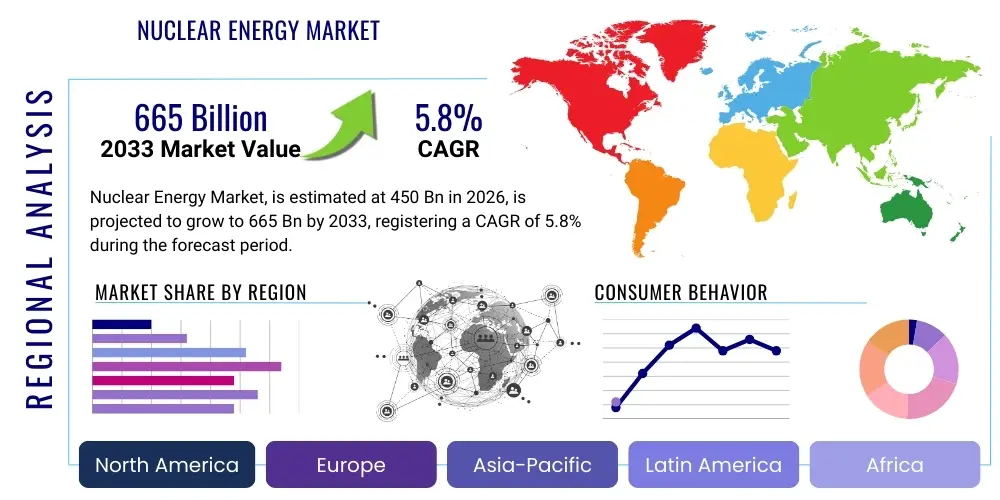

Nuclear Energy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441413 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Nuclear Energy Market Size

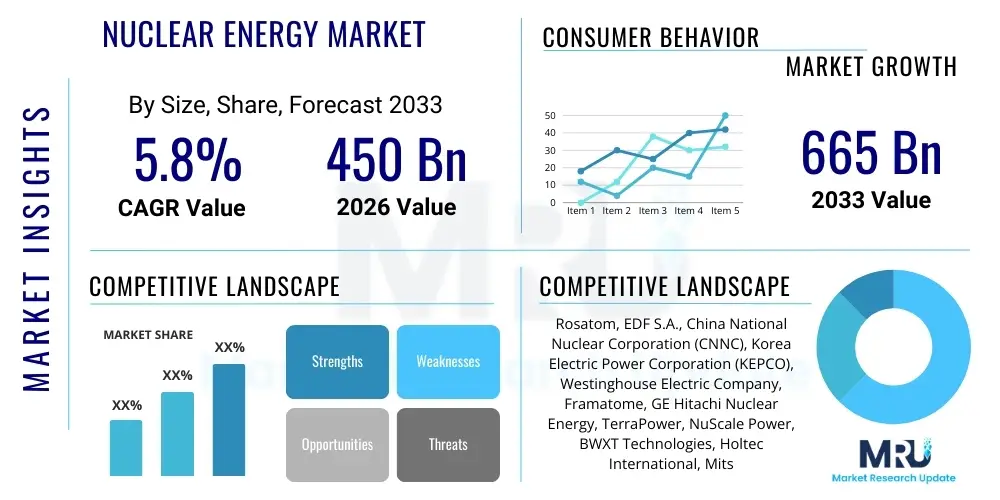

The Nuclear Energy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% CAGR between 2026 and 2033. The market is estimated at USD 450 Billion in 2026 and is projected to reach USD 665 Billion by the end of the forecast period in 2033.

Nuclear Energy Market introduction

The Nuclear Energy Market encompasses the entire lifecycle of nuclear power generation, ranging from uranium mining and fuel enrichment to reactor design, construction, operation, and eventual decommissioning and waste management. This sector is undergoing a profound global resurgence, primarily driven by urgent decarbonization mandates set forth by international climate agreements and a critical need for enhanced energy security amidst volatile geopolitical landscapes. Nuclear energy, being a low-carbon, high-density, and highly dispatchable power source, is increasingly positioned as an essential foundational element for achieving net-zero emission targets while simultaneously ensuring grid stability and reducing reliance on fossil fuels. The market expansion is fundamentally catalyzed by significant technological advancements, particularly the development and commercialization of Small Modular Reactors (SMRs) and advanced Generation IV reactors, which promise lower capital costs, faster deployment schedules, and intrinsic safety features, mitigating many of the historical barriers to adoption.

The core product within this market is the generation of electricity through controlled nuclear fission, utilizing various reactor types such as Pressurized Water Reactors (PWRs), Boiling Water Reactors (BWRs), and the newly emerging SMRs and High-Temperature Gas Reactors (HTGRs). Major applications extend beyond baseload electricity generation to include industrial heat provision, hydrogen production via high-temperature electrolysis, and desalination processes, broadening the economic applicability of nuclear technology. The primary benefit driving the market is the unparalleled capacity factor of nuclear plants, which often exceeds 90%, providing consistent, reliable power output regardless of weather conditions, a distinct advantage over intermittent renewables like solar and wind. Furthermore, the significantly reduced life cycle carbon emissions compared to fossil fuel alternatives firmly establish nuclear energy as a cornerstone of sustainable energy transition strategies worldwide, attracting substantial governmental support and private investment.

Driving factors propelling market growth include intensified global efforts to combat climate change, necessitating a rapid shift away from coal and gas; the strategic imperative for energy independence in major industrialized nations, particularly in Europe and Asia; and policy frameworks that explicitly recognize nuclear power as green or sustainable infrastructure, thereby facilitating access to green financing mechanisms. However, the market growth trajectory is intricately linked to regulatory modernization and public acceptance, requiring sustained commitment to operational safety, transparent waste management protocols, and effective communication regarding the advanced safety characteristics of new reactor designs. The market structure reflects a complex ecosystem involving government-owned entities, large engineering procurement and construction (EPC) firms, specialized fuel service providers, and innovative technology startups focusing on next-generation reactor technologies.

Nuclear Energy Market Executive Summary

The global Nuclear Energy Market is entering a renewed phase of robust expansion, moving beyond the challenges faced in the post-Fukushima era, characterized by a significant shift in business trends toward smaller, scalable, and faster-to-deploy reactor technology, specifically Small Modular Reactors (SMRs), which are fundamentally altering the project economics and risk profiles associated with nuclear power construction. Regional trends indicate that Asia Pacific (APAC), particularly China, India, and South Korea, remains the primary engine of capacity expansion due to explosive energy demand and state-backed long-term nuclear programs, while North America and Europe are focusing heavily on fleet life extension, modernization, and the deployment of advanced reactor prototypes to secure energy supplies and meet stringent climate targets. Segmentation trends reveal a growing importance of the component segment, driven by demand for advanced instrumentation and control (I&C) systems, specialized nuclear-grade steel components, and digital twin technology for operational optimization, alongside a critical focus on the fuel cycle segment, which is grappling with geopolitical supply chain diversification, particularly concerning uranium conversion and enrichment services, to ensure resilience against international disruptions. Overall, the market's strategic direction is defined by the dual pressures of decarbonization urgency and the necessity for robust energy infrastructure that can withstand global instability.

AI Impact Analysis on Nuclear Energy Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Nuclear Energy Market frequently center on enhancing operational safety, maximizing plant efficiency, and optimizing the complex nuclear fuel cycle, reflecting key industry concerns over costs and risk management. Users commonly ask how AI can predict equipment failures using sensor data, thereby preventing unplanned outages (a major economic driver), and whether AI-driven simulation models can drastically reduce the time and cost associated with licensing and deploying new reactor designs like SMRs. Furthermore, there is significant public interest in utilizing machine learning for sophisticated waste management logistics, ensuring long-term security and minimizing environmental impact. The overarching theme is the expectation that AI will serve as a foundational digital layer, moving the industry from preventative and reactive maintenance schedules to highly predictive and prescriptive operational management, accelerating the adoption curve for new technologies and enhancing the economic competitiveness of nuclear power against alternative energy sources, addressing regulatory skepticism through enhanced verifiable safety documentation and predictive modeling capabilities.

- AI significantly enhances predictive maintenance capabilities by analyzing vast streams of operational data (temperature, vibration, pressure), reducing the likelihood of critical equipment failure and minimizing costly downtime.

- Machine Learning (ML) algorithms optimize nuclear fuel loading patterns within the core, maximizing energy output from existing fuel bundles and extending the overall operational cycle efficiency.

- AI-driven digital twin technology allows for high-fidelity simulation of new reactor designs (SMRs/Gen IV) and complex operational scenarios, accelerating regulatory approval processes and improving training effectiveness.

- Natural Language Processing (NLP) and computer vision systems streamline regulatory compliance and documentation by automating the analysis of maintenance logs, safety reports, and procedural checks.

- Advanced robotics guided by AI are deployed for highly hazardous tasks such as remote inspection, repair, and decommissioning activities within high-radiation zones, improving worker safety and project timelines.

DRO & Impact Forces Of Nuclear Energy Market

The Nuclear Energy Market is simultaneously influenced by powerful drivers accelerating adoption and significant restraints related to capital and regulatory complexity, creating a dynamic set of opportunities that hinge on technological breakthroughs, particularly concerning SMRs. The primary driver is the global climate imperative demanding reliable, dispatchable, non-fossil fuel electricity generation to achieve net-zero targets by mid-century, strongly supported by governmental policies in major economies like the U.S., U.K., France, and China that have designated nuclear power as essential green infrastructure. This is compounded by the increasing geopolitical focus on energy security, where nuclear power offers strategic independence from volatile fossil fuel exporting regions. Conversely, the market faces major restraints, including the notoriously high upfront capital expenditure and the lengthy, multi-decade construction timelines associated with traditional large-scale reactors, which significantly impact investment return profiles. Furthermore, public perception issues concerning safety, specifically the management of high-level radioactive waste and the risk of catastrophic accidents, though significantly mitigated by modern Gen III+ and Gen IV designs, continue to pose formidable social and political barriers that complicate project financing and site selection.

The impact forces driving market evolution are rooted in technological innovation and regulatory streamlining. Opportunities are predominantly centered on the rapid maturation and commercial deployment of Small Modular Reactors, which inherently address the traditional cost and time restraints by offering factory fabrication and shorter construction cycles, making them viable for smaller grids, remote areas, and industrial heat applications. Another critical opportunity lies in the advanced fuel cycle technologies, such as closed-fuel cycles (recycling used nuclear fuel) and the development of High-Assay, Low-Enriched Uranium (HALEU) fuel, which promise improved resource efficiency and significantly reduced waste volume, directly counteracting a key public restraint. The market's potential expansion into non-power applications, such as large-scale hydrogen production and municipal heating, represents a substantial market diversification opportunity that broadens the addressable utility beyond traditional grid-scale electricity generation and appeals directly to industries seeking deep decarbonization.

However, the restraining force of complex and inconsistent international regulatory frameworks, often differing vastly between countries even within regions like the EU, continues to impede the global standardization and rapid deployment of advanced technologies like SMRs, necessitating extensive, project-specific licensing processes. The availability of a highly specialized workforce, encompassing nuclear engineers, safety analysts, and skilled tradespeople capable of supporting a global build-out, represents an underlying structural restraint that requires significant governmental and institutional investment in education and training. Overcoming these entrenched restraints necessitates sustained governmental backing through risk-sharing mechanisms, guaranteed power purchase agreements (PPAs), and the harmonization of safety standards globally, ensuring that the technological advantages of new reactor designs can translate effectively into commercially successful, accelerated deployment timelines, thereby sustaining the market’s projected CAGR.

Segmentation Analysis

The Nuclear Energy Market segmentation provides a crucial framework for analyzing the disparate technological pathways, infrastructure components, and end-use applications driving market dynamics. This analysis highlights the shift from purely large-scale reactor construction to a focus on advanced components and fuel services crucial for fleet optimization and SMR deployment. Key segments include the classification by reactor type, distinguishing between established conventional designs and emerging advanced technologies; by component, covering the specialized infrastructure required for plant operation; by application, recognizing the expanding utility beyond baseload electricity; and by fuel type, assessing the reliance on various enrichment levels and materials. The component segment, particularly the instrumentation, control, and digital services sub-segments, is expected to exhibit the fastest growth, reflective of the industry's digital transformation towards maximizing efficiency and safety in existing and new plants.

- By Reactor Type:

- Pressurized Water Reactor (PWR)

- Boiling Water Reactor (BWR)

- Heavy Water Reactor (HWR)

- High-Temperature Gas-Cooled Reactor (HTGR)

- Small Modular Reactor (SMR)

- Fast Breeder Reactor (FBR)

- By Component:

- Island Components (Nuclear Reactor System)

- Turbine Island Components (Steam Generator, Turbine, Condenser)

- Instrumentation & Control (I&C) Systems

- Containment Structure

- By Application:

- Electricity Generation (Baseload Power)

- Industrial Heat (Process Heat)

- Hydrogen Production

- Desalination

- By Fuel Type:

- Uranium 235 (Low-Enriched Uranium - LEU)

- High-Assay Low-Enriched Uranium (HALEU)

- Mixed Oxide Fuel (MOX)

Value Chain Analysis For Nuclear Energy Market

The Nuclear Energy value chain is highly complex, regulated, and capital-intensive, starting with the upstream segment encompassing raw material extraction and processing, moving through the midstream production and generation phase, and concluding with the highly sensitive downstream activities of decommissioning and waste management. The upstream analysis begins with uranium mining and milling, primarily concentrated in geopolitical hotspots like Kazakhstan, Canada, and Australia, followed by conversion (U3O8 to UF6) and enrichment, a technically sophisticated process dominated by a few major players (e.g., Urenco, Rosatom, Orano, DOE), which determines the fuel grade. Ensuring supply chain resilience in this upstream segment is paramount due to recent geopolitical tensions impacting enrichment capacity and pricing, driving strategic diversification efforts globally, especially towards establishing non-Russian HALEU infrastructure to support new advanced reactors.

The midstream involves the fabrication of fuel assemblies and the core activity of nuclear power generation within the reactor. This phase relies heavily on specialized engineering, procurement, and construction (EPC) firms that design and build the plant, and major utilities that operate the facility under strict regulatory oversight. Distribution channels are highly centralized, characterized by direct, long-term contractual relationships between power plant operators (potential customers) and utility transmission system operators, distributing the generated electricity directly onto the regional or national grid infrastructure. Indirect distribution is minimal, though some private developers may sell power through Power Purchase Agreements (PPAs) to large industrial customers before the electricity enters the grid. The stability of the midstream is contingent upon decades-long capital commitment and robust safety and security protocols mandated by national regulatory bodies.

The downstream segment, often overlooked in market entry discussions but critical to the industry's sustainability and public acceptance, involves the management of spent fuel and the eventual decommissioning of aging nuclear facilities. This phase requires specialized, high-cost technologies for temporary storage, reprocessing (if applicable, such as in France or Russia), and ultimately, permanent deep geological disposal of high-level waste. The efficiency and long-term security of waste management directly influence public trust and the viability of new nuclear projects. The entire value chain is characterized by exceptionally high barriers to entry, demanding billions in capital, specialized technical expertise, and navigating some of the world's most stringent regulatory environments, making collaboration between governmental bodies and private sector consortiums essential for success.

Nuclear Energy Market Potential Customers

The potential customers and primary buyers within the Nuclear Energy Market are predominantly large-scale, vertically integrated electric utilities, both government-owned and privately held, seeking reliable, baseload, low-carbon power generation to supplement intermittent renewable sources and replace retiring fossil fuel assets. These entities require long-term, stable power solutions to ensure national grid stability and meet legally binding decarbonization targets. Furthermore, national governments and defense agencies constitute a key customer segment, not only through their ownership of existing fleets but also as essential partners in funding research, development, and initial deployment of first-of-a-kind (FOAK) advanced reactors, often acting as anchor tenants or providing loan guarantees to de-risk private sector investment in novel technology like SMRs. The military and naval sector represents a specialized customer base for nuclear propulsion, utilizing highly reliable reactor technology for submarines and aircraft carriers, though this segment operates under unique regulatory and security frameworks that differentiate it from civilian energy markets.

Beyond the traditional utility and government sectors, a rapidly emerging customer segment includes energy-intensive heavy industrial users, such as steel manufacturers, chemical processing plants, and major data center operators, particularly those requiring reliable, high-temperature process heat for industrial applications or seeking 24/7 carbon-free electricity sourcing to meet corporate sustainability commitments. SMRs are especially attractive to this demographic due to their smaller footprint and potential for co-location, facilitating direct heat integration and bypassing congested electricity grids. Additionally, regions experiencing acute water scarcity represent a customer base for nuclear power utilized in large-scale desalination projects, particularly in the Middle East and North Africa (MENA), where the energy-intensive process benefits significantly from nuclear energy's high-capacity factors. The buying decision for all these customers is dictated by long-term strategic factors, including regulatory approval, economic competitiveness over the 60-80 year lifespan of a plant, and demonstrated technical maturity and safety track record.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 665 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rosatom, EDF S.A., China National Nuclear Corporation (CNNC), Korea Electric Power Corporation (KEPCO), Westinghouse Electric Company, Framatome, GE Hitachi Nuclear Energy, TerraPower, NuScale Power, BWXT Technologies, Holtec International, Mitsubishi Heavy Industries, Hitachi-GE Nuclear Energy, Orano Group, Urenco, Cameco Corporation, Areva NP, General Atomics, Rolls-Royce SMR, X-energy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nuclear Energy Market Key Technology Landscape

The current technology landscape in the Nuclear Energy Market is defined by a dichotomy between the continued deployment and life extension of conventional Generation III and III+ large-scale Light Water Reactors (LWRs) and the burgeoning focus on transformative, advanced reactor technologies designed to address the economic and safety limitations of past generations. The primary technological disruption is centered around Small Modular Reactors (SMRs), which are fundamentally factory-built, standardized reactors with capacities generally below 300 MWe. SMR technology, exemplified by designs such as NuScale's PWR SMR and Rolls-Royce's pressurized water reactor design, promises standardized construction, rapid deployment, reduced site specific labor needs, and significantly lower absolute capital costs, making them highly attractive for smaller grids or private industrial customers. The inherent passive safety features in many SMR designs also reduce reliance on active safety systems, simplifying operations and enhancing regulatory acceptance, thereby accelerating the technological maturation pathway from demonstration to commercial deployment within the forecast period.

Beyond SMRs, the market is heavily investing in Generation IV reactor concepts, which represent a paradigm shift towards enhanced sustainability, safety, and operational efficiency. Key Gen IV technologies include High-Temperature Gas Reactors (HTGRs), which use ceramic-coated particle fuel and helium coolant to achieve temperatures high enough for efficient hydrogen production and industrial heat processes, and Fast Reactors (FRs), which can utilize spent fuel from conventional reactors, thereby dramatically reducing nuclear waste volume and enhancing uranium resource utilization through a closed fuel cycle. The technological evolution also mandates a transition in fuel infrastructure, with the development of High-Assay, Low-Enriched Uranium (HALEU) fuel (enriched between 5% and 20%) becoming critical, as many advanced reactors, particularly HTGRs and certain SMRs, require this higher enrichment level to achieve longer core life and smaller reactor footprints. This demand is driving significant technological investment into domestic HALEU production and conversion capabilities in the US and Europe to mitigate dependency on current dominant suppliers, primarily Russia.

Furthermore, digital innovation, particularly the integration of Artificial Intelligence and digital twin technology, is critical to modern nuclear technology management. Digital twins create virtual, high-fidelity replicas of nuclear plants, enabling operators to simulate various operational scenarios, optimize maintenance scheduling (moving toward predictive maintenance), and manage complex aging effects on components, thus extending the reliable operational lifetime of the existing fleet and minimizing risk in new builds. The adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing) for reactor components, offers potential benefits in faster fabrication, reduced waste, and the ability to produce highly complex geometries necessary for advanced heat exchangers and core internals, further enhancing the cost-competitiveness and technical flexibility of the next generation of nuclear power plants. These technology innovations collectively redefine the economic and operational feasibility of nuclear power in the 21st century energy mix.

Regional Highlights

- North America (United States and Canada): The North American market is characterized by substantial governmental support for fleet modernization, life extension programs for existing LWRs, and aggressive promotion of advanced reactor deployment, particularly SMRs. The U.S. government, through initiatives like the Department of Energy's Advanced Reactor Demonstration Program (ARDP), is funding multiple SMR and Gen IV prototypes, positioning the region as a global leader in technological innovation and commercialization of next-generation nuclear technology. Key activities include the commercial deployment efforts of NuScale Power and TerraPower, focusing on delivering dispatchable, carbon-free power to utilities and industrial customers by the early 2030s. Canada is focusing heavily on utilizing SMRs to power remote communities and meet the large-scale energy demands of its mining and oil sands industries, establishing clear regulatory pathways for rapid deployment.

- Europe (Western and Eastern Europe): The European nuclear landscape is highly polarized but currently experiencing a massive resurgence driven by the urgent need to secure energy independence following geopolitical conflicts and the mandate to replace retiring coal capacity. Western European nations like France are committing billions to constructing new large-scale reactors (EPR technology) and developing national SMR programs (e.g., Rolls-Royce SMR in the UK and EDF's Nuward in France). Eastern European countries, including Poland and Czechia, are actively tendering for new conventional and SMR technologies to decouple from Russian gas, representing a significant short-to-mid-term market growth opportunity based on state-level commitments and secured financing mechanisms. However, the varying regulatory stances and phasing-out policies in countries like Germany and Spain still create a complex, fragmented market environment requiring tailored strategic approaches.

- Asia Pacific (APAC): APAC is the global nucleus of nuclear capacity expansion, driven primarily by China, India, and South Korea, which view nuclear energy as non-negotiable for sustaining rapid economic growth and reducing air pollution from fossil fuel use. China holds the largest pipeline of new reactor construction globally, prioritizing both indigenous Gen III designs and Gen IV technologies, such as the demonstration of the High-Temperature Gas-Cooled Reactor (HTGR). India is focusing on fleet expansion to meet its massive and rapidly growing electricity demand, while South Korea, historically a major exporter of nuclear technology, is reversing prior phase-out policies to maintain its industrial capabilities and satisfy domestic energy needs. This region’s growth is characterized by large, state-backed utility projects and a strong emphasis on self-sufficiency in the nuclear fuel cycle and reactor manufacturing.

- Latin America: The Latin American market exhibits steady, localized growth, largely concentrated in countries with established nuclear programs, specifically Argentina and Brazil. These nations are focused on completing existing projects and exploring options for extending the life of their current fleet to provide baseload power. The potential for SMRs to serve decentralized grids, resource extraction operations, and industrial parks in smaller or remote areas is gaining traction, though market penetration is constrained by limited sovereign financing capacity and perceived political risks, making international financial backing (e.g., from export credit agencies) crucial for new project initiation and execution.

- Middle East and Africa (MEA): The MEA region is emerging as a critical growth area, particularly driven by the Gulf Cooperation Council (GCC) states utilizing nuclear power for large-scale desalination and stable power supply to manage peak air conditioning demand. The UAE's Barakah Nuclear Power Plant serves as a major regional benchmark, demonstrating the successful deployment of international technology (KEPCO’s APR-1400). Other nations, including Saudi Arabia and Egypt, are actively pursuing nuclear programs, often favoring highly proven Gen III+ technology alongside exploratory interest in SMRs for more localized power and process heat applications, particularly in support of burgeoning green hydrogen initiatives where nuclear power ensures 24/7 carbon-free electricity input.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nuclear Energy Market.- Rosatom (State Atomic Energy Corporation of Russia)

- EDF S.A. (Électricité de France)

- China National Nuclear Corporation (CNNC)

- Korea Electric Power Corporation (KEPCO)

- Westinghouse Electric Company

- Framatome (Subsidiary of EDF)

- GE Hitachi Nuclear Energy (GEH)

- TerraPower (Advanced Reactor Developer)

- NuScale Power (SMR Technology Provider)

- BWXT Technologies, Inc.

- Holtec International

- Mitsubishi Heavy Industries (MHI)

- Hitachi-GE Nuclear Energy, Ltd.

- Orano Group (Fuel Cycle Services)

- Urenco (Uranium Enrichment)

- Cameco Corporation (Uranium Mining and Processing)

- Rolls-Royce SMR

- X-energy (HTGR Developer)

- General Atomics

- CAMEZAT (Mining/Conversion)

Frequently Asked Questions

Analyze common user questions about the Nuclear Energy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current resurgence of the Nuclear Energy Market?

The primary driver is the global climate imperative demanding reliable, dispatchable, low-carbon electricity generation to meet net-zero targets, coupled with the critical need for enhanced energy security and independence from volatile fossil fuel markets. Technological advances in Small Modular Reactors (SMRs) are making nuclear power deployment faster and more economically viable.

How are Small Modular Reactors (SMRs) changing the economic landscape of nuclear power?

SMRs reduce project risk and cost by employing factory fabrication and modular construction, leading to standardized, shorter construction timelines and lower absolute capital expenditure compared to large conventional reactors. This scalability makes nuclear power accessible to smaller grids and private industrial users for heat and power applications.

What role does High-Assay, Low-Enriched Uranium (HALEU) play in the future of the Nuclear Energy Market?

HALEU, uranium enriched between 5% and 20%, is essential for powering advanced reactor designs (Generation IV and many SMRs) as it allows for smaller reactor cores, longer refueling intervals, and enhanced operational efficiency. Secure HALEU supply chain establishment is a critical technological and geopolitical focus for market sustainability.

What is the most significant restraint affecting the global expansion of nuclear energy capacity?

The most significant restraint remains the high upfront capital expenditure and the extended financial risk associated with construction financing for large-scale projects. Regulatory complexity, particularly the lengthy licensing processes and inconsistent international standards, also significantly impedes the rapid deployment required for climate action.

How is AI being utilized to improve safety and efficiency in existing nuclear power plants?

AI is primarily used for advanced predictive maintenance, utilizing machine learning algorithms to analyze sensor data and anticipate equipment failure, thereby preventing costly unplanned outages and maximizing plant uptime. Additionally, AI-driven digital twins enable high-fidelity simulations for optimizing operational procedures and improving regulatory compliance documentation efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager