Non-Contact Optical Surface Profiler Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443333 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Non-Contact Optical Surface Profiler Market Size

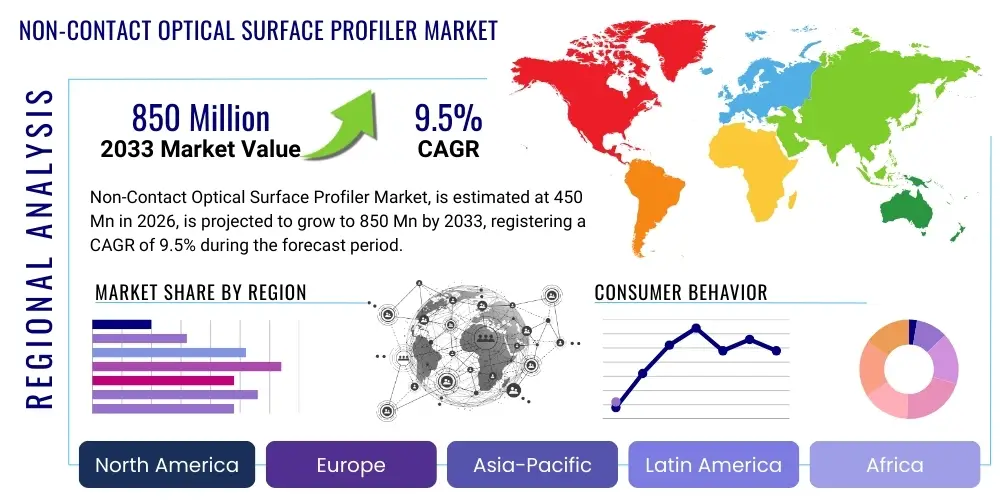

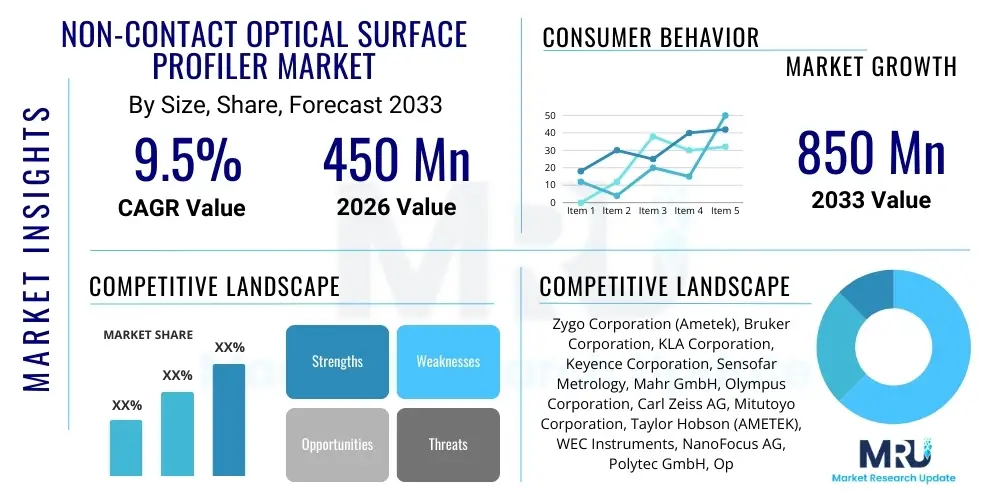

The Non-Contact Optical Surface Profiler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the relentless global push toward miniaturization in electronics and the increasingly demanding requirements for precision manufacturing across critical industrial sectors, making highly accurate, non-destructive surface characterization indispensable for modern production lines.

Non-Contact Optical Surface Profiler Market introduction

The Non-Contact Optical Surface Profiler Market encompasses advanced metrology instruments used for measuring the 3D topography, micro-geometry, and finish of surfaces without physically touching the sample. These instruments employ sophisticated optical principles—primarily White Light Interferometry (WLI), Coherence Scanning Interferometry (CSI), Confocal Microscopy, and Focus Variation—to generate high-resolution, three-dimensional maps of a surface. The fundamental necessity for these tools arises from the limitations of traditional contact methods (like stylus profilometers), which are often too slow, risk damaging delicate surfaces, and cannot achieve the required nano-scale vertical resolution demanded by modern manufacturing processes. The resulting data, typically presented as highly dense point clouds or parameterized surface texture measurements (e.g., Ra, Rq, Sa, Sq), is crucial for ensuring product functionality, controlling friction, wear, and corrosion, and validating component design tolerances in critical applications.

The core application fields driving the market growth are intrinsically linked to high-precision manufacturing. In the semiconductor industry, optical profilers are essential for quality assurance in wafer fabrication, chemical mechanical planarization (CMP) process monitoring, and verifying micro-bump height for advanced packaging. Within the rapidly evolving medical device sector, these profilers ensure the critical surface quality of orthopedic implants, drug-delivery systems, and surgical tools, where surface roughness directly impacts biocompatibility and performance. Furthermore, the automotive sector uses these systems extensively for inspecting precision-machined components like fuel injectors, bearings, and engine cylinder bores, guaranteeing optimal fit and minimizing frictional losses in high-efficiency engines. The versatility and speed of non-contact systems allow for integration into high-throughput production environments, transitioning metrology from a specialized laboratory task to an integral, real-time part of the manufacturing process.

The primary benefits fueling the sustained market expansion include the achievement of unparalleled vertical resolution, often reaching sub-nanometer levels, which is unattainable by most contact methods, and the inherent non-destructive nature of the inspection process. Coupled with significantly increased measurement speed facilitated by faster camera systems and parallel processing, these instruments offer substantial operational efficiency. Major driving factors include the global transition to smaller technological nodes in semiconductor manufacturing (sub-10 nm), the proliferation of complex micro-electromechanical systems (MEMS), and the stringent regulatory environment requiring comprehensive documentation of surface characteristics for quality standards like ISO 25178. The increasing global adoption of Industry 4.0 principles, demanding automated, high-volume inspection data, further solidifies the essential role of these advanced optical surface profilers in the future of smart manufacturing and automated quality assurance systems globally.

Non-Contact Optical Surface Profiler Market Executive Summary

The global Non-Contact Optical Surface Profiler Market is characterized by intense technological competition and a strong orientation towards automation, responding to the manufacturing imperative of higher throughput with zero-defect tolerances. Current business trends heavily favor vendors who can supply integrated, multi-functional systems that combine profiling capabilities with other metrology functions, such as 2D/3D vision systems or thickness measurement, allowing for comprehensive component analysis in a single platform. There is a perceptible shift among key players toward offering user-friendly software interfaces and extensive application support, lowering the operational complexity barrier for non-specialist users. Strategic mergers, acquisitions, and technology licensing agreements are common as companies seek to consolidate expertise in areas like advanced optics and AI-driven data processing, maintaining competitive edge in a highly specialized market. Furthermore, the growth in service contracts for calibration, software maintenance, and performance validation ensures recurring revenue and robust customer retention, especially among large industrial clients with mandated annual certification requirements.

Regionally, the Asia Pacific (APAC) region stands out as the dominant and fastest-growing market, largely due to the massive concentration of semiconductor fabrication facilities (fabs) and consumer electronics manufacturing hubs in countries like China, South Korea, Taiwan, and Japan. This leadership is directly attributable to the exponential expansion of high-volume electronics manufacturing and the substantial governmental and private sector investments pouring into advanced semiconductor manufacturing capabilities, which serve as the world's primary source for microprocessors and memory. North America and Europe, while mature, exhibit strong demand primarily from high-end R&D institutions, aerospace, and advanced medical device manufacturers requiring the highest levels of accuracy and customization, characterized by high Average Selling Prices (ASPs). The rapid industrialization and governmental emphasis on local high-tech production in emerging economies within APAC are expected to sustain its market leadership throughout the forecast period, leveraging strong governmental support for local technological advancement and R&D investment.

In terms of segmentation, the Interferometry technology segment remains the market backbone due to its unmatched precision required for nano-scale measurements. This segment, particularly Coherence Scanning Interferometry (CSI), continues to benefit from technological improvements in vertical scanning speed and noise reduction. The application segment focused on semiconductor and electronics metrology maintains the largest volume share, perpetually driven by the shrinking size of microelectronic features. However, the fastest projected segment growth is observed in the Automotive sector, specifically linked to the transition toward Electric Vehicles (EVs). EV manufacturing requires extremely precise surface quality control for battery components, power electronics, and lightweight structural materials, necessitating highly reliable and robust optical profilers capable of high-speed inline measurements. This consistent demand across both mature and burgeoning industrial applications solidifies the market’s positive trajectory and demands continuous innovation in computational metrology.

AI Impact Analysis on Non-Contact Optical Surface Profiler Market

User inquiries frequently highlight the need for AI to revolutionize the interpretation of complex 3D surface data, moving beyond simple numerical outputs to actionable quality intelligence. Common questions revolve around the potential for deep learning algorithms to automatically differentiate between functional features, harmless surface noise, and critical defects (e.g., distinguishing an acceptable surface ripple from a destructive inclusion). Users also express a keen interest in utilizing AI to standardize measurement protocols across different machines and sites globally, mitigating the persistent challenge of inter-operator variability and ensuring consistency in metrology results. The expectation is that AI integration will significantly reduce the expertise required to operate these highly technical instruments, democratizing access to high-precision surface metrology and accelerating adoption across smaller enterprises, thereby lowering the total cost of ownership.

The transformative effect of Artificial Intelligence is particularly evident in the realm of pattern recognition and high-volume data handling. Modern non-contact profilers can generate gigabytes of 3D data per measurement, making manual analysis prohibitive. AI-driven solutions, using Convolutional Neural Networks (CNNs), can be trained on vast libraries of surface measurements, enabling them to instantly identify and classify specific defect types (e.g., scratches, pits, contamination) based on their topographical signature. This automation accelerates the inspection process by orders of magnitude, allowing for 100% inspection in high-speed manufacturing lines, which was previously impossible. Furthermore, AI helps in automatically segmenting complex surfaces, distinguishing between different regions of interest, and applying appropriate analysis filters, thereby improving the reliability and objectivity of the reported quality metrics, moving metrology closer to automated prescriptive process control.

Beyond defect analysis, AI is crucial for optimizing the performance and reliability of the profiling equipment itself. Machine learning models analyze historical operational data, environmental conditions (e.g., temperature, vibration), and measurement outputs to create predictive models that anticipate when system calibration drift is likely to occur or when a core component (like the light source or piezo stage) requires maintenance. This shift to prescriptive maintenance drastically minimizes unexpected downtime, a critical factor in semiconductor and aerospace manufacturing environments where every minute of halted production incurs immense costs. Moreover, AI allows for the development of adaptive measurement strategies, where the profiler intelligently adjusts its settings in real-time based on the incoming data, maximizing measurement efficiency and minimizing measurement error due to material variations or environmental fluctuations, thereby optimizing the entire metrology workflow dynamically.

- AI enables automated defect classification and anomaly detection on complex surfaces, improving accuracy and speed and replacing time-consuming human interpretation.

- Machine Learning optimizes measurement parameters dynamically based on material characteristics and ambient conditions, ensuring highest repeatability and precision.

- Deep learning models facilitate advanced noise reduction and coherent signal filtering, enhancing the signal-to-noise ratio in challenging measurement scenarios, such as highly diffuse or low-reflectivity materials.

- Predictive maintenance driven by AI maximizes instrument uptime and reduces unplanned calibration or repair downtime, crucial for continuous high-volume production.

- AI supports seamless integration into smart factory environments (Industry 4.0) by providing real-time quality feedback loops and prescriptive process adjustment recommendations.

- Algorithms developed through Machine Learning standardize measurement consistency across multiple machines globally, addressing the challenge of inter-site metrology variability.

- AI can process and interpret large-scale 3D datasets generated by high-resolution profilers rapidly, accelerating the time-to-decision for quality engineers.

DRO & Impact Forces Of Non-Contact Optical Surface Profiler Market

The Non-Contact Optical Surface Profiler Market dynamics are strongly dictated by the intersection of technological necessity and economic viability. A primary driver is the accelerating requirement for smaller, more efficient components, especially in high-growth areas like electric vehicle battery components, advanced display technologies (OLED/MicroLED), and 5G communication devices, all demanding surface tolerances previously unattainable. The regulatory environment, particularly the tightening of quality control standards in highly sensitive sectors (e.g., FDA requirements for medical implants and ISO/AS9100 for aerospace), mandates detailed, traceable surface metrology data, intrinsically favoring non-contact, high-resolution systems that can generate comprehensive 3D documentation. This necessity is further compounded by the continuous innovation in materials science, requiring profilers capable of characterizing novel coatings, composites, and specialized metallic alloys with complex surface characteristics.

Conversely, significant restraints hinder broader market penetration. The most notable barrier is the substantial capital investment required for purchasing and installing premium interferometric systems, often running into hundreds of thousands of dollars, making them cost-prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity associated with advanced optical systems necessitates highly skilled technicians for setup, alignment, and data validation, creating a talent gap challenge in certain regions. Technical limitations persist in accurately profiling certain materials, such as deeply scattering or highly absorbing media, or surfaces with extreme angles that cause light signal loss, requiring specific technological compensations that increase system cost and complexity, thereby limiting their universal adoption across all manufacturing workflows.

Opportunities for market growth are abundant, rooted in the ongoing trend toward automation and the emergence of new high-tech manufacturing methods. The additive manufacturing (AM) sector presents a massive untapped opportunity, as the quality and performance of 3D-printed parts are highly sensitive to surface texture and porosity, creating a need for rapid, non-destructive, and scalable in-line inspection solutions. Developing more affordable, robust, and portable systems leveraging computational optics and simplified designs could significantly unlock the SME market segment. Furthermore, expanding the application scope into areas like microfluidics inspection, biometric sensor manufacturing, and specialized film metrology ensures diversification and resilience against cyclic downturns in core industries like semiconductors, while the continuous pursuit of higher measurement speed and enhanced lateral resolution promises ongoing technological competitive advantage.

The impact forces are profoundly high due to the specialized nature of the technology. The threat of substitution is low because traditional contact profilometry cannot meet the necessary resolution or non-destructive requirement for nano-scale work, and alternative non-optical methods (like AFM) are typically too slow for production environments. Supplier power is moderate-to-high, derived from the proprietary nature of key optical components (e.g., specialized objectives, high-coherence sources). However, the intensity of competitive rivalry among the top tier of metrology providers (e.g., Zygo, Bruker, KLA) is fierce, driven by continuous innovation in software and hardware integration, resulting in sustained downward pressure on technological differentiation and feature sets rather than pure price. The increasing market integration with AI tools also acts as a powerful force, creating disruptive changes in how surface data is captured, analyzed, and integrated into factory control systems.

Segmentation Analysis

The Non-Contact Optical Surface Profiler Market is meticulously structured across multiple segmentation dimensions, providing a granular view of market demand tailored to highly specific industrial requirements. The segmentation by technology is paramount, differentiating instruments based on their underlying physical principles and defining their core capabilities: Interferometry dominates for high-precision, smooth surfaces, relying on light coherence and phase analysis for vertical measurement, while Confocal and Focus Variation systems are preferred for speed and robustness on rougher, steeper surfaces. This technological dichotomy reflects the trade-off between ultra-high resolution and operational flexibility/speed that industrial users must navigate based on their specific application needs, ranging from laboratory-grade instruments to ruggedized production floor units capable of handling harsh environments.

Furthermore, segmentation by end-use industry clearly illustrates the market's reliance on high-tech sectors. The semiconductor segment requires the most demanding specifications, often driving investment in advanced Coherence Scanning Interferometry (CSI) and Spectroscopic Reflectometry for wafer and packaging inspection. In contrast, the automotive and general manufacturing segments show increasing uptake of Focus Variation and Confocal systems, valuing rapid measurement of form, texture, and wear on larger, geometrically complex parts. Analyzing the product type segmentation highlights the shift from traditional benchtop systems, used primarily in R&D and failure analysis labs, toward in-line and integrated systems that are crucial for Industry 4.0 deployment, enabling high-speed, 100% inspection integrated with robotic handling and automated data logging, reflecting the market’s move towards real-time process monitoring.

The growth dynamics within these segments are uneven. While interferometry holds steady value, Focus Variation is gaining momentum due to its improved capabilities on previously challenging surfaces and its lower overall cost of ownership compared to highly complex WLI systems, attracting wider adoption in mid-tier manufacturing. Moreover, the increasing demand for advanced materials characterization, especially in aerospace and energy, is boosting the segment related to roughness and texture measurement applications, demanding systems compliant with specific aerospace material standards. This detailed segmentation allows manufacturers to target their R&D investments effectively, focusing on developing hardware and software solutions that address the nuanced metrology challenges inherent in each distinct technological and industrial application area.

- By Technology:

- Interferometry (White Light Interferometry, Phase-Shifting Interferometry, Coherence Scanning Interferometry - CSI)

- Confocal Microscopy (Laser Scanning Confocal Microscopy - LSCM)

- Focus Variation (FV)

- Spectroscopic Reflectometry (Specialized for thin film thickness)

- Digital Holography and Fringe Projection

- By Product Type:

- Benchtop/Laboratory Grade Systems (High-end R&D)

- In-line/Integrated Systems (Automated QC for Production)

- Portable and Handheld Systems (Field inspections, large components)

- By Application:

- Roughness and Texture Measurement (e.g., Ra, Sa, fractal dimension)

- Film Thickness and Step Height Measurement

- Form, Contour, and Warpage Measurement

- Defect Analysis and Classification

- Volume and Area Measurement (e.g., craters, bumps)

- By End-Use Industry:

- Semiconductors and Electronics (Wafer inspection, advanced packaging)

- Automotive and Transportation (Engine parts, bearings, EV components)

- Aerospace and Defense (Turbine blades, coatings, structural integrity)

- Medical Devices and Pharmaceuticals (Implants, micro-fluidic channels)

- Academia and Research (Nanotechnology, Materials Science)

- Machinery and Precision Manufacturing (Tools, molds, optics)

Value Chain Analysis For Non-Contact Optical Surface Profiler Market

The value chain begins with the sourcing and procurement of highly specialized, high-performance optical and electronic components. The upstream segment is defined by critical reliance on suppliers providing ultra-precise components: high-numerical aperture (NA) objectives with extremely low aberrations, low-coherence light sources (LEDs, supercontinuum sources), ultra-high-resolution sensors (megapixel cameras with low noise), and highly precise linear or rotary nanopositioning stages (using piezoelectric or capacitive control). The cost and performance of the final profiler are fundamentally determined by the quality and integration of these proprietary components. Suppliers often require deep technical collaboration with profiler manufacturers to meet rigorous metrology standards, leading to concentrated and interdependent supplier relationships rather than a fragmented commodity market, ensuring a consistent supply of cutting-edge technology.

The core manufacturing stage involves the precision assembly, optical alignment, and integration of the complex hardware with highly sophisticated proprietary software for data acquisition, processing, and visualization. Manufacturers like Zygo, Bruker, and Keyence invest heavily in R&D to develop advanced algorithms for noise reduction, phase stitching, and surface texture parameter calculation (adhering to ISO standards like 25178), which represent a crucial source of intellectual property and competitive differentiation. The complexity of calibration is also a significant value addition at this stage, requiring climate-controlled environments and standardized traceable artifacts. Successful manufacturing requires expertise not only in optics but also in computational metrology and robust industrial design to create systems that can withstand production floor conditions while delivering laboratory-grade accuracy.

Distribution and downstream services complete the value chain. High-value systems are primarily distributed through direct sales channels, ensuring that specialized application engineers provide extensive pre-sales consultation, custom configuration, and post-installation training, guaranteeing optimal system performance tailored to unique client metrology requirements. Indirect channels, employing authorized local distributors and system integrators, are used to penetrate regional markets and provide localized, rapid service support. The highest downstream value addition comes from long-term service contracts, which include routine ISO-traceable calibration, necessary for regulatory compliance (especially in medical and aerospace industries), preventative maintenance, and continuous software updates, ensuring the equipment remains accurate and compliant throughout its lifecycle, generating predictable recurring revenue for the vendor base.

Non-Contact Optical Surface Profiler Market Potential Customers

The primary customers are organized into industrial clusters characterized by an unwavering need for dimensional and surface integrity control at the micro and nano levels. Leading the demand are the quality assurance and process control departments within major semiconductor fabrication plants (Foundries), where the profilers are deployed in cleanrooms to monitor Chemical Mechanical Planarization (CMP) uniformity, measure micro-bump heights in advanced 3D packaging, and verify the physical structure of photomasks. These customers prioritize system throughput, repeatability (gauge R&R performance), and compatibility with automated wafer handling systems (e.g., SECS/GEM interface), viewing the profiler as a mission-critical tool for yield management and defect reduction in sub-10nm processes.

A secondary, high-growth customer segment resides in the advanced materials and precision engineering sectors. This includes manufacturers of high-performance bearings, specialized gears, and complex molds, as well as firms producing optical components (lenses, mirrors, diffractive elements) requiring verification of ultra-smooth finishes. For these buyers, the key decision factors are the profiler's capability to measure steep slopes and reflective or transparent materials, coupled with adherence to strict dimensional tolerances defined by aerospace (e.g., GE, Pratt & Whitney specifications) or high-precision automotive standards. Their procurement focuses on robust, versatile systems that can handle a variety of materials and geometries, often integrated with environmental control features to ensure measurement stability regardless of ambient factory conditions.

Finally, the medical device sector constitutes a critical customer base, particularly companies manufacturing bio-compatible implants, micro-catheters, and drug-eluting stents. Surface texture in this segment is directly correlated with patient safety and device efficacy (e.g., minimizing thrombosis risk). These customers require profilers capable of verifying surface finish on complex, small, and often transparent polymer or metallic components. Their requirements extend beyond basic roughness to detailed analyses of feature edge sharpness and surface cleanliness. Research institutions, nanotech centers, and national metrology institutes also function as influential customers, often being the first adopters of next-generation technologies (like high-speed digital holography systems), driving the initial demand for innovation and helping establish new metrology standards that eventually trickle down to industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zygo Corporation (Ametek), Bruker Corporation, KLA Corporation, Keyence Corporation, Sensofar Metrology, Mahr GmbH, Olympus Corporation, Carl Zeiss AG, Mitutoyo Corporation, Taylor Hobson (AMETEK), WEC Instruments, NanoFocus AG, Polytec GmbH, Optosurf GmbH, Starrett, Shenzhen Huatong Precision Metrology, Alicona Imaging GmbH, Chotest Technology, GBS Corp., Fries Research & Technology GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-Contact Optical Surface Profiler Market Key Technology Landscape

The foundational technology underpinning the Non-Contact Optical Surface Profiler market centers heavily on advanced methods of light wave manipulation and computational imaging. White Light Interferometry (WLI), specifically Coherence Scanning Interferometry (CSI), remains the market premium standard, leveraging the low temporal coherence of broadband light sources. By scanning the optical path difference across a wide range, CSI identifies the position of highest fringe contrast (the envelope peak), which corresponds to the point of zero path difference and thus, the surface height. This method yields superior vertical resolution (often below 0.1 nm) and is indispensable for ultra-smooth surfaces, precision optics, and critical semiconductor measurements. Recent advancements focus on implementing faster reference axis scanners (e.g., voice coil motors) and improved computational engines to acquire and process the large data volumes rapidly, enabling WLI to transition from slow lab tools to in-line monitoring systems.

Confocal Microscopy, another key pillar, employs spatial filtering (using a pinhole) to ensure that only light returning from the focal plane contributes to the image, effectively rejecting scattered light from out-of-focus areas. This technique excels at measuring surfaces with steep slopes (up to 70 degrees) and complex geometries, common in additive manufacturing and precision tooling. The evolution of Confocal systems includes multi-pinhole or spinning disk technology to boost light throughput and scanning speed, maintaining excellent lateral resolution while accelerating the acquisition of 3D data. Focus Variation (FV), a more robust and mechanically simpler technique compared to interferometry, relies on analyzing image quality (contrast/sharpness) throughout the vertical scan range. FV is highly successful in general engineering applications, offering excellent depth of field and ease of use on rougher industrial surfaces, making it a critical entry point for high-volume manufacturing quality control due to its balance of speed, versatility, and cost-effectiveness.

The future technology landscape is moving towards convergence and computational enhancement. Spectroscopic Reflectometry is gaining importance for extremely high-precision thickness measurements of transparent or semi-transparent films (e.g., photoresist layers, coatings) where nanometer accuracy is required. Furthermore, the integration of advanced computational optics, often involving techniques derived from digital holography and structured light illumination, aims to eliminate or minimize the need for mechanical scanning, dramatically increasing measurement speed (potentially sub-second acquisition). Crucially, the deployment of Machine Learning and AI algorithms is becoming standard, not just for automating defect classification but also for real-time system calibration and thermal compensation, ensuring that these high-precision optical instruments maintain peak performance and data integrity within fluctuating industrial environments, guaranteeing the fidelity of complex 3D surface topography data.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and is forecasted to demonstrate the fastest growth rate (highest CAGR). This dominance is fundamentally rooted in the region's status as the global manufacturing hub for semiconductors, consumer electronics, and automotive components. Investment in new fabrication facilities (fabs) across China, Taiwan, and South Korea, coupled with strong government initiatives supporting indigenous high-tech development (e.g., China’s Made in 2025), necessitates continuous procurement of advanced, high-throughput non-contact profilers for defect control and yield optimization. Japan remains a critical center for high-end optical innovation and specialized machinery manufacturing.

- North America: North America represents a mature, high-value market driven by demand for ultra-premium, cutting-edge metrology solutions required by the aerospace, defense, and specialized medical device manufacturing sectors. Demand is characterized by extremely stringent quality requirements, often requiring customized software solutions and bespoke system integration. Significant government and private funding in nanotechnology and advanced materials research also ensures a sustained appetite for the latest interferometry and high-resolution confocal technologies, pushing innovation boundaries for ultra-precise surface analysis.

- Europe: Europe maintains a substantial market presence, heavily influenced by its strong presence in advanced manufacturing, particularly in the German automotive industry (including internal combustion, hybrid, and electric vehicle components) and high-precision machinery (tool and die making). The European market is highly regulated, prioritizing systems compliant with ISO 25178 and VDA standards, favoring robust, traceable, and automated systems capable of integrating seamlessly into sophisticated Industry 4.0 production lines. Key growth areas include verifying the surface integrity of complex additive manufactured parts across the region.

- Latin America (LATAM) and Middle East & Africa (MEA): While currently smaller in market size, these regions present significant untapped growth potential. Growth in LATAM is tied to the expansion of local automotive assembly plants and oil and gas infrastructure development, requiring specialized inspection tools for quality standardization. In MEA, market expansion is primarily focused on advanced infrastructure projects, diversification efforts away from oil economies, and growing investment in local R&D centers and defense manufacturing capabilities, leading to slow but steady demand for reliable non-contact inspection and quality assurance tools necessary for high-value national projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-Contact Optical Surface Profiler Market.- Zygo Corporation (Ametek)

- Bruker Corporation

- KLA Corporation

- Keyence Corporation

- Sensofar Metrology

- Mahr GmbH

- Olympus Corporation

- Carl Zeiss AG

- Mitutoyo Corporation

- Taylor Hobson (AMETEK)

- WEC Instruments

- NanoFocus AG

- Polytec GmbH

- Optosurf GmbH

- Starrett

- Shenzhen Huatong Precision Metrology

- Alicona Imaging GmbH

- Chotest Technology

- GBS Corp.

- Fries Research & Technology GmbH.

- Edmund Optics

- Thorlabs Inc.

- Nikon Metrology

- Vision Engineering Ltd.

- Micro-Vu Corporation

Frequently Asked Questions

Analyze common user questions about the Non-Contact Optical Surface Profiler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between White Light Interferometry (WLI) and Confocal Microscopy in profiling?

WLI provides superior vertical resolution (sub-nanometer) using broadband light coherence and is the benchmark for measuring highly smooth surfaces, critical dimensions, and thin films in semiconductor metrology. Confocal Microscopy offers better lateral resolution and is generally preferred for measuring surfaces with steep slopes, high aspect ratios, and complex geometries commonly encountered in precision mechanical engineering and tooling analysis, offering high speed on rougher samples.

Which industry segment drives the highest demand for optical surface profilers and why?

The Semiconductor and Electronics industry segment consistently drives the highest demand. This is necessitated by the non-negotiable requirement for ultra-precise, non-destructive measurement of critical dimensions, wafer flatness, and film thickness control required for high yields in advanced microchip and integrated circuit manufacturing processes, particularly as feature sizes shrink below 10nm.

How is the adoption of in-line vs. benchtop profilers changing the market?

The market is seeing a definitive acceleration in the adoption of in-line/integrated profiler systems. Driven by Industry 4.0 and the need for automated, 100% quality control, in-line systems allow for rapid, continuous process monitoring directly on the production floor, reducing measurement latency compared to traditional, dedicated benchtop systems used primarily for off-line research and failure analysis.

What is the role of AI and Machine Learning in modern surface profiler systems?

AI integration is crucial for automating complex metrology workflows. It enhances defect classification and anomaly detection, optimizes measurement parameters in real-time, compensates for environmental noise, and drives predictive maintenance, transforming profilers into intelligent, self-optimizing quality control systems that maximize throughput and measurement objectivity.

What are the main technical challenges when profiling surfaces with extreme slopes or scattering properties?

Extreme slopes cause difficulty for most optical profilers (especially interferometers) due to shadowing and signal loss, known as missing data areas. Highly scattering surfaces reduce the signal-to-noise ratio and can produce erroneous phase information. Manufacturers address these challenges through advanced objective lenses, specific illumination techniques, and sophisticated software algorithms (like noise filtering and phase stitching) or by employing alternative technologies like Focus Variation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager