Non-invasive Blood Glucose Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442201 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Non-invasive Blood Glucose Sensor Market Size

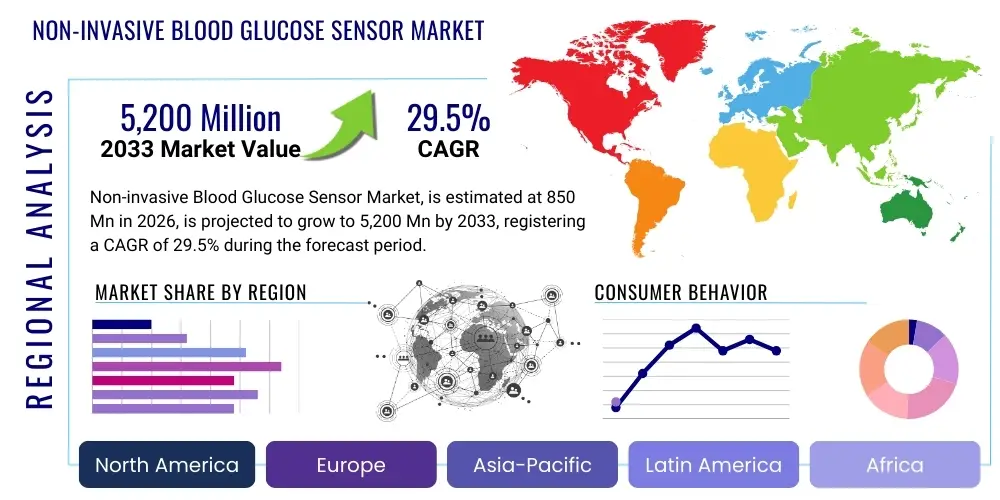

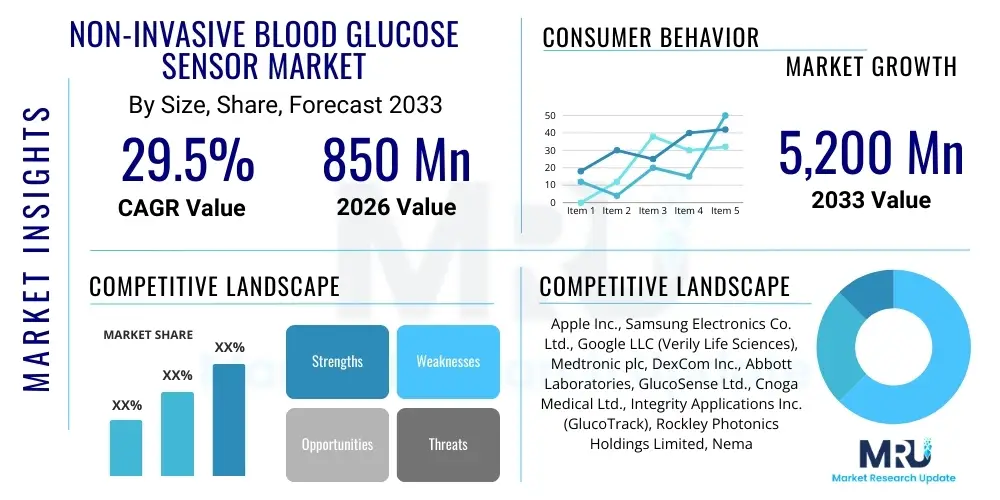

The Non-invasive Blood Glucose Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 29.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 5,200 Million by the end of the forecast period in 2033.

Non-invasive Blood Glucose Sensor Market introduction

The Non-invasive Blood Glucose Sensor Market represents a pivotal shift in chronic disease management, moving away from traditional, painful finger-prick methods toward continuous, painless monitoring solutions. These advanced sensors employ various sophisticated technologies, including spectroscopic analysis (Near-Infrared, Raman), optical coherence tomography, thermal detection, and radio frequency sensing, to measure glucose levels through the skin without drawing blood. The primary product scope encompasses wearable devices, suchately integrated into smartwatches or patches, and benchtop clinical systems designed for frequent, comfortable measurement, driving superior compliance rates among diabetic populations globally.

Major applications for non-invasive blood glucose sensors span personal health management for Type 1 and Type 2 diabetes patients, clinical diagnostics, telehealth monitoring, and fitness and wellness tracking where metabolic health is a key metric. The integration of these sensors into consumer electronics is democratizing access to crucial health data, enabling proactive lifestyle adjustments and personalized treatment regimens. Furthermore, the pharmaceutical industry is exploring these sensors for continuous monitoring during clinical trials, offering real-time kinetic data previously unattainable with intermittent testing.

The key benefits driving market expansion include significantly improved patient adherence due to the elimination of pain, reduced risk of infection associated with invasive procedures, and the ability to provide high-frequency, continuous data streams crucial for preventing hypo- and hyper-glycemic episodes. This technological evolution is fundamentally reshaping diabetes care. The market is fundamentally driven by the escalating global prevalence of diabetes, the increasing demand for remote patient monitoring (RPM) solutions, and massive investments in research and development aimed at overcoming historical accuracy and calibration challenges inherent in non-invasive sensing techniques. Regulatory support for novel medical technologies further accelerates commercialization efforts.

Non-invasive Blood Glucose Sensor Market Executive Summary

The Non-invasive Blood Glucose Sensor Market is characterized by intense technological innovation, driven by high unmet needs in the global diabetes care landscape. Business trends indicate a strong move toward strategic partnerships between sensor manufacturers and consumer electronics giants (Apple, Samsung), aiming to integrate highly accurate NIBG technology into mainstream wearable devices. This convergence promises economies of scale and significantly expanded market reach beyond traditional medical channels. Furthermore, venture capital funding is heavily focused on companies achieving clinical validation for long-term accuracy and stability, suggesting that the competitive advantage in the near term will hinge primarily on regulatory approvals (FDA, CE Mark) rather than immediate cost competitiveness. Commercial strategies are shifting from niche medical devices to mass consumer wellness products, redefining profitability models and distribution logistics.

Regionally, North America maintains market dominance due to high healthcare expenditure, significant prevalence of diabetes, and a robust regulatory environment that supports rapid adoption of advanced medical devices. However, the Asia Pacific region (APAC) is projected to exhibit the highest growth rate, fueled by expanding healthcare infrastructure, burgeoning diabetic populations in China and India, and increasing governmental initiatives promoting early disease management. European countries are focusing on reimbursement policies to integrate these cost-effective, non-invasive solutions into national health systems, driving steady, predictable growth. Latin America and MEA remain nascent but show immense potential, particularly in urban centers where access to reliable, convenient monitoring technologies addresses infrastructural deficiencies common in rural health settings.

Segment trends highlight the dominance of the wearable device category, particularly integrated smartwatch/wristband formats, primarily due to consumer preference for convenience and continuous monitoring capability. Technology-wise, spectroscopy-based methods (e.g., Near-Infrared Spectroscopy, Photoacoustic Spectroscopy) are receiving the highest investment, promising improved accuracy comparable to invasive standards. End-user segmentation shows that Type 2 diabetes management represents the largest addressable market segment globally, though the most significant clinical impact is often cited in Type 1 diabetes and pre-diabetic monitoring. The ecosystem surrounding data interpretation and AI-driven predictive modeling (Software/Services segment) is also expanding rapidly, adding critical value beyond raw sensor data acquisition.

AI Impact Analysis on Non-invasive Blood Glucose Sensor Market

User inquiries frequently revolve around the potential of Artificial Intelligence to solve the perennial challenge of signal noise and calibration drift, which historically hampered the reliability of non-invasive glucose monitoring. Common questions include: "Can AI make non-invasive sensors as accurate as invasive ones?", "How does machine learning personalize sensor calibration?", and "What role does AI play in predicting future glucose trends and preventing emergencies?" These concerns underscore a fundamental user expectation: that AI will bridge the gap between complex physiological sensing and clinically actionable data, moving NIBG devices from experimental tools to reliable medical staples.

AI, specifically machine learning and deep learning algorithms, is absolutely crucial for the commercial viability and clinical acceptance of non-invasive blood glucose sensors. Physiological measurements taken through the skin (optical, thermal, or electrical) are inherently susceptible to confounding variables such as skin hydration, temperature fluctuations, ambient light, movement artifacts, and individual patient variability (e.g., differing skin pigmentation or tissue density). AI models are leveraged to filter this noise, establish sophisticated correlation models between the non-invasive signal (the proxy measurement) and true physiological glucose levels, and drastically reduce the need for frequent manual calibration by identifying complex patterns that human analysis or simple linear regression cannot detect.

The application of AI extends beyond simple data cleaning and calibration; it powers the predictive capabilities of these next-generation sensors. By analyzing historical glucose data, patient activity, meal logging, and concurrent physiological metrics (like heart rate and skin conductance), AI algorithms can generate accurate, personalized predictive models for impending hyper- or hypo-glycemic events minutes or even hours in advance. This predictive functionality transforms the sensor from a measurement tool into a critical decision-support system, directly addressing the core need for proactive diabetes management and driving significant clinical outcomes, thereby boosting overall market valuation and accelerating adoption among high-risk patient groups.

- AI enables real-time signal processing and noise reduction in complex multi-parameter sensing.

- Machine Learning algorithms facilitate personalized sensor calibration, minimizing inter-patient variability issues.

- Deep Learning models improve correlation accuracy between proxy signals (e.g., optical properties) and actual blood glucose concentration.

- AI powers predictive analytics, offering advanced warnings of hypo/hyperglycemic trends, enhancing patient safety.

- Neural networks are used to compensate for environmental factors (temperature, humidity) affecting sensor performance.

- Data aggregation via AI supports longitudinal patient management and optimizes treatment protocols through pattern recognition.

DRO & Impact Forces Of Non-invasive Blood Glucose Sensor Market

The Non-invasive Blood Glucose Sensor Market is significantly influenced by a powerful combination of technological acceleration and clinical necessity, simultaneously facing substantial hurdles related to precision and regulatory rigor. Key market drivers include the overwhelming global burden of diabetes, the fundamental demand for patient comfort and improved adherence offered by non-invasive methods, and rapid technological advancements, especially in optics and miniaturization, enabling integration into aesthetically appealing wearables. Restraints primarily center on the persistent clinical challenge of achieving "clinical grade" accuracy comparable to invasive methods (ISO 15197 standards) without recalibration, coupled with stringent regulatory scrutiny demanding robust, long-term clinical validation data. Opportunities reside in leveraging AI for signal optimization and targeting vast, untapped consumer wellness markets alongside traditional medical users.

The primary driving force remains the unprecedented rise in diagnosed diabetes cases worldwide, demanding accessible, continuous monitoring solutions that alleviate the logistical and emotional toll of daily finger-pricking. Public health initiatives, coupled with rising consumer awareness regarding preventative health, further amplify the demand for discreet and continuous monitoring. Investments in semiconductor technology and advanced materials science are enabling the creation of smaller, more energy-efficient sensors capable of reliable long-term deployment. This synergy between clinical need and technological feasibility acts as a significant propellant, attracting substantial cross-industry investment from tech firms seeking entry into high-growth health sectors.

However, the market faces significant structural restraints. Achieving regulatory clearance necessitates overcoming accuracy hurdles, particularly in measuring glucose fluctuations across diverse physiological states and demographics. Calibration stability over weeks or months remains a major technical obstacle for purely non-invasive systems. Furthermore, the high initial cost of R&D and manufacturing advanced optical or acoustic sensor arrays, coupled with the slow pace of favorable reimbursement decisions in many territories, imposes commercial limitations. The overall impact forces are high: Drivers exert a powerful, long-term upward pressure fueled by demographic necessity, while Restraints represent acute, short-term barriers tied to technological maturation and regulatory compliance, necessitating multi-billion-dollar investments to overcome.

Segmentation Analysis

The segmentation of the Non-invasive Blood Glucose Sensor Market is vital for understanding diverse demand patterns across technology, end-user applications, and geographical reach. The market is primarily categorized based on the method of sensing (e.g., optical, thermal, electromagnetic), the device format (e.g., wearable, tabletop, handheld), and the primary end-user (e.g., hospitals, homecare settings, research institutes). This differentiation allows manufacturers to tailor R&D and commercial strategies, focusing on specific segments where the accuracy and convenience tradeoff is most acceptable, such as the consumer wellness market for general trends monitoring, versus clinical settings demanding high precision for critical decision-making.

The technology segment reveals crucial differences in maturity and investment levels. Spectroscopic techniques, particularly those utilizing Near-Infrared (NIR) light, dominate investment due to their potential to correlate light absorption changes with glucose concentration, offering the best pathway toward continuous, highly localized measurement. Conversely, the device format segmentation underscores the transition from bulky clinical prototypes to sleek, consumer-friendly wearables, which account for the largest volume share. The fastest-growing segment, however, is the integration of software and services, which transforms raw sensor data into actionable health insights and predictive warnings, thus driving value retention and subscription models.

Geographically, market potential varies significantly based on healthcare infrastructure and chronic disease management maturity. Developed regions like North America focus on integration into sophisticated telemedicine platforms and high-end consumer wearables, while emerging markets prioritize cost-effectiveness and accessibility. Accurate segmentation provides stakeholders with the necessary granularity to forecast demand accurately, manage complex supply chains tailored for specialized components (like high-performance spectrometers or sophisticated RF circuits), and effectively navigate the divergent regulatory landscapes governing medical devices versus general wellness products across major global economies.

- Technology Type:

- Spectroscopic (Near-Infrared, Raman)

- Electromagnetic (RF/Microwave)

- Thermal and Metabolic

- Optical Coherence Tomography (OCT)

- Device Type:

- Wearable Devices (Smartwatches, Wristbands, Patches)

- Tabletop/Clinical Devices

- Handheld/Portable Devices

- End-User:

- Home Care Settings

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Distribution Channel:

- Online Pharmacy/E-commerce

- Retail Pharmacy

- Direct Sales (Hospitals)

- Geography:

- North America (U.S., Canada)

- Europe (Germany, UK, France)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East and Africa (GCC Countries, South Africa)

Value Chain Analysis For Non-invasive Blood Glucose Sensor Market

The value chain for the Non-invasive Blood Glucose Sensor Market is complex and vertically integrated, extending from highly specialized component suppliers to final patient deployment. The upstream segment is dominated by niche manufacturers providing critical components, including high-precision optical components (e.g., micro-spectrometers, advanced LEDs and photodetectors), specialized semiconductor chips for signal processing, and advanced biosensing materials crucial for creating the interface layer between the device and the skin. Innovation and intellectual property ownership at this stage, particularly in miniaturization and power efficiency, are key determinants of overall device performance and cost structure. Strong relationships with suppliers specializing in medical-grade component traceability are paramount for regulatory compliance.

Midstream activities encompass device assembly, software development (including AI calibration algorithms and cloud integration), and stringent quality assurance and clinical validation testing. This stage demands significant capital investment in R&D and clinical trials to prove accuracy and reliability, which is the primary barrier to entry. Downstream activities involve distribution and end-user engagement. The distribution channel is bifurcated: direct sales targeting hospitals and large clinics, requiring specialized medical sales representatives and complex contracts, and indirect sales targeting the massive consumer segment via e-commerce platforms, retail partnerships (pharmacies, big box stores), and integration with telecommunication providers offering smart device bundles. Effective downstream strategy must manage both regulated medical device standards and high-volume consumer logistics.

The distinction between direct and indirect channels is critical for market penetration and establishing trust. Direct channels provide necessary education and integration support within clinical workflows, bolstering acceptance among healthcare professionals (HCPs). Indirect channels, leveraging vast e-commerce reach, drive rapid consumer adoption, particularly for wellness-focused devices. The success of the entire value chain is increasingly reliant on seamless integration of data services—the sensor itself acts as a gateway to recurring revenue models based on data analysis, predictive alerts, and personalized coaching services. This shift makes software developers and data scientists as valuable as sensor engineers within the value chain.

Non-invasive Blood Glucose Sensor Market Potential Customers

Potential customers and end-users of Non-invasive Blood Glucose Sensors are highly diversified, extending far beyond the traditional patient population, reflective of the device's transformation from a medical necessity to a preventative wellness tool. The core customer base includes individuals diagnosed with Type 1 and Type 2 diabetes, who seek comfortable, continuous monitoring to improve glucose control and quality of life. Within this group, the elderly population, facing dexterity issues with traditional meters, represents a high-priority segment. Endocrinologists and general practitioners are secondary customers, as their adoption and recommendation drive prescription and reimbursement approval, legitimizing the technology.

A rapidly expanding segment consists of pre-diabetic individuals and health-conscious consumers interested in continuous metabolic monitoring for preventative health, weight management, and performance optimization. These users often integrate NIBG data with existing fitness trackers to understand the impact of diet, exercise, and stress on their blood sugar stability. This segment is less sensitive to strict clinical accuracy standards but highly demands excellent user experience and seamless integration into consumer electronics ecosystems. Furthermore, clinical research organizations and pharmaceutical companies utilize these sensors for high-frequency, non-intrusive monitoring of participants in drug trials, offering significant efficiency gains over conventional methods.

Institutional buyers, such as integrated healthcare delivery networks (IDNs), hospitals, and government health programs, constitute a major procurement segment. Their interest is primarily driven by the long-term cost-effectiveness and enhanced population health management capabilities afforded by remote patient monitoring (RPM) enabled by these sensors. The ability of NIBG technology to reduce hospital readmissions related to poor glycemic control provides a compelling economic argument for large-scale institutional adoption. Finally, health insurance providers are key stakeholders, influencing adoption through coverage policies that favor preventative and non-invasive solutions over costly acute interventions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 5,200 Million |

| Growth Rate | 29.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Samsung Electronics Co. Ltd., Google LLC (Verily Life Sciences), Medtronic plc, DexCom Inc., Abbott Laboratories, GlucoSense Ltd., Cnoga Medical Ltd., Integrity Applications Inc. (GlucoTrack), Rockley Photonics Holdings Limited, Nemaura Medical Inc. (S-Patch), NovioSense BV, Bio-Rad Laboratories Inc., LifeLeaf Technologies, and PicoSens Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Non-invasive Blood Glucose Sensor Market Key Technology Landscape

The Non-invasive Blood Glucose Sensor market is defined by a dynamic and highly competitive technology landscape, characterized by several distinct approaches aimed at measuring subtle physiological changes correlated with blood glucose levels. The leading technological cluster is Spectroscopic Analysis, utilizing various parts of the electromagnetic spectrum, most notably Near-Infrared (NIR) light and Raman spectroscopy. NIR sensors measure the absorption of light by different tissue components, with glucose exhibiting specific absorption bands. The challenge lies in isolating the glucose signal from interfering substances like water and hemoglobin, a problem increasingly mitigated through advanced signal processing and multi-wavelength analysis. Raman spectroscopy, though technically complex and typically more expensive, offers higher chemical specificity, promising superior accuracy in controlled environments.

Another prominent technology involves Electromagnetic or Radio Frequency (RF) sensing, where sensors measure changes in the dielectric properties of tissue caused by varying glucose concentrations. Since glucose is a polar molecule, changes in its concentration affect the electrical properties of interstitial fluid. RF sensors, often integrated into wearable patches or wristbands, offer the advantage of requiring less direct contact with the skin and potentially lower manufacturing costs than complex optical systems. However, they are highly sensitive to movement and proximity to metallic objects, demanding sophisticated algorithms to maintain signal integrity. Recent breakthroughs involve miniaturized, wideband RF antennae and high-frequency microwave sensing, improving depth penetration and measurement stability.

Emerging technologies include Photoacoustic Spectroscopy and Optical Coherence Tomography (OCT). Photoacoustic methods use short laser pulses absorbed by glucose molecules, generating sound waves proportional to glucose concentration, which are then detected by acoustic sensors. This technique offers excellent spatial resolution and depth analysis but is mechanically complex. OCT provides high-resolution, cross-sectional imaging of the skin to analyze tissue composition, correlating changes in scattering properties with glucose levels. While highly promising, these advanced techniques require further miniaturization, energy efficiency improvements, and rigorous clinical trials to validate their long-term viability and ease of use in daily consumer settings, suggesting a phased technological adoption where simplified optical systems lead the immediate commercialization efforts.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant market share due to the early adoption of advanced medical technologies, high diabetes prevalence rates, and substantial consumer purchasing power dedicated to health and wellness wearables. The region benefits from a highly supportive ecosystem encompassing aggressive venture capital funding for NIBG startups, established clinical trial infrastructure, and strong collaboration between medical device firms and major tech companies (e.g., Apple, Google). Favorable reimbursement policies for continuous monitoring devices, even non-invasive ones once FDA-approved, are key drivers. The focus here is on integrating NIBG sensors into sophisticated telehealth and remote patient monitoring (RPM) platforms, maximizing data utility for preventative care, and serving a technologically savvy patient base.

- Europe: Europe represents a mature market with steady growth, driven primarily by government initiatives focused on reducing the long-term economic burden of chronic diseases. Countries like Germany, the UK, and France are actively exploring ways to incorporate cost-effective, non-invasive monitoring tools into national health systems. Regulatory approval via the CE Mark is often considered a stepping stone for global entry. The challenge in Europe lies in the fragmented reimbursement landscape across member states, requiring localized market entry strategies. Technological demand leans toward medical-grade devices validated for Type 1 management, emphasizing clinical accuracy over sheer consumer aesthetics, differentiating it slightly from the US market's focus on the wellness segment.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This exponential growth is fueled by massive, expanding diabetic populations in densely populated countries such as China and India, coupled with rapid modernization of healthcare infrastructure and increasing disposable incomes. Government policies in key markets are promoting domestic manufacturing and digital health initiatives. The critical success factors in APAC include scalability, affordability, and the development of sensors optimized for diverse skin types and environmental conditions (e.g., high humidity). Japan and South Korea lead in adopting integrated consumer electronics, creating a fertile ground for seamless NIBG integration into smart wearables.

- Latin America and Middle East & Africa (LAMEA): These regions currently hold the smallest market share but present significant long-term opportunities. Growth is driven by urbanization and rising chronic disease rates, combined with the necessity for solutions that bypass insufficient clinical infrastructure in remote areas (telemedicine potential). Investment is highly focused on partnerships and distribution channels that can reliably deliver and support sophisticated devices in challenging logistical environments. Price sensitivity is high, meaning market success often depends on demonstrating substantial cost savings over traditional hospital interventions and achieving mass consumer affordability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Non-invasive Blood Glucose Sensor Market.- Apple Inc.

- Samsung Electronics Co. Ltd.

- Google LLC (Verily Life Sciences)

- Medtronic plc

- DexCom Inc.

- Abbott Laboratories

- GlucoSense Ltd.

- Cnoga Medical Ltd.

- Integrity Applications Inc. (GlucoTrack)

- Rockley Photonics Holdings Limited

- Nemaura Medical Inc. (S-Patch)

- NovioSense BV

- Bio-Rad Laboratories Inc.

- LifeLeaf Technologies

- PicoSens Inc.

- Sibel Health

- K'Watch (PKvitality)

- GWave (DiaMonTech)

- Senseonics Holdings, Inc.

- Echo Therapeutics, Inc.

Frequently Asked Questions

Analyze common user questions about the Non-invasive Blood Glucose Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological hurdle preventing widespread adoption of non-invasive blood glucose sensors?

The central hurdle is achieving consistent, clinical-grade accuracy (comparable to ISO 15197 standards) across diverse patient demographics and physiological conditions without frequent manual calibration. Signal interference from skin properties (hydration, temperature) and movement artifacts significantly challenges reliability, necessitating sophisticated AI compensation.

Will non-invasive blood glucose sensors replace traditional finger-prick methods entirely?

While non-invasive sensors will significantly reduce the reliance on painful finger-prick testing for daily trend monitoring and management, traditional invasive methods are likely to remain necessary for high-accuracy calibration checks and critical decision-making (e.g., during severe hypo/hyperglycemia) until regulatory bodies fully validate the long-term clinical equivalence of non-invasive technologies.

How do wearable technology companies integrate non-invasive blood glucose sensing?

Wearable companies primarily leverage optical technologies, specifically miniaturized spectroscopic sensors (often NIR or Raman-based), integrated discreetly into the casing of smartwatches or wristbands. Data is processed using on-device AI for noise reduction and transmitted via Bluetooth to mobile apps for display, predictive analysis, and cloud storage.

What is the forecast for the Non-invasive Blood Glucose Sensor Market's growth rate?

The market is projected for explosive growth, with a Compound Annual Growth Rate (CAGR) estimated at 29.5% between 2026 and 2033. This high growth is driven by technological breakthroughs, increased consumer demand for comfort, and massive strategic investment from major technology and healthcare corporations.

Which geographic region is expected to lead market growth in the near future?

The Asia Pacific (APAC) region is forecasted to lead market growth in terms of CAGR, driven by the expanding diabetic population in countries like China and India, improving healthcare access, and the high scalability potential for integration into mass-market consumer electronics.

This report contains 29680 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager