Nuclear Moisture Separator Reheaters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440757 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Nuclear Moisture Separator Reheaters Market Size

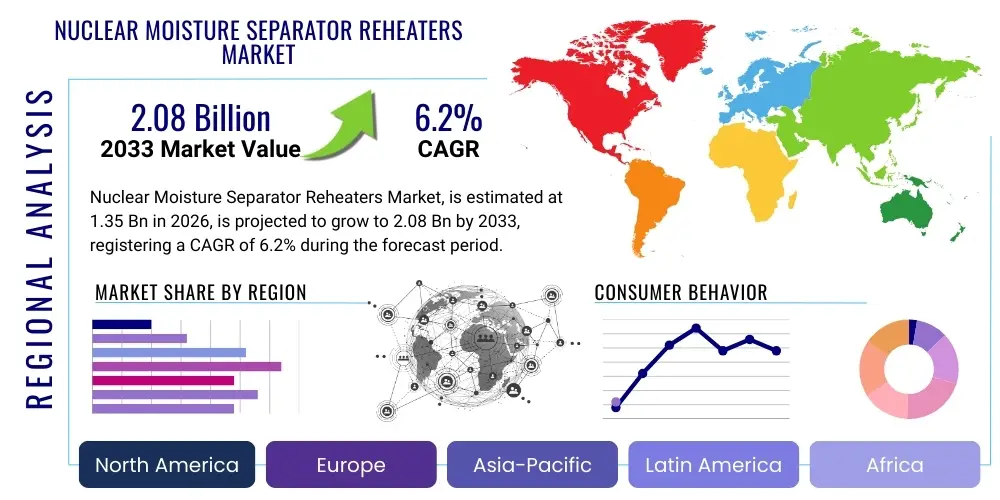

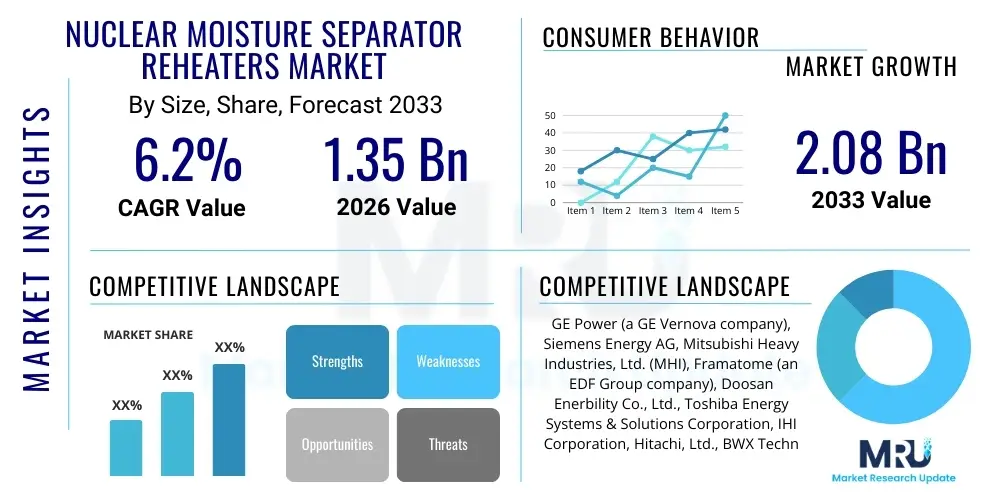

The Nuclear Moisture Separator Reheaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 1.35 billion in 2026 and is projected to reach USD 2.08 billion by the end of the forecast period in 2033. This growth is underpinned by a global resurgence in nuclear energy initiatives, driven by climate change mitigation efforts, energy security concerns, and the imperative to modernize existing nuclear infrastructure. The increasing adoption of advanced reactor designs and the extension of operational lifetimes for conventional nuclear power plants are significant contributors to the sustained demand for high-performance moisture separator reheaters, vital components ensuring optimal turbine efficiency and plant longevity.

Nuclear Moisture Separator Reheaters Market introduction

Nuclear Moisture Separator Reheaters (MSRs) are critical components within the secondary circuit of nuclear power plants, particularly in Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs). Their primary function is to enhance the thermodynamic efficiency and operational reliability of steam turbines by removing moisture from the low-pressure steam exiting the high-pressure turbine stage and subsequently reheating it. This two-stage process significantly mitigates the risk of blade erosion in the subsequent turbine stages, thereby extending turbine lifespan, reducing maintenance costs, and ultimately boosting the overall thermal efficiency and power output of the nuclear plant. The design and material selection for MSRs are highly specialized, requiring robust construction capable of withstanding the demanding conditions of a nuclear environment, including high pressures, varying temperatures, and potential radiation exposure.

The product, often comprising a shell-and-tube heat exchanger configuration or more advanced plate-fin designs, ensures that the steam fed into the low-pressure turbine is superheated, maximizing energy extraction. Major applications are predominantly found in commercial nuclear power generation facilities across the globe, where MSRs are integral to maintaining plant performance and safety standards. Their benefits extend beyond mere efficiency gains to include improved operational stability, reduced component wear, and a lower probability of unscheduled downtime. The meticulous engineering behind each unit aims to provide optimal heat transfer characteristics and effective moisture removal, critical for sustained high-capacity factor operation. As nuclear power continues to be a cornerstone of baseload electricity generation, the demand for advanced and reliable MSR technologies remains paramount.

Driving factors for the Nuclear Moisture Separator Reheaters market include the global push for decarbonization, which positions nuclear energy as a viable low-carbon power source, prompting investments in new reactor constructions and the refurbishment of existing facilities. Furthermore, stringent safety regulations and the continuous drive for operational excellence in nuclear power plants necessitate the deployment of advanced MSRs that meet the highest standards of performance and reliability. The development of next-generation reactor technologies, such as Small Modular Reactors (SMRs), also presents new avenues for MSR innovation and market expansion, as these smaller, more flexible designs will require tailored and efficient steam processing solutions. These combined forces underscore the strategic importance and sustained growth trajectory of the Nuclear Moisture Separator Reheaters market within the broader energy landscape.

Nuclear Moisture Separator Reheaters Market Executive Summary

The Nuclear Moisture Separator Reheaters (MSRs) market is currently experiencing a period of significant strategic importance, driven by both the ongoing revitalization of the global nuclear energy sector and persistent challenges in plant modernization. Business trends indicate a strong focus on enhancing the efficiency and extending the operational lifespan of existing nuclear power plants, leading to increased demand for MSR replacements and upgrades. Key market players are actively investing in research and development to introduce MSRs with improved thermal performance, reduced footprint, and enhanced resistance to corrosion and fouling. Strategic partnerships and collaborations between MSR manufacturers, nuclear EPC (Engineering, Procurement, and Construction) firms, and utility operators are becoming more prevalent, aimed at streamlining project execution and delivering integrated solutions. Furthermore, there is a growing emphasis on lifecycle services, including maintenance, repair, and spare parts, establishing long-term revenue streams beyond initial equipment sales.

Regional trends reveal a dynamic landscape with varied growth trajectories. Asia-Pacific is poised to be a dominant region, driven by ambitious nuclear power expansion programs in countries like China, India, and South Korea, which are actively constructing new reactors. North America and Europe, while having a more mature nuclear fleet, are witnessing substantial investments in plant life extensions, refurbishment projects, and the initial deployment of Small Modular Reactors (SMRs), sustaining a steady demand for MSR technologies. The Middle East and Africa regions are emerging as potential growth areas, with several nations exploring or initiating nuclear power projects to diversify their energy mix and meet rising electricity demand. These regional disparities necessitate tailored market entry strategies and localized supply chain development to effectively capture available opportunities and navigate regulatory complexities unique to each geographical area.

Segment trends within the MSR market highlight specific areas of innovation and demand. By reactor type, Pressurized Water Reactors (PWRs) continue to account for the largest share, given their widespread global presence, although Boiling Water Reactors (BWRs) also represent a substantial segment. The capacity segment is seeing particular interest in MSRs designed for large-scale, gigawatt-class reactors, alongside emerging opportunities for smaller, modular designs catering to SMR applications. In terms of technology, advanced shell and tube designs that offer superior heat transfer efficiency and reliability are favored, while research into more compact and modular designs is gaining traction. The market is also seeing a shift towards integrating predictive maintenance capabilities and digital twin technologies into MSR operation and monitoring, enhancing their long-term performance and reducing operational risks, thereby underscoring a broader industry trend towards digitalization and intelligent asset management.

AI Impact Analysis on Nuclear Moisture Separator Reheaters Market

The integration of Artificial Intelligence (AI) into the Nuclear Moisture Separator Reheaters (MSRs) market addresses critical user questions revolving around operational optimization, predictive maintenance, enhanced safety, and design efficiency. Users are primarily concerned with how AI can transform traditional MSR management by minimizing unscheduled downtime, extending asset lifespan, and improving overall plant economics. Key themes frequently explored include the application of AI for real-time performance monitoring, identifying subtle operational anomalies before they escalate, and optimizing reheating processes for maximum turbine efficiency. There is also significant interest in AI's potential to facilitate more robust material degradation prediction, leading to proactive maintenance strategies and more precise component replacement schedules, thereby ensuring compliance with stringent nuclear safety standards while mitigating human error and operational costs. Furthermore, stakeholders are keenly looking into AI-driven design tools that can accelerate the development of next-generation MSRs, optimizing their physical characteristics and thermodynamic performance for novel reactor types, including Small Modular Reactors (SMRs).

- AI-driven predictive maintenance models can analyze sensor data from MSRs to anticipate equipment failures, enabling proactive scheduling of repairs and reducing costly unscheduled outages.

- Real-time operational optimization through AI algorithms can adjust reheating parameters to maintain peak turbine efficiency, even under varying load conditions, maximizing power output.

- Advanced AI for anomaly detection can identify subtle deviations in MSR performance indicators, signaling potential issues long before conventional monitoring systems.

- AI-enhanced digital twin technology creates virtual MSR models for simulation and optimization, improving design validation and facilitating virtual commissioning and training.

- Machine learning applied to material science data can predict corrosion rates and material degradation within MSR components, informing better material selection and extending service life.

- AI-assisted design tools accelerate the iterative design process for new MSRs, optimizing form factor, heat exchange surfaces, and flow dynamics for improved performance and cost-effectiveness.

- Integration of AI with plant control systems can automate complex MSR operational adjustments, contributing to enhanced safety protocols and minimizing manual intervention errors.

DRO & Impact Forces Of Nuclear Moisture Separator Reheaters Market

The Nuclear Moisture Separator Reheaters (MSRs) market is profoundly shaped by a confluence of driving forces, inherent restraints, promising opportunities, and overarching impact forces. A primary driver is the increasing global demand for clean and reliable baseload electricity, positioning nuclear power as a vital component in achieving decarbonization targets and energy security. This global emphasis fuels investments in new nuclear power plant constructions, particularly in Asia-Pacific, and extensive life extension programs for aging fleets in North America and Europe, both of which require new or upgraded MSRs to maintain optimal performance and regulatory compliance. The continuous push for enhanced plant efficiency and safety standards further compels operators to invest in advanced MSR technologies that promise higher thermal performance and greater operational reliability, directly influencing market growth.

However, the market also faces significant restraints that temper its expansion. High capital investment requirements for nuclear projects, coupled with protracted project development cycles and stringent regulatory approval processes, create substantial barriers to entry and expansion. Public perception challenges surrounding nuclear energy, often exacerbated by safety concerns and waste disposal issues, can lead to political hurdles and slow down new project approvals. Furthermore, the specialized nature of MSR manufacturing demands highly technical expertise and advanced materials, contributing to high production costs and potentially limiting the number of qualified suppliers, which can affect market dynamics and pricing structures. These financial and societal factors necessitate careful strategic planning and robust stakeholder engagement.

Despite these challenges, substantial opportunities exist for the MSR market. The emergence of Small Modular Reactors (SMRs) represents a transformative opportunity, as their modular design and flexible deployment could reduce project costs and timelines, creating a new segment for compact and efficient MSR solutions. Advancements in material science and manufacturing processes, such as additive manufacturing, offer pathways to develop MSRs with improved corrosion resistance, enhanced thermal efficiency, and longer operational lifespans. Additionally, the ongoing modernization and refurbishment of existing nuclear power infrastructure globally present continuous demand for MSR replacements and upgrades, ensuring a stable market even without significant new reactor builds. These technological and infrastructural shifts are pivotal for the market's long-term sustainability and innovation.

Segmentation Analysis

The Nuclear Moisture Separator Reheaters market is comprehensively segmented to provide a detailed understanding of its diverse landscape, categorizing the market based on critical attributes such as type, reactor type, capacity, and component. This segmentation allows for a nuanced analysis of market trends, specific demand patterns, and the competitive environment across various product offerings and application areas. Understanding these distinct segments is crucial for stakeholders, including manufacturers, suppliers, and nuclear operators, to identify niche markets, tailor product development, and formulate effective strategic initiatives that align with specific industry requirements and technological advancements.

- By Type:

- Shell and Tube MSR: The most prevalent design, known for its robust construction, reliability, and established operational history in nuclear power plants. It involves steam flowing through a shell while a separate fluid (often extracted steam) flows through tubes, facilitating heat transfer and moisture separation.

- Plate-Fin MSR: Offers a more compact design with high heat transfer efficiency due to its large surface area-to-volume ratio, gaining traction for space-constrained applications and advanced reactor designs.

- Others: Includes specialized or experimental MSR designs tailored for specific reactor types or advanced applications, often incorporating innovative materials or unique geometries for enhanced performance.

- By Reactor Type:

- Pressurized Water Reactors (PWR): Represents the largest segment globally, characterized by a closed primary coolant loop and a secondary steam cycle where MSRs are essential for turbine protection and efficiency.

- Boiling Water Reactors (BWR): Another significant segment where steam is directly generated in the reactor vessel, requiring MSRs to ensure dry steam enters the turbine and optimize subsequent stages.

- Others (e.g., CANDU, VVER, Advanced Reactors): Includes a range of other reactor technologies, such as Canadian Deuterium Uranium (CANDU) reactors and Russian VVER designs, along with emerging advanced reactor concepts and Small Modular Reactors (SMRs), each with specific MSR requirements.

- By Capacity:

- Small (Up to 500 MW): Typically associated with smaller nuclear units, research reactors, or some SMR designs, focusing on compact and efficient MSR solutions.

- Medium (501-1000 MW): Covers a substantial portion of the global nuclear fleet, including many established reactor designs, requiring MSRs optimized for mid-range power outputs.

- Large (Above 1000 MW): Pertains to large-scale, gigawatt-class nuclear power plants, demanding high-capacity MSRs that can handle massive steam flows and ensure maximum turbine performance.

- By Component:

- Demisters: Crucial elements designed to physically remove liquid moisture droplets from the steam flow before reheating, typically mesh pads or chevron plates.

- Reheater Bundles: The heat exchange section where saturated or partially dry steam is superheated by a hotter steam source (e.g., live steam from the reactor or extraction steam from the HP turbine).

- Shells: The external pressure vessel containing the demister and reheater bundles, designed to withstand operating pressures and temperatures.

- Piping & Valves: Essential for managing steam flow into and out of the MSR, controlling pressure, and isolating components for maintenance.

Value Chain Analysis For Nuclear Moisture Separator Reheaters Market

The value chain for the Nuclear Moisture Separator Reheaters (MSRs) market is intricate, involving a specialized set of upstream suppliers, manufacturers, and downstream participants culminating in the operation of nuclear power plants. Upstream activities primarily focus on the supply of highly specialized raw materials, including high-grade stainless steel alloys, nickel-based alloys, and other corrosion-resistant metals essential for constructing MSR shells, tubes, and internal components that must withstand harsh nuclear operating environments. Key raw material suppliers, often large metallurgical companies, play a crucial role in providing materials that meet stringent nuclear industry quality, safety, and traceability standards. Furthermore, specialized component manufacturers produce critical elements such as demisters, heat exchanger tubes, and high-integrity pressure vessel parts, adhering to precise engineering specifications and often requiring advanced manufacturing techniques and rigorous quality control processes.

Mid-stream in the value chain, MSR manufacturers, typically large engineering conglomerates or specialized equipment providers, design, fabricate, and assemble these complex units. These manufacturers often engage in extensive research and development to optimize MSR performance, efficiency, and longevity, incorporating advanced computational fluid dynamics (CFD) and thermal-hydraulic modeling in their design processes. Their operations involve highly specialized welding, machining, and assembly, followed by rigorous testing and certification to meet international nuclear codes and standards. The distribution channel predominantly operates through direct sales and established relationships. Given the highly technical and capital-intensive nature of nuclear projects, MSRs are typically procured directly by Engineering, Procurement, and Construction (EPC) contractors or directly by utility companies and nuclear plant operators, rather than through broad commercial distributors. This direct engagement ensures close technical collaboration throughout the project lifecycle, from design integration to installation and commissioning.

Downstream activities involve the installation, commissioning, and long-term operation and maintenance of MSRs within nuclear power plants. EPC contractors are responsible for the integration of MSRs into the overall plant design and construction, ensuring seamless interface with turbines, piping, and control systems. The ultimate end-users are nuclear power generation companies and utility operators who depend on the MSRs for efficient and safe electricity production. Direct procurement models are common, where utilities directly engage MSR manufacturers or their authorized service providers for equipment and ongoing support. Indirect channels may involve engineering consulting firms that advise on MSR selection, design optimization, and procurement specifications, influencing purchasing decisions without directly handling the equipment. The entire value chain is characterized by a strong emphasis on quality assurance, regulatory compliance, and a long-term commitment to operational reliability and safety, given the critical role MSRs play in nuclear power generation.

Nuclear Moisture Separator Reheaters Market Potential Customers

The primary potential customers for Nuclear Moisture Separator Reheaters (MSRs) are entities deeply embedded within the global nuclear energy infrastructure, encompassing a range of organizations responsible for the design, construction, operation, and maintenance of nuclear power plants. Foremost among these are the national and international utility companies and independent power producers (IPPs) that own and operate nuclear power generation facilities. These end-users are driven by the need to maximize plant efficiency, ensure long-term operational reliability, and comply with stringent safety and performance regulations. Their demand for MSRs stems from the initial construction of new reactors, as well as crucial life extension programs and refurbishment projects for existing plants, where MSR replacement or upgrade is often a necessity to enhance performance and maintain asset integrity. The decision-making process for these entities is typically complex, involving extensive technical evaluations, cost-benefit analyses, and regulatory adherence, reflecting the high capital expenditure and long operational lifespan of nuclear assets.

Another significant customer segment comprises Engineering, Procurement, and Construction (EPC) firms specializing in nuclear power projects. These contractors act as intermediaries, procuring MSRs and other critical components on behalf of the utility owners for new build projects or major plant modifications. Their role involves integrating MSRs into the overall plant design, ensuring compatibility with turbine systems, and managing the installation process. Their purchasing decisions are influenced by factors such as supplier reputation, proven track record, compliance with project specifications, and the ability to deliver on schedule and within budget. The growth in global nuclear construction projects, particularly in emerging nuclear markets, directly translates to increased demand from these EPC giants. Additionally, national nuclear energy agencies and governmental bodies in countries embarking on new nuclear programs or expanding their existing capacities also represent potential buyers, often through public tenders and strategic national initiatives.

Beyond new installations, the aftermarket for MSRs is a substantial opportunity, targeting nuclear power plants requiring replacement parts, upgrades, or specialized maintenance services. This extends the customer base to include plant maintenance departments and specialized service providers focused on extending the operational life and improving the performance of existing MSR units. The increasing average age of the global nuclear fleet underscores the importance of this segment, as operators seek to maximize the return on investment from their assets through refurbishment and modernization. Furthermore, organizations involved in the development and deployment of advanced reactor technologies, such as Small Modular Reactors (SMRs) and Generation IV reactors, represent a future customer base, driving demand for innovative and tailor-made MSR solutions. These varied customer groups collectively form the core demand for Nuclear Moisture Separator Reheaters, propelled by the enduring strategic value of nuclear power.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.08 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Power (a GE Vernova company), Siemens Energy AG, Mitsubishi Heavy Industries, Ltd. (MHI), Framatome (an EDF Group company), Doosan Enerbility Co., Ltd., Toshiba Energy Systems & Solutions Corporation, IHI Corporation, Hitachi, Ltd., BWX Technologies, Inc., Westinghouse Electric Company LLC, Larsen & Toubro Limited (L&T), Shanghai Electric Group Co., Ltd., China National Nuclear Corporation (CNNC), Korea Hydro & Nuclear Power Co., Ltd. (KHNP), Fuji Electric Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Babcock & Wilcox Enterprises, Inc., Hyundai Engineering & Construction Co., Ltd., Rolls-Royce S.A., Equans (Engie Solutions) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nuclear Moisture Separator Reheaters Market Key Technology Landscape

The Nuclear Moisture Separator Reheaters (MSRs) market is characterized by a dynamic technology landscape, continually evolving to meet the stringent demands of safety, efficiency, and longevity inherent to nuclear power generation. Central to this evolution is the utilization of advanced materials, particularly specialized stainless steel alloys and nickel-based alloys, chosen for their superior corrosion resistance, high-temperature strength, and radiation resistance. These materials are critical for ensuring the structural integrity and long-term performance of MSR components, such as shells, tubes, and demisters, thereby extending operational lifespans and reducing maintenance frequency. Furthermore, sophisticated manufacturing processes, including precision welding techniques, advanced machining, and rigorous quality control protocols, are employed to achieve the exact tolerances and high-quality finishes required for nuclear-grade equipment, minimizing defects and enhancing reliability under extreme conditions.

Computational Fluid Dynamics (CFD) and advanced thermal-hydraulic modeling represent another cornerstone of technological innovation in MSR design. These simulation tools enable engineers to accurately predict steam flow patterns, heat transfer rates, and moisture separation efficiency within proposed MSR configurations. By virtually optimizing demister designs, tube bundle layouts, and overall MSR geometry, manufacturers can develop units that offer enhanced thermal performance and reduced pressure drop, directly contributing to improved turbine efficiency and increased power plant output. The application of these simulation technologies also supports the development of more compact and lightweight MSRs, which is particularly crucial for emerging Small Modular Reactor (SMR) designs where space and modularity are key considerations. This predictive capability significantly reduces the need for costly physical prototypes and speeds up the design iteration cycle.

Emerging technologies such as digital twin integration and advanced sensor networks are also beginning to revolutionize MSR monitoring and maintenance. Digital twins, virtual replicas of physical MSRs, can integrate real-time operational data from embedded sensors to provide comprehensive insights into performance, predict potential failures, and optimize maintenance schedules. This predictive maintenance approach leverages big data analytics and machine learning to identify anomalies and anticipate degradation, moving away from time-based or reactive maintenance strategies. Furthermore, modular design principles are gaining traction, allowing for easier fabrication, transportation, and installation of MSRs, reducing construction timelines and costs. These combined technological advancements are not only driving efficiency and safety improvements but also enabling the customization of MSRs for diverse reactor types and operational requirements, ensuring the market remains at the forefront of nuclear power technology.

Regional Highlights

- North America: This region, particularly the United States and Canada, demonstrates a mature nuclear market with significant investments in plant life extensions and modernization projects. The ongoing operations of existing reactors, coupled with strategic interest in Small Modular Reactors (SMRs), create a stable demand for MSR upgrades and replacements.

- Europe: Countries like France, the UK, and Eastern European nations are focusing on maintaining their existing nuclear fleet, alongside a renewed interest in new builds for energy security and decarbonization. Regulatory shifts and government support for nuclear power are driving refurbishment activities and potential new MSR installations.

- Asia Pacific (APAC): Positioned as the fastest-growing market, driven by ambitious new reactor construction programs in China, India, and South Korea. Rapid industrialization and increasing energy demand are key factors, leading to substantial opportunities for MSR manufacturers to supply equipment for these large-scale projects.

- Latin America: This region exhibits modest but steady growth, with countries like Argentina and Brazil operating and expanding their nuclear capacities. Investments are primarily directed towards maintaining existing infrastructure and exploring options for new, smaller-scale nuclear projects, offering niche opportunities for MSR providers.

- Middle East and Africa (MEA): An emerging market for nuclear power, with nations such as the UAE and Egypt actively pursuing or planning their first nuclear power plants. These greenfield projects represent significant long-term growth potential for MSR suppliers, as part of comprehensive energy diversification strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nuclear Moisture Separator Reheaters Market.- GE Power (a GE Vernova company)

- Siemens Energy AG

- Mitsubishi Heavy Industries, Ltd. (MHI)

- Framatome (an EDF Group company)

- Doosan Enerbility Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

- IHI Corporation

- Hitachi, Ltd.

- BWX Technologies, Inc.

- Westinghouse Electric Company LLC

- Larsen & Toubro Limited (L&T)

- Shanghai Electric Group Co., Ltd.

- China National Nuclear Corporation (CNNC)

- Korea Hydro & Nuclear Power Co., Ltd. (KHNP)

- Fuji Electric Co., Ltd.

- Bharat Heavy Electricals Limited (BHEL)

- Babcock & Wilcox Enterprises, Inc.

- Hyundai Engineering & Construction Co., Ltd.

- Rolls-Royce S.A.

- Equans (Engie Solutions)

Frequently Asked Questions

What is a Nuclear Moisture Separator Reheater (MSR) and why is it crucial in nuclear power plants?

A Nuclear Moisture Separator Reheater (MSR) is a vital component in the secondary circuit of nuclear power plants, primarily in Pressurized Water Reactors (PWRs) and Boiling Water Reactors (BWRs). Its crucial role involves two key functions: first, separating moisture droplets from the low-pressure steam exiting the high-pressure turbine, and second, reheating this drier steam before it enters the subsequent low-pressure turbine stages. This dual action significantly enhances the overall thermodynamic efficiency of the steam cycle, preventing premature erosion of turbine blades, extending turbine lifespan, and ultimately increasing the net electrical output of the nuclear power plant. Without efficient MSRs, turbine performance would degrade rapidly, leading to increased maintenance costs and reduced plant availability, underscoring their indispensability for optimal nuclear power generation.

What are the primary factors driving the growth of the Nuclear MSR market?

The Nuclear MSR market is primarily driven by several critical factors. Firstly, the global resurgence in nuclear energy development, spurred by climate change mitigation goals and the demand for stable, low-carbon baseload electricity, necessitates new reactor constructions and MSR installations. Secondly, extensive plant life extension programs and modernization initiatives for existing nuclear fleets worldwide require MSR replacements or upgrades to maintain efficiency, safety, and regulatory compliance. Thirdly, the continuous pursuit of higher operational efficiency and stricter safety standards within the nuclear industry compels operators to invest in advanced MSR technologies that offer improved thermal performance and reliability. Finally, the emerging market for Small Modular Reactors (SMRs) presents new opportunities for specialized, compact MSR designs, further stimulating market growth.

What are the main types of MSRs used in the nuclear industry, and how do they differ?

The main types of MSRs used in the nuclear industry are Shell and Tube MSRs and Plate-Fin MSRs, each with distinct characteristics. Shell and Tube MSRs are the most common and robust design, consisting of a large cylindrical shell containing numerous tubes. Steam passes through the shell, while a heating medium (typically extracted steam) flows through the tubes, facilitating heat transfer and moisture separation. They are known for their reliability and long operational history. Plate-Fin MSRs, on the other hand, offer a more compact design with a higher surface area-to-volume ratio, leading to enhanced heat transfer efficiency. This makes them suitable for applications where space is a constraint, such as in certain advanced reactor designs or SMRs. While Shell and Tube designs are generally favored for conventional large-scale plants due to their proven performance, Plate-Fin designs are gaining traction for their efficiency and reduced footprint.

How does Artificial Intelligence (AI) influence the design, operation, and maintenance of Nuclear MSRs?

Artificial Intelligence (AI) significantly influences the design, operation, and maintenance of Nuclear MSRs by introducing enhanced capabilities for optimization, prediction, and automation. In design, AI-driven computational fluid dynamics (CFD) and thermal-hydraulic modeling tools accelerate the development of MSRs with superior efficiency and a reduced footprint. For operation, AI algorithms can perform real-time analysis of sensor data to optimize reheating parameters, ensuring peak turbine performance and efficiency under varying load conditions, while also detecting anomalies that could indicate impending issues. In maintenance, AI-powered predictive models leverage historical and real-time data to anticipate equipment degradation or failures, enabling proactive scheduling of maintenance and part replacements, thereby minimizing unscheduled downtime, extending asset life, and enhancing overall plant safety and cost-effectiveness.

Which regions are showing significant growth or strategic importance in the Nuclear MSR market?

Several regions exhibit significant growth or strategic importance in the Nuclear MSR market. Asia Pacific (APAC) stands out as the fastest-growing region, driven by extensive new reactor construction programs in countries like China, India, and South Korea, fueled by increasing energy demand and decarbonization goals. North America and Europe, while having more mature nuclear fleets, are strategically important due to significant investments in plant life extension, modernization projects, and the nascent deployment of Small Modular Reactors (SMRs), which necessitate MSR replacements or new, tailored designs. The Middle East and Africa (MEA) region is emerging as a growth area, with nations like the UAE and Egypt actively developing or planning nuclear power capabilities to diversify their energy mix, presenting greenfield opportunities for MSR suppliers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager