Nonstick Spatula Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442741 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Nonstick Spatula Market Size

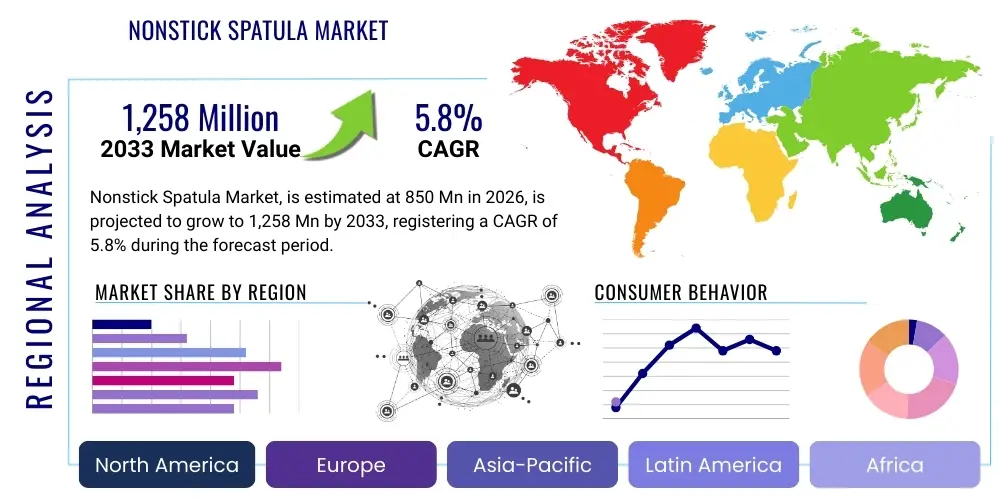

The Nonstick Spatula Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,258 Million by the end of the forecast period in 2033.

Nonstick Spatula Market introduction

The Nonstick Spatula Market encompasses a diverse range of kitchen utensils designed specifically for use with nonstick cookware, preventing damage to sensitive cooking surfaces. These specialized spatulas are typically fabricated from heat-resistant materials such as silicone, nylon, or certain high-grade plastics, offering superior flexibility, durability, and non-abrasive properties compared to traditional metal counterparts. The core function of these spatulas is centered around flipping, stirring, scraping, and serving food items without compromising the integrity of expensive nonstick coatings, thereby extending the lifespan of cookware sets. The market's growth trajectory is inherently linked to the global proliferation of nonstick pots and pans, which have become a staple in both residential and professional kitchens due to their convenience and reduced requirement for cooking oil.

The primary applications of nonstick spatulas span across various culinary domains, including baking, grilling, pan-frying, and general food preparation. Key market drivers include rising consumer awareness regarding kitchen safety and the harmful effects of scratched nonstick coatings, alongside increasing disposable incomes globally, which encourage the purchase of specialized, higher-quality kitchen tools. Furthermore, the aesthetic appeal and ergonomic design improvements, such as enhanced grip features and integrated measuring tools in some premium models, contribute significantly to consumer adoption. These tools offer tangible benefits, including improved food release, ease of cleaning (often being dishwasher safe), and protection against high heat environments, making them indispensable modern kitchen accessories.

Recent market dynamics show a strong shift towards environmentally sustainable and BPA-free materials, aligning with broader consumer preference for health-conscious products. Manufacturers are increasingly focusing on innovations such as composite materials that offer greater heat resistance (upwards of 600°F) and enhanced structural rigidity, allowing for heavier-duty use without sacrificing the nonstick-safe property. The competitive landscape is characterized by a mix of large established houseware brands and niche manufacturers specializing in high-performance silicone utensils. Digital marketing and e-commerce platforms play a crucial role in disseminating product information and driving sales, especially among Millennial and Gen Z demographics who prioritize specialized cooking tools.

Nonstick Spatula Market Executive Summary

The global Nonstick Spatula Market demonstrates robust growth driven primarily by structural changes in consumer cooking habits, characterized by a preference for convenience and durability in kitchen equipment. Business trends indicate a movement towards premiumization, where consumers are willing to invest more in ergonomic, aesthetically pleasing, and functionally superior spatulas, particularly those made from medical-grade silicone or reinforced nylon. Key manufacturers are focusing on diversifying their product portfolios, introducing specialized spatula types—such as flipper spatulas, icing spatulas, and wok spatulas—to cater to specific culinary tasks, thus expanding the average consumer’s kitchen arsenal. Strategic mergers, acquisitions, and collaborations between kitchenware giants and sustainable material suppliers are becoming common strategies to gain a competitive edge and secure environmentally conscious supply chains.

Regionally, the market is spearheaded by North America and Europe, attributed to high purchasing power, established home cooking cultures, and sophisticated retail infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is fueled by rapid urbanization, the expansion of middle-class households, and increasing adoption of Western-style cooking techniques and associated nonstick cookware. Retail distribution channels in emerging economies are maturing, shifting from traditional marketplaces to modern hypermarkets and dedicated online retail platforms, which significantly improves the accessibility of specialized kitchen tools like nonstick spatulas to a broader consumer base. Furthermore, stringent regulatory standards concerning food contact materials in regions like the EU necessitate continuous innovation in material composition, focusing on safety and non-toxicity.

In terms of segmentation, the material type segment dominated by silicone spatulas continues to hold the largest market share due to their superior heat resistance, flexibility, and longevity compared to nylon or plastic variants. The end-user segment remains dominated by the residential sector, although the commercial sector, comprising restaurants, catering services, and institutional kitchens, presents a lucrative growth avenue driven by high-volume replacement needs and requirements for commercial-grade durability. Trends within the distribution segment highlight the accelerating dominance of e-commerce platforms, offering manufacturers direct access to consumers, enabling personalized marketing, and facilitating faster product iteration based on direct customer feedback and reviews, reinforcing the dynamic nature of this seemingly simple kitchen utility market.

AI Impact Analysis on Nonstick Spatula Market

Analysis of common user questions regarding AI's impact on the Nonstick Spatula Market reveals primary concerns centered on manufacturing efficiency, smart kitchen integration, and personalized product recommendations. Users frequently inquire if AI-driven manufacturing processes, such as predictive maintenance and advanced robotics, can lower production costs and improve the quality consistency of complex materials like multi-layer silicone. There is also significant curiosity about how AI could influence product design, specifically through generative design algorithms that optimize spatula geometry for better ergonomics or specialized flipping tasks. Furthermore, users anticipate that AI-powered recommendation engines and personalized shopping experiences will streamline the purchasing process, suggesting the optimal nonstick spatula based on individual cooking styles, cookware brands, and dietary habits, fundamentally shifting marketing and distribution strategies within the specialized kitchen tool domain.

- AI-driven Quality Control: Implementation of computer vision systems to detect minute defects in silicone molding and nylon fabrication, ensuring high product consistency and reducing manufacturing waste.

- Generative Product Design: Utilizing AI algorithms to optimize spatula geometry for specific tasks (e.g., maximum contact area for pancakes, optimal angle for scraping jars), leading to specialized, high-performance tools.

- Predictive Maintenance in Production: AI monitoring of injection molding machines and extrusion equipment to minimize downtime, ensuring efficient, high-volume production of popular nonstick spatula models.

- Personalized E-commerce Recommendations: AI-powered platforms analyzing user purchasing history and cooking preferences to suggest the ideal spatula type, material, and size, enhancing conversion rates for online retailers.

- Supply Chain Optimization: Use of machine learning models to forecast demand volatility, especially during seasonal peaks like holidays, improving inventory management and reducing logistical costs for global distribution.

DRO & Impact Forces Of Nonstick Spatula Market

The Nonstick Spatula Market is governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary driver is the widespread global adoption of nonstick cookware, necessitating the use of specialized, non-abrasive utensils to maintain surface integrity, coupled with heightened consumer interest in cooking and specialized culinary equipment. However, the market faces restraints such as the relatively high replacement rate of lower-quality plastic spatulas, which necessitates frequent repurchase, and intense competition from highly fragmented, unorganized local players offering cheaper, non-certified alternatives, particularly in price-sensitive developing markets. Opportunities are vast, focusing on material innovation (e.g., bio-based, sustainable polymers) and expanding into specialized commercial kitchen applications, while the major impact forces include evolving food safety regulations and significant shifts in retail channels towards digital platforms.

Key drivers include the demonstrable functional superiority of nonstick spatulas, especially those made from high-heat silicone, which offers excellent resilience and prevents melting or warping—a common issue with cheaper nylon alternatives. Furthermore, the growing influence of cooking shows, social media food influencers, and dedicated culinary blogs has generated a cultural trend that emphasizes specific, high-quality tools for every task, positioning premium spatulas as necessary investments rather than simple commodity items. The rising awareness regarding potential health risks associated with substandard plastic kitchenware also pushes consumers toward certified, high-grade, food-safe silicone and nylon products, thereby increasing the market value. These factors collectively create a positive feedback loop, encouraging both innovation and consumer spending within the category.

Conversely, market growth is hampered by the perception of nonstick spatulas as low-involvement, discretionary purchases, leading some consumers to opt for the cheapest available option without considering material quality or longevity. This low barrier to entry for generic manufacturers creates significant pricing pressure on established brands who adhere to rigorous safety standards (e.g., FDA or LFGB certification). Moreover, while silicone offers superior heat resistance, some consumers report issues with oil retention or staining over long-term use, creating a restraint that manufacturers must address through surface treatment innovations. The reliance on petrochemical derivatives for most nonstick spatula materials poses an environmental constraint, pressuring the industry to invest heavily in sustainable, plant-based, or recycled material alternatives to align with global eco-friendly consumer movements.

Segmentation Analysis

The Nonstick Spatula Market segmentation provides a granular view of the market landscape based on material type, product type, application (end-user), and distribution channel. Material type segmentation, which includes silicone, nylon, and reinforced plastics, is crucial as it directly relates to heat resistance, durability, and cost. Silicone remains the dominant segment due to its unparalleled performance characteristics, while nylon serves the mid-range segment effectively. Product types differentiate between flipping, scraping, and serving tools, reflecting the specialized needs of modern cooking. The application segmentation clearly demarcates the larger residential segment from the highly demanding commercial sector, each with distinct volume and quality requirements. Analyzing these segments is essential for manufacturers to tailor product development, pricing, and distribution strategies accurately, ensuring optimal market penetration and maximizing revenue streams across diverse consumer groups.

The market analysis reveals that the residential segment, encompassing everyday home cooks and enthusiasts, drives the bulk of sales volume. These consumers prioritize versatility, aesthetic design, and ease of cleaning, often purchasing multi-piece utensil sets. In contrast, the commercial segment, including professional kitchens and large-scale catering operations, demands extreme durability, resistance to continuous high temperatures, and adherence to strict hygiene standards, resulting in a focus on heavier-gauge, long-lasting products. The rapid expansion of direct-to-consumer (DTC) models through e-commerce platforms is disrupting traditional distribution channels, enabling smaller, specialized brands to gain traction by offering unique, niche products that appeal to specific culinary interests, such as specialized spatulas for cast iron or delicate baked goods.

Furthermore, geographic segmentation is critical, with mature markets focusing on replacement cycles and premiumization, while emerging markets emphasize first-time purchases and general kitchen outfitting. The growth of specialized food preparation techniques, such as sous vide and induction cooking, subtly influences the demand for spatulas that are designed to handle specific equipment or temperature ranges. The shift toward subscription box services for meal kits also indirectly boosts the market, as these services often encourage consumers to purchase higher-quality, specialized tools necessary for executing their recipes perfectly. This multi-faceted segmentation structure allows for targeted strategic planning and accurate forecasting of demand trends across the global market.

- Material Type:

- Silicone

- Nylon

- Reinforced Plastics

- Wood/Bamboo Hybrids (with nonstick tips)

- Product Type:

- Turner Spatulas (Flippers)

- Scraping Spatulas (Rubber Spatulas/Jar Scrapers)

- Slotted Spatulas

- Offset Spatulas (Baking/Icing)

- Fish Spatulas (Flexible)

- Application/End-User:

- Residential Use

- Commercial Use (Restaurants, Cafeterias, Catering)

- Distribution Channel:

- Offline Channels (Hypermarkets/Supermarkets, Specialty Stores, Department Stores)

- Online Channels (E-commerce Retailers, Company Websites)

Value Chain Analysis For Nonstick Spatula Market

The value chain for the Nonstick Spatula Market commences with the upstream activities involving the sourcing and processing of raw materials, primarily silicone polymers, polyamide (nylon) resins, and stainless steel for core reinforcement or handles. Suppliers of high-grade, food-safe polymers must comply with international standards (e.g., FDA 21 CFR 177.2600 for silicone rubber), leading to strong partnerships between manufacturers and certified chemical suppliers. The complexity lies in ensuring material purity and consistency, as these factors directly impact the spatula’s thermal stability and non-abrasive properties. Efficient material procurement and inventory management are critical in the upstream segment to mitigate price volatility in raw material markets, especially those tied to petrochemical costs, which affects nylon and plastic variants significantly.

Midstream activities involve core manufacturing processes, including injection molding, extrusion, and assembly. Manufacturers focus heavily on tooling precision to achieve ergonomic designs and flawless finishes, especially for high-volume silicone products. Quality control at this stage is paramount, utilizing testing for heat tolerance, flexibility, and handle integrity. Large-scale producers leverage automation and specialized robotics to maintain cost efficiency. Following manufacturing, spatulas are packaged, often in attractive, shelf-ready formats that communicate key selling points like heat rating and material certification. Branding and intellectual property protection related to unique design features or proprietary material blends constitute a significant investment in this stage of the value chain.

Downstream activities center on distribution and sales, utilizing a mix of direct and indirect channels. Indirect distribution through large hypermarkets, specialized kitchen supply stores, and major e-commerce platforms like Amazon and Alibaba accounts for the majority of sales volume. Direct channels, increasingly relevant through brand-specific websites and social media sales, allow manufacturers greater control over branding and pricing. The final stage involves the consumer purchase experience and after-sales service, including managing warranties and facilitating returns. The effectiveness of the downstream segment relies heavily on robust logistics networks capable of handling high-volume, low-value items efficiently, often requiring manufacturers to partner with third-party logistics (3PL) providers specialized in consumer goods retail distribution.

Nonstick Spatula Market Potential Customers

The potential customer base for the Nonstick Spatula Market is broad and segmented primarily into residential end-users and commercial food service buyers. Residential customers represent the largest volume segment, encompassing general consumers ranging from novice cooks who require basic, durable tools, to enthusiastic home chefs who seek specialized, aesthetically pleasing, and high-performance utensils. This segment is driven by factors such as kitchen renovation cycles, gift-giving occasions, and the increasing trend of healthy home cooking, which often mandates the use of nonstick surfaces to minimize oil usage. These buyers are highly influenced by online reviews, visual merchandising, and celebrity chef endorsements, leading to diverse demand for various price points and material qualities.

The commercial market constitutes the key high-value segment, including restaurants, hotel chains, institutional kitchens (schools, hospitals), and large catering operations. These professional buyers prioritize longevity, ability to withstand commercial-grade cleaning processes (e.g., high-temperature dishwashers), high operational heat resistance, and adherence to professional hygiene standards. For commercial customers, purchasing decisions are typically volume-driven and based on cost-per-use metrics, favoring products that offer exceptional durability and compliance with NSF International or similar professional certification standards. Specialized procurement teams often source these products through dedicated food service equipment suppliers and wholesalers, focusing on bulk ordering and long-term supply contracts rather than individual retail purchases.

An emerging segment includes institutional buyers such as cooking schools and culinary arts programs, who purchase nonstick spatulas for educational and training purposes, requiring a balance of professional quality and accessibility for students. Furthermore, the burgeoning segment of meal kit delivery services represents an indirect customer base, as their focus on quality home cooking implicitly drives demand for the necessary specialized tools, sometimes bundling spatulas or offering them as premium add-ons. Targeting these diverse customer needs requires manufacturers to maintain distinct product lines, differentiating material specifications, packaging, and distribution strategies suitable for both B2C and high-volume B2B environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,258 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OXO International, Le Creuset, Williams Sonoma Inc., Calphalon (Newell Brands), Cuisinart (Conair Corporation), KitchenAid (Whirlpool Corporation), Zyliss, StarPack Products, Dreamfarm, Rada Mfg. Co., Tovolo, Victorinox AG, Tramontina, Fissler GmbH, IKEA, All-Clad, Vremi, Chefman, Farberware, Mercer Culinary |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nonstick Spatula Market Key Technology Landscape

The technology landscape in the Nonstick Spatula Market is fundamentally defined by advancements in polymer science and manufacturing precision, rather than complex electronics. The primary technological focus is on enhancing the material properties to achieve superior heat resistance, flexibility, and non-reactivity with food products. Key innovations revolve around high-temperature vulcanization (HTV) silicone molding techniques, which allow for the creation of seamless, single-piece spatulas. This single-piece construction eliminates crevices where bacteria can accumulate, significantly improving hygiene—a critical selling point, particularly for commercial-grade products. Furthermore, the use of fiberglass or internal stainless steel cores represents a technological advancement, reinforcing the spatula handle and head without compromising the protective nonstick-safe silicone exterior, thus enhancing durability and stiffness necessary for handling heavier foods.

Another crucial technological area is surface engineering applied to nylon and plastic spatulas. Manufacturers utilize proprietary chemical treatments or composite material blending techniques to make these surfaces less porous, resisting staining from oils and vibrant ingredients like turmeric or tomato paste. For nylon spatulas specifically, advanced polymer chemistry is employed to raise the melting point significantly beyond standard nylon 6/6, addressing one of the material's historical weaknesses. These engineered materials ensure the tools remain safe and functional even when resting momentarily on hot pan edges or handling extremely high-temperature preparations, directly addressing common consumer complaints regarding premature material degradation.

The manufacturing technology itself, specifically precision injection molding, is vital for producing complex, ergonomic designs with soft-touch grips and textured patterns that improve handling. The application of two-shot injection molding allows for the simultaneous creation of rigid core structures and flexible outer coatings (e.g., silicone over nylon handles) in a single process, improving manufacturing efficiency and the overall quality of the joint between the head and handle. In the context of e-commerce, digital technology plays an indirect role; advanced 3D scanning and computer-aided design (CAD) are now standard for rapid prototyping and iterative design improvement based on detailed consumer feedback, enabling quick adaptation to evolving market preferences for specialized kitchen tools.

Regional Highlights

- North America: North America, encompassing the United States and Canada, represents a mature and dominant market segment characterized by high consumer spending on specialized kitchen gadgets and an ingrained culture of frequent home cooking. The region exhibits high demand for premium, branded nonstick spatulas, particularly those made from high-grade, heat-resistant silicone that comply strictly with FDA standards. E-commerce penetration is exceptionally high, with consumers relying heavily on platforms like Amazon and specialized kitchen retailers (e.g., Williams Sonoma, Sur La Table) for product discovery and purchase. The regional trend leans towards sustainable sourcing, demanding spatulas that are BPA-free and manufactured using ethical processes, thereby commanding a higher average selling price compared to other global markets. Replacement cycles are relatively short due to consumer enthusiasm for upgrading to the latest, most ergonomically optimized designs.

- Europe: The European market is highly sophisticated, driven by strong food safety regulations (such as LFGB in Germany and broader EU mandates), which necessitate rigorous material testing, especially for silicone and plastics that come into contact with food. Western Europe (Germany, UK, France) maintains a strong market presence, characterized by traditional kitchenware brands focusing on timeless design and exceptional longevity. Scandinavia, in particular, shows elevated interest in environmentally friendly materials, fueling the demand for bio-based plastic and wooden handle variants. The market growth here is steady, supported by established retail chains and a consistent consumer emphasis on functional design and certified quality assurance, often preferring spatulas that integrate seamlessly into high-end kitchen aesthetics.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, fueled by demographic shifts including rapid urbanization, rising middle-class income levels in countries like China and India, and the increasing adoption of modern, nonstick cookware in households previously reliant on traditional metal utensils. While price sensitivity remains a factor, there is a burgeoning segment in countries like Japan and South Korea that prioritizes high-quality, precision-engineered spatulas, often imported from Western brands. The commercial sector is expanding rapidly alongside the proliferation of international restaurant chains and centralized catering facilities, driving massive bulk demand for durable, commercial-grade nylon and silicone options. Local manufacturing is scaling up, focusing on cost-efficient production to capture the vast, diverse domestic market, often necessitating adaptation to local culinary needs, such as woks and deep frying.

- Latin America: The Latin American market exhibits moderate growth potential, driven primarily by improving retail infrastructure and increasing access to international consumer brands in major economies such as Brazil and Mexico. Market penetration of specialized kitchen tools is accelerating, moving away from basic metal or inexpensive plastic utensils. Consumers here often seek value-for-money, leading to a strong demand for durable nylon and plastic spatulas in the mid-price range. Distribution is heavily reliant on traditional retail channels and regional hypermarkets, although e-commerce is rapidly gaining traction in metropolitan areas. Economic stability fluctuations remain a factor influencing consumer discretionary spending on non-essential kitchen upgrades.

- Middle East and Africa (MEA): The MEA market is characterized by diverse consumer behavior. The Gulf Cooperation Council (GCC) countries show high demand for premium and luxury kitchen items, mirroring European consumer trends, driven by high disposable incomes and a preference for imported, high-end brands. Conversely, parts of Africa focus on basic utility and affordability, resulting in a higher market share for durable, entry-level plastic and nylon spatulas. The commercial food service industry is a key driver in the region, particularly in tourism hotspots, requiring robust and heat-stable nonstick spatulas to equip rapidly expanding hotel and restaurant kitchens. Logistics and supply chain complexities remain a challenge across certain sub-regions within MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nonstick Spatula Market.- OXO International

- Le Creuset

- Williams Sonoma Inc.

- Calphalon (Newell Brands)

- Cuisinart (Conair Corporation)

- KitchenAid (Whirlpool Corporation)

- Zyliss

- StarPack Products

- Dreamfarm

- Rada Mfg. Co.

- Tovolo

- Victorinox AG

- Tramontina

- Fissler GmbH

- IKEA

- All-Clad

- Vremi

- Chefman

- Farberware

- Mercer Culinary

Frequently Asked Questions

Analyze common user questions about the Nonstick Spatula market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is best for nonstick spatulas in terms of heat resistance and durability?

High-grade silicone is generally considered the best material for nonstick spatulas due to its superior heat resistance (often up to 600°F), excellent flexibility, and non-reactive properties, which ensure it does not scratch nonstick surfaces or leach chemicals into food, offering maximum durability and safety.

How do I prevent my nylon spatula from melting when cooking at high heat?

To prevent nylon spatulas from melting, consumers should select models made from reinforced polyamide resins designed for higher melting points (often labeled heat-safe). It is crucial to avoid leaving the spatula resting in hot pans or near open flames, as even reinforced nylon has lower heat tolerance compared to silicone alternatives.

Is there a difference in quality between residential and commercial nonstick spatulas?

Yes, commercial nonstick spatulas are typically designed for higher volume use and harsher cleaning environments, often featuring heavier gauge construction, reinforced cores (such as stainless steel), and materials certified for extreme durability and sanitation standards, like NSF certifications, which residential models usually lack.

What is the current growth driver for the online sale of specialized nonstick spatulas?

The key growth driver for online sales is the proliferation of specialized culinary content and direct-to-consumer (DTC) marketing, enabling niche manufacturers to effectively target home cooking enthusiasts seeking very specific tools (e.g., specialized fish turners or offset icing spatulas) with detailed product information and extensive user reviews.

Are biodegradable or eco-friendly nonstick spatula options available, and are they effective?

Yes, the market is seeing increased availability of eco-friendly options, typically featuring handles made from sustainable wood, bamboo, or recycled plastics, sometimes paired with standard silicone heads. While material science is advancing, the effectiveness of fully biodegradable polymer heads in high-heat, long-term use scenarios is still under continuous development and testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager