecting the market?

Environmental concerns are driving market innovation toward sustainable packaging (e.g., recyclable aluminum cans), reduced water usage in brewing, and transparent sourcing of ingredients, appealing to environmentally conscious younger consumers and bolstering brand reputation.

What role does social media play in non-alcoholic beer adoption?

Social media platforms are critical for market penetration, facilitating the spread of the 'Sober Curious' movement and enabling targeted marketing campaigns that align non-alcoholic beer consumption with aspirational, health-focused lifestyles, driving rapid brand discovery and engagement.

Is the market moving toward flavored or traditional non-alcoholic beer?

While traditional lagers maintain the volume base, the market demonstrates a strong trend toward diversification and flavored options. Fruit-infused, botanical, and heavily hopped non-alcoholic specialty beers are driving the highest growth rates and consumer experimentation.

How is the packaging of non-alcoholic beer evolving?

Packaging is evolving to mirror premium alcoholic craft beers, utilizing high-quality graphics and materials to signal sophistication and quality. There is a strong shift towards cans over bottles for better light protection, extended shelf stability, and superior recyclability.

What is the significance of the North American market growth?

The North American market’s high growth signifies a major cultural shift where non-alcoholic consumption is moving from a necessity to a deliberate lifestyle choice, backed by a robust local craft brewing scene that is heavily investing in innovative low- and no-alcohol offerings.

How does the pricing of non-alcoholic beer compare to alcoholic beer?

Due to the complex and capital-intensive de-alcoholization processes, premium non-alcoholic beers often command prices comparable to, or sometimes slightly higher than, standard full-strength mass-market beers, positioning them as a premium beverage choice.

What are the key segments under Distribution Channel?

The Distribution Channel is segmented into On-Trade (hospitality venues like bars and restaurants) and Off-Trade (retail outlets like supermarkets, convenience stores, and dedicated online platforms), with Off-Trade accounting for the majority of volume sales.

How does reverse osmosis work in non-alcoholic brewing?

Reverse Osmosis forces beer through extremely fine, semi-permeable membranes under high pressure. These membranes selectively separate the small ethanol and water molecules from the larger flavor and aroma compounds, allowing the compounds to be recombined later with de-ionized water.

What is the role of government regulation in the Non-Alcoholic Beer Market?

Government regulations define the legal thresholds for labeling (e.g., 0.5% ABV maximum), influence excise tax structures that often favor lower ABV beverages, and support public health campaigns promoting responsible consumption, all of which indirectly bolster the non-alcoholic segment.

Which technology is generally considered the most cost-effective for high volume production?

Continuous flow vacuum distillation is often considered the most efficient technology for high-volume production of non-alcoholic beer, as it allows for rapid processing and consistent results at industrial scale, despite the high initial investment costs.

What defines a specialty non-alcoholic beer?

Specialty non-alcoholic beers move beyond traditional styles like lagers or pilsners to include complex, niche varieties such as non-alcoholic sours, barrel-aged alternatives, and heavily spiced or botanical-infused malt beverages, appealing to sophisticated palates.

How does competition from non-alcoholic spirits affect the beer market?

Competition from non-alcoholic spirits and wines increases the threat of substitutes, forcing non-alcoholic beer producers to continuously innovate flavor and packaging to maintain market relevance and differentiate themselves within the broader low-and-no beverage category.

What opportunities exist in the Latin American Non-Alcoholic Beer Market?

The Latin American market offers opportunities through rising urbanization, increasing consumer spending power, and successful targeted marketing efforts that align non-alcoholic beer with regional culinary preferences and cultural events.

How important is supply chain optimization for non-alcoholic beer?

Supply chain optimization is extremely important due to the relatively shorter shelf life and higher sensitivity of non-alcoholic beer to temperature fluctuations, necessitating efficient cold chain logistics and precise inventory management to prevent spoilage.

Which demographic is driving the innovation in flavor profiles?

The younger demographics, specifically Gen Z and Millennials, are the primary drivers of flavor innovation, demanding experimental, complex, and high-quality taste profiles that reflect the diversity found in the full-strength craft beer sector.

What is the significance of the term 'Mindful Drinking' in this market?

'Mindful Drinking' defines the core cultural shift where consumers consciously moderate their alcohol intake, prioritizing mental and physical well-being. This movement underpins the accelerated demand for all high-quality, non-intoxicating beverage alternatives, including non-alcoholic beer.

How are traditional brewers responding to the rise of specialized non-alcoholic brands?

Traditional brewers are responding through strategic acquisitions of successful specialized non-alcoholic craft brands, heavy internal investment in dedicated non-alcoholic production facilities, and launching premium, high-quality non-alcoholic versions of their flagship established alcoholic brands.

What is the role of malt quality in non-alcoholic beer production?

Malt quality is foundational; since traditional fermentation is limited or arrested, the malt provides the essential body, mouthfeel, and baseline flavor complexity. Brewers often use specialized mash protocols to enhance the non-fermentable sugars that contribute to the final product's texture.

Why is the Middle East and Africa a unique market for non-alcoholic beer?

MEA is unique because consumption is largely driven by religious and cultural mandates against alcohol, resulting in historically high penetration rates. Market growth is stable and centers on continuous product diversification and robust, compliant distribution networks.

How does the non-alcoholic beer market benefit from celebrity endorsements?

Celebrity and influencer endorsements, particularly those focused on fitness, health, and sport, lend credibility to the category, reinforcing the message that non-alcoholic beer is a suitable, functional beverage for an active, modern lifestyle.

What are the typical upstream components in the value chain?

Upstream components involve the sustainable and quality-focused sourcing of raw ingredients: premium barley malt, specialty hops, water treatment technologies, and the procurement of specialized, low-alcohol producing yeast strains.

How is the definition of "non-alcoholic" beer regulated internationally?

The definition varies; in the US, up to 0.5% ABV is common for "non-alcoholic." In the UK and EU, "alcohol-free" typically means 0.05% ABV, while "low-alcohol" is usually up to 1.2% ABV. These differing regulatory landscapes necessitate country-specific labeling strategies.

What are the investment priorities of major brewing companies?

Major brewing companies prioritize investment in proprietary de-alcoholization technology, expanding global production capacity dedicated to non-alcoholic lines, and aggressive marketing campaigns focused on lifestyle integration and premiumization.

How is digital retail affecting non-alcoholic beer sales?

Digital retail platforms are highly effective, providing consumers with easy access to a wider selection of niche craft brands and facilitating direct-to-consumer sales. They are crucial for brand discovery and are driving significant volume growth, especially in North America.

What is the primary restraint related to distribution costs?

The primary distribution restraint is the necessity for maintaining a strict cold chain throughout the logistics process to preserve the delicate flavor profiles and prevent spoilage of non-alcoholic products, which significantly increases transportation and storage costs compared to traditional beer.

What is the forecasted market size of the Non-Alcoholic Beer Market by 2033?

The market is projected to reach an estimated value of USD 45.9 Billion by the end of the forecast period in 2033, reflecting substantial consumer adoption and expansion across global markets.

How do brewers mitigate the risk of off-flavors in non-alcoholic beer?

Brewers mitigate off-flavors by using precise, low-temperature de-alcoholization methods (like vacuum stripping), selecting specialized yeast strains that produce minimal unwanted compounds, and utilizing flavor matching techniques to reconstruct lost notes.

Which product type currently holds the largest volume share?

Non-Alcoholic Lagers currently hold the largest volume share due to their broad consumer acceptance, light flavor profile, and historical dominance in established European non-alcoholic markets.

What is the strategic significance of vertical integration in this market?

Vertical integration allows large players to gain greater control over the entire value chain, from raw material sourcing (malt, hops) to proprietary de-alcoholization technology, enabling cost control, quality assurance, and faster product innovation cycles.

How do health claims influence consumer purchasing decisions?

Health claims related to lower calorie content, the presence of vitamins or electrolytes, and isotonic properties are highly influential, driving purchasing decisions among consumers prioritizing fitness, recovery, and overall healthier beverage choices.

What are the technological challenges related to mouthfeel?

A key technological challenge is restoring the mouthfeel and body lost during the de-alcoholization process. Brewers use techniques like specialized mash schedules and adding non-fermentable carbohydrates or natural stabilizers to emulate the viscosity and richness of full-strength beer.

Why is the APAC region considered a high-potential market?

APAC is high-potential due to its enormous population base, rapidly growing middle class, increasing exposure to Western health trends, and rising consumer demand for premium, imported lifestyle beverages in sophisticated markets like Japan and South Korea.

What differentiates non-alcoholic beer from traditional soft drinks?

Non-alcoholic beer differs by offering the complex flavor profile, bitterness, and perceived sophistication of traditional beer, derived from malt and hops, distinguishing it from the simpler, often sweeter profile of carbonated soft drinks.

How are small craft brewers competing against large global players?

Small craft brewers compete by focusing intensely on innovation, creating unique and highly acclaimed niche flavors (e.g., small-batch non-alcoholic sours or double IPAs), and building strong, community-focused brand identities primarily through digital and direct sales channels.

What is the core driver related to demographic changes?

The core demographic driver is the shifting attitude of Millennials and Gen Z toward moderation and wellness, viewing non-alcoholic alternatives not as substitutes for sobriety but as integrated, enjoyable lifestyle choices compatible with health goals.

How does the On-Trade channel support brand building?

The On-Trade channel is crucial for brand building as it provides the opportunity for consumers to sample products in a social, high-visibility environment, helping to normalize consumption and build confidence in the product's quality and taste profile.

What is the significance of the Base Year 2025 in the report?

The Base Year 2025 serves as the reference point for calculating the projected CAGR and market size estimates over the forecast period (2026-2033), representing the current operational market conditions and structural trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Non-Alcoholic Beer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Non-Alcoholic Beer Market Size Report By Type (Limit Fermentation, Dealcoholization Method), By Application (Man, Woman), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Alcoholic and Non-Alcoholic Beer Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Alcoholic: Beer, Non-Alcoholic Beer), By Application (Bar, Restaurant, Daily Life, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager