Non-Alcoholic Wine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442630 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Non-Alcoholic Wine Market Size

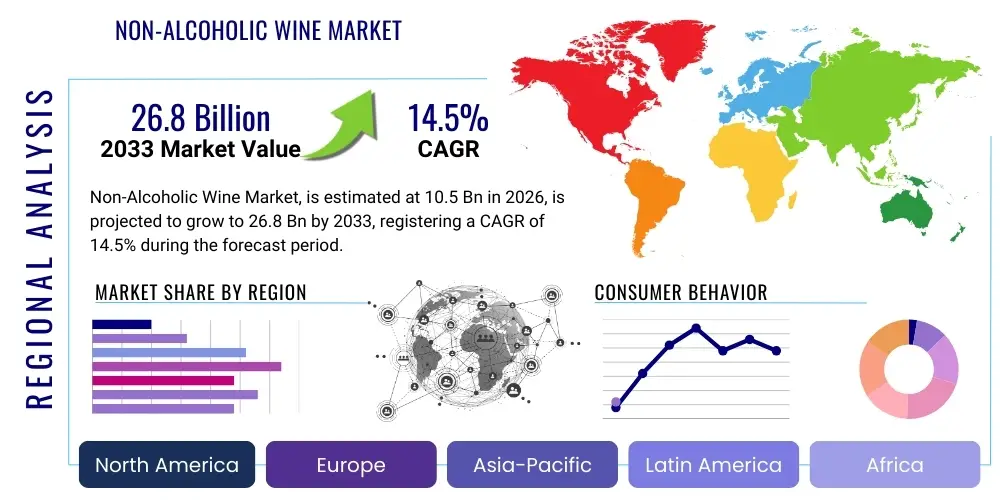

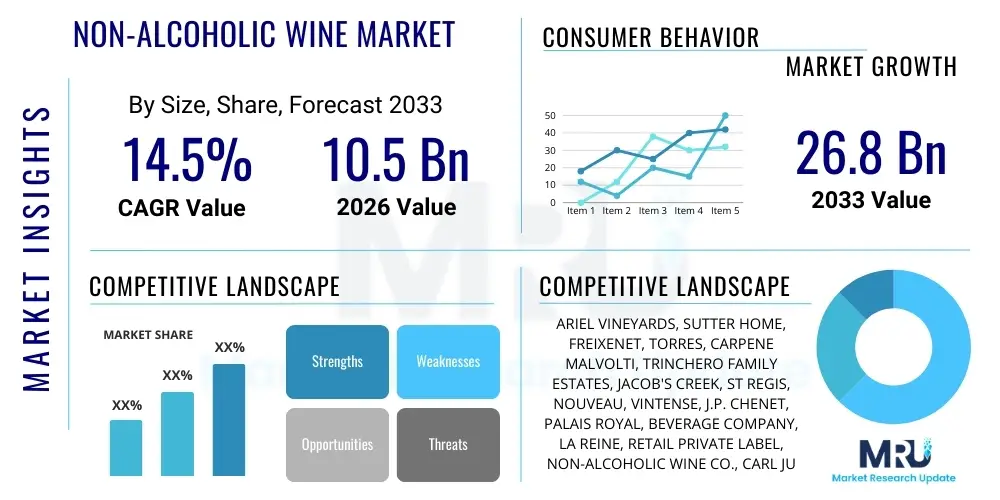

The Non-Alcoholic Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. This robust expansion is fueled by shifting consumer preferences towards healthier lifestyles, increased social acceptance of abstention, and continuous innovation in de-alcoholization technologies that improve the sensory profile of the final product. Market dynamics are heavily influenced by regulatory clarity and enhanced retail visibility, particularly in developed regions like Western Europe and North America.

The market is estimated at USD 10.5 Billion in 2026, driven primarily by the strong performance of off-trade distribution channels, including supermarkets and specialized online retailers. Consumer awareness campaigns focusing on the benefits of moderation and sober curiosity have significantly broadened the market appeal beyond traditional teetotaler demographics, drawing in Millennials and Gen Z who prioritize wellness and transparency in product labeling. Investment in premiumization within the non-alcoholic category further supports value growth, allowing producers to command higher price points similar to their alcoholic counterparts.

By the end of the forecast period in 2033, the market is projected to reach USD 26.8 Billion. This substantial valuation reflects the maturation of the production landscape, with sophisticated filtration and aroma recovery methods becoming standard, thereby narrowing the quality gap between alcoholic and non-alcoholic wines. Emerging markets, especially in Asia Pacific, are poised to contribute significantly to this growth as westernized drinking culture evolves alongside governmental initiatives promoting responsible alcohol consumption. The proliferation of specialized non-alcoholic retail environments and subscription services will solidify its position as a mainstream beverage category globally.

Non-Alcoholic Wine Market introduction

The Non-Alcoholic Wine Market encompasses beverages derived from traditional wine grapes that undergo a process to remove or significantly reduce the alcohol content (typically below 0.5% ABV). These products retain the complex flavor profiles, tannins, and aroma characteristics associated with wine, offering an alternative for consumers seeking mindful drinking options without sacrificing the sophisticated experience of wine consumption. The market is broadly segmented by product type (sparkling, still), process (de-alcoholized, low-alcohol), and distribution channel, reflecting a diverse consumer base and application landscape.

Major applications of non-alcoholic wine span across household consumption, social gatherings, and the hospitality sector (on-trade). In the household setting, it serves as a daily beverage choice for health-conscious individuals or those avoiding alcohol due to religious, medical, or lifestyle reasons. Within the on-trade environment, restaurants and bars are increasingly incorporating curated non-alcoholic wine lists to cater to demand for premium ‘mocktails’ and sophisticated pairings, enhancing the inclusiveness of their beverage offerings. The core product description emphasizes authenticity and flavor integrity, achieved through advanced technologies like vacuum distillation, reverse osmosis, and spinning cones.

The primary driving factors propelling this market include global trends toward preventive healthcare and wellness, increasing social acceptance of sobriety movements (such as Dry January and Sober October), and regulatory support emphasizing lower ABV options. Benefits to the consumer include reduced calorie intake, elimination of alcohol-related health risks, and the ability to participate in social rituals associated with wine drinking without impairment. Continuous research and development focused on improving shelf stability and sensory attributes are crucial for sustaining the market’s positive trajectory and ensuring long-term consumer loyalty.

Non-Alcoholic Wine Market Executive Summary

The Non-Alcoholic Wine Market is experiencing an epochal shift driven by fundamental changes in consumer lifestyle and heightened health consciousness across developed economies. Business trends indicate aggressive portfolio diversification among established alcoholic beverage producers, who are increasingly investing in dedicated non-alcoholic production lines and acquiring specialized non-alcoholic brands to capture new market share. Strategic partnerships between vineyards and food technology firms are accelerating innovation in flavor retention and stabilization processes. Furthermore, targeted marketing campaigns utilizing digital platforms are successfully normalizing non-alcoholic options, transforming them from niche products into mainstream lifestyle choices, particularly appealing to younger, digitally native generations who value transparency and ethical consumption.

Regionally, Europe dominates the non-alcoholic wine landscape, driven by strong regulatory frameworks supporting low and no-alcohol labeling, and deeply ingrained drinking cultures where wine alternatives are readily integrated into daily life. Germany, Spain, and the UK lead in consumption and production maturity. North America, particularly the US, shows the fastest growth, propelled by the wellness trend and robust e-commerce penetration which facilitates product discovery and availability across vast geographical areas. The Asia Pacific region, though starting from a smaller base, presents significant future opportunities, with countries like Australia and Japan quickly adopting western health trends and premium non-alcoholic options.

Segment trends highlight the dominance of the still non-alcoholic red and white wine categories due to their versatility, although the sparkling segment is registering the highest growth rate, fueled by its association with celebratory occasions and its widespread use in mixed drinks. Distribution channel analysis confirms that the off-trade segment (especially supermarkets and online retail) holds the majority market share, yet the on-trade segment is rapidly expanding as restaurants recognize the profitability and necessity of catering to sober patrons. Premiumization is a critical segment trend, with high-quality, vintage-specific non-alcoholic offerings commanding significant attention and contributing disproportionately to revenue growth.

AI Impact Analysis on Non-Alcoholic Wine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Non-Alcoholic Wine Market primarily center on three areas: optimizing the complex de-alcoholization process, predicting consumer acceptance of new flavor profiles, and enhancing supply chain efficiency from vineyard to shelf. Consumers and industry stakeholders are keen to know how AI can resolve the historical challenge of retaining nuanced flavor and aroma, which is often lost during alcohol removal. There is significant interest in using predictive algorithms to analyze regional preference data, ensuring that product development aligns perfectly with localized taste profiles, minimizing R&D waste. Furthermore, questions address the potential of AI-driven precision viticulture to manage grape quality optimally before processing, ensuring the finest raw materials for non-alcoholic production.

AI’s influence is profound in improving the technical aspects of non-alcoholic wine production. Machine learning models are being deployed to monitor fermentation and de-alcoholization parameters in real-time, adjusting temperature, pressure, and filtration rates dynamically to maximize the retention of volatile aroma compounds and minimize thermal stress on the product. This precision engineering significantly reduces batch variation and elevates the overall quality consistency, addressing a key historical restraint of the market. AI also plays a crucial role in quality control, utilizing image recognition and spectral analysis to quickly identify and reject substandard products or contaminants, ensuring only premium goods reach the consumer.

In market strategy, AI algorithms analyze vast datasets of consumer behavior, social media sentiment, and purchase history to segment the market with unprecedented granularity. This allows brands to execute highly personalized marketing campaigns, predicting which demographics are most receptive to specific product launches (e.g., non-alcoholic Rosé versus sparkling white). In logistics, AI optimizes warehousing, route planning, and inventory management for sensitive non-alcoholic products, improving cold chain management and reducing spoilage. Ultimately, AI adoption is viewed as essential for scaling operations efficiently and cementing the long-term viability and competitiveness of the non-alcoholic wine sector against traditional alcoholic beverages.

- AI optimizes de-alcoholization process parameters (temperature, pressure) for maximum flavor retention.

- Predictive analytics determine optimal market segmentation and personalized marketing strategies.

- Machine learning models enhance vineyard management (Precision Viticulture) for superior grape quality.

- AI-driven automated quality control ensures product consistency and integrity at scale.

- Supply chain optimization through AI minimizes logistics costs and ensures rapid, temperature-controlled distribution.

DRO & Impact Forces Of Non-Alcoholic Wine Market

The Non-Alcoholic Wine Market is shaped by a potent combination of Drivers (D), Restraints (R), and Opportunities (O) which collectively form the Impact Forces driving strategic decisions. The primary driver is the accelerating global health and wellness movement, characterized by consumers actively seeking lower sugar, lower calorie, and functional beverages. Coupled with this is the increasing sophistication of de-alcoholization technology, which has significantly improved taste profiles, making non-alcoholic wine a truly appealing alternative rather than a compromise. These positive forces are currently outweighing significant restraints, though challenges persist.

Major restraints include the complex regulatory landscape surrounding the labeling and taxation of non-alcoholic products, which can vary drastically by region, creating hurdles for international expansion. Furthermore, consumer perception remains a challenge in certain traditional wine markets, where a persistent skepticism about the quality and authenticity of non-alcoholic wine requires extensive educational marketing efforts. The high production cost associated with advanced de-alcoholization technologies (like spinning cone column or reverse osmosis), which are necessary for high-quality flavor retention, also presents a restraint, potentially limiting affordability compared to lower-cost traditional wines.

Opportunities for growth are vast, particularly in product innovation, focusing on single-varietal non-alcoholic premium lines and the incorporation of functional ingredients (e.g., adaptogens). Geographic expansion into rapidly developing Asian and South American markets, coupled with the leveraging of e-commerce and direct-to-consumer (D2C) channels, offers substantial avenues for market penetration. The synergistic impact forces result in a market where technology and consumer health demands create a high-growth environment, necessitating continuous investment in research to overcome residual taste and cost constraints.

Segmentation Analysis

The Non-Alcoholic Wine market is meticulously segmented to allow producers and retailers to tailor products and marketing strategies to specific consumer needs and consumption occasions. Segmentation is crucial for maximizing reach and understanding the diverse motivations driving purchases—whether for health reasons, specific dining pairings, or social participation. The primary breakdown includes product type, which differentiates between still (red, white, rosé) and sparkling varieties; process type, highlighting the distinction between truly de-alcoholized products (alcohol removed after fermentation) and low-alcohol alternatives; and the critical distribution channel, determining accessibility and pricing strategy.

Analyzing these segments reveals that while still wines represent the largest volume share due to their widespread use in food pairing and daily consumption, the sparkling segment is exhibiting the fastest value growth. This acceleration is linked to the increased use of non-alcoholic sparkling wine in social and celebratory contexts, where it acts as a perfect stand-in for traditional champagne or prosecco. The Off-Trade distribution channel, encompassing massive retail outlets and online platforms, dominates sales, reflecting the primary motivation of consumers buying for home use and stocking up. However, the premiumization trend is strongly driven by the On-Trade sector, where high-end restaurants validate the quality and sophistication of the non-alcoholic offerings.

Further segmentation by end-user, differentiating between household consumption and institutional/HORECA (Hotel, Restaurant, Cafe) usage, provides insight into demand elasticity and price sensitivity. Household consumers are often driven by price and convenience, favoring large retail chains, whereas institutional buyers prioritize consistency, premium branding, and the ability to serve sophisticated alternatives to their patrons. This detailed segmentation analysis is paramount for manufacturers to optimize their production volumes, packaging, and channel specific marketing investments effectively.

- Type: Still (Red, White, Rosé), Sparkling

- Product Category: De-alcoholized Wine (less than 0.5% ABV), Low-alcohol Wine (0.5% - 1.2% ABV)

- Distribution Channel: On-trade (Bars, Restaurants, Hotels), Off-trade (Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

- End-User: Household, Commercial (HORECA)

Value Chain Analysis For Non-Alcoholic Wine Market

The Non-Alcoholic Wine value chain begins with upstream activities focused on high-quality viticulture, where the selection of grape varietals and optimal growing conditions are crucial, as the base wine quality directly impacts the final de-alcoholized product. Unlike traditional winemaking, the production phase requires significant investment in specialized de-alcoholization technology, such as reverse osmosis units, vacuum distillation equipment, or spinning cone columns, adding complexity and cost to the manufacturing process. Key upstream players include specialized grape growers and technology providers specializing in low-pressure separation techniques necessary for flavor retention.

The midstream focuses on blending, stabilization, and bottling, often involving the reintroduction of reserved volatile aroma components or rectified concentrated grape must to enhance the sensory profile post-alcohol removal. Downstream activities involve distribution channels, which are bifurcated into direct and indirect routes. Direct distribution involves D2C sales via brand e-commerce platforms or specialized non-alcoholic retail boutiques, providing higher margins and direct consumer feedback. Indirect distribution utilizes wholesalers, large national distributors, and international importers, essential for penetrating mass market retail.

The final stage involves reaching the end-user through both on-trade (HORECA) and off-trade channels. The off-trade channel, dominated by large supermarket chains and hypermarkets, provides the highest volume sales and market visibility. However, online retail has emerged as a particularly critical distribution channel, offering consumers vast choice, detailed product information, and discreet home delivery. Success in the downstream segment is highly dependent on effective logistics management, brand positioning, and securing prime shelf space or prominent digital visibility in competitive retail environments.

Non-Alcoholic Wine Market Potential Customers

The Non-Alcoholic Wine Market targets a broad and evolving demographic spectrum, extending far beyond traditional non-drinkers to include proactive health consumers and flexible drinkers. The primary potential customers are health-conscious Millennials and Gen Z who prioritize physical and mental wellness and often practice mindful consumption or 'dry periods' (e.g., Dry January). These individuals seek sophisticated, adult-tasting alternatives that integrate seamlessly into social occasions without the negative effects of alcohol. Their purchasing decisions are heavily influenced by brand transparency, clean labeling, and ethical sourcing practices.

A second major segment comprises pregnant women, individuals on specific medications, and those restricted by religious or cultural beliefs from consuming alcohol. This group relies on non-alcoholic options for inclusion in social settings, demanding high-quality substitutes for ceremonial or celebratory events. Retailers and hospitality providers who can assure quality and variety for this demographic capture significant loyalty. Furthermore, the burgeoning segment of "sober curious" consumers, who are reducing their overall alcohol intake without eliminating it entirely, represents a high-growth customer base, viewing non-alcoholic wine as a bridge product.

Institutional buyers, specifically high-end restaurants, corporate caterers, and luxury hotels, are also critical potential customers. These entities purchase non-alcoholic wine to elevate their beverage programs, providing premium pairing options for non-drinking guests. Their demand focuses on consistency, prestigious branding, and robust supply chain reliability. Successfully marketing to this group requires detailed educational material on flavor profiles and optimal food pairings, positioning non-alcoholic wine as a gourmet culinary component rather than merely an alcohol substitute.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 26.8 Billion |

| Growth Rate | CAGR 14.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ARIEL VINEYARDS, SUTTER HOME, FREIXENET, TORRES, CARPENE MALVOLTI, TRINCHERO FAMILY ESTATES, JACOB'S CREEK, ST REGIS, NOUVEAU, VINTENSE, J.P. CHENET, PALAIS ROYAL, BEVERAGE COMPANY, LA REINE, RETAIL PRIVATE LABEL, NON-ALCOHOLIC WINE CO., CARL JUNG, BLUE NUN, KÖNIG & MEIER, VINADA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Alcoholic Wine Market Key Technology Landscape

The technological landscape of the Non-Alcoholic Wine Market is defined by sophisticated methods designed to remove ethanol while minimally compromising the complex aromatic and structural components derived from the initial fermentation. The two dominant technologies are Vacuum Distillation and Reverse Osmosis. Vacuum distillation involves heating the wine under reduced pressure, allowing ethanol to evaporate at much lower temperatures (typically below 30°C). This low-heat approach is superior to older methods as it mitigates heat damage to volatile flavor molecules, offering a cleaner, fresher final product. Producers are continually optimizing vacuum levels and processing times to enhance efficiency and flavor fidelity.

Reverse Osmosis (RO) is a filtration process where wine is forced through semipermeable membranes at high pressure, separating water and alcohol from the larger flavor molecules, tannins, and pigments. The separated water/alcohol solution is then processed to remove the alcohol, and the remaining flavor-rich concentrate is blended back with the dealcoholized water. RO is highly effective in maintaining the integrity of delicate flavor compounds but is a time-consuming and energy-intensive process. Recent innovations focus on improving membrane selectivity and longevity to reduce operational costs and increase throughput, making RO more commercially viable for large-scale premium production.

A third, highly specialized method is the use of Spinning Cone Columns (SCCs). SCCs utilize centrifugal force and counter-current steam or inert gas stripping to rapidly and gently remove volatile components, including alcohol, at low temperatures. This technology is highly valued for its ability to separate and recover delicate aroma compounds before de-alcoholization, allowing them to be reintroduced later. The investment in these high-tech solutions underscores the industry's commitment to quality, as superior technology directly translates into higher consumer acceptance and the premium positioning of non-alcoholic wine products.

Regional Highlights

The geographical analysis of the Non-Alcoholic Wine Market reveals distinct consumption patterns, regulatory environments, and growth trajectories across major global regions, essential for guiding market entry and expansion strategies. Europe stands as the mature leader, driven by established wine culture and early adoption of low/no-alcohol trends, particularly in Germany and the UK. North America, however, exhibits the most dynamic growth, fueled by strong consumer health trends and massive investment in digital commerce platforms, facilitating broad consumer access. Asia Pacific is the key region for future exponential expansion, spurred by evolving consumer tastes and rising disposable incomes, specifically in urban centers.

- Europe: Dominant market share attributed to sophisticated retail infrastructure and high consumer acceptance. Countries like Germany and Spain lead production and consumption, benefiting from cultural integration of low ABV beverages. Strict labeling standards ensure consumer trust.

- North America: Fastest growing region, centered in the United States and Canada. Growth is powered by wellness movements, robust e-commerce penetration, and major investments by domestic and international beverage conglomerates into dedicated non-alcoholic ranges.

- Asia Pacific (APAC): Emerging market with high potential, driven by urbanization and the adoption of Western healthy lifestyle trends in countries like Australia, Japan, and parts of China. Focus on premium imported non-alcoholic wines catering to sophisticated, affluent consumers.

- Latin America: Developing regional market showing moderate growth, primarily focused on imported premium products. Local production is nascent but is expected to accelerate as health awareness increases among middle-class populations, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Regionally crucial market due to cultural and religious restrictions on alcohol consumption, making non-alcoholic wine a necessary mainstream option. Growth is concentrated in the UAE and South Africa, driven by the tourism and luxury HORECA sectors demanding high-quality substitutes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Alcoholic Wine Market, encompassing traditional wine houses, specialized non-alcoholic brands, and large beverage conglomerates investing heavily in this high-growth category. These companies are characterized by their commitment to R&D in de-alcoholization technology and strategic expansion via premium product lines and global distribution networks.- ARIEL VINEYARDS

- SUTTER HOME

- FREIXENET

- TORRES

- CARPENE MALVOLTI

- TRINCHERO FAMILY ESTATES

- JACOB'S CREEK

- ST REGIS

- NOUVEAU

- VINTENSE

- J.P. CHENET

- PALAIS ROYAL

- BEVERAGE COMPANY (TESCO, WAITROSE PRIVATE LABELS)

- LA REINE

- RETAIL PRIVATE LABEL (ALDI, LIDL)

- NON-ALCOHOLIC WINE CO.

- CARL JUNG

- BLUE NUN

- KÖNIG & MEIER

- VINADA

Frequently Asked Questions

Analyze common user questions about the Non-Alcoholic Wine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Non-Alcoholic Wine Market?

The primary driver is the global shift toward health and wellness, characterized by consumer demand for low-calorie, low-sugar alternatives, coupled with significant technological improvements in de-alcoholization that enhance product taste and quality consistency.

How is non-alcoholic wine typically produced to retain its flavor?

High-quality non-alcoholic wine is produced using advanced, low-temperature methods like Vacuum Distillation, Reverse Osmosis, or Spinning Cone Columns. These techniques remove alcohol gently, minimizing heat damage to the delicate aromatic compounds and tannins essential for wine flavor.

Which distribution channel holds the largest market share for non-alcoholic wine sales?

The Off-Trade distribution channel, primarily comprising supermarkets, hypermarkets, and dedicated online retail platforms, currently dominates the market share due to its accessibility and the high volume of consumers purchasing for household consumption.

Which geographical region exhibits the fastest growth rate in this market?

North America, particularly the United States, is projected to register the highest Compound Annual Growth Rate (CAGR), driven by pervasive wellness trends, strong venture capital investment, and extensive e-commerce penetration enabling brand discoverability.

What is the key technological restraint facing non-alcoholic wine producers?

The key technological restraint is the high capital cost and energy intensity associated with advanced de-alcoholization equipment (like Reverse Osmosis and SCCs), which, while necessary for premium quality, increases the final unit production cost compared to traditional wine.

What defines a 'De-alcoholized' wine versus a 'Low-alcohol' wine?

De-alcoholized wine generally contains less than 0.5% alcohol by volume (ABV), achieved through active alcohol removal. Low-alcohol wine has a slightly higher ABV, typically ranging between 0.5% and 1.2% ABV.

How does AI contribute to improving non-alcoholic wine quality?

AI uses machine learning to optimize real-time parameters during the de-alcoholization process, such as temperature and pressure, ensuring optimal flavor retention and consistency across production batches, thereby resolving historical quality challenges.

Are established alcoholic wine producers entering the non-alcoholic segment?

Yes, major alcoholic beverage companies are significantly investing in the non-alcoholic segment through portfolio diversification, launching dedicated product lines, and strategic acquisitions to capture the growing demand for mindful drinking options.

Which consumer generation is driving the current boom in non-alcoholic wine consumption?

Millennials and Gen Z are the primary drivers of the non-alcoholic wine boom, as they prioritize health, transparency, and moderation, viewing non-alcoholic options as sophisticated alternatives for social engagement without impairment.

What is the market outlook for non-alcoholic sparkling wine?

Non-alcoholic sparkling wine is forecast to experience strong above-average growth, fueled by its premium perception, versatility, and increasing use in celebratory and social settings as a substitute for traditional champagne and prosecco.

What is the role of flavor retention agents in non-alcoholic wine?

Flavor retention agents and the reintroduction of concentrated aroma compounds, often separated and stored prior to de-alcoholization, are crucial steps post-processing to reconstruct the full sensory profile that mimics traditional wine characteristics.

How important are private labels in the non-alcoholic wine market?

Private label brands, especially those from large supermarket and hypermarket chains (e.g., Tesco, Aldi), are highly important as they provide affordable, accessible options, driving volume growth and mainstream acceptance of the category.

Does non-alcoholic wine contain fewer calories than traditional wine?

Generally, non-alcoholic wine contains significantly fewer calories than its alcoholic counterpart, as ethanol (alcohol) is the primary source of calories in traditional wine, making it highly attractive to diet-conscious consumers.

What is the significance of the HORECA segment (On-trade) for non-alcoholic wine?

The HORECA segment is significant because it validates the premium status of non-alcoholic wine. Restaurants and hotels offering sophisticated, curated options legitimize the category and drive consumer discovery and high-margin sales.

Which APAC country is a key emerging market for non-alcoholic wine?

Australia is a key emerging market due to its mature winemaking industry, strong health trends, and cultural proximity to European and North American consumption patterns, rapidly adopting premium local and imported non-alcoholic ranges.

What role do tannins play in the taste profile of quality non-alcoholic wine?

Tannins are critical for replicating the structure, mouthfeel, and complexity of traditional wine. Producers often employ specific methods or post-processing additions to ensure adequate tannic presence, overcoming the "watery" perception associated with low-quality substitutes.

What is the forecasted CAGR for the Non-Alcoholic Wine Market between 2026 and 2033?

The Non-Alcoholic Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period, reflecting high market dynamism and increasing consumer demand.

How do regulatory restraints affect market expansion?

Regulatory restraints, such as inconsistent labeling requirements and varied taxation rules across different countries regarding beverages categorized as 'low' or 'no' alcohol, complicate international logistics and standardization efforts, impeding seamless global market penetration.

What is meant by the 'sober curious' consumer segment?

The 'sober curious' segment refers to consumers who consciously choose to reduce their overall alcohol intake or periodically abstain, seeking mindful drinking options without the commitment of lifelong teetotalism, driving demand for premium substitutes.

Which non-alcoholic wine type holds the largest volume share?

Still non-alcoholic red and white wines currently hold the largest volume share, primarily due to their versatility for everyday consumption and established suitability for food pairings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Non-Alcoholic Wine and Beer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Non-Alcoholic Wine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Alcohol Free, Low Alcohol), By Application (Liquor Stores, Convenience Stores, Supermarkets, Online Stores, Restaurants), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager